Billing Statement Samples

-

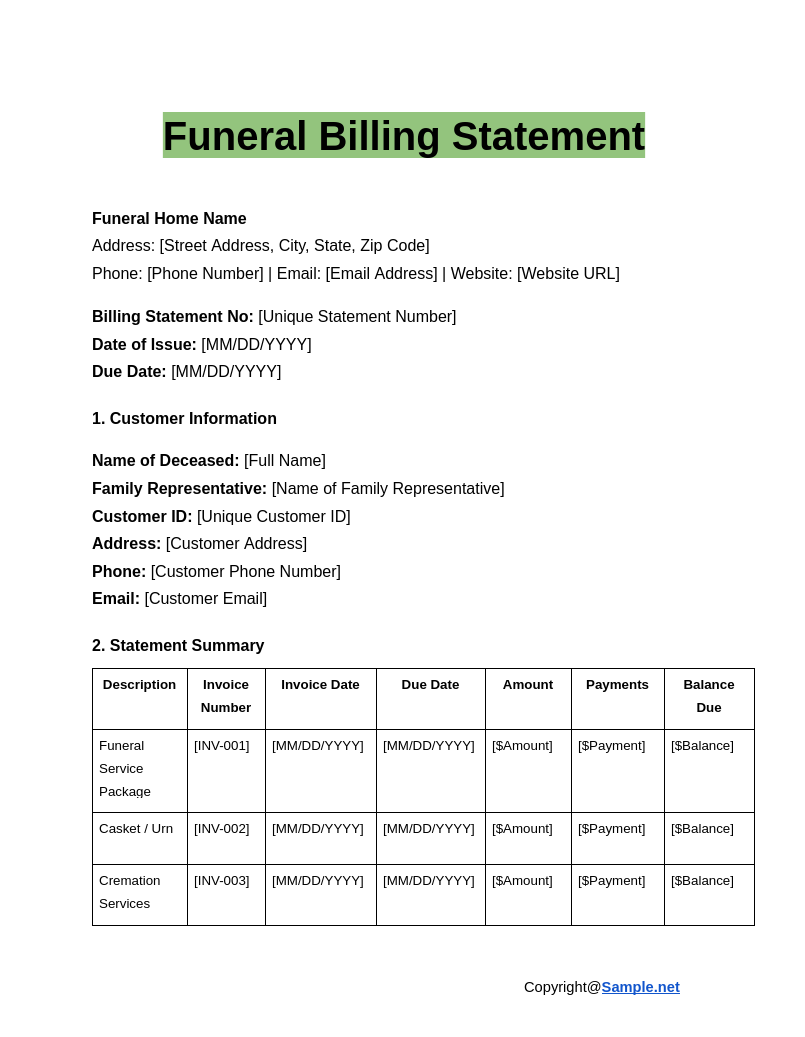

Funeral Billing Statement

download now -

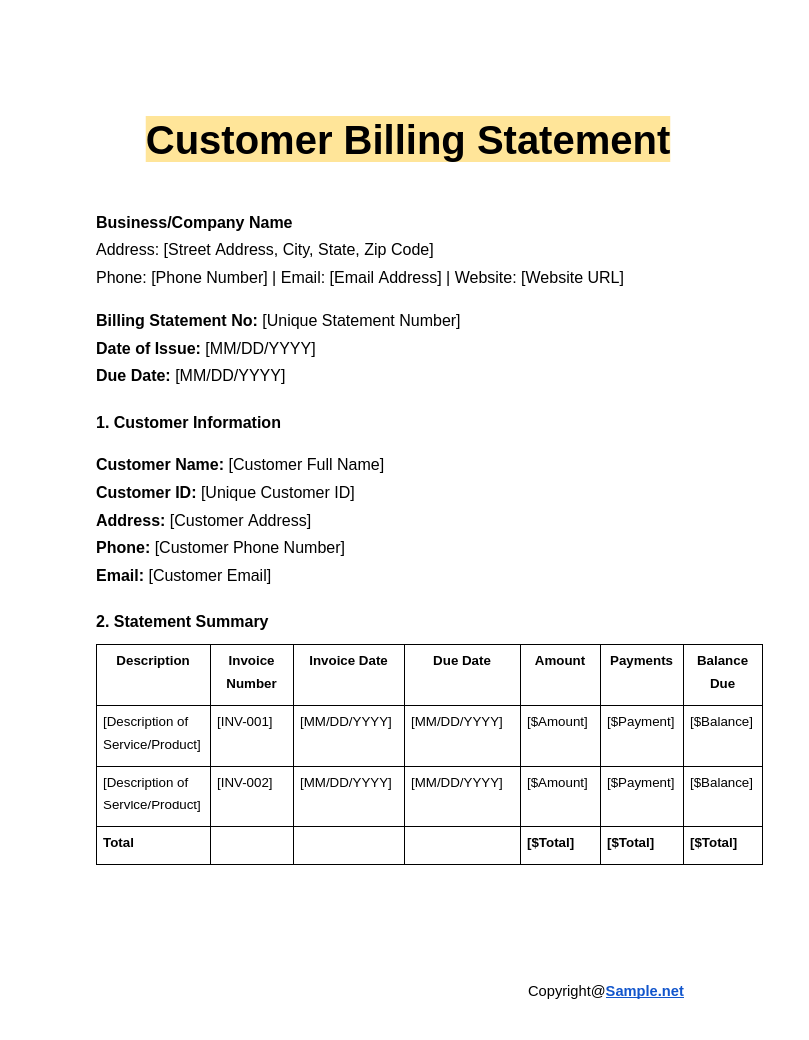

Customer Billing Statement

download now -

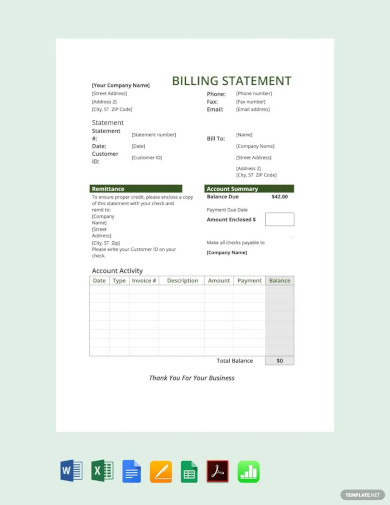

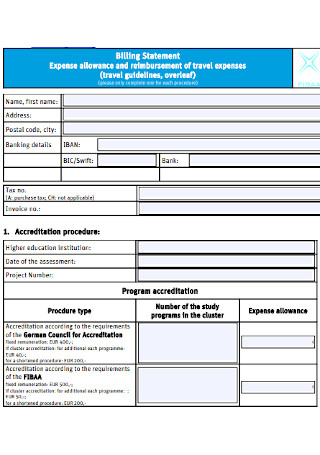

Billing Statement

download now -

Billing Statement Letter Template

download now -

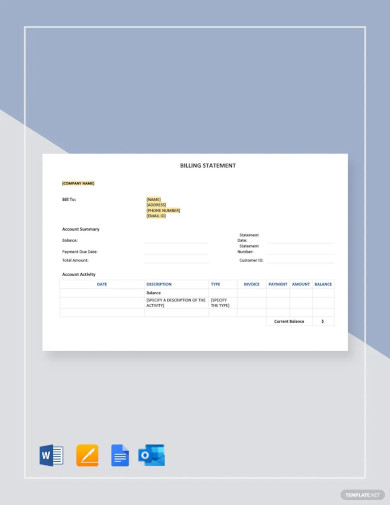

Billing Statement Template

download now -

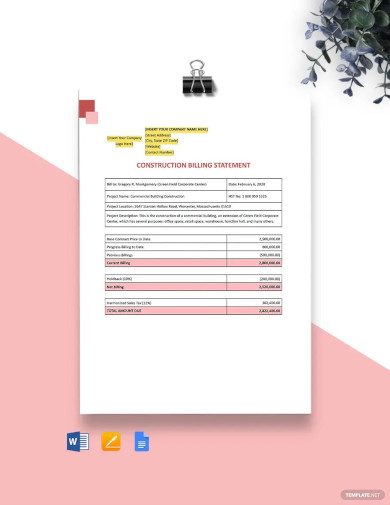

Construction Billing Statement Template

download now -

Sample Construction Billing Statement Template

download now -

Sample Billing Statement Template

download now -

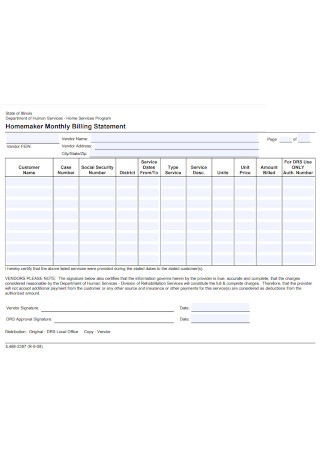

Blank Monthly Billing Statement

download now -

Credit Card Patient Billing Statement

download now -

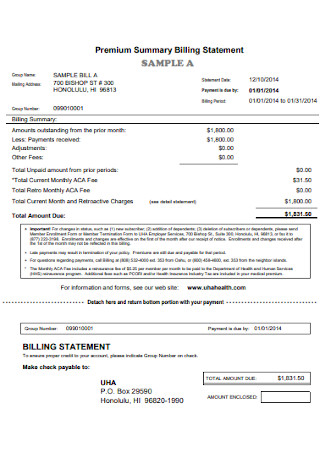

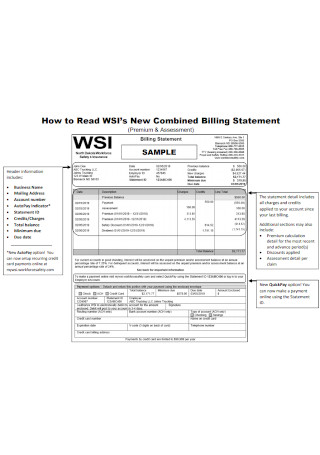

Premium Summary Billing Invoice Statement

download now -

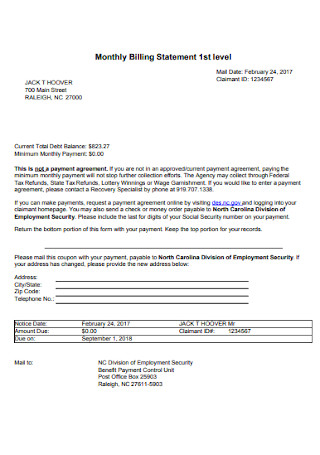

Monthly Payment Billing Statements

download now -

Sample Request for Rental Billing Statement

download now -

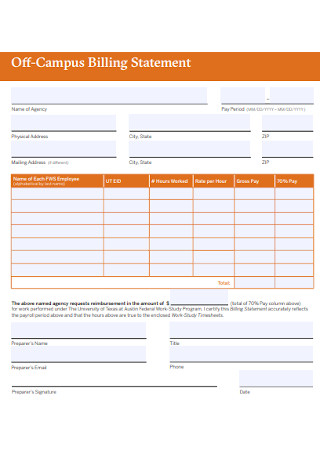

Construction Billing Statement Request Form

download now -

Printable Billing Statement

download now -

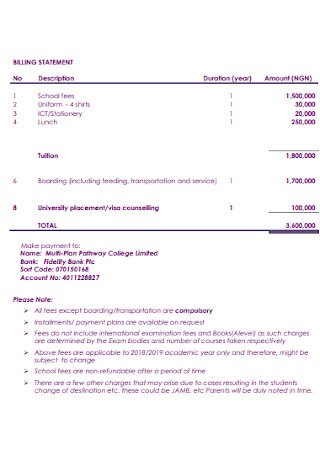

Sample School Billing Statement Example

download now -

Basic Receipt Billing Statement

download now -

Medical Billing Statement

download now -

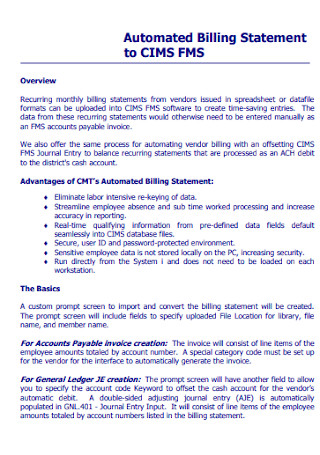

Automated Catering Billing Statement

download now -

Simple Business Billing Statements

download now -

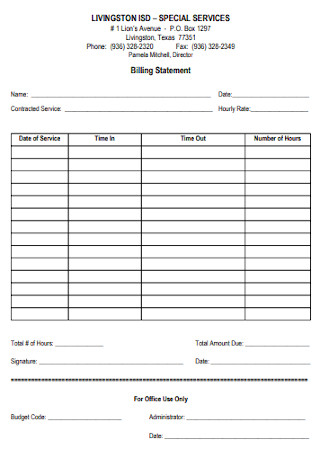

Special Service Billing Collection Statement

download now -

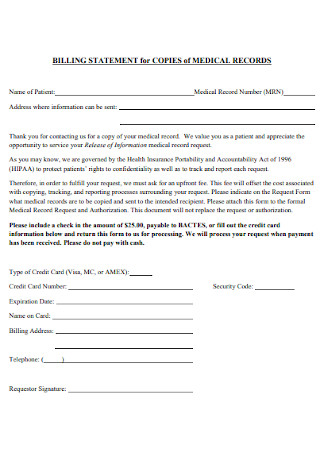

Billing Landlord Statement for Medical Records

download now -

Debit Card Billing Statement

download now -

Current Trucking Billing Statement

download now -

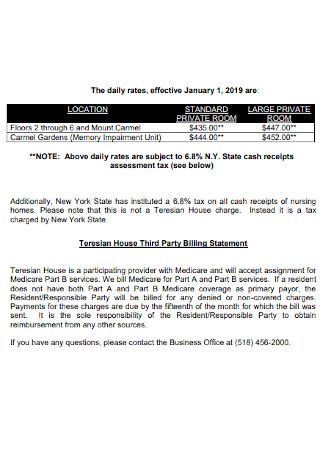

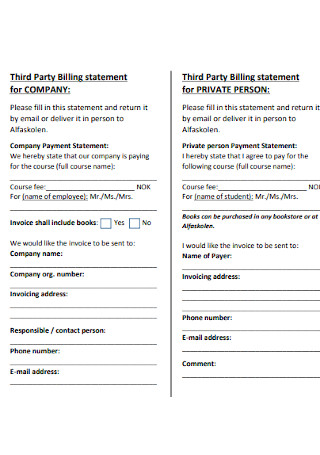

Third Party Billing Statement

download now -

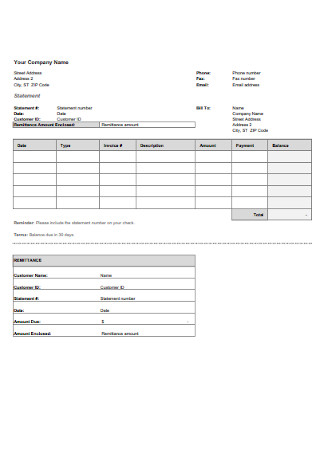

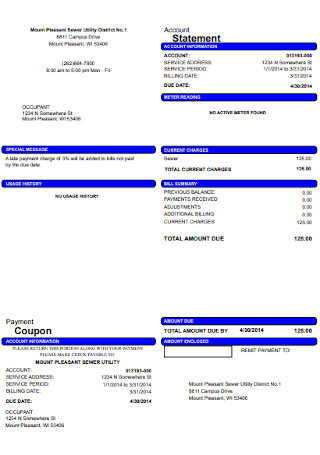

Billing Account Statement

download now -

Monthly Billing Statement Example

download now -

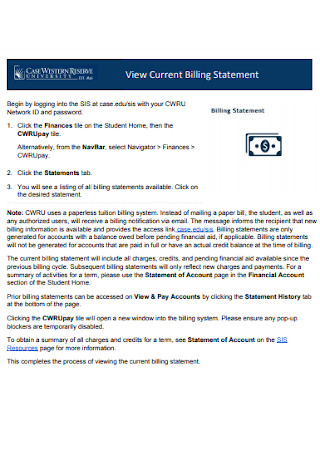

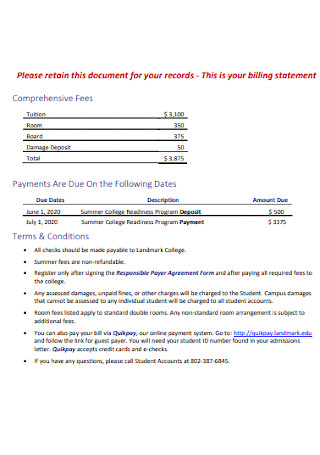

College Billing Statement

download now -

Self Payment Billing Statement

download now -

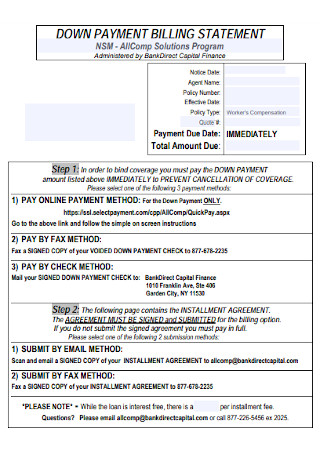

Down Payment Billing Statement

download now -

Third Party Billing Statement Example

download now -

Billing Statement Format

download now -

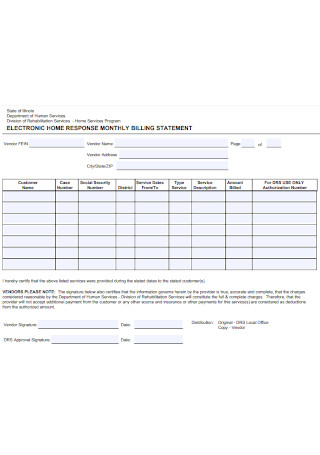

Eloctronic Home Billing Statement

download now -

Loan Billing Statement

download now -

Dair Credit Billing Statement

download now -

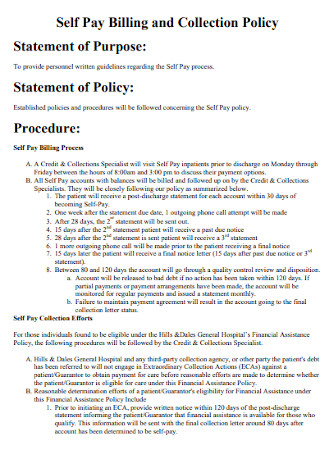

Self Pay Billing Statement

download now -

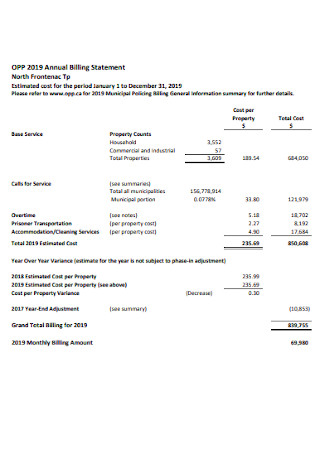

Annual Billing Statement

download now -

Interpreter Billing Statement

download now -

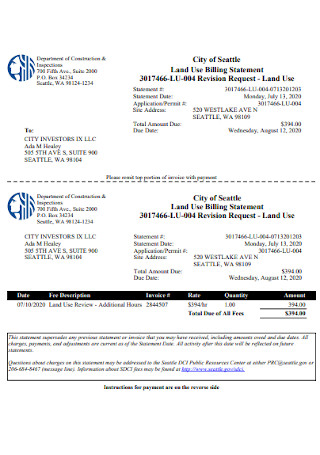

Land Use Billing Statement

download now -

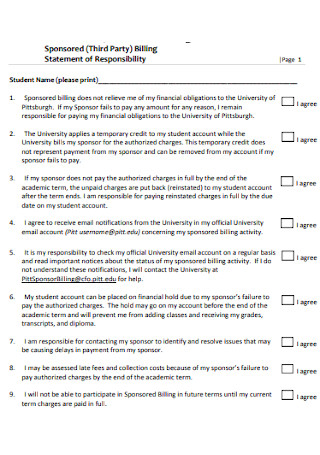

Sponsored of Billing Statement

download now -

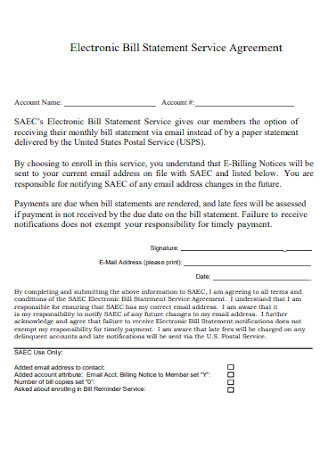

Electronic Bill Statement Service Agreement

download now -

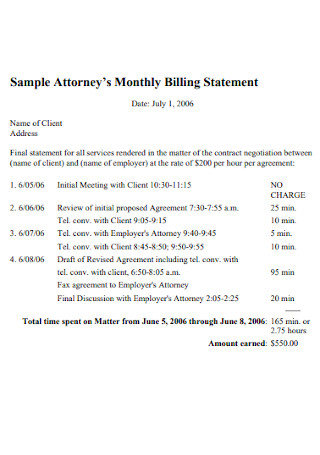

Sample Attorneys Monthly Billing Statement

download now -

Basic Billing Statement Example

download now -

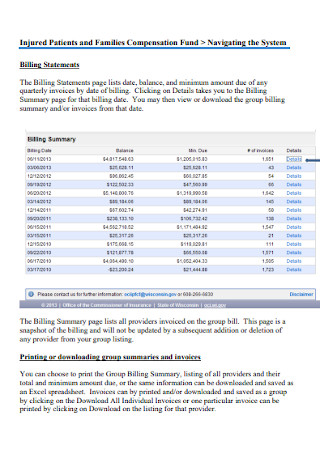

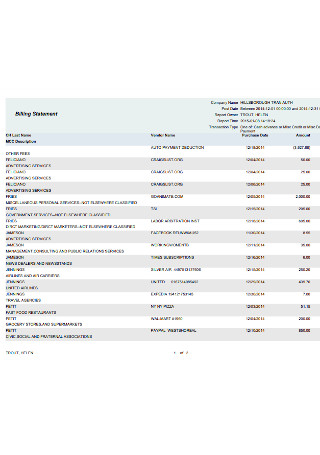

Reconciliation of Billing Statements

download now -

Paperless Billing Statement Agreement

download now -

Formal Billing Statement Template

download now -

Standard Billing Statement Template

download now -

Facey Billing Statement

download now -

Sample Monthly Billing Statement

download now -

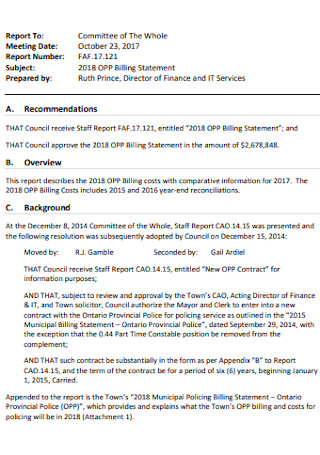

IT Services Billing Statement

download now -

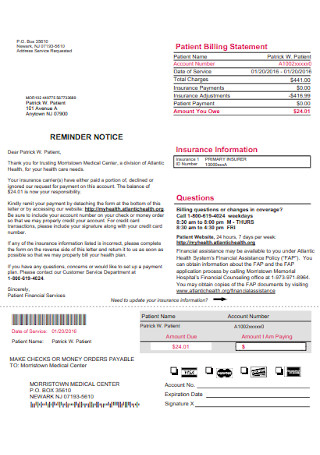

Patient Billing Statement

download now -

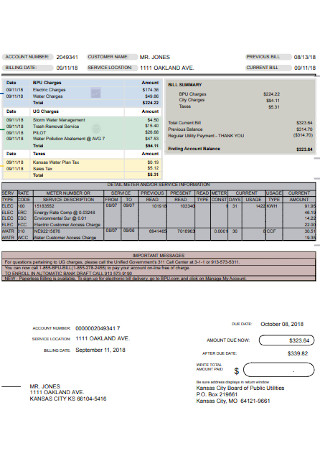

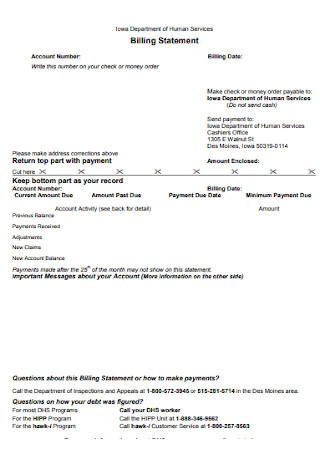

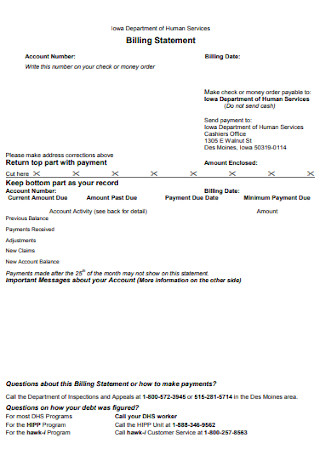

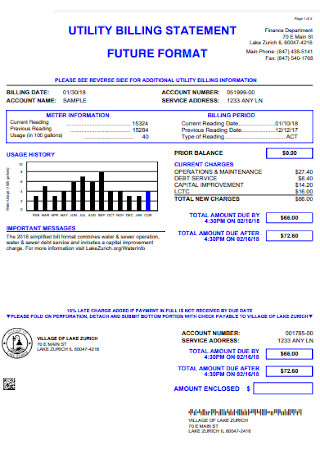

New Utility Billing Statement

download now -

Online Billing Statement.

download now -

Utility Billing Statement Format

download now -

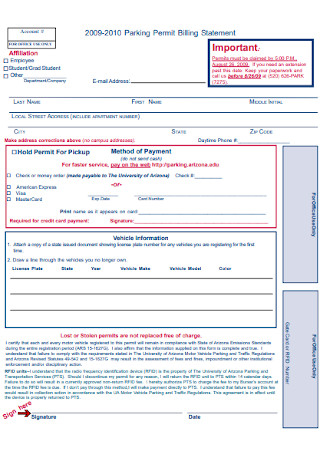

Parking Permit Billing Statement

download now -

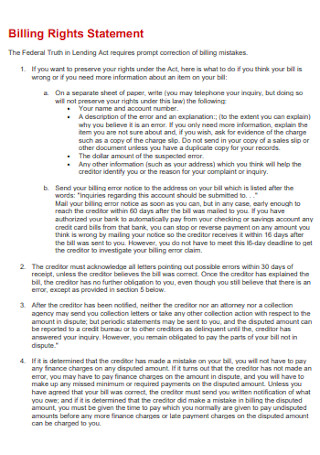

Billing Rights Statement Example

download now -

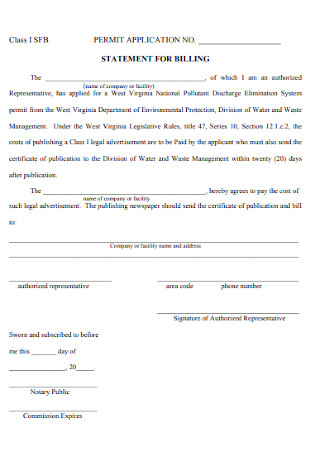

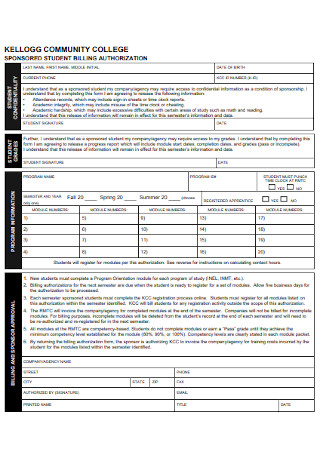

Billing Authorization Statement

download now -

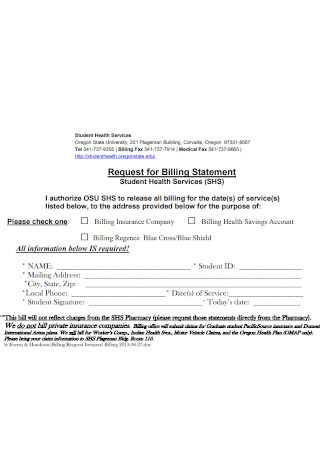

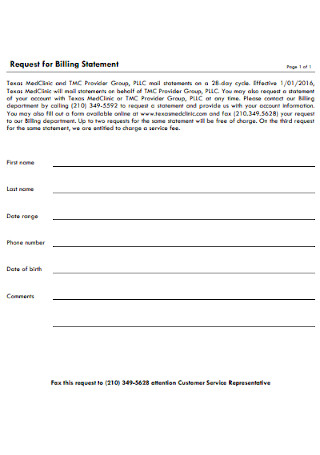

Request for Billing Statement Template

download now -

College Billing Statement Example

download now

FREE Billing Statement s to Download

Billing Statement Format

Billing Statement Samples

What is a Billing Statement?

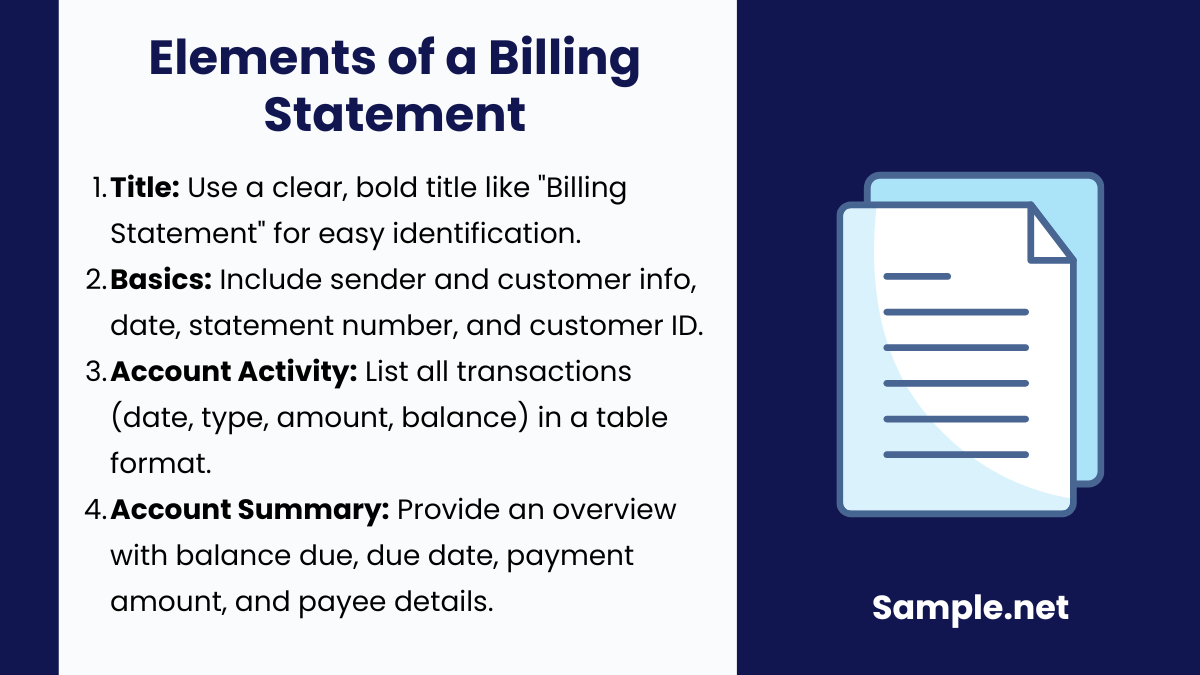

Elements of a Billing Statement

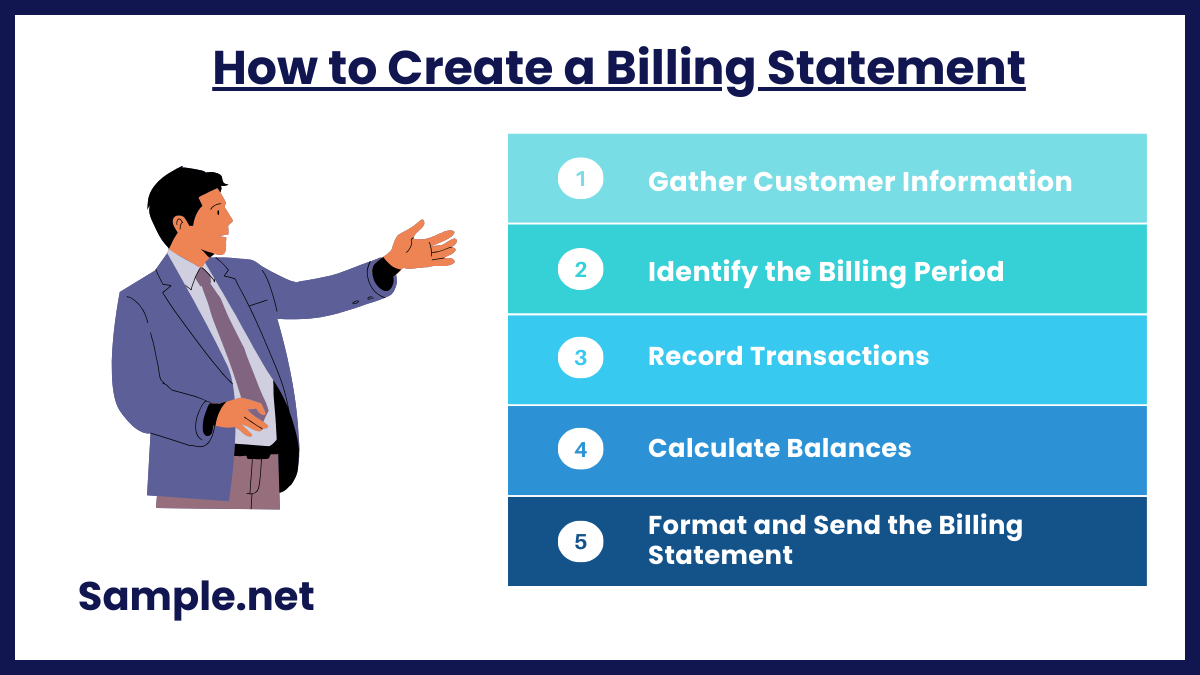

How to Create a Billing Statement

FAQs

How often is a billing statement issued?

Is a billing statement the same as an invoice?

Can I pay directly through a billing statement?

What details should be included in a billing statement?

How is the opening balance of a billing statement calculated?

How do billing statements benefit businesses?

Download Billing Statement Bundle

Billing Statement Format

Business/Company Name

Address: [Street Address, City, State, Zip Code]

Phone: [Phone Number] | Email: [Email Address] | Website: [Website URL]

Billing Statement No: [Unique Statement Number]

Date of Issue: [MM/DD/YYYY]

Due Date: [MM/DD/YYYY]

1. Customer Information

Customer Name: [Customer Full Name]

Customer ID: [Unique Customer ID]

Address: [Customer Address]

Phone: [Customer Phone Number]

Email: [Customer Email]

2. Statement Summary

| Description | Invoice Number | Invoice Date | Due Date | Amount | Payments | Balance Due |

|---|---|---|---|---|---|---|

| [Description of Service/Product] | [INV-001] | [MM/DD/YYYY] | [MM/DD/YYYY] | [$Amount] | [$Payment] | [$Balance] |

| [Description of Service/Product] | [INV-002] | [MM/DD/YYYY] | [MM/DD/YYYY] | [$Amount] | [$Payment] | [$Balance] |

| Total | [$Total] | [$Total] | [$Total] |

3. Payment Details

Total Amount Due: [$Total Amount Due]

Payment Due Date: [MM/DD/YYYY]

Payment Methods:

- Bank Transfer: [Bank Name, Account Number, SWIFT/BIC]

- Online Payment Link: [Payment URL]

- Other Payment Methods: [Specify if applicable]

4. Terms and Conditions

- Payments must be received by the due date to avoid any late fees.

- Any unpaid balance after [X days] will incur a late fee of [X%] per month.

- If you have questions regarding this billing statement, please contact us at [Phone Number] or [Email Address].

5. Notes and Remarks

- [Any special instructions or comments, e.g., “Thank you for your business!” or “Please reference your statement number when making a payment.”]

What is a Billing Statement?

A Billing Statement is a financial document provided by a business to its customers to summarize all account activity over a particular billing cycle. It displays an overview of payments, charges, credits, and the outstanding balance owed. These statements serve as a reminder for customers to pay any outstanding amounts and ensure both parties have a transparent record of transactions. Billing statements are used in various industries, including banking, utilities, healthcare, and retail. You can also see more on Billing Invoices.

Elements of a Billing Statement

Now that you already know that billing statements are a part of the billing process, the next thing you should learn is its elements. Every billing statement is different depending on what pricing arrangement a client has chosen. Because of that, a statement must be specifically made for that business transaction. However, some businesses created standardized billing statements solely for their payment transactions. If you want to make one, here is a list of all elements this document should have. Continue reading below.

How to Create a Billing Statement

Step 1: Gather Customer Information

Start by collecting the necessary details for the customer. This includes their name, address, contact information, and account number. Accurate customer data ensures there are no discrepancies in the billing process and avoids delays in payment collection.

Step 2: Identify the Billing Period

Clearly define the billing cycle or statement period for which the statement is being generated. This could be a month, a quarter, or any custom period that matches the business’s billing process. Make sure to specify the start and end dates of the billing period. You can also see more on Statement Of Purpose.

Step 3: Record Transactions

List all financial transactions, including payments, charges, fees, and credits, made during the billing period. Each transaction should have a description, date, and corresponding amount. Be sure to categorize them as “credits” or “debits” to maintain clarity.

Step 4: Calculate Balances

Determine the customer’s balance at the start of the billing period, then add any charges and deduct payments made. The resulting figure will be the outstanding balance due. Double-check calculations for accuracy to avoid billing errors.

Step 5: Format and Send the Billing Statement

Design a clear and professional format for the statement. Include a summary section that highlights the opening balance, total payments, new charges, and the final balance due. Send the statement via email, mail, or an online customer portal for easy access. You can also see more on Background Statements.

FAQs

How often is a billing statement issued?

Billing statements are typically issued monthly, but the frequency depends on the type of service or agreement between the business and the customer.

Is a billing statement the same as an invoice?

No, an invoice is a single bill for a specific transaction, while a billing statement summarizes multiple transactions over a period.

Can I pay directly through a billing statement?

Many billing statements offer a payment link, QR code, or instructions on how to make payments. This makes it easier for customers to settle their dues. You can also see more on Account Statements.

What details should be included in a billing statement?

A billing statement should include customer information (name, address, and account number), statement date, billing period, list of transactions (charges, credits, payments), and the total balance due. Including these elements ensures the statement is clear and actionable.

How is the opening balance of a billing statement calculated?

The opening balance is the amount carried over from the previous billing cycle. It includes unpaid amounts or credit balances from prior statements. This figure becomes the starting point for the current billing period’s calculations.

How do billing statements benefit businesses?

Billing statements promote financial transparency, simplify payment tracking, and encourage timely payments. They help avoid payment disputes and support better cash flow management. For B2B businesses, they offer a consolidated view of multiple invoices, simplifying client payment processes. You can also see more on Goal Statement.