Download Bank Deposit Slip Bundle

Bank Deposit Slip Format

Bank Name: ___________________________

Branch: ______________________________

Date: //_________

Depositor’s Information

- Depositor’s Name: _______________________________

- Account Number: ________________________________

- Phone Number: __________________________________

- Email (optional): _______________________________

Deposit Details

| S.No | Description | Cheque No./DD No. | Amount (Currency) |

|---|---|---|---|

| 1. | _________________________ | _________________ | __________________ |

| 2. | _________________________ | _________________ | __________________ |

| 3. | _________________________ | _________________ | __________________ |

Total Amount: ________________________

Mode of Payment

- Cash

- Cheque

- Demand Draft (DD)

- Others: __________________________

Signature

- Depositor’s Signature: __________________________

Bank Deposit Slip Samples

-

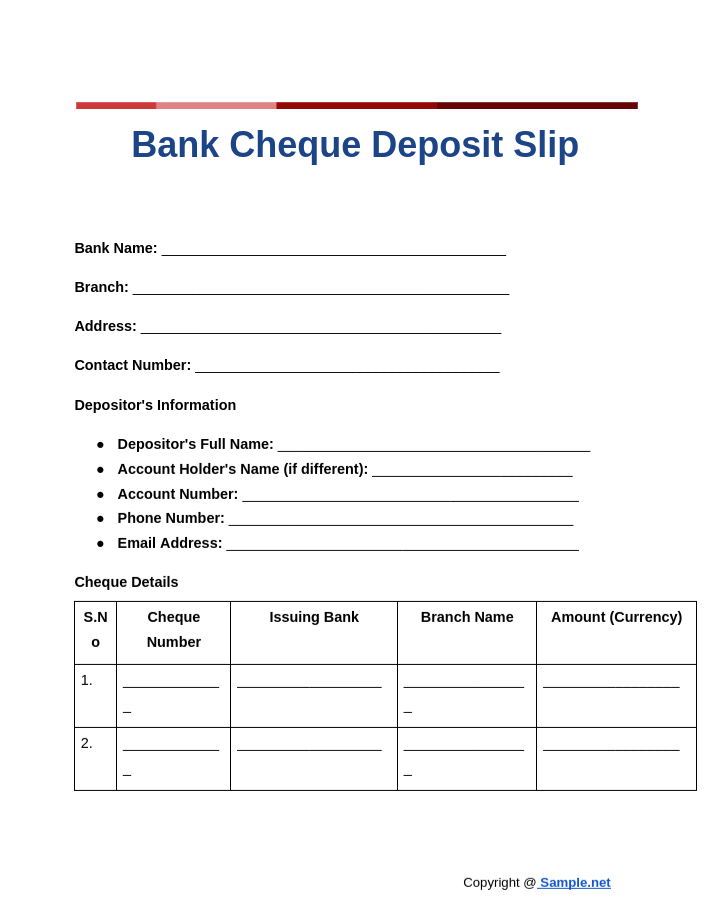

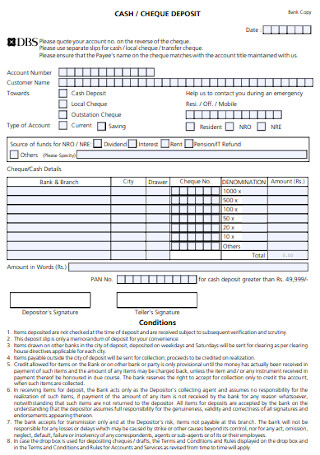

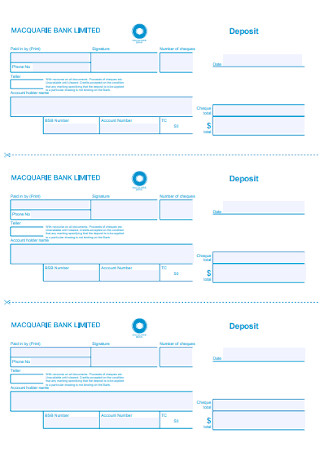

Bank Cheque Deposit Slip

download now -

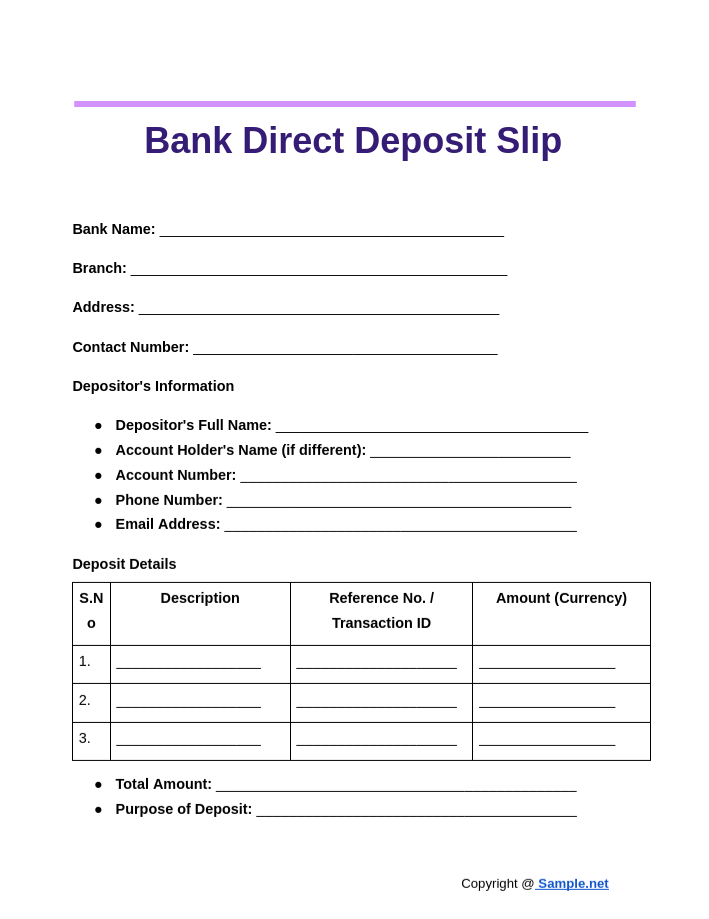

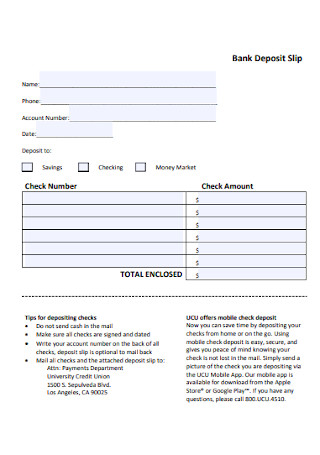

Bank Direct Deposit Slip

download now -

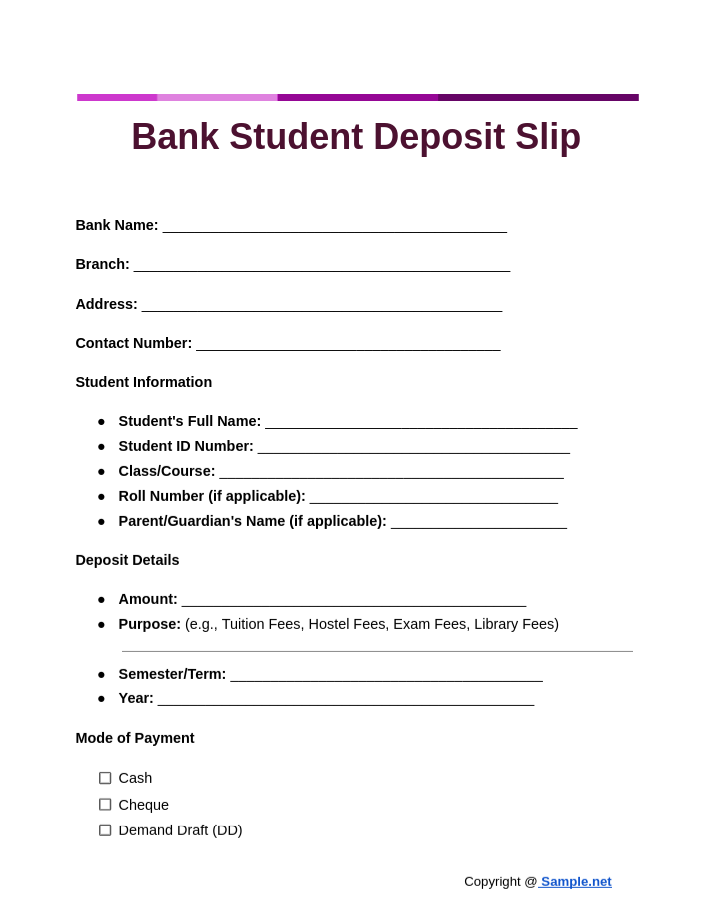

Bank Student Deposit Slip

download now -

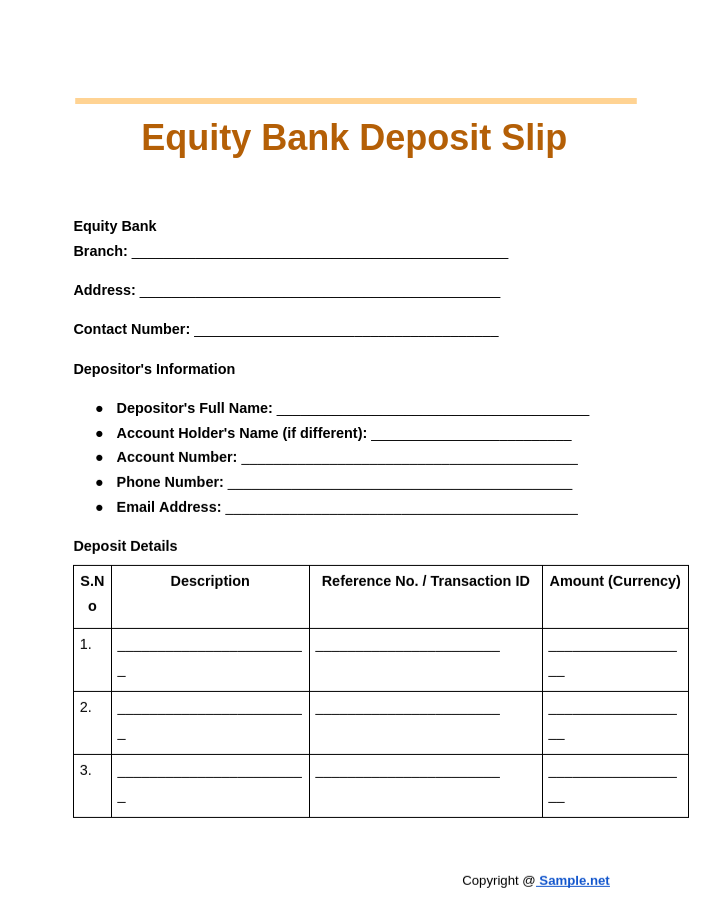

Equity Bank Deposit Slip

download now -

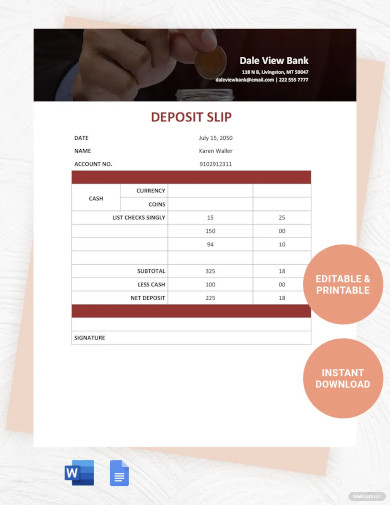

Bank Deposit Slip Template

download now -

Free Blank Bank Deposit Slip Template

download now -

Sample Bank Deposit Slip Template

download now -

Bank Deposit and Pay in Slip Template

download now -

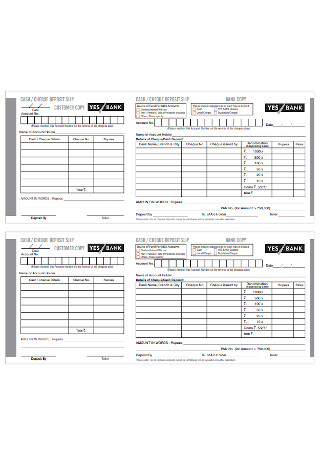

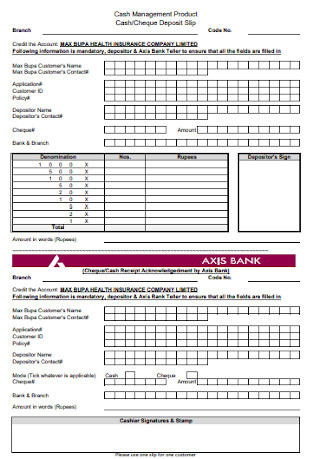

Bank Cash and Cheque Deposit Slip Template

download now -

Basic Bank Deposit Slip Template

download now -

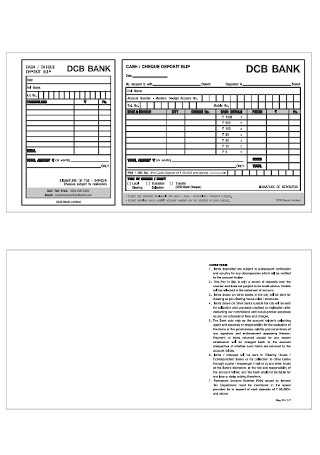

Bank Cash Deposit Slip Template

download now -

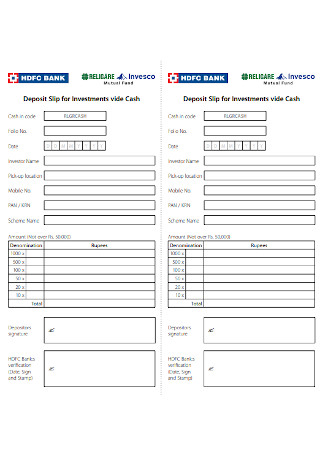

Deposit Slip for Investments Vide Cash

download now -

Simple Bank Deposit Slip Template

download now -

Formal Bank Deposit Slip

download now -

Bank Deposit Slip for Cash Template

download now -

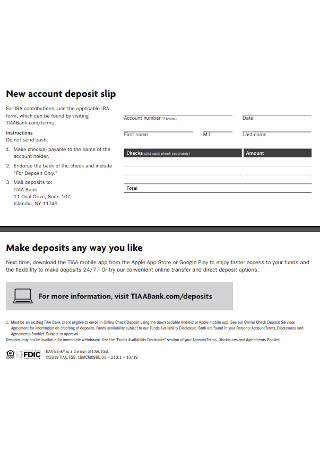

Bank New Account Deposit Slip Template

download now -

Cash Deposit Slip for Management Product Template

download now -

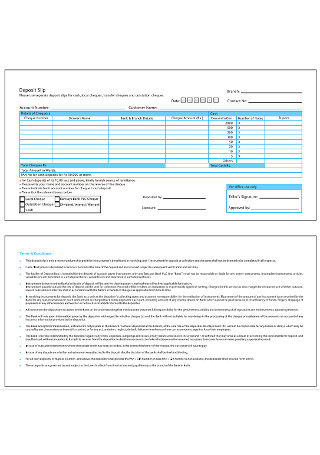

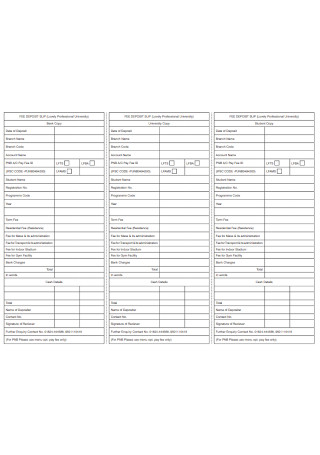

Sample Bank Deposit Slip for Fees Template

download now -

Sample Student Fees Deposit Slip

download now -

Small Financial Bank Deposit Slip Template

download now -

Bank Investment Deposit Slip

download now -

Bank University Deposit Slip Template

download now -

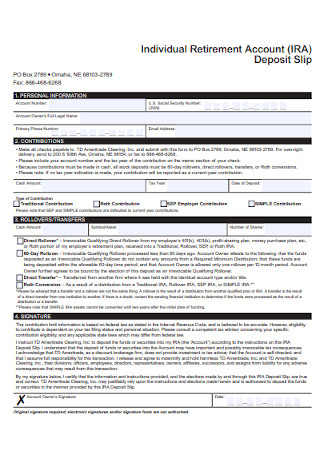

Individual Retirement Account Deposit Slip

download now -

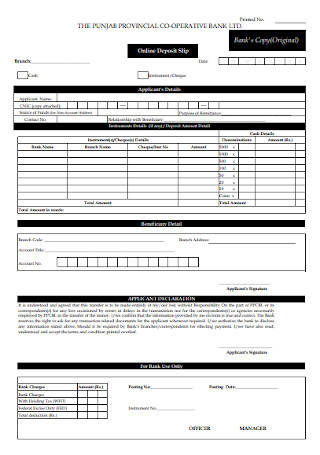

Bank Online Deposit Slip

download now -

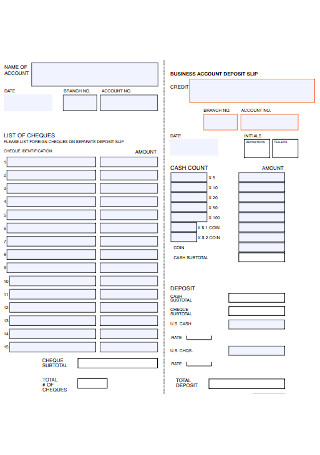

Bank Business Account Deposite Slip Template

download now -

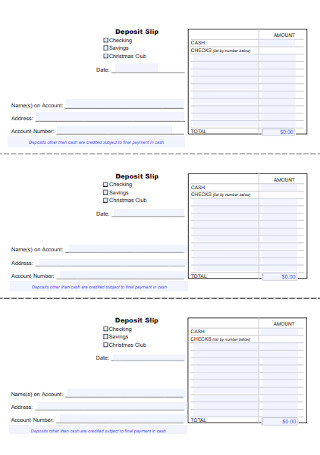

Bank Common Deposit Slip Template

download now -

Bank Saving Deposit Slip Template

download now -

Printable Bank Deposite Slip Template

download now -

Bank Faculty Staff Deposit Slip Template

download now -

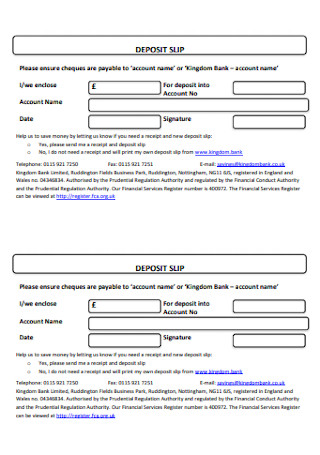

Deposit Slip for Lock Box Template

download now -

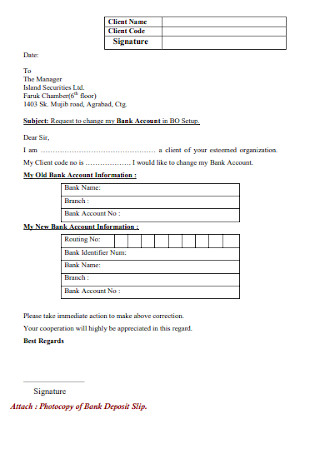

Sample Photocpoy of Bank Deposit Slip

download now

What is a Bank Deposit Slip?

A bank deposit slip is a printed form used to confirm a deposit made into a bank account. It includes information about the depositor, the deposit amount, and the account being credited. You can also see more on Payroll Slip Samples.

When you need to deposit funds into your bank account or someone else’s account, you’ll need to use a bank deposit slip. A deposit slip is a paper that comprises the name and account number of a depositor, the date, and the amount of deposit. Moreover, the slip also indicates whether the deposit is going to be in cash or check form. Before lining up to get assistance from a teller, a customer must first fill out a deposit slip. The slip guides the teller on where exactly he/she should deposit the funds. The bank clerk then processes the deposit slip and gives a receipt to the depositor after carefully checking if the slip and the funds match. You might think that deposit slips are no longer used by banks, but even the Bank of America uses deposit tickets for processing.

The Different Forms of Deposit

In general, the term deposit involves placing something somewhere else for safekeeping. When financial institutions mention deposits, they refer to the money that is in your account, which they are keeping on your behalf. Also, deposits can also be another asset (e.g., jewelry). You can also see more on Permission Slip Samples. With that being said, here are the different forms of deposit.

How to Completely and Correctly Fill Out a Bank Deposit Slip

Filling out a bank deposit slip depends on what you need to do. Note that there is a different section for cash and a different section for checks. The process is simple and easy. You can also see more on Bank Reconciliations. For a successful transaction, follow the basic and standard steps below.

Step 1: Provide Some Basic Information

The first thing you need to do is to write your name and account number on the deposit slip print. Note that if your checkbook has printed deposit slips on the back portion, you don’t have to do this step. Also, don’t forget to write the branch information if necessary. Moreover, if you need to deposit several items, you can utilize the back of the slip. Usually, deposit slips contain extra boxes at the back so you don’t have to keep on entering the same information over again.

Step 2: List the Amount of Deposit

If your money is cash, list the currency of the money that you have in your hands, whether it be bills or coins or both. To make the teller’s job easier, write carefully the amounts in cents or dollars. Typically, a deposit ticket has separate free blank boxes for both entries. The boxes on the right side are intended for coins or cents, while the boxes on the left are for bills or dollars. If you are going to deposit a large amount of money, you must place all the decimals and commas correctly. If you don’t have any cash to deposit, leave the spaces blank. If you have checks, you need to list them one by one. Write the check number and the total amount listed on each one. If you have no checks to deposit, go directly to the subtotal.

Step 3: Sum up the Deposits

To get the subtotal, you just need to sum up the total amount of checks and cash that you need to deposit. Before you compute for the subtotal, review the details you have written in the slip. The amount you have should be the same with the amount you have placed in the slip.

Step 4: Write the Amount of Money You Want to Withdraw

If your plan is to get some cash from the deposit you make, you must write the amount of money you want to withdraw in the slip. This applies to checks, you might need some cash at the moment, and you don’t have time to wait for the minimum period before a check deposit becomes withdrawable. By doing that, you will be able to save some time.

Step 5: Compute for the Total Amount of Deposit

The last thing you need to do is to calculate the total amount of deposit, which is the deposit sum minus the cash you desire to withdraw. Place your signature on the slip. Then line up and give the slip to the bank teller.

Bank deposit slips play a crucial role in maintaining accurate banking transactions. They provide a transparent record of deposits, ensuring the correct amount is credited to the respective account. Familiarity with filling out a deposit slip can help ensure smooth, error-free banking experiences. You can also see more on Sample Check.

FAQs

What are the benefits of using a deposit slip?

Deposit slips do not only offer protection to customers but also to banks. They serve as a collection of accounts that ensures nothing will be overlooked throughout the day. For customers, deposit slips are receipts that prove that a bank has placed the right amount into the right account. If the customer’s account balance remains the same after a deposit, a deposit slip will serve as evidence that the establishment has received the money from the depositor. Note that a deposit slip only displays the total amount deposited. If conflicts arise between the bank and a customer, the customer can ask for a copy of all the necessary documents to confirm the deposit.

What are the three common ways you can make a deposit?

There are three common ways you can deposit your funds: (1) You can deposit your funds by visiting a bank. In this case, you might need to fill out a deposit slip. In some banks, they have ATMs where you can directly fill your account details. (2) If you are using a money order or checks, you can deposit them through the mail. You can ask the bank how you can get the most convenient service, and you can also ask for requirements. Note that it is not advisable to send cash via mail because you might not get it back if it loses track. (3) Employers usually pay their employees through direct deposit, where the money goes directly to the worker’s bank account electronically. The money is then available for withdrawal or spending. Anyone can transfer money electronically as long as he/she has the means to do it.

What does a direct deposit mean?

There are many options you can choose from when receiving or sending payments. These options include utilizing checks, cash, or electronic payment. Electronic payments are also referred to as direct deposits. In other words, a direct deposit is a payment done electronically from one establishment to another.

What is a cheque?

A cheque or check is a paying instrument a customer uses to charge a particular bank to pay for a specific amount of money to a receiver. The entity or individual using the check is called the drawer or payor, and the person who receives it is called the payee. A payee can either deposit or withdraw a check. When a payee decides to get cash from the check, he must negotiate with the bank. Only then will the bank deduct the money from the drawer’s account. You can also see more on Bank Statement.

What is a remittance slip?

A remittance slip is a paper a customer, which can be a financial institution, to a supplier together with the payment. The slip explains where the payment should go so for it to be credited correctly. Several bills that customers send through the mail have remittance slips. The slip usually contains the sender’s name, account number, address, balance, invoice number, and due date.

How does a deposit slip ensure transaction accuracy?

It serves as a written record of the amount deposited, helping the bank verify and match the deposit to the account holder.

What should I do if I make a mistake on the deposit slip?

Correct it using a new slip. Do not alter the existing one, as this can cause confusion or rejection by the bank. You can also see more on Credit Card Forms.