Temporary Receipt Samples

-

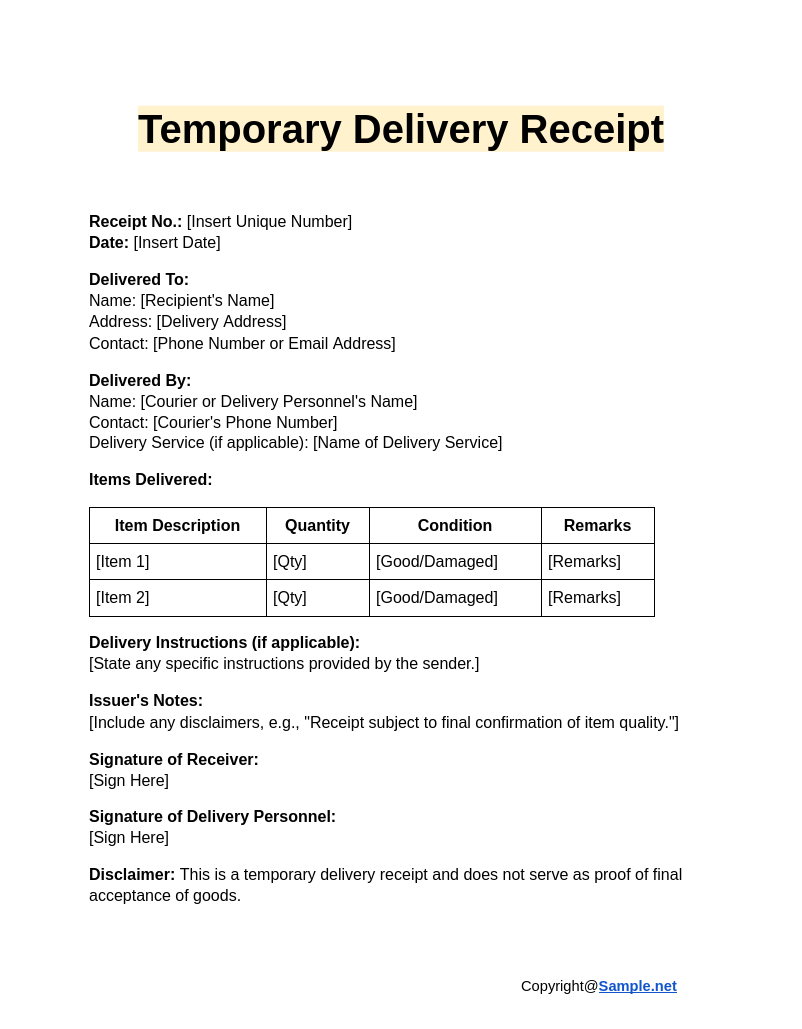

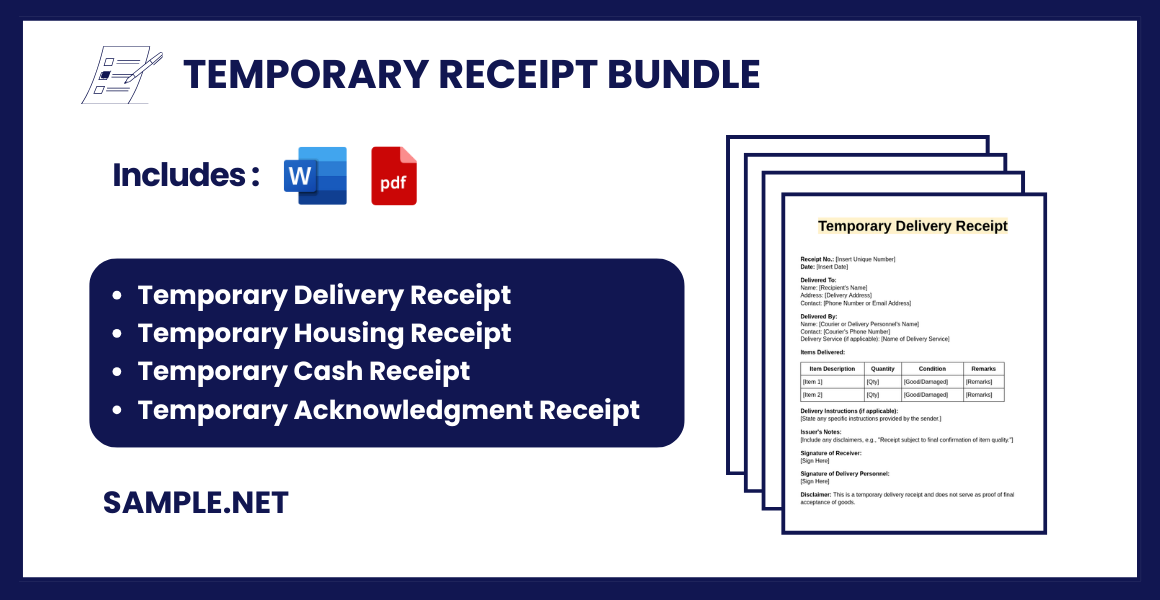

Temporary Delivery Receipt

download now -

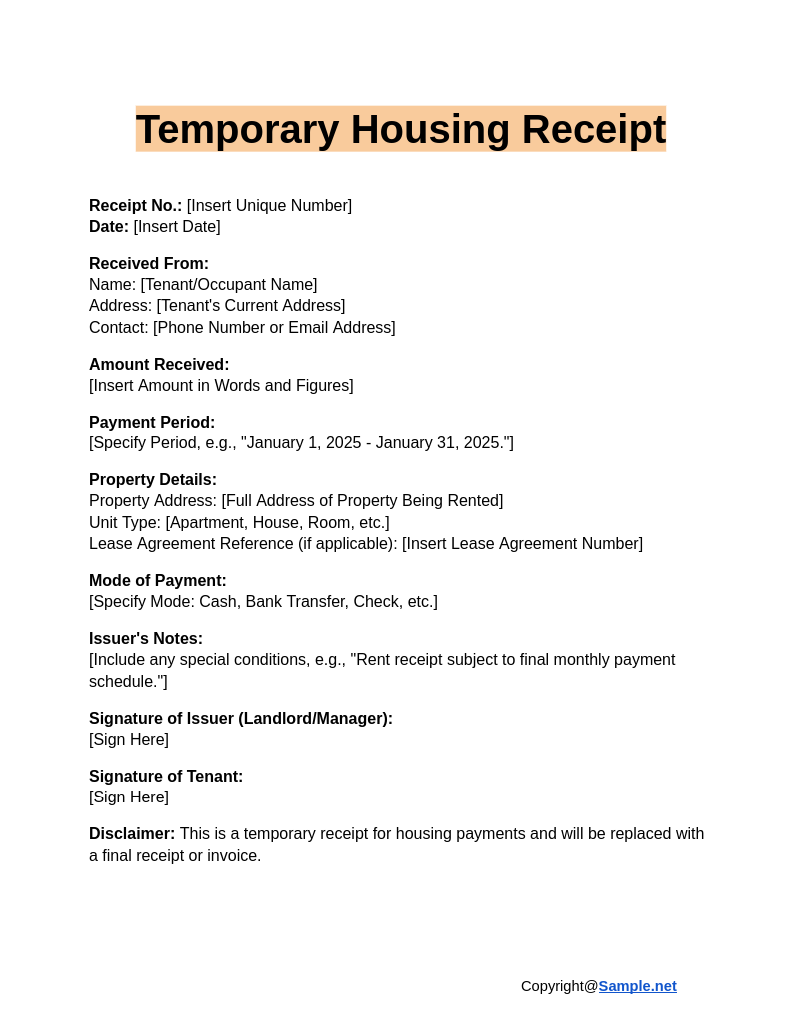

Temporary Housing Receipt

download now -

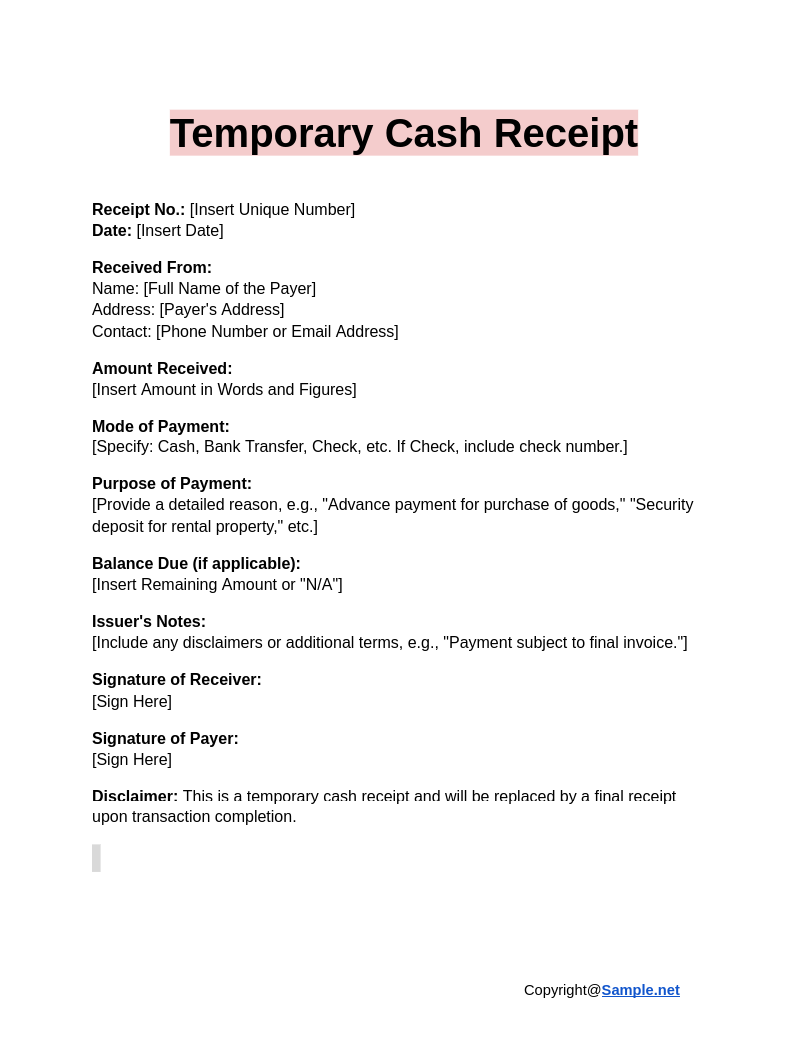

Temporary Cash Receipt

download now -

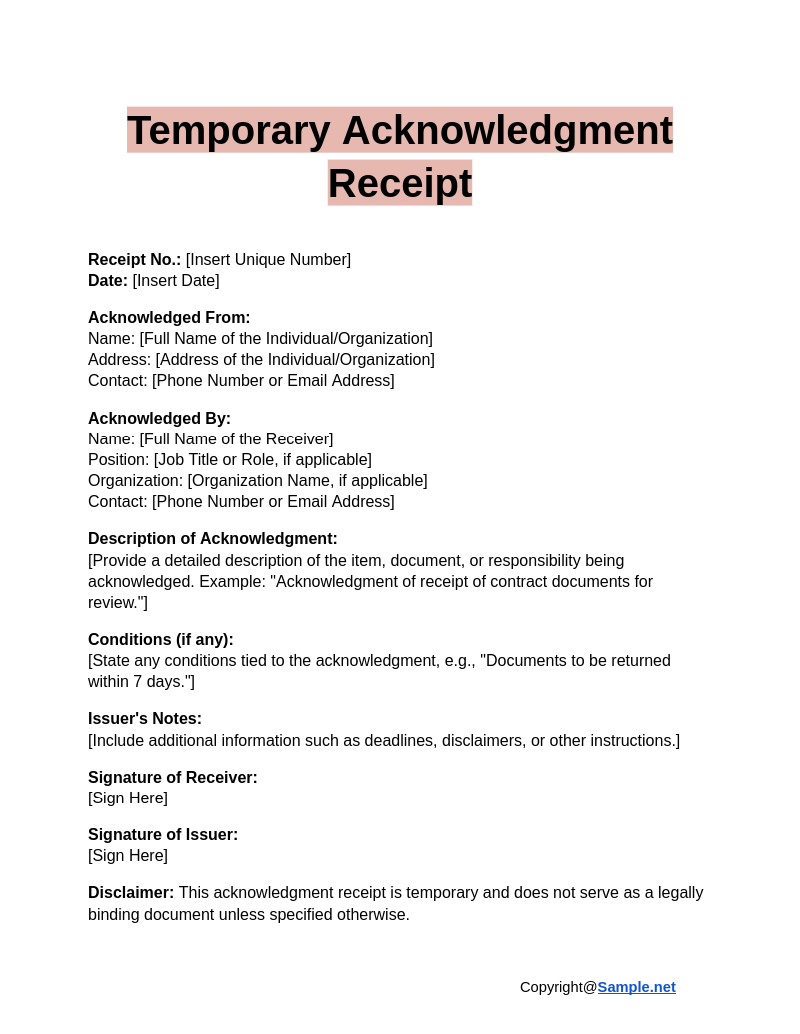

Temporary Acknowledgment Receipt

download now -

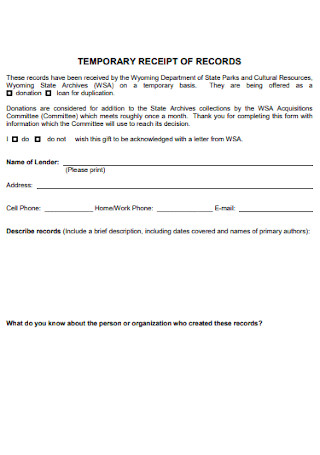

Temporary Receipt of Records Template

download now -

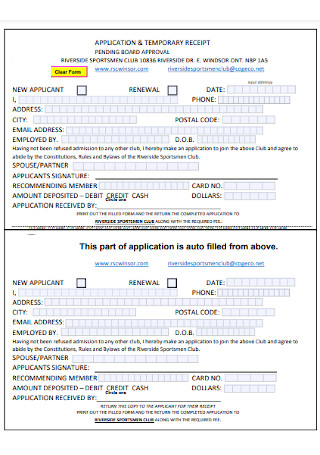

Temporary Receipt and Application Template

download now -

Temporary Insurance Agreement and Receipt

download now -

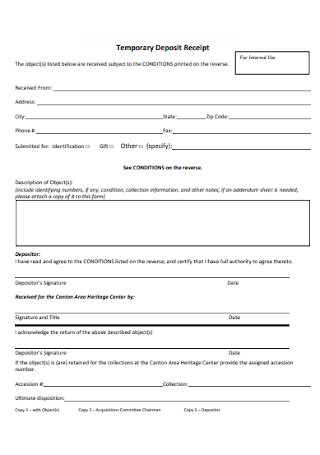

Temporary Deposit Receipt

download now -

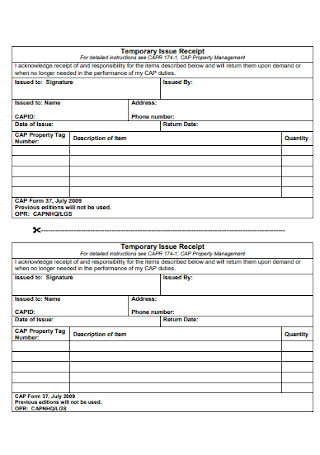

Temporary Issue Receipt

download now -

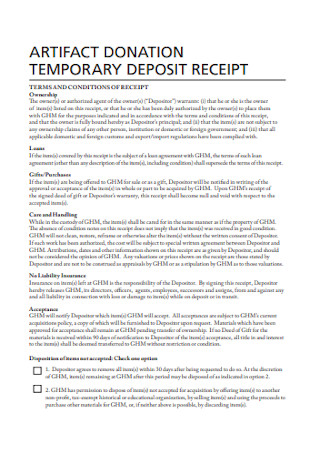

Temporary Donation Deposit Receipt

download now -

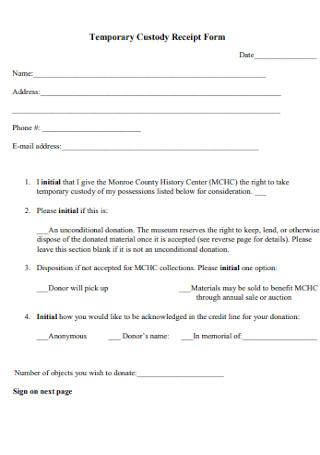

Temporary Custody Receipt Form

download now -

Sample Registration and Temporary Receipt

download now -

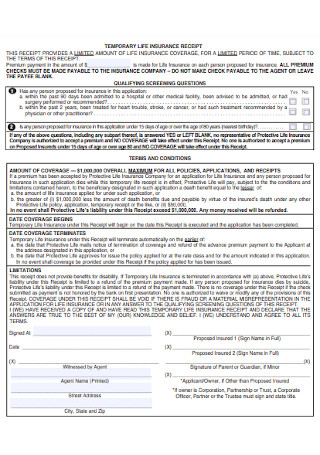

Temporary Life Insurance Receipt

download now -

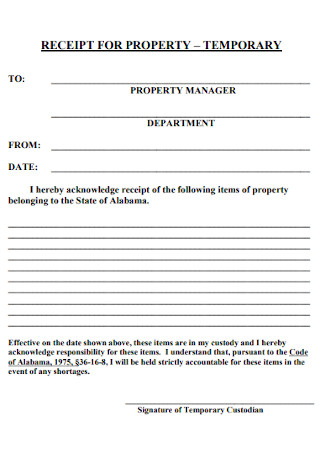

Temporary Property Receipt

download now -

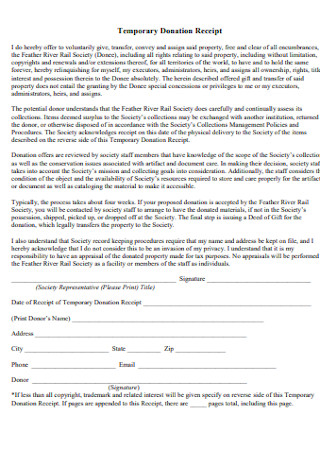

Temporary Donation Receipt

download now -

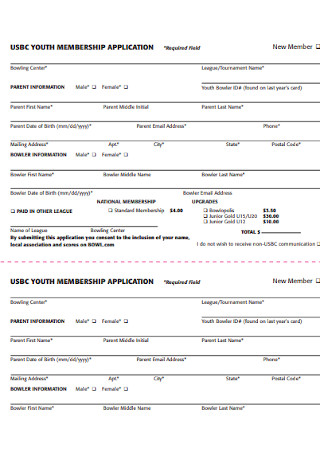

Temporary Membership Receipt

download now -

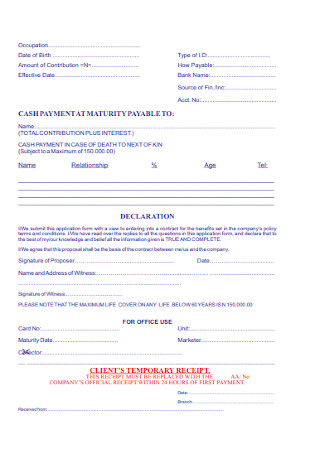

Client Temporary Receipt

download now -

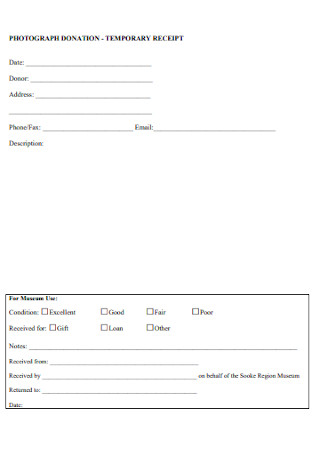

Photograph Donation Temporary Receipt

download now -

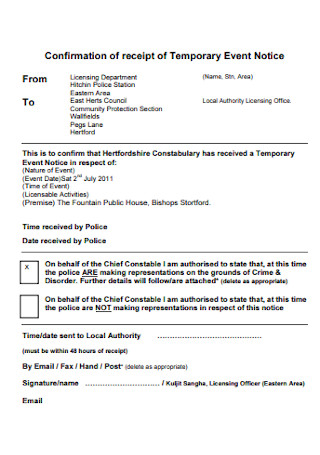

Confirmation of Receipt of Temporary

download now -

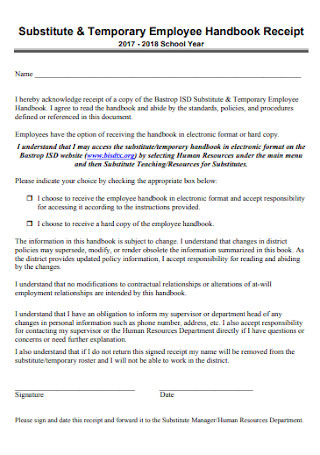

Temporary Employee Handbook Receipt

download now -

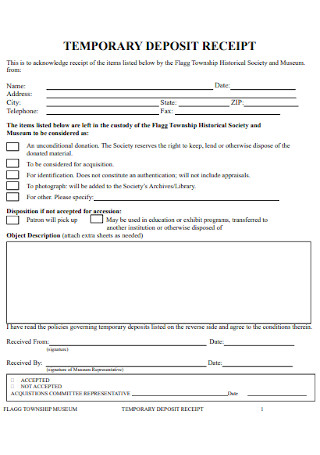

Temporary Deposit Receipt Template

download now -

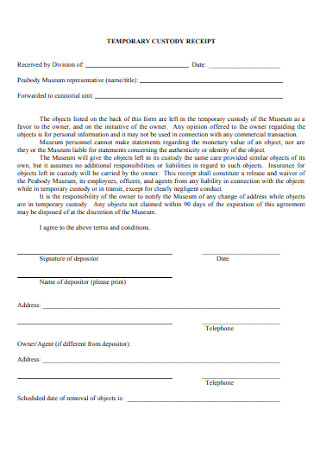

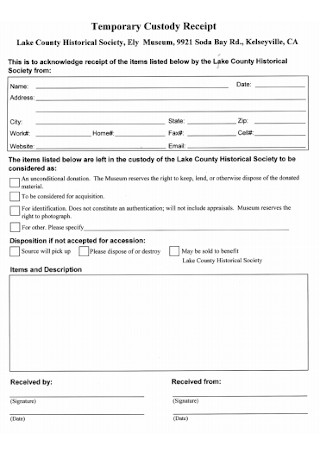

Temporary Custody Receipt Template

download now -

Receipt of Temporary Injunction

download now -

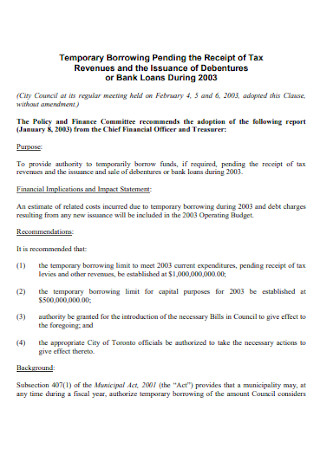

Temporary Borrowing Pending the Receipt

download now -

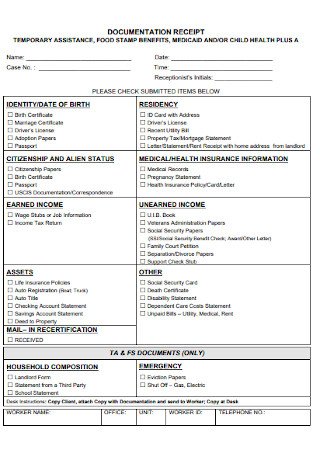

Temporary Documentation Receipt

download now -

Bridge Loan Temporary Receipt

download now -

Temporary Custody Receipt Format

download now

FREE Temporary Receipt s to Download

Temporary Receipt

Temporary Receipt Samples

What is a Temporary Receipt?

Purposes of a Temporary Receipt

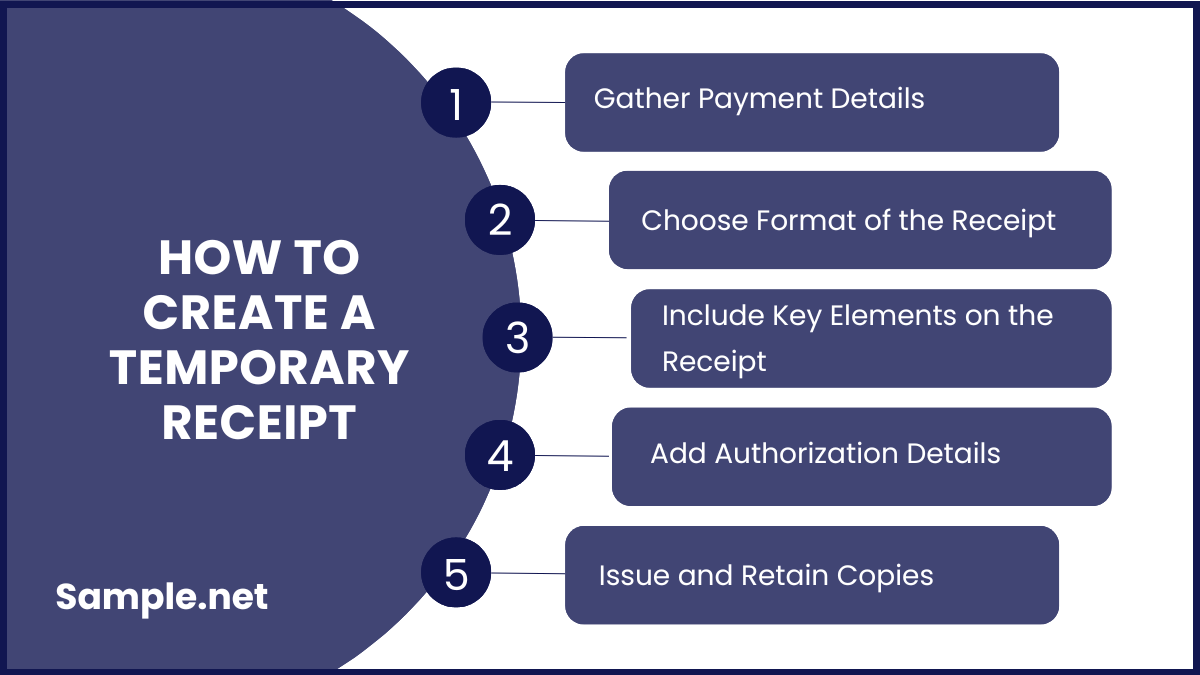

How to Create a Temporary Receipt

FAQs

What are the elements of a temporary receipt?

What are the benefits of a temporary receipt?

What are the differences between a temporary receipt and an official receipt?

What information should a temporary receipt include?

What happens if an official receipt is not issued after a temporary receipt?

How can businesses streamline the process of issuing temporary receipts?

Download Temporary Receipt Bundle

Temporary Receipt

Date: [Insert Date]

Receipt Number: [Insert Unique Number]

Received From:

[Name of the Payer]

Amount Received:

[Insert Amount]

Payment Method:

[Cash/Check/Bank Transfer/Other]

For the Purpose of:

[Reason for Payment, e.g., “Advance Payment,” “Reservation Fee,” etc.]

Balance (if applicable):

[Insert Remaining Amount or “N/A”]

Issuer Details:

Name: [Your Name or Business Name]

Contact: [Your Contact Information]

Authorized Signature:

[Sign Here]

What is a Temporary Receipt?

A temporary receipt is a document that serves as a substitute for the official receipt. It is issued to customers while the official receipt is not yet available. There are stores and establishments that cannot issue a cash payment receipt immediately sometimes. When this happens, a temporary receipt can be issued to you. It can be an online receipt or a physical receipt. Some examples of temporary receipts are a temporary delivery receipt, a temporary payment receipt, and a temporary issue receipt. Whether you are going to get a bill receipt or a travel receipt, sometimes a temporary receipt will be first given.

Purposes of a Temporary Receipt

1. Acknowledgment of Payment

A temporary receipt provides immediate confirmation that a payment has been received. This is especially important in transactions where the payer needs assurance that their payment has been recorded.

2. Record-Keeping

It acts as an interim document to keep track of financial transactions. This ensures that both parties have a clear understanding of the payment details until an official receipt is issued. You can also see more on Fee Receipt.

3. Customer Assurance

Temporary receipts instill confidence in customers or payers by showing that their payment has been acknowledged, even if the official receipt is delayed.

4. Legal Protection

In case of disputes or misunderstandings, a temporary receipt can serve as evidence that payment was made. This protects both the payer and the issuer during the waiting period for a formal receipt.

5. Operational Continuity

Temporary receipts enable smooth operations, especially in busy scenarios where issuing official receipts immediately might not be feasible. It helps businesses or organizations manage transactions efficiently while maintaining professionalism. You can also see more on Donation Receipt.

How to Create a Temporary Receipt

Step 1: Gather Payment Details

The first step in creating a temporary receipt is collecting all necessary payment information. This includes the payer’s name, payment amount, date of transaction, purpose of payment, and the method of payment (e.g., cash, card, or bank transfer). Accuracy in these details is essential to ensure the receipt serves its purpose effectively. Mistakes can lead to confusion or disputes later. Keep a record of this information for both the payer and the issuer. You can also see more on Property Receipts.

Step 2: Choose the Format of the Receipt

Decide whether to issue a paper-based or digital receipt. Paper-based receipts are common in physical transactions, while digital receipts are preferred in online or remote dealings. Tools like receipt templates in Word, Excel, or specialized software like QuickBooks can make the process efficient. Digital receipts can be emailed or sent via messaging platforms, offering convenience. Choose the format based on the nature of the transaction and your business setup.

Step 3: Include Key Elements on the Receipt

The receipt should contain essential components like the receipt number, payer and payee details, payment amount, purpose of payment, and transaction date. Add a note clearly indicating that it is a “Temporary Receipt” to differentiate it from an official document. You may also include terms or conditions, such as validity or expected issuance of the official receipt. Make the design simple but professional, ensuring the information is easy to read. This ensures clarity for both the payer and issuer. You can also see more on Self Employee Receipts.

Step 4: Add Authorization Details

To make the receipt credible, include the issuer’s signature, name, or a company stamp. For digital receipts, a scanned signature or company logo can add authenticity. This step is crucial to build trust, especially in transactions involving significant amounts. The presence of an authorizing entity reassures the payer that their payment is secure and recognized. Without proper authorization, the receipt may be considered informal or invalid.

Step 5: Issue and Retain Copies

Once the receipt is prepared, provide the payer with a copy and retain one for your records. For paper receipts, ensure duplicates are safely stored, and for digital receipts, organize them in secure folders. Retaining copies helps businesses track payments, resolve disputes, or audit financial records later. Delivery should be prompt, whether physically or electronically. A well-organized system for receipt management is essential for transparency and accountability.

FAQs

What are the elements of a temporary receipt?

The elements of a temporary receipt are the name of the buyer, the contact information of the buyer, the date of transaction, the description of the product or service, the amount paid, the payment method, the reference number, the disclaimer, and the signature of the vendor. You can also see more on Money Receipt.

What are the benefits of a temporary receipt?

The benefits of a temporary receipt are having proof of payment, helping to track purchases, offering a convenient solution, enabling faster processing, and facilitating record-keeping.

What are the differences between a temporary receipt and an official receipt?

Temporary receipts serve as interim payment proof with basic details, while official receipts are final and include additional legal elements like tax details, company logos, and formal acknowledgment of the transaction. Both play critical roles in transaction workflows but differ in validation levels. You can also see more on Monthly Rent Receipt.

What information should a temporary receipt include?

A temporary receipt should include the payer’s name, amount paid, date, purpose of payment, and a note stating it is temporary. Including a receipt number and signature adds credibility.

What happens if an official receipt is not issued after a temporary receipt?

If no official receipt follows, the temporary receipt may serve as the only proof of payment. In disputes, it can act as evidence but may lack comprehensive legal standing.

How can businesses streamline the process of issuing temporary receipts?

Businesses can use digital tools and templates to automate the creation of temporary receipts. Incorporating payment systems that generate receipts automatically can enhance efficiency and accuracy. You can also see more on Acknowledgement Receipt.