26+ Sample Sale Receipt Templates

-

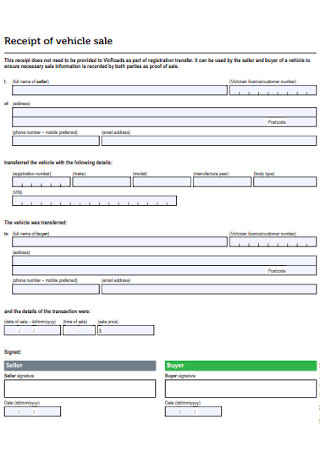

Receipt of Vehicle Sale

download now -

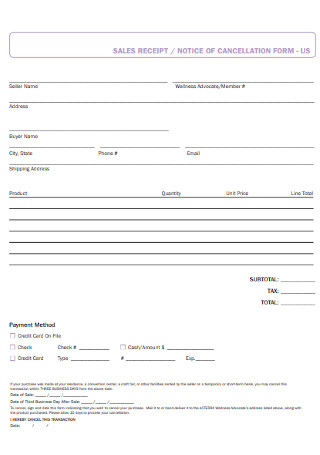

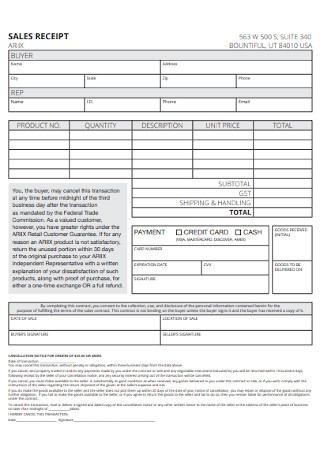

Sales Receipt and Form

download now -

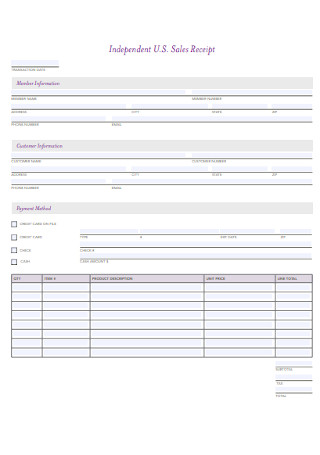

Independent Sales Receipt

download now -

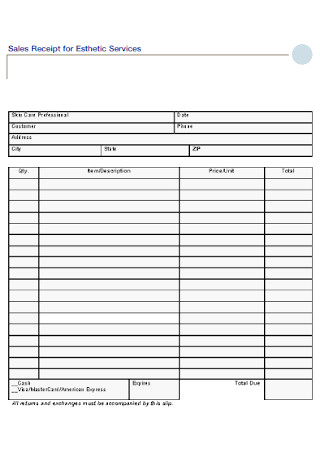

Sales Receipt for Esthetic Services

download now -

Vehicle Sales Tax Receipt

download now -

Simple Sales Receipt Template

download now -

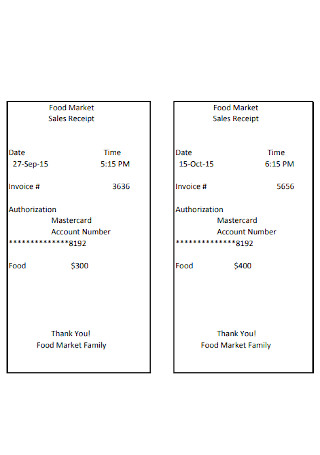

Food Market Sales Receipt

download now -

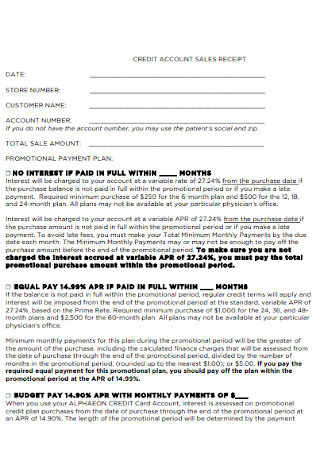

Credit Account Sales Receipt

download now -

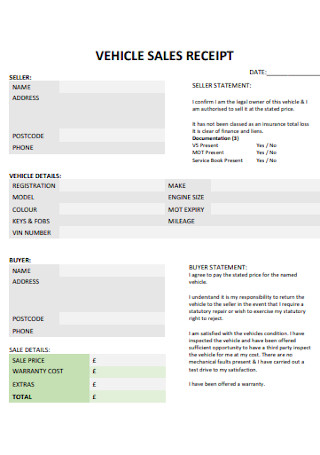

Vehicle Sales Receipt Template

download now -

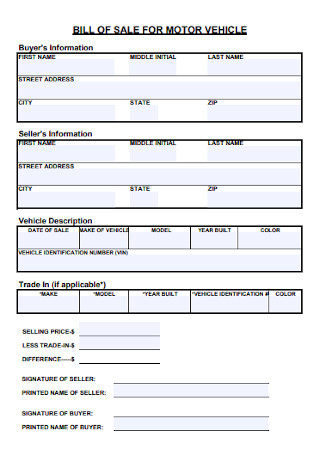

Motor Vehicle Sales Receipt

download now -

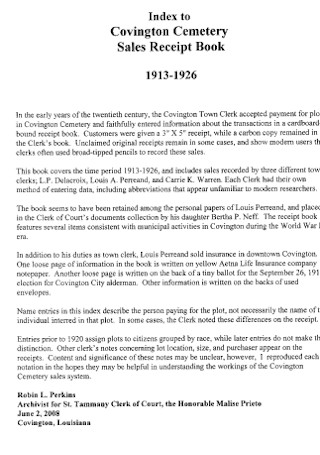

Book Sales Receipt Template

download now -

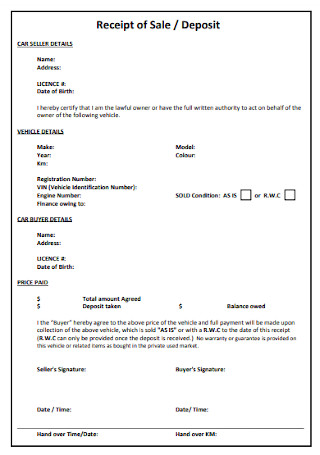

Sales and Deposit Receipt

download now -

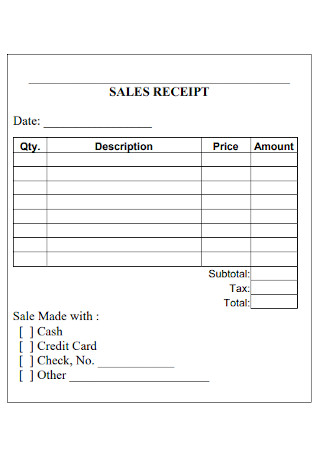

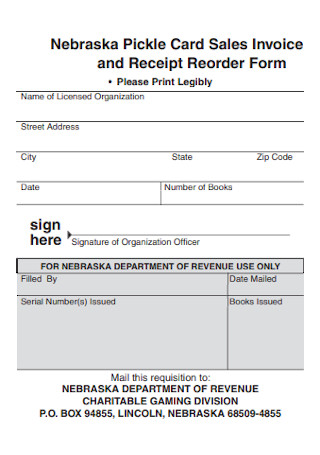

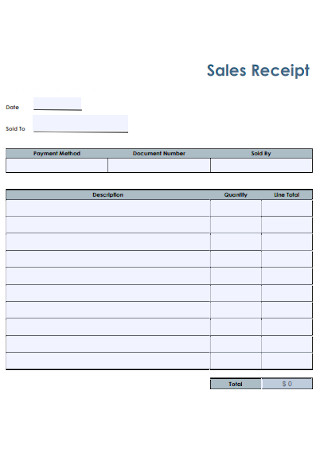

Sales Receipt Form Template

download now -

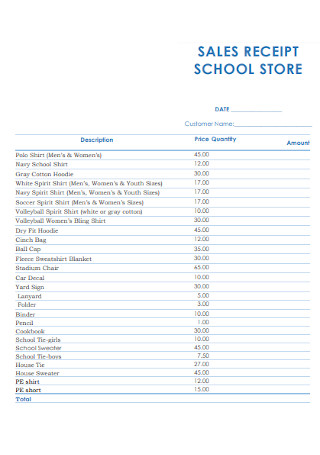

School Store Sales Receipt

download now -

Standard Sales Receipt Template

download now -

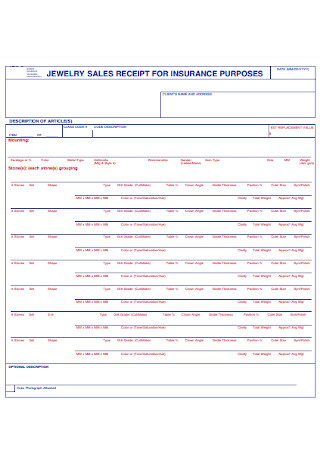

Jewelry Sales Receipt Template

download now -

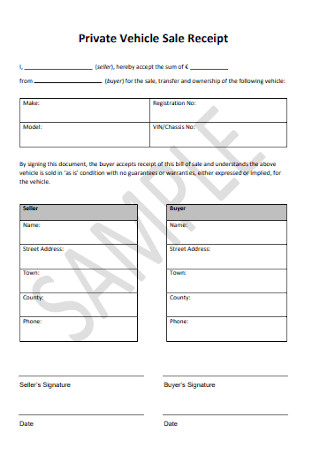

Private Vehicle Sale Receipt

download now -

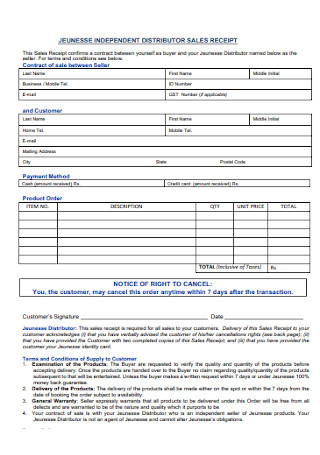

Distributor Sales Receipt Template

download now -

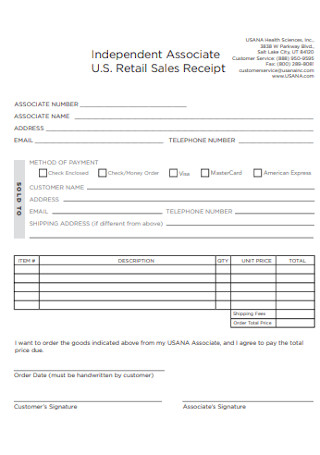

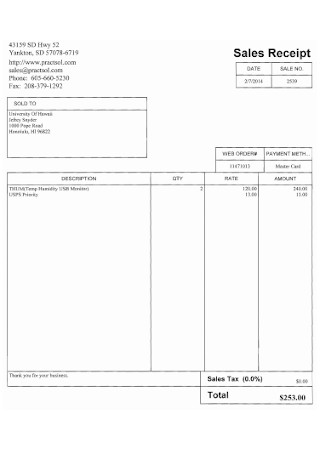

Sample Retail Sales Receipt

download now -

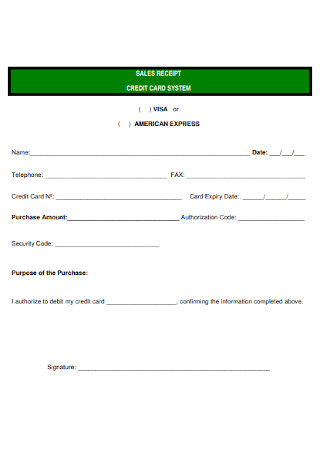

Credit Card Sales Receipt

download now -

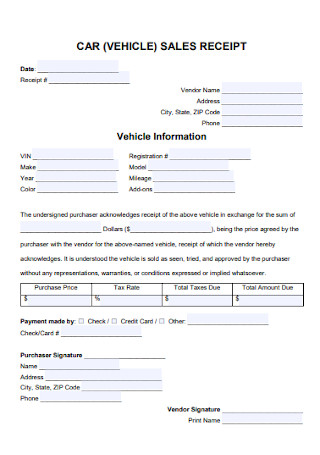

Car Sales Receipt Template

download now -

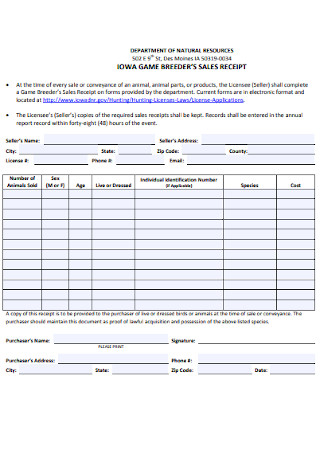

Game Breeder Sales Receipt

download now -

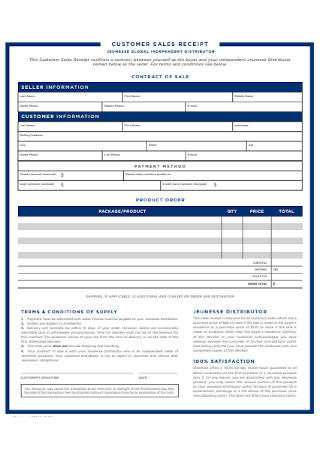

Customer Sales Receipt Template

download now -

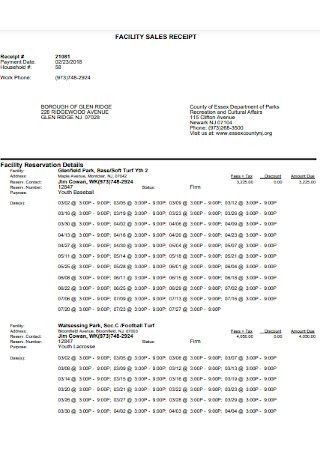

Basic Facility Sales Receipt

download now -

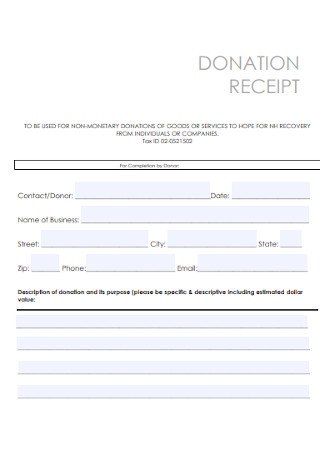

Sales Donation Receipt

download now -

Formal Sales Receipt Template

download now -

Printable Sales Receipt Template

download now

FREE Sale Receipt s to Download

26+ Sample Sale Receipt Templates

Sales Receipts: What Are They?

The Different Receipt Types You Should Know

How Do You Create a Sales Receipt?

FAQs

What is the difference between a receipt and an invoice?

Is it illegal not to issue a receipt?

Why should you keep official receipts?

Sales Receipts: What Are They?

A sales receipt is one of the many essential business documents. It is primarily made for products that are sold by a vendor to a customer. Usually, it is consists of the number of items (quantity) multiplied by the price per unit. More so, sales receipts are crucial accounting records as it serves as evidence that a transaction happened. Businesses keep payment receipts to lower their income tax return and increase their potential for deductions.

Meanwhile, the Turbo Tax suggested keeping the receipts of the following expenses if you want to lower taxable income and increase your potential for a tax refund: medical, childcare, unreimbursed work-related, self-employment, and other expenses.

Based on an article by Chron, although both forms are used in business transactions, their main difference is that an invoice is a request for payment, while receipts are proof of purchase.

According to the Internal Revenue Service (IRS), there were approximately 1800 and 1700 tax crimes investigated in 2018 and 2019 respectively. Examples of these crimes are tax evasion and tax frauds, which have a fine of up to $250,000 for individuals while $500,000 for corporations.

The Different Receipt Types You Should Know

What comes to mind when you hear the word ‘receipt’? Some may think about bills of sale and payments, while it reminds others of the groceries they purchased last week. All of these are a true assumption of receipts. But there is more to it than that. The receipts you received from the cashier of your favorite mart is not the same as the one issued by your bank. In short, there are different types of receipts and each one serves a different purpose. Below is a list of the different types of receipts and their descriptions.

How Do You Create a Sales Receipt?

Creating a cash receipt is not as challenging as you think. The easiest way around it is by using a template, but you can also start from scratch and make your own receipt format. On the other hand, if you are considering getting a template, begin browsing our website and discover a collection of ready-made templates that are fit for every business need. Before selecting your template, make sure you fully understand the transaction it will be used in. This way, you can decide on a stencil suitable for that transaction. Then press the download button and get started with your receipt making task.

1. Label the Sales Receipt

To begin, access an editor tool that is compatible with your template’s file format. It can either be Microsoft Word, Microsoft Excel, Microsoft Publisher, Apple Pages, Apple Numbers, etc. You will know if an editor tool is compatible with the template if it is featured on the website. So, check on your source’s webpage to be sure. The second thing you should do is to properly label the template. Templates are specially created with suggested content users can modify. On top of every document is a text box allocated for the title. Edit the text box to your preferred title. You can label yours as “Sales Receipt” or “Official Receipt.” To make the title stand out, use a bold font that is eye-catching. Moreover, a title helps in setting your sales receipt apart from other paper works on your table.

2. Provide the Basics

Like most important business documents, your sales receipt should contain the basics. These are the merchant and the customer’s information used in the transaction. The merchant information or the details of the business involved in the transaction must be in the first part of the receipt. The details are the following: (1) receipt number, (2) merchant name or business name, (3) phone number, and (4) complete address, including street, city, state, and ZIP code. After that is the customer information. Before providing any detail, put a label that says “Sold To” to indicate the person who receives the service or product. Then proceed and provide the customer’s (1) complete name or company name, (2) complete address, and (3) contact information.

3. Indicate the Purchased Items

As an important element of a receipt, a list of the purchased item must be present in your sales receipts. It is a shortlist of all the items being transferred in the transaction. To neatly organize, A concise table with several columns must be placed in the body of this business receipt. This is where you will define what was bought from the merchant by the customer. Often, it is required to add a description of the purchased merchandise on a line by line basis in the first column of this table. The quantity, price/unit, and line total should also be on a separate column in the table. In case you want to know how to get the line total. It is by multiplying the quantity by the price/unit. Yet, you can not worry about this because the template is already formatted with the correct formulas.

4. Get the Numbers Right

In addition to calculating the line total, other values such as subtotal, discount, sales, final total, and the amount paid must be provided beneath the table. Once again, you do not have to worry about calculating these amounts because your template will do the work for you. But if you want to do this manually, you can get the subtotal by adding the amount of all the items in the total line. That is not yet the final amount the customer needs to pay. Applicable discounts and sales tax must be deducted from the subtotal to obtain the final total. And, provide a line for the amount the customer paid. Furthermore, specify what payment method is used in the transaction, whether it be in cash, card credit, or check.

5. Review Your Receipt

Knowing that your sales receipts can accurately sum up the total amount a customer is required to pay makes it seem complete. However, even though it is not a business plan or a project proposal, you must review the receipt before using it. This way, you avoid committing errors like misspelled words, inaccurate amounts, and wrong information. In terms of the format, you can make adjustments if necessary. When all this is done, the receipts are both useful as printed or digitally-generated.

FAQs

What is the difference between a receipt and an invoice?

Both receipts and invoices are accounting documents but serve different purposes. Based on an article by Chron, although both forms are used in business transactions, their main difference is that an invoice is a request for payment, while receipts are proof of purchase. Moreover, invoices commonly provide a list of goods or services provided by the seller along with the corresponding prices, credits, discount, taxes, and total due. In short, the amount in an invoice is unpaid. On the other hand, a receipt is a record that proves the existence of a transaction. When a receipt is issued, it means that something of value and payment has been made to finalize a sale.

Is it illegal not to issue a receipt?

There was an act passed by Congress in December 2003, which is called the Fair and Accurate Credit Transaction Act (FACTA). This act applies to merchants of all sizes in the United States. The act aimed to protect consumers from credit card fraud and identity theft by prohibiting the printing of credit card numbers and expiration dates on sales receipts. Because of that, businesses must issue receipts to their customers, whether they pay using credit card or debit card. Non-compliance to FACTA will invite lawsuits and fines and face legal action by the Federal Trade Commission that could cost them fines of $100 to $1,000 per violation.

Why should you keep official receipts?

Recordkeeping is essential to your business. And properly storing receipts and other business records will help you with documentation. Strong record retention has several benefits. First, it monitors your business progress by helping you see how your business is doing. Whether you are improving in terms of sales or declining customer feedback, accurate records help measure your business. Second, receipts are part of the preparation for financial statements, which is essential in tracking profit and loss. Lastly, receipts keep a trail of deductible expenses. The Turbo Tax suggested keeping the receipts of the following expenses if you want to lower taxable income and increase your potential for a tax refund: medical, childcare, unreimbursed work-related, self-employment, and other expenses.

Properly tracking every business transactions and sales are essential to a business. An efficient sales receipt is the cornerstone of a smooth record-keeping as it is necessary for accounting and bookkeeping. Therefore, you should invest in creating a useful receipt form to promote efficiency. For more receipt form templates, visit our website and download a copy from our trove now!