Cash Receipt Samples

-

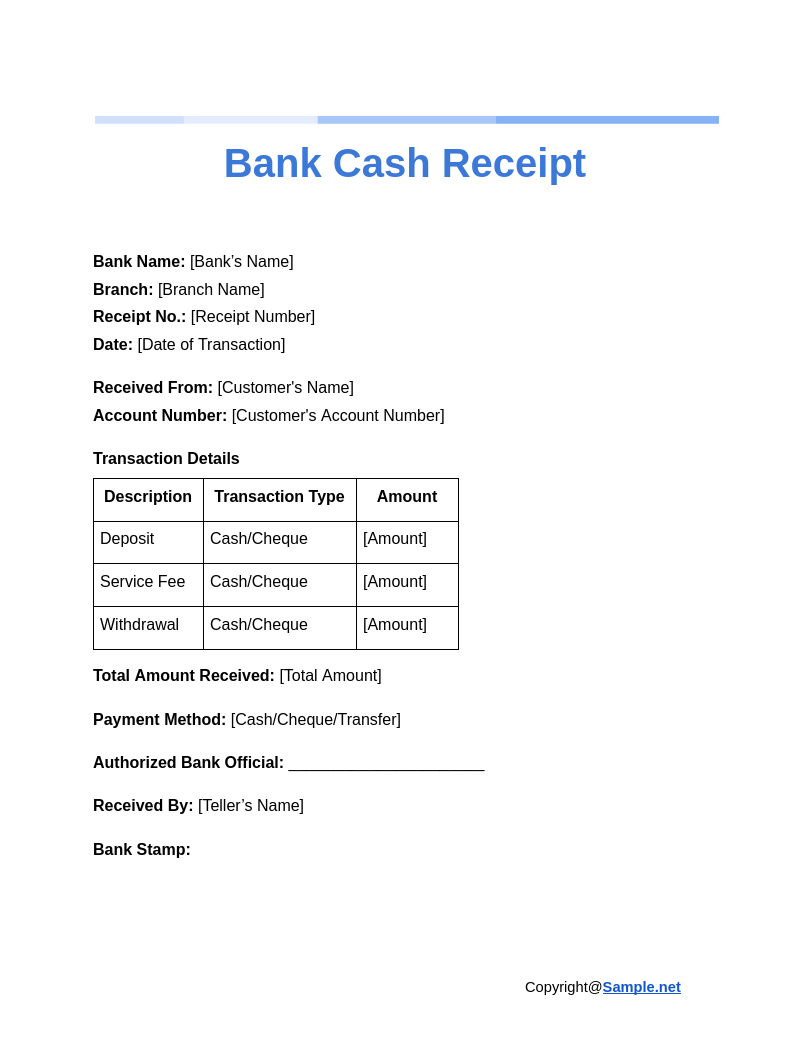

Bank Cash Receipt

download now -

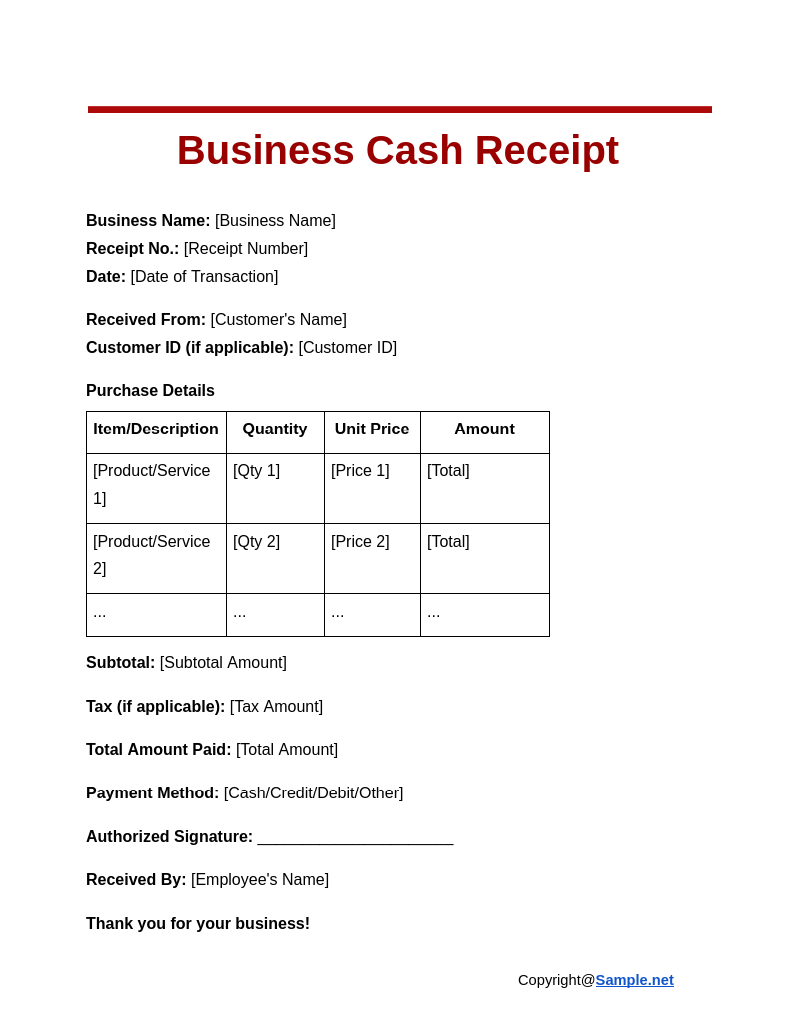

Business Cash Receipt

download now -

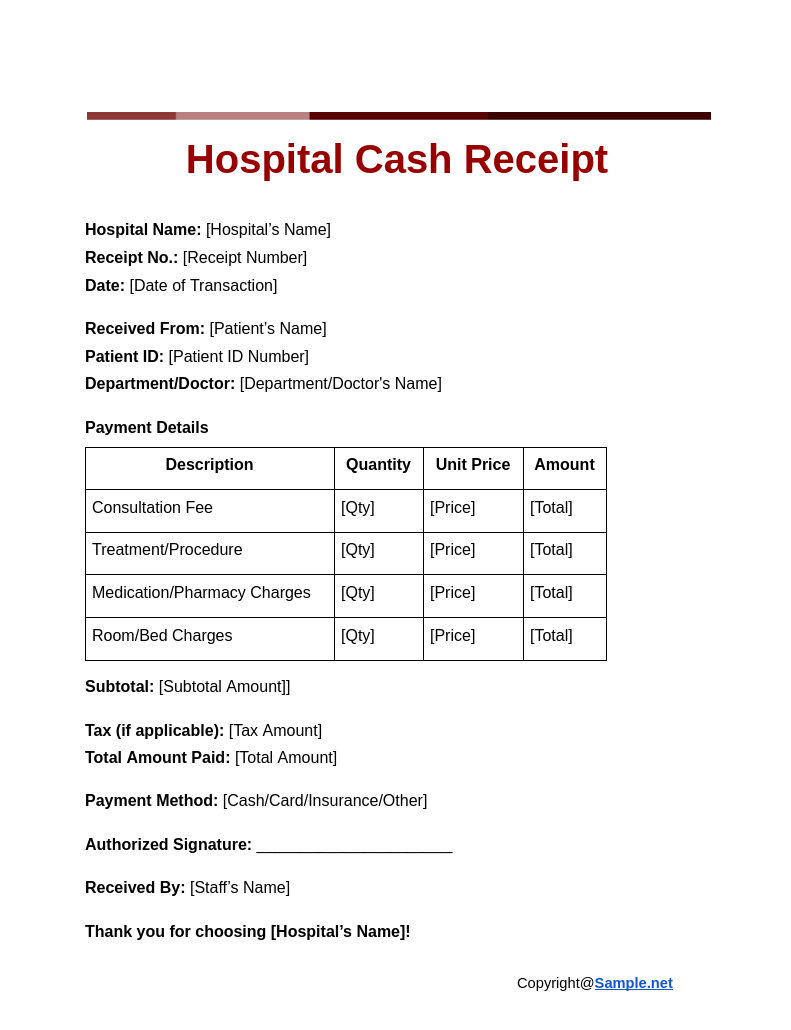

Hospital Cash Receipt

download now -

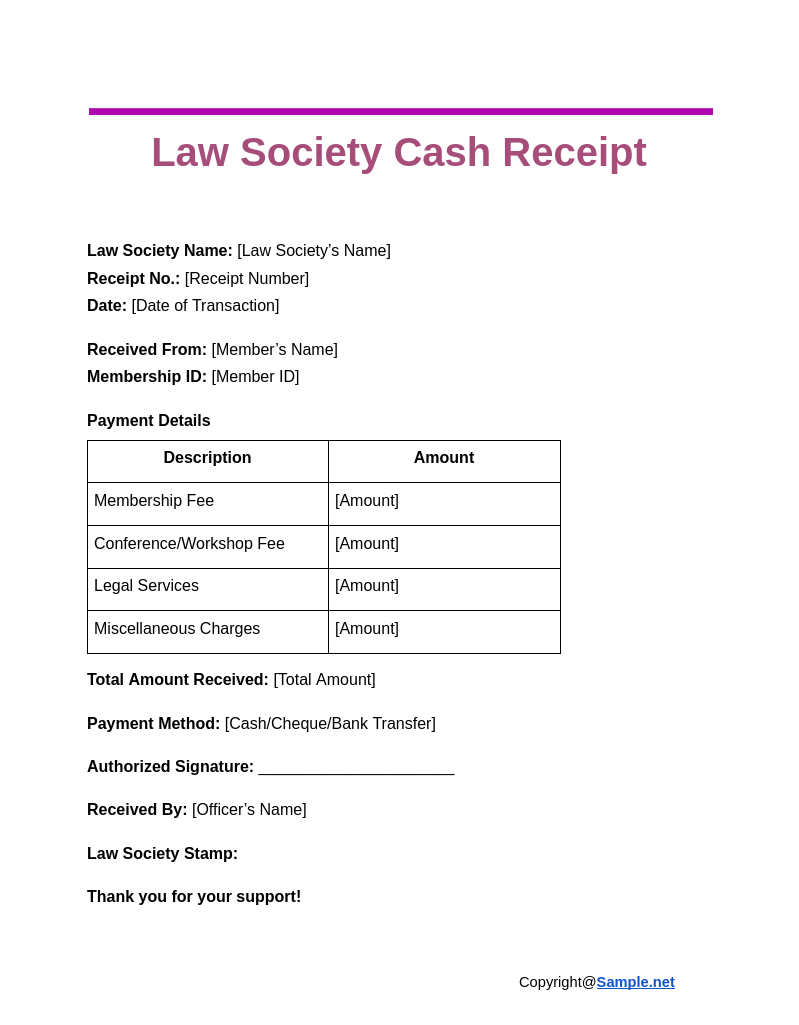

Law Society Cash Receipt

download now -

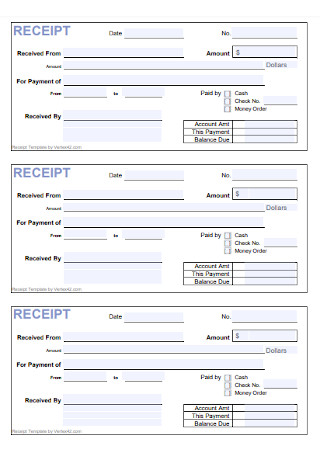

Sample Cash Receipt Template

download now -

Cash Receipt Deposit Template

download now -

Petty Cash Receipts Template

download now -

Cash Receipt Format

download now -

Cash Receipts and Departmental Deposit

download now -

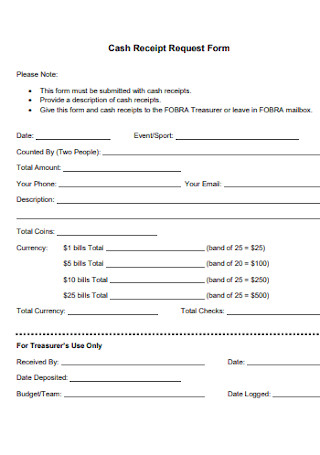

Foundation Cash Receipt

download now -

Cash Receipts Voucher Template

download now -

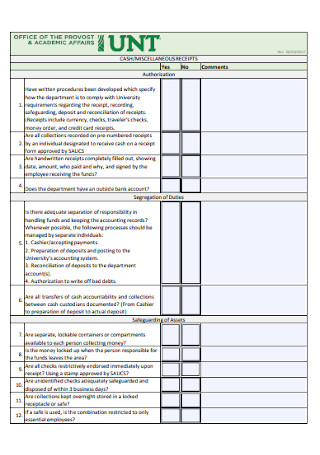

Cash Scellanceous Receipt

download now -

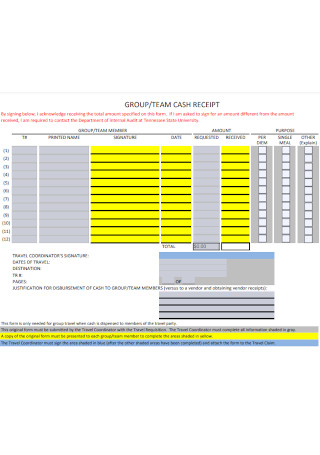

Team Cash Receipt Template

download now -

Office Cash Receipt Template

download now -

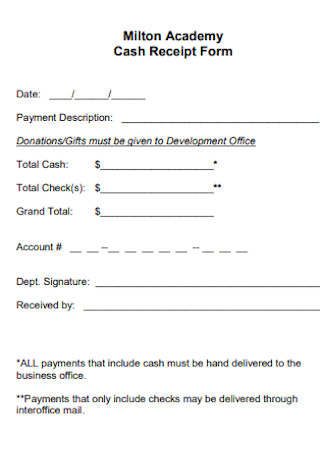

Academy Cash Receipt Form

download now -

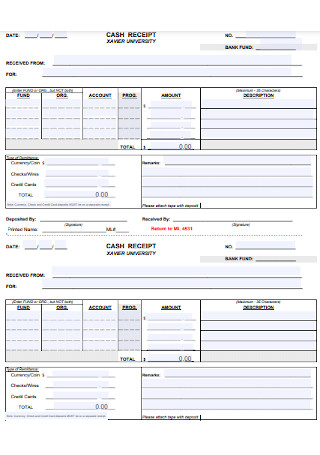

University Cash Receipt Template

download now -

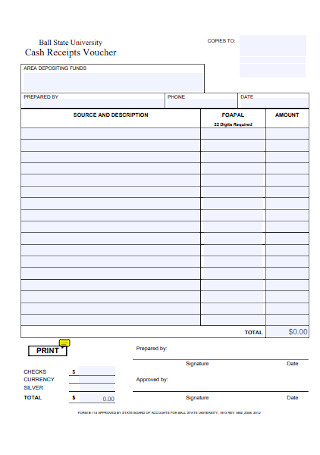

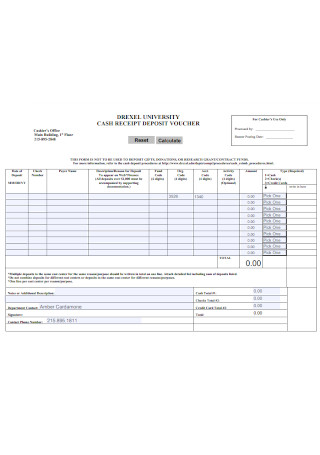

Cash Receipt Deposit Vocher Template

download now -

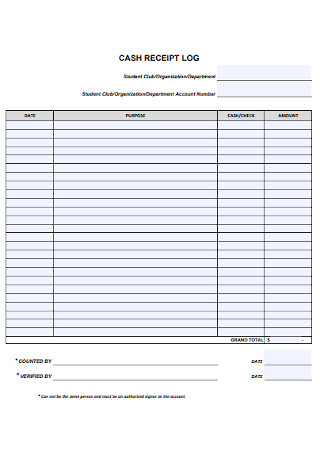

Cash Receipt Log Form

download now -

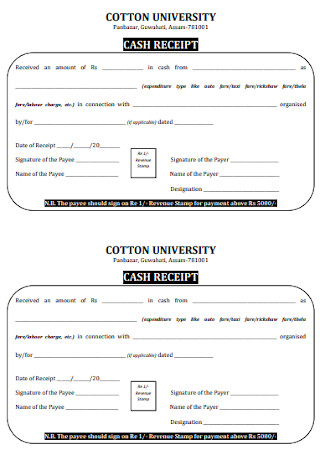

College Cash Recepit Vocher Template

download now -

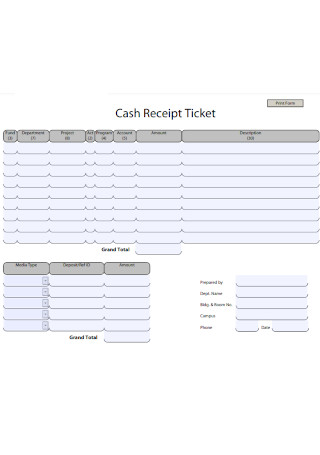

Cash Receipt Ticket Template

download now -

Simple Cash Receipt Template

download now -

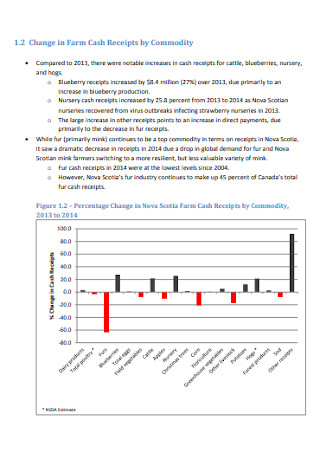

Farm Cash Receipts

download now -

Basic Cash Receipt Template

download now -

Workday Cash Receipts Templates

download now -

Formal Cash Receipt Template

download now -

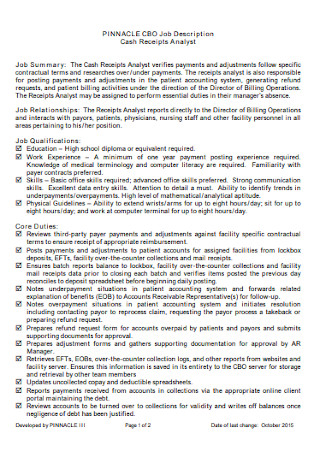

Cash Receipts Analyst Template

download now -

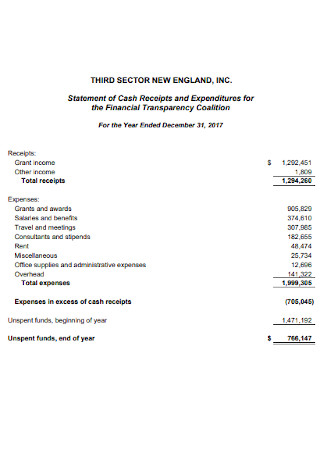

Statement of Cash Receipts

download now -

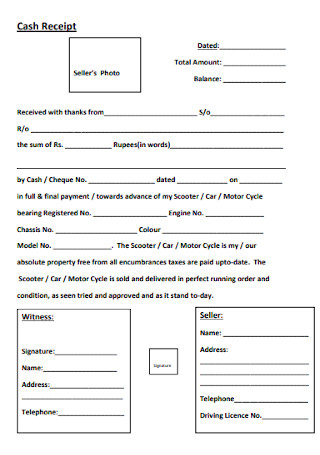

Cash Payment Receipt

download now -

Cash and Equivalent Receipt

download now -

Entering Cash Receipt Template

download now -

Cash Receipts Checklist

download now -

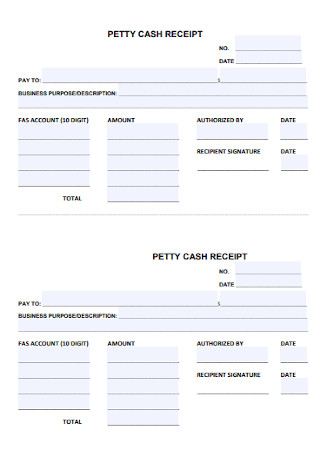

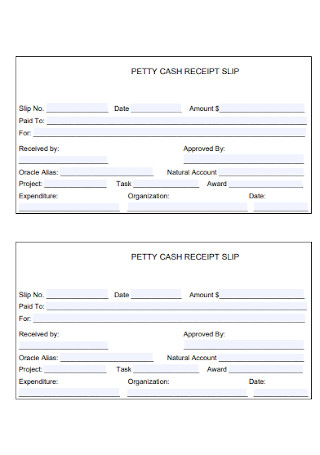

Sample Petty Cash Receipt Template

download now -

Cash Receipt and Internal Invoice

download now -

Cash Receipt Vocher Template

download now -

Cash Receipt Document Template

download now -

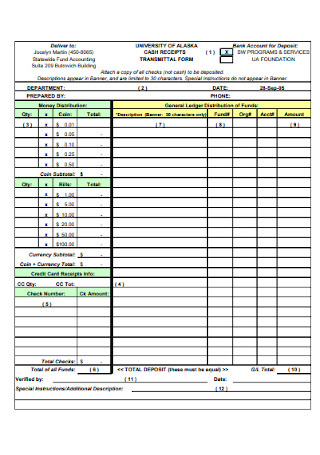

Cash Receipts Transmittal Form

download now -

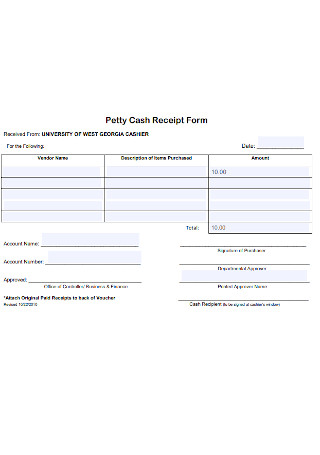

Petty Cash Receipt Form

download now -

Cash Receipt Request Form

download now -

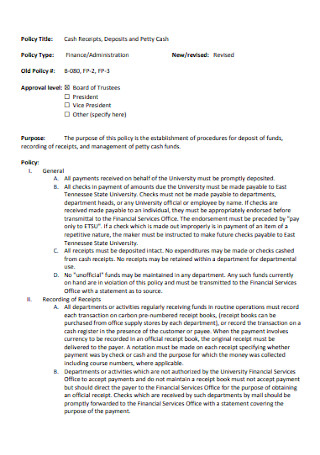

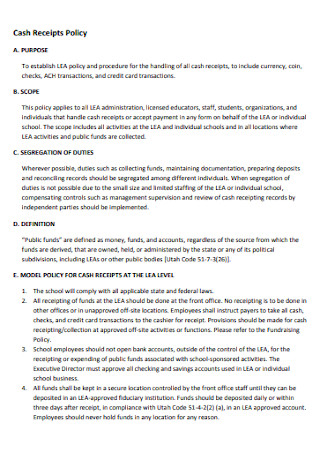

Cash Receipts Policy Template

download now -

Farm Cash Receipts Example

download now -

Self Assessment Cash Receipt

download now -

Official Cash Receipt Template

download now -

Financial Cash Receipt Template

download now -

Building Department Cash Receipts

download now -

Cash Receipt Slip Template

download now -

Cash Receipts Transmittal Form Template

download now -

Cash Benefit Related Receipt

download now -

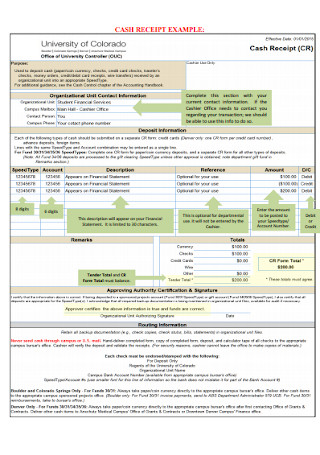

Standard Cash Receipt Example

download now -

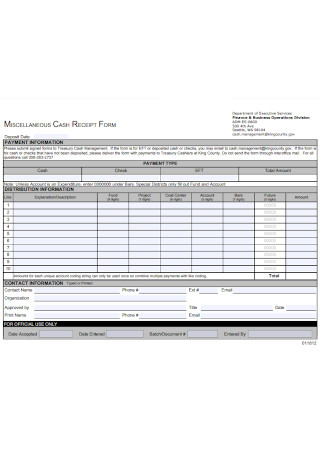

Miscellaneous Cash Receipt Form

download now -

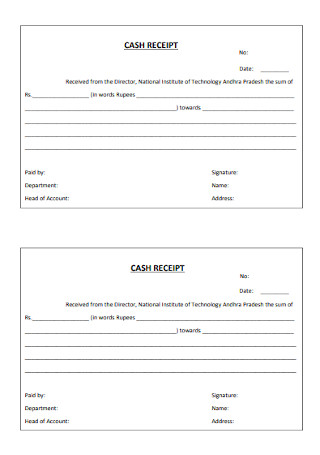

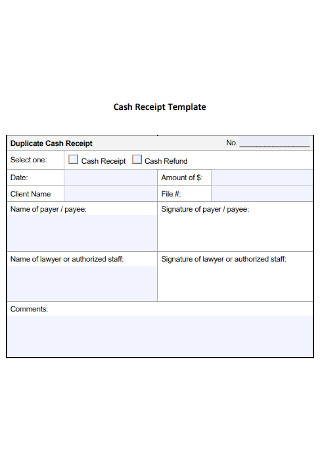

Duplicate Cash Receipt

download now -

Cash Receipt Log Template

download now -

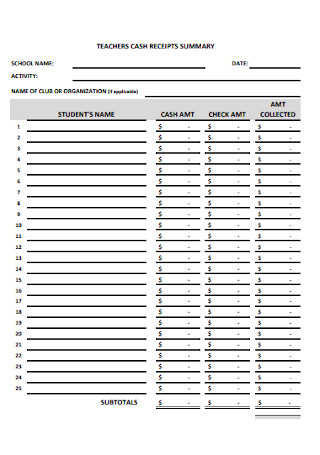

Teachers Cash Receipt Template

download now -

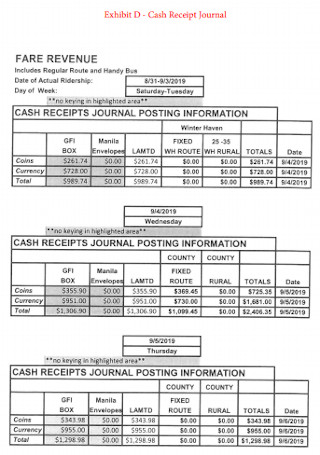

Cash Receipt Journal Template

download now -

Fee Cash Receipt Template

download now

FREE Cash Receipt s to Download

Cash Receipt Format

Cash Receipt Samples

What Is a Cash Receipt?

Why Are Cash Receipts Important?

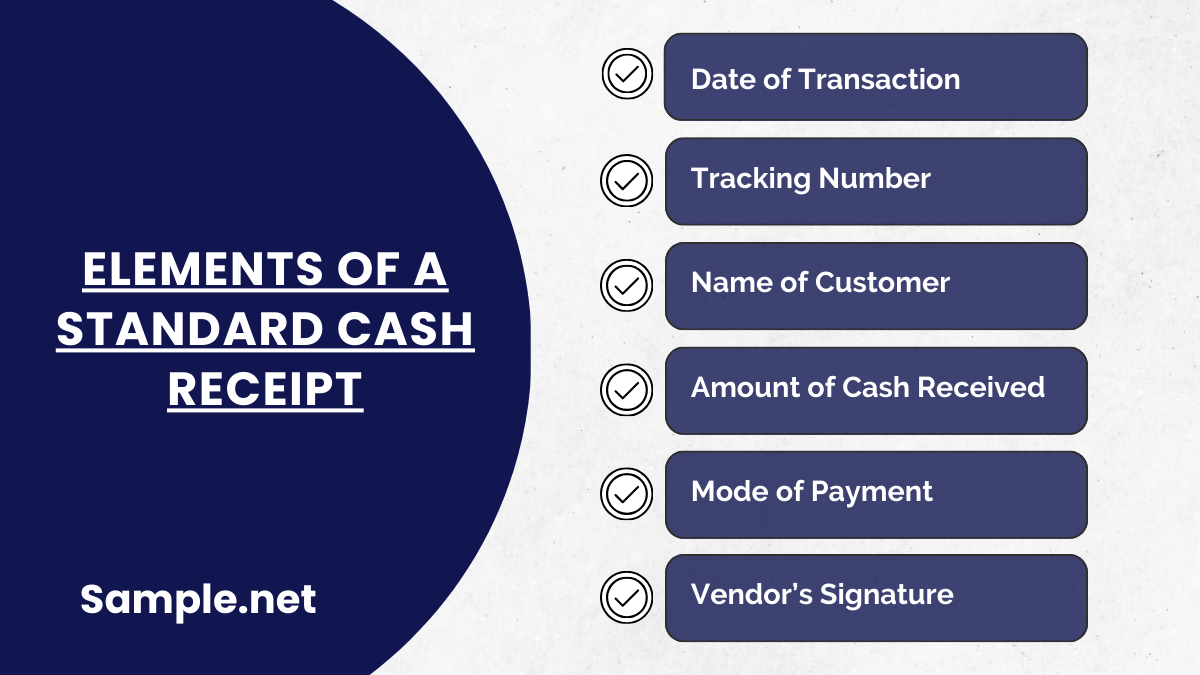

What are the Elements of a Standard Cash Receipt?

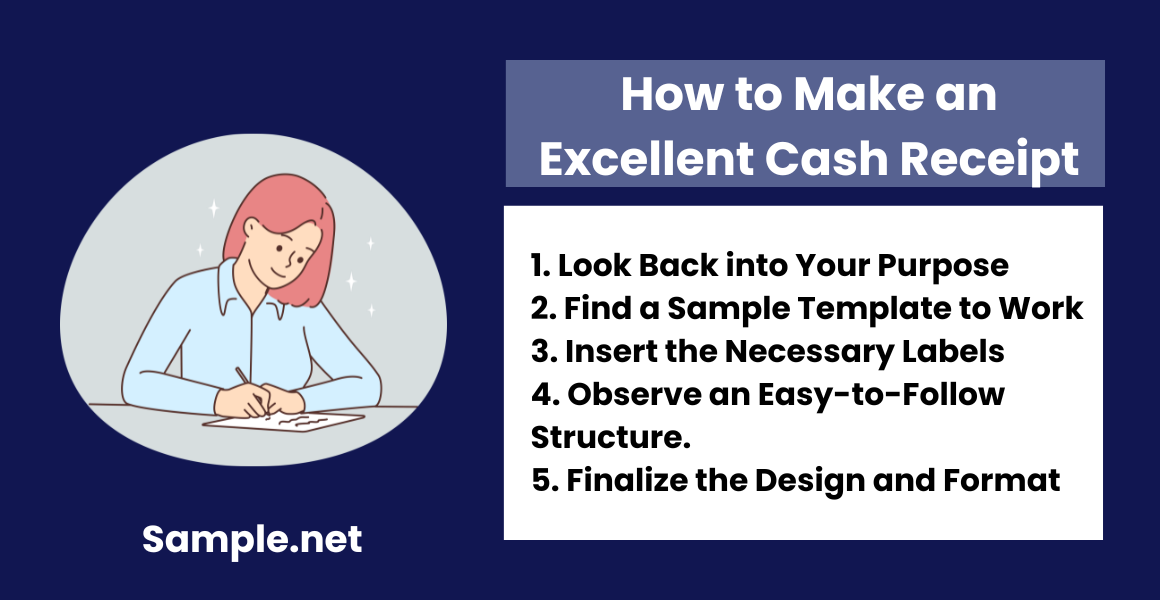

How to Make an Excellent Cash Receipt

FAQs

What is a cash receipt in simple terms?

When should I send a cash receipt?

What are the benefits of cash receipts?

How will I send a cash receipt?

Who needs to issue a cash receipt?

How can businesses avoid cash receipt fraud?

Cash Receipt Format

Receipt No.: [Receipt Number]

Date: [Date of Transaction]

Received From: [Customer’s Name]

Address: [Customer’s Address]

Phone Number: [Customer’s Phone Number]

Transaction Details

| Item/Description | Quantity | Unit Price | Amount |

|---|---|---|---|

| [Item/Service Name 1] | [Qty 1] | [Price 1] | [Total] |

| [Item/Service Name 2] | [Qty 2] | [Price 2] | [Total] |

| … | … | … | … |

Subtotal: [Subtotal Amount]

Tax (if applicable): [Tax Amount]

Total Amount Paid: [Total Amount]

Payment Method: [Cash/Credit/Debit/Other]

Authorized Signature: ______________________

Received By: [Cashier or Clerk’s Name]

Thank you for your payment!

What Is a Cash Receipt?

A cash receipt is a document provided to customers upon payment, detailing the amount received, the date of the transaction, and relevant purchase information. It acts as proof of payment and aids in financial record-keeping for businesses. You can also see more on Payment Receipt.

According to Investopedia, there are three takeaways of a cash receipt: (1) the receipt displays the proof of a cash transaction, (2) it is commonly issued in business deals and stock market transactions, and (3) it is needed for tax purposes and proof of expenses.

Meanwhile, it was reported that in 2016, the yearly cash receipts of rice for food in America reached around $2.37 billion.

Why Are Cash Receipts Important?

A cash receipt is essential since, in a transaction, the buyer and the seller will both receive proof of transaction. Hence, a customer receives an original copy of the receipt and the seller also receives a copy for accounting reasons. And there are many businesses and clients that are very particular in knowing if transactions were done in cash or not. It could be if the person who transacted will be disbursed or for any other reason. And a cash receipt is crystal clear that the transaction is done in cash. You can also see more on Fee Receipt.

Moreover, a cash receipt is relevant for many different businesses and purposes. The same as you can pay cash in various examples. For example, such receipts matter in the rice for food in the US, which garnered around $2.37 billion in 2016. That is, according to Statista’s research survey. You could pay cash in rent, school tuition, vehicle maintenance, the list goes on. And probably the most important feature of a cash receipt is how it can answer questions. From how much was spent, what item was bought, down to the date of the purchase, it is all found in that piece of paper.

What are the Elements of a Standard Cash Receipt?

Now that you are aware of a cash receipt’s meaning and important features, how about what you can find inside the sample receipt itself? Indeed, businesses can create cash receipts in different format, content, and design. But there are common elements noticed from each example too. And a generic cash receipt usually contains the following elements:

How to Make an Excellent Cash Receipt

When you run a business with numerous transactions daily, it can be an unbearable headache to deal with the recordkeeping process. Keep in mind that by managing every transaction’s receipt, it involves more than just numbers. There are classes and different details to consider too. And to make sure your experience with accounting records will not be too much of a bother anymore, let us guide you in making an excellent cash receipt in just six basic steps. You can also see more on Payment Receipt.

Step 1: Look Back into Your Purpose

Why do you need a cash receipt in the first place? Is it for your hotel business, school, book shop, or house rental? Whatever it is, your purpose in making the receipt should be how your cash receipt’s layout and content must be tailored. For example, your cash receipt should have your business name, company logo, and other details. And if you are offering a rental, then make the receipt that is appropriate for rentals. And if you need help on what template to use, we have plenty of options available above.

Step 2: Find a Sample Template to Work

Have you checked our sample templates already? Your next task is to choose your preferred sample cash receipt template. And you will work on its design, content, and other customizable features. Everything will be made easier for you since these templates are premade. On that note, you never have to start from scratch. Focus on inserting what is still missing, improving the content, and adding the finishing touches only. And that is just what you need to form a cash receipt in no time. You can also see more on Bill Receipts.

Step 3: Insert the Necessary Labels

If you can still recall the elements of a cash receipt that were introduced earlier, then you would know those are the needed parts to add for your cash receipt. Your receipt should have relevant elements from the transaction date down to the signature. And be sure the labels are clear and organized so clients will not have to guess what each element means. Our templates already have some of the important elements but you can always add more detail to them.

Step 4: Observe an Easy-to-Follow Structure

No seller or buyer would want to keep a receipt that is hard to understand and process. Conduct an easy-to-follow structure to the document instead. Maybe the receipt has too much information or they were not arranged properly. You can always add some instructions or reminders in the receipt so customers can read and understand everything without hassle. A tip is to be in the shoes of either the buyer or customer. Evaluate the cash receipt if the details inputted there are understood easily or needs improvement. You can also see more on School Receipt.

Step 5: Finalize the Design and Format

Lastly, finalize your decision on how the cash receipt’s format and design should be. Do you want such documents in small pieces of paper or slightly bigger? Do you need printed receipts or just submit soft copies? And do you prefer the PDF format or the MS Word format? Decide now. Conduct final evaluations of the whole receipt if you can still add some embellishments. And once you are confident with the entire result, launch your cash receipt.

In summary, a cash receipt is crucial for any business transaction, as it provides legal proof of payment. This document is essential for maintaining financial records and verifying sales activities. Properly issued cash receipts help businesses manage cash flow and uphold transparency in their financial dealings. You can also see more on Sale Receipt.

FAQs

What is a cash receipt in simple terms?

You can simply learn about a cash receipt in just three takeaways: (1) the receipt shows the proof of a cash transaction, (2) it is widely issued in stock market transactions and business deals, and (3) it is needed for tax evidence and proof of expenses.

When should I send a cash receipt?

A cash receipt must be given in every product or service purchase from your company. But that is only applicable if the customer bought in cash. You can also see more on Purchase Receipts.

What are the benefits of cash receipts?

Cash receipts are beneficial, just as they are important. Although there are plenty of advantages to expect, some of the key benefits of a cash receipt are the following:

- They prove who the owner is in every purchased product.

- They help a vendor know if warranty claims would be entertained for customers.

- They are necessary for processing returns and exchanges.

- They are useful in completing accounting records and audits.

How will I send a cash receipt?

A cash receipt can be given in the printed form, and you will provide it to the customer right after their purchase. However, it is also possible to send receipts via email, especially in PDF form as a soft copy. Submit and keep such copies in case they go in handy for a quick reference.

Who needs to issue a cash receipt?

Usually, businesses or individuals selling goods or services issue cash receipts to document received payments. You can also see more on Payroll Receipts.

How can businesses avoid cash receipt fraud?

Businesses should maintain consistent record-keeping practices, assign unique receipt numbers, and ensure authorized personnel issue receipts. Signature verification is another fraud prevention step. You can also see more on Self Employee Receipts.