Fee Receipt Samples

-

SEVIS Fee Receipt

download now -

Fee Receipt Template

download now -

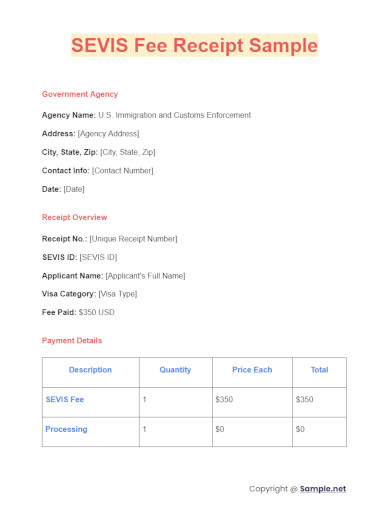

SEVIS Fee Receipt Sample

download now -

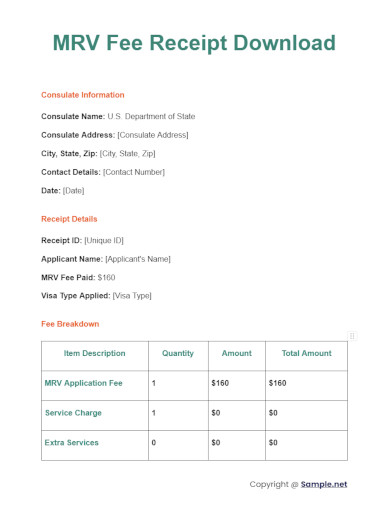

MRV Fee Receipt Download

download now -

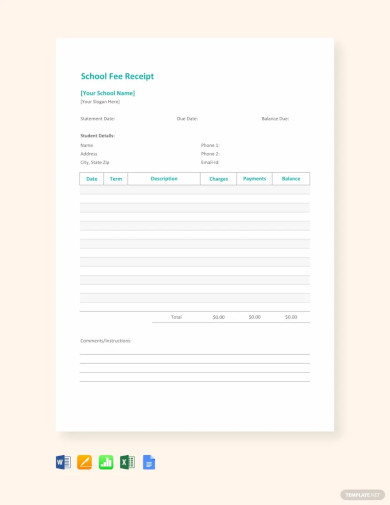

School Fee Receipt Template

download now -

School Fee Payment Receipt Template

download now -

Sample School Fee Receipt Template

download now -

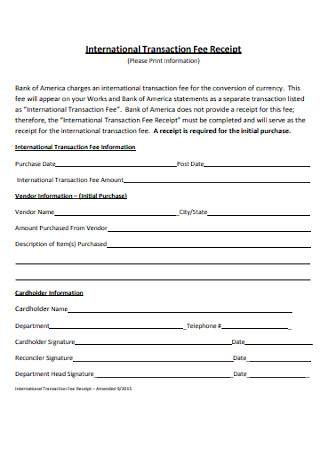

College Transaction Fee Receipt

download now -

Receipt for Coaching Academy Fees

download now -

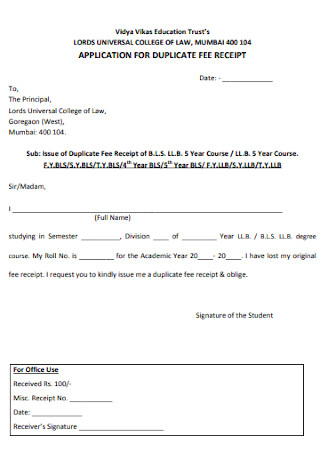

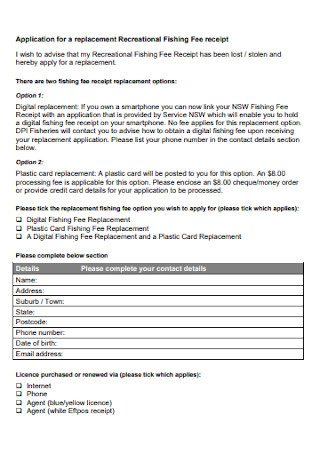

Sample Application for Duplicate Fee Receipt

download now -

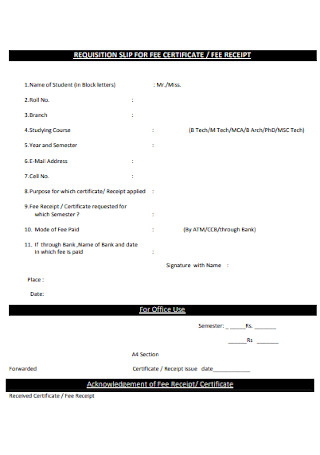

Fee Certificate and Receipt Template

download now -

Club Fee Payment Receipt

download now -

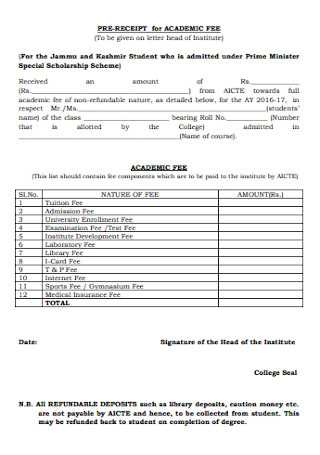

Institute Fee Receipt

download now -

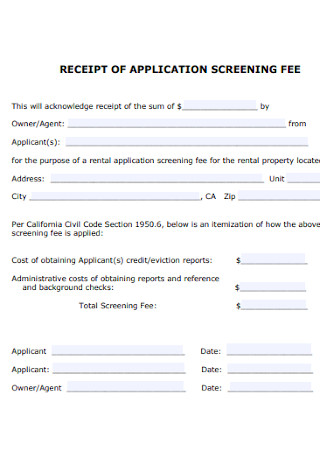

Receipt for Application Screening Fee

download now -

Blank Fee Receipt

download now -

Designing Fee Receipt

download now -

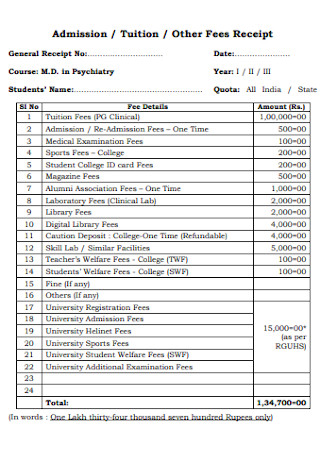

Tuition Fees Receipt

download now -

Monthly Examination Fee Receipt

download now -

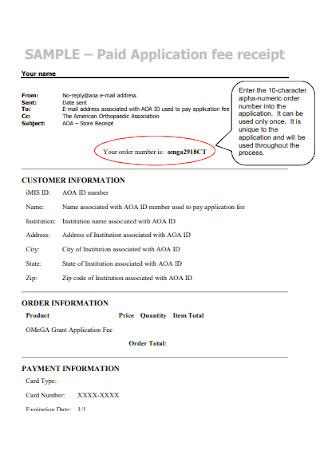

Paid Application Fee Receipt

download now -

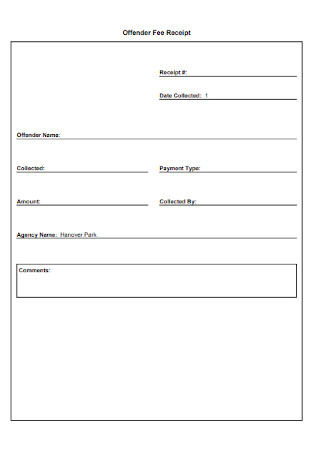

Offender Fee Receipt Template

download now -

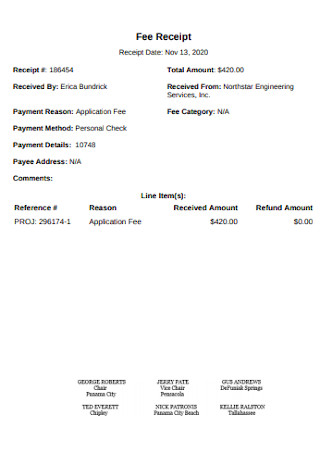

Fee Receipt Invoice

download now -

Sample Receipt for Fees Template

download now -

Pre-School Fee Receipt Template

download now -

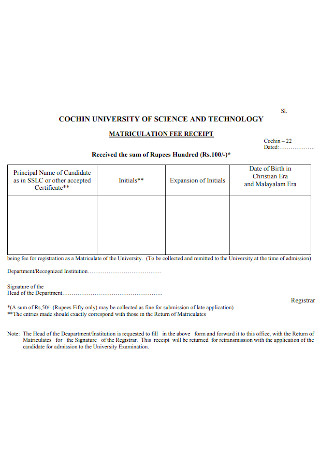

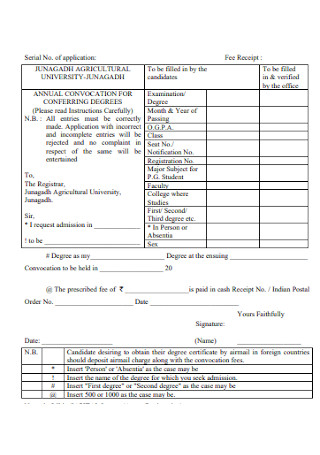

Agriculture University Fee Receipt

download now -

Simple Fee Receipt Template

download now -

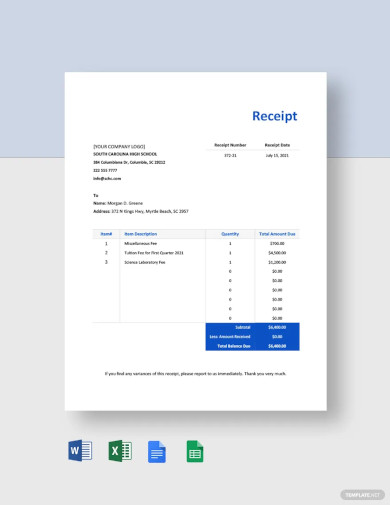

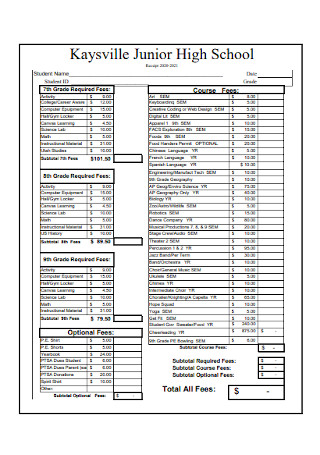

High School Fee Receipt

download now -

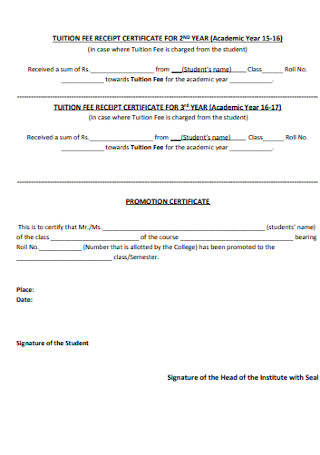

Sample Tuition Fee Receipt

download now -

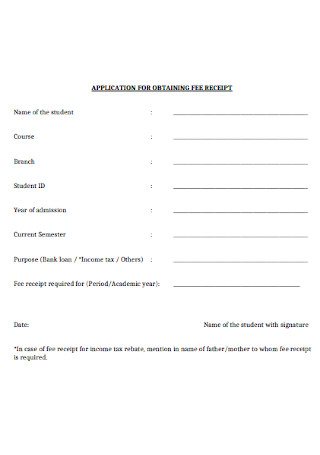

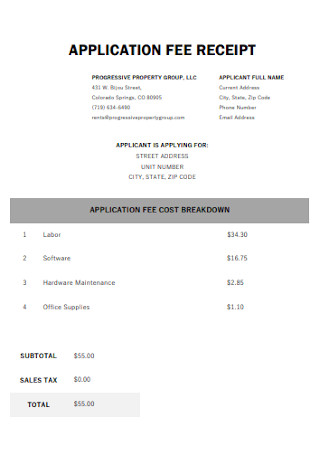

Sample Application Fee Receipt

download now -

Membership Fee Receipt

download now -

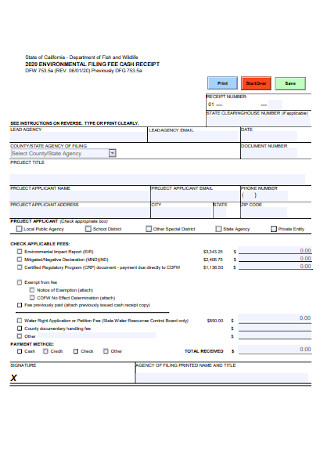

Sample Environmental Filling Fee Receipt

download now -

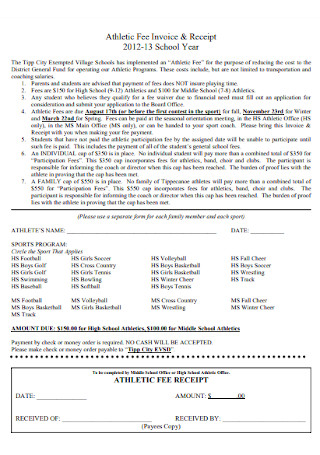

Athletic Fee Invoice and Receipt

download now -

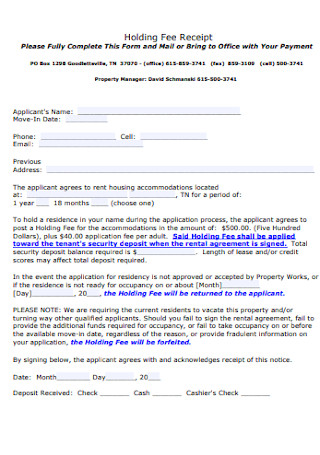

Holding Fee Receipt

download now -

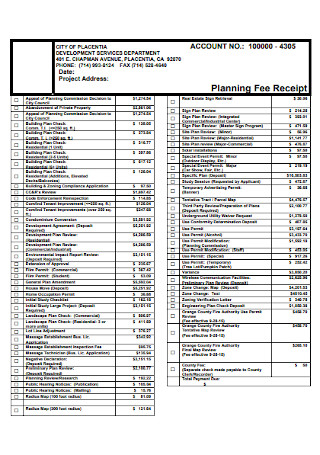

Planning Fee Receipt

download now -

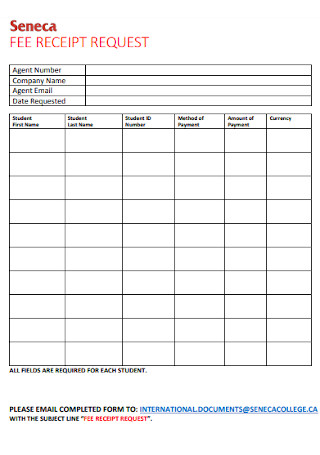

Sample Fee Request Receipt

download now -

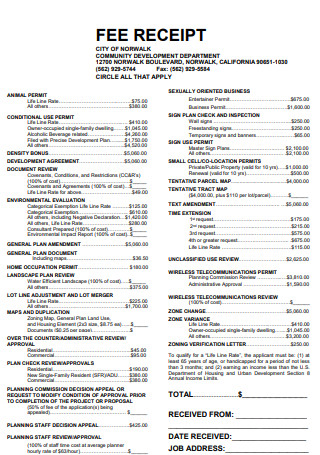

Formal Fee Receipt Template

download now

FREE Fee Receipt s to Download

Fee Receipt Format

Fee Receipt Samples

What is Fee Receipt?

What Are the Parts of a Fee Receipt?

How to Make a Proper Fee Receipt

Are receipts and invoices the same?

What are some examples of receipts?

How long should I keep fee receipts?

Who can qualify as recipients of fee receipts?

What is the Fee Receipt for US Visa?

What Happens If I Don’t Pay SEVIS Fee?

How Do You Ask for a Fee Receipt?

How Do I Get My SEVIS Fee Receipt?

How Do I Get a US Visa Fee Receipt Number?

How Long Does It Take for a MRV Receipt to Get Activated?

How Do I Prove a Payment Without a Receipt?

Why Is a Receipt Called a Receipt?

Who Pays the SEVIS Fee?

How Long Is a US Visa Fee Receipt Valid?

Does Receipt Mean Paid?

What Is a SEVIS Fee Receipt?

Is There a Deadline to Pay SEVIS Fee?

What Are the Three Types of Fees?

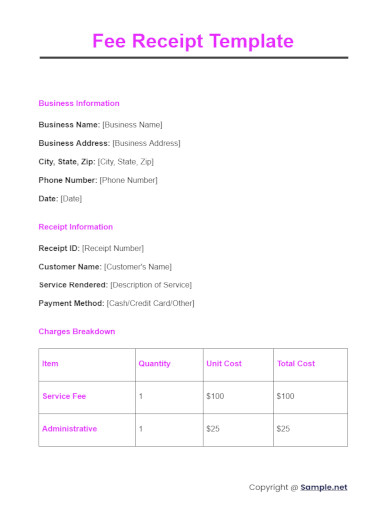

Fee Receipt Format

Heading

- Your Organization’s Name

- Your Organization’s Address

- City, State, Zip Code

- Phone Number

- Date

Body

- Recipient’s Name

- Description of Service

- Amount Paid

- Payment Method

Closing

- Confirmation of Receipt

- Signature of Receiver

What is Fee Receipt?

A Fee Receipt is a written acknowledgment that confirms the receipt of payment for goods or services. Typically issued by the service provider or seller, this document details the amount paid, the date of the transaction, the parties involved, and the method of payment. Fee Receipts are crucial for both personal and business financial tracking. They serve as proof of transaction for accounting purposes and can be critical for resolving discrepancies in billing or during tax assessments. Whether it’s a simple cash transaction or a more complex business dealing, having a Fee Receipt ensures that every financial exchange is recorded and recognized officially

According to Statista, around 19.6 million college students were enrolled in America last 2018.

The Value of Education reported that the US is one of the leading yet most expensive options in considering a university abroad; students paid an average of $99,417 for their chosen degree or course.

Based on a survey, the US has over 130,930 K–12 schools as of 2018.

Why Do You Need Fee Receipts?

Just like any business receipt, a fee receipt is needed for evidence. The document will lay out the details of the transaction date, payment amount, and more information. So if ever the payee and the payer have questions related to fees and transactions, they can simply refer to the receipt as reference. Also, fee receipts are needed for accounting and recordkeeping purposes. Payment may be audited for some time, or perhaps, the fee receipt might be used as a tool for dispute.

Indeed, fee receipts play a great role in educational matters. Take college for example. Statista’s research survey confirmed that about 19.6 million college students enrolled in the US last 2018. Nonetheless, America is still one of the leading yet most expensive choices to consider for a university abroad. Based on records, students paid an average of $99,417 for their degree. Parents and students who paid for a college admission would want to know if their money was spent as intended, and fee receipts can prove that. Most importantly, fee receipts are not limited to education. There are other special services to pay for like shipping fees, travel fees, environmental fees, etc.

What Are the Parts of a Fee Receipt?

You already know that helpful details are inside fee receipts. But what exactly are they? Bear in mind that what a fee receipt contains may differ from one business to another. However, common elements can be found in most receipts. So in this segment, we will guide you in familiarizing the basic parts of a standard fee receipt.

How to Make a Proper Fee Receipt

Clearly, fee receipts bring a sense of acknowledgment if payments and transactions did happen. More so, this receipt can be a written agreement between the payers and the payees. But something you should know very well is how to create a fee receipt. Since such receipts are important, you should learn how to come up with a proper fee receipt. And you can do so by following these steps:

Step 1: Save Your Effort with Sample Templates

Making receipts from scratch is very time-consuming. Luckily, premade sample fee receipt templates are up for grabs, as seen above. Check out our different samples until you can select a template to work with. Using printable and downloadable templates, you can produce fee receipts anytime. To boot, you can create as many copies as you want. What is even better? You may freely customize any detail, format, or design from each template. A tip is to go for receipt forms with carbon copies because once you write on a receipt and send it to a payer, you get to keep the carbon copy. You may also see Service Receipt

Step 2: Ensure to Complete the Fee Receipt’s Elements

From the title down to the signatures, be sure all the necessary elements of your fee receipt are added. You already know the different sections as discussed earlier anyway. But the catch now is to arrange them accordingly. For example, you can create tables to divide every label from the amount paid, balance, mode of payment, and so forth. Categorizing the elements into charts is another approach. The problem with just blindly inserting every element is how you could have jumbled details or a hodgepodge of information. And that is something to avoid. You may also see Employee Receipt

Step 3: Incorporate Company Branding

Part of designing the fee receipt is to include your company’s brand strategy. Branding means you include your organization’s logo, contact information, signature colors, and the like. That way, your fee receipt will not just be regarded as any other general receipt. Your fee receipt is now personalized. What makes a personalized receipt beneficial is how it also boosts your organization’s marketing factor. As more people get to see the branding from your receipts, more people would know about your company. You may also see Tax Receipt

Step 4: Print or Write Receipts in Dark Ink

Ensure that the fee receipt copies you produce are legible enough. And the key is to print with dark ink. It is bad to make copies that are hard to read because those might create confusion. Dark ink is also needed when you write information into the receipt. Thus, the handwritten documents’ ink will not easily fade over time. Fee receipts are supposed to work as permanent records so illegible and incorrect details inside are a big no-no. Fraudulent actions might happen if the ink fades, like when someone overwrites false information in a receipt. You may also see Investment Receipt

Step 5: Keep It Short and Simple

You have to keep in mind that receipts are not bulky documents. They don’t even have to be as big as a long bond paper. These are small documents so you should only write short and simple sentences. Focus on using words that are easily understood by the public so it will be user-friendly. In fact, you need not write complete sentences because you can just enumerate or answer each element in the form directly. And once you are glad about the outcome, produce those copies now! You may also see Expense Receipt

Are receipts and invoices the same?

No, receipts and sample invoices are different. And how different they are is based on timing. With invoice, it is only issued when goods and services have been rendered but there is no payment yet. Meanwhile, the receipt is issued when the payment is already done.

What are some examples of receipts?

Besides fee receipts, there are more types and examples of receipts out there. And here are a few examples:

- Cash receipt

- Rent receipt

- Donation receipt

- Payroll receipt

- Hotel receipt

- Gift receipt

How long should I keep fee receipts?

The Internal Revenue Service (IRS) amends individuals to keep any receipt for three years minimum. You never know when you might need your receipts for reference lists within those few years. So better yet, keep them in a safe place to be prepared.

Who can qualify as recipients of fee receipts?

Anyone can be a recipient of a fee receipt if payers paid them in return for services. Besides an individual, it can be a group or organization too like universities, workshops, and businesses. But, they should be identified for compliance. You may also see Landlord Receipt

What is the Fee Receipt for US Visa?

A US visa fee receipt is crucial for confirming payment prior to scheduling a visa interview appointment.

- Purpose of the Receipt: Serves as proof that you have paid the visa application fee.

- Where to Obtain: Available after payment at designated banks or online via the visa application website.

- Information Included: Contains unique receipt number necessary for making an interview appointment.

- Format: Similar to Acknowledgement Receipt, providing detailed transaction validation.

- Storage: Keep it safe as it is required during the visa interview process. You may also see Self Employee Receipt

What Happens If I Don’t Pay SEVIS Fee?

Failing to pay the SEVIS fee can significantly impact your U.S. study plans.

- Visa Denial: No payment means you cannot complete your visa application process.

- Entry Issues: Without a SEVIS fee payment, entry into the United States is not permitted.

- Appointment Scheduling: You will be unable to schedule a visa interview without a fee payment confirmation.

- SEVIS Registration: Your SEVIS record will not be activated, affecting your school enrollment.

- Legal Consequences: Non-payment may be flagged as a violation of U.S. federal regulations. You may also see Property Receipt

How Do You Ask for a Fee Receipt?

Requesting a fee receipt requires clear communication and understanding of your needs.

- Specify Details: Clearly state the date, amount paid, and service or product received.

- Contact Method: Approach via email, phone, or in person depending on the service provider.

- Use Formal Language: Politely request the receipt as you would for a Monthly Rent Receipt.

- Follow-Up: If not received promptly, follow up respectfully, emphasizing the need for record-keeping.

- Record Keeping: Store receipts carefully once received for your financial tracking. You may also see Temporary Receipt

How Do I Get My SEVIS Fee Receipt?

Recovering a SEVIS fee receipt is essential for your visa processing.

- Access SEVIS Portal: Log into the SEVIS fee payment site where you initially paid the fee.

- Account Review: Check your payment history for the receipt.

- Print Receipt: Download and print the receipt, similar to retrieving School Fee Receipt.

- Contact Support: If the receipt is not available online, contact SEVIS helpdesk for assistance.

- Keep Copies: Save digital and physical copies of the receipt for future reference. You may also see Travel Receipt

How Do I Get a US Visa Fee Receipt Number?

The US visa fee receipt number is a key component of your application.

- Payment Confirmation: Obtain the number immediately upon paying the visa fee.

- Check Email: Often sent via email similar to a Rent Receipt format.

- Online Account: Log into your visa payment online account to view the receipt number.

- Bank Receipt: If paid at a bank, the receipt number is printed on your receipt.

- Customer Service: Contact customer service if the receipt number is not clearly visible or provided. You may also see Restaurant Receipt

How Long Does It Take for a MRV Receipt to Get Activated?

Activation of a MRV receipt is critical for scheduling your visa appointment.

- Typical Time Frame: Usually takes 24 hours post-payment to activate.

- Check Status Online: Monitor the status via the visa application portal.

- Payment Method Impact: Delays may occur depending on the payment method used, akin to Taxi Receipt processing.

- Bank Holidays: Consider bank holidays which might delay activation.

- Customer Support: Contact support if activation takes longer than expected. You may also see Equipment Receipt

How Do I Prove a Payment Without a Receipt?

Proving payment without a receipt can be challenging but manageable.

- Bank Statements: Use your bank or credit card statements showing the transaction.

- Electronic Confirmation: Use email confirmations or SMS notifications as proof, similar to Hospital Bill Receipt.

- Witness Testimony: If in a small business context, use witness accounts of the transaction.

- Written Acknowledgement: Ask the recipient to provide a written confirmation if possible.

- Legal Advice: Consider consulting a legal professional if large sums are involved and no formal receipt exists. You may also see Purchase Receipt

Why Is a Receipt Called a Receipt?

A receipt is called a receipt because it’s derived from the Latin word “recipere,” meaning to receive or take, signifying proof of a transaction like Salary Receipt.

Who Pays the SEVIS Fee?

The SEVIS fee is paid by prospective students and exchange visitors before applying for their respective visas to enter the United States, crucial for Medical Receipt management.

How Long Is a US Visa Fee Receipt Valid?

A US visa fee receipt is typically valid for one year from the date of payment, aligning with processes similar to Delivery Receipt in terms of usage duration.

Does Receipt Mean Paid?

Yes, a receipt usually means that a payment has been made and acknowledged, serving as a record similar to Real Estate Receipt in property transactions.

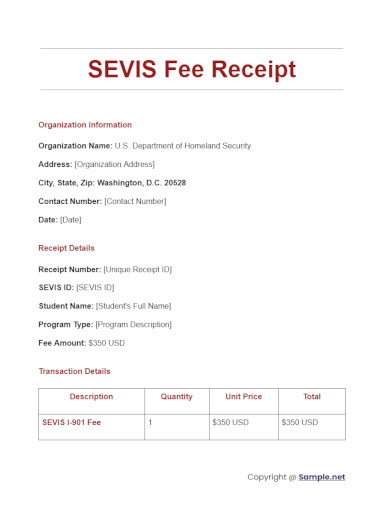

What Is a SEVIS Fee Receipt?

A SEVIS fee receipt is a document that confirms payment of the SEVIS fee, required for all new applicants under student or exchange visitor visas, akin to Insurance Receipt for policy processing.

Is There a Deadline to Pay SEVIS Fee?

Yes, the SEVIS fee must be paid at least three days before submitting your visa application or applying for entry at a U.S. port of entry, critical like Vehicle Sale Receipt deadlines.

What Are the Three Types of Fees?

The three types of fees generally include application fees, processing fees, and administrative fees, similar to the diverse categories in Used Car Sales Receipt.

In conclusion, Fee Receipts play a pivotal role in the financial management of any entity. They not only provide a legal proof of payment but also help in maintaining accurate records for accounting and tax purposes. By using forms like Sample Receipts and following structured guidelines, businesses and individuals can ensure that their financial dealings are transparent and traceable. The utility of Fee Receipts extends beyond mere record-keeping; they enhance financial integrity and accountability across various transactions. As we continue to move towards a more digitized financial environment, the importance of maintaining robust and reliable documentation like Fee Receipts cannot be overstated.