40+ Sample Account Statements

-

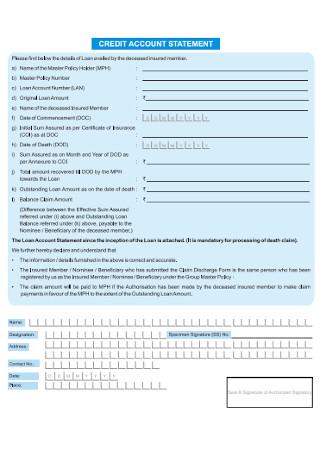

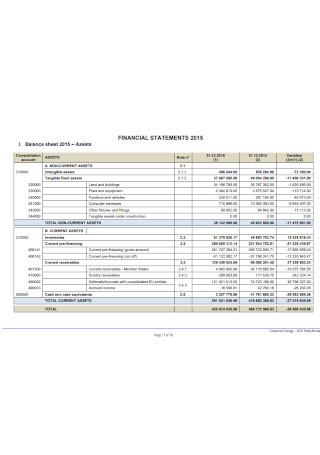

Credit Account Statement

download now -

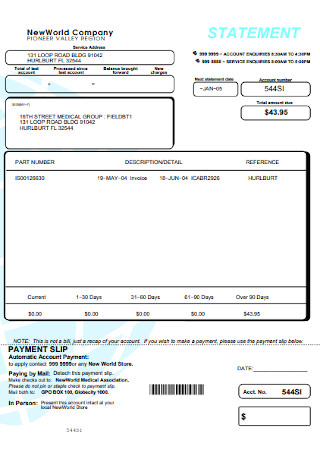

Sample Account Satement Template

download now -

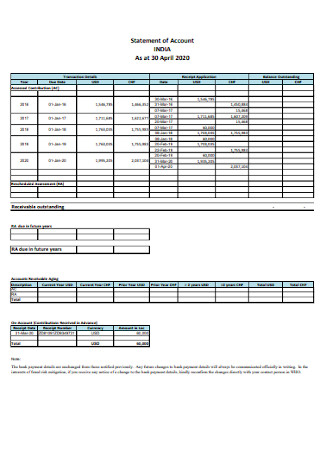

Company Account Statement

download now -

Health Organization Account Statement

download now -

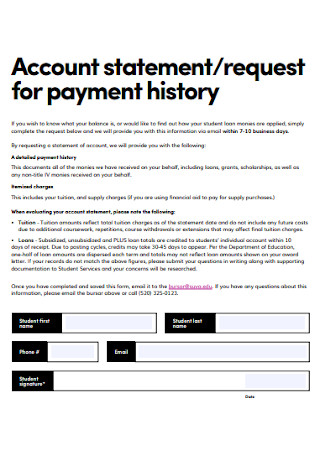

Account Statement Registration Form

download now -

Account Statement Format

download now -

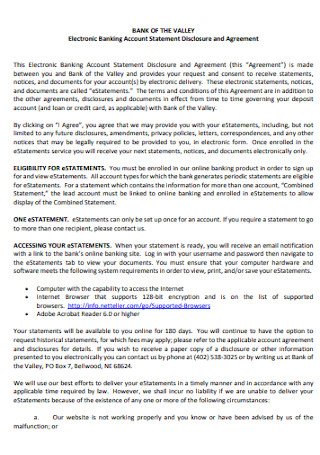

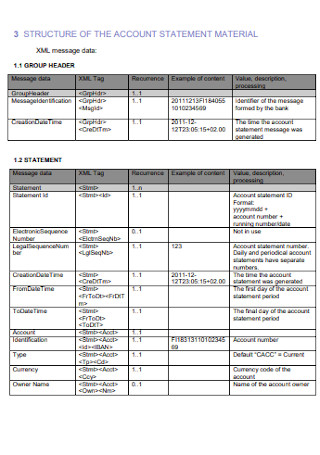

Electronic Banking Account Statement

download now -

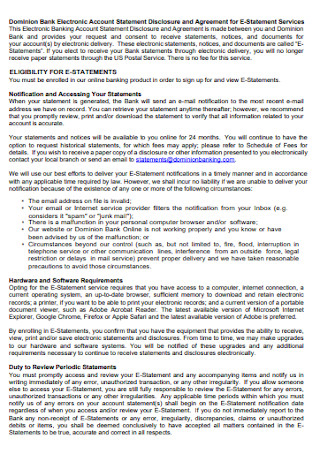

Bank Electronic Account Statement

download now -

Water Account Statement

download now -

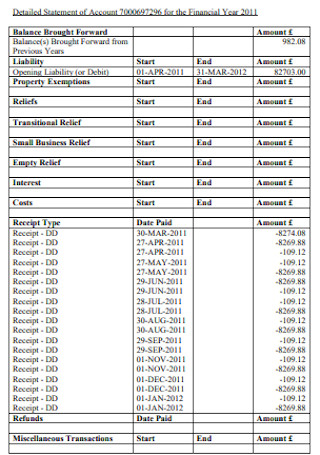

Statement of Financial Year Account

download now -

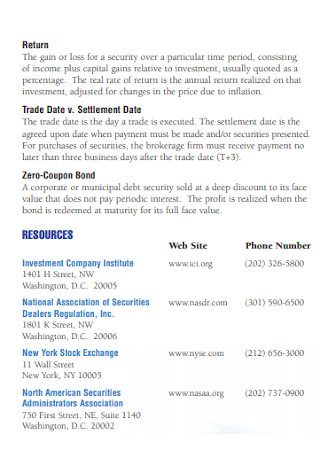

Brokarage Account Statement

download now -

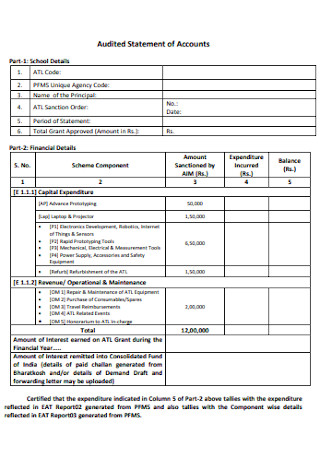

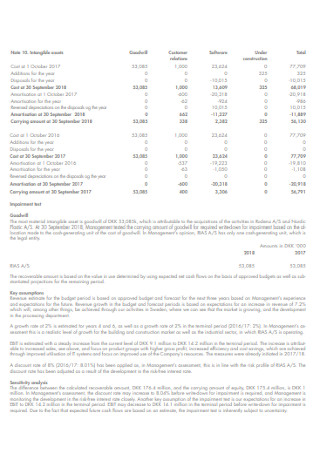

Audited Statement of Accounts

download now -

Account Statement Example

download now -

Customer Account Statement Template

download now -

Daily Account Statement

download now -

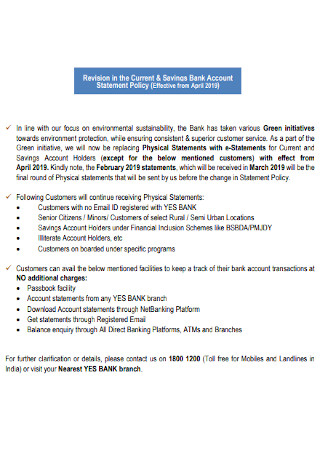

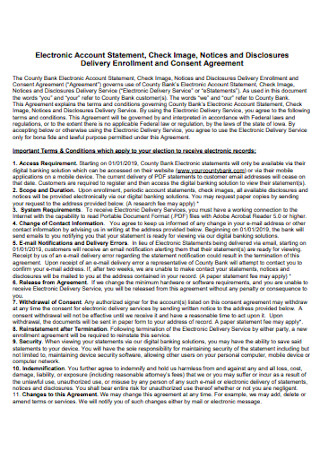

Electronic Delivery of Account Statements

download now -

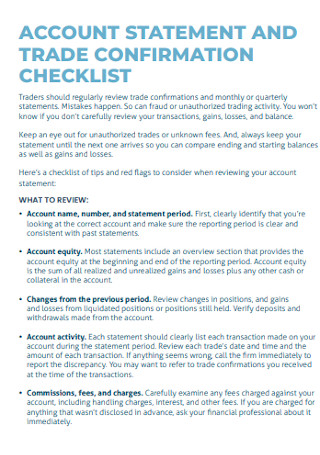

Account Statenment Checklist

download now -

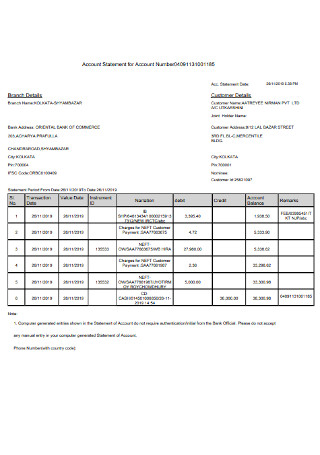

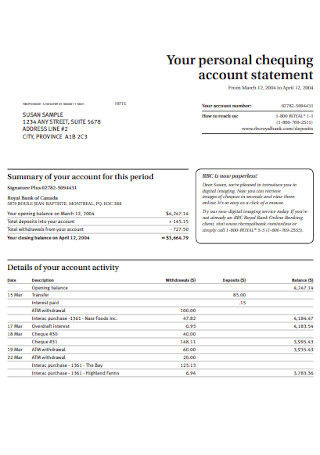

Bank Account Statement Template

download now -

Annual Financial Account Statement

download now -

Basic Account Statement Template

download now -

Personal Account Statement

download now -

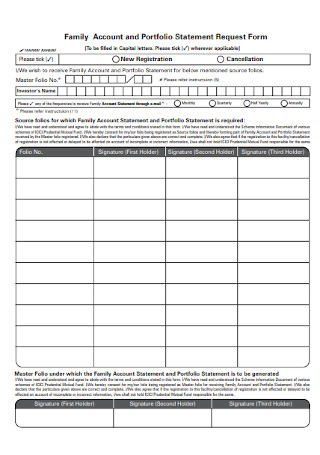

Family Account Statement Form

download now -

Account Statement Registration Form Template

download now -

Formal Account Statement Template

download now -

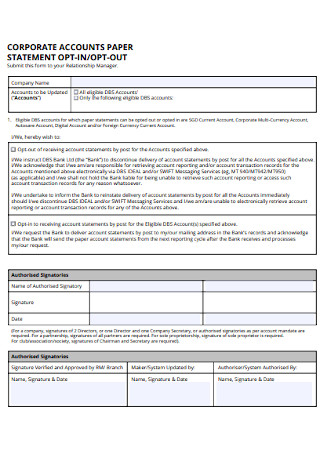

Corporate Account Paper Statement

download now -

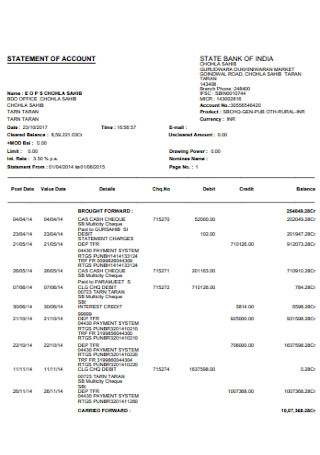

Savings Bank Account Statement

download now -

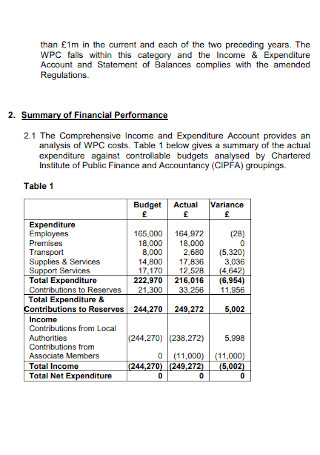

Account and Statement of Balances Template

download now -

Sample New Account Statement

download now -

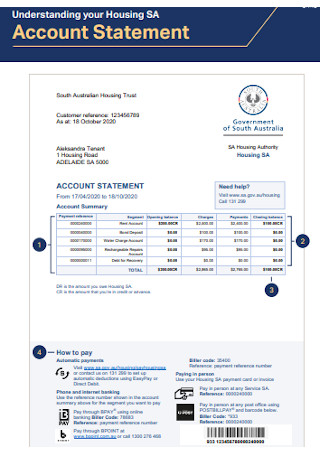

Housing Account Statement

download now -

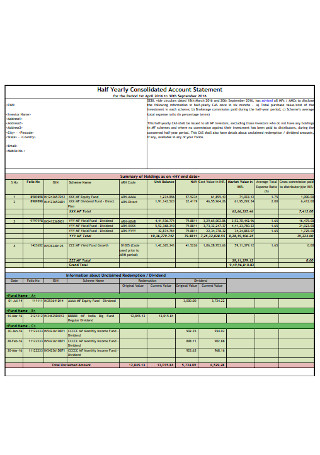

Half Yearly Consolidated Account Statement

download now -

Financial Account Statement Template

download now -

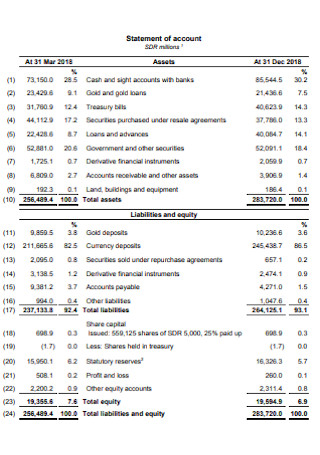

International Account Statement

download now -

Current Account Statement Template

download now -

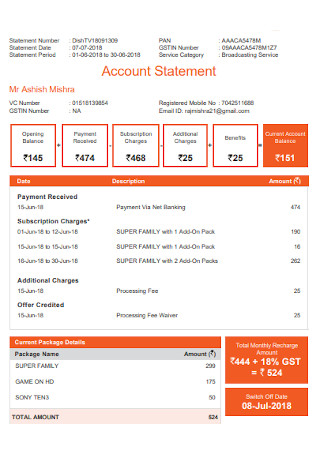

Account Payment Statement

download now -

Annual Financial Account Statement Example

download now -

Printable Account Statement Template

download now -

Banking Account Statement Template

download now -

Electronic Account Statement Example

download now -

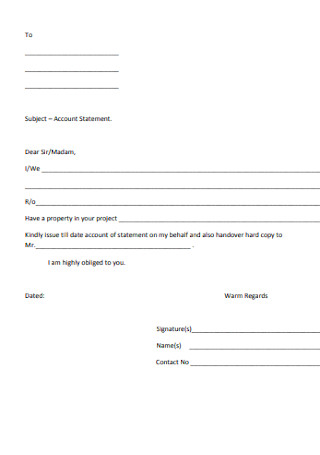

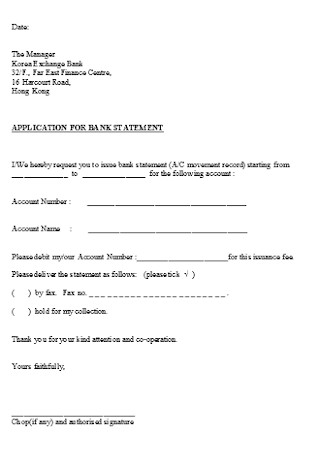

Back Account Statement Application Template

download now -

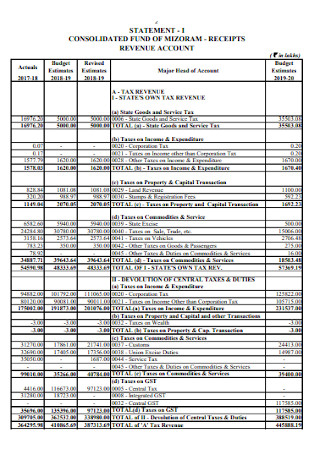

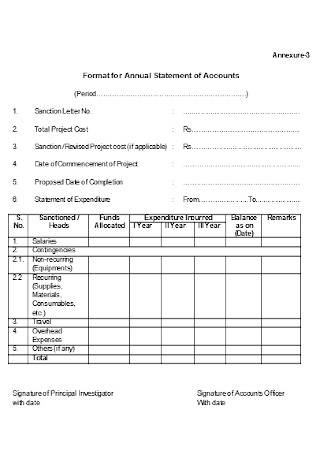

Annual Statement of Accounts Format

download now -

Trust Account Statement Template

download now

FREE Account Statement s to Download

40+ Sample Account Statements

What Is an Account Statement?

Components of an Account Statement

How To Generate an Account Statement

FAQs

How do you get an account statement?

Who is responsible for issuing an account statement?

What makes an account statement significant for vendors and clients?

What Is an Account Statement?

Account statements cover nearly every single account’s official summary, regardless of where the account originates. Account statements summarize paid-in cash amounts, for example, provided by insurance companies. Statements stem from almost any account classification representing ongoing transactions in which the process of exchanging funds regularly happens. It includes PayPal accounts, Apple Pay and Google Play services, credit card accounts, brokerage accounts, and savings accounts. Utility companies, telephone, and subscription service providers, usually produce account statements for their customers detailing their usage and any overage fees during the payment cycle. Debits paid, incoming funds or credits received by the account holder, and other fees associated with the account are typically available on account statements. It also exhibits customer billings and payments, resulting in an ending balance that can be positive or negative. Companies send an account statement to a customer to notify them of unpaid credits for rendered services. A customer receives a printed document of the account statement at their mailing address or the customer’s email address. Customers can also access the service provider’s portal and download a period account statement.

According to the Consumer Expenditure Survey from the United States Bureau of Labor Statistics, an average household’s income amounts to $84,532 while spending $70,258 annually. About $5,854 goes to paying bills, utilities, and other expenses, with housing and transportation costs covering almost half of the expenses.

Components of an Account Statement

An account statement details the financial information of an individual or entity, providing an accurate overview of a customer’s financial situation and transaction history during a billing period. Unlike sales invoices, account statements do not strictly follow a format. However, when constructing an account statement, the document must consist of sufficient information to supply a comprehensive record. The section below details the different components of an account statement that individuals can find in their copies.

How To Generate an Account Statement

Different organizations create account statements that suit their business needs and requirements. Account statements come from account cycles, and companies have different accounting cycles depending on the account they are operating and preparing. When an institution generates an account statement for its clients and customers, they follow the accounting cycle for accurate and up-to-date information.

1. Examine and Document All Transactions

Gather all transactions for the current accounting period, including purchase receipts, invoices, and other transactions. These records serve as bare financial information that the company or organization enters into its accounting system to become valuable and useful data. When recording these transactions, take note of the date, amount, and location of each one. An institution must also study and analyze the purpose of the transactions for specificity in the following steps of the accounting cycle.

2. Incorporate Transactions In a Ledger

Add all the transaction information into a general ledger. The ledger is a numbered list containing all of an entity’s transactions, detailing the individual accounts that they transact with for a specific period. The general ledger serves as a master document or record for bookkeeping purposes, especially when tracking financial transactions. Institutions construct their ledgers in chronological order to avoid double-entry accounting or bookkeeping to have an accurate record of business transactions.

3. Generate a Header for the Account Statement

When creating the header for the account statement, make sure to indicate the details about a customer and the organization, including their names and addresses. The vendor details must include the business name, address, and contact information, like their phone numbers and email addresses. After completing the vendor information, add the customer’s details either below or next to the vendor information. The customer details must include the customer’s name, address, customer number or account number, and contact information. After all the information, the vendor or organization must establish the date range the statement covers, either monthly, quarterly, or yearly.

4. Insert a Brief Account Summary

A brief outline of the account comes after the header of the account statement, containing the opening balance, the invoiced amount, the amount paid, and the balance due. The opening balance reflects cash due from the previous account period or cycle and could be zero if the customer does not owe the company anything. The invoice amount represents the total invoiced amount that the company invoiced the client, containing their spending, while the amount paid is the total amount of payments the customer accomplishes. Finally, the balance due shows the total unpaid balance from both the opening balance and the current accounting cycle. When writing the account summary, remember that this is optional, as there is an itemized table containing more detailed information about the account.

5. Add the Itemized Table of Transactions

After the summary, insert the itemized table containing all financial transactions with a specific timeline or timeframe. The table must contain the necessary information for every transaction that a customer makes with the company, including the transaction date, reference number or invoice number, type of transaction (sale, payment, refund), invoiced amount, the amount paid after billing or invoicing, and the amount due for unpaid bills and invoices. Once the transactions table is complete, insert two lines for the total outstanding amount and the interest charges. Finally, sum up the amounts and insert another line below for the client’s total amount due.

6. Incorporate a Section for Further Details and Comments

The very last section to remember when generating the account statement consists of additional information for the client or customer, including different payment methods. As much as possible, an organization must offer as many payment options to prevent any transfer or payment delays for customers and the business. Aside from payment methods, the section also indicates any late payment fees and other additional comments and information, like a thank you note or a payment reminder.

FAQs

How do you get an account statement?

Vendors send out account statements to their customers and clients at the end of a payment or accounting cycle; similar to bank account statements wherein banking institutions send or deliver their customer’s statements through their email accounts, banking application, or express mail delivery service.

Who is responsible for issuing an account statement?

A vendor or an institution offering goods and services to its clients and customers is responsible for issuing an account statement or statement of account containing all financial transactions between the two parties within a specific pay period, typically every month.

What makes an account statement significant for vendors and clients?

Account statements enable organizations to provide their customers with a list of products and services to help business owners confirm the customer’s made and unpaid payments for a specific statement period. It also helps businesses to check for any inconsistencies in their records, ensuring that their clients pay their dues on time.

Account statements are valuable financial documents for many industries and organizations, especially when directly offering goods and services to clients and consumers. The account statement helps organizations with their accounting and bookkeeping to ensure that their clients and customers clear payments for a specific pay period. When developing the account statement, guarantee that all the necessary information is present, especially the itemized table showcasing all the transactions from the vendor and customer. Familiarize yourself with the components of an account statement and the process of creating the statement to guarantee vital information is made available to clients. Browse through our selection of account statement samples above and download a template for your business today!