18+ Sample Loan Receipts

-

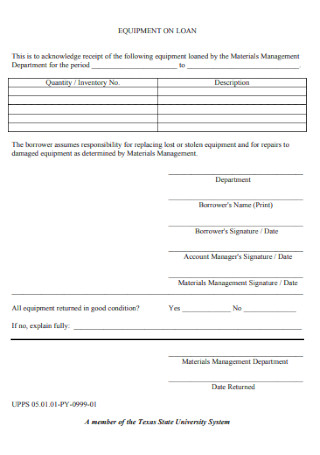

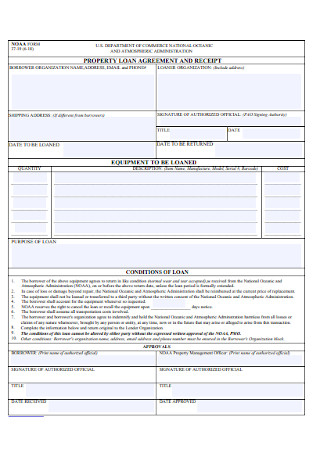

Equipment Loan Receipt Template

download now -

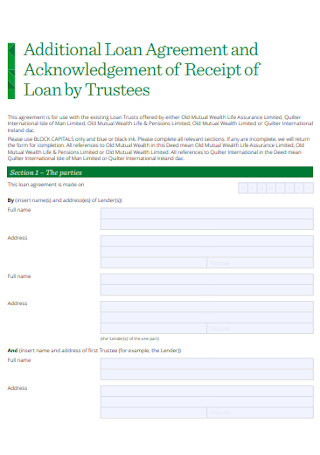

Trust Laon Receipt Template

download now -

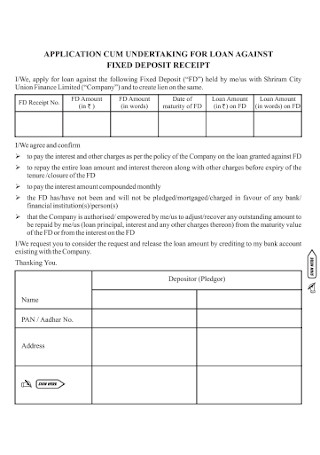

Loan Deposit Receipt

download now -

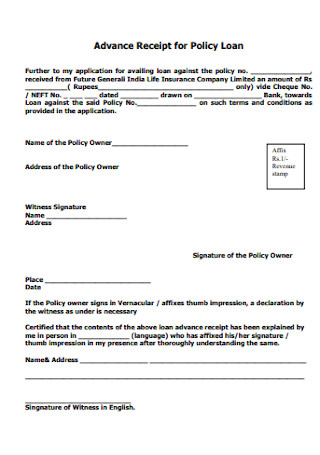

Advance Receipt for Policy Loan

download now -

Home Loan Receipt Template

download now -

Loan Agreement Receipt

download now -

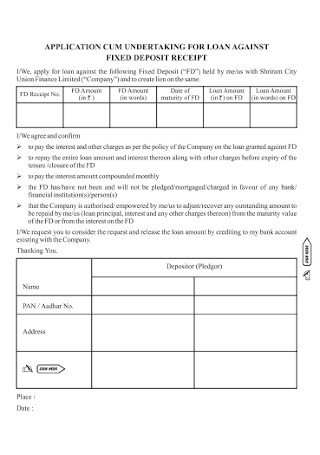

Loan Fixed Deposit Receipt

download now -

Bridge Loan Temporary Receipt

download now -

Property Loan Receipt

download now -

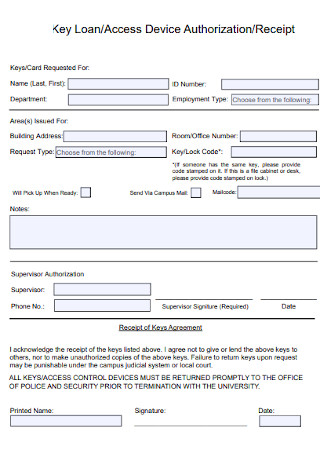

Loan Access Device Authorization Receipt

download now -

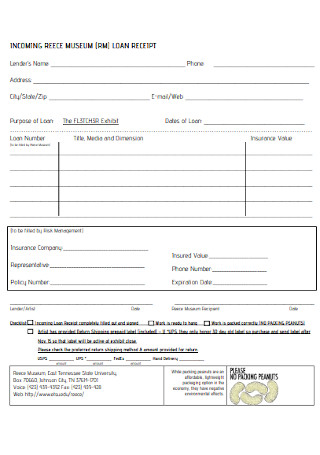

Mesum Loan Receipt Template

download now -

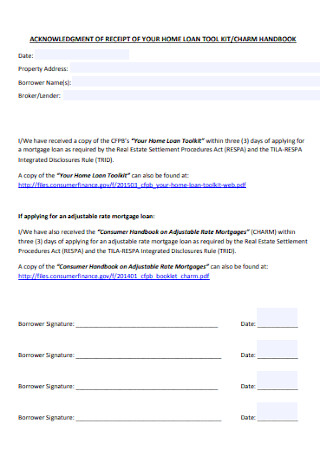

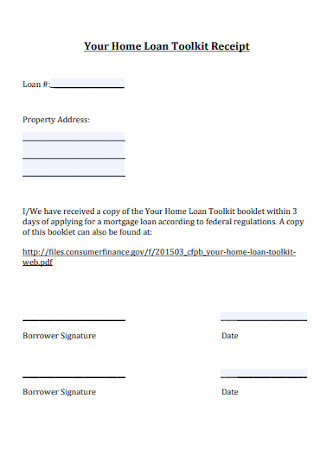

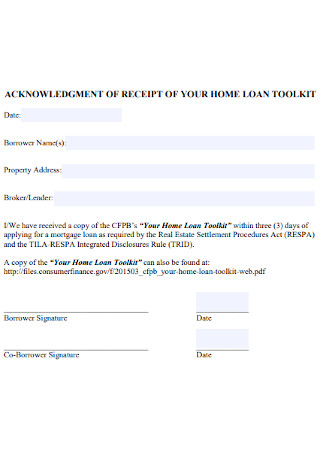

Home Loan Toolkit Receipt

download now -

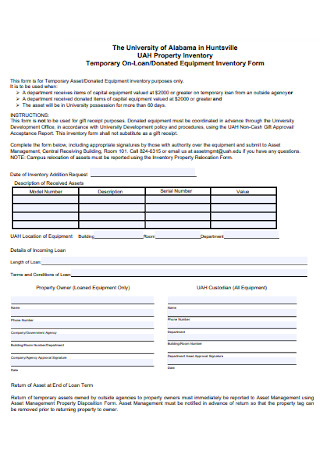

Temporary On-Loan Receipt

download now -

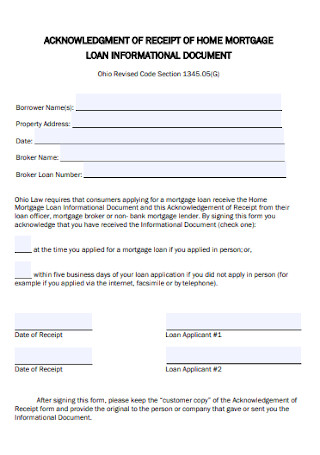

Loan Informational Receipt

download now -

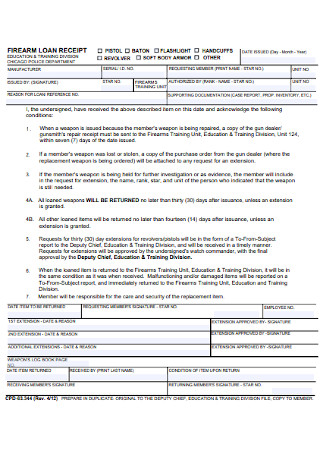

Firearm Loan Receipt Template

download now -

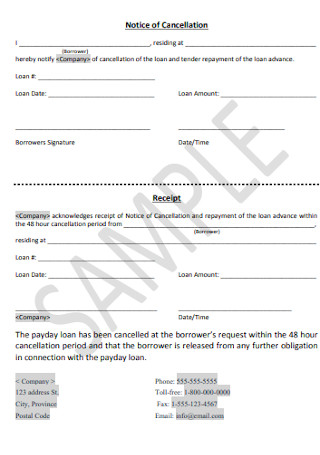

Loan Notice of Cancellation Receipt

download now -

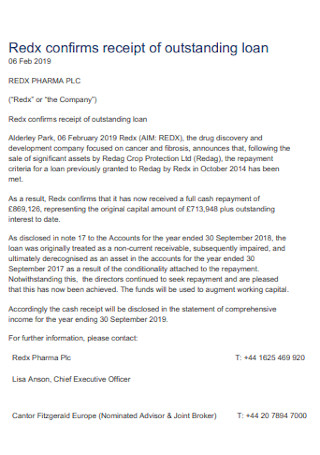

Receipt of Outstanding Loan Template

download now -

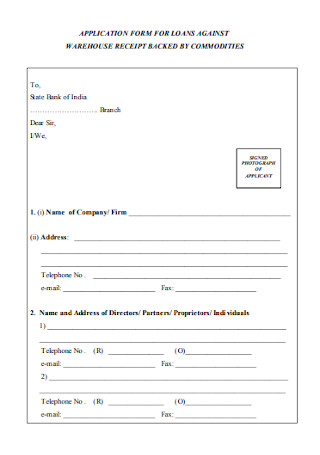

Warehouse Loan Receipt Template

download now -

Basic Loan Receipt Template

download now

What Is a Loan Receipt?

A loan receipt is a formal or official receipt that documents the financial transaction between a lender and a borrower. The former loans money to the latter for all kinds of reasons. The document serves as proof or evidence that the borrower received the money from the lender.

According to an online article by The Ascent, the number of people with personal loans has nearly doubled in the last decade. From 11 million in 2010, around 21 million people took out personal loans in 2020. From $55 billion, personal loan debt has also ballooned to $162 billion. The same article reported that the average amount of personal loan debt per borrower has evidently increased from $8,618 to $9,025.

Types of Loan

People take out loans for various reasons. Loans can be classified according to different categories as well. There are several different types of loans, with each serving a different purpose. The following examples describe just some common and universal examples of loans.

Tips for Borrowing and Lending Money

As discussed in the previous section, taking out a loan requires prudence and diligence. Borrowing money is a responsibility. You have the responsibility of paying back the loan and upholding your end of the bargain. For lenders or loaners, you also have to understand the risks involved and must ensure your protection and interests. The following examples are some simple yet effective tips to keep in mind for loan transactions.

How to Create a Loan Receipt

To create a loan receipt, you need to have had a prior agreement with whom you are transacting business with. And if you are looking for quick and easy receipt templates, you can easily download any of the available receipt templates above. Simply choose one that suits your needs then follow the basic steps below.

Step 1: Decide on a Format

The first step in creating a loan receipt is to decide on a format that will work for you. You can always use standard receipt templates or if you prefer to make your own design, that would work just fine as well. But by using a ready-made template, you can save a lot of time and effort versus starting from scratch. Alternatively, you can just use a standard receipt layout then customize the fine details or content of your receipt. Whatever you decide, just be sure that your format is consistent and comprehensible. The format should help the receiver or recipient understand the document easily.

Step 2: Indicate the Basic Details

Once you have established a clear format, the next step is to cover the basic details in your loan receipt. In a simple loan receipt, usually the date, name and amount are what matters. But depending on individual needs and circumstances, you can also indicate other secondary information. In some cases, the receipt number is indicated at the top of the document. Contact information can sometimes be included as well. In a loan receipt, it is typically stated in the first few lines of the receipt that a specified amount was received from the money lender. Be sure to write the complete name of the lender in the receipt.

Step 3: Include Notes or Conditions

After completing all the essential details, the next step is to enumerate any notes or stipulations that may be applicable. It is not always required, but some people find it necessary to include reminders or disclaimers in their receipt. You can list these notes below the basic information. Make sure they are organized and the font size is appropriate. Generally, conditions or notes are considered secondary, so the text size should be smaller in comparison to the basic information in the previous section. Aside from terms and conditions, you can also incorporate a table detailing the loan amount. A simple table that contains the description and value will work just fine.

Step 4: Leave Space for the Signature

After covering all the primary and secondary details in your loan receipt, do not forget to allot adequate space for the recipient to affix his or her signature. Make sure to leave enough space at the bottom of the document for the borrower to sign, indicating that he has received the loan amount indicated in the receipt. You can include a single line for them to sign on. A separate line for the date may also be placed beside it.

FAQs

What is a loan receipt?

A loan receipt is an official written receipt that a lender issues a borrower for a loan amount. It is a key part in the important process of documentation to protect both the lender and borrower.

What is receipt of payment?

A receipt of payment is a standard protocol whenever there is a financial exchange or transaction. The recipient of the money is usually issued a formal or official receipt of payment.

How do I write a loan agreement?

To write a formal loan agreement, you need to establish the identity of both the borrower and the lender. Once you have identified the parties entering into the agreement, indicate the amount borrowed, outline the different responsibilities, and enumerate the specific stipulations of the contract.

A loan receipt is essential for documenting the financial transaction of lending, borrowing, and advancing payment. If you are looking for quick and convenient templates to use as reference, browse the wide selection of sample templates above and customize your own receipt today!