16+ Sample Bank Reconciliation Statements

-

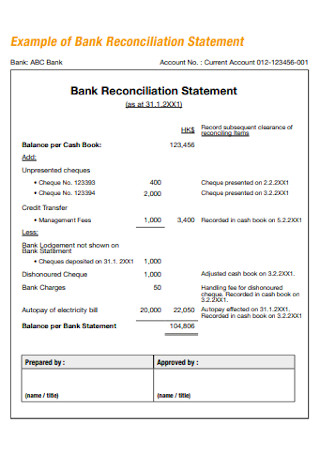

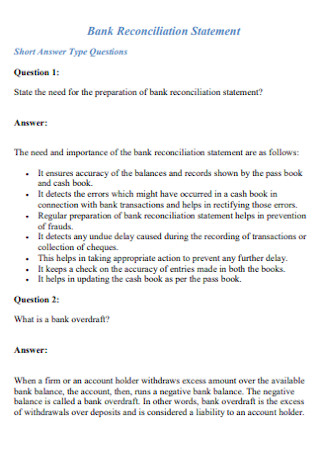

Bank Reconciliation Statement Example

download now -

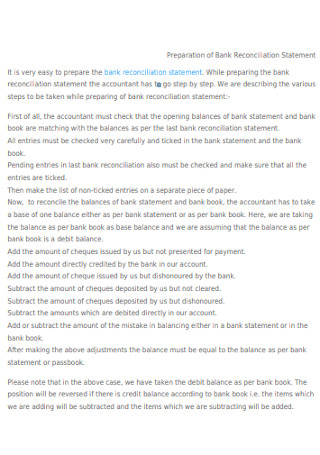

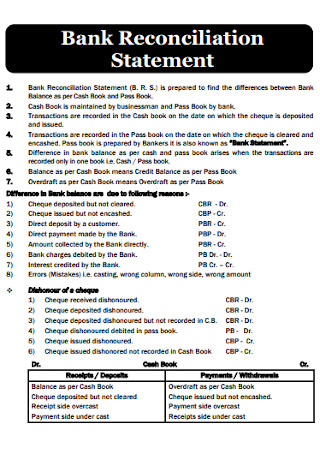

Preparation of Bank Reconciliation Statement

download now -

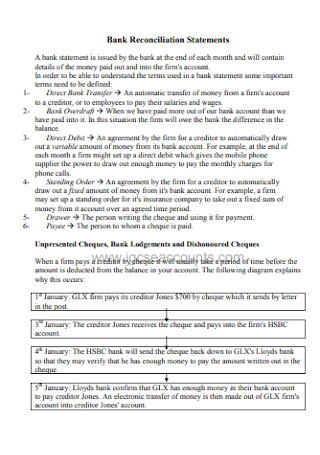

Bank Book Reconciliation Statement

download now -

Bank Reconciliation Statement Format

download now -

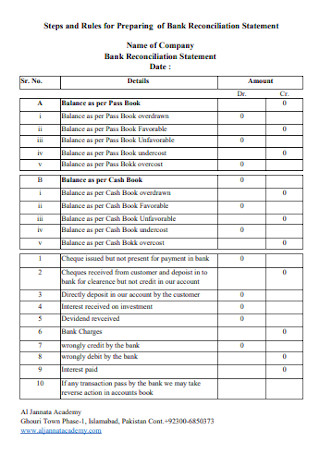

Preparing of Bank Reconciliation Statement

download now -

Basic Bank Reconciliation Statement

download now -

Bank Reconciliation Statement Template

download now -

Standard Bank Reconciliation Statement

download now -

Automated Bank Reconciliation Statement

download now -

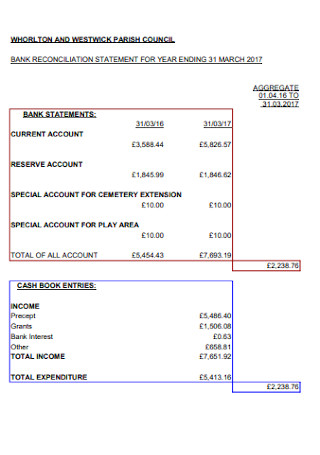

Bank Reconciliation Statement for Year

download now -

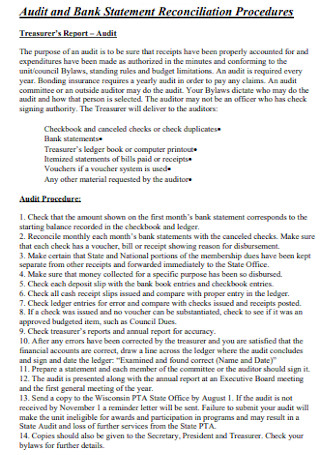

Audit and Bank Statement Reconciliation Template

download now -

Bank Debit Balance Reconciliation Statement

download now -

Formal Bank Reconciliation Statement Template

download now -

Bank Reconciliation Statement of Drawing

download now -

Bank Accounting Reconciliation Statement

download now -

Bank Cash Book Reconciliation Statement

download now -

Bank Pass Book Reconciliation Statement

download now -

Printable Bank Reconciliation Statement

download now

FREE Bank Reconciliation Statement s to Download

Bank Reconciliation Statement Format

16+ Sample Bank Reconciliation Statements

What is a Bank Reconciliation Statement?

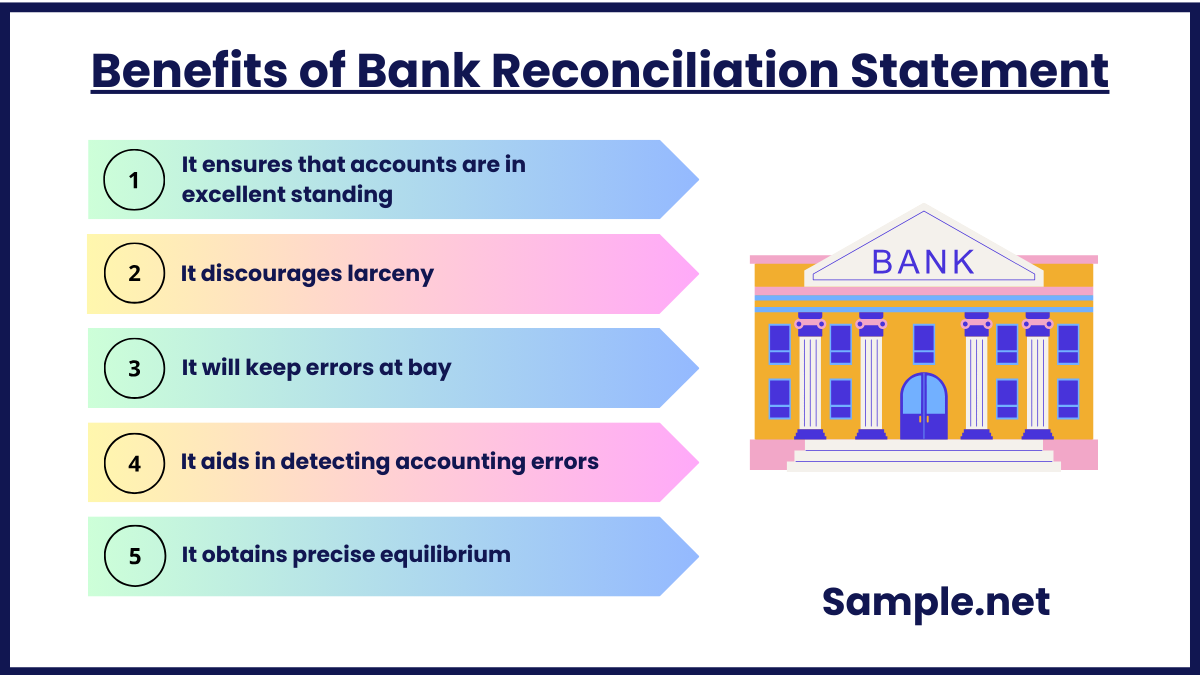

Benefits of Bank Reconciliation Statement

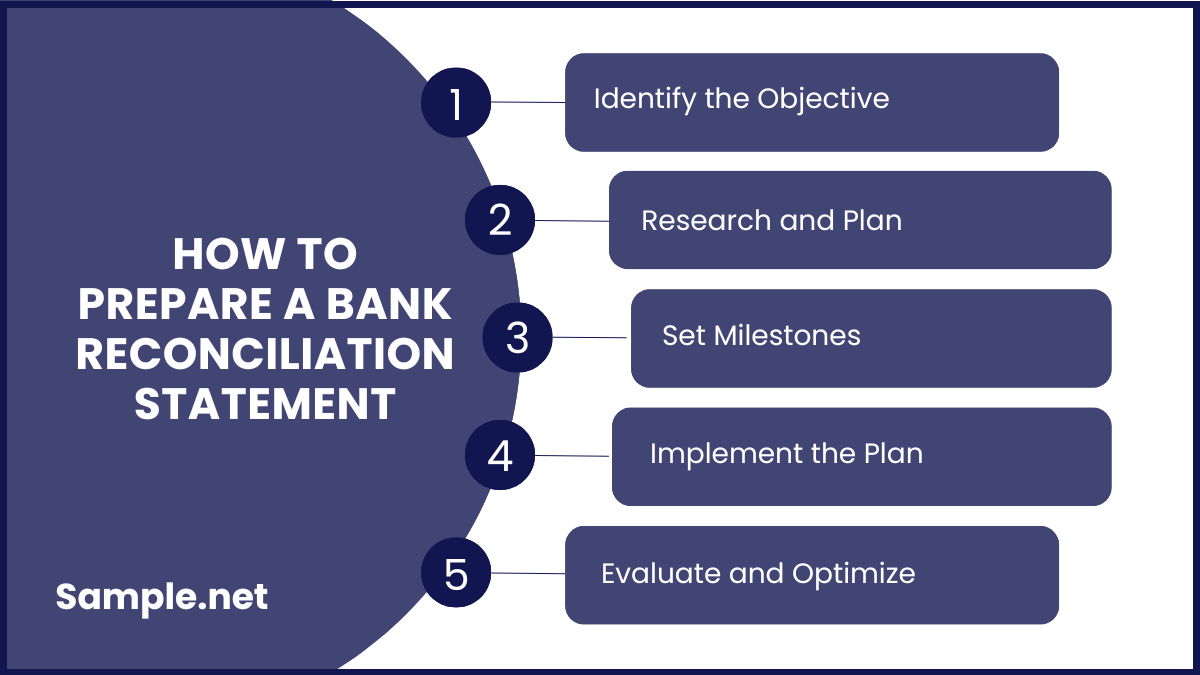

How to Prepare a Bank Reconciliation Statement

FAQs

What is the importance of bank reconciliation in financial reporting?

What are the duties of a reconciliation?

What is cash reconciliation?

How often should a Bank Reconciliation Statement be prepared?

How does a Bank Reconciliation Statement affect financial reporting?

Bank Reconciliation Statement Format

1. Heading

- Bank Reconciliation Statement for: [Company Name]

- As of: [Date]

2. Opening Balance

- Bank Balance as per Books: [Amount]

(This is the closing balance from your company’s accounting records or general ledger.) - Bank Balance as per Bank Statement: [Amount]

(This is the closing balance from the bank statement received from your bank.)

3. Additions to Books

- Deposits not recorded in the books: [Amount]

- Details: (Add any deposits made by the company that haven’t been recorded yet in the books.)

- Interest earned (credit entries by bank): [Amount]

- Details: (Interest or credits by the bank not recorded in the company’s books.)

4. Subtractions from Books

- Bank charges not recorded in books: [Amount]

- Details: (Bank fees, penalties, etc., which the company has not yet recorded.)

- Checks issued but not yet cleared: [Amount]

- Details: (Outstanding checks issued by the company but not yet cleared by the bank.)

- Payment errors or corrections: [Amount]

- Details: (Any payment errors that have not been adjusted in your books.)

5. Additions to Bank Statement

- Deposits in transit: [Amount]

- Details: (Deposits made by the company that the bank has not yet processed.)

- Other credits by bank: [Amount]

- Details: (Bank credits like refunds or other adjustments not reflected in the company’s records.)

6. Subtractions from Bank Statement

- Outstanding checks: [Amount]

- Details: (Checks that have been written but have not yet been processed by the bank.)

- Automatic payments/collections not recorded: [Amount]

- Details: (Payments like direct debits or collections by the bank that the company has not yet recorded.)

7. Adjustments

- Adjustments to Bank: [Amount]

(Correcting errors or any discrepancies that were found between your books and the bank statement.) - Adjustments to Books: [Amount]

(Corrections needed to align your books with the bank statement.)

8. Final Balance

- Adjusted Balance as per Books: [Amount] (This is the updated balance after all additions and subtractions to the books have been made.)

- Adjusted Balance as per Bank Statement: [Amount] (This is the updated balance after all additions and subtractions to the bank statement have been made.)

9. Conclusion

- Bank reconciliation is complete when the adjusted balance per books equals the adjusted balance per the bank statement.

What is a Bank Reconciliation Statement?

A corporation or individual will compile a bank reconciliation statement, a summary of banking and business activity, to compare the balance in their cash records to the balance in their bank statements. This assertion explains the causes of any differences between the two. Throughout its financial periods, a business may prepare a bank reconciliation statement whenever it sees fit. The report lists all transactions involving a bank account for a given time, including deposits, withdrawals, and other activities. A bank reconciliation statement is a practical financial internal control instrument to fight fraud.

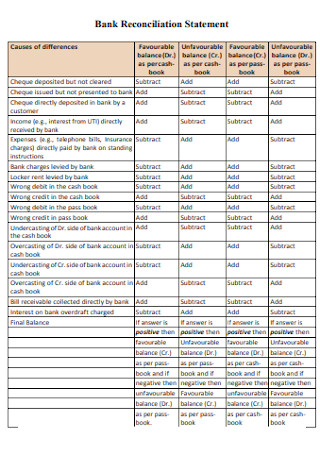

Benefits of Bank Reconciliation Statement

In bank reconciliation, the bank statement balance and the book bank account balance in the client’s books of accounts are reconciled, resulting in a tally of the two credits, where the adjusted bank balance should equal the adjusted book bank balance. It involves a structured process of preparation in which forms containing pre-printed items should omit omission errors and can be found on the back of physical copies of your monthly bank statement, simplifying the entire process. The following are the pros of bank reconciliation:

How to Prepare a Bank Reconciliation Statement

Step 1: Identify the Objective

Start by clearly defining your goal. Understand what you want to achieve, and make sure it’s specific and measurable. For instance, if your goal is to increase website traffic, outline a target number of visitors. You can also see more on Statement Sheet.

Step 2: Research and Plan

Conduct research to gather relevant information that will help you achieve your goal. This can include market trends, competitor analysis, and customer insights. Plan a strategy based on this information, breaking it down into actionable tasks.

Step 3: Set Milestones

Divide the journey into smaller, achievable milestones. Each milestone represents a key accomplishment that leads you closer to your ultimate goal. This helps keep track of progress and stay motivated. You can also see more on Income and Expense Statements.

Step 4: Implement the Plan

Put your plan into action. Begin executing the tasks outlined in your strategy. Monitor your progress regularly, and make adjustments as needed based on results or new information.

Step 5: Evaluate and Optimize

Once the plan has been implemented, evaluate the outcomes. Analyze the data to see if the goal was met. Identify areas for improvement and optimize the plan for better results in the future. You can also see more on Bank Deposit Slip.

FAQs

What is the importance of bank reconciliation in financial reporting?

Bank reconciliation is crucial for gaining detailed visibility into cash availability, accurate reporting, fraud detection, a quicker financial close, and streamlined audit proposals. Regular bank reconciliations can assist businesses in identifying any discrepancies in their bank statements and taking immediate corrective action. Financial reporting aims to monitor, analyze, and report your company’s income. This enables you and any investors to make informed business management decisions. These reports analyze resource utilization and cash flow statements to evaluate an institution’s financial condition.

What are the duties of a reconciliation?

Ensures accuracy of financial balance sheet accounts and bank reconciliations; verifies legal and statutory compliance of deductions and reports on controls and processes; and Identifies and describes areas where systemic problems and inefficiencies exist.

What is cash reconciliation?

Cash reconciliation in accounting is aligning journal entries to bank statements. The primary objective of cash reconciliation is to ensure that your business’s documented balance and your bank statement’s recorded balance are identical. You can also see more on Self Declaration Statement.

How often should a Bank Reconciliation Statement be prepared?

It is best practice to prepare a BRS on a monthly basis or as frequently as needed to ensure the company’s cash balance is accurate and up-to-date.

How does a Bank Reconciliation Statement affect financial reporting?

Bank reconciliation ensures that the cash balance reported in financial statements is accurate, providing a true reflection of the company’s liquidity and helping prevent errors in financial reporting.