17+ Sample Weekly Expense Reports

-

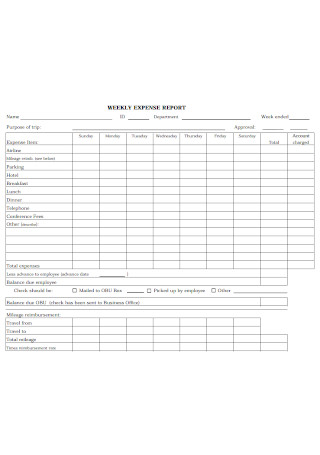

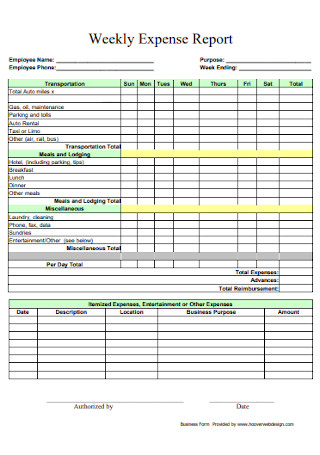

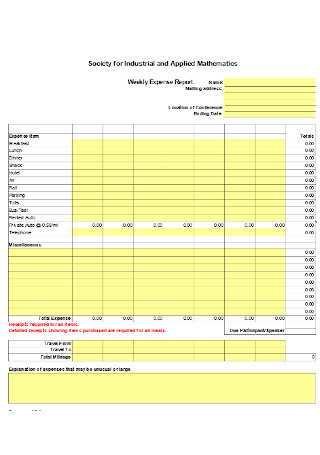

Sample Weekly Expense Report

download now -

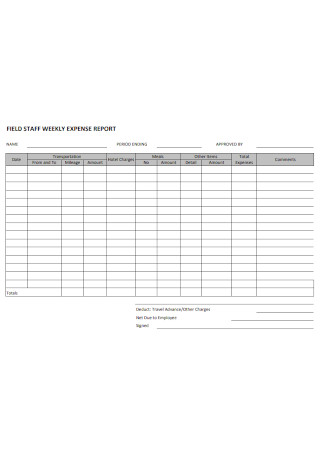

Field Staff Weekly Expense Report

download now -

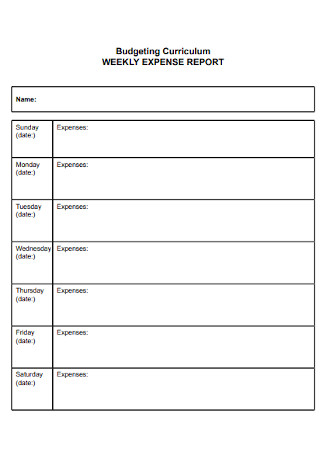

Weekly Expense Budget Report

download now -

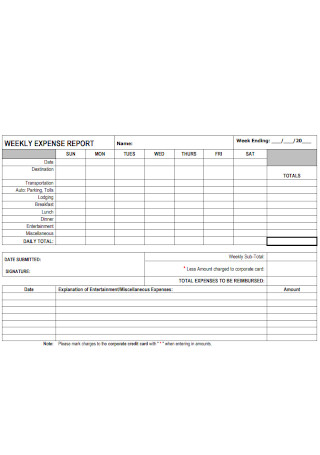

Weekly Capital Expense Report

download now -

Basic Weekly Expense Report

download now -

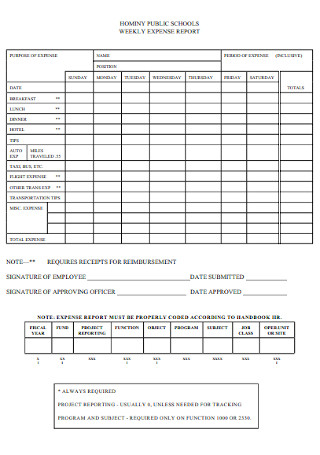

School Weekly Expense Report

download now -

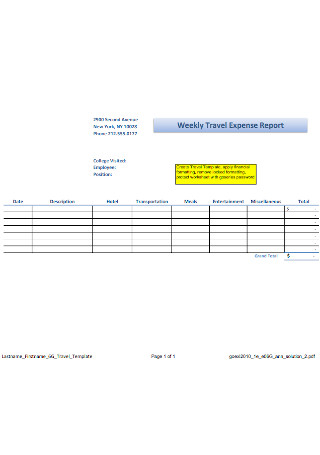

Weekly Travel Expense Report

download now -

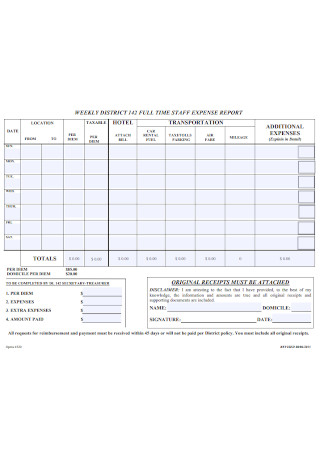

Weekly Full Staff Expense Report

download now -

Industrial Weekly Expense Report

download now -

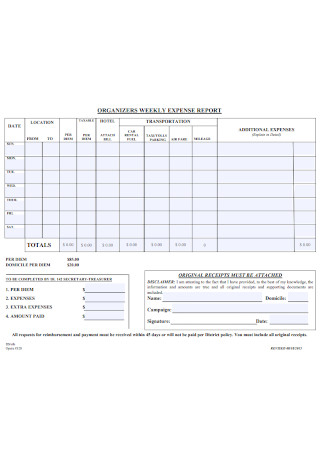

Sample Organizer Weekly Expense Report

download now -

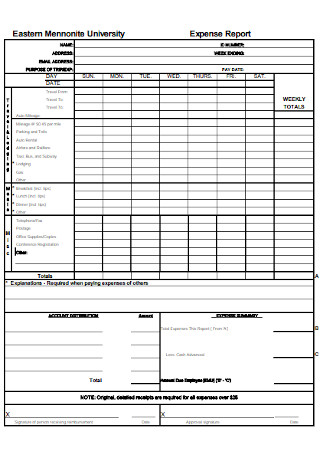

University Weekly Expense Report

download now -

Bi-Weekly Hours and Expense Report

download now -

Simple Weekly Expense Report

download now -

Formal Weekly Expense Report

download now -

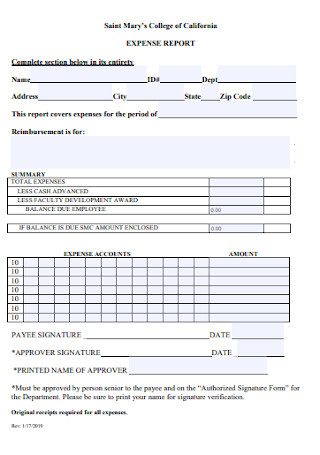

College Weekly Expense Report

download now -

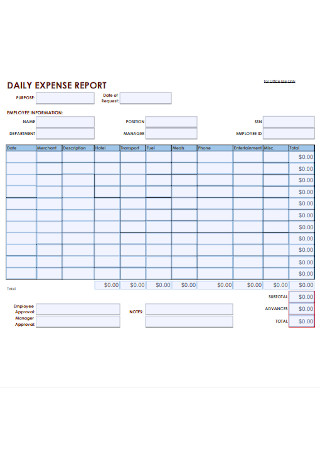

Daily and Weekly Expense Report

download now -

Weekly Expense Report Format

download now -

Kids Weekly Expense Report

download now

FREE Weekly Expense Report s to Download

17+ Sample Weekly Expense Reports

Weekly Expense Reports: What Are They?

What Are the Elements of an Expense Report?

When to Use Weekly Expense Reports

How to Create a Weekly Expense Report

FAQs

How do you manage expense reports?

What are the expense statements?

What are the common examples that can be reimbursed by businesses?

What are the recommended finance apps for both Android and IOS?

Weekly Expense Reports: What Are They?

No business would accept numerous transactions continuously without tracking every cent spent. Otherwise, that business would experience financial losses. So, an official form or document, called an expense report, exists as the company’s official financial tracker. When the concern lies in the weekly performance tracking of expenses, it is necessary to use the weekly expense report. This weekly report refers to the required expense reports that must be submitted by employees every week. Records may involve travel, business meals, mileage expenses, and more.

Based on a report, the ancient people started using cash currency around 40,000 years ago, with the Mesopotamian shekel as one of the first forms of currency.

Meanwhile, Business Wire reported that employee expense fraud commonly costs American businesses up to $2.8 billion every year.

On the other hand, Statista confirmed that global business travel expenses amounted to $1.33 trillion back in 2017.

Why Is a Weekly Expense Report Essential?

Expense reports are important to document specific business expenses. For example, a worker may attend a business event in another city. Meanwhile, that worker used his or her vehicle to drive. Also, that employee spent money on gas, parking, and food. As it would be unfair for that single worker to spend everything for business-related matters, the small business can require that employee to submit a business report outlining the expenses until the manager approves the employee’s reimbursement.

Furthermore, weekly expense reports are not only applicable to businesses but also for personal spending. Do you want to note all your expenses like groceries and travel fees for the week? Write every expense in the weekly report. Writing is helpful to track how much money you spent. It would lead you to smart decisions like spending less next week if you spent a considerable amount this week. Or, you could check the amount of a specific product once again from your records in case you forgot. Thus, you are wholly aware of your weekly spending.

What Are the Elements of an Expense Report?

Whether you use a daily, weekly, monthly, quarterly, or yearly expense report, what matters most is that you have all the critical elements to your sheet. Although these factors may vary according to what your expense report focuses on, it is no surprise that general expense sheets would have such factors to report effectively. And these expense report elements consist of the following:

When to Use Weekly Expense Reports

Weekly expense reports track business spending every week. But it is not as basic as that. There are different applications on how to use such expense reports too. In this section, be introduced to the many examples of when to use a weekly expense report.

General Expense

The general expense report refers to recording basic expenses. Since this is the standard example, it also marks as the easiest example. If you plan on outlining personal expenses for the week, then lay it out using this report.

Travel Expense

According to Statista, the 2017 global business travel expenses reached $1.33 trillion. And it is not a surprise to see that travel expense reports are a notable application for expense reports. This example typically applies to employees on a business trip, as their travel expenses gets reimbursed after.

Business Mileage

With the business mileage report, employees may record how far they drove for work purposes. For example, a construction worker used his or her car to buy extra materials and supplies needed for operations. Besides reimbursing the worker for buying materials, employers reimburse that employee for gas or travel fees, according to the mileage recorded.

Contractor Expense

Sometimes, businesses need to hire more people to achieve certain tasks. If a larger scope is required for operations, then other contractors also become necessary. And by inviting more contractors, more costs are present as well. Use the contractor expense report to track the costs here.

Project or Event Expense

Whenever there are events or projects set up by a company, and its employees end up paying for its related operations, a project or event expense report becomes useful. Many expenses get added there, including the general, travel, contractor, and mileage—a hybrid of costs.

How to Create a Weekly Expense Report

Did you know that expense fraud is a common issue among American businesses? Reports show that employee expense fraud costs $2.8 billion for companies in the US annually. With that said, it is no surprise how important expense reports are to avoid financial fraud schemes among employees and businesses. And a weekly expense report is a good practice to start. Reports done per week is not too tiring as that of a daily report. Meanwhile, many problems may be missed out if reports take too long as a yearly expense report. Thus, make an effective weekly expense report by following these steps:

Step 1: Choose a Template and Edit

First things first, check out all the weekly expense report templates that are ready to download. Compare every template until you can select the best one that applies to your purpose. Once selected, be sure to edit the template according to your preferences. How do you want the format should look? And what columns should be included in the report? Note it down. Remember to make the weekly expense report as easy as possible, so you need not have a hard time updating it.

Step 2: Insert the Expense Report Elements

Recall those elements of an expense report discussed earlier down from the date to the notes. You would need those to make a whole expense report. But, what to incorporate also depends on how you wish to use the report. Maybe you do not plan on making a basic expense report but rather a weekly travel expense or perhaps, a weekly event expense report. This reason is why specifying what purpose or example to observe in the document is essential. And once you’ve tailored all the elements, fill out what needs answering in each column.

Step 3: Review the Calculations

Expense reports are not complete without calculations. Of course, you would need to add all the expenses to determine the total amount. Other calculations may be necessary, too, like figuring out the subtotal expenses, tax deductibles, savings, etc. Most importantly, the formula used and answers recorded in the report should be correct. Otherwise, the whole sheet’s financial statement is already pointless and unreliable—an error. A tip is to review every calculation and make sure that it has the same answers.

Step 4: Incorporate Evidence

To make weekly expense reports believable, always include receipts to justify claims. Maybe no employer believes the overall costs to reimburse for an employee if that same employee did not attach receipts in the report. Also, refrain from including random receipts because employers will check if everything is accurate enough. Thus, supporting documents that help in validating the report are essential evidence that should be safely kept. And after reviewing the overall report’s content, submit or print it once you are confident with everything.

FAQs

How do you manage expense reports?

An expense report can be properly managed if there is a well-planned expense policy. This way, it is clear to determine how much the business is willing to compensate employees and other details. More so, planning and management for such reports must include an easy tracking system, official corporate credit cards, and regular audits. If you follow all these steps appropriately, rest assured your expense report goes well.

What are the expense statements?

Expense statements are detailed business reports that tailor every specific business budget, transaction, and general expense. Expect the statement to be a necessary tool in giving employee reimbursements, especially if such workers paid using their money for business purposes.

What are the common examples that can be reimbursed by businesses?

What will be reimbursed by companies would generally depend on what is under the company policy. But generally, acceptable reasons for reimbursements include charges for meals, gas, parking, lodging, transportation fees, and business supplies.

What are the recommended finance apps for both Android and IOS?

You can use plenty of apps for budgeting and personal finances that are available for Android and IOS. Examples include PocketGuard, Wallet, Money Lover, MoneyStrands, Clarity Money, Honeyfi, Dollarbird, and Fudget. But, which app is the best depends on the user itself, so be sure to explore and compare each app to choose right.

With seven days, 168 hours, 10,080 minutes, and 604,800 seconds in a week, many expenses can be made. Do not lose track of every money spent because it may shock you when the effects of poor financial plans take place. Record and track all the important factors down from the total amount, expense description, date, and more. And you can start by drafting well-thought-out weekly expense reports.