Income and Expense Statement

-

Statement of Financial Income and Expense Example

download now -

Basic Income and Expense Statement

download now -

University Income and Expense Statement

download now -

Rental Income Expense Statement

download now -

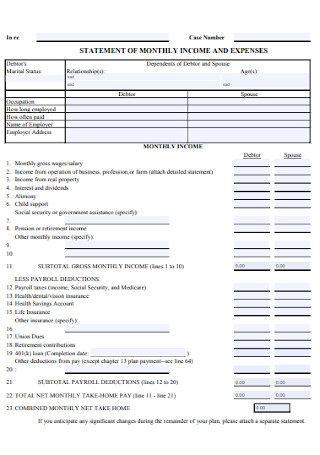

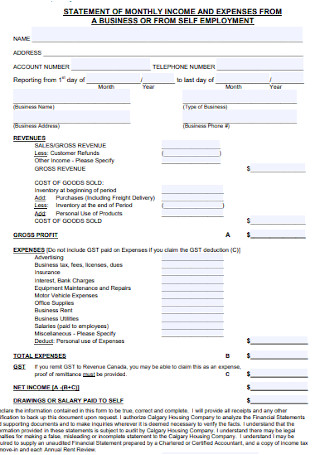

Statement of Monthly Income and Expense

download now -

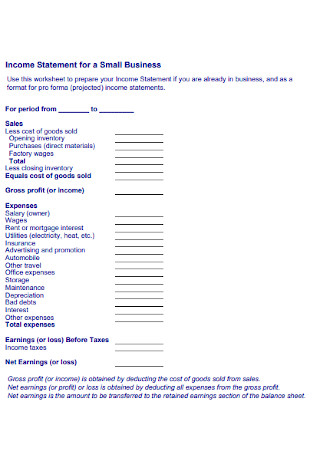

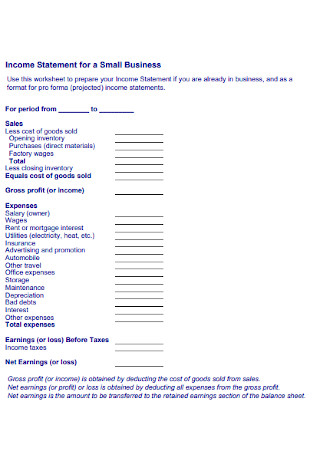

Income and Expense Statement for Small Business

download now -

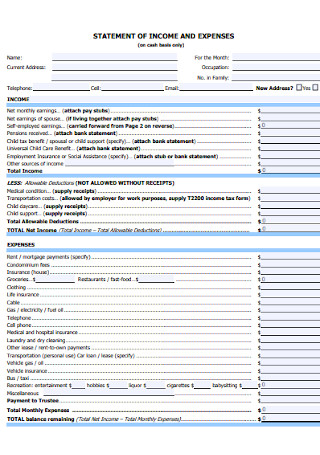

Statement of Income and Expenses for Individual

download now -

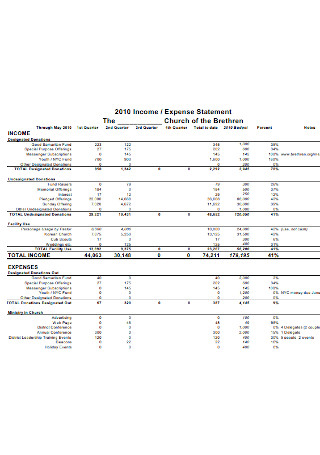

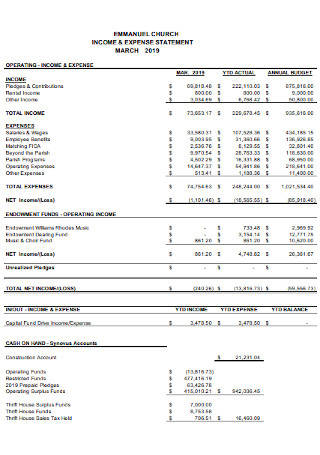

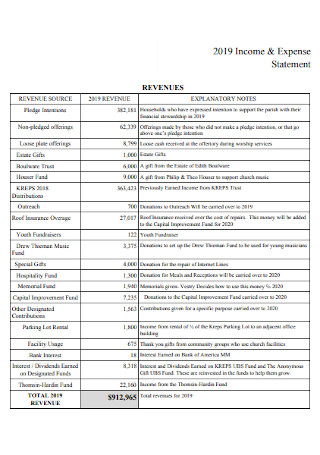

Church Income and Expense Statement Example

download now -

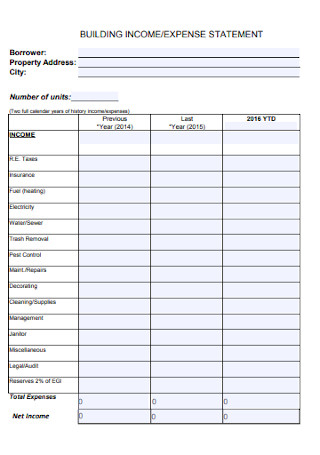

Building Income and Expense Statement

download now -

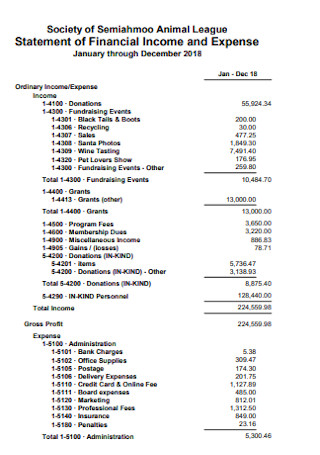

Statement of Financial Income and Expense

download now -

Property Income and Expense Statement

download now -

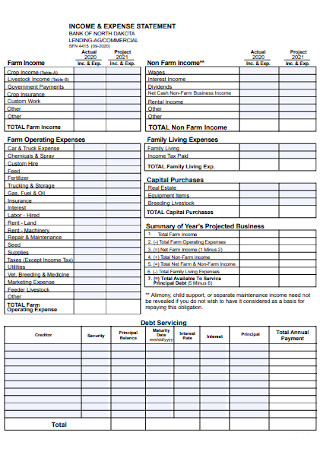

Bank Income and Expense Statement

download now -

Statement of Income and Expenses Template

download now -

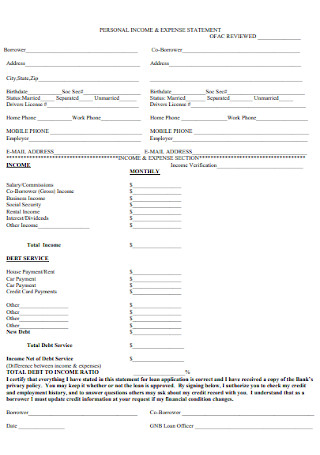

Personal Income and Expense Statement

download now -

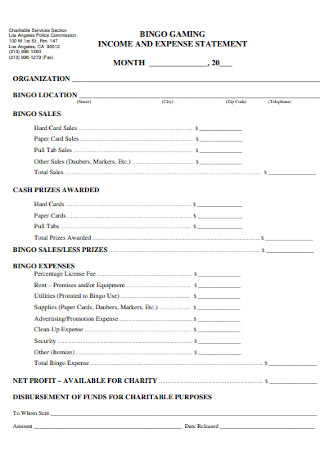

Gaming Income and Expense Statement

download now -

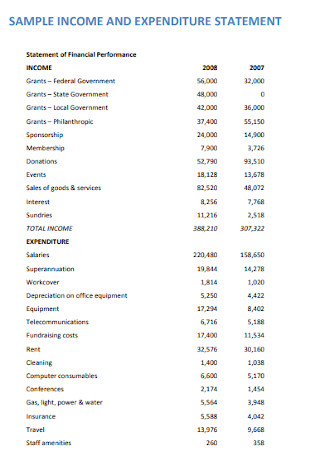

Sample Income and Expenditure Statement

download now -

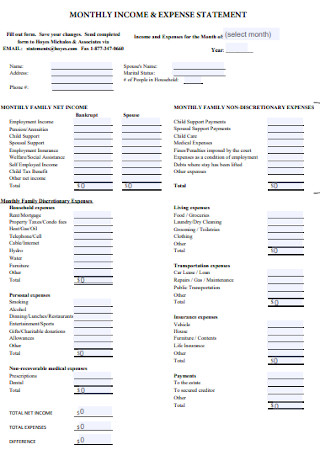

Monthly Income and Expense Statement Example

download now -

School of Law Income and Expense Statement

download now -

Simple Income and Expense Statement

download now -

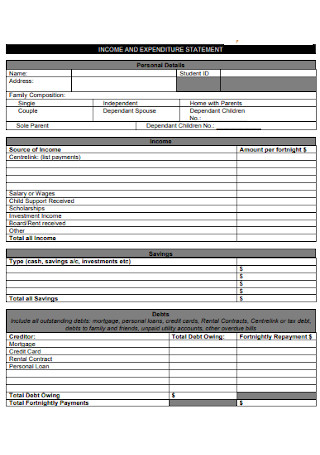

Income and Expenditure Statement

download now -

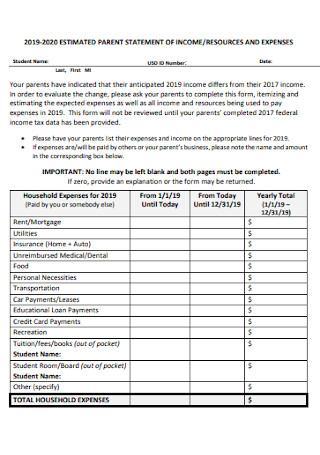

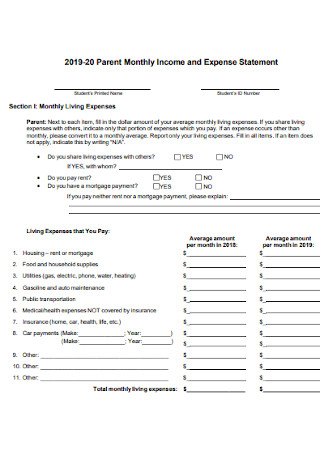

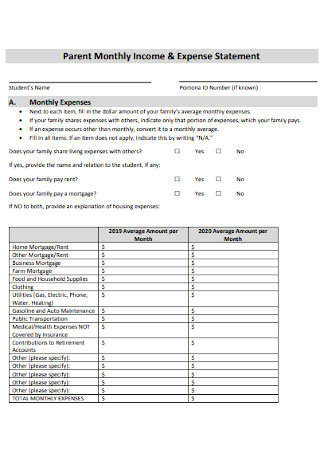

Parent Monthly Income and Expense Statement

download now -

Household Income and Expense Statement

download now -

Income and Expense Statement Form

download now -

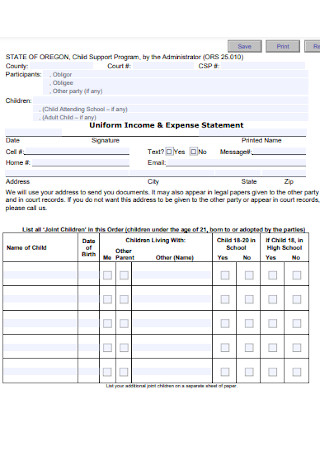

Uniform Income and Expense Statement

download now -

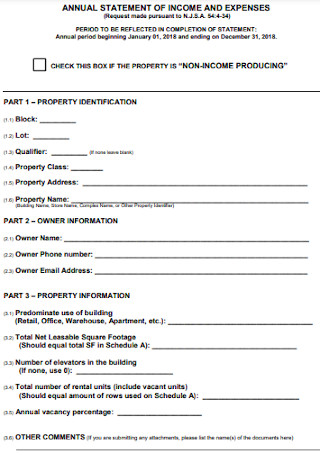

Annual Income and Expense Statement

download now -

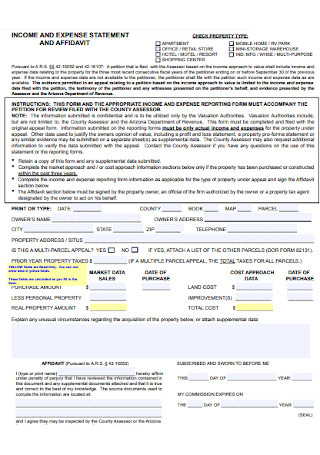

Income and Expense Affidavit Statement

download now -

Church Expense Affidavit Statement

download now -

Parent Monthly Income Expense Statement

download now -

Monthly Income Expense Statement

download now

FREE Income and Expense Statement s to Download

Income and Expense Statement

an Income and Expense Statement?

Benefits of Income Statements

Types of Financial Statements

How To Write an Income and Expense Statement

FAQs

What are profit and loss statements, and what do they mean?

Is a bank statement the same as a statement of account?

How do you explain financial statements?

What Is an Income and Expense Statement?

The income statement, related to the profit and loss statement, summarizes all revenue and expense accounts during a specific time. This financial statement indicates the amount of money that the business will earn after all expenses are deducted. An income statement does not disclose concealed difficulties, such as insufficient cash flow. According to a survey conducted by the United States Bank, 82% of business failures result from ineffective cash flow management or a lack of awareness of how cash flow affects the organization. Cash flow is crucial because it is your business’s lifeline. Also, income statements are read from top to bottom and summarize a company’s earnings and expenses over time.

Benefits of Income Statements

The income and expense statement provides a summary of revenue and expenses generated by operational and non-operating operations. When these numbers are compared, it is possible to determine if a net profit or loss happened during the period under consideration. Income statements are beneficial for businesses of all sizes. Also, certain circumstances in which an income statement may prove more effort than it is worth. To summarize, these are the advantages of income statements.

Types of Financial Statements

Every organization requires several critical financial statement documents. It’s not just about complying with regulations or following best practices; they are essential tools for staying on top of your financials. The following are the necessary documents you should be aware of:

Income Statement

A business must keep a careful check on profit and revenue, which the income statement does. An income statement, alternatively referred to as a profit and loss statement, summarizes your business’s revenue and expenses for a specified period. The income statement accounts for payment, losses, and costs to determine whether your company made a profit or fell short of expectations.

Cash Flow Statement

The cash flow statement illustrates how money enters and exits your organization, allowing you to determine how much working capital you have available at any given time. A cash flow statement is critical for determining how soon you could obtain cash if necessary, as it excludes items such as raw materials and purchases bought – but not yet paid for – on credit.

Statement of Change in Equity

This document details the changes to the share capital retained earnings and accumulated reserves of your business. It reflects changes in the owner’s equity for a sole trader. It depicts the changes in the equity of both partners in a partnership. In this case, the statement of change in equity details how the equity stake of each shareholder has changed.

Note to Financial Statements

This is a requirement of IFRS and helps put the information contained in your other financial statement forms into context. For instance, while your balance sheet may indicate your assets, it is in your note to financial statements document that you will detail the nature of those assets. The information contained in this paper is necessary to ensure that you comply with applicable standards and requirements.

Balance Sheet

The balance sheet summarizes three critical items: your asset lists, liabilities, and equity. The balance sheet can be used to determine the current value of a business for the period covered by the statement. Examining your balance sheet might assist you in deciding whether you can meet your financial responsibilities.

How To Write an Income and Expense Statement

To determine the amount of income and expense earned by your organization, you’ll need to create a performance statement in addition to other financial reports. Follow these accounting processes to generate an income and expense statement and report the earnings generated by your small business:

Step 1 Select a time for reporting.

The first stage in compiling an income statement is to determine the period covered by the report. Businesses frequently use annual, quarterly, or monthly income statements. While publicly traded firms are required to prepare quarterly and annual financial statements, small companies are not subjected to the level of control. Monthly income statements can assist you in identifying trends in your revenue and expenses over time. This information can assist you in making business decisions that will improve your company’s efficiency and profitability.

Step 2 Produce a Trial Balance Report.

To construct your business’s income and expense statement, you’ll need to print a basic trial balance report. You may generate the trial balance quickly and conveniently using your cloud-based accounting software. Trial balance reports are internal documents that detail the ending balances of all accounts in the general ledger for a specific reporting period. Balance sheets are a critical component of the income statement because they are how a business gets data for its account balances. It will give you all of the end-of-period balance information necessary to produce an income statement.

Step 3 Determine your revenue.

Following that, you’ll need to determine the total revenue generated by your business during the reporting period. Revenue is defined as the total number of money earned for your services during the reporting time, even if you have not yet collected all payments. Add up all of the revenue line items in your trial balance report and enter the total in the income statement’s revenue line item.

Step 4 Calculate the cost of goods sold and the gross profit margin.

Your cost of goods sold reflects the direct labor, materials, and overhead costs associated with providing your goods or services. Add the cost of goods sold line items on your trial balance report and record the total cost of goods sold just below the revenue line item on the income statement. Subtract the total of your cost of goods sold from the sum of your revenue on your income statement. This computation will provide you with the gross margin or the gross revenue generated by the sale of your goods and services.

Step 5 Calculate your gross, taxable, and net income.

Subtract the gross margin from the amount of selling and administrative expenses. This will calculate your pre-tax income. The sum should be entered at the bottom of the income statement. To compute income tax, multiply your pre-tax income by the applicable state tax rate. This sum should be added to the income statement underneath the pre-tax income figure. Subtract the income tax from the pre-tax income amount to determine your business’s net income. Incorporate the figure into the income statement’s final line item. This will provide you with a broad overview of your business’s performance, allowing you to determine how lucrative you have been.

Step 6 Complete and submit the statement.

To complete your income and expense statement, include a header indicating that it is an income statement. Include information about your business and the reporting period covered by the income statement. After compiling all of the data, you’ve constructed an accurate income statement. This will provide you with a future grasp of income statement definition, significantly benefiting you and your business practice.

FAQs

What are profit and loss statements, and what do they mean?

The profit and loss statement is a business report that details revenue, costs, and spending for a specific time. The P&L statement, together with the balance sheet and cash flow statement, is one of three financial statements that every public business releases quarterly and annually.

Is a bank statement the same as a statement of account?

The term “bank statement” is also used to refer to an account statement. It demonstrates whether the bank is accountable for the money in an account holder’s account. Bank statements are an excellent resource for account holders who struggle to keep track of their money. Research shows that 1.7 billion individuals worldwide lack access to bank accounts. It’s pretty astounding that 1.7 billion individuals still lack bank accounts simply because they lack access to banks or ATMs in this day and age of sophisticated technology. And to think that this figure had improved significantly over the last three years when more than half a billion individuals gained access to proper banks.

How do you explain financial statements?

A statement of accounts is a record that summarizes all transactions between you and a particular customer over a specified time. Generally, business owners provide funds reports to their consumers to inform them of the balance due on credit sales made during that period.

Investors pay special attention to the Income and Expense Statement because it provides a comprehensive picture of its performance over a certain period. Lenders also consider it while determining the eligibility of a loan. Comparing income and expense statements to prior periods provides valuable insight into the direction a business is taking. Additional financial and expense reports can be found in our article on balance sheets.

You may also like these articles here

25+ FREE IT Statement Samples to Download

16+ FREE Bank Reconciliation Statement Samples to Download

11+ FREE Character Witness Statement Samples to Download

31+ FREE Settlement Statement Samples to Download

50+ FREE Risk Appetite Statement Samples to Download

10+ FREE Dissertation Problem Statement Samples to Download

4+ FREE University Equity Statement Samples to Download

18+ FREE Copyright Transfer Statement Samples to Download

7+ FREE Credibility Statement Samples to Download

3+ FREE Analytical Thesis Statement Samples to Download

50+ FREE Investment Policy Statement Samples to Download

8+ FREE Analytics Problem Statement Samples to Download

8+ FREE Technology Problem Statement Samples to Download

3+ FREE Revised Problem Statement Samples to Download

50+ FREE Acknowledgement Statement Samples to Download

2+ FREE Value Proposition Statement Samples to Download

browse by categories

Categories

- Marketing

- Business

- Plans

- Contracts

- Proposal

- Questionnaire

- Survey

- Sales

- HR

- Letter

- Form

- Agreement

- Checklist

- Biography

- List

- Analytics

- Finance

- Chart

- Documents

- Sheet

- Payroll

- Reports

- Log

- Maps

- Statement

- Analysis

- Notice

- Schedule

- Leave

- Note

- Design

- Calendar

- Budget

- Work

- Evaluation

- Profile

- Policy

- Certificate

- Project

- Donation

- Brief

- Worksheet

- Affidavit

- Checklist

- Assessment

- Memo

- Estimate