38+ SAMPLE Self Employee Receipts

-

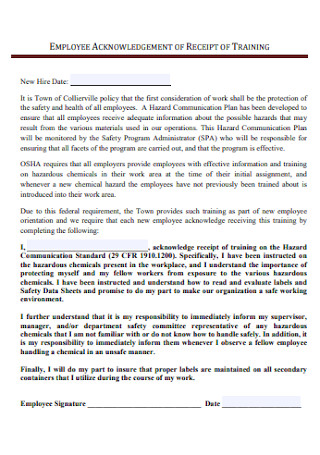

Employee Acknowledgement Receipt

download now -

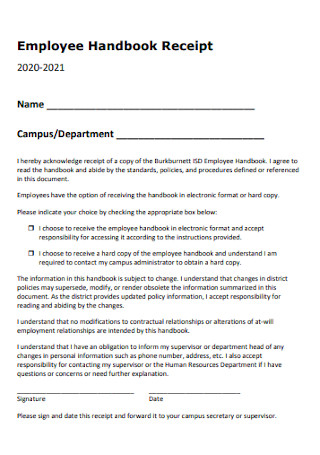

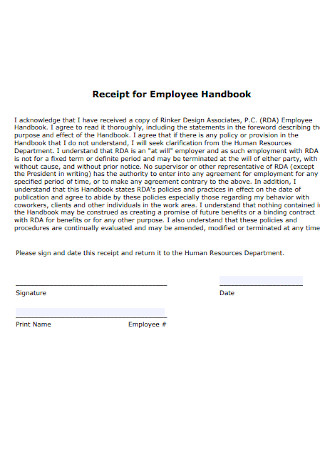

Self Employee Handbook Receipt

download now -

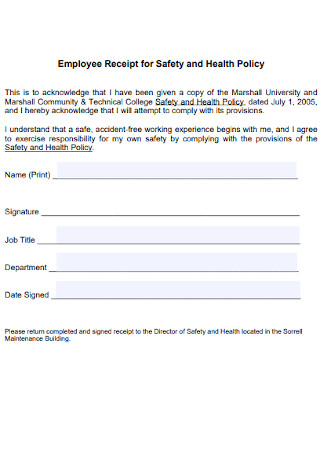

Employee Receipt for Safety

download now -

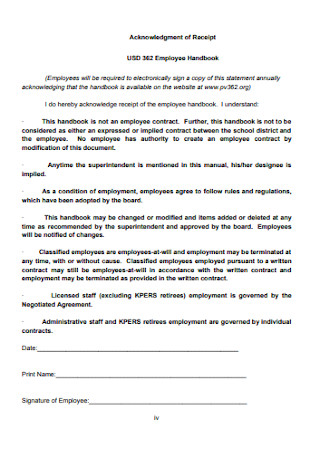

Self Employee Acknowledgment of Receipt

download now -

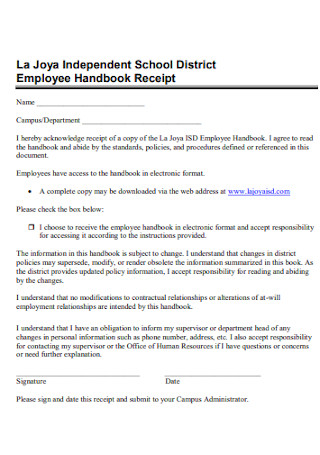

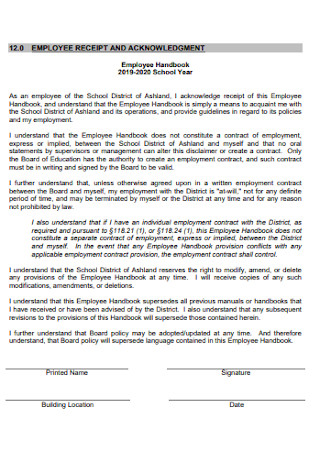

School Employee Receipt

download now -

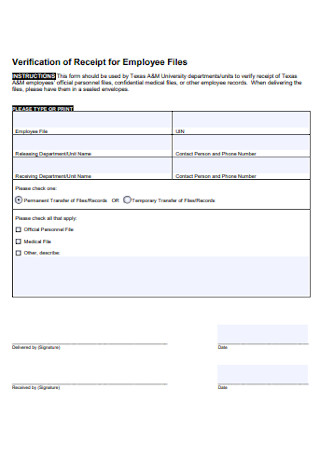

Verification of Receipt for Employee

download now -

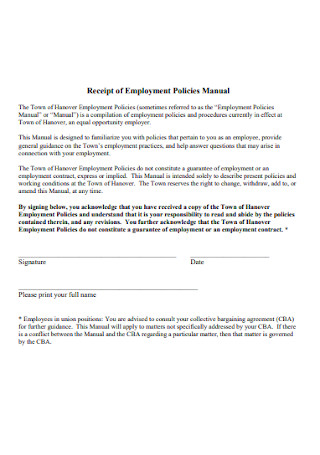

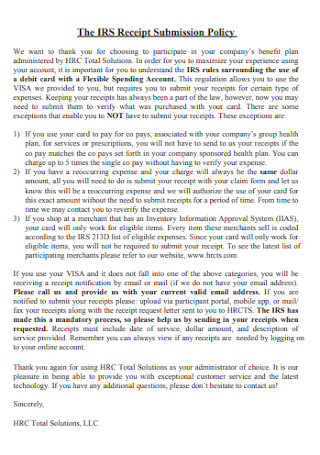

Receipt of Employment Policies Manual

download now -

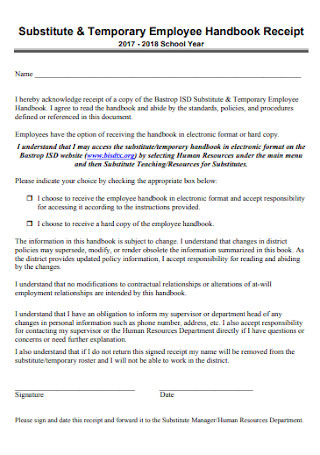

Temporary Employee Receipt

download now -

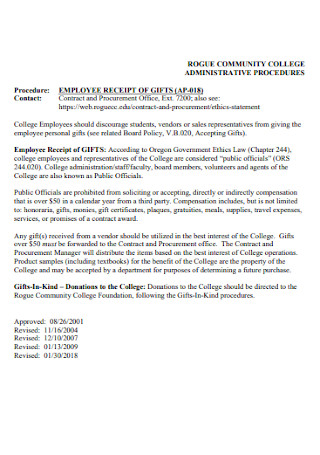

Self Employee Receipt of Gifts Template

download now -

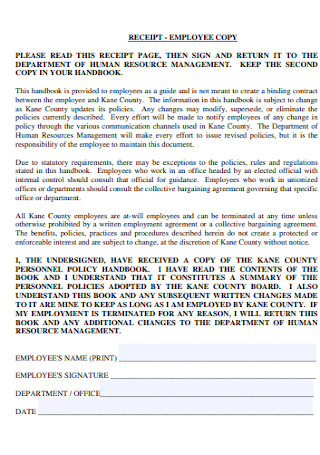

Self Employee Copy Receipt Template

download now -

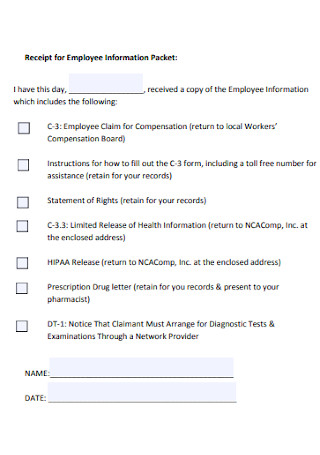

Receipt for Employee Information Packet

download now -

Receipt for Employee Handbook

download now -

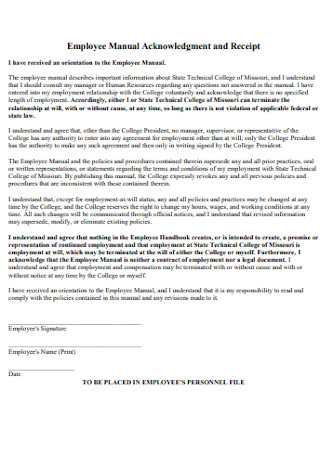

Employee Manual Acknowledgment and Receipt

download now -

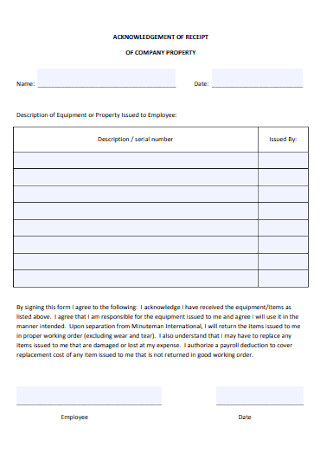

Company Self Employee Receipt

download now -

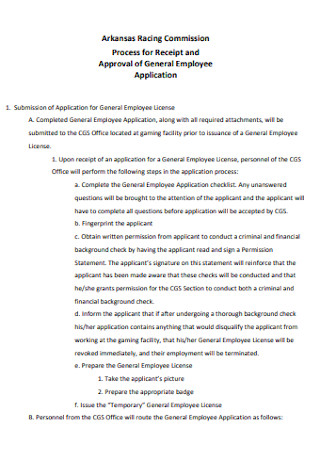

Approval of General Employee Receipt

download now -

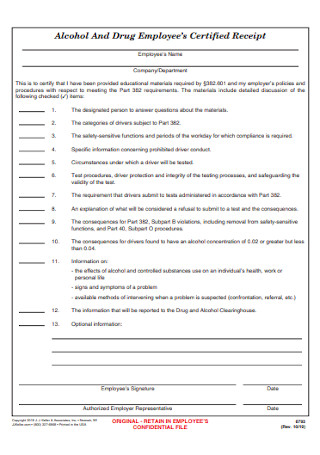

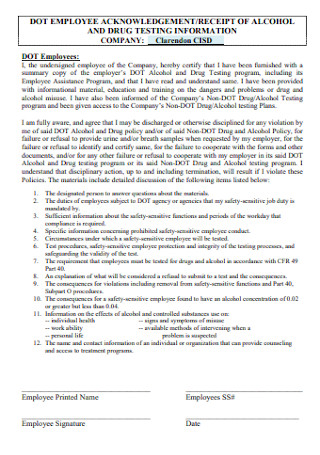

Drug Employees Certified Receipt

download now -

Standard Receipt of Employee

download now -

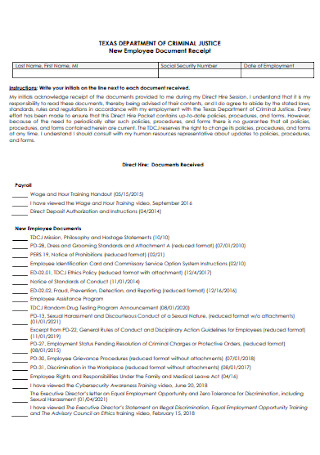

New Employee Document Receipt

download now -

Self Employee Receipt of Pay Selection Form

download now -

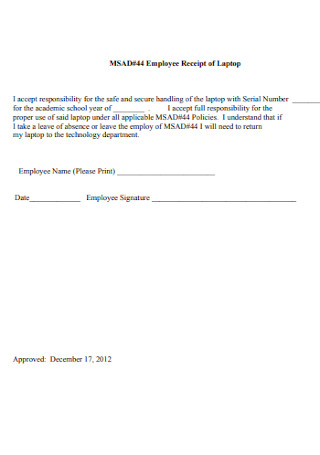

Employee Receipt of Laptop Template

download now -

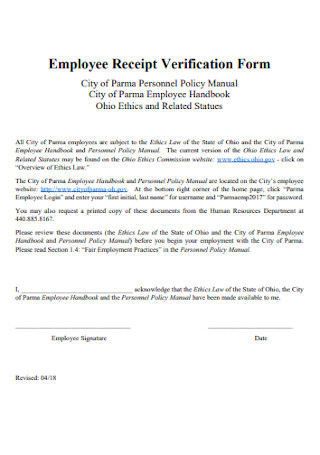

Employee Receipt Verification Form

download now -

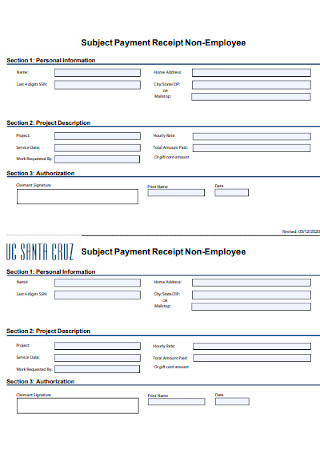

Subject Payment Receipt Non-Employee

download now -

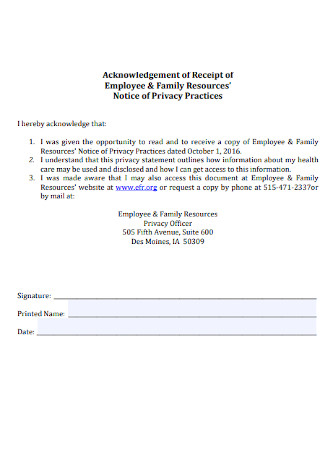

Self Employee and Family Receipt

download now -

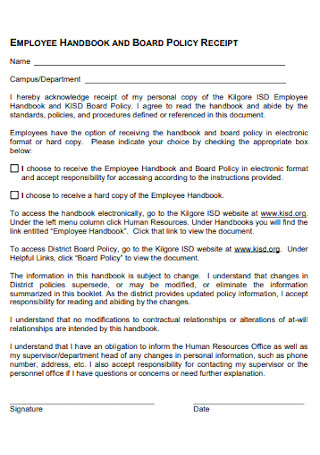

Employee Board Policy Receipt

download now -

State Employee Receipt of Gifts

download now -

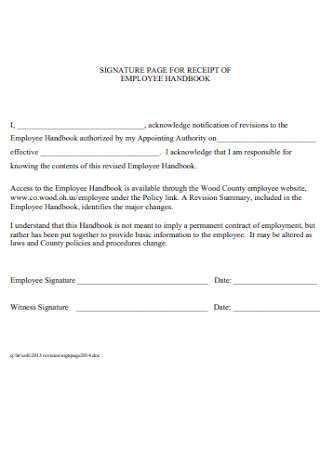

Signature Page of Employee Receipt

download now -

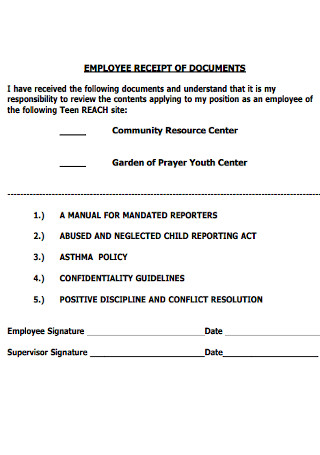

Employee Receipt of Document

download now -

Employee Education Receipt

download now -

School Self Employee Receipt

download now -

Employee of Staff Receipt

download now -

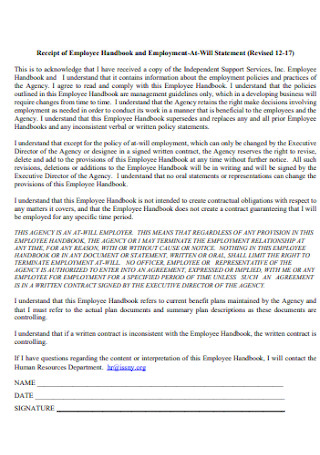

Receipt of Employee Handbook and Employment

download now -

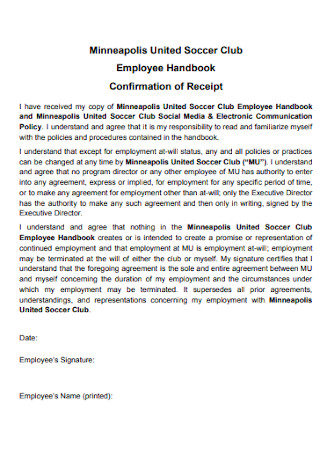

Employee Confirmation of Receipt

download now -

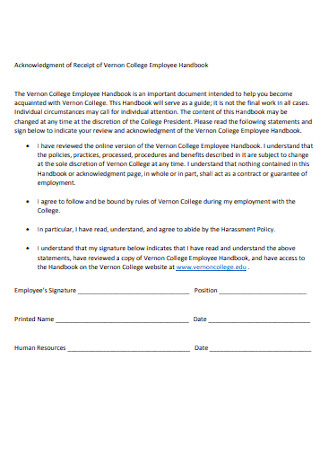

College Employee Receipt

download now -

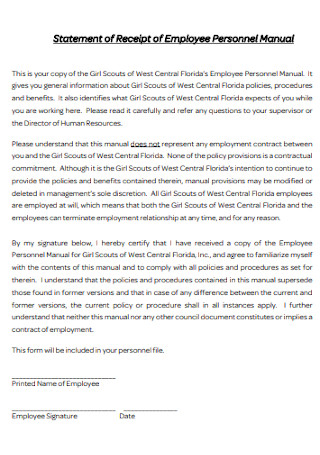

Statement of Receipt of Employee

download now -

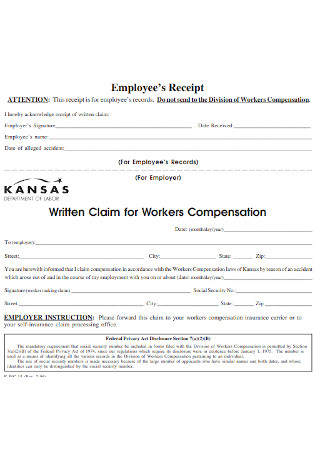

Self Employee Workers Receipt

download now -

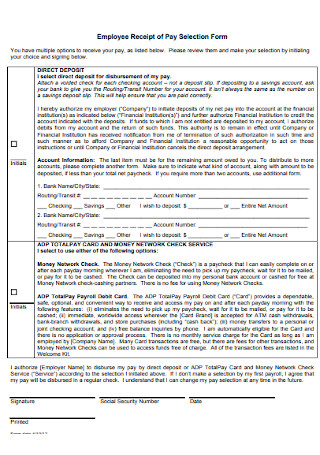

Employee Receipt of Pay Selection Form

download now -

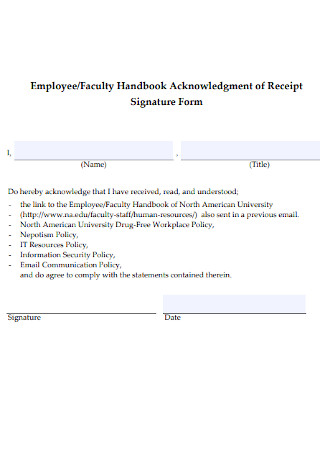

Employee and Faculty Receipt Template

download now -

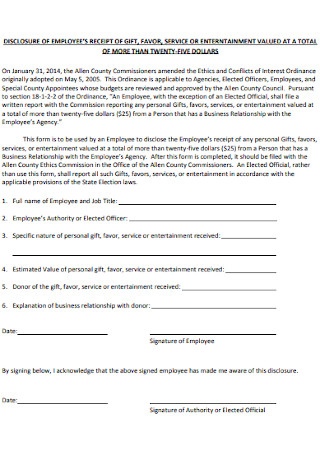

Disclosure of Employee Receipt

download now -

Formal Employee Receipt Template

download now

FREE Self Employee Receipt s to Download

38+ SAMPLE Self Employee Receipts

What Is a Self Employee Receipt?

How to Create a Self Employee Receipt

The Essential Items of A Self Employee Receipt

FAQs

Does the IRS accept handwritten receipts?

How long can a self employee keep a receipt?

Why is it important to keep self employee receipts?

Are there other types of receipts that a self employee can use?

What Is a Self Employee Receipt?

To understand what a self employee receipt is, you have to understand what self-employment means. While most people prefer to work for an employer for easy money, some people prefer to be their own boss. They want to work on their own time, follow no one’s directives but themselves, and even increase their income potential. In this case, one of the few options that they can choose from is to become a self-employed person.

That said, self-employment refers to the status of an individual who works for oneself instead of an employer. For self-employment to work, one of the tasks that one has to do is to create self employee receipts. Self-employee receipts are documents that a self employee creates for several reasons after a transaction occurs, such as record-keeping for both the self employees and the customers. To create this type of document one can use pen and paper. However, if the self-employed person wants to make it more professional and easy, it is best to use a template via word processors and print them if needed.

How to Create a Self Employee Receipt

Just like creating a school receipt, you can create a self employee receipt in a few simple steps. The following instructions are the basic ones that you need to follow to make the document more credible.

Step 1: Choose the right word processor

There are several word processors that you can use. You can use Quickbooks, Microsoft Office, Apache OpenOffice, and other downloadable software. You can also use web applications for creating receipts, which Microsoft Office offers as well as Google Docs. A rule of thumb is to always use the word processor that you are comfortable with or the one that can give you the edge as a self employee. Other processors also offer receipt templates. By using one, you will save more time because all you need to do is fill out the necessary fields and save the document.

Step 2: Create a header for the receipt

The header of a receipt is more powerful than you think. It established the identity of your business. You can also take it as an advantage to enhance your branding. Take your time to create a creative logo for your business. Yes, as a self-employed person, you have to consider what you are doing as your business. If you lack the skills, you can either use online applications or hire a graphics designer for a more professional look receipt. If you are just starting, you can do it yourself through online applications. These tools can generate cool graphics. All you have to do is to input the details.

Speaking of details, the header of your receipt should include the name of your business and contact information. Also, don’t forget to include the date and time of the transaction next to it.

Step 3: Describe the product or service involved

Needless to say, the name and the description of the product or service are the very meat of this document. Thus, you have to make sure that all the necessary details are present in this area. For instance, you are selling books online. In your receipt, you need to input the names of each book that the buyer purchased and the quantity of each book name the customer ordered. In some cases, the title of the book may not suffice to create a unique identity for the product. Therefore, you may want to create a unique ID for each of the product names. If you are selling both hardbound copy and softbound of the same book title, put an indicator for each of the products. ISBN also works.

Step 4: Don’t forget the price

Lastly, you have to include the price of each of the items. In addition to the price of each product, insert the amount of tax charged for the items. Depending on which area you are operating, you may need to impose a certain percentage of the tax. Better do your research first before you start your business. The last thing that you will need is having authorities on your tail.

The Essential Items of A Self Employee Receipt

FAQs

Does the IRS accept handwritten receipts?

As we have mentioned earlier, using printed receipts will make the self employee receipts more professional. However, it does not mean that handwritten receipts are anything less than the printed ones. Whether it is a used car sales receipt or any type of receipt, the Internal Revenue Service accepts both handwritten and computerized receipts.

How long can a self employee keep a receipt?

Since you have to operate like a regular business, you can’t keep any self employee receipts forever without conditions. Internal Revenue Service (IRS) allows businesses to keep any records, such as a self employee receipts, for up to seven years for bad debts deduction. It’s also applicable if the business is planning to file a loss claim due to worthless security. In the instance that a business fails to provide the government-mandated income reports that involve more than 25% of the declared gross income in the tax returns, it can keep these documents for up to 6 years. A self employee can only keep the receipts and other records indefinitely if one does not file a return or if one files a fraudulent return.

Aside from the tax purposes, a self employee may have to keep receipts for other reasons, such as insurance. You must have probably known that an insurance company may require these records longer than the IRS requirements. Thus, it is best to double-check the receipts if they can still be used after they served their legal tax purpose.

Why is it important to keep self employee receipts?

To effectively manage your business, you will do certain tasks, such as creating an annual business sales plan. Self employee receipts are a great item for this plan. These documents will also be quite essential if you are going to track your sales for periodic reports, such as monthly and quarterly sales reports. Aside from that, bookkeeping these documents will allow you to properly compute the turnover of the business. This process will help you build the financial statements or reports. You will even need these documents to calculate the profits of your business as well as the amount of taxes it needs to pay.

Are there other types of receipts that a self employee can use?

There are other types of receipt that you may have to use as a self employee, such as the following:

- Expense receipts – To properly manage your resources, it is essential to create a budget. To ensure that the plan happens as intended, you will need to track your business expenses. There is only one way to do expense tracking, which is to keep the expense receipts and compile them for future use.

- Salary receipts – At some point, the time will come that the number of customers that are willing to avail of your services or products will rise to the point where you are unable to accommodate them all. You will have two options. The first one is to ignore the ones that you can’t possibly accommodate. The second one is to recruit people to share the other tasks with. If you choose the latter, then, you will need to put them under your payroll. Thus, creating salary receipts may be needed.

- VAT Summary – We have mentioned earlier that your self employee receipts have a section for the VAT imposed on the services and products involved. You will also see these items in the VAT summary. However, this receipt will include not just the mentioned VAT, but the entire VAT imposed on all the transactions within a period. Usually, businesses create this report every month to avoid getting bombarded with tedious tasks, which can be possible if you choose to do it once a year or longer.

- Bank Statement – As a self employee, you can accept many payment options. It’s going to be a choice that you have to make. However, you should know that clients love convenient ways to pay, such as credit and debit cards, e-wallets, etc. If you wish to provide great customer service, you’ll have to avail of the banks’ services. If you do, you’ll get this type of receipt. A bank statement is a document that you will receive from the bank every month, quarter, and year. It contains all the transactions occurring in your bank account. These transactions include deposits, withdrawals, bank charges that are deducted from your account, and interests you earned, which will be credited to your account. It also includes all the online payments that your clients make.

- Travel Receipts/Invoice – Another thing that you may have to do while doing business is to travel. You will be given travel receipts by the travel agencies. As a businessman, it is best to keep track of them and include them as items in your business’s expenses. It will also help if you create a travel budget to properly account all your business travels.

According to Statista, since 1992, except for a few years in the late 1990s and early 2000s, the number of self-employed people in the UK has been steadily growing. In 2020, it reached its peak(5.03 million self-employed individuals). Then the COVID-19 pandemic came into the equation. In April 2021, the number of United Kingdom self-employed workers plunged to 4.35 million. However, these figures should not discourage you from becoming self-employed. With the help of some business tools, such as self employee receipts, you can ensure that becoming a self-employed person will not be hindered by the situation.

Self-employee receipts are indeed crucial in doing business. It helps you organize everything about your business, create perfect business plans for making your business prosper and thrive, and ensure that it adheres to federal policies. Take note, though, that there are still other important tools that you may have to utilize for the benefit of your business. Today, you have learned one of these most important tools. Make use of what you have learned here to make your business operate better than you ever have.