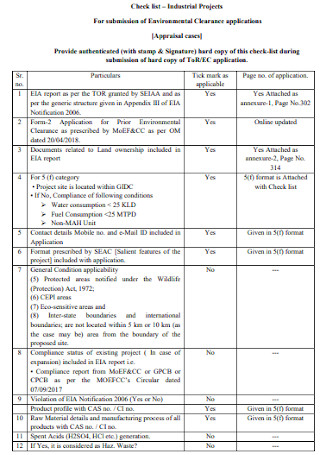

Payment Receipt Samples

-

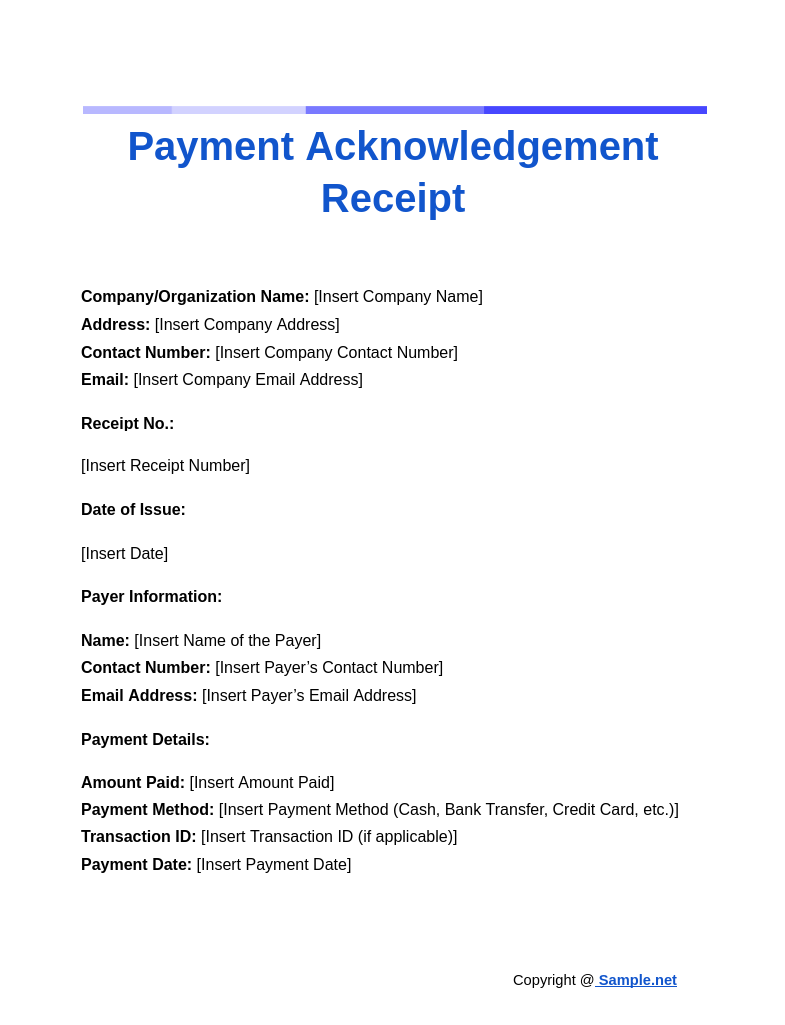

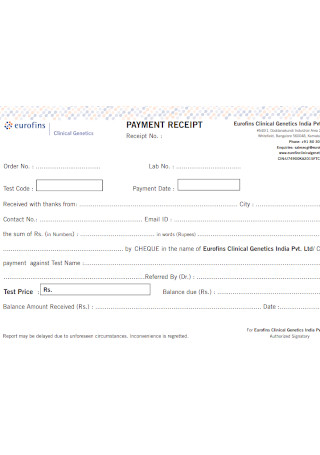

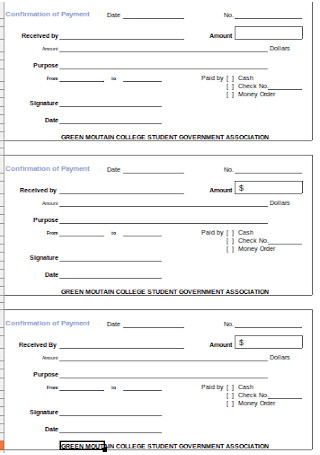

Payment Acknowledgement Receipt

download now -

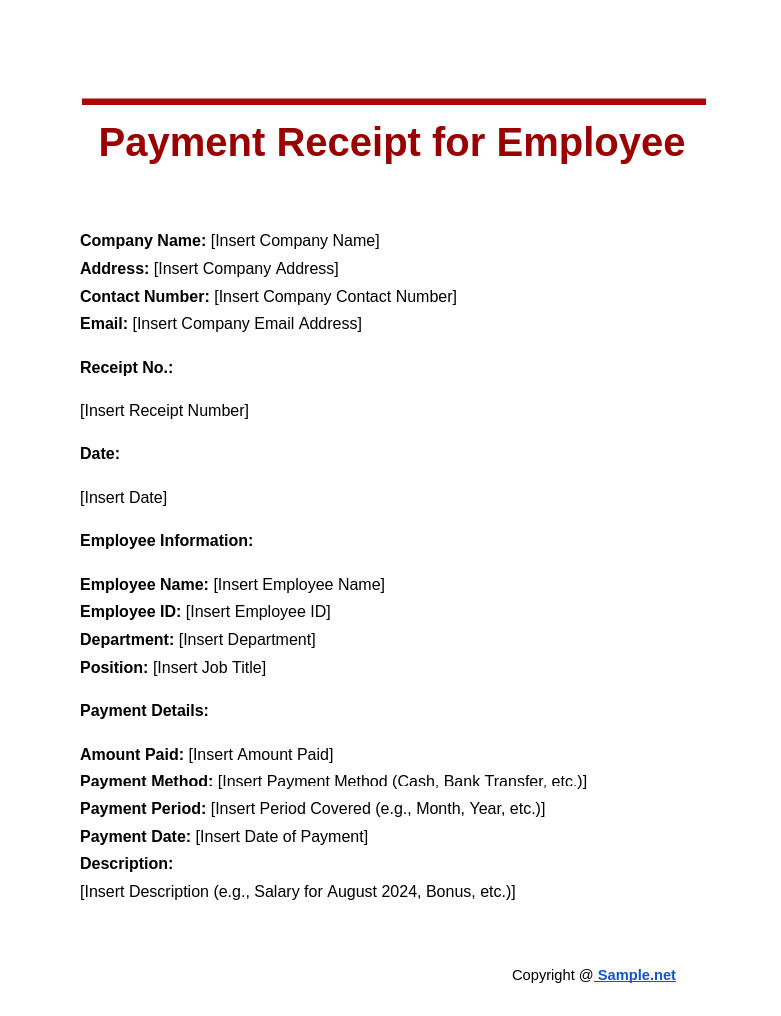

Payment Receipt for Employee

download now -

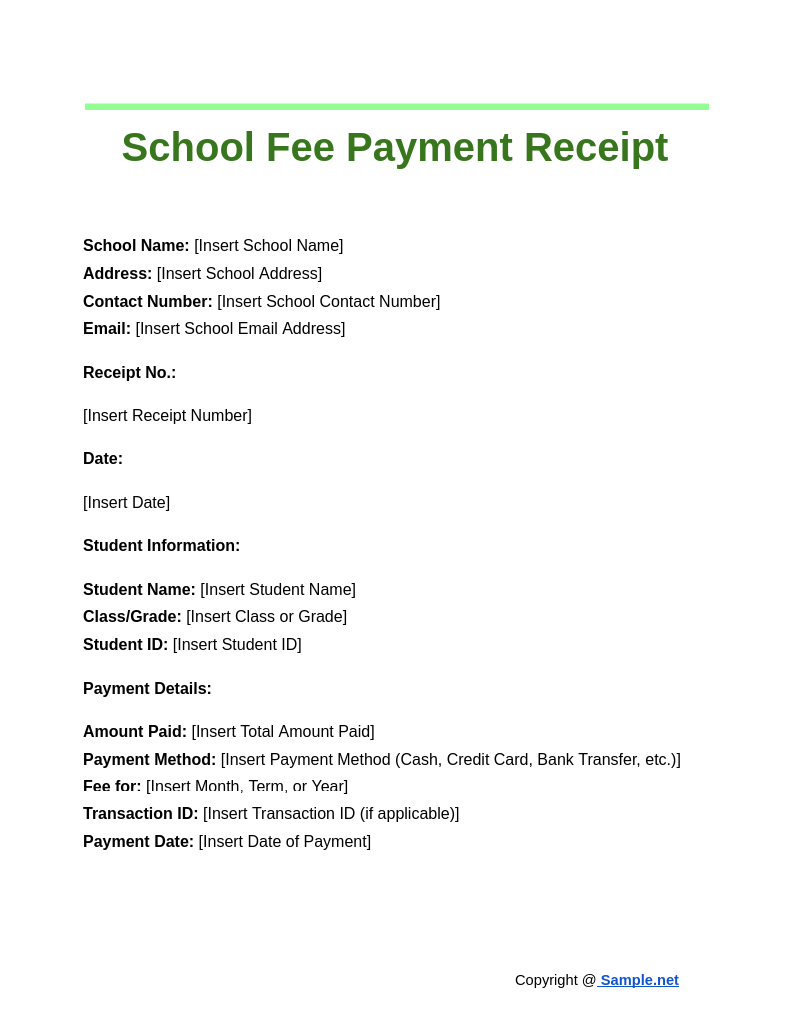

School Fee Payment Receipt

download now -

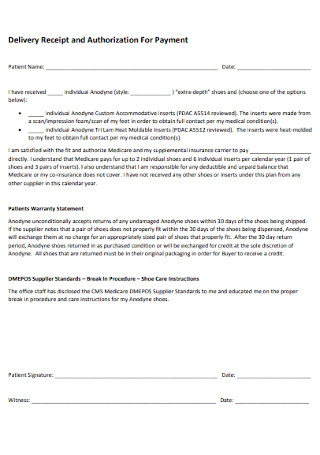

Delivery Payment Receipt

download now -

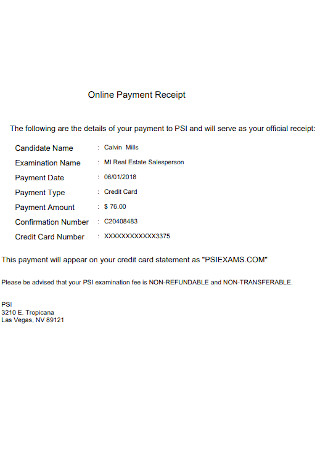

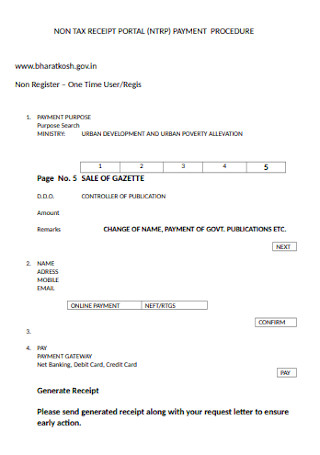

Online Payment Receipt

download now -

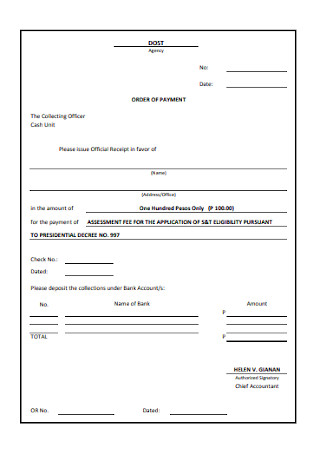

Official Payment Receipt

download now -

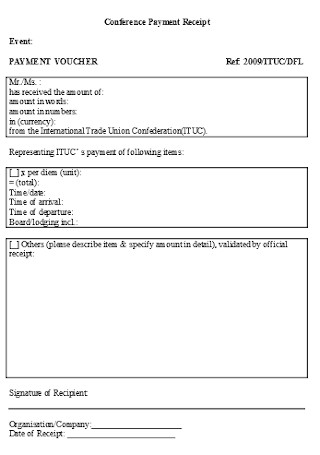

Conference Payment Receipt

download now -

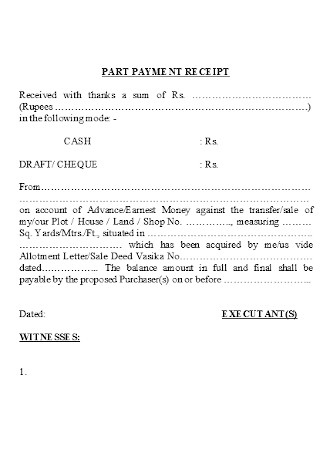

Part Payment Receipt Template

download now -

Simple Payment Receipt Template

download now -

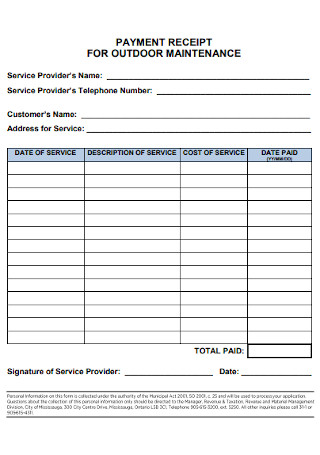

Payment Receipt for Outdoor Maintenance

download now -

University Payment Receipt

download now -

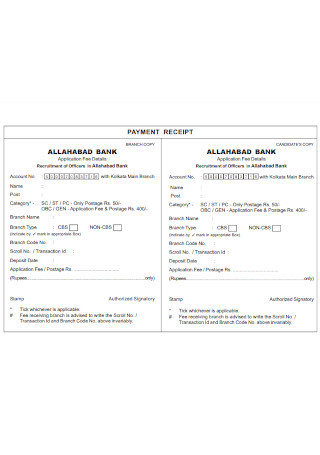

Bank Payment Receipt Template

download now -

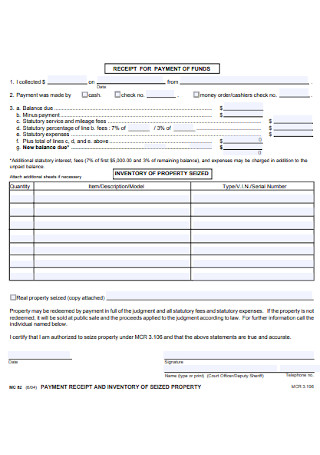

Receipt for Payment of Fund

download now -

Payment Log Receipt Template

download now -

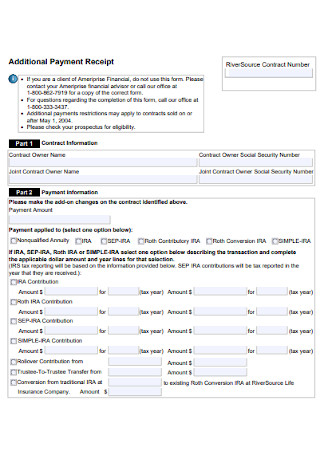

Additional Payment Receipt Template

download now -

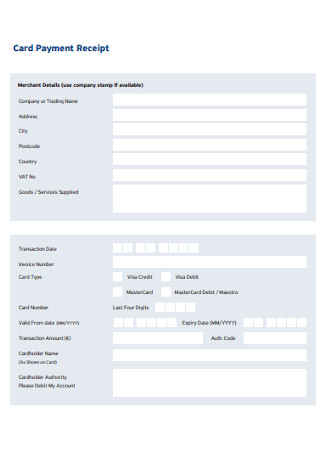

Card Payment Receipt Template

download now -

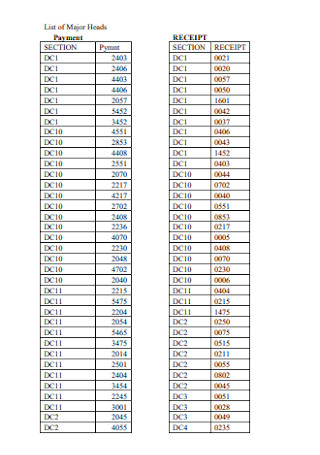

List of Payment Receipt

download now -

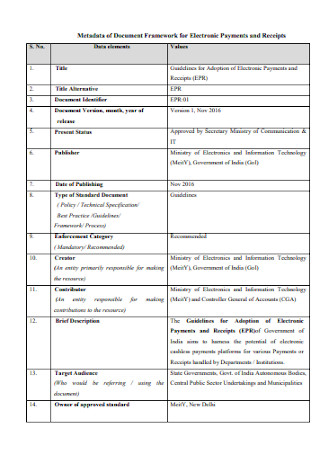

Electronic Payment of Receipt

download now -

Goods Payment Receipt Template

download now -

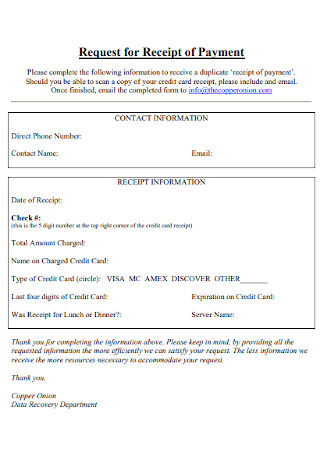

Request for Receipt of Payment

download now -

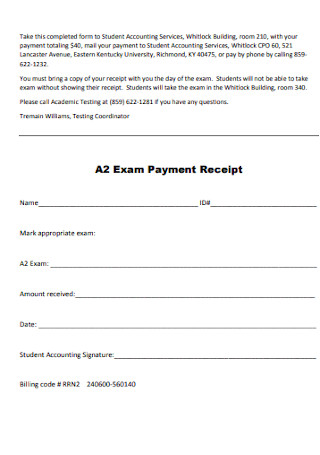

Exams Payment Receipt Template

download now -

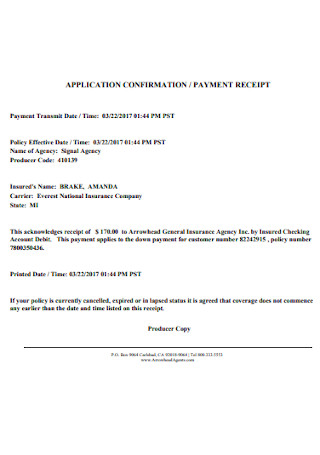

Payment Conformation Receipt Template

download now -

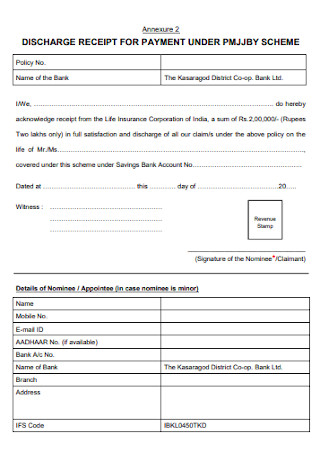

Discharge for Payment Receipt

download now -

Participant Payment of Receipt

download now -

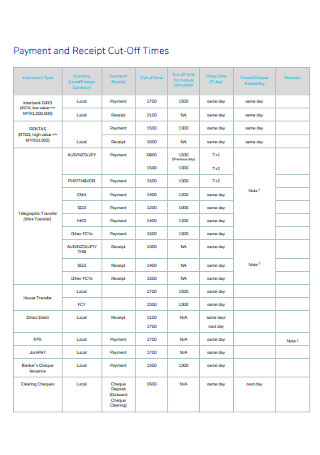

Payment of Receipt Cut of Times

download now -

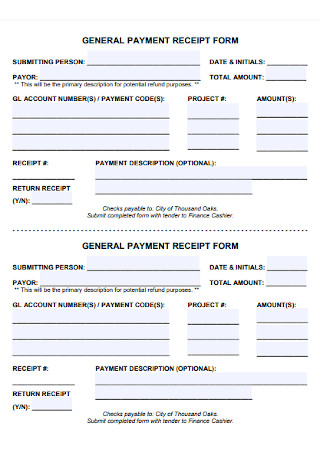

General Payment Receipt Template

download now -

Report on Receipt and Payment

download now -

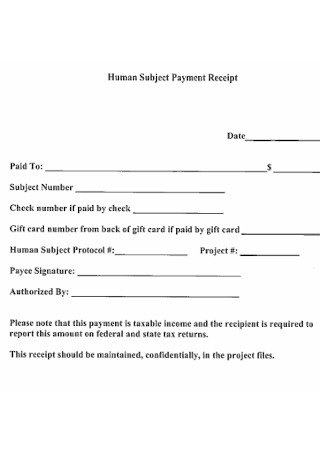

Human Subject Payment Receipt

download now -

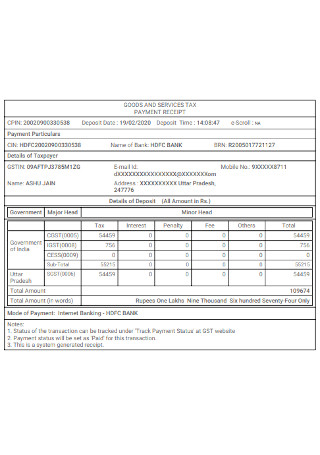

Tax Payment Receipt Template

download now -

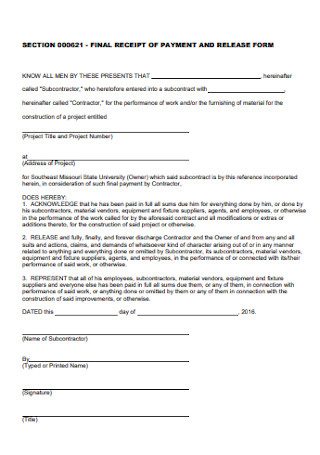

Final Receipt for Payment Template

download now -

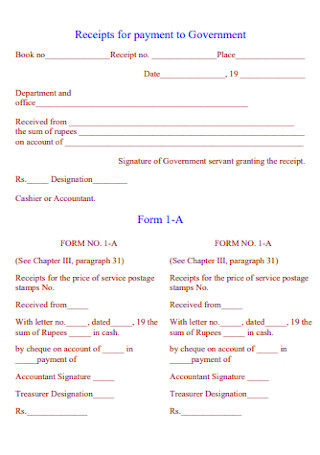

Receipts for Payment to Government

download now -

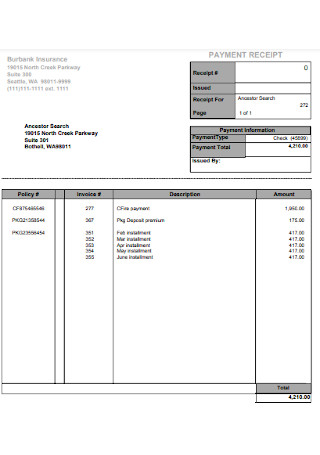

Insurance Payment Receipt Template

download now -

Payment Receipt Format

download now -

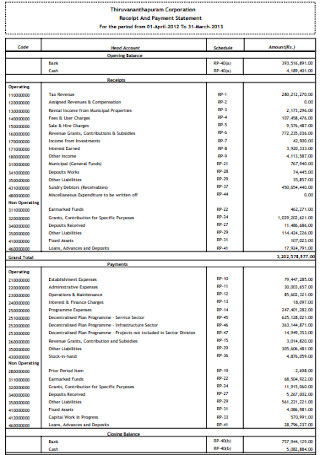

Corporation Payment Receipt

download now -

Payment and Receipt Form

download now -

Annual Payment Receipt Template

download now -

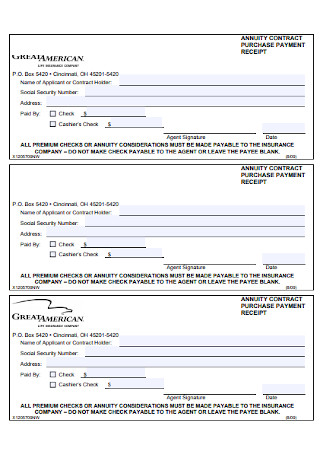

Contract Purchase Payment Receipt

download now -

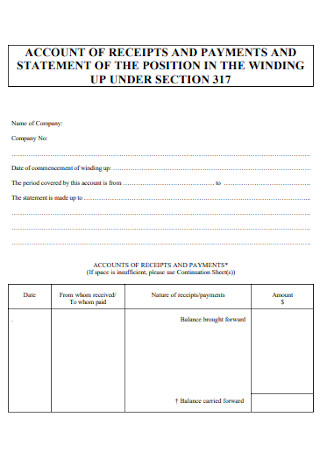

Account Payment Receipt Template

download now -

Basic Payment Receip[t Template

download now -

NET Payment Receipt Template

download now -

Sports Fee Payment Receipt

download now -

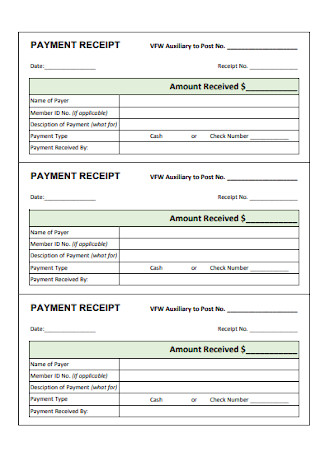

Sample Payment Receipt Template

download now -

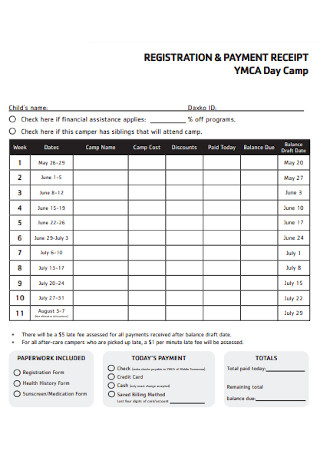

Registration and Payment Receipt

download now -

Cash Payment Receipt Template

download now -

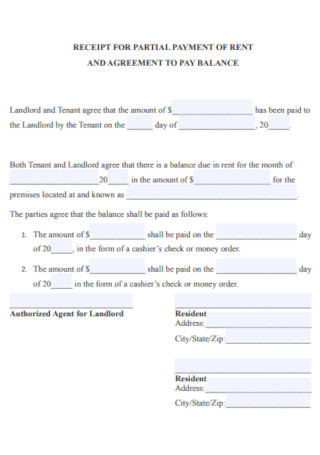

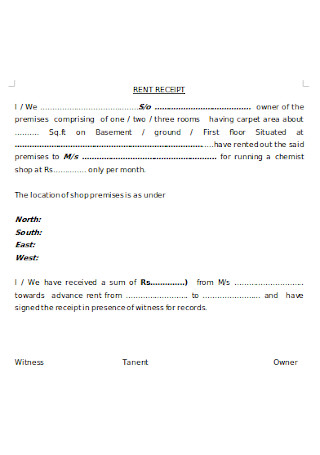

Rent Payment Receipt Template

download now -

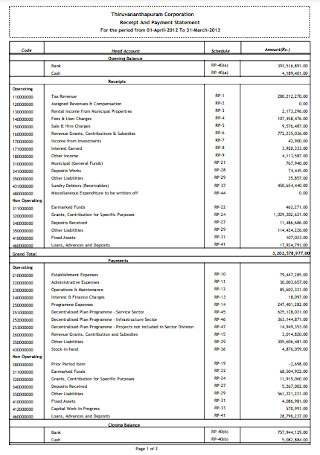

Receipt And Payment Statement Template

download now -

Research Participant Receipt

download now -

Payment Conformation Receipt Template

download now -

Rent Payment Receipt Template

download now -

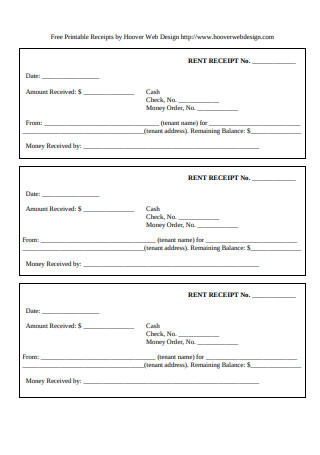

Printable Rent Payment Receipt

download now

FREE Payment Receipt s to Download

Payment Receipt Format

Payment Receipt Samples

What is a Payment Receipt?

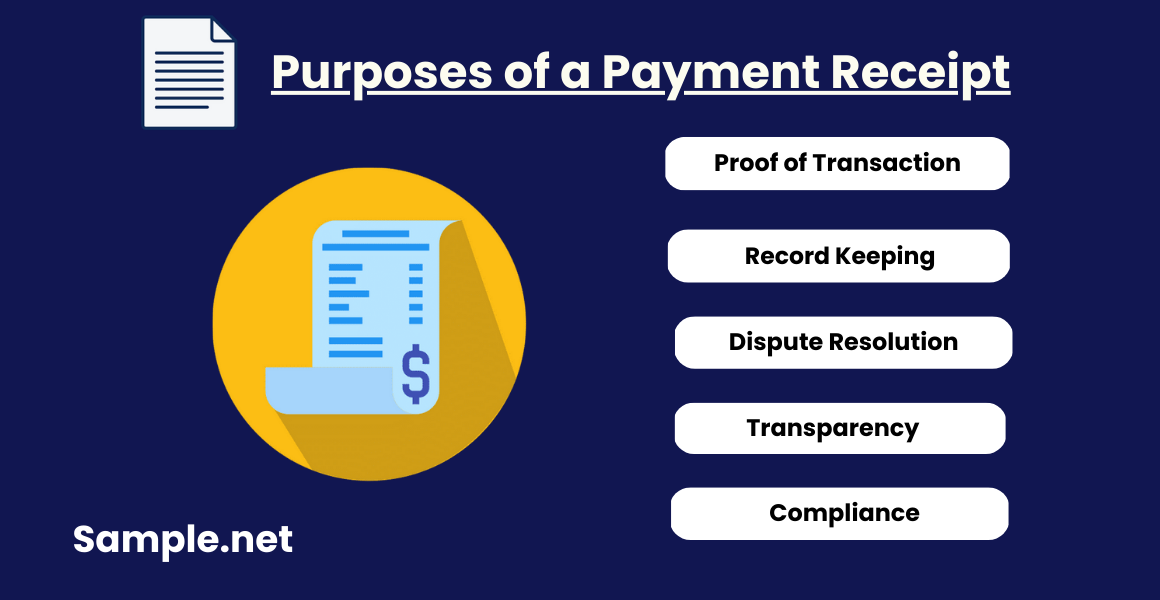

Purposes of a Payment Receipt:

What is Included on a Payment Receipt?

The Different Types of Payment Receipts You Should Know

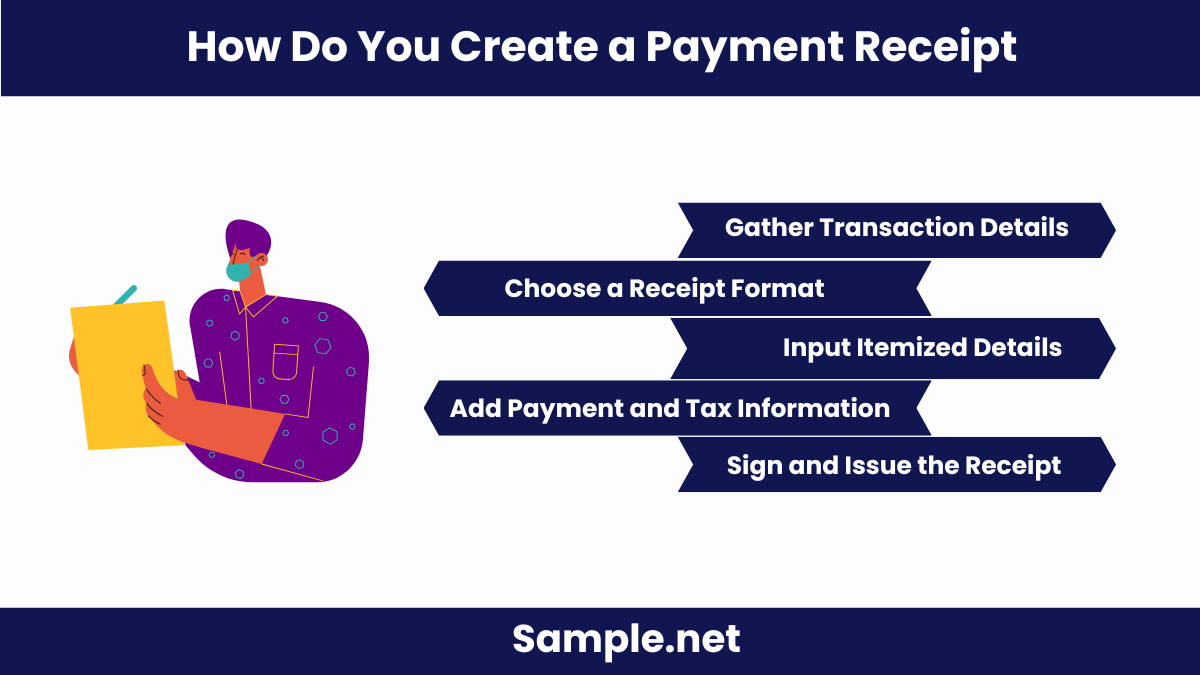

How Do You Create a Payment Receipt?

FAQs

Why should you keep receipts?

What is the difference between a receipt and an invoice?

How long do you keep official receipts?

Why issue a payment receipt?

What is the difference between a payment receipt and a sales receipt?

Is it mandatory to issue a payment receipt?

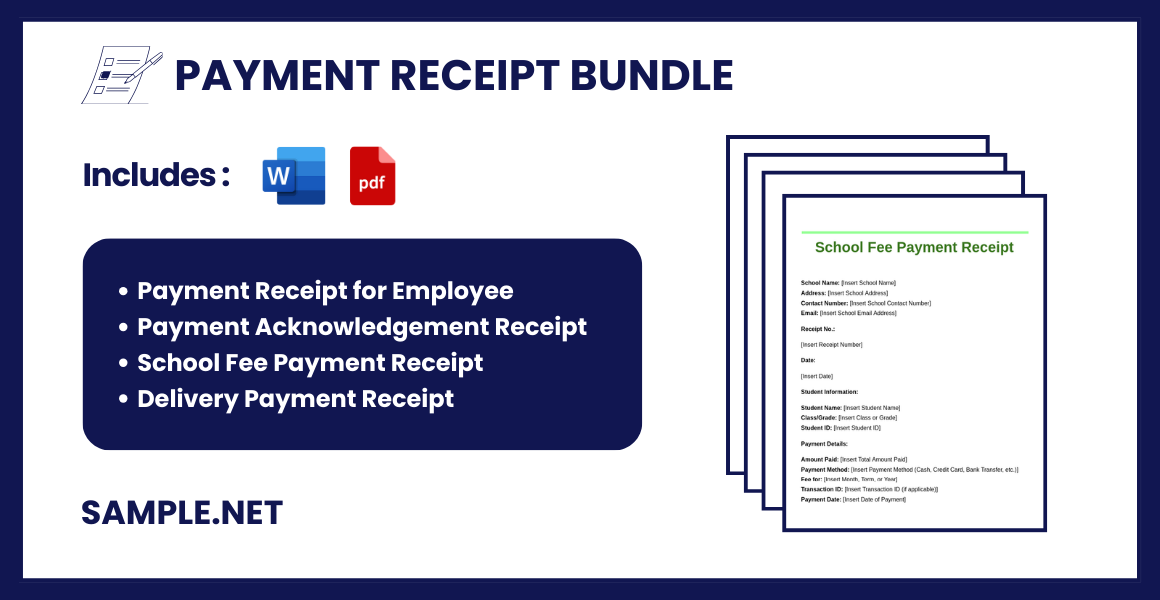

Download Payment Receipt Bundle

Payment Receipt Format

Receipt Number:

[Insert Unique Receipt Number]

Date of Issue:

[Insert Date of Issue]

Payer Information:

Name: [Insert Full Name of the Payer]

Address: [Insert Full Address of the Payer]

Contact Number: [Insert Contact Number]

Email Address: [Insert Email Address]

Payment Details:

Amount Paid: [Insert Total Amount Paid]

Payment Method: [Insert Payment Method (Cash, Credit Card, Bank Transfer, etc.)]

Transaction ID: [Insert Transaction ID, if applicable]

Payment Date: [Insert Payment Date]

Description of Payment:

Reason for Payment:

[Provide a detailed description of the goods, services, or reason for payment]

Invoice/Reference Number:

[Insert Invoice or Reference Number, if applicable]

Breakdown of Charges:

| Item/Service | Quantity | Unit Price | Total |

|---|---|---|---|

| [Item/Service Description] | [Qty] | [Price] | [Total] |

| [Item/Service Description] | [Qty] | [Price] | [Total] |

| Subtotal: | [Subtotal] | ||

| Tax (if applicable): | [Tax] | ||

| Grand Total: | [Grand Total] |

Additional Information:

Terms and Conditions:

[Insert any relevant terms and conditions or notes regarding the payment]

Authorized Signature:

Name: [Insert Name of Receiver or Company Representative]

Position: [Insert Job Title]

Signature: ____________________

Date: [Insert Date of Signature]

Company Information:

Company Name: [Insert Company Name]

Company Address: [Insert Company Address]

Company Phone: [Insert Company Contact Number]

Company Website: [Insert Company Website]

What is a Payment Receipt?

A payment receipt is a document provided by the seller to the buyer after a payment has been received. It includes essential details of the transaction, like the amount paid, payment method, date, and transaction ID, and serves as proof of the exchange. You can also see more on Bill Receipts.

Purposes of a Payment Receipt:

1. Proof of Transaction: Confirms that payment was successfully made.

2. Record Keeping: Useful for personal, business, and tax records.

3. Dispute Resolution: Helps settle disputes over payments or services.

4. Transparency: Ensures clear communication between buyer and seller.

5. Compliance: Fulfills legal or organizational requirements for financial records.

What is Included on a Payment Receipt?

A payment receipt typically includes the following information:

- Receipt Number: A unique reference number for tracking purposes.

- Date of Payment: The date when the payment was made.

- Seller’s/Service Provider’s Information: Business name, address, phone number, and contact details.

- Buyer’s Information: Name and contact information of the person or entity making the payment.

- Description of Goods/Services: A brief description of what was purchased or the service provided.

- Amount Paid: The total amount of the payment, including currency symbol.

- Payment Method: The method of payment used (e.g., cash, credit card, bank transfer).

- Taxes: Any applicable taxes (e.g., VAT) broken down separately, if necessary.

- Balance Due: If applicable, any remaining balance after the payment.

- Signature (Optional): Signature of the buyer or seller to confirm the transaction.

The Different Types of Payment Receipts You Should Know

What does the word ‘receipt’ remind you of? Some may think about how much they have paid for the groceries they purchased last week, or it brings back the memory of a returned item because it was the wrong size. All these are common assumptions of receipts and they are not wrong. But more than that, this little piece of paper is not a one-size-fits-all form. It is important to keep in mind that receipts must be specifically made for each purpose it serves. The sales receipt issued by a restaurant is not similar to the ones your bank gives you. Below is a list of the different types of receipts that you should know.

How Do You Create a Payment Receipt?

Step 1: Gather Transaction Details

Start by collecting all the essential details of the transaction. This includes the buyer’s and seller’s names, date of the transaction, payment amount, and payment method (credit card, cash, etc.). Also, gather information on the item or service being paid for, and any relevant invoice or order number.

Step 2: Choose a Receipt Format

Decide on the format for your receipt—whether it will be digital or printed. You can use ready-made templates, accounting software, or design your own layout. Make sure the format includes sections for the transaction date, payment amount, description of the item/service, and payment method. You can also see more on Purchase Receipts.

Step 3: Input Itemized Details

Clearly list the items or services purchased. Each line should detail the item or service name, quantity, unit price, and total price. For services, outline the service provided. Be specific to ensure that both the buyer and seller have a clear record of the transaction.

Step 4: Add Payment and Tax Information

Indicate the payment method used (cash, credit, debit, etc.) and any taxes applied to the purchase. Itemize any taxes or discounts separately to make the receipt transparent. Ensure the final total, including tax, is prominently displayed on the receipt.

Step 5: Sign and Issue the Receipt

Review the receipt for accuracy. Once everything is correct, sign the receipt if required (either digitally or physically). Send the receipt to the buyer, either electronically via email or as a physical copy. Always keep a copy for your records, whether in digital form or paper-based.

A payment receipt is an essential document that provides proof of payment and ensures smooth communication between the buyer and seller. Whether in paper or digital form, it plays a crucial role in managing records, resolving disputes, and maintaining transparency. By following the steps outlined above, you can easily create and manage payment receipts effectively. You can also see more on Collection Receipts.

FAQs

Why should you keep receipts?

Properly storing receipts and other business records is essential to your business. It initially monitors your business progress by helping you see how your business is doing. Whether you are improving in terms of sales or declining customer feedback, accurate records help measure your business. That why Turbo Tas suggested keeping the receipts of the following expenses if you want to lower taxable income and increase your potential for a tax refund: medical, childcare, unreimbursed work-related, self-employment, and other expenses.

What is the difference between a receipt and an invoice?

Based on an article by Chron, invoices and receipts are different. Their main difference is as follows: An invoice is a request for payment, while receipts are proof of purchase. Moreover, invoices commonly provide a list of goods or services provided by the seller along with the corresponding prices, credits, discount, taxes, and total due. In short, the amount in an invoice is unpaid. On the other hand, a receipt is a record that proves the existence of a transaction. When a receipt is issued, it means that something of value and payment has been made to finalize a sale.

How long do you keep official receipts?

Keeping receipts depends on your situation. However, IRS said that you must record receipts for at least three years or as long as it is necessary.

Why issue a payment receipt?

Issuing a payment receipt provides proof of payment, helps with legal and tax requirements, supports record-keeping, builds customer trust, and ensures clarity in transactions. It’s also necessary for returns, exchanges, or warranty claims.

What is the difference between a payment receipt and a sales receipt?

A payment receipt confirms that a payment was made, while a sales receipt records the details of a sale, including the items sold, price, and payment method. This printable payment receipt focuses on the payment itself, whereas the sales receipt covers the full transaction.

Is it mandatory to issue a payment receipt?

In many cases, issuing a payment receipt is mandatory, especially for businesses, to comply with legal and tax requirements and provide proof of payment. However, rules vary by country and type of transaction.