26+ Sample Credit Reports

-

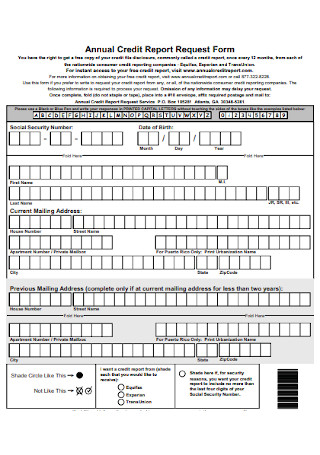

Annual Credit Report

download now -

Credit Score Report

download now -

Basics Credit Report Template

download now -

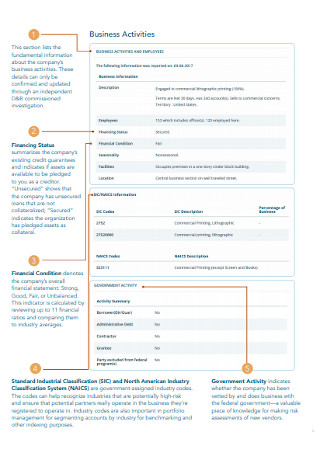

Credit Reporting for a Small Business

download now -

Sample Reading Credit Report

download now -

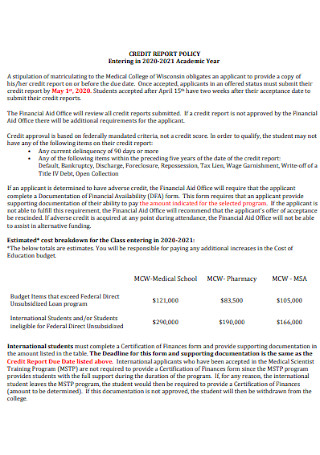

Credit Policy Report Template

download now -

Free Credit Reports

download now -

Experian Credit Report

download now -

Building Better Credit Report

download now -

Simple Credit Report Template

download now -

Credit History Report

download now -

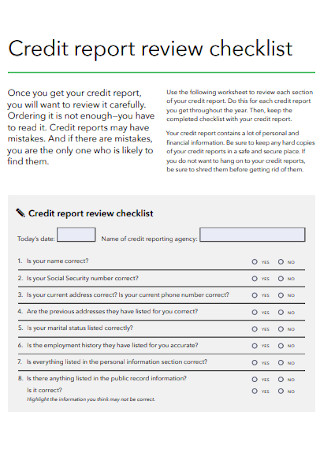

Credit Report Review Checklist

download now -

Credit Application Report

download now -

Credit Report Dispute Template

download now -

Business Credit Reports

download now -

Sample Credit Report Example

download now -

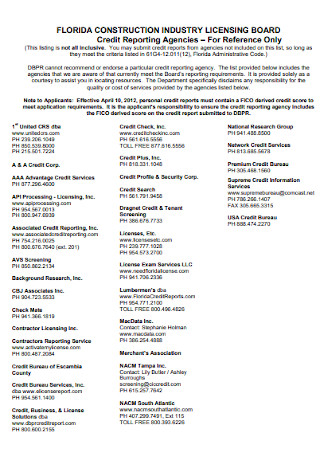

Credit Reporting Agencies Template

download now -

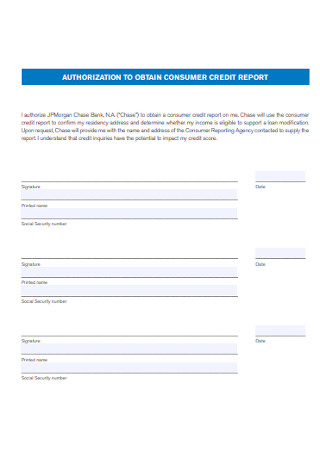

Consumer Credit Report

download now -

Credit Loan Report

download now -

Fair Credit Reporting Template

download now -

Question and Answers Credit Report

download now -

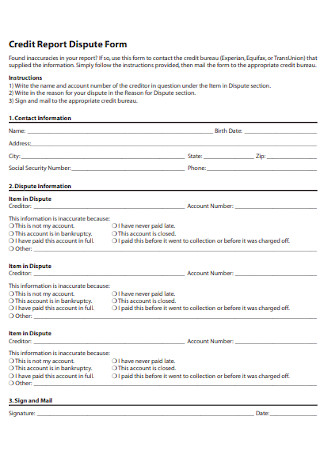

Credit Report Dispute Form

download now -

Free Annual Credit Report

download now -

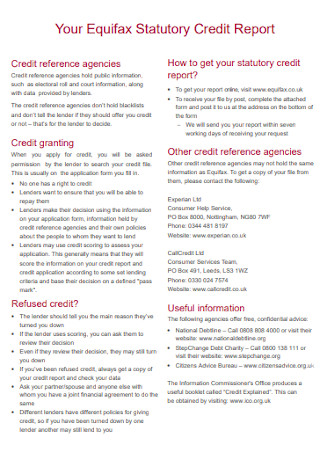

Statutory Credit Report

download now -

Company Credit Report

download now -

Credit Plan Report

download now -

Business Credit Report Template

download now

What Is a Credit Report?

Credit reports contain a summary of information about a person’s credit history. The credit report is a document that lists an individual’s history of managing and repaying their credit or debt. It works similarly to a report card from lenders and other companies to help them decide whether they want to do business with an organization. In a credit report, individuals can find historical documentation of when and how a person pays their bills, their current financial debt, and the duration of how long they have been managing credit accounts. Lenders and other organizations and institutions use credit reports to identify, learn, and gather information about previous borrowing experiences to help their decision-making processes and procedures for granting an individual credit. Creditors also utilize credit reports to calculate credit scores, verify an individual’s identity, and other intentions and purposes deemed necessary under federal laws. Businesses also use a person’s credit report to offer insurance plans, house rental agreements, cable television subscriptions, utilities, and phone plans and services. On the one hand, employers can also look at an individual’s credit report with permission to make employment decisions.

According to Credit.org and their article covering credit and credit scores, the average US credit card debt amounts to $15,762. The statistics also show that Alaska has the highest credit card debt among 50 states, amounting to 6,547 US dollars, while Iowa has the lowest with $4,246.

Components of a Credit Report

Credit reports are valuable tools for any business or individual looking to keep positive credit scores and allow them to acquire more credit or leave a lasting impression on creditors. Different entities utilize credit reports in their evaluation procedures to determine whether they want to extend credit and the associated terms. When submitting credit reports to different industries, agencies, or lenders, guarantee all necessary information is present in the document to avoid further questions that lead to the denial of credit.

How To Acquire a Credit Report

Credit reports list all the necessary information about an individual’s payment history, loans, debt, and other financial information to support and enhance credit and check for indications of identity theft. The document indicates details about an individual’s work, address, and whether they have existing or previous arrests, convictions, or bankruptcies. Regularly checking credit reports guarantees the accuracy of personal and financial information. If there are errors or inconsistencies in the report, individuals must take the necessary steps and precautions to correct them.

1. Determine How To Receive the Credit Report

An individual receives a free credit report annually from each of the three major credit bureaus, namely Experian, Equifax, and TransUnion from the United States. People can visit AnnualCredit Report.com for an online application, call a specific hotline, or mail an Annual Credit Request Form and mail it to the Annual Credit Report Request Service. Individuals can also acquire free credit reports if there is a denial of credit, insurance, or employment through an adverse reaction to the credit report, for inaccurate information due to fraud, applying for a new job after being unemployed, or for public assistance.

2. Have All Necessary Personal Information Ready

Before making a credit report request, an individual must provide vital personal information, including their full name, previous and current mailing address, date of birth, and social security number. For any additional information, the bureau requires for application procedures, contact the person through the mail. Failing to provide all the essential details while requesting by phone slows the process, and the representative can ask the person to restart the entire process. There are several security questions a user answers about their finances when requesting credit reports online. Inquiries vary between individuals, and thorough preparation is advisable.

3. Make a Request for the Credit Report

After selecting how to request the report and preparing the necessary information, the next step is the request submission. An individual can request all three credit bureaus for a report consecutively or one at a time. If a person requests the report at a specific time, through spacing request periods, they can continuously monitor credit scores and health throughout the year with no additional costs. After receiving the credit report from a company, individuals can still request a credit report with additional charges for the following reports until the 12 months are up since the initial request.

4. Read the Report and Look for Any Errors Closely

After receiving the credit report, the person must read over the information to verify all the information are correct, accurate, and true. Check the Personal Identifiable Information or PII, which is the individual’s name, address, social security number, birth date, and employment information. Credit accounts must indicate the account type, opening date, credit limit, loan amount, and repayment history. Another section to check is the credit inquiries section, listing entities and agencies having access to the credit report for the past two years. People permit a lender to view their credit reports when persons apply for loans or request credit. Credit bureaus also collect public information from state and country agencies regarding bankruptcies and foreclosures. If a person has unresolved debt handed to a collection agency, it also reflects in the document. Individuals can raise credit disputes with the credit bureau, agency, or business providing the report for mistakes and inaccuracies.

5. Repeat the Acquisition Process Using Regular Intervals

Once a person is familiar with requesting and acquiring a credit report, an individual must repeat the procedure for periodic intervals for continuous monitoring of credit state, worthiness, health, and score. Aside from tracking personal credit and its growth, individuals can also watch and monitor possible errors, inconsistencies, problems, and mistakes. Remember, spacing the time for acquiring credit scores from various credit bureaus and agencies allows individuals to acquire the necessary information they need throughout the year.

FAQs

What is the best website to obtain a credit report?

The best overall website for acquiring a credit report is AnnualCreditReport.com enables individuals to compare their credit reports from the three credit bureaus in a single page and remains the official website for doing so, according to the Consumer Financial Protection Bureau.

How much does it cost to acquire a credit report?

For individuals applying to get their credit report, the first report from a specific bureau is free, whether it is from Experian, TransUnion, or Equifax; however, the following reports have a charge of no more than $13.50 for a credit report under law.

What is a good credit score?

FICO® Scores range from 300 to 850, with the definition of a good credit score ranging from 670 to 739, similar to industry-specific FICO® scores despite having varying ranges for overall credit scores.

Credit reports contain a record of a person’s history in managing debt and credit. Various industries and businesses require credit reports to make pivotal decisions that affect a person’s life. Banks review a person’s credit report before issuing an individual a credit card, loan, and mortgage. Credit reports are reliable sources of information to calculate an individual’s credit score that lenders use to determine the likelihood of the person paying on time. Credit reports affect a person’s finances and ability to set long-term goals. Remember the necessary information that must be in a credit report and the process of acquiring the document. Familiarize yourself with a credit report using the available samples of these documents above, only from Sample.net.