10+ SAMPLE Store/Shop Receipts in PDF

-

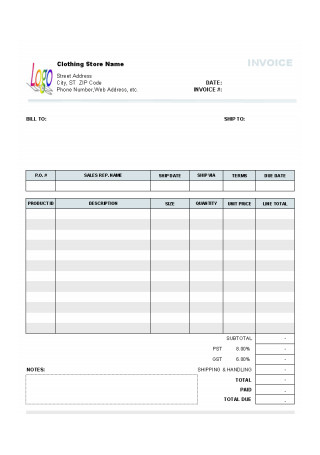

Clothing Store Invoice Template

download now -

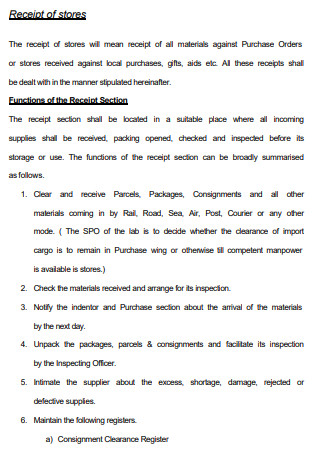

Receipt of stores

download now -

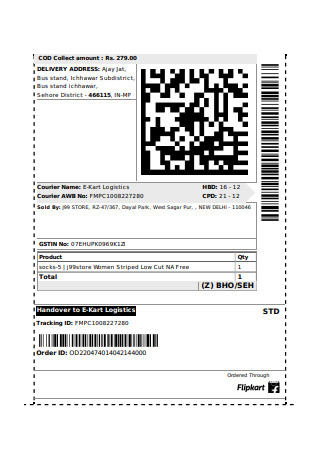

Flipkart Receipt Label

download now -

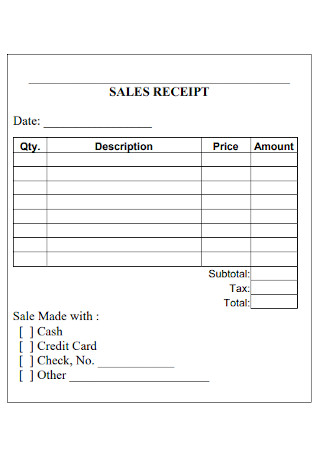

Sales Bill Receipt Template

download now -

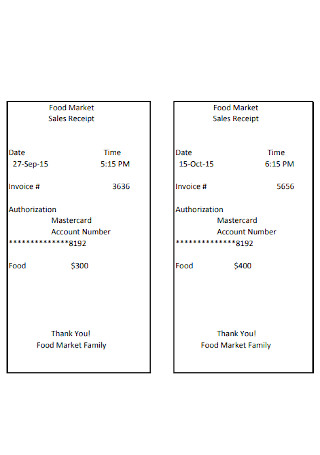

Food Market Sales Receipt

download now -

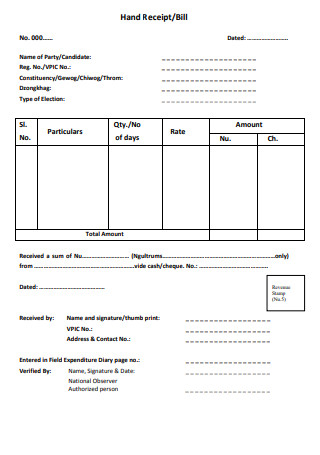

Hand Receipt/Bill

download now -

Receipt of Purchased Materials

download now -

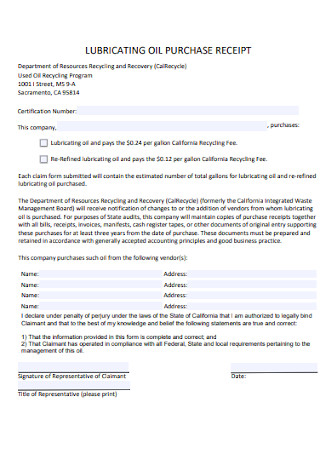

Oil Purchase Receipt Template

download now -

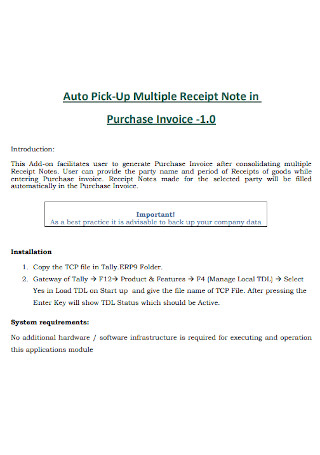

Purchase Invoice Receipt

download now -

Purchase Order Good Receipt

download now

FREE Store/Shop Receipt s to Download

10+ SAMPLE Store/Shop Receipts in PDF

What Is a Store/Shop Receipt?

How to Properly Create Store/Shop Receipts?

The Crucial Components of a Store/Shop Receipt

FAQs

What’s the difference between store/shop receipt and invoice?

Can a store keep old receipts?

What is the importance of store/shop receipts?

What is a cash receipt?

Is a handwritten store/shop receipt legal?

Are there other types of receipts that you can use?

What Is a Store/Shop Receipt?

According to a statistic that Tugba Sabanoglu of Statista published on November 30, 2020, in 2019, 30% of the global order returns are due to faulty or damaged items. This statistic is the result of the online survey conducted by the team from December 2018 to January 2019. This survey involves 18,000 online shoppers that are 17 years old and older. Other major reasons include poor quality products and not as described products. This research should convince you that your store should take into account possible customer returns. However, it is crucial to have a protocol to follow in accepting returns to avoid experiencing problems as a result of fraudulent transactions. Part of this caution is to ensure that the returned products are indeed from your store. It can be done through sale verification. This process is especially important if you are selling products that are also available in the CVS pharmacy, supermarkets, stops, or any other stores. One way to do it is to bring or deliver the store/shop receipt along with the item.

A store/shop receipt is a document produced by a store and, just like a billing statement is usually printed on paper through cash registers. Many people also call this document a sale receipt. Producing this document indicates the seller has received the payment from the customer for the goods that the customer bought and services rendered. The seller then gives the document to the customer. These days, online transactions are very common, making the sellers send the store/shop receipt to the customers in the form of email or any electronic copy.

How to Properly Create Store/Shop Receipts?

If you have an online store, you can save your time from doing this process and make a receipt manually. You can automate this process by letting an online application do it for you. However, this may require you to hire a web and software developer to make it happen. Otherwise, you have to do it manually through the following steps. Take note, however, that making a store or shop receipt for every transaction your store makes with a customer will never become a major additional task if you have established a process that the sales attendant you hire will follow.

Step 1: Determine the reason for the payment

If the software that your POS machine operates in the form of workflows, this step is crucial. Let the customers make up their minds first before you even touch the workflows. Once the customers have finalized the items that they want to purchase, gather the items and select the workflows accordingly. If your shop offers a service, make sure to choose accordingly to avoid going back to the beginning. This first mistake can turn your entire day into an excruciating one. Thus, better be careful.

Step 2: Get the details

At this point, you should be in the right workflow. If you are accepting payments other than tangible products, there are chances that you are not fully knowledgeable about the entire specification details. Luckily, through a programmed POS, once you follow a workflow, the workflow will show a list of specifications, such as length of service, date and time the service is to be rendered, etc., which will need you to fill out, helping you to avoid missing certain details. If you are using a traditional POS machine, where inputting specific details is not a requirement, take your time to know about the specific product or service that your shop is offering. If you are hiring a cashier to do the job on your behalf, make sure that the new personnel is properly trained before you let him or her do this task.

Step 3: Do the Math

Once you have gathered all the necessary information for all the items that the customers ordered, let the machine do the computation. Most of these machines are programmed to pop up a prompt box, asking you if the items and the details you entered are final. Aside from that, it may also show the details of the order, allowing you to double-check the list.

Step 4: Enter the exact amount of money the customer gave

With the pandemic that we are currently facing, both the customers and the cashiers, most likely, wear masks and face shields. While this protocol intends both parties to become safe, it affects communication. There are chances that you cannot hear the customers clearly and vice versa. Thus, it is crucial to make your voice as clear as you possibly can. Count the amount of money that you received and mention it to them to confirm before you finally enter the amount into the machine.

Step 5: Print and sign the receipt

Once everything is good, print the store/shop receipts. However, before you give it to the customer, make sure to sign it. It is also smart to make it a habit to give the change along with the receipt. By doing so, you are eliminating the possibility of having a very dissatisfied customer as a result of a small mistake – forgetting to get the change even if it’s just a small amount. You may also use a mini to-do list and check-list to refer to during the process to ensure that you don’t miss a thing.

The Crucial Components of a Store/Shop Receipt

A certain document, may it be a behavior plan, or a business plan, is called as is because it has distinct items that serve a unique purpose. In this section, you will learn the basic items that a store/shop receipt should include to serve its purpose.

FAQs

What’s the difference between store/shop receipt and invoice?

Despite their similarities, a store/shop receipt or sales receipt and an invoice are two different things. A store provides the invoice before it receives the payment from the customer. It states the amount that a customer needs to pay, the due date of the payment, and the available payment methods that the customer can use to send the payment. On the other hand, store/shop receipts are the documents that the seller gives to the customers after they receive the payment. Most likely, at this moment, the seller will give the products or render the services to the customers. However, in some cases, the customers receive the products ahead of time before they get the sales receipt.

Can a store keep old receipts?

According to the IRS, businesses can keep records, such as invoices and store/receipts depending on the purpose of keeping the documents. For instance, you can keep records for up to 7 years for bad debt deduction or if you intend to file a claim for bad securities. You can also keep records for up to 6 years if, for some reason, you are unable to provide income reports that the government requires if it is more than 25 percent of your gross income declared in the returns. You can only keep these records if you don’t file a return or if you intend to file a fraudulent return. A piece of advice? Don’t discard store/shop receipts right away after you have finalized that they don’t longer serve you for tax purposes. Instead, separate them from the other documents and double-check if you will still need them for other purposes to finally decide if you can throw them away. One example is if your company is insured, most likely, the insurance company will require you to keep these records, which is probably longer than the IRS requires.

What is the importance of store/shop receipts?

In business management, store/Shop Receipts are more important than they look. These documents will be a great item for tracking the sales of your business. Through these receipts, you can update or create your business’s sales or marketing plan.

Aside from the tracking purposes, these documents are also a great item for calculating the turnover of the business. This turnover will help you create financial statements/reports, calculating profits, and the tax that you need to remit.

From the customers’ perspective, these documents, along with invoices, are essential if they will ask for reimbursements from the company they work for. They may also use sales receipts for expense tracking. Aside from that, they also use the store/shop receipts as proof if they have complaints about the items that they received.

What is a cash receipt?

Cash Receipts are documents that state the money that companies, such as Walmart and Amazon, makes within a period. These earnings may come from online sales, interests earned, and even the earnings of the physical store itself. If your business is making investments in other companies, you can also generate a cash receipt for it. IRS(Internal Revenue Service) encourages businesses to create daily cash receipt records and compile them for a monthly report.

Is a handwritten store/shop receipt legal?

Yes, a handwritten store/shop receipt is valid. It means that its worth is never any lesser than a sales agreement. It does not need a notarization to prove its authenticity. However, it is crucial to note that it still needs certain signatures of the representatives of the company to become valid. If you are using a notary, you should also have to ensure that a signature that you will incorporate in the document is a third-party entity. It means that it should not be from a family member or a close friend of yours.

Are there other types of receipts that you can use?

Yes, there are other types of receipts that you can use aside from store/shop receipts. While store/shop receipts are important in maintaining your business. Other types of receipts can be equally important. Thus, it is a great idea to learn them as well. In this section, you will learn a few of the receipts that you may find valuable to your business.

Expense Invoice – In doing business, you will have to make transactions to other parties that involve spending money. These expenses should be recorded as business expenses. To document it properly, you may consider using an expense invoice.

Salary Receipt – Through a salary receipt, you can share details about the periodic income that each of your employees earns. Most companies issue this type of document twice a month(in the middle and at the end of the month). Many also refer to it as payroll receipts.

VAT Summary – Unlike a school receipt and sales receipt, through a VAT summary, you will include all the VAT for all the transactions happening in the month. This document allows business owners to easily adhere to IRS regulations. It also aids them in creating financial reports and other relevant reports with ease.

As your business grows, the need for establishing an effective process of getting things done will become more persistent. However, you should not take it as an additional item of your list of business problems because this is part of doing business that can save you and your business from a more serious situation. Today, you have learned a part of the business process you will have to implement sooner or later as part of your business model. Take learning about store/shop receipt template as your starting point of establishing a process that will make your business thrive.