Financial Statement Samples

-

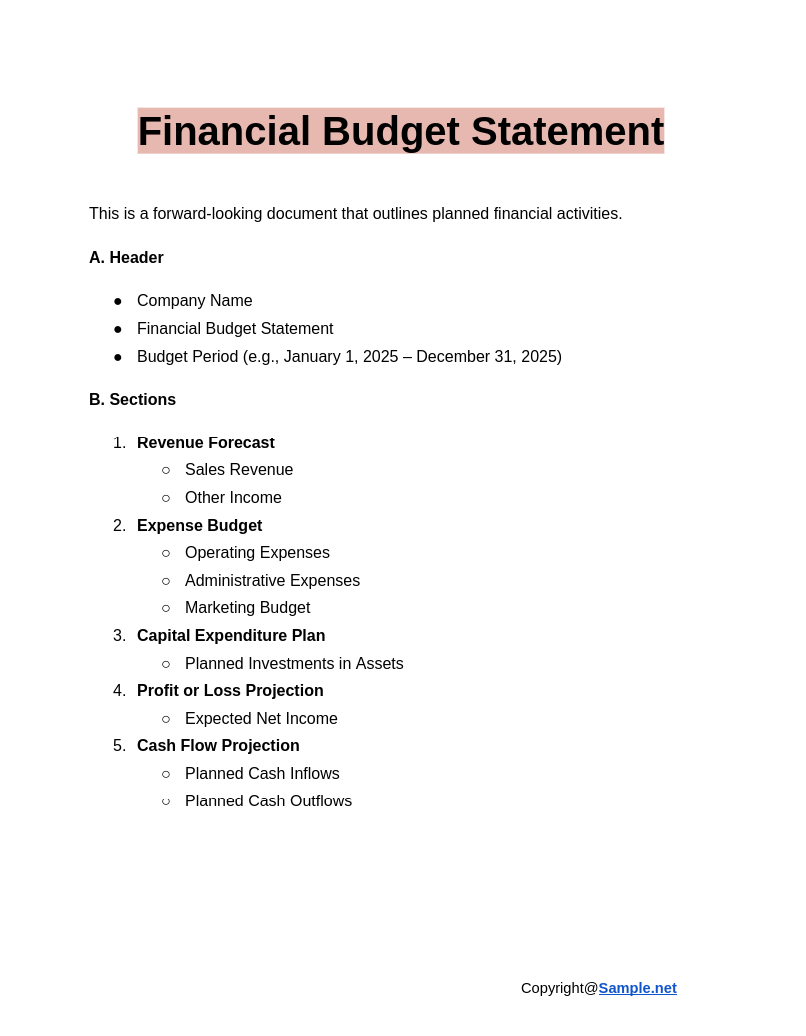

Financial Budget Statement

download now -

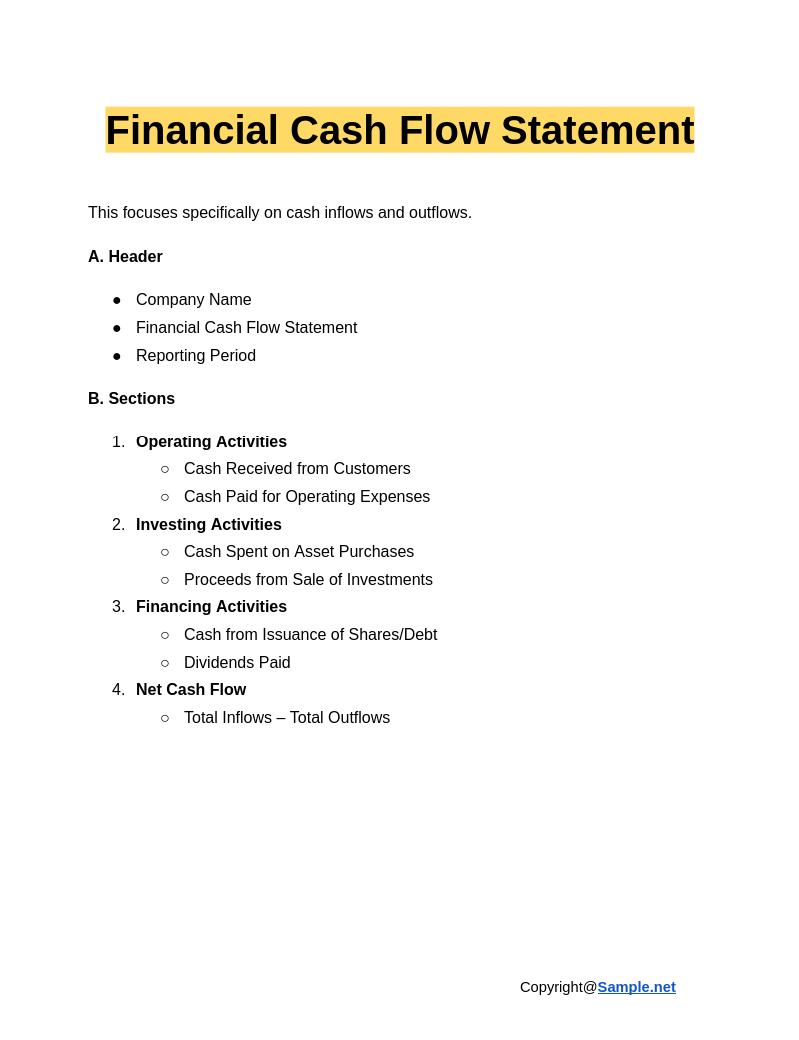

Financial Cash Flow Statement

download now -

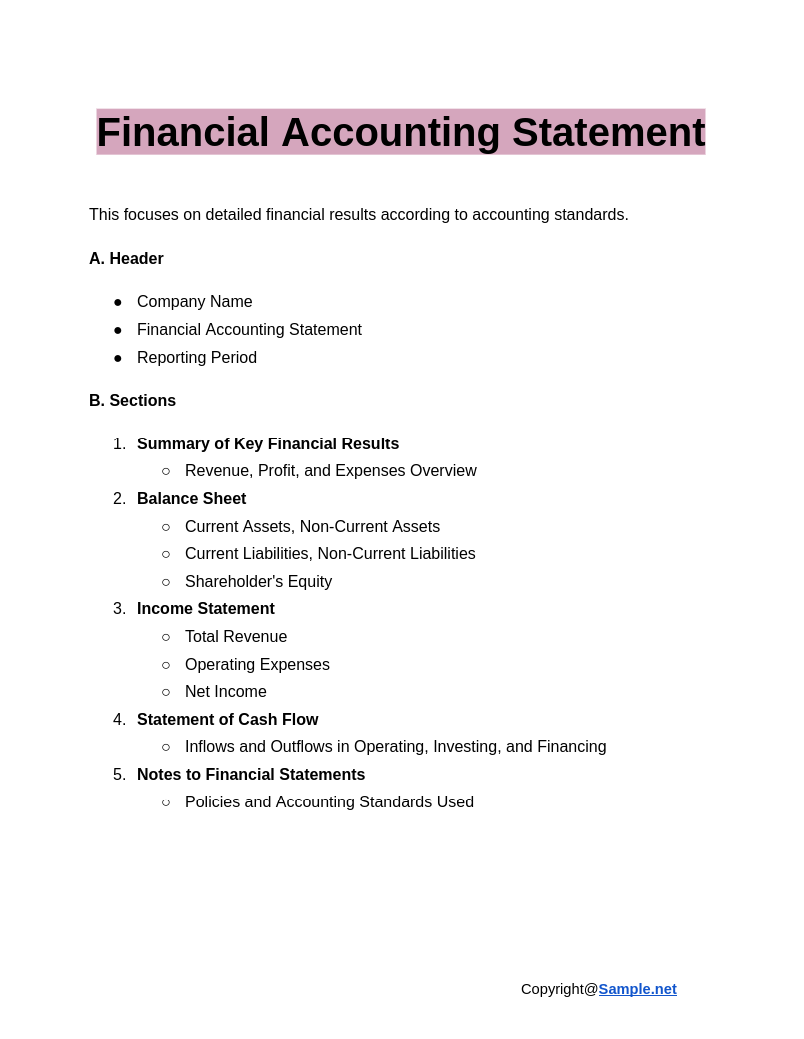

Financial Accounting Statement

download now -

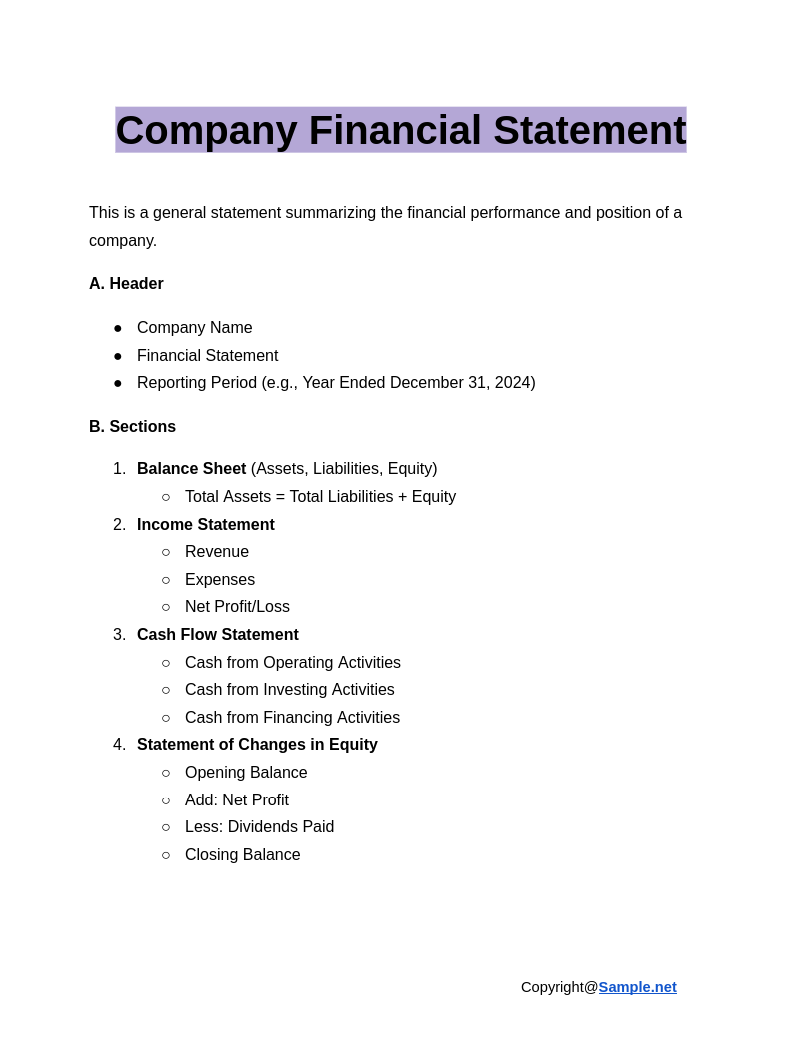

Company Financial Statement

download now -

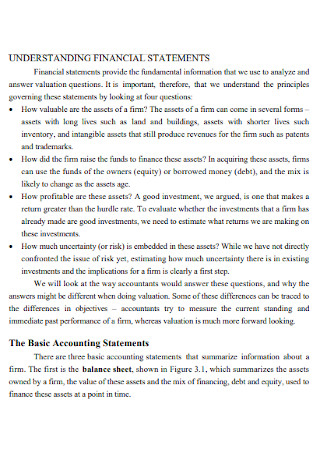

Understanding Financial Statement Template

download now -

Board Financial Statements

download now -

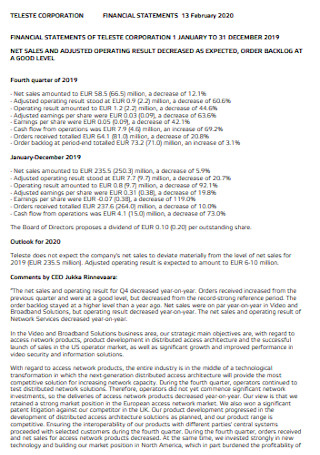

Corporation Financial Statement

download now -

Tutorial Financial Statements

download now -

School Financial Statement Template

download now -

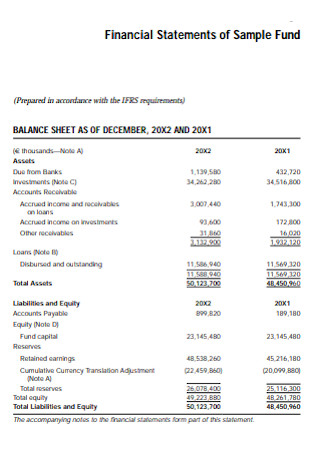

Sample Fund Financial Statements

download now -

Racing Financial Statement Template

download now -

Financial Statement Data Sets Template

download now -

Industry Financial Statement Analysis Template

download now -

Annual Financial Statement

download now -

Yearly Financial Statement

download now -

Management Financial Statement

download now -

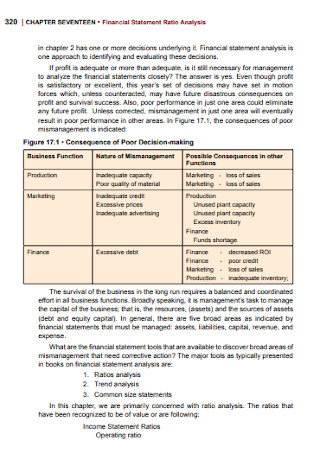

Financial Statement Ratio Analysis Template

download now -

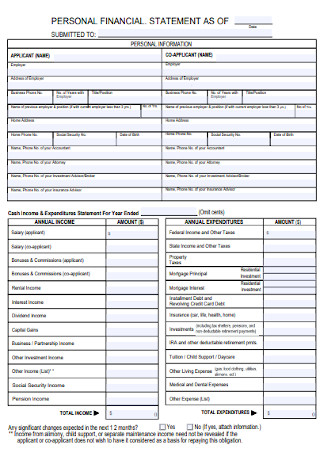

Personal Financial Statement

download now -

Financial Statement Format

download now -

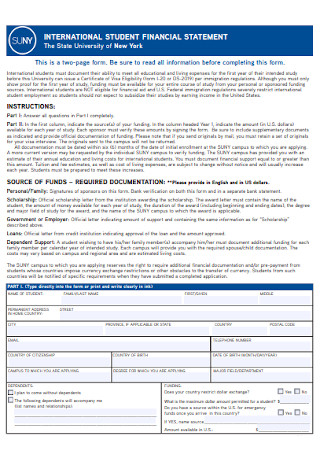

International Student Financial Statement

download now -

Financial Income Statements

download now -

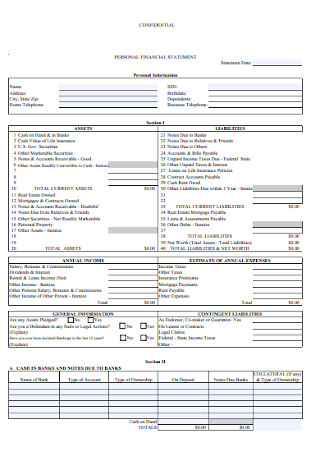

Confidential Personal Financial Statement

download now -

Financial Data Statement

download now -

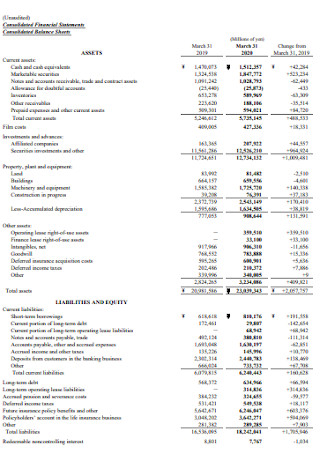

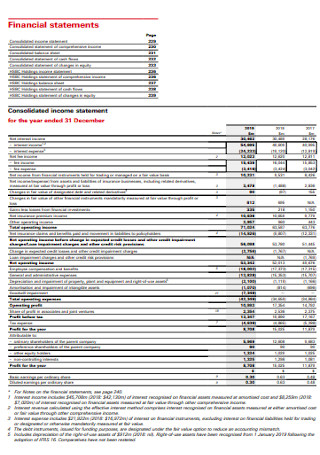

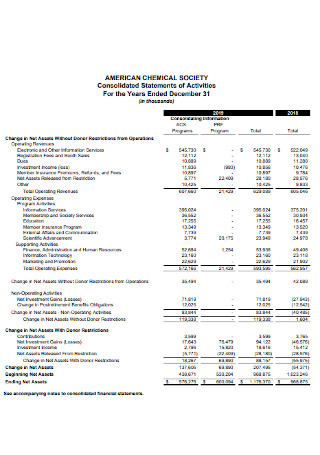

Consolidated Financial Statements

download now -

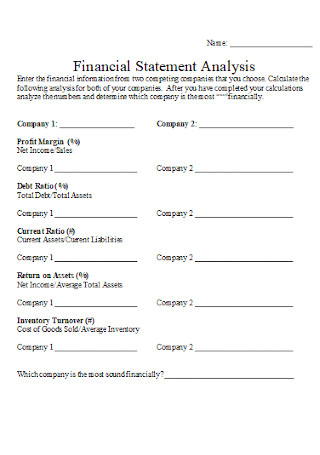

Financial Statement Analysis Template

download now -

College Financial Statement

download now -

Institution Financial Statement

download now -

Monthly Financial Statement

download now -

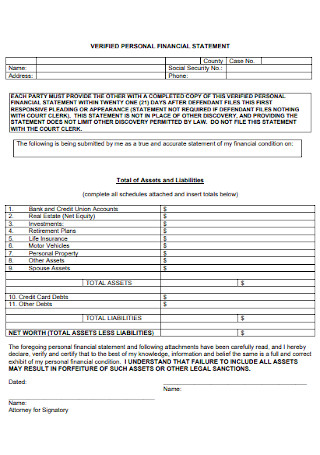

Verified Personal Financial Statement

download now -

Notes to the Financial Statements

download now -

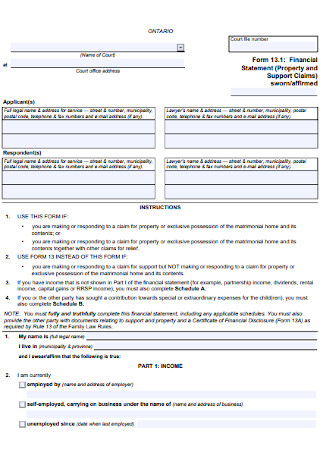

Property Financial Statement

download now -

Interpreting Financial Statements

download now -

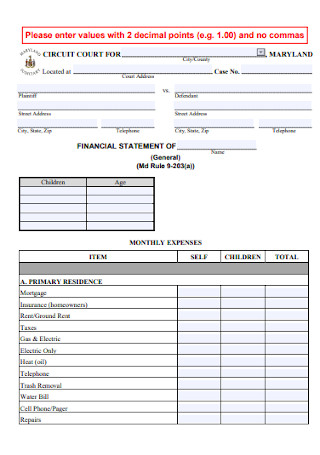

General Financial Statement

download now -

Basic Financial Statement Template

download now -

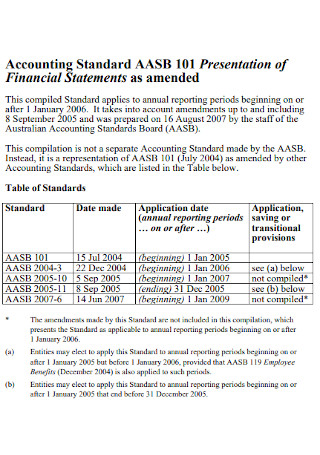

Presentation of Financial Statements

download now -

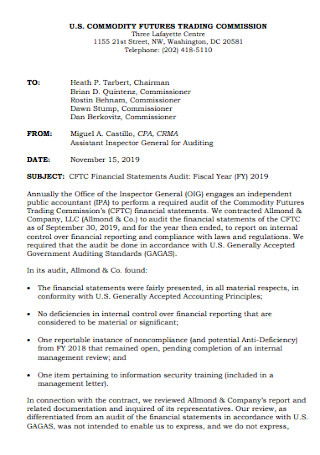

Audited Financial Statement

download now -

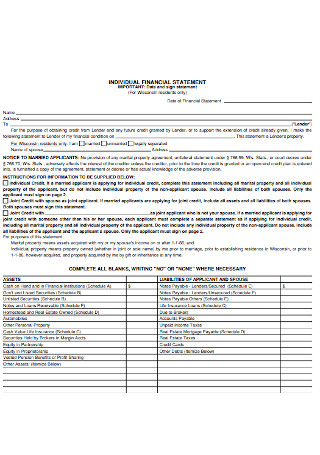

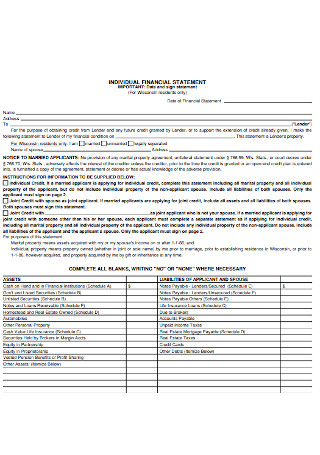

Indicidual Financial Statement

download now -

Principal Financial Statements

download now -

Improving Financial Statements

download now -

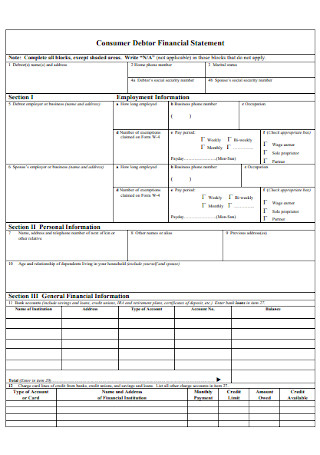

Consumer Debtor Financial Statement

download now -

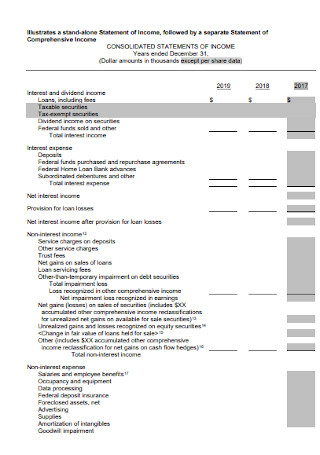

Bank Financial Statement Template

download now -

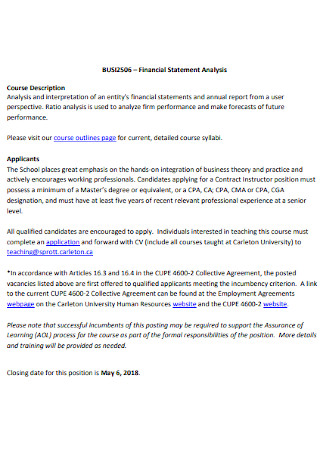

Financial Course Statement Template

download now -

Formal Financial Statement Template

download now -

Audit Financial Statements Template

download now -

Public Financial Statement

download now -

Financial Statement Analysis Example

download now

FREE Financial Statement s to Download

Financial Statement Format

Financial Statement Samples

What is Financial Statement?

Purpose of a Financial Statement

How to Write a Financial Statement

FAQs

When can a financial statement be useful?

What ratios are calculated in a financial statement?

Are financial statements required?

What challenges do businesses face in preparing financial statements?

How do financial statements support investor confidence?

What is the importance of equity in a financial statement?

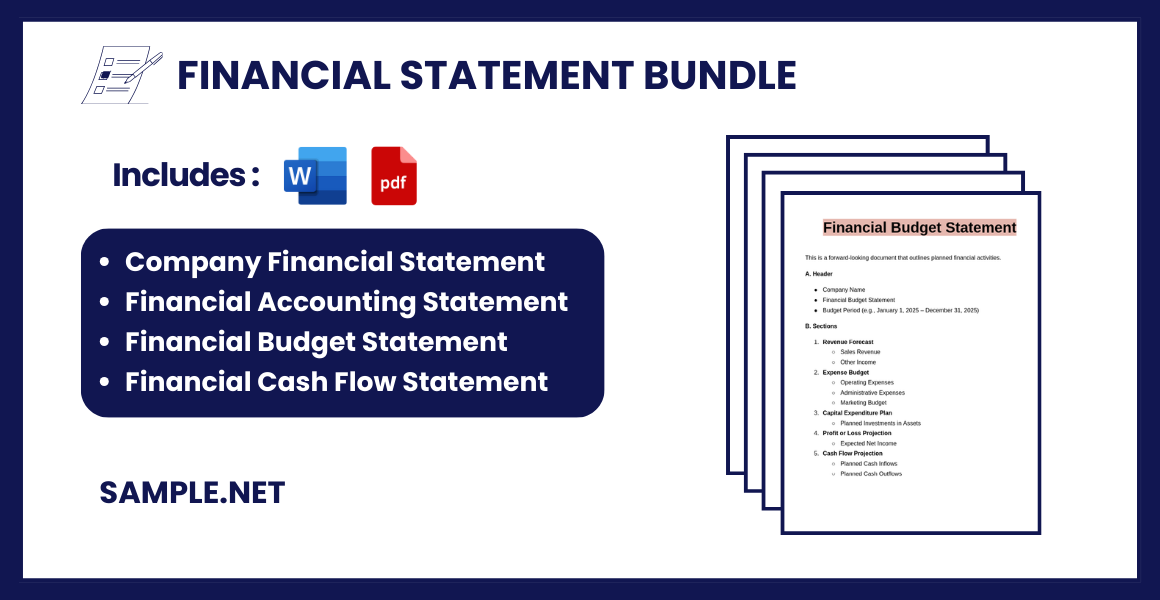

Download Financial Statement Bundle

Financial Statement Format

1. Company Information

- Company Name

- Address

- Contact Information

- Reporting Period (e.g., Year Ended December 31, 2024)

2. Table of Contents

1. Balance Sheet

2. Income Statement

3. Statement of Cash Flows

4. Statement of Changes in Equity

5. Notes to the Financial Statements

3. Balance Sheet (Statement of Financial Position)

Assets

- Current Assets

- Cash and Cash Equivalents

- Accounts Receivable

- Inventory

- Prepaid Expenses

- Non-Current Assets

- Property, Plant, and Equipment

- Intangible Assets

- Investments

Liabilities and Equity

- Current Liabilities

- Accounts Payable

- Short-Term Loans

- Accrued Expenses

- Non-Current Liabilities

- Long-Term Debt

- Deferred Tax Liabilities

- Equity

- Common Stock

- Retained Earnings

- Additional Paid-in Capital

4. Income Statement (Profit and Loss Statement)

- Revenue

- Sales Revenue

- Other Income

- Expenses

- Cost of Goods Sold (COGS)

- Operating Expenses (e.g., salaries, rent, utilities)

- Depreciation and Amortization

- Net Income

- Operating Income

- Interest Expenses

- Tax Expenses

- Net Profit/Loss

5. Statement of Cash Flows

- Operating Activities

- Cash Received from Customers

- Cash Paid to Suppliers and Employees

- Investing Activities

- Purchase/Sale of Equipment

- Investment Income

- Financing Activities

- Issuance of Shares or Bonds

- Dividend Payments

6. Statement of Changes in Equity

1. Opening Balance of Equity

2. Additions: Net Income, Issuance of Shares

3. Deductions: Dividends, Treasury Stock

7. Notes to the Financial Statements

- Accounting Policies

- Breakdown of Key Items

- Detailed Analysis of Revenue and Expenses

- Asset Valuation and Depreciation Policies

- Contingent Liabilities and Legal Matters

8. Auditor’s Report (Optional)

If applicable, include an auditor’s opinion on the financial statements.

What is Financial Statement?

A financial statement is a formal record of an organization’s financial activities and position over a specific period. It typically includes the balance sheet, income statement, and cash flow statement. These documents provide insights into a company’s financial performance, profitability, and cash flow management. Financial statements are crucial for stakeholders, such as investors, creditors, and management, to make informed decisions. They are prepared following standardized accounting principles to ensure accuracy and comparability. You can also see more on Income Statements.

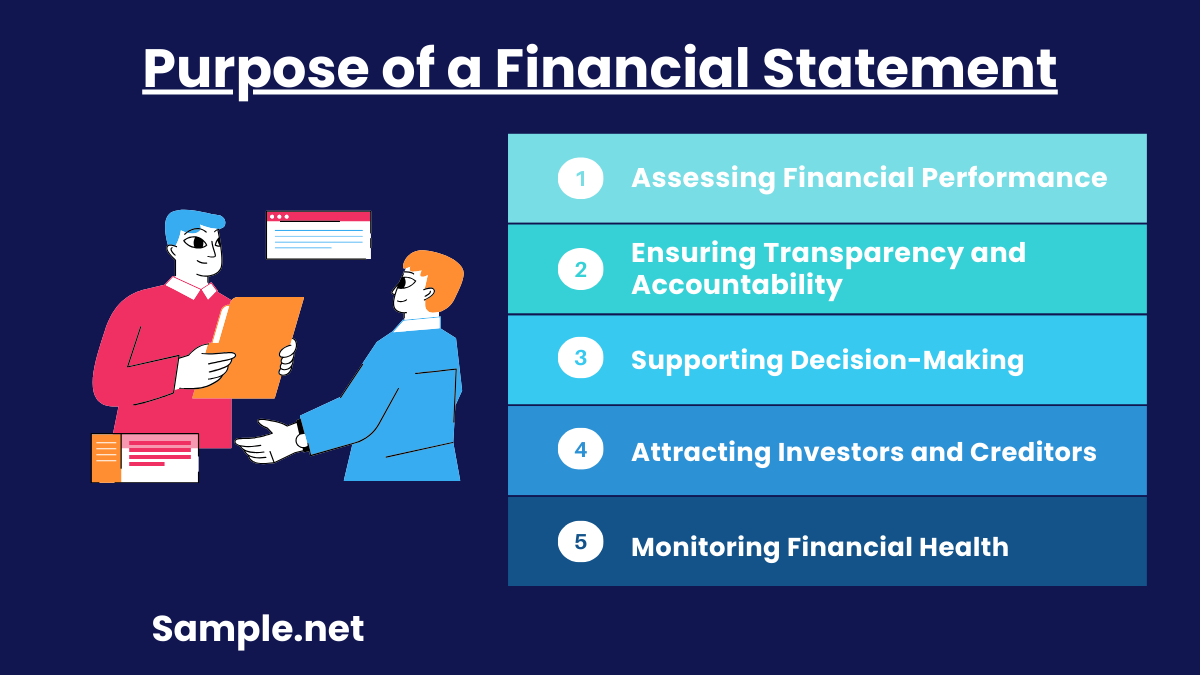

Purpose of a Financial Statement

1. Assessing Financial Performance

Financial statements provide a comprehensive analysis of a business’s financial performance over a specific period. They showcase revenue, profits, and expenses, offering a clear picture of how well the organization has achieved its financial objectives. This analysis helps businesses gauge their profitability and overall growth trajectory.

2. Ensuring Transparency and Accountability

These statements ensure that businesses maintain transparency in their financial dealings. By presenting accurate financial data, organizations build trust with stakeholders, including investors, lenders, and regulatory authorities. It reflects the company’s commitment to ethical practices and compliance. You can also see more on Financial Report.

3. Supporting Decision-Making

With detailed financial insights, businesses can make informed decisions about investments, budgeting, and strategic planning. Financial statements highlight areas of improvement, enabling companies to allocate resources efficiently. They serve as a roadmap for achieving financial goals.

4. Attracting Investors and Creditors

Investors and creditors rely on financial statements to evaluate a company’s financial stability and potential for growth. A well-prepared financial statement can attract funding by demonstrating the company’s ability to generate returns and manage risks effectively. You can also see more on Profit and Loss Statement.

5. Monitoring Financial Health

Financial statements act as a diagnostic tool for assessing the financial health of a business. They provide a clear view of cash flow, asset management, and liabilities, helping organizations address issues before they escalate. Regular reviews ensure long-term sustainability

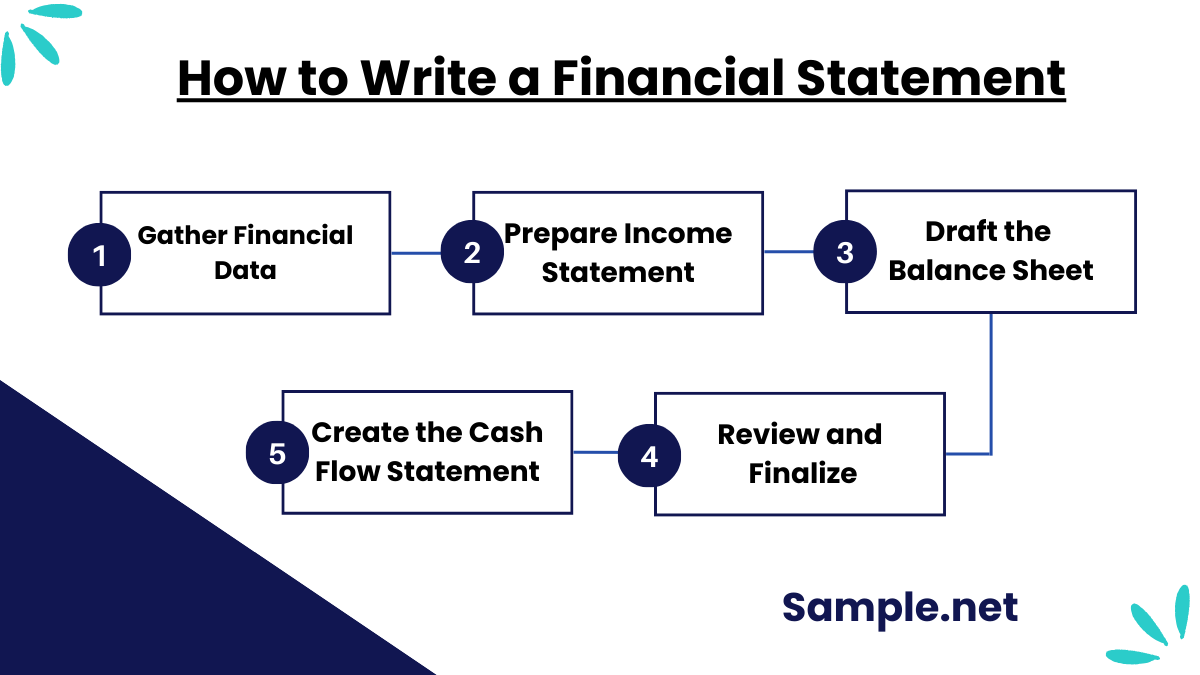

How to Write a Financial Statement

Now let us head on to the main tea, how do you make a financial statement in the first place? You already know of a financial statement’s meaning, importance, and necessary elements to complete it. But the challenge lies in writing the complete statement. Not to worry because we will guide you in the process. Kindly follow these four easy steps on how to create a financial statement effectively:

Step 1: Gather Financial Data

Collect all financial information for the reporting period, including revenues, expenses, assets, and liabilities. Ensure that all records are accurate, complete, and categorized properly. This step is critical for producing a reliable and comprehensive financial statement. You can also see more on Audited Financial Statement.

Step 2: Prepare the Income Statement

Start by calculating the total revenues earned during the reporting period. Deduct all expenses, including cost of goods sold and operating expenses, to determine the net profit or loss. This statement reflects the organization’s profitability.

Step 3: Draft the Balance Sheet

List all assets, liabilities, and equity as of the reporting date. Ensure that the equation Assets = Liabilities + Equity balances accurately. The balance sheet provides a snapshot of the company’s financial position at a specific point in time. You can also see more on Cash Flow Statements.

Step 4: Create the Cash Flow Statement

Record all cash transactions categorized into operating, investing, and financing activities. This statement shows how cash is generated and spent, providing insight into the company’s liquidity and operational efficiency.

Step 5: Review and Finalize

Carefully review all components of the financial statements for accuracy and consistency. Add explanatory notes where necessary to clarify any complexities. Once verified, the final report is ready for presentation to stakeholders. You can also see more on Income Statement.

FAQs

When can a financial statement be useful?

If you look back into the financial statement’s different purposes earlier, those are common examples of when the statement is needed. And a more specific example is the latest COVID-19 issue. Based on a survey, 68.9% of businesses have struggled and were affected negatively or worse due to the pandemic. A way to be updated on your company’s current financial performance and to look for ways on how to cope will be through your financial statement’s results. You can also see more on Account Statements.

What ratios are calculated in a financial statement?

A financial statement is also known for its ratio calculations. And the most common examples of what you calculate are the following:

- Inventory turnover ratio

- Price per share or earnings per share ratio (P/E ratio)

- Operating margin

- Working capital

- Debt-to-equity ratio

Are financial statements required?

According to the generally accepted accounting principles (GAAP), businesses should provide cash flow reports, profit-driven operations, and many other financial reports. The most common examples are the income statement, balance sheet, and cash flow statement. Consequently, you should prepare a financial statement since the three core statements are under the financial statement itself.

What challenges do businesses face in preparing financial statements?

Challenges include ensuring data accuracy, complying with accounting standards, managing complex transactions, and maintaining consistency across all components. These challenges require careful planning and expertise to produce reliable and compliant financial statements. You can also see more on Restaurant Income Statement.

How do financial statements support investor confidence?

By presenting accurate and transparent financial data, these statements demonstrate a company’s stability and growth potential. This transparency reassures investors about their investment’s safety and the likelihood of returns, fostering long-term confidence.

What is the importance of equity in a financial statement?

Equity represents the owner’s residual interest after liabilities are deducted from assets. It reflects the company’s financial stability and growth, helping stakeholders understand the value generated for shareholders. You can also see more on Expense Statement.