8+ Sample Annual Business Reports

-

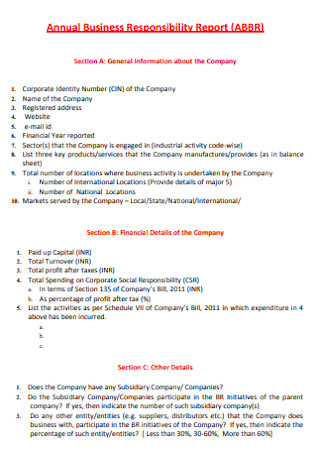

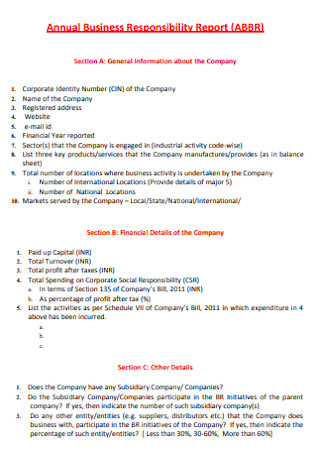

Annual Business Responsibility Report

download now -

Sample Annual Business Plan

download now -

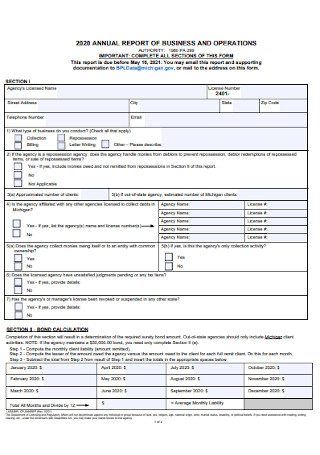

Annual Business and Operation Report

download now -

Electronic Annual Business Report

download now -

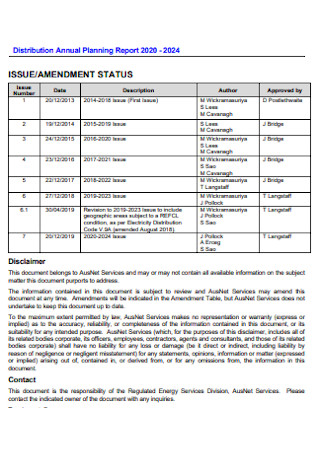

Annual Business Distribution Report

download now -

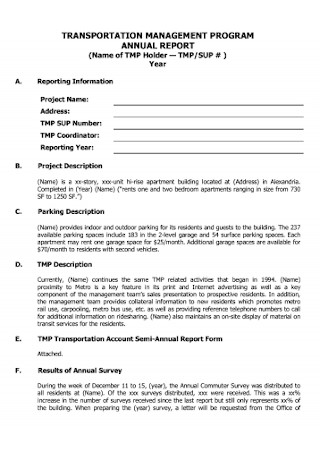

Transportation Annual Business Report

download now -

Annual Business Plan Report

download now -

Business Chamber Annual Report

download now

FREE Annual Business Report s to Download

8+ Sample Annual Business Reports

What Is a Annual Business Report?

Components of an Annual Business Report

Types of Business Reports

How To File an Annual Business Report

FAQs

What is the best way to present an annual report?

What is the best way to summarize an annual report?

What is the purpose of an annual report?

What happens if you fail to submit your annual report on time?

However, today’s corporations and organizations produce a wide range of annual business reports. Every report on the market is created with a specific end aim in mind. If that’s what you’re interested in, you’ve come to the perfect place. This article will discuss the things you need to know about annual business reports, including what they are, the many varieties, what goes into them, who reads them, and how to prepare them.

What Is a Annual Business Report?

A traditional annual business report is a detailed, comprehensive overview of a business’s accomplishments and financial statements for the previous fiscal year. It is published annually and distributed to shareholders, investors, stakeholders, and others to keep them informed about its overall performance, financial status report, and future vision. Organizations frequently use annual reports as marketing tools to impress shareholders, investors, and donors, attract new ones, and showcase their brand to employees, clients, and others. Annual business reports contain information about the company’s mission and history and a summary of the company’s accomplishments over the previous year. While financial achievements are included, other actions such as research advancements, market share gains, or honors bestowed on the company or its employees are also noted. Additionally, the achievement section may include increased sales or new machinery that improves profitability and productivity. The accomplishments section’s primary objective is to reassure shareholders and stakeholders about their investments or participation in your business. Only 20% of financial experts, according to some estimates, are successful investors. Success could be defined as generating returns that are on par with or better than the stock market’s average earnings. According to the Daily Finance website, 80% of the investment management community has made lesser earnings than the larger stock market.

Components of an Annual Business Report

An annual business report is a detailed account of a company’s operations during the previous year. It is intended to provide information about the company’s activities and financial analysis to stakeholders and other interested parties. The following are some of the items that make up the annual business report’s components:

Types of Business Reports

It’s challenging to manage and grow a business without visibility into how it’s performing and where it can improve. That is why business reports are critical for evaluating your business and charting your course to success. By analyzing the data in various reports, you can determine what is and is not working and where improvements and adjustments can be made. The following are some of the most frequently used types of reports by business owners.

Website Traffic Report

These types of business reports provide you a sense of your company’s online performance. You may use them to acquire all kinds of information, from demographics to engagement levels, by customizing them to your needs. Although you can always keep track of your business reports yourself, some business owners find outsourcing this process more convenient. Another advantage is that having your reports run by an objective third party ensures accuracy and is free of subjective bias.

Marketing Report

Marketing is a critical component of many businesses, and tracking your efforts and their results is vital. By compiling and analyzing this data, you can follow the source of your sales and ensure you’re getting a good profit on your marketing investment. Additionally, it is a document that contains data from various platforms that illustrates the effectiveness of your marketing plan. Your marketing report aims to determine whether the marketing strategies you are currently employing effectively make necessary improvements.

Inventory Report

Inventory reports show you how much of your product is in stock at any one time. This report does not have to be complex; in fact, it can be as essential as a checklist. If you want to get a little more involved, you can create an inventory ranking report to see how well your products sell relative to the expense of maintaining them in stock. All commodities, goods, merchandise, and materials retained by a firm to resell in the market to gain profit are referred to as inventory or record. Only the newspaper will be considered inventory if a newspaper seller utilizes a vehicle to distribute newspapers to customers. The automobile will be viewed as a valuable asset.

Sales and Revenue Report

A sales and income report are one of the simplest types of business reports to create, as it just provides your sales numbers for a specified time. Most importantly, you can immediately establish your profit margin by comparing these data to your expenses. You can also receive a fast overview of how to effectively manage future sales efforts, such as finding the optimal time to run marketing campaigns, by comparing these data to those from other periods.

Annual Report

An annual report’s principal function is to show you what your organization has accomplished in the previous year. Suppose the financial data are in your favor. In that case, you may also use this type of performance report as a marketing tool to get people enthused about your firm, especially potential investors and customers. Annual reports to the Securities and Exchange Commission are required by law for publicly traded corporations (SEC).

How To File an Annual Business Report

You may have come across a company’s “annual report.” The Securities and Exchange Commission mandates publicly traded corporations to provide shareholders a yearly financial report outlining the company’s business and activities for the previous year, as well as a forecast of its prospects. Annual reports for industries are frequently glossy books with lots of pictures and graphics. However, another yearly report form is arguably more significant for small business owners: the annual report that you must file with your state. This report is a brief document that contains current information on your company, such as its name and address, the people who operate it, and its registered agent. A firm can ensure that it receives the notification of litigation and other essential letters by keeping this information up to date. It is not difficult to prepare an annual report and file it with the state, although the criteria vary significantly from state to state. The following is a step-by-step method to filing an annual report.

Step 1: Determine if an annual report is required.

Every state has its standards for annual reports. They are required in some states for all sorts of business enterprises. Others don’t even require yearly reports—moreover, some mandate reports for some types of corporate organizations but not for others. Visit the state agency’s website where you filed your organizational paperwork to see if your state requires an annual report for your type of business company. You may also check “annual reports” in your state on the internet. Some states do not refer to their reports as “annual reports.”

Step 2: Determine the Due Date for the Annual Report

Your state’s company filing website should specify when yearly reports are due, in addition to who is required to file them. Some states demand annual reporting, while others require biannual (every other year) or even decennial (every ten years) reporting. The report may be due on the anniversary of your business entity’s formation, or it may be scheduled on a single date for all statements in your state. Some states require you to file an initial report within a specific amount of time after the formation of your company. If your report isn’t due yet, make a note of it and put it on your work calendar as a reminder. Businesses that miss the reporting date in some states face steep penalties, and failing to file a report might endanger your good standing with the state.

Step 3: Fill out the Annual Reporting Form

Many states allow you to electronically fill out and file your annual report on the website of the state business filing agency. In other states, you must print the form from the internet and mail it to the state.

Step 4: Submit an Annual Report

After you’ve finished filling out the form, you’ll need to submit it to the state, along with any applicable filing fees. When you file your annual report, some states also require you to pay franchise taxes or other business taxes. Many states enable you to file this paperwork online, but others may need you to mail it to the appropriate office.

Step 5: Repeat the procedure in any other states where you have a business license.

You may be required to file annual reports in each state where your business is registered if you are filed to do business in more than one. To do so, you’ll need to follow the same steps you did while filing in your home state.

Step 6: Make a note of the deadline for your next annual report.

It’s easy to overlook filing your yearly report. Make a note on your calendar of the deadline for your following report while you’re working on this year’s report. It’s not difficult to file an annual report, but staying on top of deadlines and criteria can be challenging, especially if you make sales in multiple states. Your annual reports will be filled out correctly and filed on schedule if you hire a yearly report provider.

FAQs

What is the best way to present an annual report?

It usually starts with a welcome from the CEO, followed by a description of its financial status report and performance, and a look back at the past 12 months’ activities. You can present the annual report to shareholders by mailing or handing out copies at an annual general meeting.

What is the best way to summarize an annual report?

Write two or three phrases that clarify the annual report’s aim. Write, for example, that the report highlights the company’s financial overview and position and gives statistics about the company’s earnings and spending to investors and shareholders.

What is the purpose of an annual report?

Annual reports contain information about the company’s mission and history and a summary of the company’s accomplishments over the previous year. While financial achievements are included, other accomplishments such as research advancements, market share gains, or honors bestowed on the company or its employees are also noted.

What happens if you fail to submit your annual report on time?

- Fees for late payments-The most evident consequence of failing to file your annual report on time is that most jurisdictions will charge you a late fee. Depending on the jurisdiction, these late fees can be pretty expensive. For example, Illinois charges fines for each month your report is late, and if your report is not filed five and a half months after the due date, your entity will be revoked.

- Reinstatement fees- If the report isn’t filed after a specified amount of time has passed after the due date, and the jurisdiction will remove your company’s good standing or place it in a forfeited position. Once this happens, you’ll need to file a reinstatement application. Most states require a late annual report, as well as a certificate of reinstatement and additional expenses.

- Corporate protection is eroded- You don’t enjoy the protections that come with having a corporation in good standing if your company is dormant or revoked. For starters, you can lose your company’s name. Inactive entities are often not investigated for name conflicts if another firm with similar reputation registers conducts business in that state. Second, you will be unable to file a lawsuit.

The annual business report can be used for various objectives and, when done effectively, can be one of the essential components of a planning agency’s public communication program. Good reporting necessitates an early identification of the target audience and the topics that will pique their attention. But, more importantly, it is contingent on a straightforward approach to the issue. Indeed, not all communities are as prosperous as their reports suggest. An excellent report will invite citizens to express the planners’ concerns about the community’s challenges and their pride in its past triumphs.