35+ Sample Trust Receipts

-

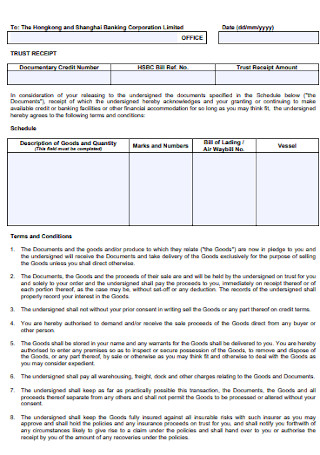

Sample Trust Receipt Template

download now -

Trust Financing Receipt

download now -

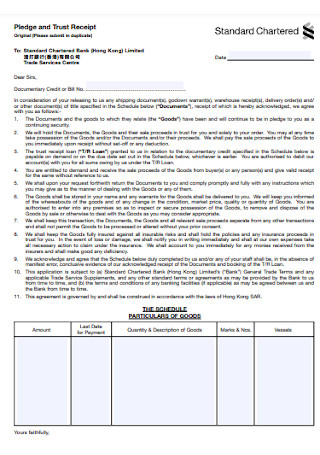

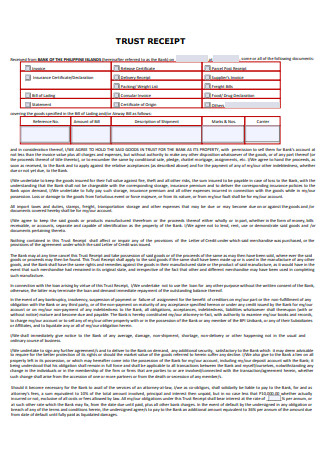

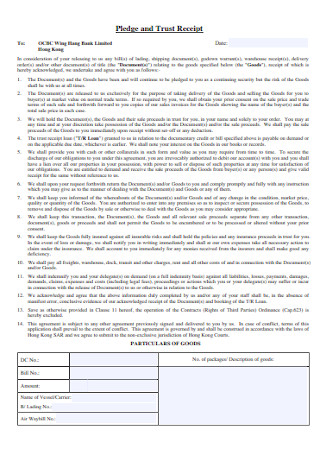

Pledge and Trust Receipt

download now -

Trust Loan Receipt Template

download now -

Agricultural Trust Receipt Template

download now -

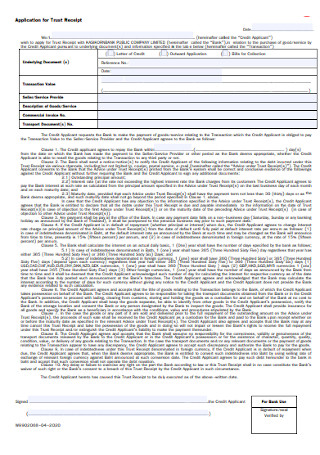

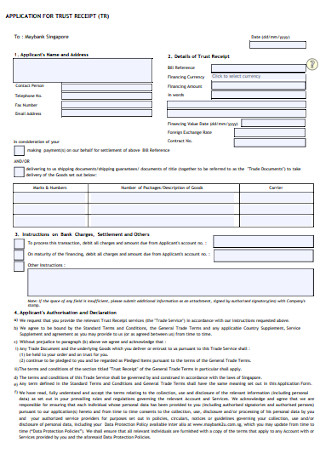

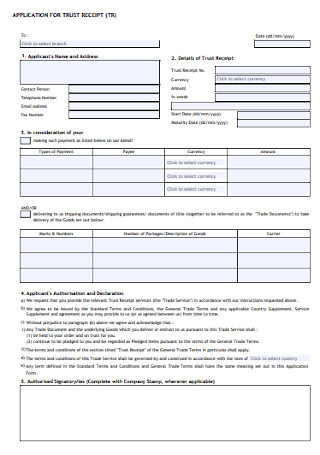

Application for Trust Receipt

download now -

Trust Receipt Sheet Template

download now -

Trust Receipt Format

download now -

Simple Trust Receipt Template

download now -

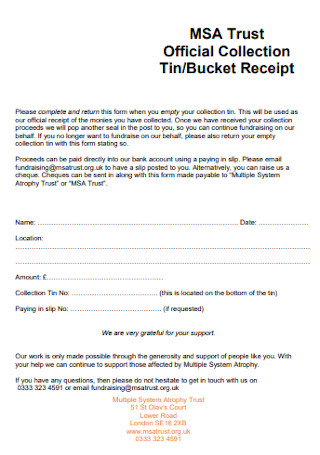

Trust Official Receipt Template

download now -

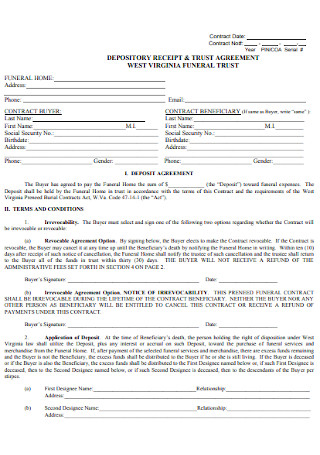

Trust Agreement Receipt

download now -

Sample Trust Receipt Format Template

download now -

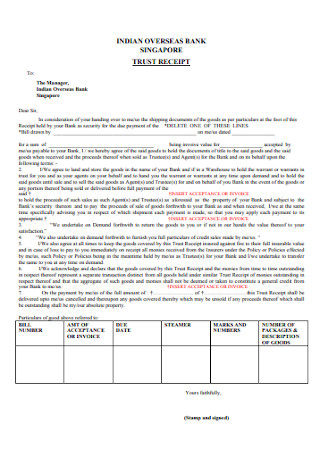

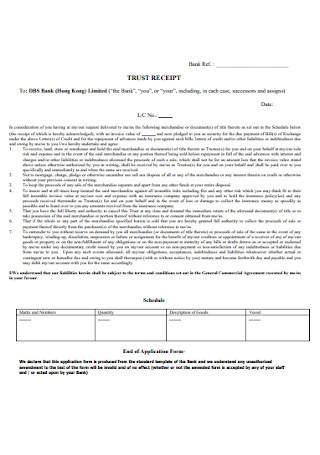

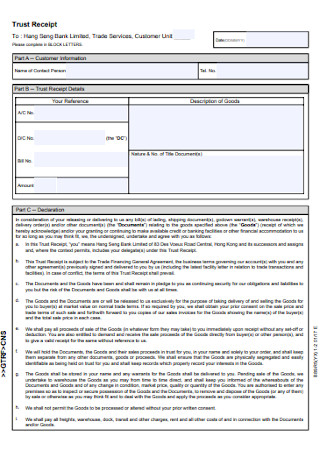

Bank Trust Receipt Template

download now -

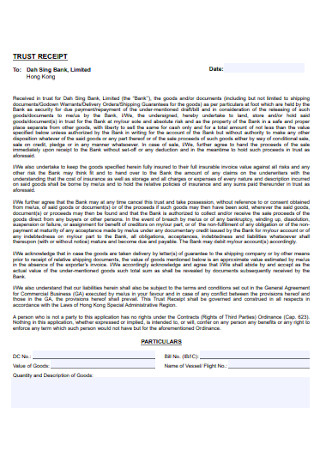

Standard Trust Receipt Template

download now -

Sample Application Trust Receipt Template

download now -

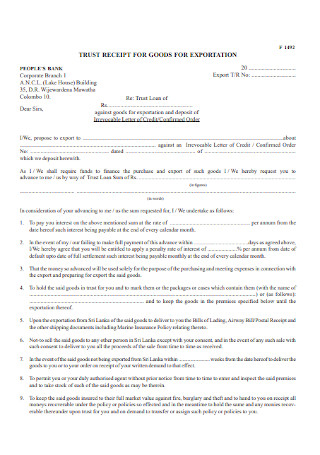

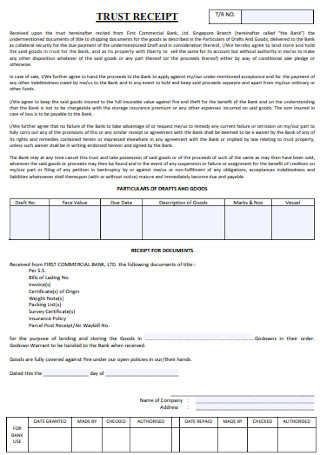

Trust Receipt for Goods

download now -

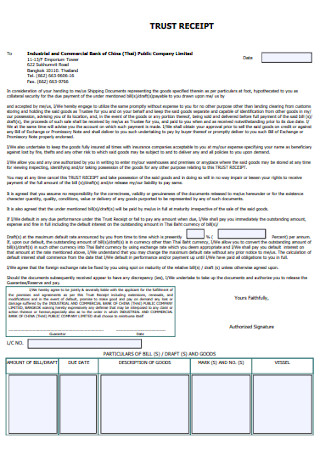

Bank Trust Receipt Format

download now -

Corporation Trust Receipt Template

download now -

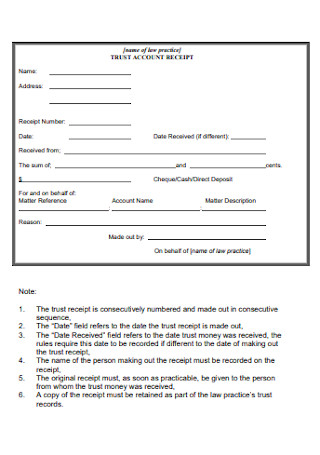

Trust Account Receipt Template

download now -

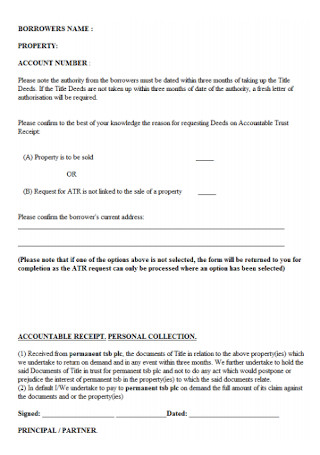

Trust Property Receipt

download now -

Trust Goods Receipt Template

download now -

Trust Product Receipt Template

download now -

Trust Law Receipt Template

download now -

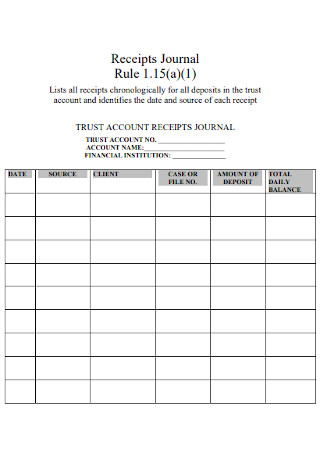

Trust Journal Account Receipt

download now -

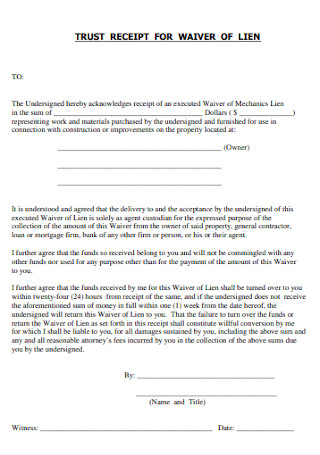

Trust Receipt for Waiver Template

download now -

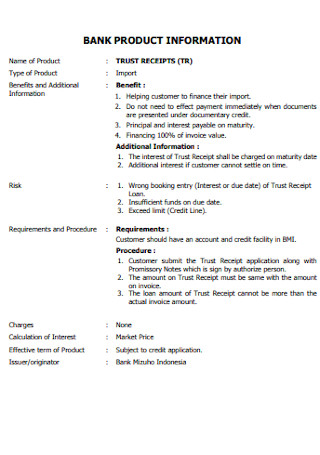

Trust Bank Information Receipt

download now -

Formal; Trust Receipt Template

download now -

Formal Trust Receipt Template

download now -

Trust Receipt Agreement Template

download now -

Sample Trust Receipt Format

download now -

Trust Documentary Receipt Template

download now -

Trust Receipt Form Template

download now -

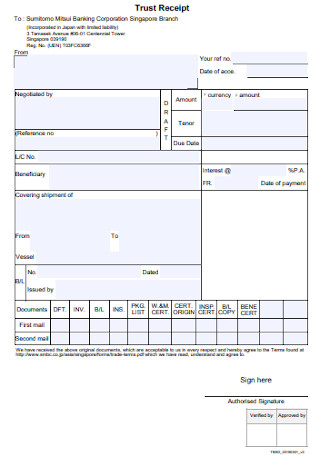

Commercial Bank Trust Receipt Template

download now -

Standard Trust Receipt Format

download now -

Pledge and Trust Receipt Example

download now -

Trust Customer Receipt Template

download now

FREE Trust Receipt s to Download

35+ Sample Trust Receipts

What are Trust Receipts?

Types of Trust Receipts

Advantages of Trust Receipts

Disadvantages of Trust Receipts

How to Use a Trust Receipt Template

FAQs

What is the difference between letters of credit and trust receipts?

Can I edit the sample trust receipt templates in both PDF and MS Word formats?

What are Trust Receipts?

Trust receipts are financial documents that serve as evidence of a transaction between a buyer and a seller, particularly in the context of international trade agreements. They play a crucial role in managing accounts, cash, and payments. Trust receipts provide a mechanism for buyers to take possession of goods before full payment is made, allowing them to use or sell the goods to generate cash flow. Trust deposit receipts, a type of trust receipt, are utilized when a buyer places a deposit or trust funds with the seller to ensure the fulfillment of the agreement. Additionally, tender option bond trust receipts are specialized forms of trust receipts related to the issuance and management of bonds. These receipts provide legal protection, facilitate transparency, and help ensure compliance in complex international trade transactions.

These receipts serve various important purposes across different businesses, providing tangible benefits and addressing common financial challenges. According to credible statistics, they are extensively used for cash flow management, allowing firms to preserve liquidity while guaranteeing on-time payments. Trust receipts are especially crucial when it comes to international trade because they enable safe transactions and agreement compliance. They give consumers a way to get their hands on the products before making the final payment, enabling instant usage or resale. Trust deposit receipts are also widely used; according to one survey, more than 70% of organizations use them to safeguard transactions. By doing this, the danger of non-payment or default is reduced.

Types of Trust Receipts

Trust receipts in their various forms are indispensable tools for businesses in managing accounts and cash flow, and ensuring secure payments. They play a vital role in international trade agreements. Explore different types of trust receipts with reliable statistics reflecting their widespread adoption and their contribution to financial stability and risk mitigation.

Advantages of Trust Receipts

It is important for businesses to carefully assess their specific circumstances, industry requirements, and financial goals to determine whether the advantages of utilizing trust receipts outweigh the potential disadvantages. Proper risk assessment and understanding of legal implications are essential to make informed decisions regarding the use of trust receipts.

Disadvantages of Trust Receipts

While trust receipts offer numerous benefits, it is important to consider potential drawbacks. In this section, we explore the disadvantages of trust receipts, including increased administrative burden, potential cash flow disruptions, limited applicability, and complex legalities businesses should be aware of.

How to Use a Trust Receipt Template

Follow these four simple steps so that you can easily use a trust receipt template. In this way, you can streamline your transaction processes, provide clarity, and help ensure smooth payment handling and compliance with agreements.

Step 1: Select a Trust Receipt Template

Choose a trust receipt template that suits your specific needs, whether it’s a standard trust receipt, invoice financing trust receipt, or any other type. Make sure the template has vital information including payment conditions, a description of the products, and buyer-seller specifics.

Step 2: Customize the Trust Receipt Template

Tailor the trust receipt template to reflect your specific transaction details, including the agreed-upon payment terms, delivery conditions, and any additional contractual obligations. Modify sections to match the terms and conditions of your agreement, ensuring accuracy and clarity.

Step 3: Input Relevant Information

Fill in the trust receipt template with the necessary information, including buyer and seller names, payment amounts, delivery dates, and any specific terms or conditions unique to your transaction. Double-check all entered details to minimize errors and ensure accuracy.

Step 4: Review and Finalize the Trust Receipt

Thoroughly review the completed trust receipt template, paying attention to all terms, conditions, and figures. If necessary, seek legal or expert counsel. If you are certain that the trust receipt is accurate and comprehensive, sign it, date it, and then seal it to make it legally enforceable for all parties.

FAQs

Letters of credit or credit dispute letters and trust receipts are both financial instruments used in commercial transactions, but they differ in their purpose and nature. A letter of credit is a deal made by a bank on behalf of the buyer to the seller, guaranteeing payment subject to the satisfaction of certain requirements. A trust receipt, on the other hand, is a legal instrument that enables a buyer to take possession of items before full payment, acting as a method for controlling cash flow and ensuring transaction compliance.

Yes, you can edit both PDF and MS Word versions of sample trust receipt templates. In MS Word format, you can easily modify the content, customize fields, and adjust formatting according to your specific requirements. While PDFs are generally non-editable, you can use PDF editing tools or converters like PDF editor or PDF converter to make changes to the text or add your information to the template.

What is the difference between letters of credit and trust receipts?

Can I edit the sample trust receipt templates in both PDF and MS Word formats?

Overall, trust receipts play a vital role in enhancing financial transparency, minimizing risks, and promoting smoother business operations. Understanding the various types of trust receipts and knowing how to effectively utilize trust receipt templates is crucial for businesses. By familiarizing themselves with different trust receipt types, businesses can select the appropriate one for their specific needs. Additionally, following the steps in using a trust receipt template ensures accuracy, compliance, and efficient transaction handling. This knowledge empowers businesses to streamline their cash flow management, mitigate risks, and maintain smooth operations in the realm of international trade and beyond. Easily download and use our sample receipts like property receipts, sponsorship receipts, and other form templates.