25+ Sample Non Profit Audit Report

-

Nonprofit Organization Data Backup Audit Report

download now -

Nonprofit Audit Plan Report

download now -

Internal Nonprofit Audit Report

download now -

Nonprofit Financial Audit Report

download now -

Simple Nonprofit Audit Report

download now -

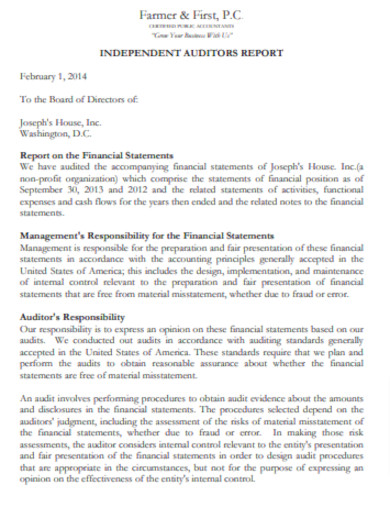

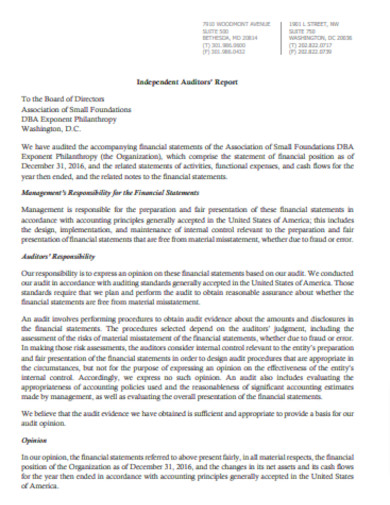

Independent Nonprofit Audit Report

download now -

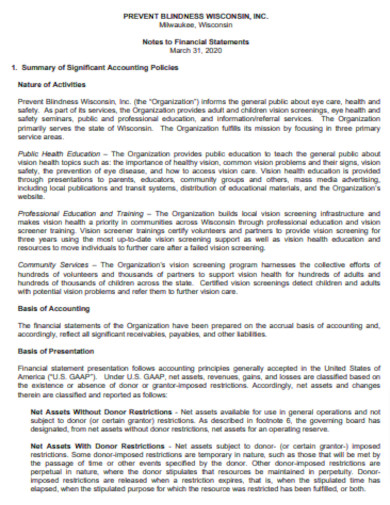

Nonprofit Financial Statement Audit Report

download now -

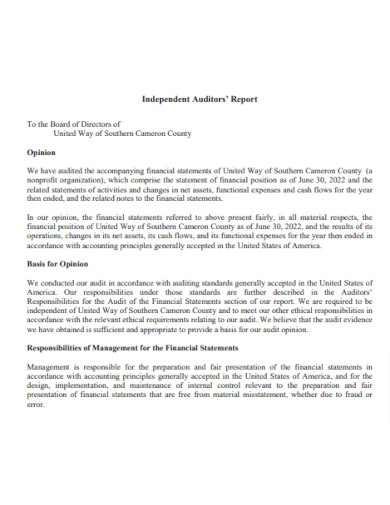

Nonprofit Auditors Report

download now -

Sample Nonprofit Audit Report

download now -

Nonprofit Audit Committee Report

download now -

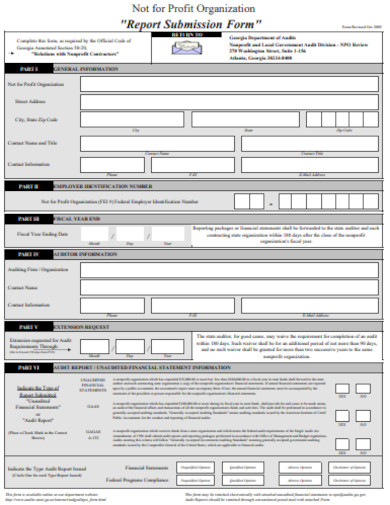

Nonprofit Audit Report Form

download now -

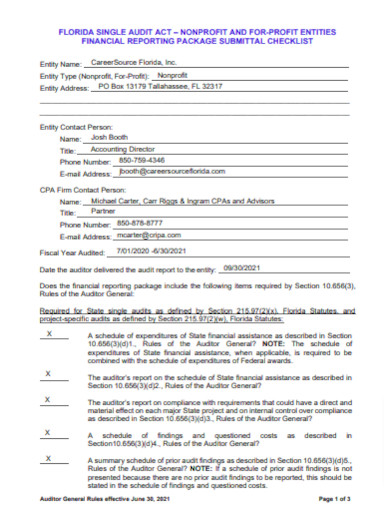

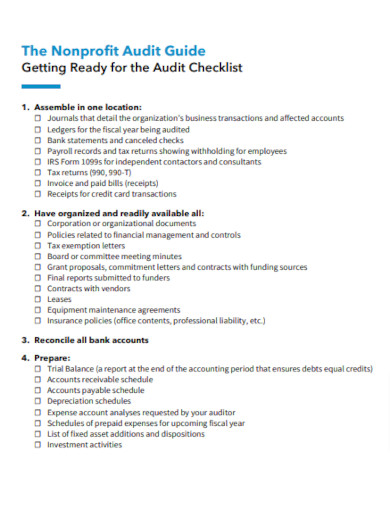

Nonprofit Audit Checklist Report

download now -

Basic Nonprofit Audit Report

download now -

Nonprofit Analyze Audit Report

download now -

Nonprofit Balance Sheet Audit Report

download now -

Nonprofit Annual Audit Report

download now -

Printable Nonprofit Audit Report

download now -

Editable Nonprofit Audit Report

download now -

Nonprofit Internal Auditor Report

download now -

Nonprofit Organization Audit Report

download now -

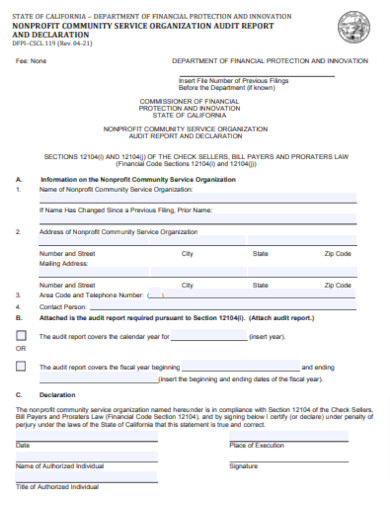

Nonprofit Community Service Audit Report

download now -

Standard Nonprofit Audit Report

download now -

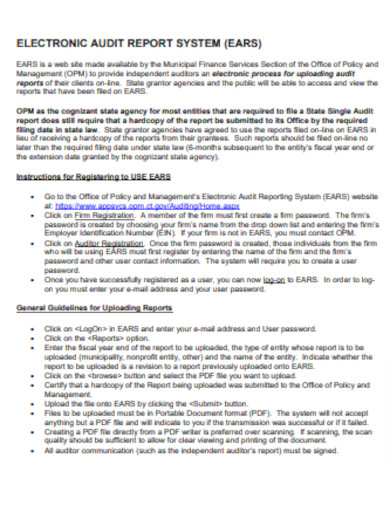

Nonprofit Audit System Report

download now -

Nonprofit Audit Report Outline

download now -

Nonprofit Audit Report Format

download now -

Nonprofit Audit Report Layout

download now

FREE Non Profit Audit Report s to Download

25+ Sample Non Profit Audit Report

History and Background

Pre-audit Preparations

Components of an Audit Report

Understanding the Auditor’s Opinion

Critical Aspects to Examine

Red Flags in Audit Reports

Post-audit Actions

Benefits of a Clean Audit Report

Role of Technology in Modern Non-profit Auditing:

Importance of Continuous Auditing

Challenges in Non-profit Auditing

Future Trends in Non-profit Auditing

Why is an audit necessary for a non-profit organization?

How often should a non-profit undergo an audit?

How does a non-profit audit differ from a for-profit audit?

What are the primary components of an audit report?

What does an “unqualified opinion” mean?

Are there costs associated with getting an audit?

In the expansive world of finance, a non-profit audit report is a vital document that presents an impartial review of an organization’s financial statements. Its objective is twofold: ensuring transparency and fortifying stakeholder trust.

History and Background

Tracing back to the genesis of non-profit auditing, it has always been perceived as a mechanism to ensure accountability. Legislative landscapes have, over time, molded and refined its nuances. The emphasis on non-profit accountability has led to the entrenchment of regular audit requirements in numerous jurisdictions.

Pre-audit Preparations

Before diving into the audit process, it is important to align the prerequisites. First, the task begins by choosing a skilled auditor – often a complex task due to the required expertise. The next step involves carefully gathering financial records, making sure they are both complete and organized. An essential but sometimes neglected aspect is proactive communication with stakeholders, informing them about the upcoming audit and its consequences.

Components of an Audit Report

At its core, the report comprises several cardinal components:

Auditor’s Opinion: A distilled essence of the auditor’s perspective on the financial statements’ veracity.

Statement of Financial Position: A snapshot of the organization’s assets, liabilities, and net assets at a specific juncture.

Statement of Activities: An exposé of revenue and expenditures over a defined period.

Notes to Financial Statements: A detailed exegesis providing context to the numbers, often elucidating accounting policies and potential contingencies.

Understanding the Auditor’s Opinion

The auditor’s opinion isn’t monolithic; it’s varied and nuanced:

Unqualified Opinion: This is the gold standard, signifying that the financial statements present a true and fair view.

Qualified Opinion: Indicates minor discrepancies, but nothing that would distort an overall understanding.

Adverse Opinion: A red flag, highlighting that the presented information significantly deviates from actuality.

Disclaimer of Opinion: An abstention from opinion, often due to insufficient evidence or scope limitations.

Critical Aspects to Examine

Key areas warrant deeper scrutiny in a non-profit audit:

Revenue Recognition: Ensuring contributions, grants, and other incomes are recorded in the correct period.

Expense Allocation: Verifying the allocation between program, administrative, and fundraising expenses.

Internal Controls: Evaluating processes designed to safeguard assets and ensure accurate financial reporting.

Red Flags in Audit Reports

Certain aspects in an audit report should be approached with circumspection:

Significant Uncertainties: Pertaining to events or conditions that might cast doubt on the organization’s ability to continue its operations.

Going Concern Issues: Indicating that the organization might not be able to sustain itself in the foreseeable future.

Discrepancies and Inconsistencies: Variances in numbers or policies that lack a logical underpinning.

Post-audit Actions

The audit’s conclusion doesn’t signify the end; it’s a prelude to introspection and amelioration. Constructive responses to the auditor’s findings, diligent implementation of recommended changes, and perpetual monitoring form the cornerstone of post-audit actions.

Benefits of a Clean Audit Report

A pristine audit report isn’t merely a feather in the cap. It amplifies credibility, augments stakeholder confidence, and paves the way for augmented funding opportunities.

Role of Technology in Modern Non-profit Auditing:

1. Digital Audit Tools:

In today’s digitized milieu, auditors harness a plethora of sophisticated software that not only expedite the auditing process but also enhance its precision. Tools like AI-enhanced analytics, data mining, and blockchain are reshaping the contours of non-profit auditing.

2. Data Integrity and Security:

Ensuring the sanctity of data is paramount. Advanced encryption techniques and multi-layered security protocols are increasingly being deployed to protect sensitive financial data from breaches, ensuring confidentiality and integrity.

3. Automation and Efficiency:

Robotic Process Automation (RPA) is no longer a futuristic concept. By automating repetitive tasks, RPA has brought about a seismic shift, eliminating human errors and significantly reducing the time taken for data validation and reconciliation.

Importance of Continuous Auditing

1. Real-time Analysis:

Continuous auditing is not a mere periodic check but an ongoing process. It provides real-time feedback, allowing organizations to make informed decisions promptly.

2. Swift Issue Resolution:

By identifying and rectifying discrepancies in real-time, continuous auditing facilitates swift remedial measures, ensuring that minor issues don’t snowball into major crises.

3. Enhanced Stakeholder Confidence:

The very nature of continuous auditing sends a robust message to stakeholders. It reassures them of the organization’s unwavering commitment to financial probity and transparency.

Challenges in Non-profit Auditing

1. Evolving Regulatory Frameworks:

The regulatory landscape is in a state of flux, with new legislations and guidelines being introduced at frequent intervals. Keeping abreast of these changes and ensuring compliance can be challenging.

2. Diverse Revenue Streams:

For many non-profits, revenue streams are diverse, ranging from donations and grants to events and sales. Each stream may have its nuances, making the auditing process intricate.

3. Resource Constraints:

Given their mission-driven approach, many non-profits operate on tight budgets. This can sometimes limit their access to top-tier audit expertise or advanced tools, making the audit process more arduous.

Future Trends in Non-profit Auditing

1. Integration of Artificial Intelligence:

The potential of AI in auditing is vast. Predictive analytics, pattern recognition, and anomaly detection are just a few facets where AI can play a transformative role.

2. Cloud-based Audit Platforms:

The cloud is democratizing access to advanced tools. With cloud-based audit platforms, even smaller non-profits can avail of sophisticated audit solutions without the hefty price tag.

3. Stakeholder Engagement:

Audits are increasingly being viewed as a collaborative endeavor. Engaging stakeholders, be it donors, beneficiaries, or staff, will likely become a mainstay, ensuring that the audit process is holistic and all-encompassing.

Why is an audit necessary for a non-profit organization?

Audits enhance transparency and credibility with donors, stakeholders, and governing bodies. They also ensure compliance with financial reporting standards and can reveal areas of financial management that might need improvement.

How often should a non-profit undergo an audit?

The frequency can vary based on regional regulations, donor requirements, and the organization’s bylaws. However, many non-profits undergo annual audits.

How does a non-profit audit differ from a for-profit audit?

While the fundamental principles of auditing remain consistent, non-profit audits specifically focus on areas like donor restrictions, grant compliance, fundraising activities, and the allocation of expenses between administrative, program, and fundraising categories.

What are the primary components of an audit report?

Key components include the Auditor’s Opinion, Statement of Financial Position, Statement of Activities, and Notes to the Financial Statements.

What does an “unqualified opinion” mean?

An unqualified opinion indicates that the financial statements give a true and fair view of the organization’s financial health, without any reservations.

Are there costs associated with getting an audit?

Yes, auditing services come at a cost, which can vary based on the size and complexity of the organization, the region, and the specific audit firm’s rates.

Non-profit auditing is not static; it’s evolving, mirroring the rapid transformations in the financial and technological landscape. By staying informed and adaptive, non-profits can ensure that their audit processes are not only compliant but also strategic, harnessing audits as a tool for organizational betterment and stakeholder reassurance.