Expense Report Templates

-

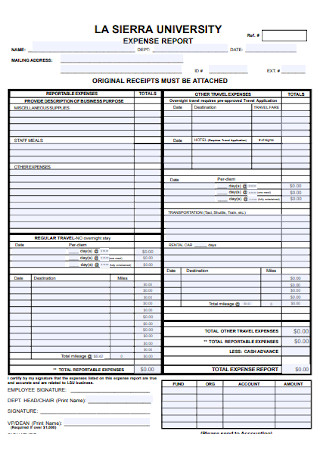

University Expense Report

download now -

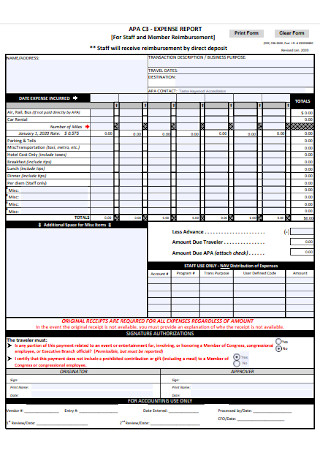

Sample Staff Expense Report

download now -

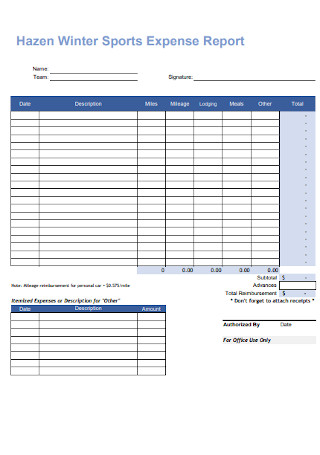

Winter Sports Expense Report

download now -

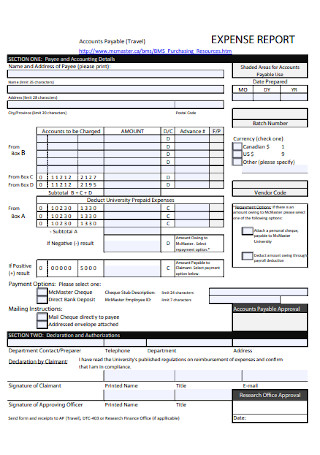

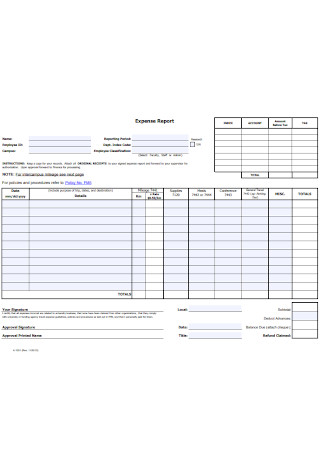

Sample Expense Report Template

download now -

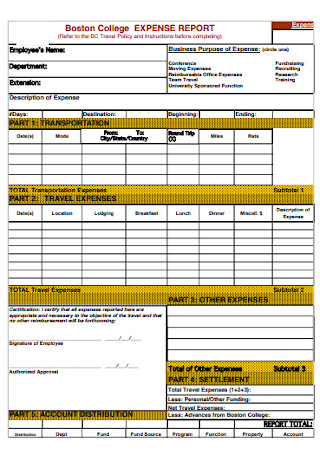

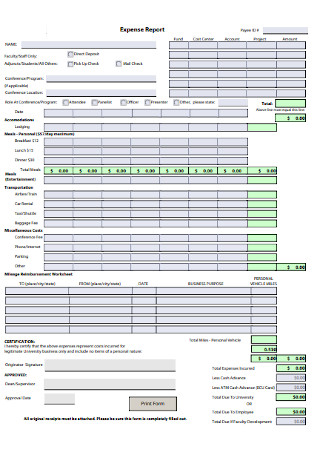

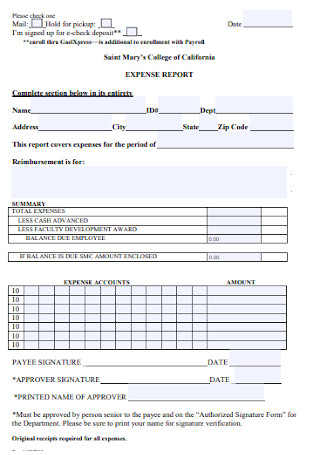

College Expense Report

download now -

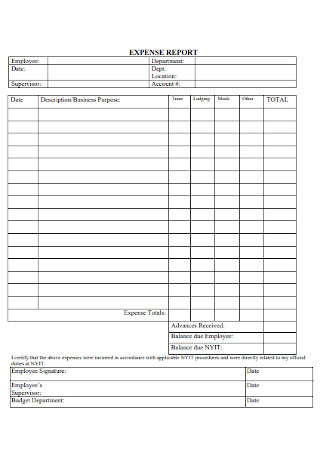

Basic Expense Report

download now -

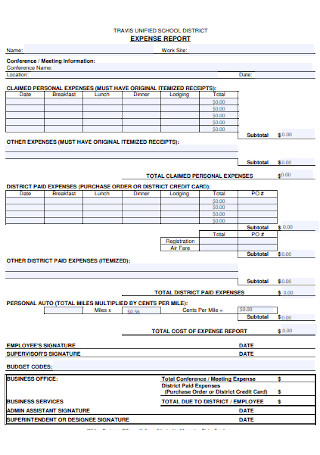

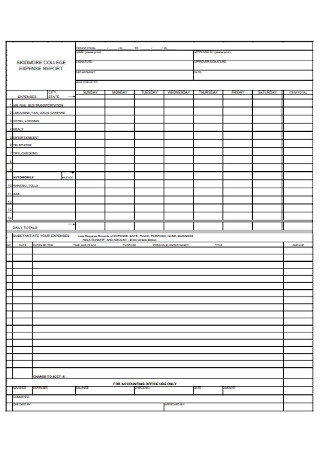

School Expense Report

download now -

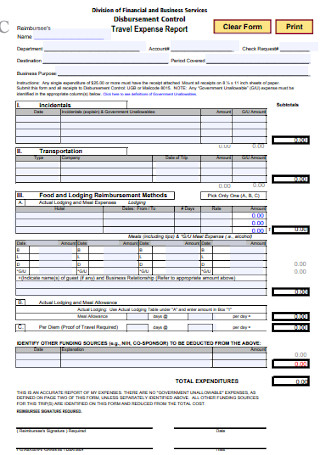

Travel Expense Report

download now -

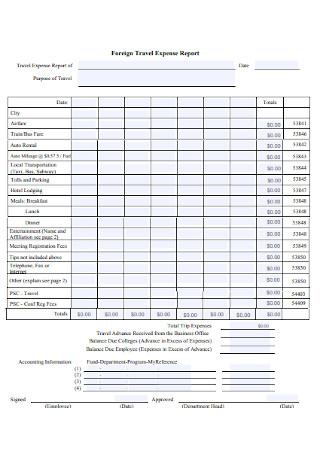

Foreign Travel Expense Report

download now -

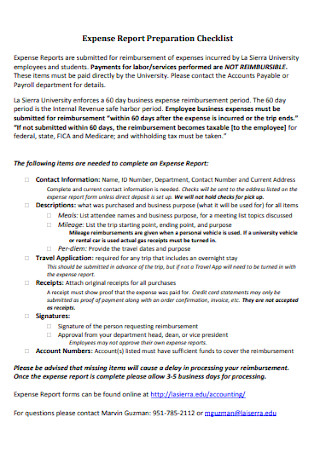

Expense Report Preparation Checklist

download now -

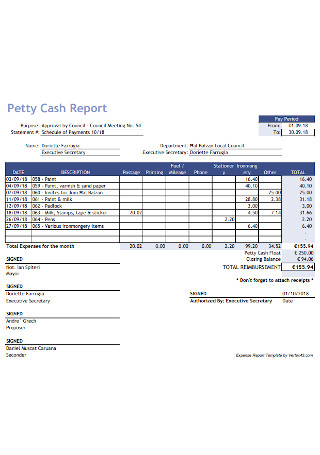

Petty Cash Report

download now -

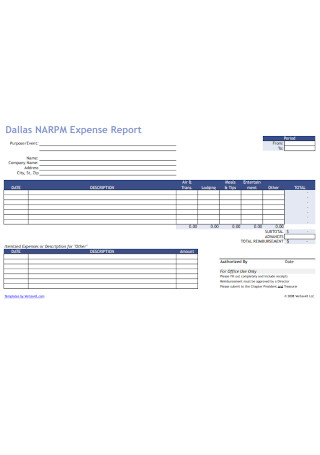

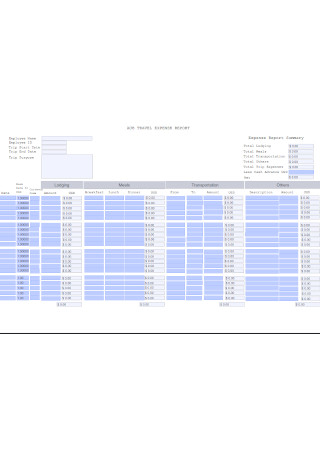

Sample Travel Expense Report

download now -

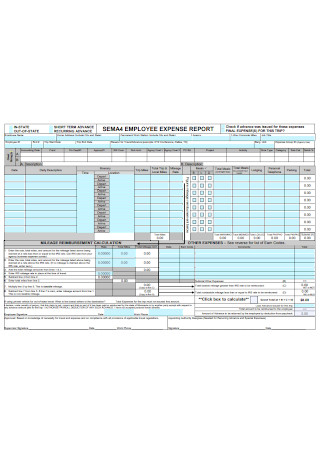

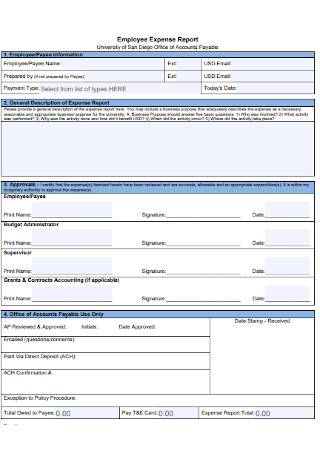

Employee Expense Report

download now -

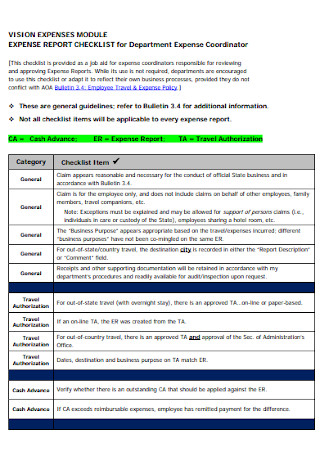

Sample Expense Report Checklist

download now -

Formal Expense Report

download now -

Standard Expense Report

download now -

Sample College Expense Report

download now -

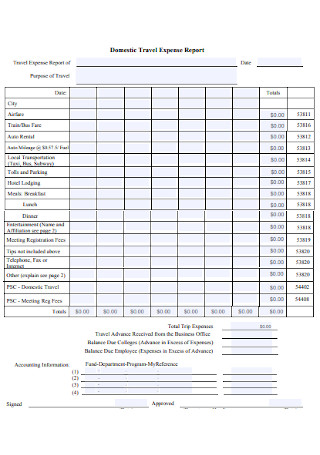

Domestic Travel Expense Report

download now -

Expense Report Format

download now -

Student Expense Report

download now -

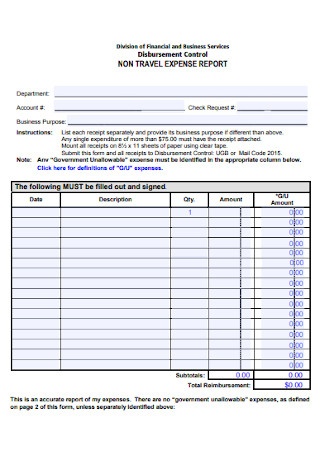

Non Travel Expense Report

download now -

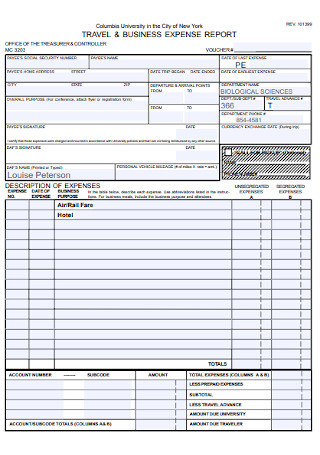

Travel and Business Expense Report

download now -

Applicant Interview Expense Report

download now -

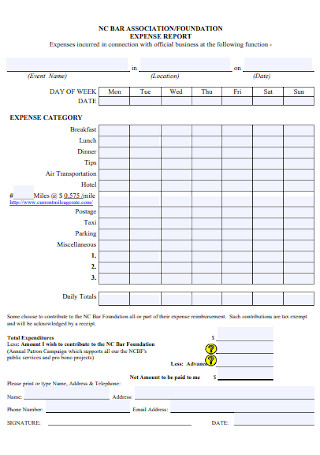

Foundation Expense Report

download now -

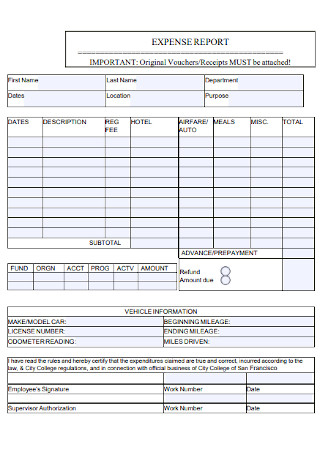

Printable Expense Report

download now -

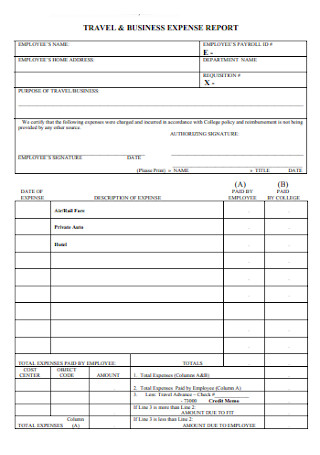

Travel and Business Expense Report Template

download now -

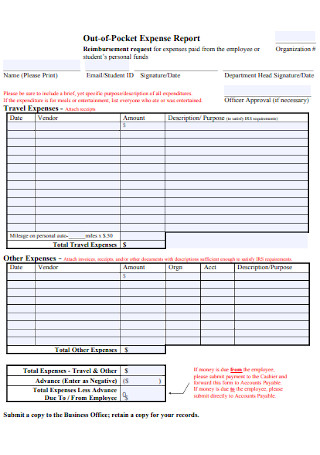

Out-of-Pocket Expense Report

download now -

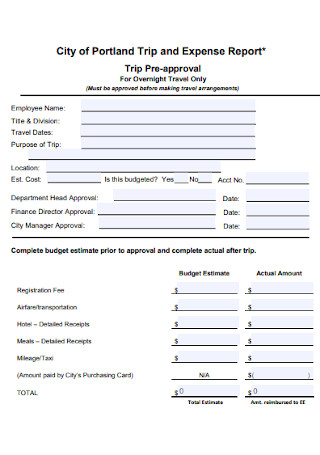

City of Portland Trip and Expense Report

download now -

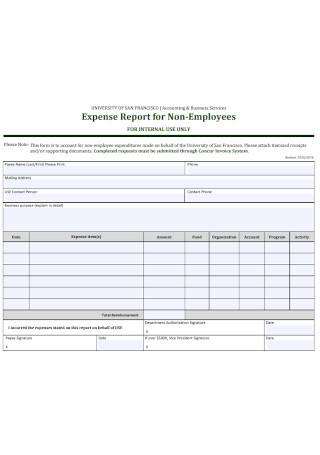

Expense Report for Non-Employees

download now -

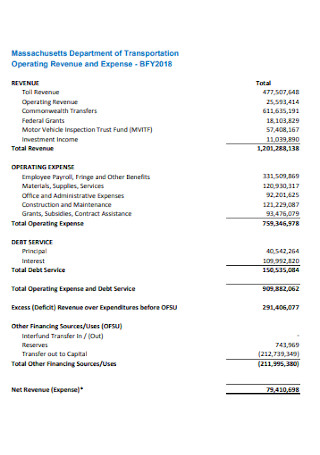

Revenue and Expense Report

download now -

Professional Expense Report Template

download now -

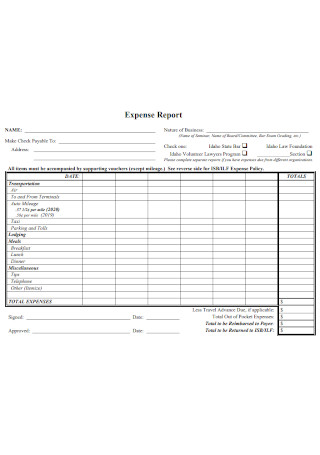

Law Foundation Expense Report

download now -

Office Employee Expense Report

download now -

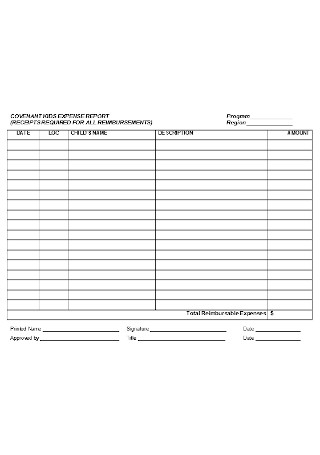

Covenant Kids Expense Report

download now -

Officials Expense Report

download now -

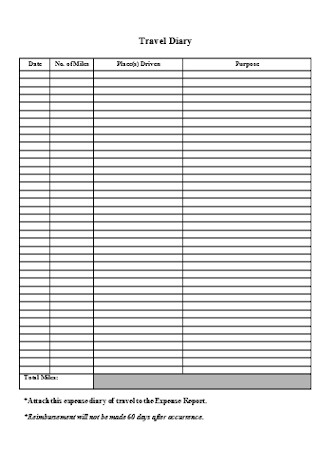

Expense Report of Travel Dairy Template

download now -

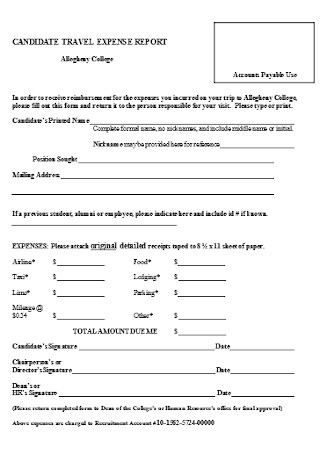

Candidate Travel Expense Report

download now -

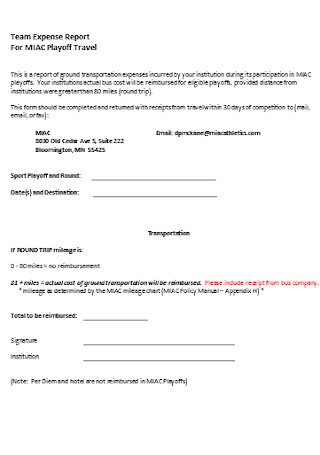

Team Expense Report

download now -

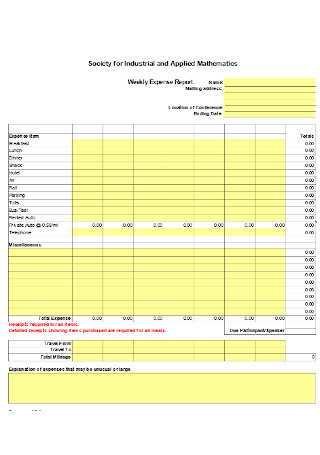

Weekly Expense Report

download now -

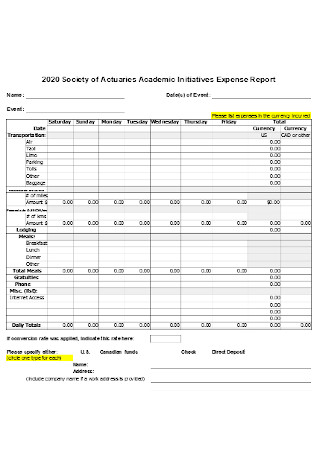

Academic Initiatives Expense Report

download now -

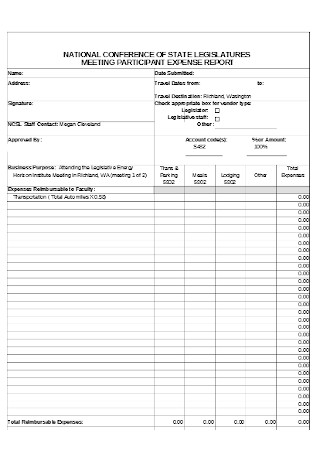

Sample Meeting Expense Report

download now

What Is an Expense Report?

For any manager in a small business or a big corporation, there are plenty of factors to consider in reaching specific goals. Considerations include employee management, work development, marketing, and more. And one of the essential factors is how to manage expense reporting. The expense report, which often comes in a printed document or a spreadsheet, notes how companies and their workers spend on a business trip, special event, or any factor reimbursed by the business. Aside from reporting how much was spent, the sheet is also useful for tax management and accounting information.

Studies show that employee expense fraud among businesses in the US costs about $2.8 billion each year.

On another note, Statista reported that the global business travel expense reached $1.33 trillion in 2017.

Also, via the Bureau of Labor Statistics (BLS), Chron stated that the wages or salaries per hour are responsible for 70.4% of employer expenses for workers’ compensation.

Why Is an Expense Report Important?

Expense reports are mainly business reports that track spending. So any form of purchase that runs a business is documented. It is essential to record business expenses because of reimbursement. If an employee bought meals for visitors, equipment for an event, or plane tickets for a business trip, expense reports show how much was spent. The same goes for determining how much to reimburse the expenditures. And instead of guessing the amount of spending, detailed reports prevent inaccurate calculations and lies, especially when receipts are required.

On the other hand, expense reports are vital for tracking and recording any expenditure in general. For example, you might need to note your weekly spending on personal items. The report contains all the info regarding how much savings were used, what items were purchased, and others. Nonetheless, you no longer question why your budget increased or decreased when all data is recorded under the report—your reliable evidence.

What Are Common Examples of Expense Reports?

Indeed, expense reports are essential. But what exactly makes them useful? To determine their uses, be introduced with the typical examples of how expense reports are applied. In this section, we outlined seven of the notable applications of expense reports and how they work.

How to Make an Excellent Expense Report

As human as we are, remembering and notetaking expenses may have errors. That is why there should be a thorough plan on how to write expense-driven data, which is by drafting an expense report. And with many expenses to track, do not be overwhelmed. Instead, learn to familiarize the basic steps on how to create an excellent expense report. To do that, please follow these simple steps:

Step 1: Select Your Preferred Template

From our sample expense report templates, you no longer start from nothing. Explore and choose which template you desire to fulfill your expense report needs. In choosing, always remember to recognize your report’s purpose. Indeed, you track expenses. But are you making an expense report for travel, an event, a project, or any other example? Specify that. With a clear purpose, everything inputted in your report would be relevant. Also, the templates you can choose are already pre-formatted. You only need to fill out what’s missing to complete the document.

Step 2: Familiarize and Tweak the Different Columns

What columns and elements to input in the report are up to you and your expense form’s purpose. And if you are confused with what elements to incorporate, there are generally eight elements. The date, vendor, client, project, account, author, notes, and amount. For example, you indicate when you bought a product under “Date,” and from who or where you bought the product under “Vendor.” And after identifying what answers to provide in each element, be sure to update every column with the answers.

Step 3: Itemize Your Data and Improve the Format

Do not just provide answers without an organized presentation. Of course, data should be itemized for clarity. An example is to present the listed dates in chronological order for your timed expense report. Anything which helps in arranging the details of your document is recommended. Also, tweak the format according to how you want the presentation looks. And why is organizing important? It enables everyone who views the expense report to understand the content easily.

Step 4: Add the Total and Calculate What’s Needed

It is expected among expense reports to add the total amount of expenses. You may calculate for the total costs of office supplies, meals, and other expenses that are relevant to your concern. Aside from the overall expenses, you could input the subtotal of every category incorporated in the sheet. Do not forget other calculations to record in the report too like the tax deductions, profits, income statements, and more. Moreover, mention the over and underpayments if involved, which typically happens in reimbursing employees.

Step 5: Include Receipts if Necessary

Anyone who files for reimbursement must attach printable receipts in justifying claims. Otherwise, employers could easily reject someone’s claim to be reimbursed, especially without proof of where expenses went or how they were utilized. Aside from printed receipts, submitting e-receipts is standard as well wherein receipts are merely scanned or attached as files. Nonetheless, always put it in your head to keep important receipts in case those will be needed for evidence, like reimbursements.

FAQs

What is inside expense reports?

What an expense report contains will depend on who created it and how it was formatted. But generally, these reports include the company name, employee name, date, list of expenses, expense columns (description, code, mileage, etc.), subtotal, total, and signature blocks.

What is a monthly expense report?

It was already mentioned that expense reports could be generated per week, month, and so forth. So, a monthly expense report outlines all the purchases or transactions of any business at a particular month.

What is an expense statement?

The expense statement refers to a detailed report that outlines financial transactions or general expenses. And such statements are also useful in reimbursing workers who spent personal funds for business trips and the like.

At the end of the day, you cannot deny that spending time and effort on managing personal or business expenses can affect you or the business in many ways. Without expense reports, you cannot tell if employees are merely making stories about company expenses. Or perhaps, some workers inflated the price so that they get reimbursed with more money. But, an expense report is not as basic as listing the amount of every expense only. The process also deals with strategic plans on how to record and track expense-driven data—which is how your final expense report should turn out.