11+ SAMPLE Landlord Receipts in MS Word | PDF

-

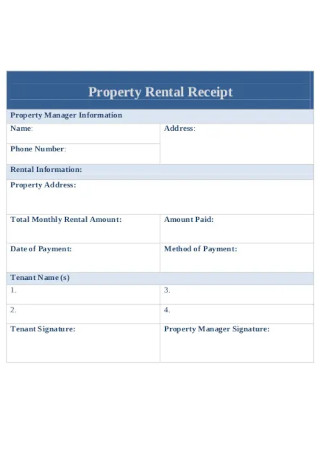

Property Rental Receipt

download now -

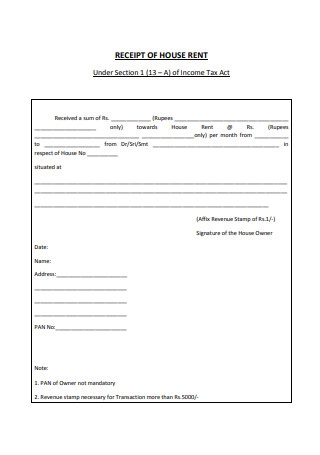

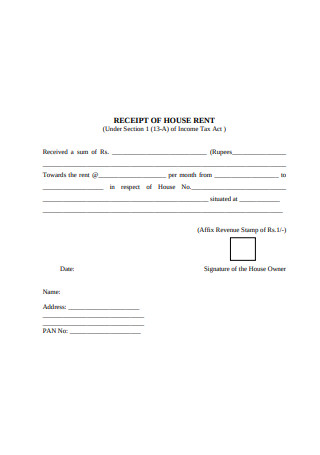

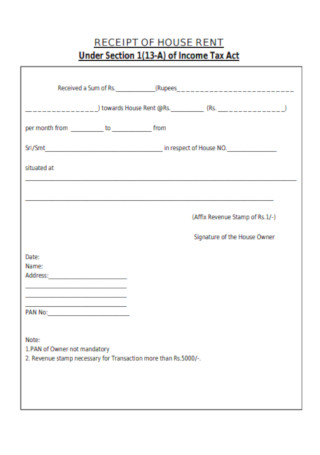

Landlord Receipt of House Rent

download now -

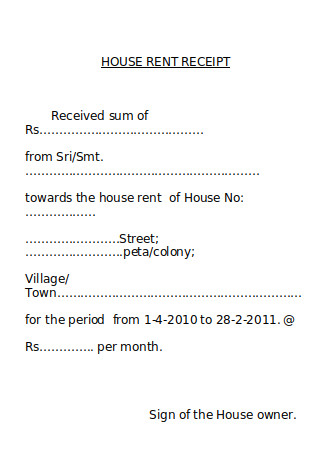

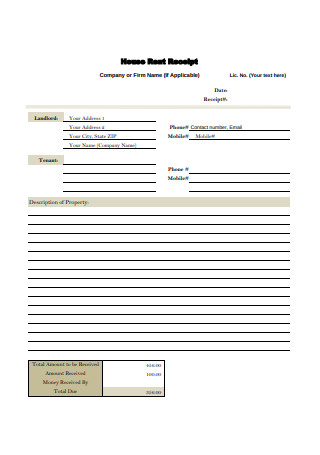

Landlord House Rent Receipt

download now -

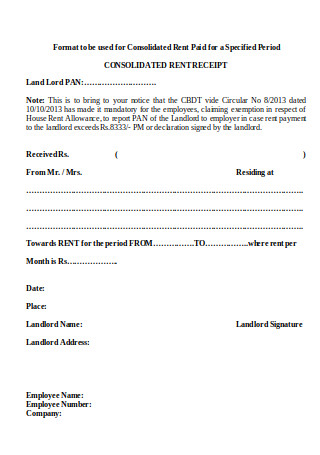

Consolidated Rent Receipt

download now -

Landlord Receipt of House Rent

download now -

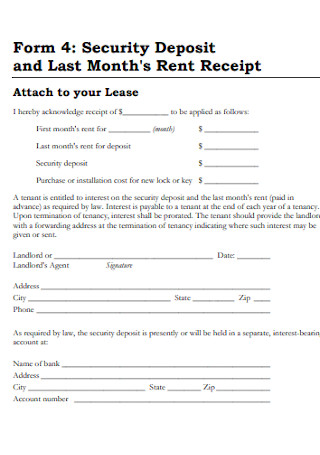

Monthly Rent Deposit Receipt

download now -

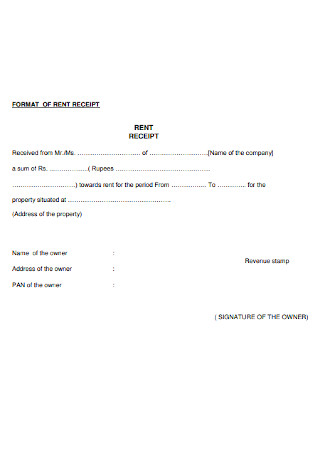

Monthly Rent Receipt Format

download now -

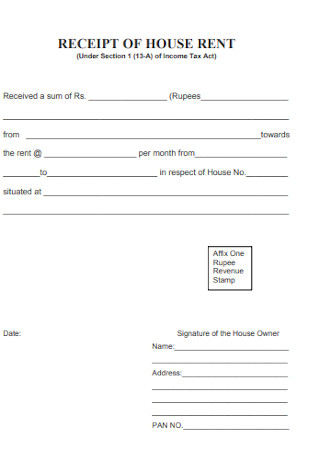

Monthly Receipt of House Rent

download now -

House Rental Receipt of Landlord

download now -

Simple House Rent Receipt

download now -

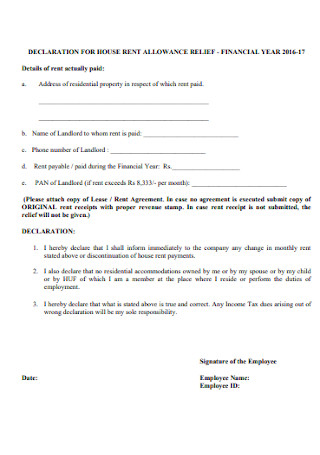

House Rent Allowance Receipt

download now -

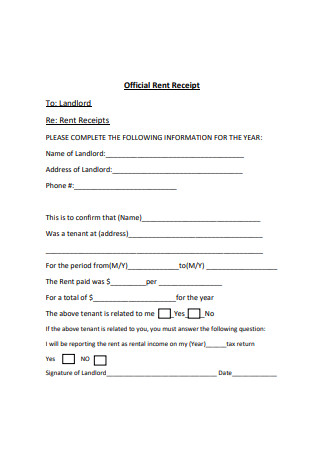

Official Rent Receipt

download now

FREE Landlord Receipt s to Download

11+ SAMPLE Landlord Receipts in MS Word | PDF

Landlord Receipts: What Are They?

What Are the Different Types of Receipts?

How to Make a Landlord Receipt

FAQs

What are the benefits of a landlord in providing rent receipts?

How is having a rent receipt beneficial to tenants?

What states require landlord receipts?

Landlord Receipts: What Are They?

There are many types of receipts and each of them is unique depending on what type of business they are used to and what industry they serve. But whether it is a bill receipt or a restaurant receipt, it only serves one purpose, which is to acknowledge something with value has been transferred from one party to another.

When it comes to a rental business, sale receipts are essential documents. A landlord receipt comes in many names. Some call it a rent receipt or a tenant receipt. This receipt is an acknowledgment of payment made by a tenant. Typically, it is in the form of cash but can be for cards and physical checks too to show that the tenant paid on time. A receipt commonly consists of the property address, payment source, landlord’s signature, and most importantly the amount paid.

A report published by United Nations found that 3.6 million eviction cases each year are filed in the United States on average. This results in approximately 1.5 million eviction judgments annually. There are many factors affecting eviction. It is a cause and consequence of poverty. Housing costs also contribute to why the eviction rate in the US is so bad as it is too high for poor renting households, placing them at risk of eviction.

What Are the Different Types of Receipts?

Did you know that receipts can improve your chance of getting a refund from the Internal Revenue Service (IRS)? If you collect the right payment receipts, you can lower your taxable income and increase your potential for a tax refund. A great place to start is ransacking your home on a mad hunt to cull all those receipts from business trips, work lunches, and any other necessary expenditure when the deadline to file taxes is nearly approaching. To be more acquainted with what receipts to keep and not to keep, here are the different types of receipts that you should be more familiar with.

How to Make a Landlord Receipt

If there different types of receipts, it means there is no one way in making one. Many methods are used to make receipts. That includes using a template. If you do not want to start from scratch, you can get a template from our collection. The advantage of using a stencil is it promotes consistency to your document. It also saves you time. Browse through our website and discover an array of ready-made templates. Click the download button and start editing your template. The steps below will help you modify your receipt template into a working landlord receipt.

Step 1: Collect the Payment

Collecting payment will depend on what the landlord and tenant agreed on in the lease contract. For rent, it should be collected once a month. When it is time to pay the rent, you can send a notice or billing statement to the tenant. It will remind them of their due. Once they have paid the bill, you can send them the receipt.

Step 2: Include the Tenant Details

To make a receipt complete, it must contain tenant details. This includes the tenant’s name, contact information, location of the rented property, and other relevant information. You can also include in this part business information. Do not forget to indicate the date of the last payment, amount due, and date of the payment form.

Step 3: Let the Landlord Sign the Receipt

Signing the receipt means you understand and attest that everything in it is based on facts. That why it is important to review the receipt before affixing your signature to it. You can not take it back when you have signed it. The receipt is considered official.

Step 4: Keep the Receipts

Give the tenant a copy of the receipt and save a copy for your record keeping. This is very helpful in case the tenant claims to have paid their monthly rent when they have not yet paid the current one. An official receipt can stand against the law of court too as it is a legal document.

FAQs

What are the benefits of a landlord in providing rent receipts?

There are several reasons why a landlord should issue rent receipts. This includes helping the landlord or management maintain a professional appearance. Additionally, a lease receipt helps landlords keep track of which tenants have paid and which have not. However, a receipt of payment by check does not prove that the check actually cleared. If a check is invalid, the landlord can still go after the tenant for the nonpayment of rent.

How is having a rent receipt beneficial to tenants?

For a tenant, having a landlord’s official receipts means you are current with your rent payments. If the landlord claims you have not paid, you can present a copy of the receipt you received from them. Similarly, if a landlord sues you for nonpayment or takes you to court for eviction notices, you can prove your payment by showing the receipt. Because a rent receipt shows you when rent is paid, it is a great tool when it comes to legal disputes in line with the lease.

What states require landlord receipts?

The requirements for house rent receipts are not the same in every state. Some states do even require landlords to issue lease receipts to their tenants. In Washington, Maryland, and Newyork, it is to provide receipts to tenants when they pay in cash. In other states, rent receipts are required upon tenant’s request, while others, such as Massachusetts, require rent in any situation. Moreover, there are cities that require rent receipts even if the state does not. So, check with your city’s local housing board.

Whether you are a landlord or a tenant, keeping rent receipts is a very helpful habit. The best way to get you started is by organizing your receipts from one type to another. More so, if your state allows a tax deduction for payment of rent, make sure you collect a receipt every month. To make the process easier, you can also use an online rental receipt form.