19+ Sample Insurance Receipts

-

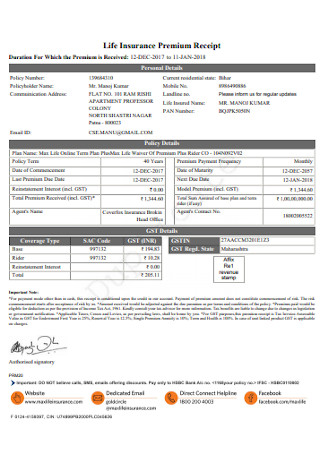

Life Insurance Premium Receipt

download now -

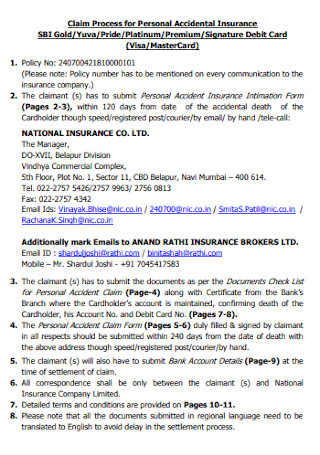

Personal Accidental Insurance Receipt

download now -

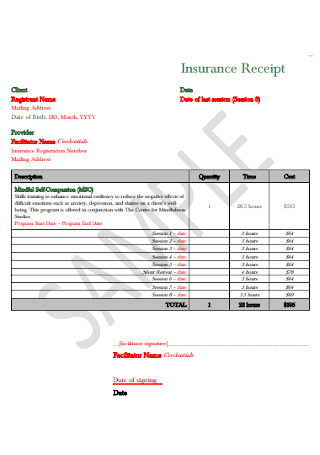

Insurance Receipt Format

download now -

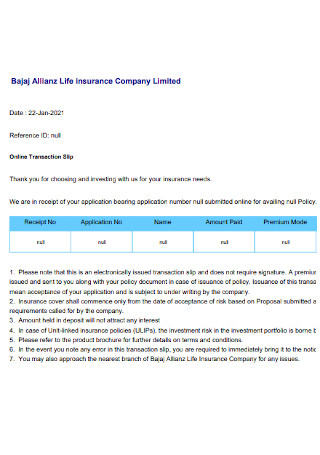

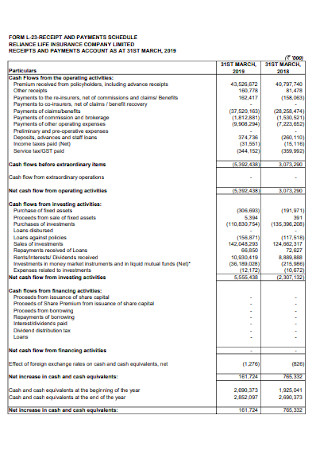

Life insurance Company Receipt

download now -

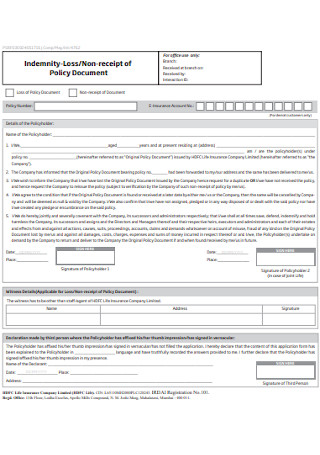

Insurance Policy Receipt Template

download now -

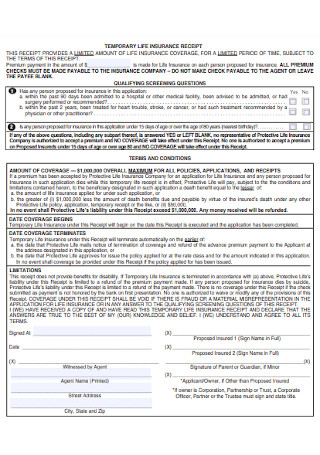

Temporary Life Insurance Receipt

download now -

Disability Insurance Receipt

download now -

Insurance Payment Receipt

download now -

Sample Temporary Insurance Receipt

download now -

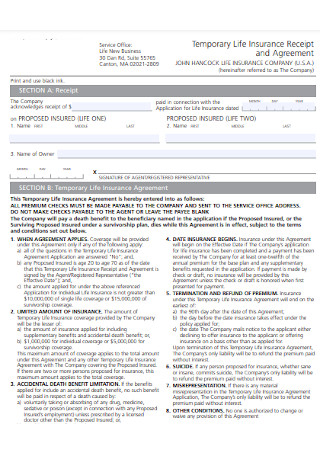

Temporary Insurance Agreement Receipt

download now -

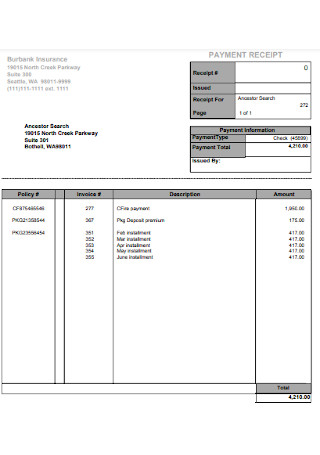

Insurance Payment Receipt

download now -

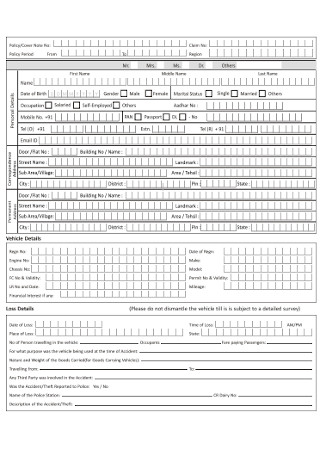

Motor Insurance Receipt Form

download now -

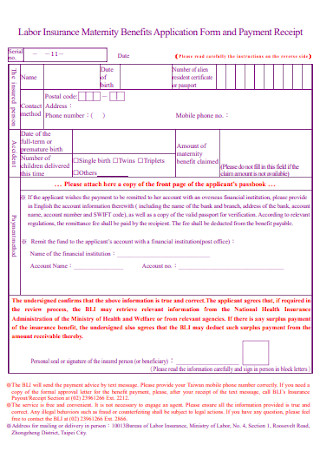

Labor Insurance Payment Receipt

download now -

Insurance Bill Receipt Template

download now -

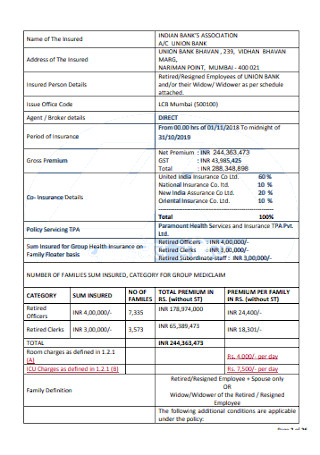

Health Insurance Receipt Template

download now -

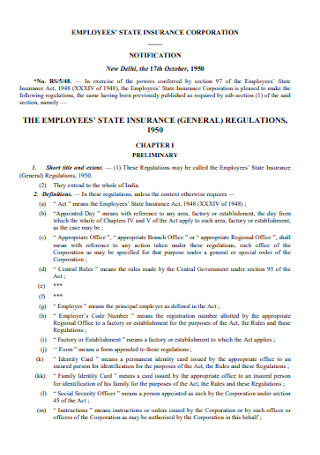

Corporation Insurance Receipt

download now -

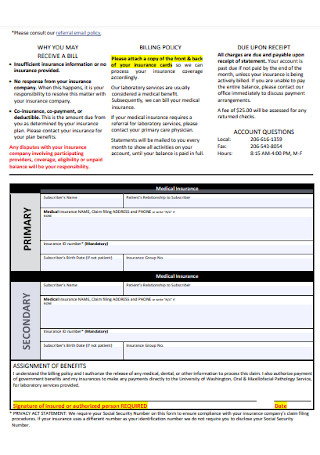

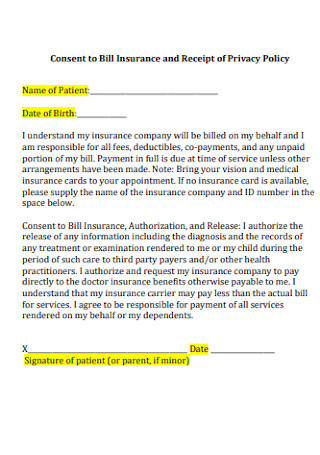

Consent to Bill Insurance and Receipt

download now -

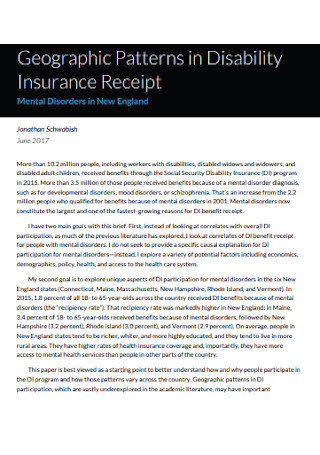

Patterns in Disability Insurance Receipt

download now -

General Insurance Company Receipt

download now

FREE Insurance Receipt s to Download

19+ Sample Insurance Receipts

What Is an Insurance Receipt?

The Top Four Important Types of Insurance

How to Create an Insurance Receipt

FAQs

Is the insurance receipt the same as proof of insurance?

What are other examples of insurance?

What is a conditional binding receipt?

What Is an Insurance Receipt?

An insurance receipt refers to the official receipt given to the person whose payment will proceed to insurance. And it is a useful tool to prove that one’s payments did not go wasted but actually went to their insurance coverages. Expect the insurance receipt to tackle the account holder’s name, payment amount, balance, serial number, and more.

It was reported that in 2019, 92% of Americans are secured with health insurance.

The Top Four Important Types of Insurance

One of the important considerations in making an insurance receipt is to ensure that the details encoded in the receipt are relevant to the purpose. Thus, don’t assume that a life insurance receipt’s details are the same as the vehicle insurance receipt’s. And in this section, get introduced to the four main types of insurance you would need.

How to Create an Insurance Receipt

In general, insurance safeguards people. Anything can happen in future circumstances anyway. So it only makes sense to also be concerned about insurance receipts—your proof of payment. But make sure the insurance receipt is legitimate, comprehensive, and detailed. And you can make insurance receipts by following these steps:

Step 1: Use an Insurance Receipt Template

What better way to craft insurance receipts quickly than to use sample insurance receipt templates? Using such templates, there is no need to make a receipt form out of scratch. Just work on a sample insurance receipt’s format, design, and other information. However, ensure that the template used suits your insurance receipt’s purpose. For example, are you using an insurance receipt for health, vehicle, or any other example? Be specific.

Step 2: Insert the Labels and Categories

Speaking of purpose, continue the finishing details of the insurance receipt from its labels and categories. Expect to write the name of the account holder, the amount paid, date of payment, unique serial number, and the company branding. Moreover, label if the insurance receipt covers a gold member, premium member, or just a general member. That is because different benefits could be present in the coverage. Also, add tables and charts to categorize details.

Step 3: Keep It Simple and Direct

As much as possible, keep the insurance receipt short and simple. Focus only on the essential details as mentioned in step two. And be direct because too many flowery words won’t help; they only confuse whoever reads the receipt. And don’t forget that a receipt is just like a small certificate. It doesn’t need to be big. What matters most is that the insurance payment details are written.

Step 4: Secure Extra Copies

When you are confident with the outcome, print the receipts. But, be mindful about keeping an extra copy of such receipts. A customer might lose it or perhaps, some people might create fake receipts. At least your official copy proves what the real insurance receipt’s details are. And the unique serial number of each receipt is helpful for easy tracking, if necessary.

FAQs

Is the insurance receipt the same as proof of insurance?

Although an insurance receipt can be regarded as proof, it is not the same as proof of insurance. The insurance receipt only confirms that payment for insurance was received. Hence, proof of insurance has more information about the insurance and not just the regular payment confirmation.

What are other examples of insurance?

There are tons of insurance out there. And besides the four examples mentioned earlier, you might also be interested in property insurance, social insurance, guarantee insurance, marine insurance, liability insurance, and fire insurance.

What is a conditional binding receipt?

A conditional binding receipt commonly applies to health, life, and property insurance agreements. And the receipt guarantees insurers to accept the risk. Thus, the insured will be covered on the date he or she got the receipt.

An insurance receipt marks the official confirmation that an individual’s payment was received. And to ensure its purpose works as intended, the written details should not be taken for granted. Any tiny error inputted in the receipt could lead to a grievance. Hence, always double-check its content and be guided with sample insurance receipts so you won’t fail in the process. Download now!