Official Receipt Samples

-

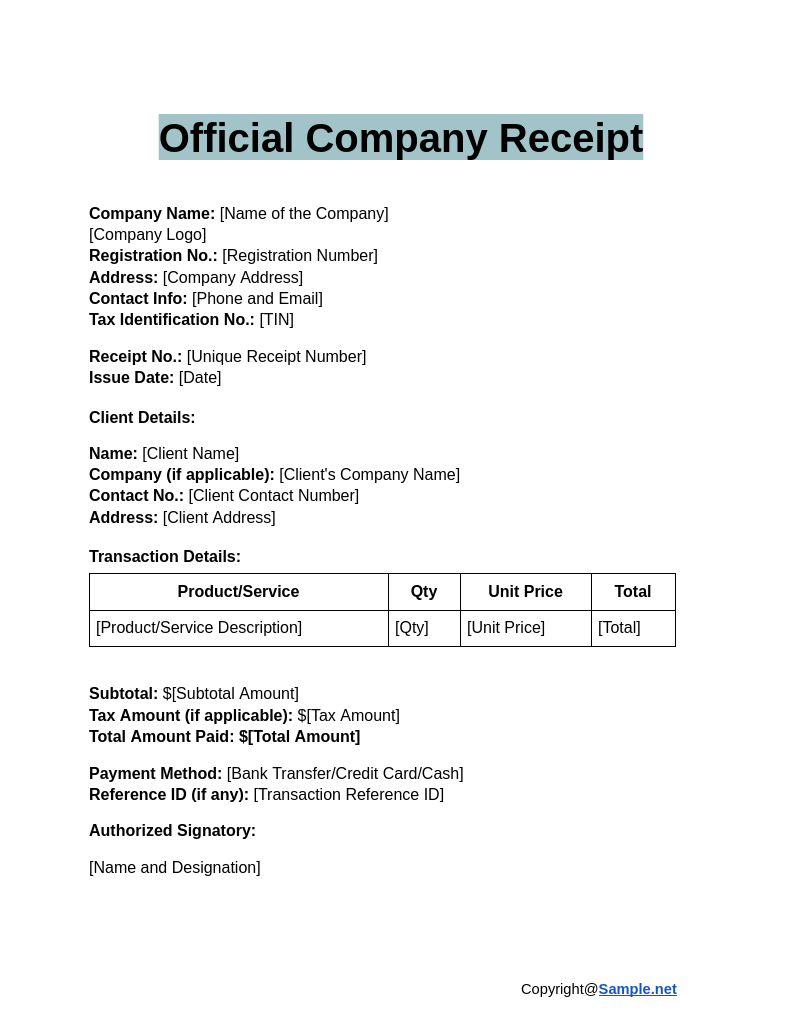

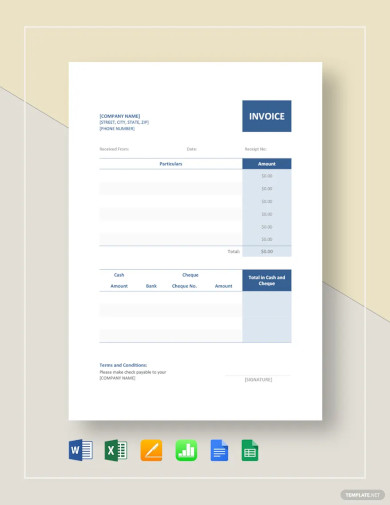

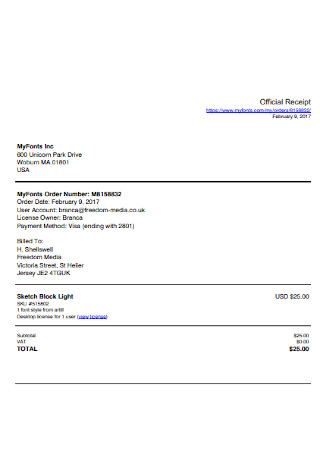

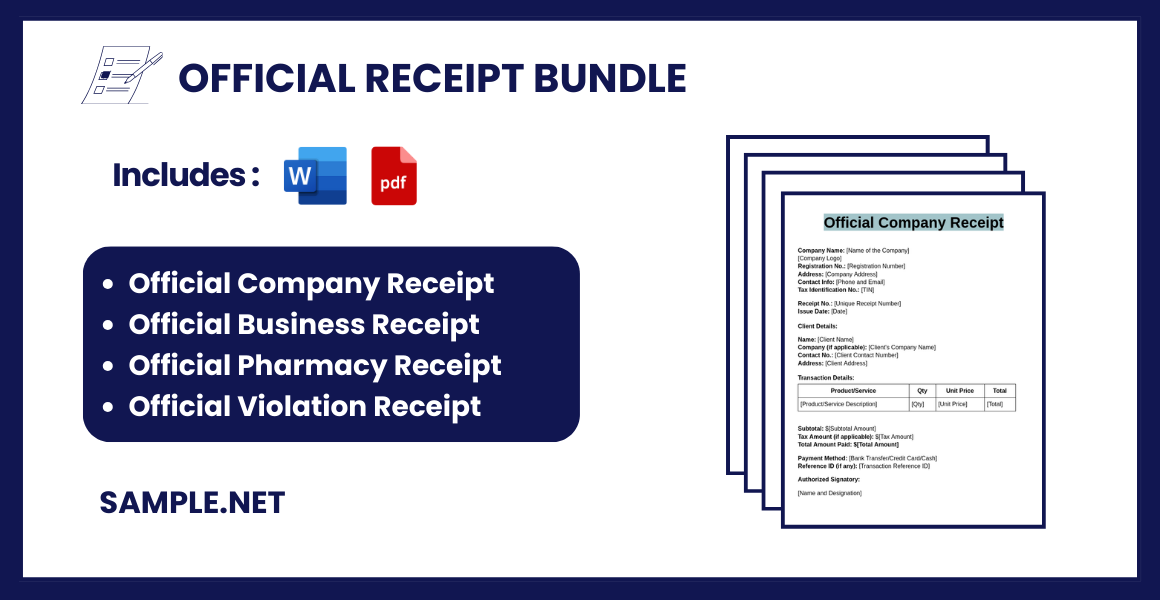

Official Company Receipt

download now -

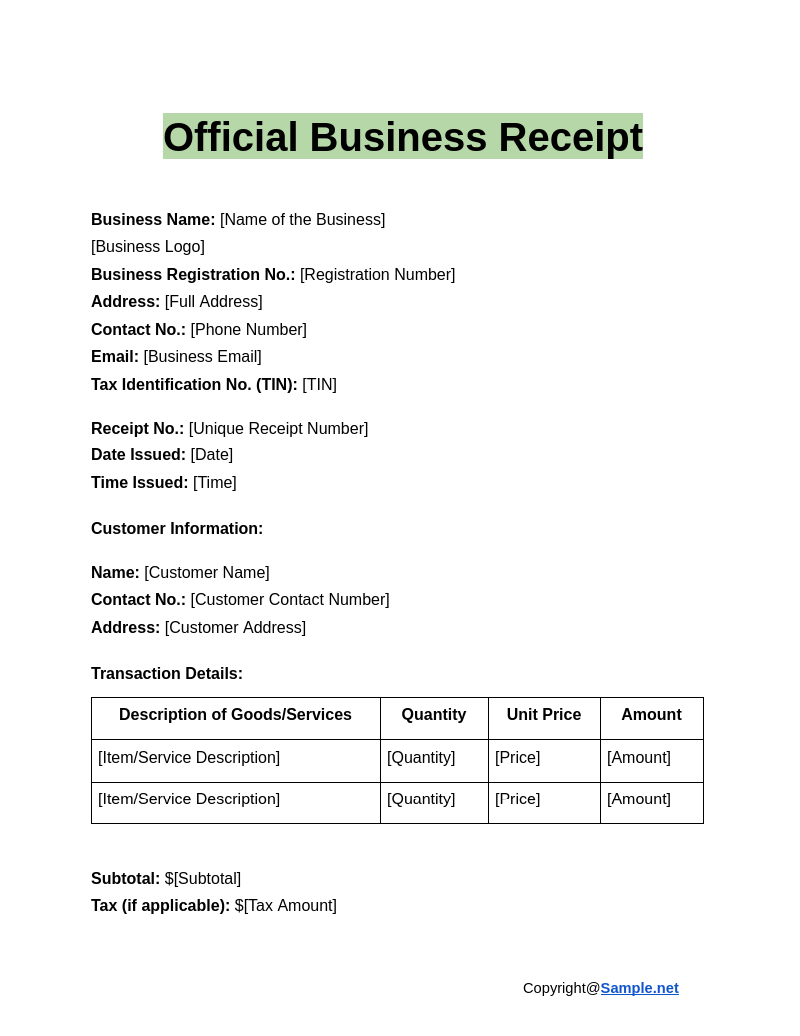

Official Business Receipt

download now -

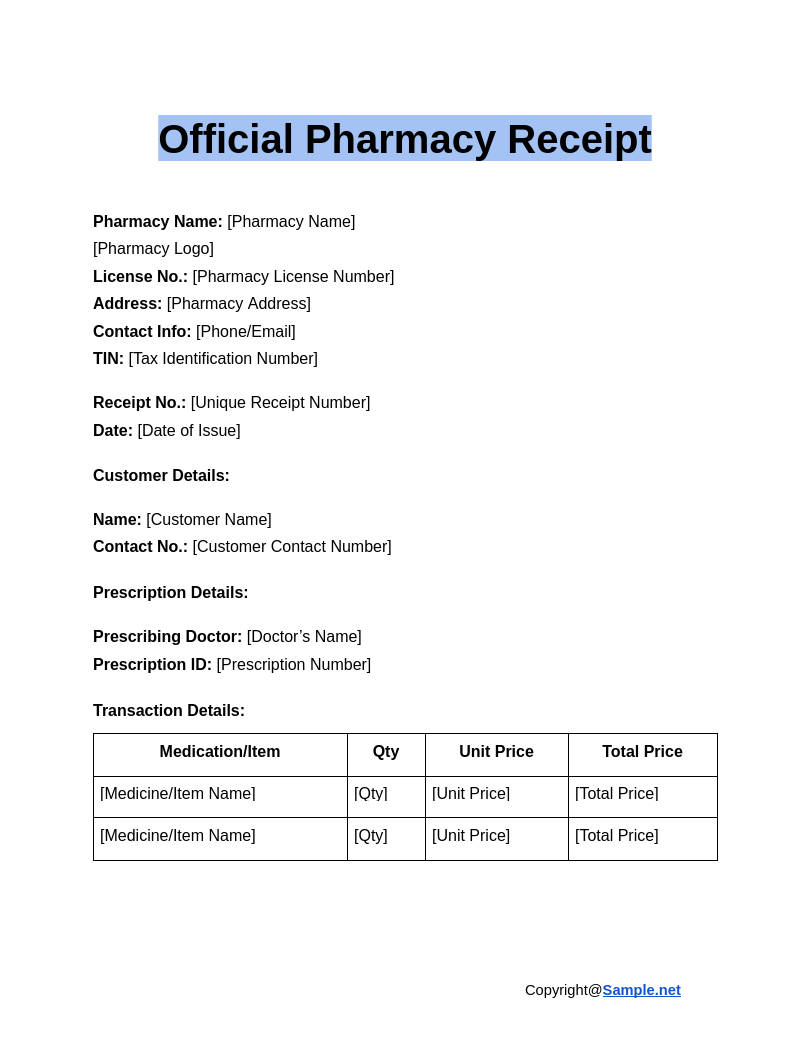

Official Pharmacy Receipt

download now -

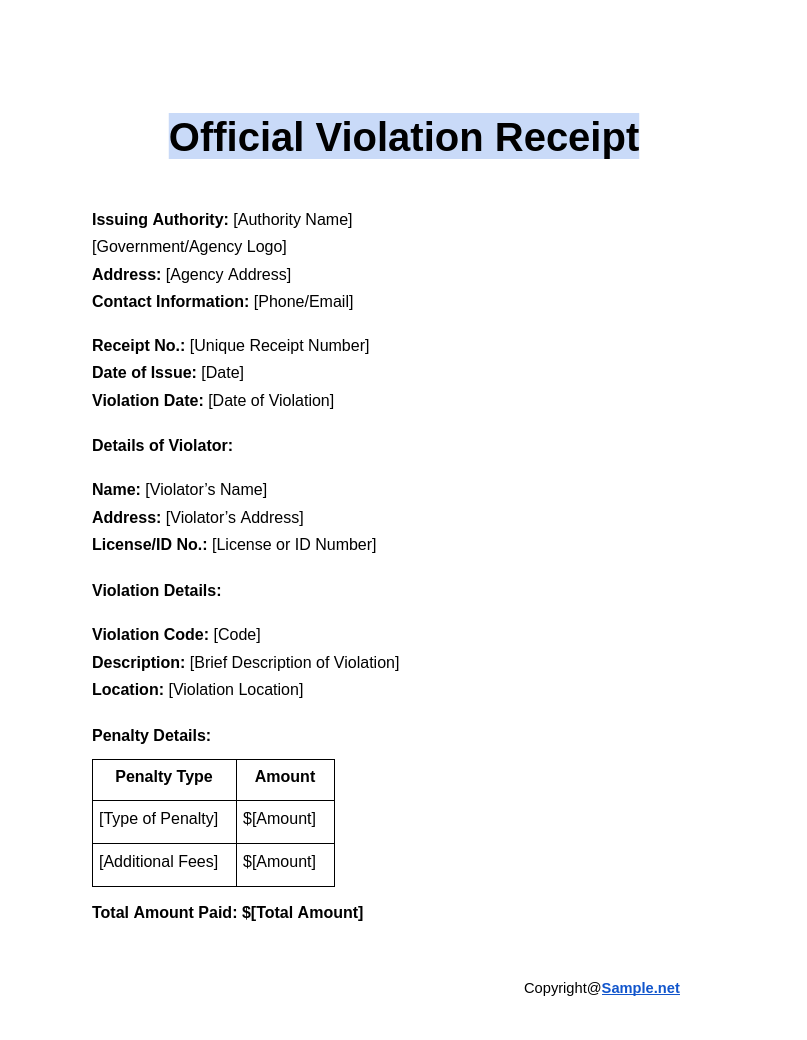

Official Violation Receipt

download now -

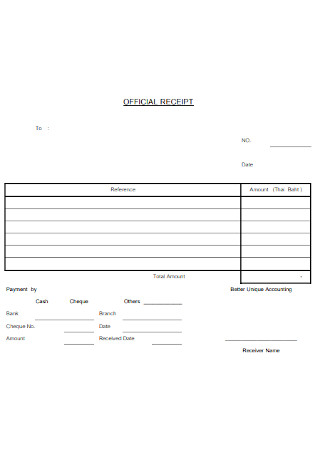

Official Receipt Template

download now -

Blank Official Payment Receipt

download now -

Official Cash Rent Receipt

download now -

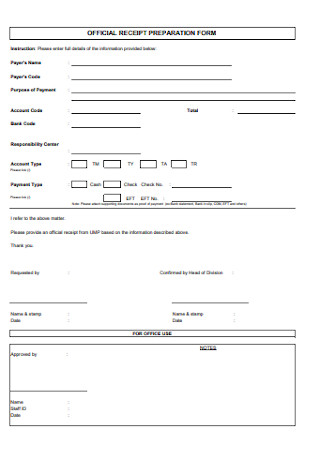

Official Receipt Preparation Invoice Form

download now -

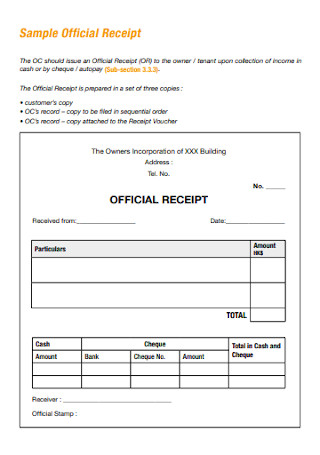

Sample Official Receipt Template

download now -

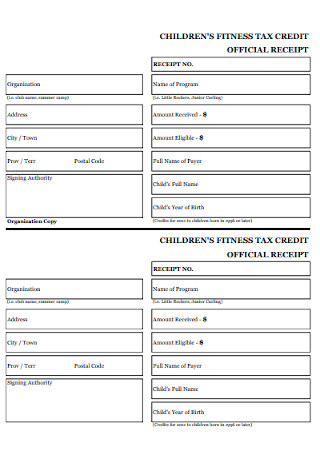

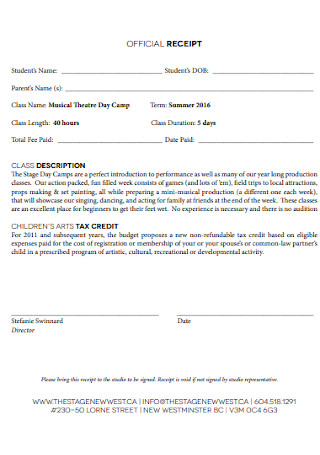

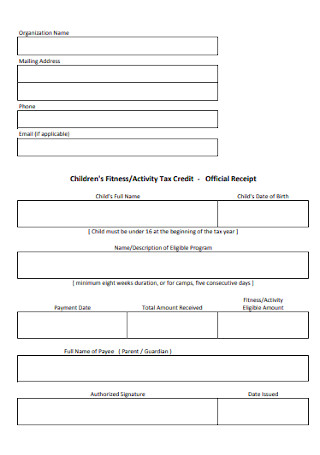

Editable Tax Credit Official Receipt

download now -

Official Acknowledgement Meeting Receipt

download now -

Official Restaurant Shooting Receipt

download now -

Sample Official Bill Receipt Form

download now -

Official Sales Invoice Receipt Format

download now -

Hotel Taxes Official Receipt

download now -

Zero Rated Official Receipt for Collection

download now -

Autocount Club Official Receipt

download now -

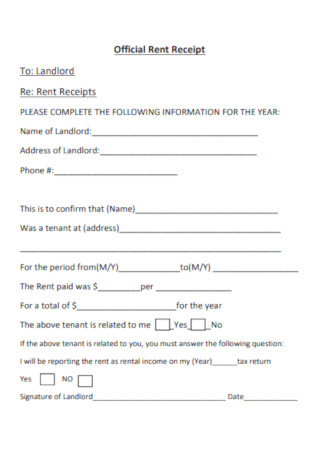

Official Rental Payment Receipt

download now -

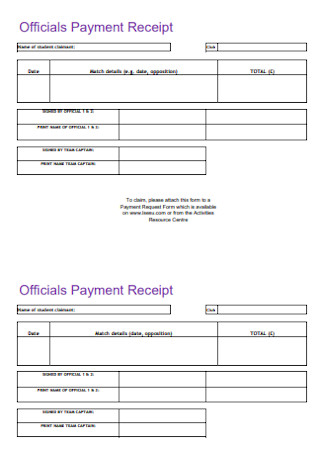

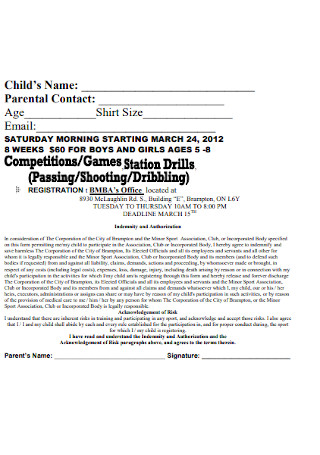

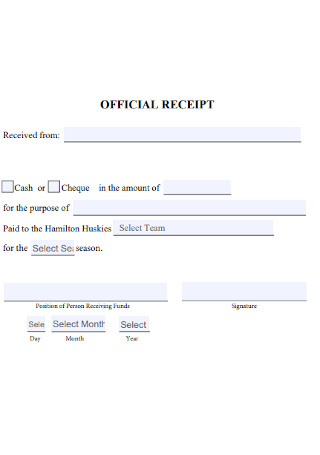

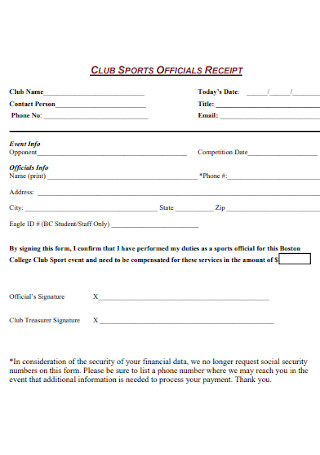

School Club Sports Official Receipt

download now -

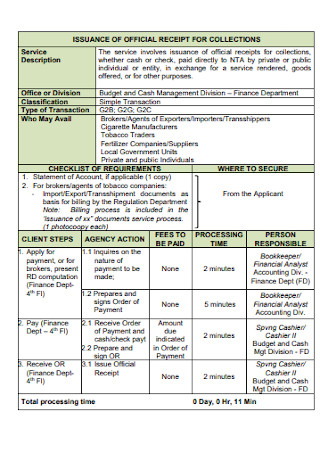

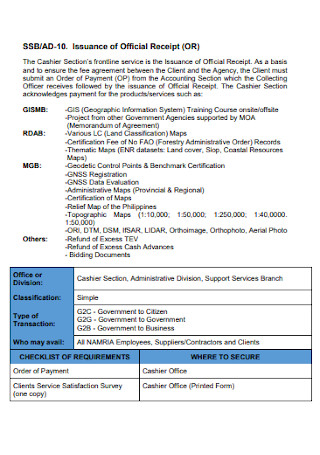

Issuance of Official Receipt

download now -

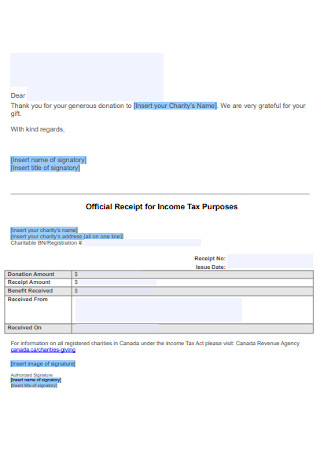

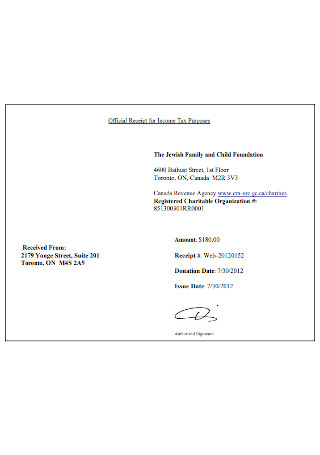

Official Receipt for Income Tax

download now -

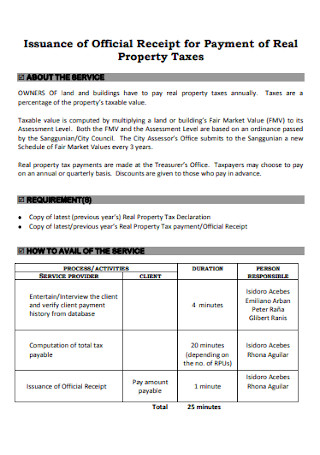

Official Property Taxes Receipt

download now -

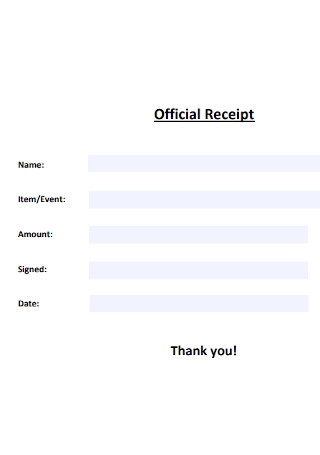

Simple Official Receipt Template

download now -

Sample Official Receipt for Income Tax

download now -

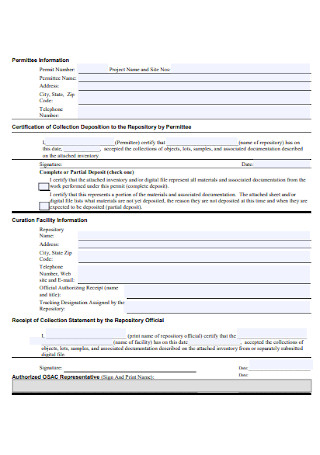

Official Receipt for Deposit Form

download now -

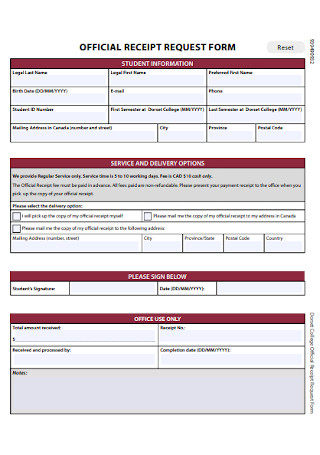

Official Receipt Request Form

download now -

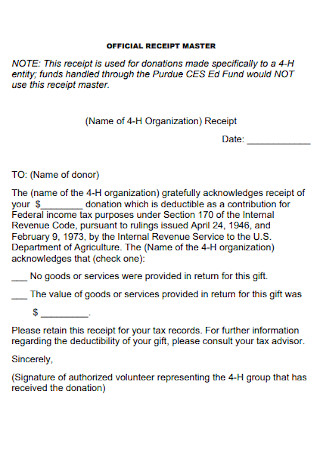

Official Receipt Master Template

download now -

Sample Official Receipt Format

download now -

Basic Tax Official Receipt

download now -

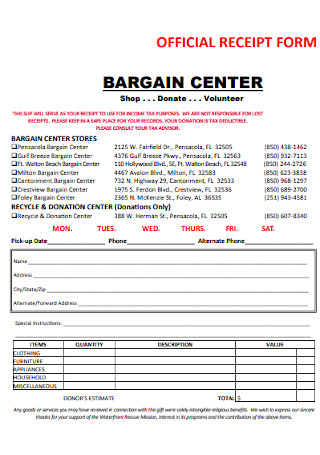

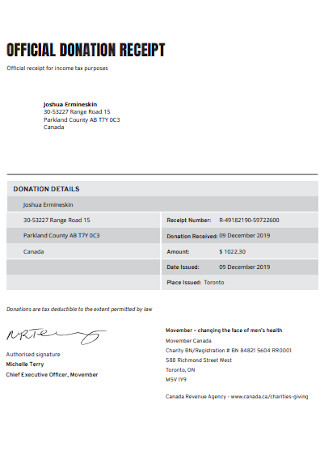

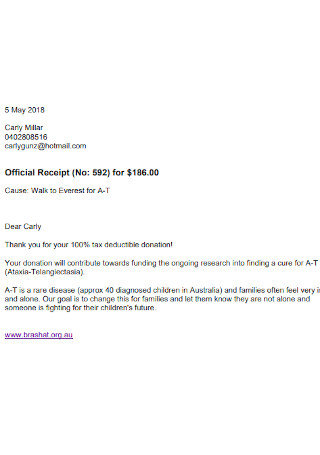

Official Donation Receipt

download now -

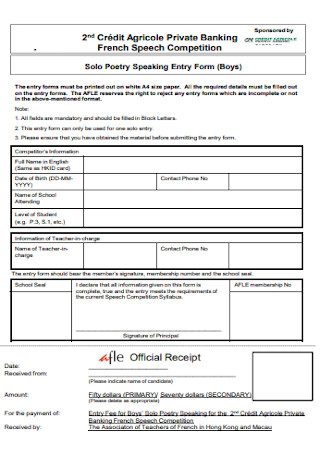

Official Banking Receipt Template

download now -

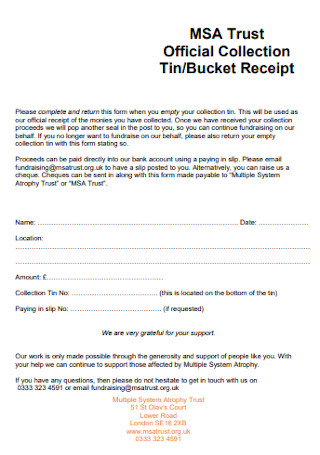

Trust Official Receipt Template

download now -

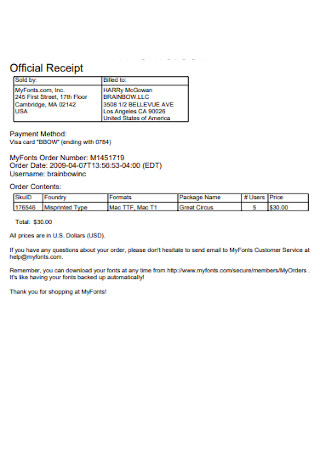

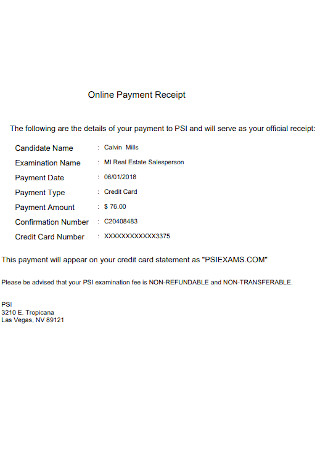

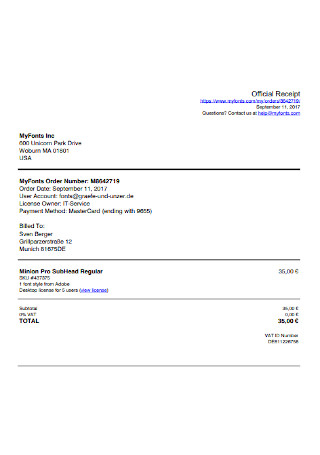

Official Online Payment Receipt

download now -

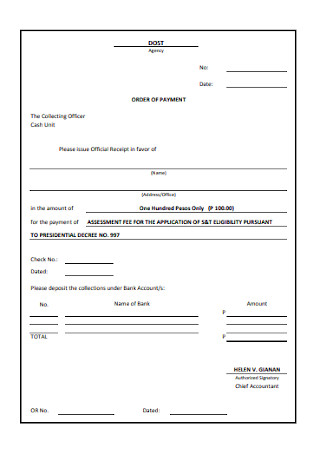

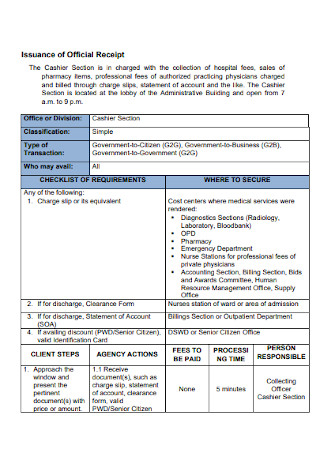

Issuance of Official Receipt Format

download now -

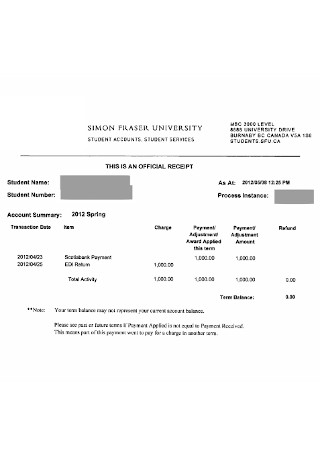

University Official Receipt

download now -

Standard Official Receipt Template

download now -

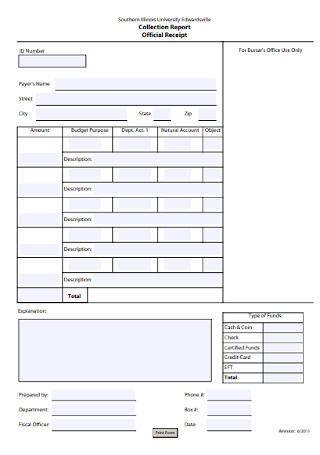

Official Receipt Report

download now -

Standard Official Receipt Example

download now -

Simple Official Receipt Example

download now -

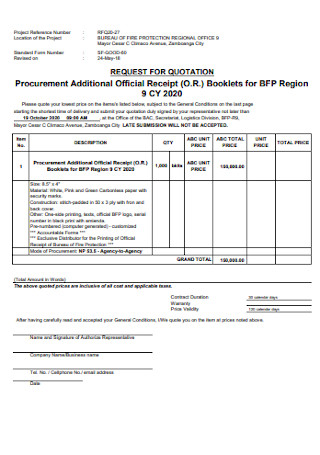

Procurement Additional Official Receipt

download now -

Printable Official Receipt Template

download now

FREE Official Receipt s to Download

Official Receipt

Official Receipt Samples

What are Official Receipts?

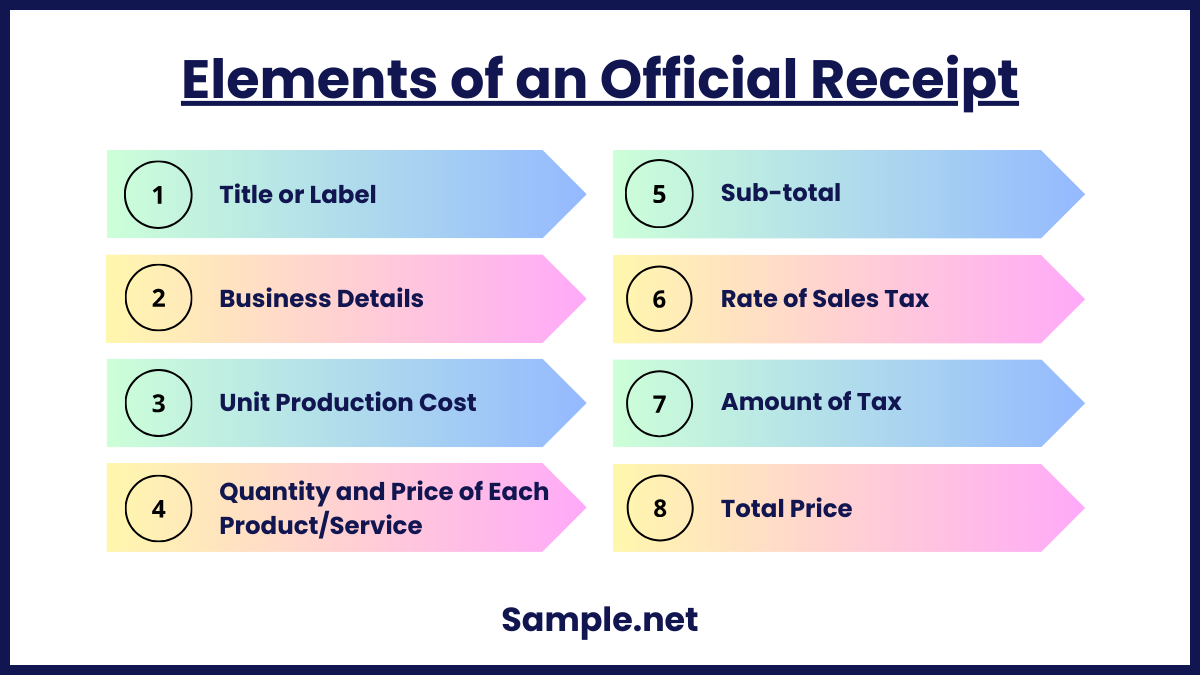

Elements of an Official Receipt

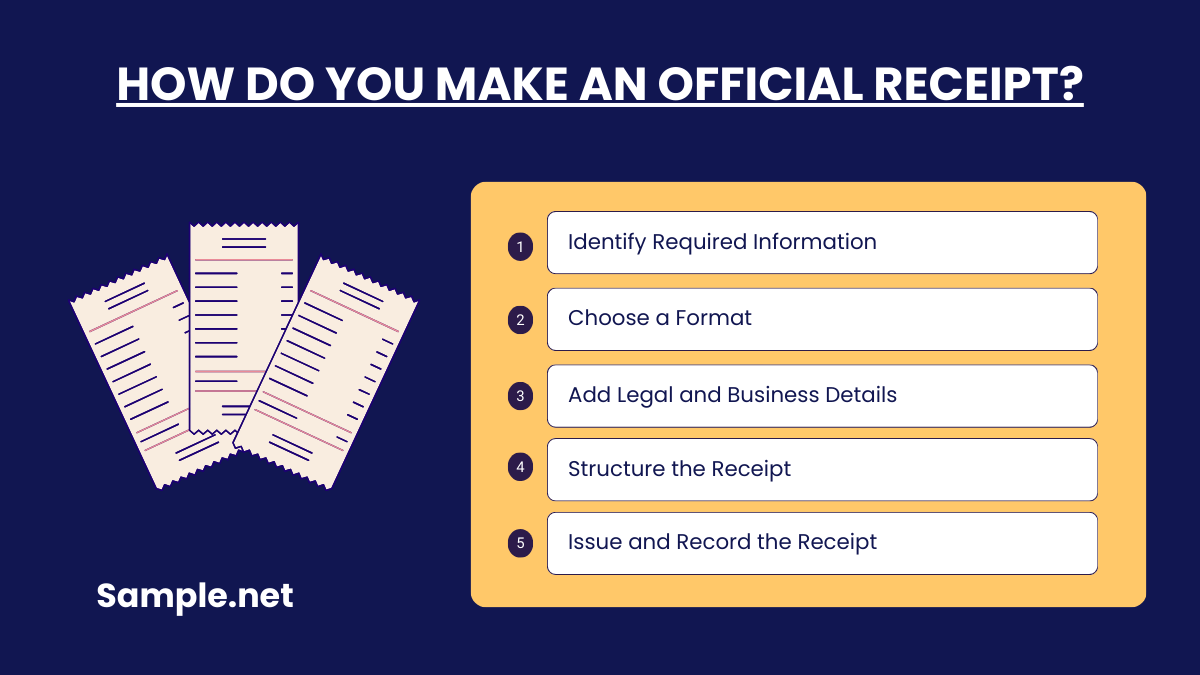

How Do You Make an Official Receipt?

FAQs

What are the different types of receipts?

How long should a receipt be kept?

What other business records should I keep?

Why are official receipts important for tax purposes?

What is the difference between an official receipt and an invoice?

What should I do if a business refuses to issue an official receipt?

Download Official Receipt Bundle

Official Receipt

Business Name

[Business Logo (optional)]

Address: [Business Address]

Contact Number: [Phone Number]

Email: [Email Address]

Tax Identification Number (TIN): [TIN]

Receipt No.: [Unique Receipt Number]

Date: [Date of Issue]

Customer Details:

Name: [Customer Name]

Address: [Customer Address]

Contact Number: [Customer Contact Number]

Transaction Details:

| Item/Service | Quantity | Unit Price | Total Price |

|---|---|---|---|

| [Item/Service Description] | [Quantity] | [Unit Price] | [Total] |

Subtotal: $[Subtotal Amount]

Discount (if applicable): $[Discount Amount]

Tax (if applicable): $[Tax Amount]

Total Amount: $[Total Amount Paid]

Payment Method: [Cash/Credit Card/Bank Transfer/Other]

Transaction ID (if applicable): [Transaction Reference Number]

Authorized Signature:

[Name of Authorized Person]

Note:

- This receipt serves as proof of payment.

- Please retain this receipt for your records.

What are Official Receipts?

An official receipt has many names depending on who you ask. Some people call it a cash receipt or a payment receipt. But whatever this small piece of paper is called, it serves a single purpose. The main reason why a receipt is printed is to produce hard copies of financial transactions to be used by businesses for tax and accounting procedures. Furthermore, receipts are used as proof of income received throughout the year. Because of that, receipts are easily considered as official tax documents. While invoices are only used in accrual-based accounting, they are not used during tax season because invoices just indicate that a value is owed than being received.

Elements of an Official Receipt

Whether you are a startup or a business operating for many years, issuing receipts should be on top of your priority list. Non-compliance with this order can result in tax evasion or other tax crimes. The Criminal Defense lawyer said that the penalty for such crimes is between $250,000.00 for individuals and $500,000.00 for corporations. Other tax frauds can cost an individual $100,000.00 and a corporation $250,000.00. Hence, learning to create receipts is a crucial skill for having a business. Before starting to make your official receipt, make sure you know what it is consists of. The list below will tell you everything you need to know about elements of an official receipt.

How Do You Make an Official Receipt?

Making official receipts is not as challenging as you think. Receipt templates are available online. You can start by browsing through our website and discover a collection of different types of ready-made business templates. Additionally, editing tools and word processors are helpful for customizing the template’s suggested content. Before we tell you the tips in creating impressive receipts, make sure you started a plan to outline different parts of your receipts.

Step 1: Identify Required Information

Begin by compiling all essential details needed for the receipt. This includes the buyer’s name, the date of the transaction, and a detailed description of the goods or services provided. Additionally, ensure the total amount paid is clearly specified, including any applicable taxes or discounts. Verify the accuracy of this data to avoid discrepancies that may cause issues later. These details are the foundation of creating a legally compliant and professional receipt. You can also see more on Purchase Receipts.

Step 2: Choose a Format

Decide on the format for your official receipt based on your business operations. Manual receipts are ideal for small businesses or one-off transactions, while digital receipts work well for online or larger-scale operations. Consider using receipt templates or specialized accounting software to streamline the creation process. Ensure the format aligns with your brand identity, whether it’s a physical or electronic document. A clear and professional format is crucial for customer trust and record-keeping.

Step 3: Add Legal and Business Details

Incorporate all legally required information, such as your business name, address, and tax identification number (TIN). Depending on your location, include any other regulatory details that ensure the receipt complies with tax laws. Clearly mention your business contact details so customers can reach out if needed. Also, make sure your branding, such as logos or slogans, is visible to enhance professionalism. Legal details not only ensure compliance but also add credibility to the receipt.

Step 4: Structure the Receipt

Design the receipt layout with clear sections for each piece of information. Include areas for the receipt number, payment method, and itemized costs, which help make the receipt easy to understand. Organize these details systematically, ensuring no important information is overlooked. Use readable fonts and a clean design to maintain professionalism. A well-structured receipt reflects positively on your business and minimizes confusion for both parties. You can also see more on School Receipt.

Step 5: Issue and Record the Receipt

Once the receipt is created, provide a copy to the customer immediately after the transaction. Retain another copy for your records, either digitally or in physical form, for accounting and tax purposes. Organize these records systematically to facilitate audits and financial reviews. If you use accounting software, ensure it is updated with each transaction for seamless record-keeping. Proper issuance and documentation of receipts are essential for business transparency and legal compliance

FAQs

What are the different types of receipts?

- Purchase Invoices

- Bank Statements

- Bills of Lading and Commercial Letters

- Expense Reports

- Tax Assessments

- Commercial Receipts

How long should a receipt be kept?

The IRS suggested keeping official receipts for at least three years or as long as necessary.

What other business records should I keep?

- Invoices

- Payroll

- Journals

- Ledgers

- Previous Tax Returns

- Employment Taxes

- Assets and Business Property

- Canceled Checks and Bank Statements

- Credit Card Statement

Why are official receipts important for tax purposes?

Official receipts serve as proof of income and expenses for businesses. They help accurately calculate taxable income and comply with government regulations. In audits, receipts provide evidence of transactions. You can also see more on Real Estate Receipts.

What is the difference between an official receipt and an invoice?

An invoice is a request for payment sent before payment is made, while an official receipt is issued after payment as proof that the payment was received.

What should I do if a business refuses to issue an official receipt?

You can report non-compliance to relevant tax authorities. In some jurisdictions, businesses are legally obligated to issue receipts, and failure to do so can result in penalties. You can also see more on Bill Receipts.