10+ Sample Investment Receipts

-

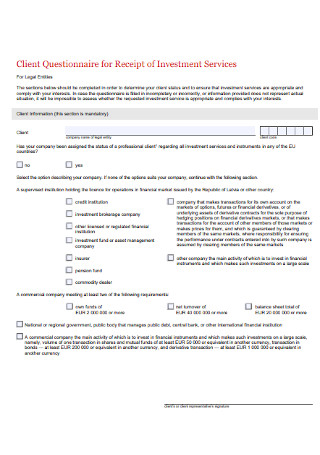

Questionnaire for Receipt of Investment

download now -

Notification of Receipt of Application for Investment

download now -

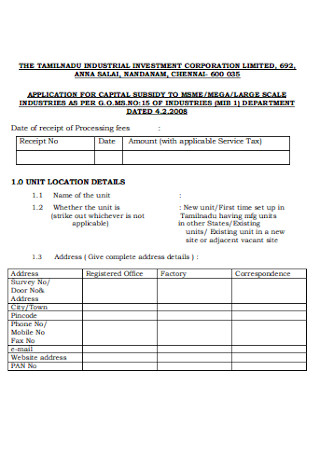

Industrial Investment Receipt

download now -

Invetment Prospectus Receipt

download now -

Fundamentals of Investment Receipt

download now -

Real Estate Investment Receipt

download now -

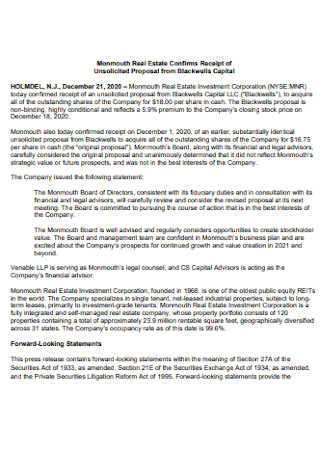

Real Estate Confirms Receipt

download now -

Investment Claim Receipt

download now -

Social Investment Partners Announces Receipt

download now -

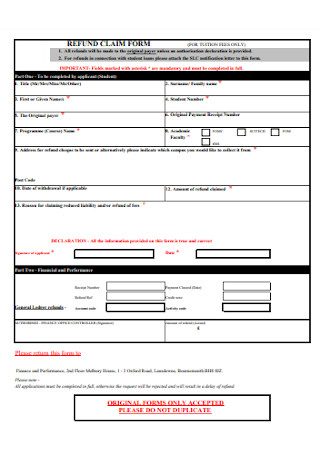

Investment Refund Receipt

download now

FREE Investment Receipt s to Download

10+ Sample Investment Receipts

What Is an Investment Receipt?

What Is the Purpose of a Deposit Receipt?

Components of an Effective Investment

How to Maintain an Investment Receipt

FAQs

Why Is it Important to Invest in Depositary Receipts?

What Kind of Security is a Depositary Receipt?

What do Receipts Mean in a Financial Transaction?

An acknowledgment of payment receipt is a written acknowledgment that the cash, property, or anything of value was collected; in addition, this receipt serves as a record and confirmation of the transaction. An acknowledgment of payment receipt is a legal document. These documents are also critical in preventing any disputes or misunderstandings about the specifics of the deal. It is generally acceptable to utilize the information included in this record to track any type of payment that has been received from customers, suppliers, customers, or business partners. These receipts are also extremely important when market analysts are putting out a business plan that is intended to increase revenue and profit. Essentially, these receipts aid the business owner in keeping track of all business transactions as well as the names and contact information of clients or consumers. As a result, it is a more convenient method for any company’s accounting department to conduct an audit of the company’s profits, losses, and other important information. In order to write an acknowledgment reception effectively and professionally, you must first use your organization letterhead to communicate with an expert, then identify the basic objective of the document and address it to the appropriate individual or organization. Other important actions include being sincere, sending the acknowledgment reception on time, being polite, and proofreading the document.

What Is an Investment Receipt?

When a person obtains capital or assets as compensation as a result of a purchase or other transfer of goods or services, the receipt is known as an investment receipt. Investment receipts are sometimes referred to as bills in particular situations. The receipt is usually provided by the person who has received the money, but in other instances, such as in the specific instance of items returned for reimbursement, the receipt is provided by the person who has paid the money. There are other investment receipt templates that are associated with the original one. We have an investment transaction receipt, investment receipt budget, refund receipt, investment receipt agreement, investment receipt & replacement form, investment receipt & payment schedule, receipt of the investment services form, receipt of an application for investment promotion, investment remittance receipt, foreign direct investment, receipt of investment in diagnostics, investment receipts, advance receipts, and application for receipt of investment. These templates can be downloaded anywhere in any search engine.

What Is the Purpose of a Deposit Receipt?

A deposit receipt is a piece of paper that a bank issues to a depositor in exchange for money or bank deposit checks that the depositor has made. The receipt contains information on the deposit, including the date and time of the deposit, the amount of the deposit, and the account into which the funds were sent. Using a deposit receipt as part of the money-processing scheme of inner checks can be extremely beneficial. As soon as a bank deposit receipt is returned, it should be compared to the total amount of money that was recorded in the cash receipts notebook for that particular day.

Components of an Effective Investment

There are a variety of approaches that may be used to create a deposit receipt that will eventually convert into a profitable investment. Stated below are the components on how to make an investment effective.

How to Maintain an Investment Receipt

When your company receives money from an external source, such as a client, an investor, or a bank, you must report the money as investment receipts. In addition, when you receive payment from a customer, you must document the transaction and display the sale on your balance sheet in order to be compliant. When you get money from a customer, the money goes into your bank account and boosts (debits) your balance sheet.

1. Specify the Overall Layout of the Document

The first step in creating the receipt is deciding on its appearance. To accomplish this, you must first consider why you are creating the receipt; the reason for creating the receipt will then define the layout of the receipt. Suppose you are opening a restaurant and making an investment in it. The format of a restaurant receipt will typically feature the name and address of the establishment placed at the top of the receipt. This is followed by the bill number, a list of the articles with their corresponding prices, and a closing statement.

2. Make a Decision on the Typography

The next stage is to choose the design elements that will be used. In addition, the typeface is a critical component of every design. The font has an impact on how people perceive what they are seeing. There are two font families to pick from serif and sans serif. Serif fonts are the more traditional style. Serif fonts are more elegant and have a more retro vibe to them than sans serif fonts. Sans serif fonts, on the other hand, are more contemporary and easier to read. When selecting a font family from any of the two options, be certain that it is appropriate with the overall theme of the product or service.

3. Create a Color Scheme for Your Project

Color is a design element that may be used to convey a variety of moods and feelings. Colors such as blue and teal, for example, provide coolness, whilst brown and beige bring warmth. Because of this, selecting the appropriate color palette is critical. However, for the text, do not use more than one color in one paragraph. Even in the background, avoid using too many colors because it may become distracting. The text color should be kept black, and the background color should be kept close to the color of the product/service or the company’s theme color to avoid confusion.

4. Applicable Software Should Be Utilized

When you have settled on the part of the invoices, the next step is to create the invoice receipt. You can use any application for this, such as Google Docs, Google Sheets, Word, Pages, Excel, and Numbers, to create your document. Once you have chosen the suitable program for your receipt, you must create separate rows and columns for each of your different headings and sub-headings, as well as assign titles to each of these rows and columns.

5. Include All of the Necessary Information

After you have assigned titles to the various columns, you will need to fill in the blanks with the relevant information. Examples of sample receipts include information about the establishment (for example, the address). Generally, every receipt contains exactly the same information, which begins with the company’s name and contact information at the top of the page. This comprises the company’s name, address, and other contact information, among other things. These particulars must be provided.

6. Mention the Purchased Item as Well as the Purchase Price, and Print the Receipt

The other elements that should be included on the receipt are the items that were purchased and their relative prices. The bill number and purchase date need to be included before this step can be completed successfully. Listed under the bill number in two different columns should be the list of things to be purchased, as well as their respective prices. Alternatively, you can offer one-line descriptions of the things after the names of the items. A discount or voucher should be included at the conclusion of the transaction if one has been issued. It is necessary to include the whole sum at the end of the document. Once you’ve gathered all of the necessary components, you’ll need to put them together and put them together into a receipt. Following that, you should properly review the dummy document for any errors or inconsistencies. Check to see if there are any mistakes. If you are satisfied with it, you may take the dummy to a printing store and have the copies printed for you there. Alternatively, if you have the necessary equipment, you can print them at home. Following this, your receipt will be ready to be used.

Despite the fact that most receipts contain exactly the same information, it is recommended that you check a variety of receipt sample resources before presenting your preferred receipt format. It is critical that you take a look around. If you get a free template from the Internet, you will be able to customize each receipt by adding your company name, logo, and receipt number to each one that is generated electronically. Many customers choose to manage their commitments through the internet. In order to keep up with these transfers, your office personnel will need to be informed. Your bank statements will need to be reviewed on a daily basis, and any payments made will need to be deducted from your clients’ accounts.

FAQs

Why Is it Important to Invest in Depositary Receipts?

Investment in depositary receipts provides you with the option to reap the benefits of international investment while avoiding the extra dangers associated with investing outside of your home country. Investment in DRs, like any other security, requires an understanding of why they are utilized, as well as how they are issued and traded, in order to be successful.

What Kind of Security is a Depositary Receipt?

When it comes to financial securities, a depositary receipt (DR) is a sort of negotiable (transferable) financial security that is sold on local stock exchanges but reflects security (typically in the form of equity) issued by a foreign publicly traded corporation. It is possible for investors to hold equity in other nations through the use of a DR, which is a tangible document.

What do Receipts Mean in a Financial Transaction?

The Most Important Takeaways It is a type of paper that serves as proof that a financial transaction has taken place. Receipts are issued in a variety of transactions, including business-to-business and stock market transactions. Receipts are also required for tax purposes in order to prove the reimbursement of certain expenses.

If you deal with a small number of receipts, maintaining them in paper form by the month may be sufficient for your needs. There are other options for storing them, including hanging reference files or an accordion file that is divided by month. It should be quite simple to enter information from a limited number of receipts into a financial management tool, and retrieving a receipt should be straightforward provided the receipts are filed in the proper manner. In the event that you manage a disproportionately large number of receipts, you can save energy and time by automating the storage, retrieval, and entry of receipt information.