10+ Sample Investment Tracking Spreadsheets

-

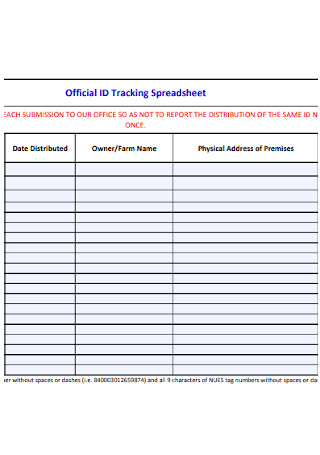

Official Investment Tracking Spreadsheet

download now -

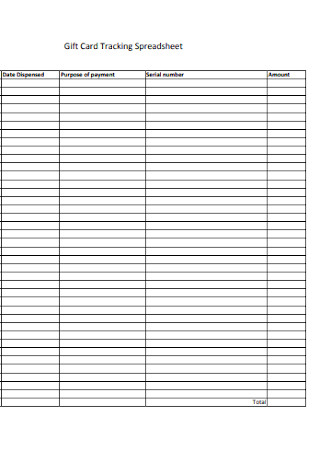

Investment Gift Card Tracking Spreadsheet

download now -

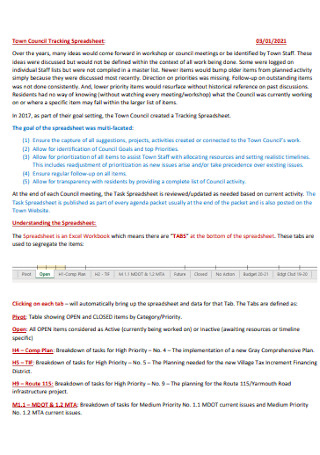

Investment Council Tracking Spreadsheet

download now -

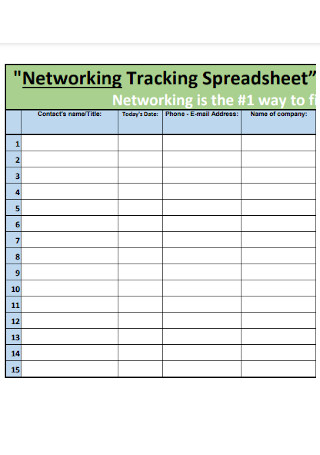

Networking Investment Tracking Spreadsheet

download now -

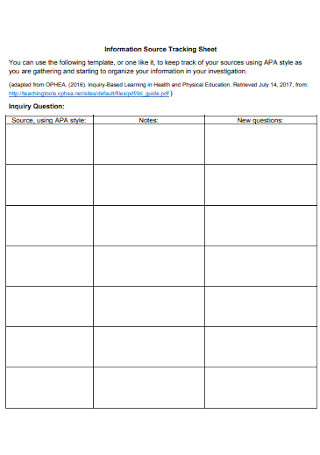

Information Source Tracking Sheet

download now -

Investment Tracking Spreadsheet Format

download now -

Sample Investment Tracking Spreadsheet

download now -

Simple Investment Tracking Spreadsheet

download now -

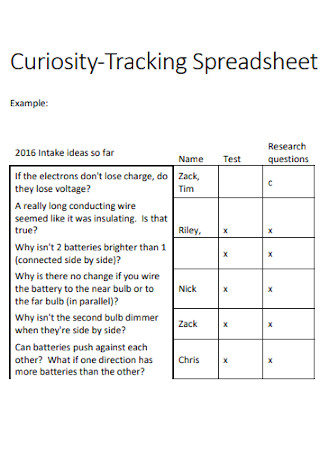

Curiosity-Tracking Spreadsheet

download now -

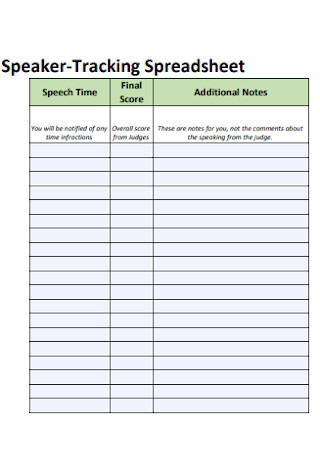

Investment Speaker-Tracking Spreadsheet

download now -

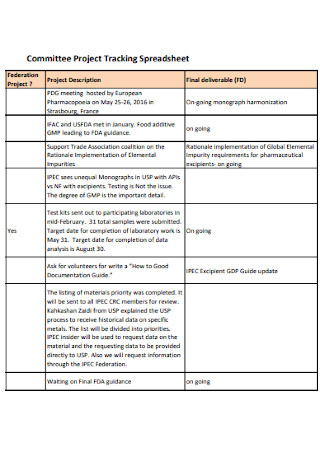

Investment Project Tracking Spreadsheet

download now

What Is an Investment Tracking Spreadsheet?

A spreadsheet for tracking investments is a highly helpful tool for any investor to have. This is a straightforward method for you to keep track of the value of your investments throughout the course of time. Investment trackers make it easy to keep track of your company’s investments, as well as your personal investments, whether you’re in charge of monitoring them or just want to keep track of your own.

A large number of people are interested in making investments in various enterprises and startups. However, making an investment in some firms does not imply that profits will be generated without any work on your part. The feasibility analysis of any venture is only the beginning of the process. As a result, for a variety of reasons, investors must carefully monitor the project’s key performance indicators (KPIs). As a result, the usage of an investment tracking spreadsheet can be quite beneficial to small investors. Other templates are available on our website, and you can use them whenever you need them. They are as follows: asset allocation spreadsheet, cryptocurrency investment tracking, dividends investment tracking, inventory sheet, tracking spreadsheet, financial portfolio, investment portfolio, investment return tracking spreadsheet, property investment tracking, stock investment tracking sheet, project tracking, brokerage tracking account spreadsheet, investment analysis sheet, and other similar template are available. This post will not only provide you with templates but will also provide you with important information that you need to know in order to complete your template.

What Is the Importance of Investment Tracking Spreadsheet?

The above sections provide a good deal of information about the subject. Now, let’s take a look at the importance of the tracking process to investors in general. It is the projected return on investment, payback, cost-benefit analysis, and risk profit analysis that determine an investor’s willingness to invest in a certain company. It is therefore not sufficient to just do a feasibility study prior to making an investment. Proper follow-up and communication channels are essential for the achievement of anticipated investment benefits. Consequently, the project team and investors should place an emphasis on involving and communicating with stakeholders throughout the project’s lifespan. Both the project team and the investors will profit from a well-executed stakeholder engagement strategy. As a result of the timely dissemination of accurate information, investors will be able to disburse funds sooner rather than later without wasting time on updates and investigations. Also in this vein, an updated business phase will be communicated to an investor, who may then assess the feasibility of expected benefits in their current state. Consider looking at the spreadsheet for the candidate tracking system (CTS).

How to Track the Investment using Spreadsheet?

You can track your investments using a variety of tools such as spreadsheets and online platforms such as Mint.com, Morningstar.com, Microsoft Excel with SharePoint 2010, QuickBooks 2010, and Quicken 2010. When it comes to tracking investments, the use of an excel tracking spreadsheet is straightforward and requires no special technical knowledge. Various functions such as total invested amount, profit/loss, percent profit/loss, status date, total invested amount, gain, and variation are tracked in this process. You may also be interested in a monthly budget excel spreadsheet template. Almost all of the parameters have been combined using formulas. As a result, investors only need to enter the value of their investment and the total amount of their investment. All of the other results are calculated automatically through the use of Excel predefined formulae. This makes tracking investments extremely straightforward, time-saving, and economical, and it eliminates the need to hire expert staff to do so on a regular basis. Create some sort of investment tracker if you want to gain control over your money and keep track of what you’re doing. If you prefer to work with spreadsheets, the following are the best methods for keeping track of your investments:

1. Microsoft Excel is a spreadsheet program.

This software can be used to keep track of the cost basis of taxes on your individual lots as well as to calculate or map out your dividend distribution plan. The downside is that this isn’t very effective when you’re trying to import stock quotes in real-time.

2. Google Spreadsheets is a spreadsheet program developed by Google.

This is useful if you want the information in your spreadsheet to automatically update with information from public finance sources when you make changes. Despite the fact that it is not as powerful as Microsoft Excel, you may access it from any computer as long as you are logged into your Google account.

Why Do You need Investment Tracking Documents?

One of the most adaptable and straightforward ways to understand, track, and report on the overall success of your investments is through the use of an investment tracking spreadsheet. Anyone can now become an investor in today’s world. However, there are a plethora of opportunities and places to put your money. If you have a large number of investments, it is critical that you keep track of everything. The following are the primary reasons why you should use an investment or stock portfolio tracker in Microsoft Excel:

1. In order to keep all of your investment information in one convenient location,

If you have a large number of various investments, it is only logical to keep an investment tracking spreadsheet in place. In any other case, you would have to check every one of your investments individually, which would be extremely time-consuming. It enables you to obtain a comprehensive picture of your financial health in terms of your investments by employing it.

2. In order to evaluate the overall performance of your investments in comparison to industry standards

Using benchmarks to evaluate the performance of your investments is a good approach to ensure that your investments are performing as expected. If the benchmark you employ improves for a number of months or even years while your investments remain the same or decline, you may need to rethink your investment tactics, according to the SEC. There are several different sorts of benchmarks available for use in your investment tracker, depending on the types of investments you have in your tracker. These benchmarks establish an index that is based on a variety of different pieces of information regarding the stock mix contained within it. Consequently, they are comprehensive representations of the industry in which they specialize. Keep in mind that no matter how well your investments do, you must constantly retain a positive attitude. Keep in mind that the market will always fluctuate between high and low. As a result, keeping track of your investments on a regular basis using a spreadsheet will make things easier for you in the long term.

3. In the process of developing your investment strategy, it is much simpler to examine the allocation of your assets.

Asset allocation is the process of dividing your assets and putting them into different types of investments. The type of asset allocation you choose would be mostly determined by the reason for which you are investing. This goal also aids in determining the aggressiveness of the asset allocation you’re aiming for in your portfolio. Make use of the facts contained in your investment Excel template to plan your investment strategy for the future. Utilize the information contained in the spreadsheet after defining your asset allocation target in order to compare your planned asset allocation with your actual or existing asset allocation. This allows you to make more educated decisions about your assets as a result of this.

Benefits of Investment Tracking Spreadsheet

An investment tracking spreadsheet can be beneficial to a variety of different types of investors. This is a straightforward, but extremely effective, technique. Make use of the stock portfolio tracker Excel to keep track of how well your investments are doing in relation to your financial objectives. This provides you with a clear understanding of the money you hold, where your money has been placed, and the performance of your investments. Creating an investment Excel template gives you the ability to have a centralized spot to keep all of your critical financial data in one convenient location. The following are some of the additional advantages of using an investment tracking spreadsheet:

How to Write an Investment Tracking Spreadsheet

1. Getting Some Data

Before we can accomplish anything with Excel, we must first get some data. The information you enter into Excel is referred to as “Data.” Some of it will need to be written down, while others may be copied and pasted, and still, others can be downloaded as an excel file directly.

2. Changing the Order of the Data

First and foremost, this data is presented in the inverse order of our portfolio values. We want to arrange this table by date, starting with the oldest and working our way up to the most recent. Select “Data” from the top-level menu, and then select “Sort.” You now have the option of selecting what we want to sort by and how we want to sort it. If you pick “Date” from the drop-down option under “Sort By,” Excel displays a list of all the column headers that it has detected. You should now have your data organized in the same manner as your portfolio values from earlier.

3. Graphing

Having collected some data, let’s put it to use by creating some graphs. How to create line graphs of your daily portfolio value and percentage change, as well as a bar chart showing your open positions, will be covered in this lesson. In most cases, this is the most enjoyable aspect of using Excel to keep track of your stock portfolio.

4. Calculations

We’ll need to do some math now to figure things out. To calculate the percentage change each day, we want to make the difference between the most recent day’s value and the value from the day before, and divide that result by the value from the day before: To calculate the percentage change each day, we want to make the difference between the most recent day’s value and the value from the day before.

The most significant reason you would want to utilize Excel to maintain your stock portfolio is to be able to compute your profit and loss from each trade as accurately as possible. In order to do so, open the spreadsheet that contains your transaction history.

FAQs

What Is the Best Way to Track an Investment?

This investment tracker template is the result of my spreadsheet’s evolution into something more formal. You may find out more about it in the section below. Using this template, you can keep track of your investment accounts in a more straightforward manner. Everything boils down to tracking only what you have invested and the current value of that investment, which is all there is to it.

Which Is the Best Spreadsheet to Rebalance Your Investments?

As you’ll see in the following section, the spreadsheet assists me in rebalancing my investments. Personal Capital is a wonderful tool for keeping track of investment fees, asset allocation, and even my monthly spending budget. It is, without a doubt, my favorite financial tool, and it is completely free.

What Can a Spreadsheet be Used to Track?

A number of online platforms, tools, and spreadsheets have been launched, each with a unique target market in mind. Investments in stocks, mutual funds, bonds, real estate, cash, and certificates of deposit can all be managed with the use of these tools, which are available for free online.

The use of an Excel spreadsheet to create an investment tracker has been increasingly popular in recent years. Additionally, it is a simple, adaptable, and inexpensive method of administering investments. The most important components of the investment tracking spreadsheet have already been discussed in detail in the preceding section. As a result, the tabular spreadsheet contains all of the information that can be utilized to keep track of the investments in an efficient manner. It is necessary to establish a table with the titles “date,” “amount invested,” “overall value,” and so on. There are only three columns that need to be filled out in order to enter the information. The date of the investment, the amount of money invested, and the overall value of the investment are all recorded.