8+ Sample Loan Amortization Schedules

-

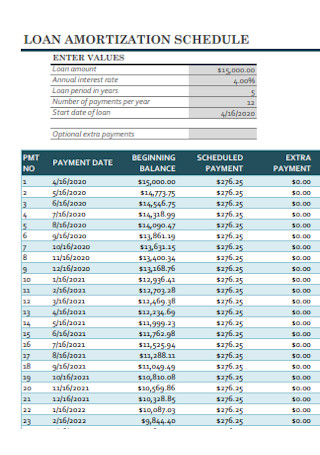

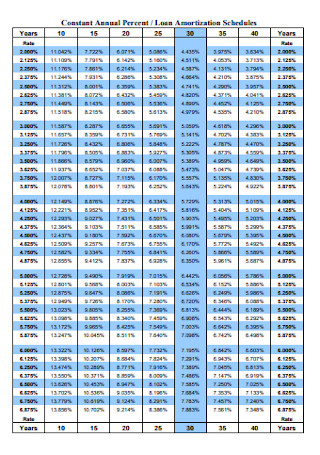

Basic Loan Amortization Schedule

download now -

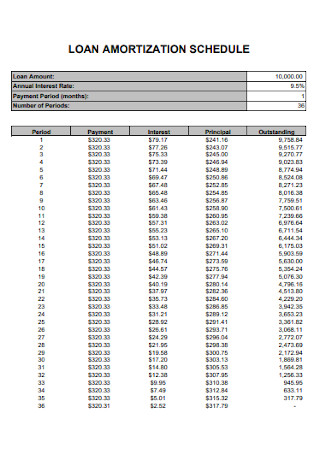

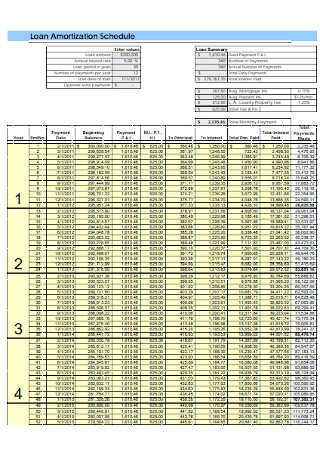

Loan Amortization Schedule Format

download now -

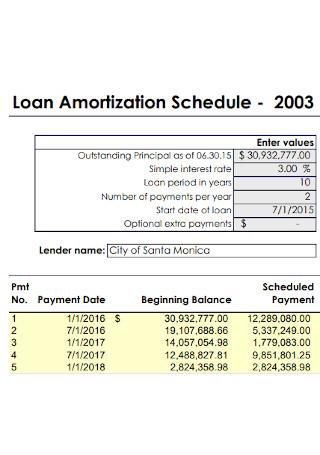

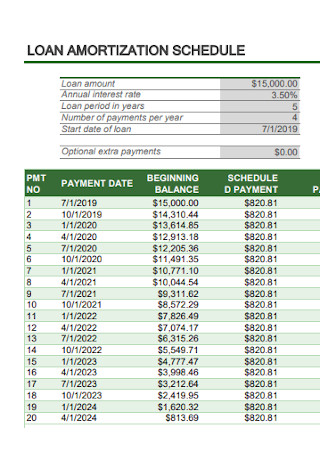

Simple Loan Amortization Schedule Template

download now -

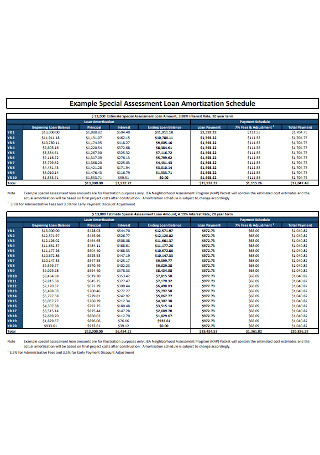

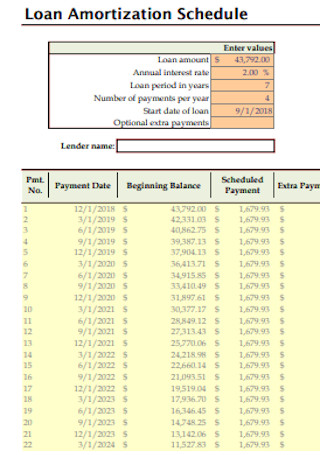

Special Assessment Loan Amortization Schedule

download now -

Loan Amortization SpreadsheetSpre

download now -

Annual Loan Amortization Schedule

download now -

Simple Loan Amortization Schedule

download now -

Formal Loan Amortization Schedule

download now -

Printable Loan Amortization Schedule

download now

FREE Loan Amortization Schedule s to Download

8+ Sample Loan Amortization Schedules

What Is a Loan Amortization Schedule?

Benefits of Keeping an Amortization Schedule

Steps on Making a Loan Amortization Schedule

FAQs

What is the Definition of Amortization?

What Do You Mean by Amortization Schedule?

Is Amortization Calculator Essential?

What is the Meaning of an Amortization Chart?

We have expenses to be paid and we do not know where to get money anymore. Then all we could do is to have a loan. A loan is any kind of credit where we can get a particular money. We would pay it with interest. What else can we do? We need money, so a loan is the answer. We would have a loan first for us to have money to spend and to invest then paying will be just the next step. Then the problem would come. It is not easy to pay sometimes. We have to study ways on how we can pay properly. A good loan amortization schedule is needed.

What Is a Loan Amortization Schedule?

Loan amortization schedule is the periodic payments of loan installments. It is composed of the principal amount and the interest paid each month until the end of the loan term. It is a record of how much you must prepare each month to pay your loan.

Benefits of Keeping an Amortization Schedule

You will find benefits on keeping an amortization schedule. These are:

Steps on Making a Loan Amortization Schedule

Let us have an example: A home loan with a principal of $1,500,000 with an interest of 1% per month and the payment term is 60 months. Let us make an amortization schedule.

Step 1 Have your input in a standard format

Make a format. Then put the details of the principal amount, the interest, and the payment terms.

Step 2 Find out what you pay monthly or the EMI(Equal Monthly Installments)

Use the PMT function in Excel. You can easily know your monthly installments with it.

PMT = [ rate, nper, pv, fv, type]

The rate is the interest rate or the monthly interest rate of 1%. The nper is the period which is 60 or 60 months. The PV is the amount of loan which is $1.5 million. The FV is the future amount of loan, in the matter that you want to pay the full amount. You have the equation: FV=0. The type is equal to 0 or 1. We know that at every end of the month, payment is made.

Step 3 Make your loan amortization table

Prepare a table with the following in each column: month, beginning balance, interest, balance before payment, monthly payment, principal repaid and existing balance.

With your first balance, calculate the interest. Compute your balances before all the monthly payments. Get the principal amount that you pay in a month. Compute for the loan balance at the end of the month. Compare the beginning balance that you will have on the next month. Fill in the amounts in the loan amortization schedule in an Excel table. Complete your table.

At the end of 60 days, check if the balance is zero.

FAQs

What is the Definition of Amortization?

Amortization is the reduced amount on your loan at a particular time. It is divided into multiple installments. Each installment has an amortization schedule. Examples of the amortization process is mortgage loans, personal loans, and car loans. Amortization helps you better pay your loans.

What Do You Mean by Amortization Schedule?

Amortization schedule generates an amortization calculator. It is a table which details each of your payments on the span of your loan. It includes the amount of each paid installment, the date when you paid it, the amount you paid towards the interest, the amount of your principal balance, and what is the amount after the payment is made. With an amortization schedule, you can see your progress in paying your loans.

Is Amortization Calculator Essential?

Yes. It is. It can be a big help for analyzing your amortization table. Loan amortization calculator can automate and simplify your amortization table. These calculators are accessible. We can access one of these through the Internet for free.

What is the Meaning of an Amortization Chart?

It is a synonym for the table of amortization schedules. It is a graphic chart which visualizes all processes of amortization. It has all the data. Everything is clearer to see with it.

If we can have time to prepare a loan amortization schedule, things will be easier. Payment each month will not surprise us because we are recording it month per month. We can also know when we forgot to pay our loan bills. We can keep everything at a good pace. Have a loan amortization schedule and you will see that you can be of better control of your finances.