15+ SAMPLE Audit Investigation Report

-

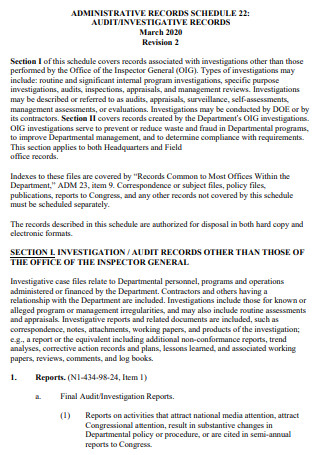

Audit Investigation Report

download now -

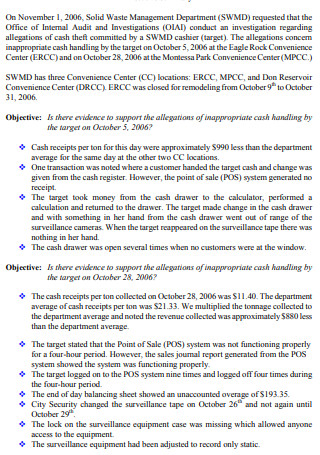

Internal Audit Investigation Report

download now -

Forensic Audit Investigation Report

download now -

Final Audit Investigation Report

download now -

Internal Audit Special Investigation Report

download now -

Office Internal Audit Investigation Report

download now -

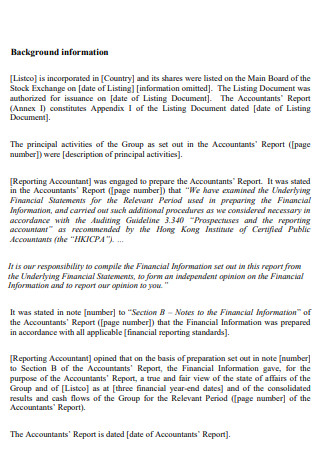

Financial Audit Investigation Report

download now -

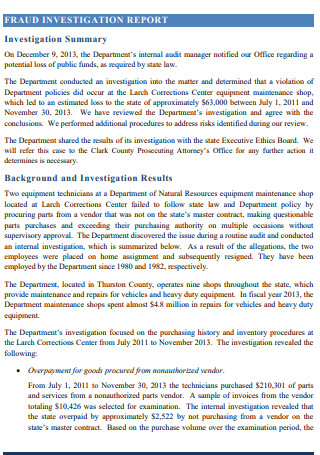

Internal Audit Fraud Investigation Report

download now -

Audit Fraud Investigation Report

download now -

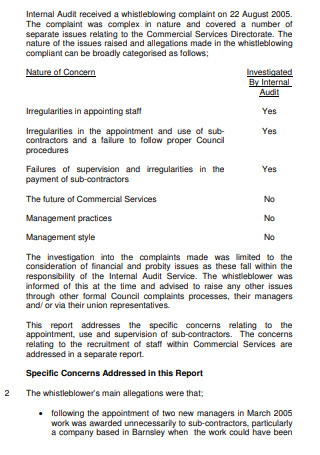

Subcontractor Internal Audit Investigation Report

download now -

Administrative Audit Investigation Report

download now -

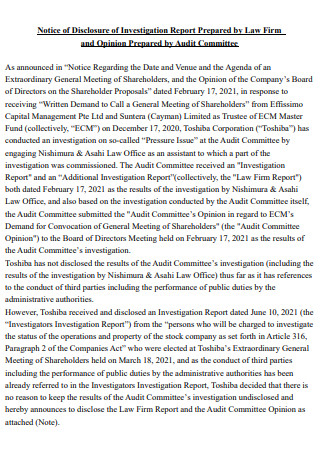

Audit Committee Investigation Report

download now -

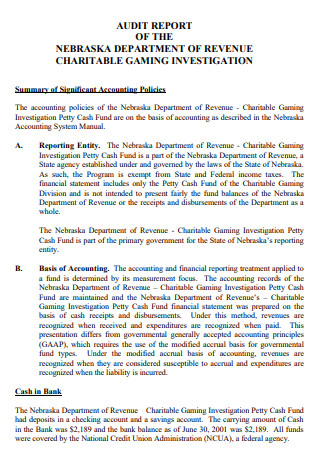

Revenue Audit Investigation Report

download now -

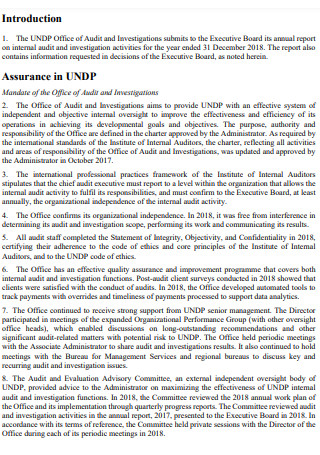

Audit Investigation Annual Report

download now -

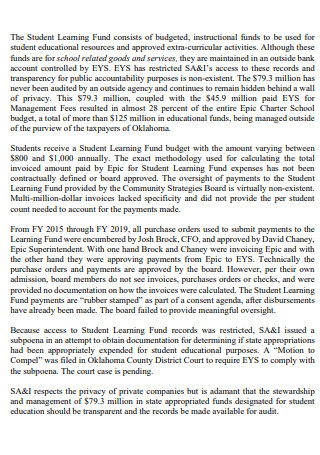

School Audit Investigation Report

download now -

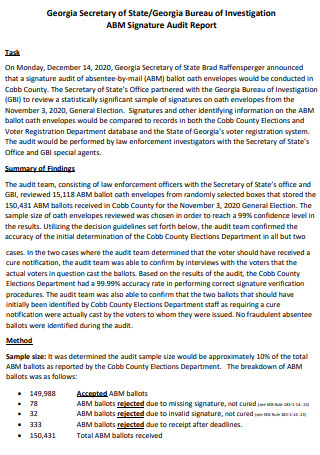

Signature Audit Investigation Report

download now

FREE Audit Investigation Report s to Download

15+ SAMPLE Audit Investigation Report

What Is an Audit Investigation Report?

Benefits of Audit

Procedures of an Audit

Steps on How to Write an Audit Investigation Report

FAQS

What Is an Audit Investigation?

Why Is an Audit Necessary?

Why Is It Necessary to Prepare an Audit Investigation Report?

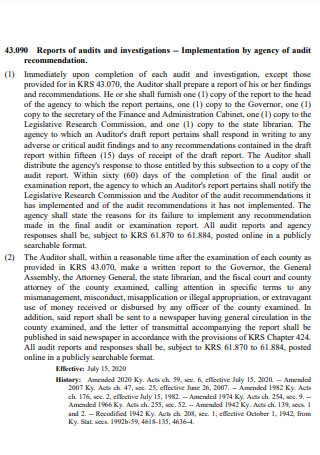

What Is an Audit Investigation Report?

An audit investigation report is a detailed document that examines if a corporation is in compliance with regulatory standards. An investigation, on the other hand, would be more in-depth than a routine audit. An audit investigation would be more specific in terms of gathering relevant documents and evidence that could be included in the report. This will therefore assist in demonstrating if the organization has suitable auditing standards and control systems in place. But the investigation would also be focused in identifying irregularities in the flow of money and funds.

Benefits of Audit

Audits are performed to better manage a company’s financial factors. It is done by looking at the financial review and reports, which includes balance sheets, income worksheets and income statements. To avoid prejudice, most audits are performed by an external group. One of its functions is to determine whether the expenditures correspond to the appropriate budget. Or whether the company’s current financial status is sustainable. And there are numerous advantages to performing audits on a regular basis. Take a peek at the section below for more!

Procedures of an Audit

Auditing is done in a series of steps. These procedures then govern the audit’s pace and methodology. There are internal controls that aid in the preparation for the actual ISO conducted by an external agency. Auditing methods are not sequential in nature. They could be carried out concurrently or in any order. As long as their aim is met. So, here are some procedures that could be carried out during an internal or external audit.

Steps on How to Write an Audit Investigation Report

An audit examination is designed to identify faults in each environment. The keyword “investigation” distinguishes it from a standard audit. So there’s a reason for investigating, and it’s most likely to discover something, more probably a mistake. It not only examines the company’s financial statements in general, but it can also investigate a questionable area. It’s not dissimilar to a criminal investigation with the goal of proving guilt. As a result, writing a specific audit investigation report may be more difficult. The steps outlined below may be of assistance.

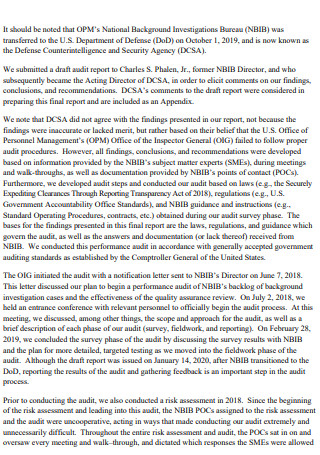

1. Identify the Purpose of the Audit Investigation

The first stage in conducting an audit investigation is, of course, determining its precise goal. There is always the goal of absolving or demonstrating guilt in an investigation. It’s not dissimilar to an audit probe. As a result, the probing in an audit review may be limited to a certain account. Or a specific aspect of the financial statement that requires further explanation and documentation. When there is a particular aim for the investigation, it is easier to carry out. Because it could aid in the development of a systematic procedure for conducting the investigation. And it makes it easier to write the contents of a report when there is a clear direction.

2. Scope of the Investigation

A purpose is distinct from the scope. The scope of the investigation specifies which properties or components to be investigated. Or what are the requirements, such as documentation and other items, that auditors would need. Furthermore, how wide do they need to investigate in order to reach a more conclusive result? A scope helps define limitations of what to write in a report based on what was investigated. It also delineates regions where the emphasis should be placed. As a result, determining which critical evidence is required to support a claim.

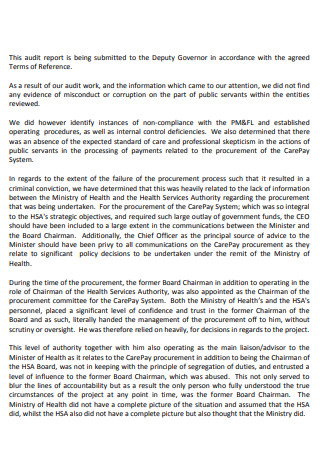

3. Auditing Standards

The report also addresses the auditing standards, particularly the company’s internal controls. A loophole would be sought after during an audit examination. Policy and control measures have flaws that could be exploited. In addition, the auditing standards aid in the investigation. Since it serves as a guidance for how the audit is often carried out. As a result, an auditor investigating will know exactly where to search. And this should be reflected in a report. Whether or not anything was discovered. It helps in tracing and establishing a firm foundation throughout and after the investigation.

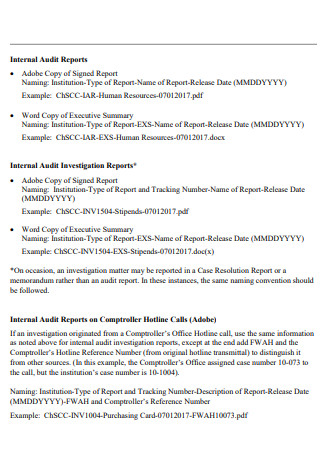

4. Documentation

Almost everything done during an audit requires documentation. It could be interviews with people who are related to the account. Any evidence, including financial statements and other documentation are collected as well. As evidence, important papers such as complaints should be attached to the report. It’s also a good idea to include references to this type of documentation throughout the report to establish the point and conclusion. It is critical that this evidence or papers be included in report.

5. Executive Summary, Conclusion

A report may begin with an executive summary and conclude with a conclusion. These are extremely common in any given report. The executive summary informs the reader of the report’s principal aim. As well as providing a hint about the substance of the pages that follow. And a conclusion is critical in demonstrating whether there is adequacy within a company’s auditing standards. Or if there is evidence that could shed some light on the problem.

FAQS

What Is an Audit Investigation?

An audit investigation investigates a company’s accounts or financial statements, primarily searching for discrepancies. This entails gathering evidence as well as producing the relevant documents. Essentially, the inquiry monitors the fund’s flows to determine whether it follows government regulations and standards.

Why Is an Audit Necessary?

Auditing is crucial because it assists a firm in determining the sufficiency of its internal controls. Furthermore, it informs them as to whether they are efficient. And that they are also in accordance with regulations.

Why Is It Necessary to Prepare an Audit Investigation Report?

An audit investigation report reveals what is discovered during the audit investigation. It exposes any inconsistencies or inefficiencies. It also aids in the detection of fraud and the prevention of financial damages to a company. In addition, the report is extremely extensive and detailed. Companies can make use of it.

In company, financial accountability is fundamental. Uncertainty about where losses are coming from is a source of even greater losses. An audit investigation can assist in determining a company’s financial health. Their inaccuracies, inefficiency, and points of interest where fraud can occur. A report on an audit inquiry is simply the end result of the process. And to start, you can get audit investigation report pdf right now!