30+ SAMPLE Petty Cash Receipts in MS Word | PDF

-

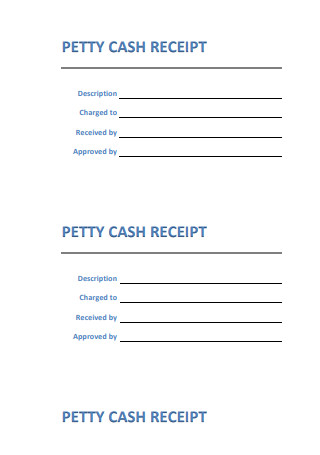

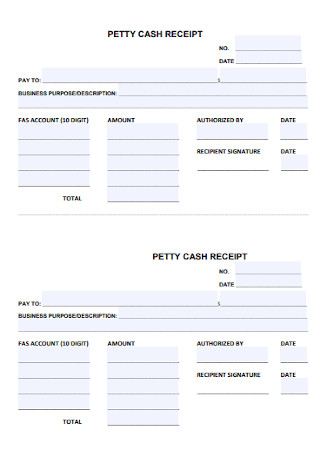

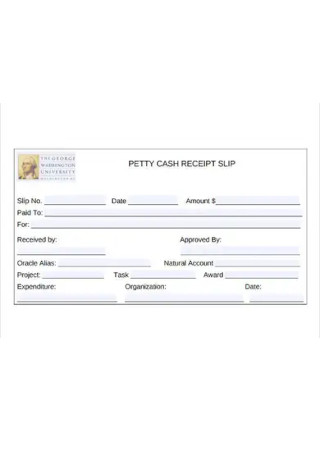

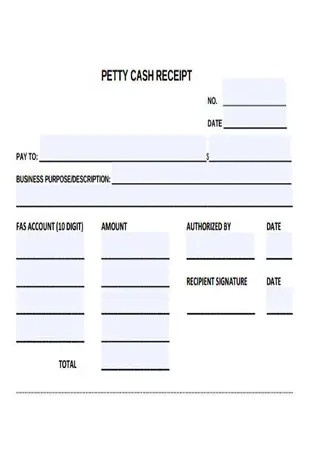

Petty Cash Receipt Template

download now -

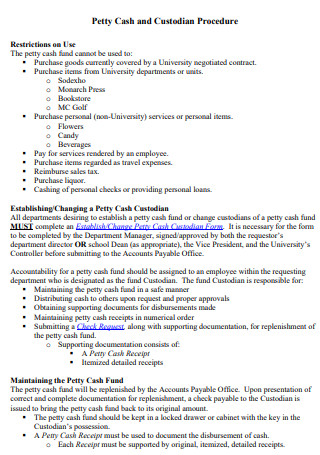

Petty Cash and Custodian Procedure

download now -

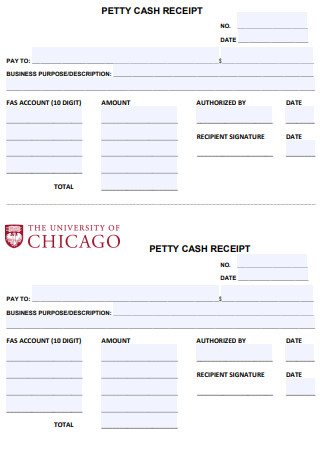

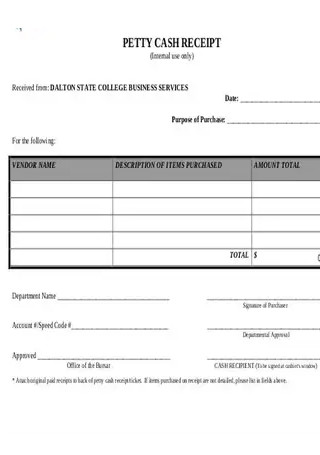

Petty Cash Receipt Form

download now -

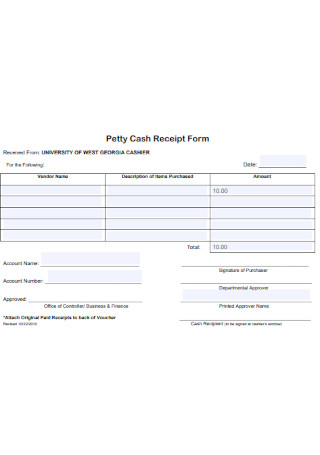

Petty Cash Form

download now -

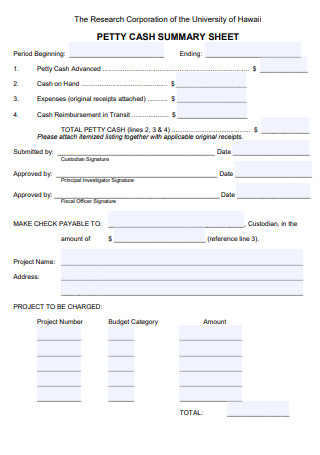

Petty Cash Summary Sheet

download now -

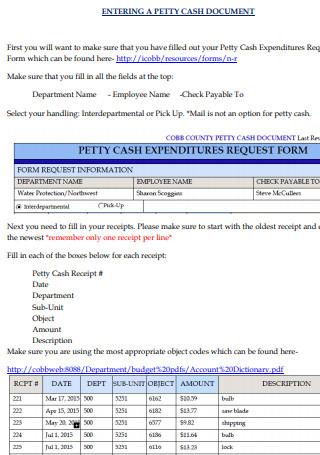

Petty Cash Expenditure Request Form

download now -

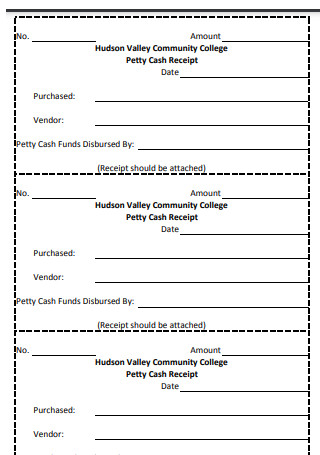

Petty Cash Receipts

download now -

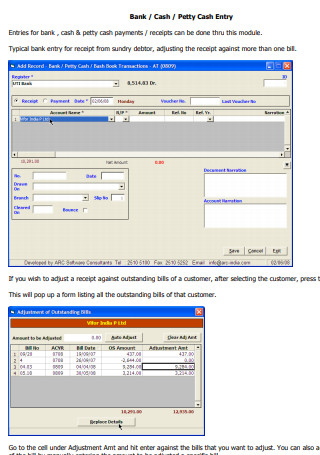

Bank Petty Cash Entry

download now -

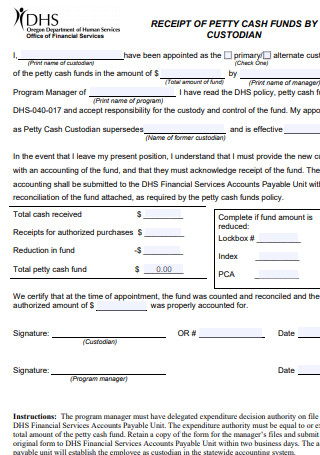

Receipt of Petty Cash Fund

download now -

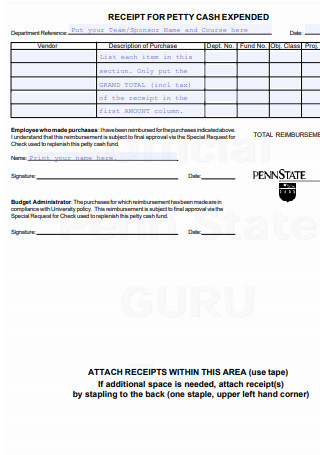

Receipt for Petty Cash Expanded

download now -

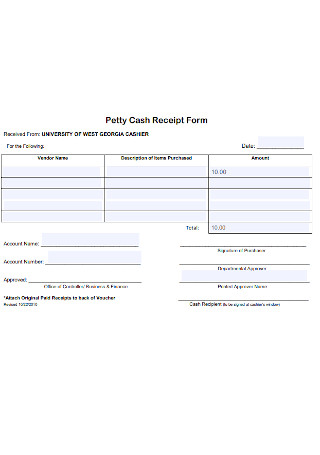

Petty Cash Receipt Form

download now -

Formal Cash Receipt Form

download now -

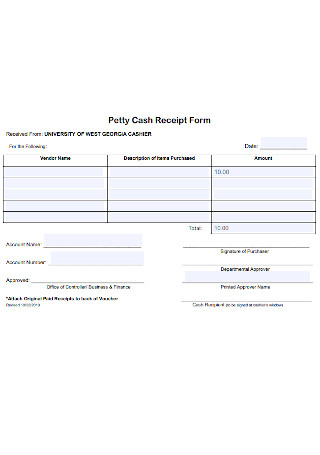

Petty Cash Receipt Form

download now -

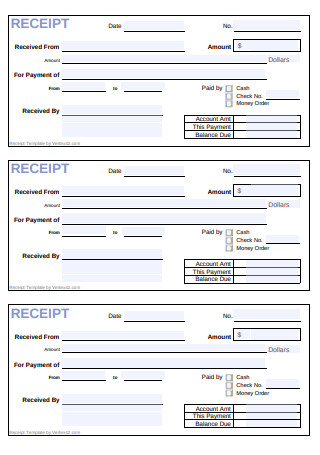

Basic Cash Receipt Form

download now -

Petty Cash Receipts Template

download now -

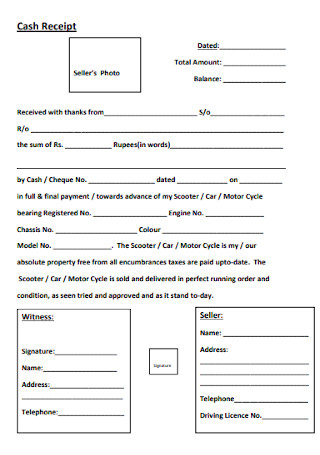

Cash Receipt Format

download now -

Sample Petty Cash Receipt Template

download now -

Simple Petty Cash Receipt

download now -

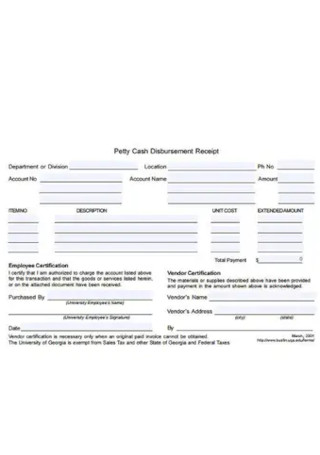

Petty Cash Disbursement Receipt

download now -

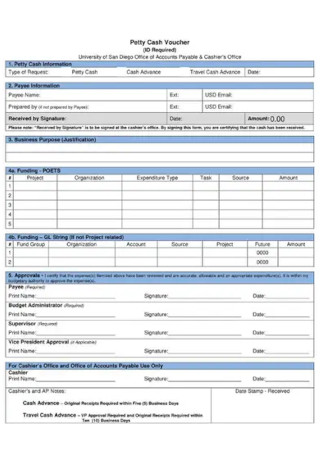

Petty Cash Voucher

download now -

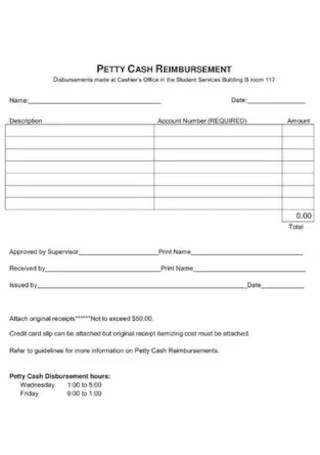

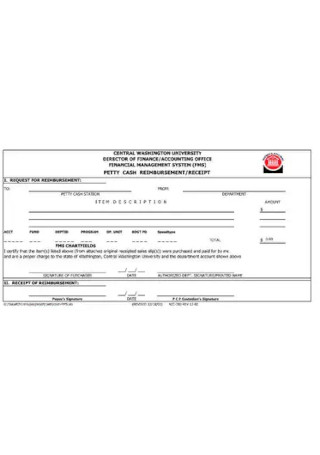

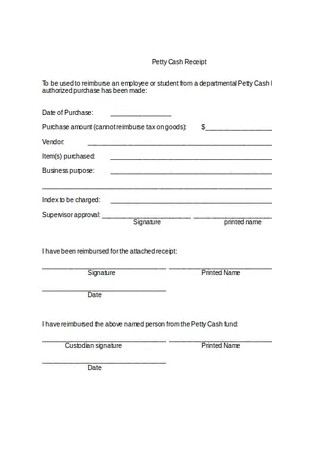

Petty Cash Reimbursement

download now -

Petty Cash Reimbursement Receipt

download now -

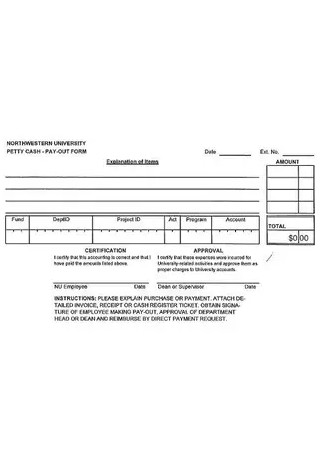

Petty Cash Form Template

download now -

Petty Cash Receipt Form Sample

download now -

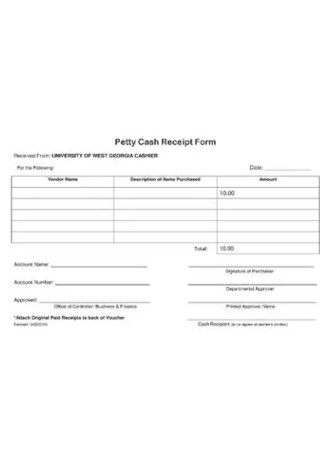

Blank Petty Cash Receipt

download now -

Basic Petty Cash Receipt

download now -

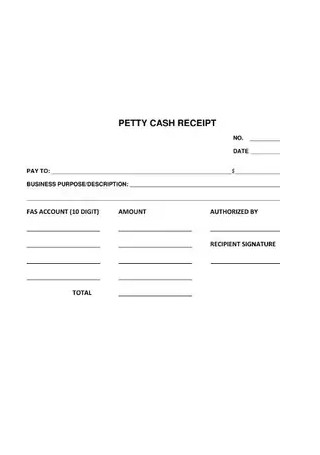

Formal Petty Cash Receipt

download now -

Petty Cash Receipt Form Template

download now -

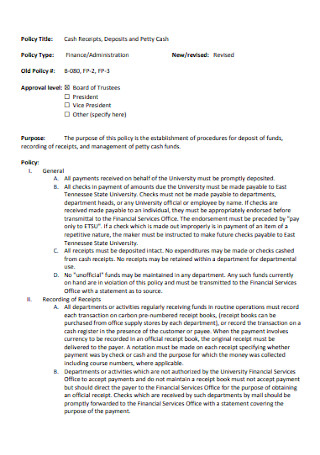

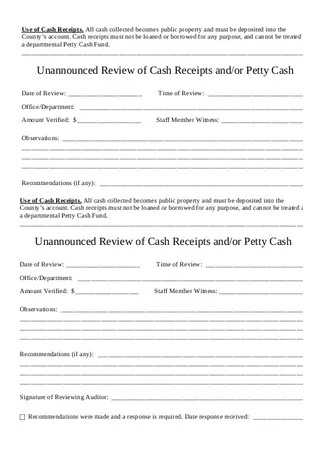

Review Cash Receipt/ Petty

download now -

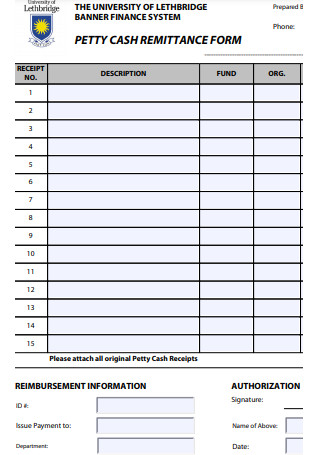

Petty Cash Remittance Voucher

download now

FREE Petty Cash Receipt s to Download

30+ SAMPLE Petty Cash Receipts in MS Word | PDF

What is a Petty Cash Receipt?

Advantages of a Petty Cash Receipt

Tips on Petty Cash Receipt

How to Complete a Petty Cash Receipt

FAQs

What are the disadvantages of a petty cash receipt?

Why is it called a petty cash receipt?

What is a Petty Cash Receipt?

A petty cash receipt is a receipt that can disburse money to the employees to pay for the small expenses of a company. Staff can get money from the petty cash fund when they have to pay company expenses like office supplies or catered lunches. Expenditures from a petty cash fund are documented by a petty cash receipt. This can be a kind of bill receipt that makes everything convenient to pay expenses that are too small for a business check. By having a petty cash receipt PDF, the company can keep track of small expenses. Usually, companies will have petty cash receipt vouchers from a petty cash receipt book. Sometimes. a petty cash receipt acknowledgment letter is needed to issue expenses.

Any petty cash receipt example or petty cash receipt sample can prove to be useful to companies. Through it, they will have a record of their small expenses. To make a petty cash receipt, you can use a petty cash receipt template or a printable petty cash receipt template. Use a petty cash receipt app to manage your work better. Through the petty cash fund, you can control the expenses of your company without the administrative hassle. Petty cash receipts as purchase receipts can prove to be helpful when you are minimizing the cost of your company.

Advantages of a Petty Cash Receipt

Petty cash receipts are a fast method to give funds to your employees for small expenses. For one thing, you can keep a record of your expenses. This is especially good for businesses that have small business budgets and need to be careful with expenses. The next thing that we will discuss is the advantages of a petty cash receipt. They are the following:

Tips on Petty Cash Receipt

Though it may be easy to handle the petty cash fund, there may come a time when you will experience some problems like deficits. To avoid this kind of problem, you should have strategies for managing the petty cash receipt. The following are some tips that you can do:

How to Complete a Petty Cash Receipt

A certain procedure is needed in issuing a petty cash receipt. This procedure must be known to your employees so that they can have convenience in having a petty cash receipt. If you are out of steps to use, you can use the following:

1. Allot a Petty Cash Amount

The first thing to do is to designate a particular amount for petty cash. As a work plan, this amount will be the funds where employees will deduct small expenses. You need a petty cash box where you can store this money.

2. Be Clear on Disbursements

Of course, your employees cannot just get money from the petty cash funds any way they want. You should specify the allowable disbursements that can be given to your employees. This way, they will know the amount of money that they can get and when they can possibly get it.

3. Write the Details in the Petty Cash Receipt

When your staff knows the right process, they can request money from the petty cash custodian. When the custodian confirms their request, the petty cashier will give the money. The receipt will be issued with the necessary details. This includes the sequential number of the custodian, the date when the petty cash receipt is issued, the name of the payee, the amount of payment, a brief explanation of the use of funds, the account number, the reference number, and the signature of the authorized signer.

4. Maintain a Log

After issuing a petty cash receipt, you must keep a record of the transaction. Maintain a log of the request. Tracking logs can help you manage your finances.

FAQs

What are the disadvantages of a petty cash receipt?

The disadvantages of a petty cash receipt are there is a risk in security, requires manual monitoring, and it may be outdated.

Why is it called a petty cash receipt?

It is called petty cash receipts because “petty” means small or little and petty cash receipts are used for small or little expenses.

Using petty cash receipts is a great way of handling your business finances when it comes to small expenses. Though this may be an old-fashioned way of managing your costs, it can still be fun. Imagine that your staff will not have difficulties in getting funds. Besides, everything is convenient so this is still recommended.