12+ SAMPLE Transunion Credit Report

-

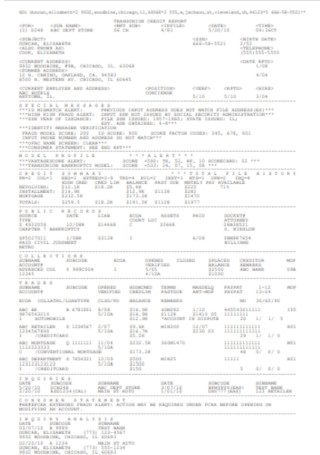

Sample Transunion Credit report

download now -

Transunion Business Credit Report

download now -

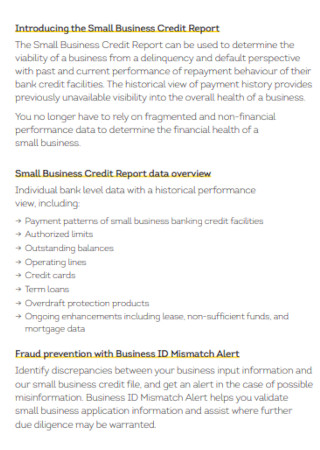

TransUnion Personal Credit Score Report

download now -

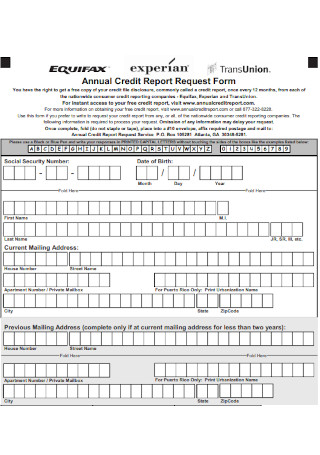

Transunion annual-credit report-request-form

download now -

Transunion Free Credit Report

download now -

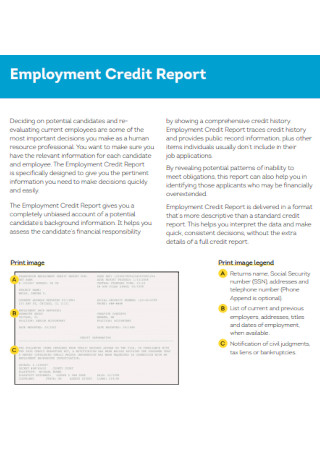

Transunion Employment Credit Report

download now -

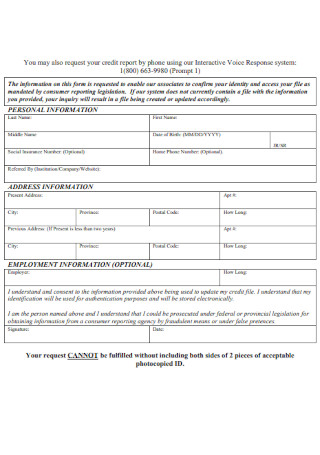

Transunion Credit Report Form

download now -

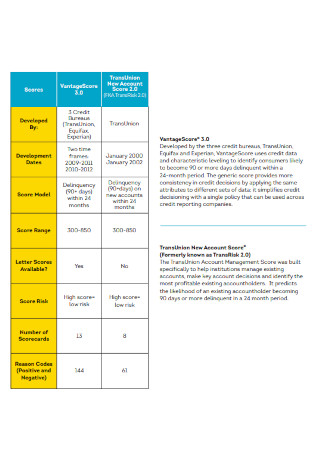

Transunion Credit Report Chart

download now -

Transunion Credit Report Letter

download now -

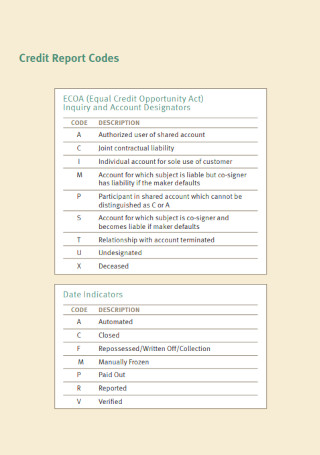

Transunion Credit Report Code

download now -

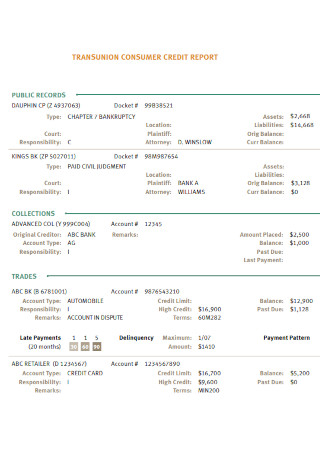

Transunion Consumer Credit Report

download now -

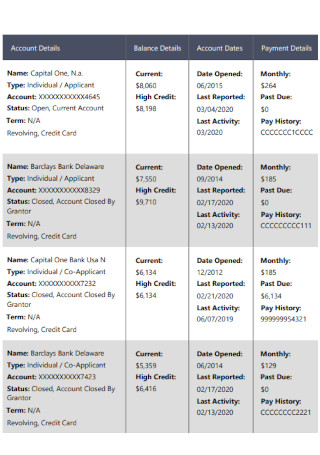

Transunion Credit Report Data

download now -

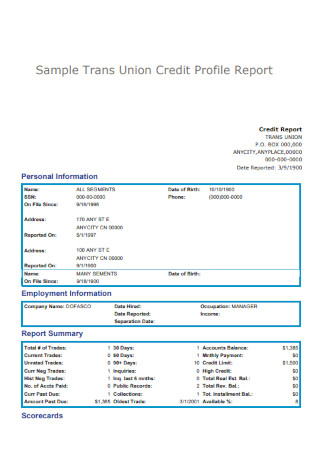

Transunion Credit Profile Report

download now

FREE Transunion Credit Report s to Download

12+ SAMPLE Transunion Credit Report

What Is a Transunion Credit Report?

Benefits of Having a Good Credit

Tips to Help Raise Your Credit Score

How to Build Credit with a Credit Card

FAQs

Can everyone see your credit report?

Can someone clean your credit report?

Do unpaid debts ever disappear?

What Is a Transunion Credit Report?

The Transunion credit report contains your personal information, including your name, address, date of birth, Social Security number, and employment history. Your account history and payment patterns, i.e., if you settle your bills on time and consistently. Transunion is one of the three leading credit agencies with a solid reputation for generating consistent and dependable credit scores. It offers credit monitoring services, fraud warnings, identity theft protection, and other valuable services to assist consumers in maximizing their credit.

Benefits of Having a Good Credit

Your credit score reflects your financial health and creditworthiness as a whole. Because your credit is a significant part of your financial identity, it is essential to establish strong credit early on. While a low score can increase the cost of your most important financial transactions, a high score can give you an edge in financing selections. Bad credit can be managed, but it’s not always easy, and it’s certainly not inexpensive. Establishing a good credit score will save you money and simplify your financial life. If you’re looking for reasons to retain good credit, consider the following advantages.

Tips to Help Raise Your Credit Score

Establishing a decent credit score is simple, but it is essential to your overall financial picture. A high credit score grants you access to the best credit cards and a cheaper interest rate on personal loans and can even impact your ability to obtain a new job contract proposal or lease an apartment. Improving your credit score to qualify for the best rates and more credit cards is essential. When establishing credit, use secured credit cards. Here are some simple suggestions for improving your credit score.

1. Pay Your Bills on Time

Paying your obligations on time is an essential thing you can do to enhance your credit score. For lenders, the capacity to make timely credit card payments implies that a person can obtain and repay a loan. However, your credit score is affected by more than simply your credit card payments. You must pay all of your bills promptly. This includes any utility bills, loan proposals, and medical expenses.

2. Establish Auto-Payment or Calendar Reminders

A simple solution to remembering to pay your monthly bills is an autopay agreement. If you’re not sure you’ll be able to pay your account in full, you can configure it, so you pay the minimum. And the same holds for your utility costs: Most major providers allow you to set up automated monthly withdrawals from your checking or savings account. Some student loan firms offer a discount on your interest rate if you enroll in autopay. You may set up a payment schedule if you choose not to use autopay. Numerous banks and card issuers let you arrange reminders via their websites, including email and push notifications.

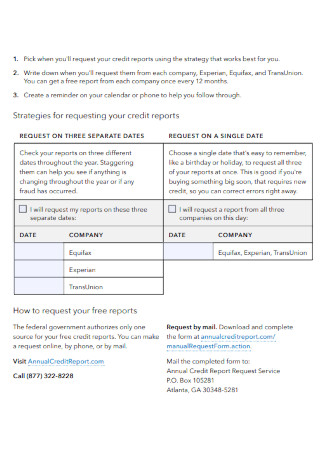

3. Request a credit report

Check your credit reports for any inaccuracies that could be lowering your score. Common mistakes arise when a person registers for credit cards under several names, when information is typed from a handwritten application, or when an ex-information spouse remains on a person’s report. If you discover an inaccuracy, you should collect any supporting information and challenge the error online or by phone with the agency that provided the inaccurate report.

4. Pay Attention to Your Credit Utilization Rate

Your credit usage rate (CUR) is calculated by dividing your credit card debt by your total credit limit. If your CUR is above 30% and you pay your payments on time and in full, you may contact your card issuer and request a credit increase. If you need help settling your bills and have a high CUR, identify areas where you might reduce your spending.

How to Build Credit with a Credit Card

Credit cards are one of the most effective methods for establishing credit. Credit cards are the most prevalent kind of credit and can be used to verify credit over time. For example, using a credit card to pay for groceries or vacation expenses and promptly paying off the balance demonstrates to lenders that you can appropriately manage a debt settlement agreement. If you want to establish credit with a credit card, it’s crucial to understand how you use it will decide whether your credit ratings improve or decline. Signing up for a credit card to establish credit, then maxing out and missing payments will leave you worse off than before. The objective is to develop sufficient credit to qualify for some of the top available credit cards by making prompt payments on your debts. Here are four techniques for developing credit safely with a credit card:

1. Create a New Credit Card Account

Which credit card you apply for should depend on your credit history. There are credit cards for persons with average credit, poor credit, strong credit, and no credit. Consider applying for a starter card (such as a store card) that is easier to get approved for if you have some credit history. If you lack a credit history, you will likely need to apply for a secured credit card to get authorized. Once you acquire your first credit card, make tiny, easily-affordable purchases. Pay your balance monthly to demonstrate to lenders that you are a responsible borrower by establishing a track record of on-time payments.

2. Acquire a Secured Credit Card

As previously stated, your credit card alternatives will likely be limited if you have high credit. Nevertheless, you may still qualify for a secured credit card. This card operates similarly to a typical credit card, except that it needs an upfront security deposit, which the issuer holds as collateral against your spending. If you stopped making payments and defaulted on the account, the issuer would retain the deposit to repay the debt. This protects credit card issuers financially and allows them to approve applicants with poor credit histories. Once you obtain a secured credit card, utilize it to make small purchases and pay your monthly bill in whole and on time. This will contribute to your payment history, increasing your credit score.

3. Become a Registered User

Those who have difficulty qualifying for a credit card on their own may benefit by becoming authorized users. You will be added as a certified user to an existing account and issued your card. The positive payment history is then included in your credit report and considered when calculating your credit ratings. Since you are not responsible for managing the account or making payments, the positive impact on your creditworthiness is limited.

4. Request a Credit Limit Increase

If you currently have a credit card, there are ways to ensure that you maximize its credit benefits. First, use it and pay your monthly bill in whole and on time. Then, after a few months of card ownership, try requesting a credit limit increase. This could boost your credit utilization ratio, which is the ratio of your balances to your available credit. Your credit usage is critical in determining your credit score, and keeping your balances below 30% of your available credit can improve your ratings. And while 30% is an excellent starting point, the lower your credit utilization, the more valuable your ratings will be. Before requesting an increase in your credit limit or applying for new credit, you should pay off as much of your debt as feasible. If your credit card limit is increased, avoid the impulse to boost your spending.

FAQs

Can everyone see your credit report?

Certain groups have legal access to your credit record, although the general public cannot view this information. These groups include creditors, landlords, employers, insurers, government authorities, and utility providers.

Can someone clean your credit report?

Unfortunately, there is no quick way to clear your credit report. When you dispute the information, the credit bureaus have 30 to 45 days to conduct an investigation, per federal law. Seven to ten years if the credit bureaus can verify the information on your credit record.

Do unpaid debts ever disappear?

In most states, the obligation expires or disappears once it is paid. By the Fair Credit Reporting Act, debts can remain on your credit report for a minimum of seven years and, in some instances, longer.

Every day brings new projects and to-do lists, frequently similar to previous assignments. Many of our day-to-day responsibilities resemble previous endeavors. We provide this basic Transunion Credit Report template to help you improve your professionalism. If duration or quality is of the essence, this pre-made template will help you save time and concentrate on the most important themes!