Taxi Receipt Sample

-

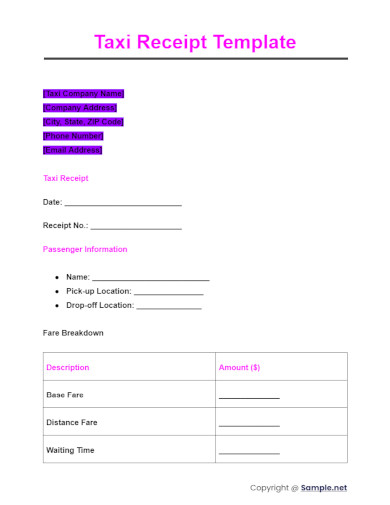

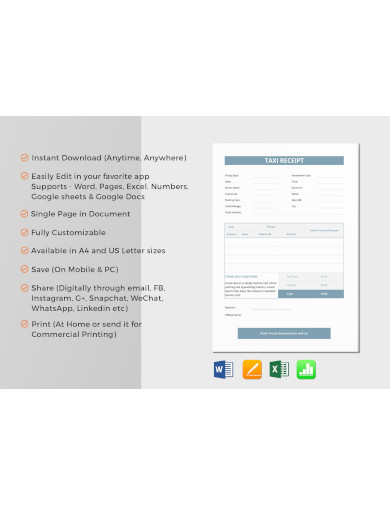

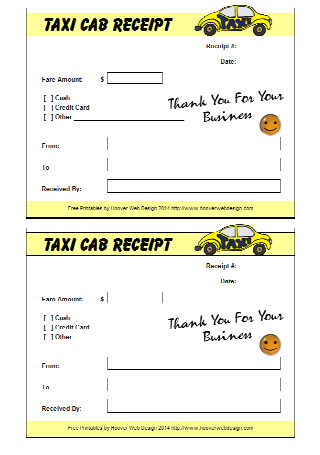

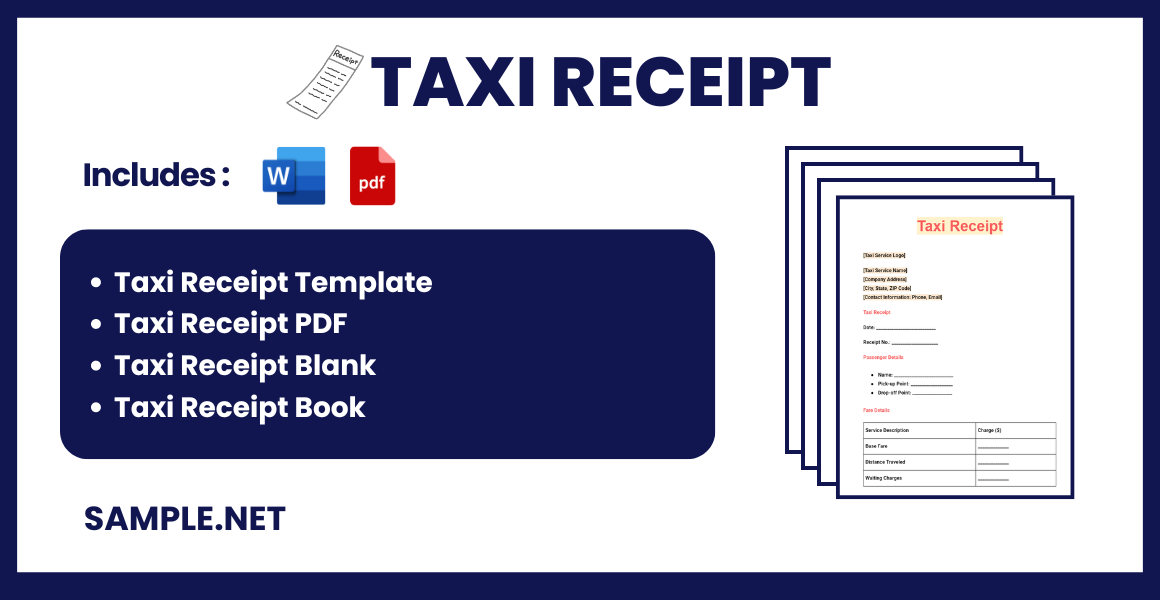

Taxi Receipt Template

download now -

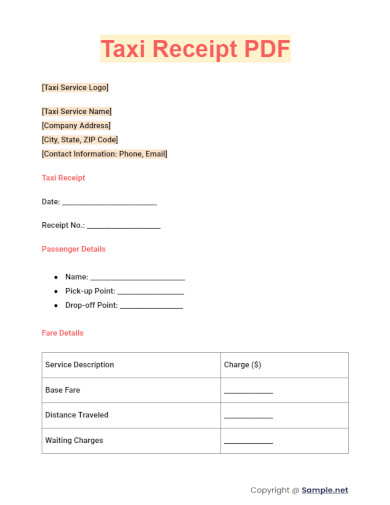

Taxi Receipt PDF

download now -

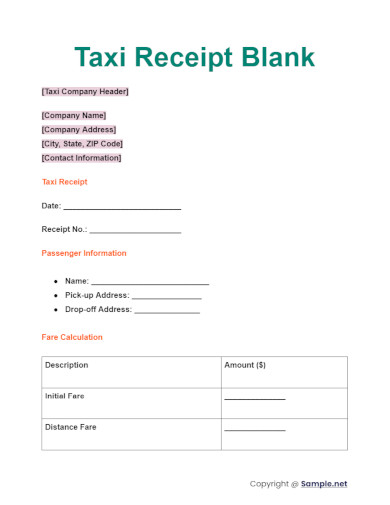

Taxi Receipt Blank

download now -

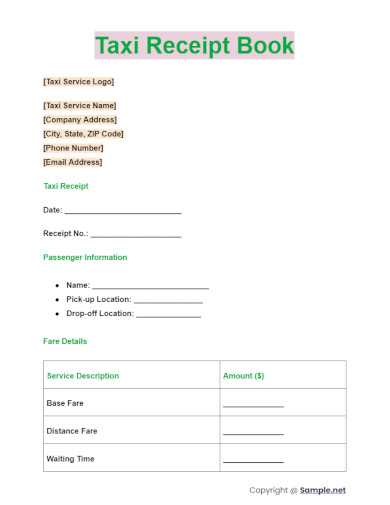

Taxi Receipt Book

download now -

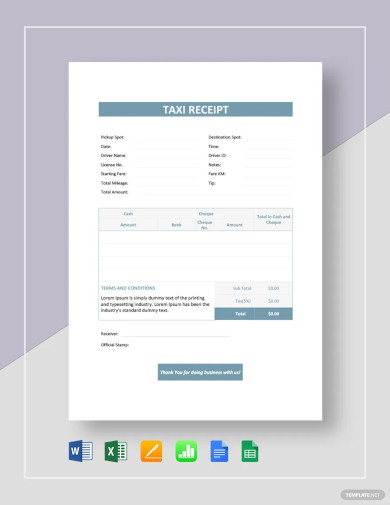

Taxi Receipt Template

download now -

Taxi Receipt

download now -

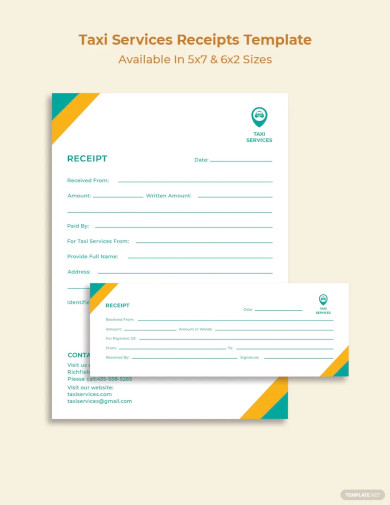

Taxi Services Receipt Template

download now -

Simple Taxi Receipt Template

download now -

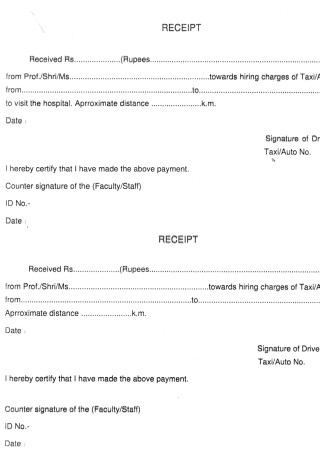

Sample Taxi Auto Receipt

download now -

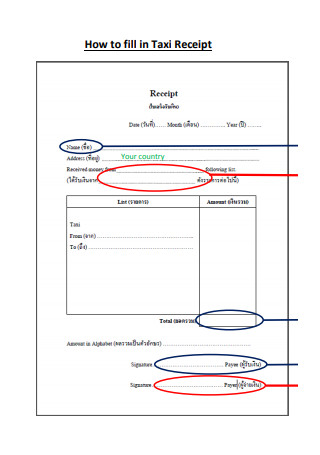

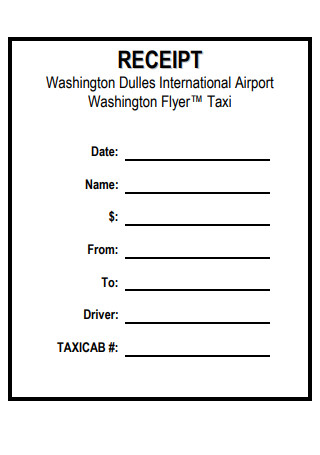

Fill in the Taxi Receipt

download now -

Handwritten Taxi Receipt

download now -

Online Taxi Receipt

download now -

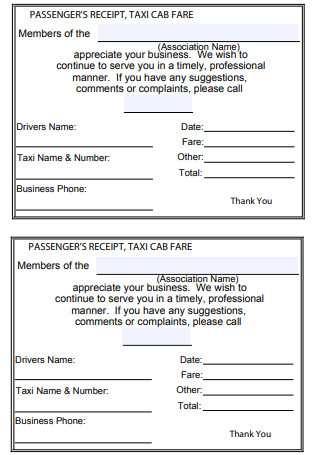

Passengers Taxi Receipt

download now -

Free Taxi Receipt

download now -

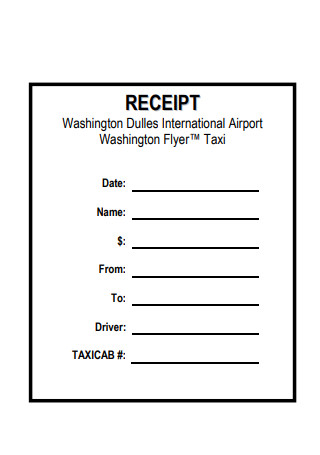

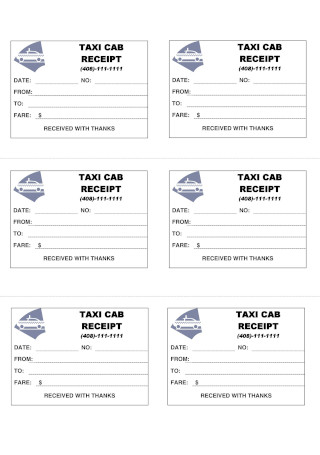

Taxi Cab Receipt

download now -

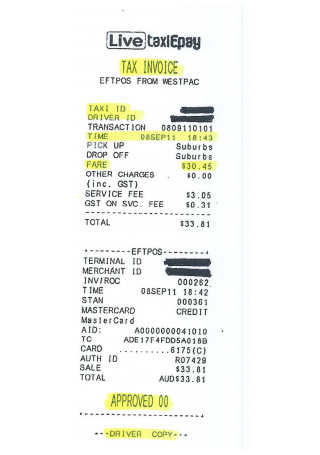

Taxi Tax Invoice

download now -

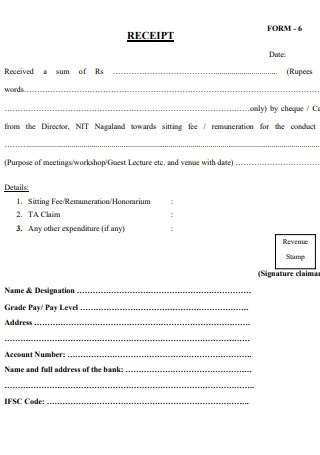

Taxi Claim Receipt

download now -

Taxi Receipt Sample

download now -

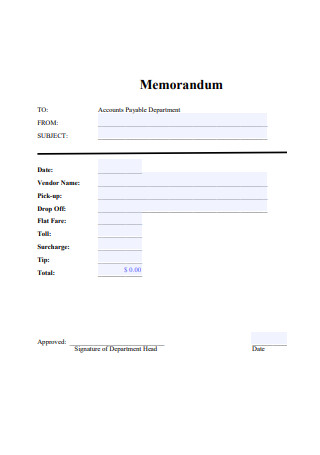

Petty Cash Missing Taxi Receipt

download now -

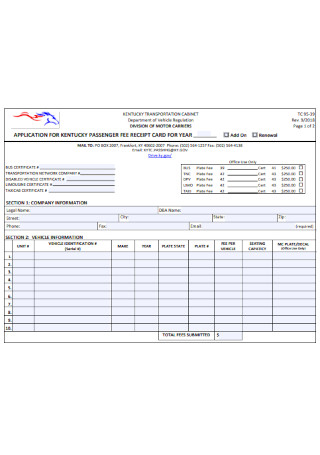

Application for Kentucky Passenger Fee Receipt

download now -

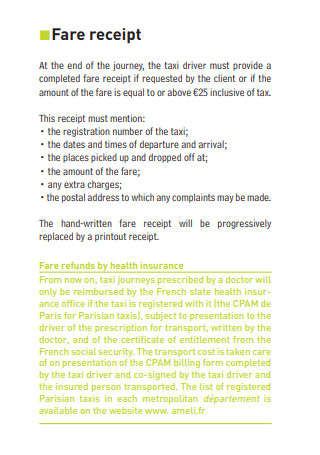

Sample Taxis Rules and Rates

download now -

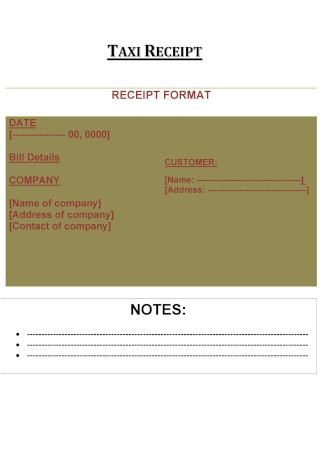

Taxi Receipt Format

download now -

Editable Taxi Receipt

download now -

Taxi Receipt Sample Template

download now -

Professional Taxi Receipt

download now -

Formal Taxi Receipt

download now -

Taxi Fare Refund Form

download now -

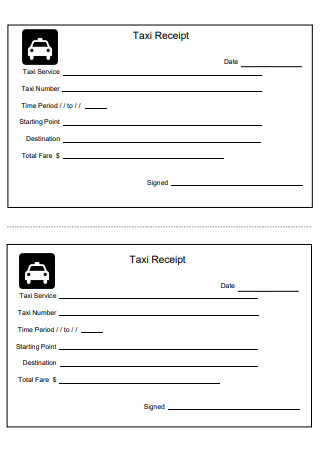

Printable Taxi Cab Receipts

download now

FREE Taxi Receipt s to Download

Taxi Receipt Format

Taxi Receipt Sample

What is Taxi Receipt?

How to Properly Create a Taxi Receipt Template?

Essential Parts of a Taxi Receipt

Why is a Taxi Receipt important?

Why should you consider using a POS machine for your taxi?

Is a handwritten Taxi Receipt acceptable?

How long can you keep a Taxi Receipt?

What is the difference between a Taxi Receipt and an invoice?

Other Types of Receipts That You May Need as a Taxi Business Person

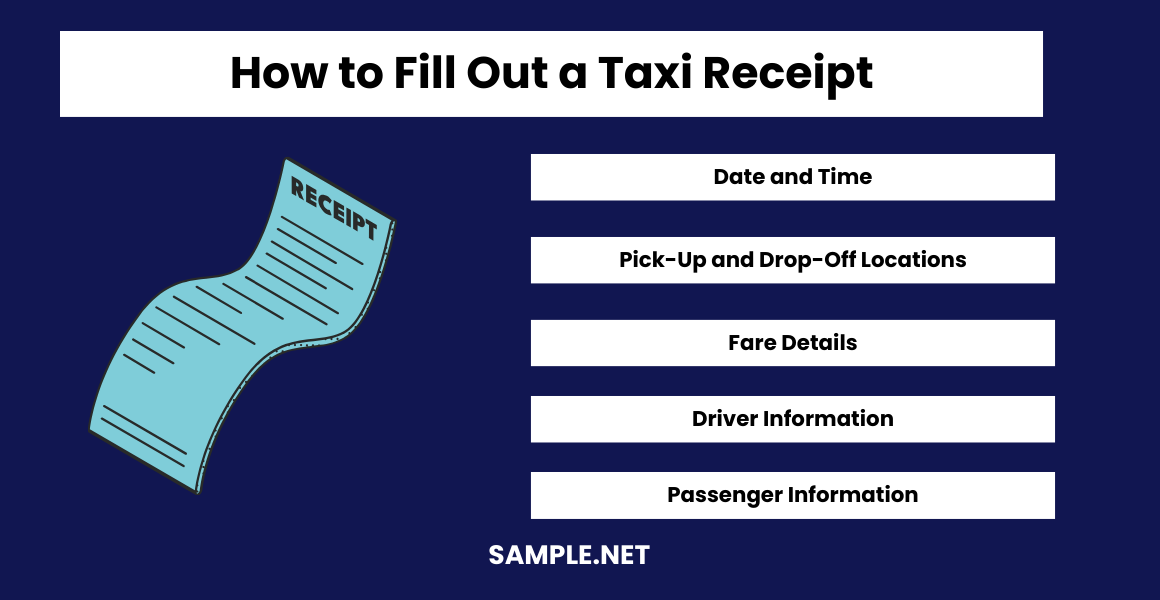

How do I fill out a taxi receipt?

How do I get a free receipt from Uber?

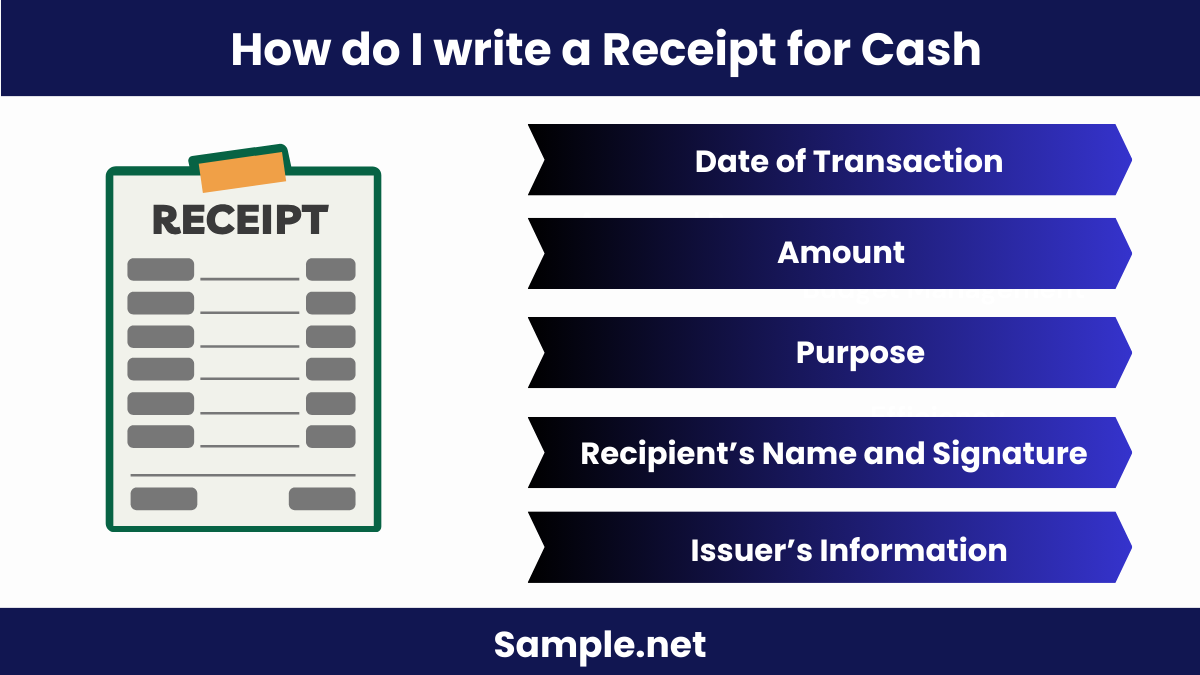

How do I write a receipt for cash?

What happens if you leave something in a taxi?

What to do if you leave your belongings in a taxi?

What happens after taxi driver?

What is a transport receipt?

Can you get a receipt from taxis?

How much can taxi drivers earn?

What can I use instead of a receipt?

Do black cabs give a receipt?

What is the proper name for taxi?

Taxi Receipt Format

[Company Name]

[Company Address]

[City, State, ZIP Code]

[Phone Number]

[Email Address]

[Website URL]

Date: [Date]

Receipt No.: [Receipt Number]

Passenger Name: [Passenger’s Name]

Pick-up Location: [Pick-up Address]

Drop-off Location: [Drop-off Address]

| Description | Amount |

|---|---|

| Base Fare | $[Amount] |

| Distance Fare | $[Amount] |

| Waiting Time Fare | $[Amount] |

| Total Fare | $[Amount] |

Driver’s Name: [Driver’s Name]

Vehicle Number: [Vehicle Number]

Thank you for choosing our service.

What is Taxi Receipt?

A taxi receipt is a document provided by taxi drivers to passengers, detailing the fare, distance traveled, date, and other pertinent information of the ride. It serves as proof of payment and is essential for record-keeping and reimbursement purposes. Taxi receipts are commonly used by passengers to track travel expenses and by drivers to maintain accurate business records.

If the taxi business is what you want to get into as a business venture, one of the important tools that you need to prepare is a taxi receipt. A taxi receipt is a document that you can provide to your passengers as proof that they paid a fare for a trip. Aside from being proof of the payment, it also proves that your passenger traveled from a place to another. In most cases, you are going to give this receipt to the customer once you reach the destination.

How to Properly Create a Taxi Receipt Template?

Through a POS machine, you can easily print a taxi receipt. However, just like a store/shop receipt, to make your taxi receipt valid it needs to be in a proper format, which you are going to learn in this section.

Step 1: Put a Header

Any receipt should have an expressive header for the reader to easily make out. That does not exclude the taxi receipt. You can either hire a graphic designer to design it for you or do it on your own through the many logo creator tools available in the market. Many taxi companies also prefer to use a simple header that contains only the name of their company, address, and contact information, which are the most important information for a header.

Step 2: Include the Customer Information

Next to the customer information, it would be a great idea to enter the name of the customer and contact information. Most mobile app vehicles for hire, usually have information about the customer. However, if your taxi business is more traditional, which means, you only pick up random passengers that you find along the road or outside the establishments, you can skip this part.

Step 3: Assign a Unique Identification

If you are using a POS machine, the machine itself will provide unique identification. It is best to put this detail after the customer information. You may also consider the date and time of the transaction as a unique identification. However, most taxi companies assign a separate receipt number that serves as identification.

Step 4: Make the Pick-Up and Destination Address More Subtle

Needless to say, the information about the pick-up and destination are a few of the most important items that you should include in a taxi receipt. Thus, it is best to make it more expressive. Your best bet is to add a space before and after this section. You can also put a horizontal line as a border or put this section in a box.

Step 5: Emphasize the Amount to be Paid and the Actual Amount Paid

Another item that is equally important with the pick-up and destination addresses is the total amount that the customer needs to pay, which will depend on the distance that the cab covers to arrive at the destination. This information is what the passenger will try to look at first. Therefore, it would be a big help if you emphasize this item.

Step 6: Put a Note Field

For some reasons, most especially if you are operating in a mobile app vehicle for hire, the customer may need to add a note about the booking that he or she has to make. For instance, their area is not located on the map that the app uses. The passenger may give additional instructions. It can also be that the passenger asks you to approach a certain person or asks you to wait up for 5 minutes. Adding this field will ensure that your template will not get messed up.

Essential Parts of a Taxi Receipt

Why is a Taxi Receipt important?

As we have mentioned earlier, a taxi receipt serves as proof that the passenger paid for a fare and proof that he or she traveled to a certain destination. Aside from that, these receipts also play a crucial role in accounting purposes. It also an essential item in case of disputes, which, as a businessman, you have to always take into consideration. Another benefit of using a taxi receipt is in an event that a passenger accidentally left a valuable item in the cab, he or she can easily reach out to your team and have the lost item returned to him or her. This capability will surely earn your business a good reputation, which, in turn, contributes to good branding for your business. You should also take a look at our Cash Receipt

Why should you consider using a POS machine for your taxi?

While creating a written taxi receipt is fine, using a template for an instant print will make your life and the customer’s easy. Imagine the amount of time writing the items for the taxi receipt that it takes to receive, it will be a lot if you combine it to the amount of time that you have to spend in counting the money you receive from the passenger and returning the change. For all you know, your passenger is in a hurry. If it is the case, you are still earning the money but there is a big chance that your customer will not book a cab from your company again. By using a POS machine that automatically prints a taxi receipt, you can avoid this situation. You should also take a look at our Advance Receipt

Is a handwritten Taxi Receipt acceptable?

Yes. Printed receipts look more professional, clearer, and organized. However, it does not make handwritten taxi receipts any less in terms of validity. For legal and other purposes, you can use handwritten, school receipts, taxi receipts, or any type of receipts. For instance, you can use printed receipts for Internal Revenue Service adherence.

How long can you keep a Taxi Receipt?

Just like any business, keeping records, such as taxi receipts has a limitation. According to IRS or Internal Revenue Service, as a businessman, you can keep records, such as taxi receipts, for up to 3 years from the date you filed your original return or two years after you paid the tax, whichever is later. You can keep records for up to seven years only for bad debts deduction or if you wish to file a claim for worthless security. You can also keep these records for up to 6 years if you fail to submit the income reports that the government requires, which involves more than a quarter of the declared gross income in the tax returns. You can only keep the records indefinitely if you don’t file a return or if you are going to file a fraudulent return. You should also take a look at our Official Receipt

Another reason why you may want to keep taxi receipts and other records are for insurance purposes. It is a known reason why businessmen keep records longer than the IRS requirements. Insurance companies may require you to do so. A rule of thumb is to make sure to double-check all your receipts after these documents have served their purpose for tax payments. These documents may still be useful for other things. You should also take a look at our Salary Receipt

What is the difference between a Taxi Receipt and an invoice?

While it is true that a receipt and an invoice seem similar, they are two different documents. An sample invoice is created by a seller/business person to inform a buyer about the amount of payment that one has to pay. Along with the total amount that the buyer is yet to pay, the document also contains all the items and the details involved that result in the total amount. Additionally, most of the time, it contains instructions of how the payments should be done, the name of the customer, etc. Most importantly, it should also include “Invoice” as a title.

On the other hand, business people provide receipts, such as used car sales receipts and taxi receipts as proof that they received a payment from a buyer. Depending on the type of the receipt, a receipt generally contains customer information, store information, the title of the document that indicates the document is a receipt, order number/receipt number, payment mode & details, details of the goods and services, discounts, taxes, and the total amount paid.

Other Types of Receipts That You May Need as a Taxi Business Person

If you are managing a taxi business, aside from the taxi receipts, you may also need to use other types of receipts, such as the following:

- Salary Receipts – Just like any other business, by the time that your business grows, you may not do all the tasks alone. You will have to hire people to delegate certain tasks to, such as the accounting process and customer service representatives. You of all people should know that providing salary receipts or payroll receipts is a smart move. This document contains the breakdown of the employee’s take-home pay for the services they have rendered, indicating that the employee has received their salary.

- Expense Receipts – As a business manager in India, Ireland, the USA, or Brussels, Belgium, you will have to spend money to operate a business. For instance, you will have to pay for the rent of your office, utilities, and even the salary that you have to pay for the employees. To take these expenses into account, it is best to compile the receipts of these expenses. You can also check our article about expense worksheets to learn more about the proper accounting of your company’s spendings.

- Bank Statement – These days, many people are becoming more confident to make their payments electronically. It means they may use debit cards and credit cards to make payments. Thus, to give your customers the convenience in terms of paying through a cashless means, you will have to use a bank’s services. By availing of the bank’s services, you will receive a document periodically. This document contains the withdrawals and deposits, among other transactions in your bank account. This document is called a bank statement.

How do I fill out a taxi receipt?

Filling out a taxi receipt ensures that all relevant trip details are documented for both the driver and the passenger. Here’s how to do it:

- Date and Time: Record the date and time of the trip.

- Pick-Up and Drop-Off Locations: Include the starting and ending addresses.

- Fare Details: Write down the total fare, including any additional charges.

- Driver Information: Note the driver’s name and taxi identification number.

- Passenger Information: Optional but can include the passenger’s name for record-keeping. Similar to filling out School Fee Receipt.

How do I get a free receipt from Uber?

Getting a free receipt from Uber is straightforward and can be done through the app. Here are the steps:

- Open the Uber App: Access the Uber app on your smartphone. You should also take a look at our Insurance Receipt

- Go to Your Trips: Navigate to the ‘Your Trips’ section.

- Select the Trip: Choose the trip for which you need a receipt.

- View Receipt: Tap on ‘Receipt’ to view the details.

- Download or Email: Download or email the receipt for free, similar to retrieving Hospital Bill Receipt.

How do I write a receipt for cash?

Writing a receipt for cash transactions ensures clear documentation and proof of payment. Follow these steps:

- Date of Transaction: Include the date the cash was received.

- Amount: Clearly state the amount of cash received.

- Purpose: Specify the reason for the payment (e.g., services rendered, goods sold).

- Recipient’s Name and Signature: Include the name and signature of the person receiving the cash.

- Issuer’s Information: Provide the name and contact details of the issuer, akin to issuing a Payment Receipt.

What happens if you leave something in a taxi?

Leaving something in a taxi can be stressful, but there are steps you can take to recover your belongings:

- Contact the Taxi Company: Immediately call the taxi company and provide details about your trip. You should also take a look at our Money Receipt

- Describe the Item: Clearly describe the lost item to the dispatcher.

- Provide Trip Details: Give information about your pick-up and drop-off locations and the time of the trip.

- Follow Up: Regularly follow up with the taxi company.

- File a Report: If necessary, file a report with local authorities, similar to handling Honorarium Receipt issues.

What to do if you leave your belongings in a taxi?

If you leave your belongings in a taxi, act quickly to increase the chances of recovery:

- Contact the Taxi Company: Call the taxi company immediately.

- Provide Specifics: Give detailed information about your trip and the lost items.

- Driver Contact: If possible, get in touch with the driver directly.

- Check Lost and Found: Many taxi companies have a lost and found service.

- Report to Authorities: If the item is valuable, report the loss to the police. This process is similar to handling lost Rent Receipt or Hotel Receipt.

What happens after taxi driver?

After a taxi driver completes a trip, they often record trip details, collect fare, and issue a Business Receipt if requested.

What is a transport receipt?

A transport receipt documents a transaction for transportation services, detailing fare, distance, and other relevant trip information, similar to an Investment Receipt.

Can you get a receipt from taxis?

Yes, you can request a receipt from taxis. Drivers typically provide a printed or handwritten Expense Receipt upon request.

How much can taxi drivers earn?

Taxi driver earnings vary by location and hours worked, averaging between $30,000 to $60,000 annually, similar to Employee Receipt documentation for wages.

What can I use instead of a receipt?

Instead of a receipt, you can use a detailed Day Care Receipt, email confirmation, or transaction record from the payment provider.

Do black cabs give a receipt?

Yes, black cabs can provide a receipt upon request, similar to requesting a Tenant Receipt from a landlord for rent payment.

What is the proper name for taxi?

The proper name for a taxi is a “taxicab” or simply “cab,” which is a common term in Landlord Receipt documentation for transport services.

In conclusion, understanding and properly using taxi receipts is crucial for both passengers and drivers. This guide has provided comprehensive information on creating and interpreting taxi receipts, including Sample Letters, forms, and practical uses. Whether you are a driver issuing receipts or a passenger collecting them, following these guidelines will ensure accuracy and efficiency. Remember, well-maintained taxi receipts are essential for financial tracking and reimbursement processes. For freelancers or small business owners, integrating Self Employee Receipt practices can further streamline your record-keeping.