20+ Sample Payroll Reports

-

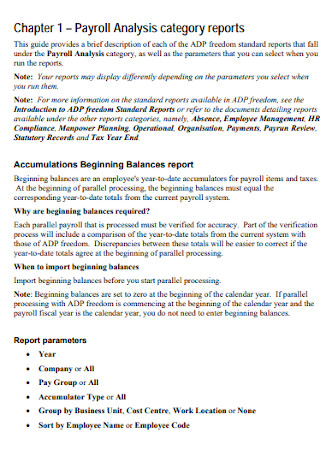

Payroll Analysis Report

download now -

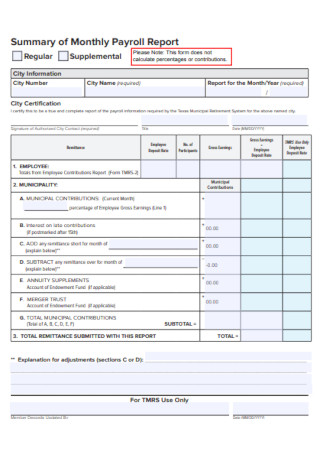

Monthly Payroll Report

download now -

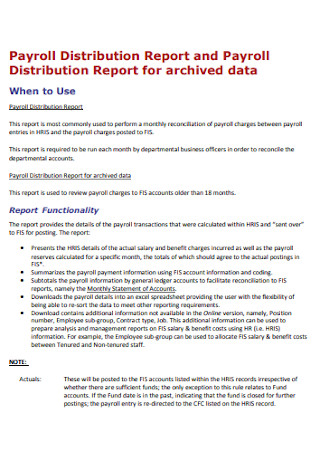

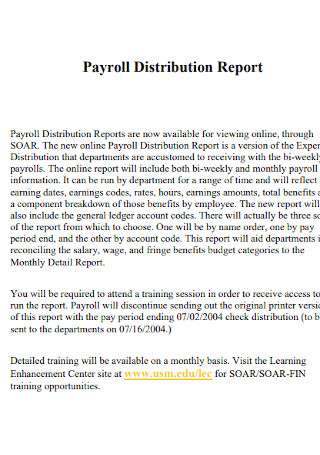

Payroll Distribution Report

download now -

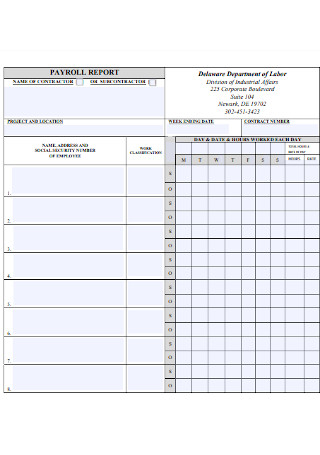

Simple Payroll Report

download now -

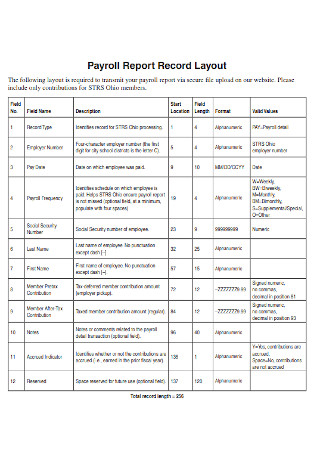

Payroll Record Report

download now -

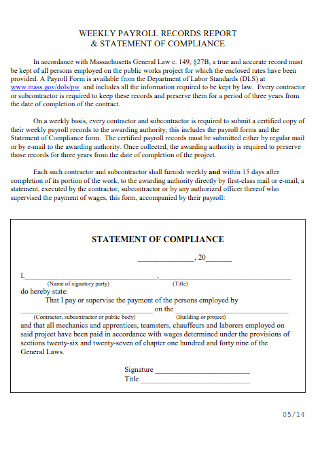

Weekly Payroll Record Report

download now -

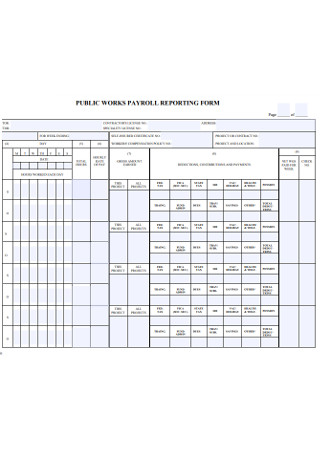

Public Work Payroll Report

download now -

Distribution of Payroll Expense Report

download now -

Payroll Distribution Report Template

download now -

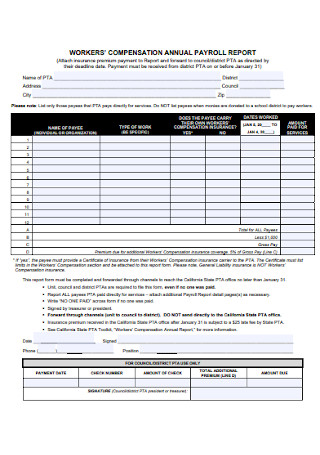

Annual Payroll Report

download now -

Payroll Reconciliation Report

download now -

Payroll Document Report

download now -

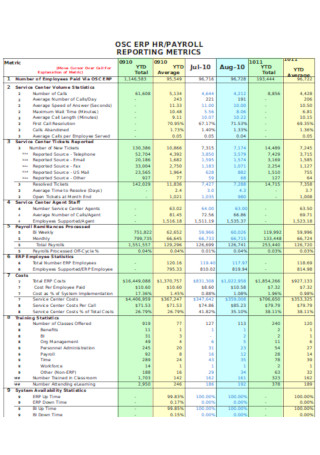

HR Payroll Report

download now -

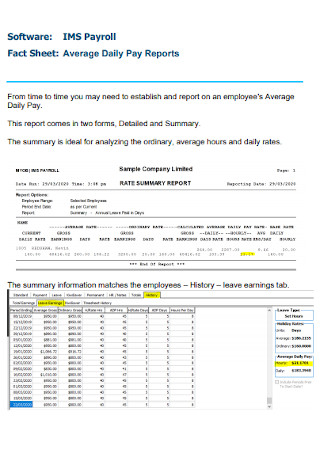

Daily Payroll Report

download now -

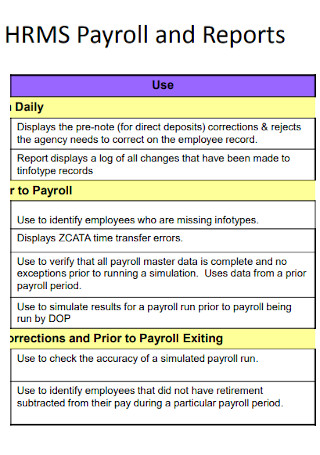

HR Payroll and Report

download now -

Payroll Report Form

download now -

Sample Monthly Payroll Report

download now -

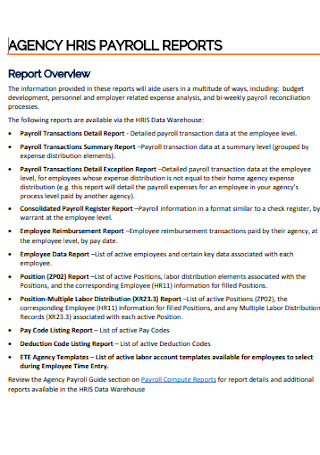

Agency Payroll Report

download now -

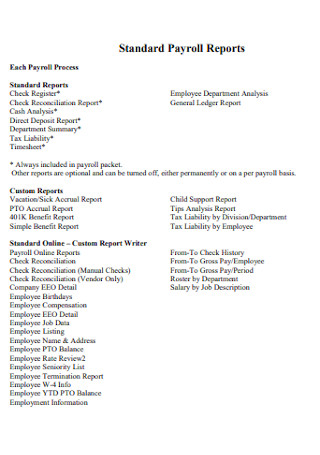

Standard Payroll Reports

download now -

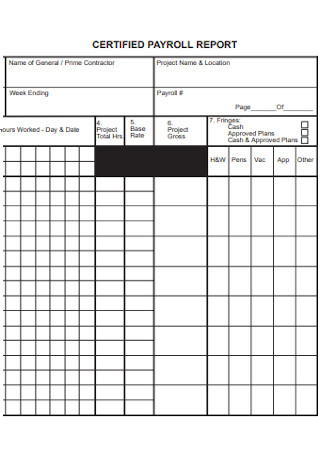

Certified Payroll Report

download now -

Formal Payroll Report

download now

FREE Payroll Report s to Download

20+ Sample Payroll Reports

What Is a Payroll Report?

Components of a Payroll Report

Types of Payroll Reports

Types of Federal Payroll Reports

How to Create a Payroll Report

FAQs

What is the purpose of constructing payroll reports?

What is a payroll summary?

What payrolls costs are eligible for PPP forgiveness?

What payroll reports are due on an annual basis?

What Is a Payroll Report?

A payroll report provides valuable information on staffing, helping employers to understand, estimate, and regulate labor costs. These are relevant tools for auditing and preparing statutory tax forms for government agencies. Payroll reports serve as references for employers to verify tax liabilities or for cross-checking financial information. The document accounts for all payroll transactions of staff within a specific period, either singular, quarterly, or annual. There are various forms for reporting payrolls, and they all depend on the type of tax. Payroll reports aid employers, lenders, and government agencies in analyzing business costs, including applying for business or personal loans.

In the most recent data from the Bureau of Labor and Statistics regarding Employment Situation Summary dated August 6, 2021, nonfarm payroll employment rose to a staggering 943 thousand in July. Most of the jobs of payroll employees are from industries related to leisure, hospitality, local government education, professional and business services. All these employees are subject to having payroll reports from their respective employers.

Components of a Payroll Report

Payroll reports are vital documents that must be accurate to the employee’s payroll. Payroll reports must contain all essential information for the purpose it serves. There are various types of documents, and each one needs different components. However, here are the common elements you can find in any payroll report for the company.

Types of Payroll Reports

As mentioned earlier, a company makes use of various types of payroll reports. The use of these reports varies depending on what purpose they may serve. Below are the common payroll reports an organization uses for employees or the business.

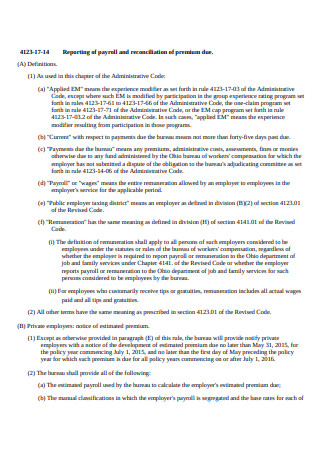

Types of Federal Payroll Reports

Businesses are not required to submit payroll reports to a third party unless the Internal Revenue Service (IRS), employee’s carrier, or state agencies audits them. However, businesses must submit quarterly and annual reports to federal, state, and local governments. Below are the federal payroll report forms organizations must accurately fill out and submit to necessary agencies.

How to Create a Payroll Report

With various types and forms, the creation of payroll reports can be quite challenging to many. The payroll report must be accurate and factual, especially as federal, local, and state governments require copies of these reports. Below are helpful steps that you can use to create your company’s payroll report.

Step 1: Identify All the Necessary Information for Your Report

Every payroll report starts with recognizing the details you need to input in your document. It is also the company’s responsibility to limit the information they give to third parties, especially if it concerns details about the business and its employees. For example, if an employee is trying to apply for a loan for income verification, you will want to restrict unnecessary information, instead, indicate the employee’s wages, taxes, and fringe benefits.

Step 2: Select the Period of the Report

Unless the purpose for creating the payroll report is for submission to the IRS, you can choose the report’s time period. It is under your jurisdiction to create reports that can aid you with explaining various trends and fluctuations clearer to employees or the management. For example, creating a monthly payroll report.

Step 3: Include the Essential Payroll Data

In choosing to input payroll details, the best application you can use is Microsoft Excel; it is every human resources staff and accountant’s best friend. There are plenty of Excel templates for payroll worksheets available online from trusted websites. These templates resemble the payroll outline you can have for your company, customizing it to fit the business’ needs. Once you have a workable sheet, you can input all essential information into your payroll system. Be wary of formulas and entries for your system and familiarize yourself with the application.

Step 4: Review the Results of Data

After processing the data and finalizing the draft of your report, guarantee that the document is free from errors, and note the insights you can add or improve for the following reports. Note the fluctuations in employee payroll rate, tax deductions, and other relevant information relating to the payroll system. If you are creating a report specifically for a third party, decide if it is better to provide a narrative report rather than a report showing figures. The report you send to lenders or banks says a lot about the company’s ability to gauge their knowledge about these documents.

FAQs

What is the purpose of constructing payroll reports?

For one, constructing payroll reports allow you to understand your business better. Collating accurate and up-to-date information allows the company to make more precise and informed choices. It also helps with other relating detail, including employee turnover rates. The reports also help with understanding employees better. By referring to the reports, you can infer which employees are performing well and give interventions to those underperforming. It also helps to visualize the data quickly and easily, using it to compare payroll trends and costs.

What is a payroll summary?

A payroll summary provides brief information about a business’ obligations connecting to payroll within a specific timeframe. The document lists an employee’s wage earnings, withholding taxes, deductions, and all other taxes owed by the employer.

What payrolls costs are eligible for PPP forgiveness?

Small businesses construct PPP report or Paycheck Protection Program report to apply for forgiveness for clearing debt, especially for applying for loans. A business or individual seeking forgiveness if the proceeds are for payroll, mortgages, rents, and other essential utilities ranging from the eight and 24 weeks from the start of disbursement of the loan’s proceeds.

What payroll reports are due on an annual basis?

Remember that payroll reports are presented to government agencies only during audits. These documents are necessary when filing annual tax forms, including Employer’s Annual Tax Return (Form 944), Employer’s Annual Federal Unemployment (FUTA) Tax Return (Form 940), Wage and Tax Statement (Form W-2), Transmittal of Wage and Tax Statements (Form W-3), and Nonemployee Compensation (Form 1099-NEC).

Businesses prepare payrolls for their employees every cut-off to list the employee’s pay, including tax deductions. Payroll reports serve both the company and the employee’s benefit. These documents help the organization track its spending and financial status. Meanwhile, employees use these reports to accomplish their respective federal tax forms. The company must have sufficient knowledge in creating these documents, especially accounting and human resource staff. Familiarize yourself with using payroll reports by using and downloading the sample templates above. Start writing up your payroll reports today!