20+ SAMPLE Income Statement

-

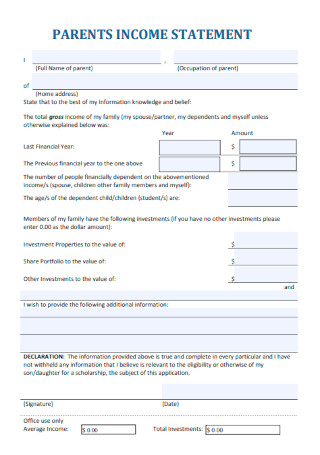

Parents Income Statement

download now -

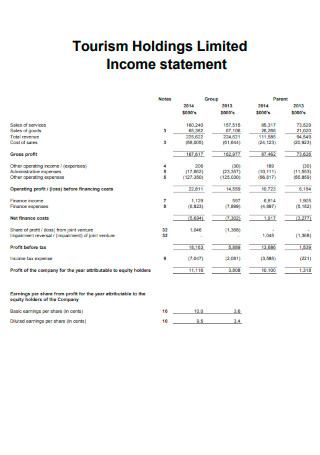

Tourism Holdings Limited Income Statement

download now -

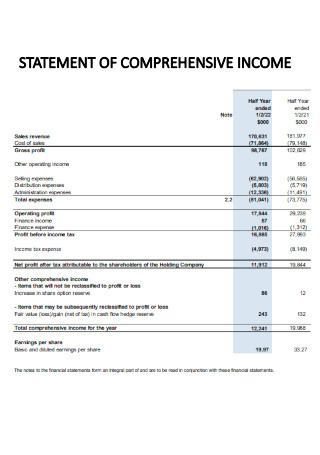

Statement of Comprehensive Income

download now -

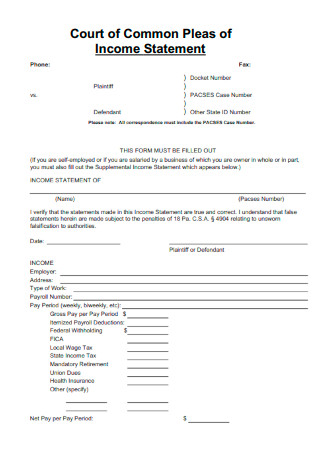

Court of Common Pleas of Income Statement

download now -

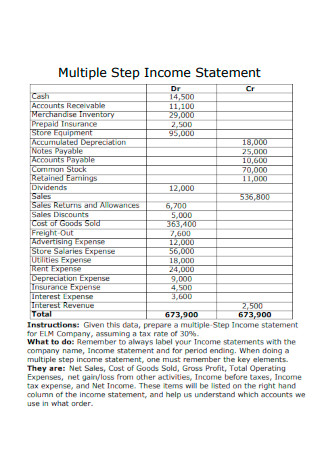

Multiple Step Income Statement

download now -

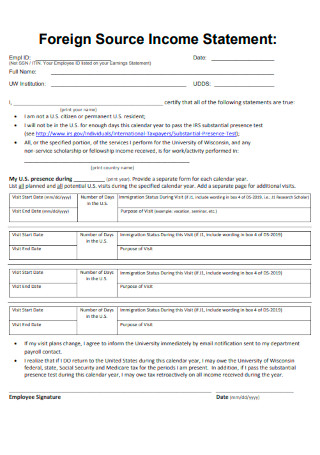

Foreign Source Income Statement

download now -

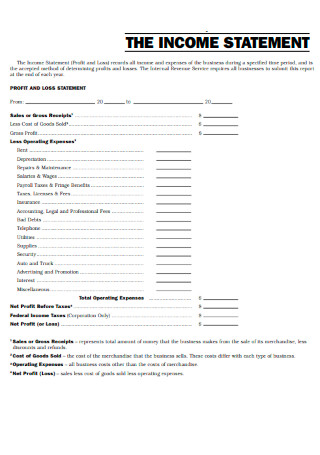

Sample Income Statement

download now -

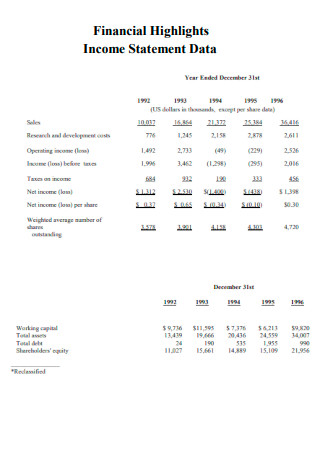

Financial Highlights Income Statement Data

download now -

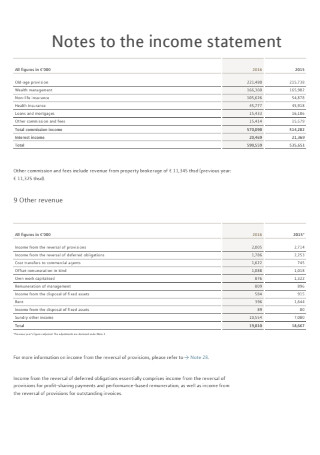

Notes to the Income Statement

download now -

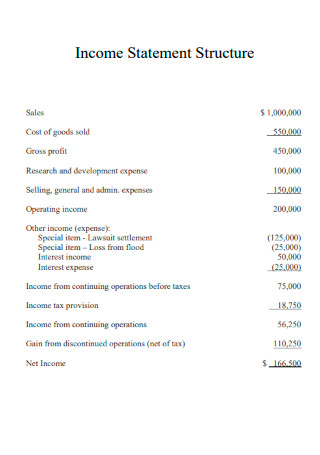

Income Statement Structure

download now -

Single Step Income Statement

download now -

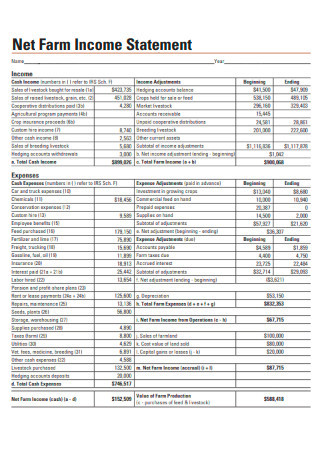

Net Farm Income Statement

download now -

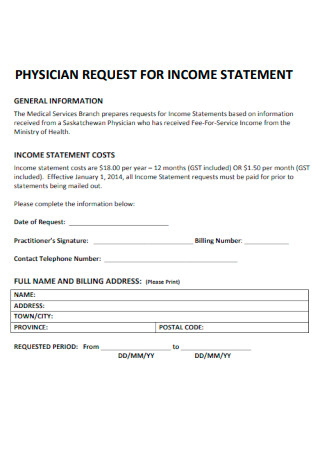

Physician Request for Income Statement

download now -

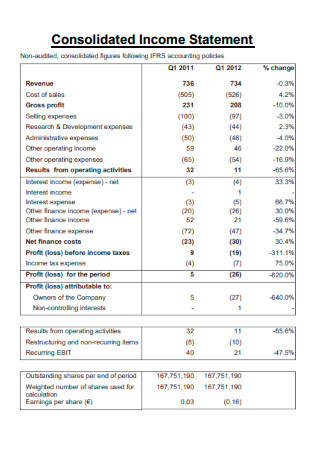

Consolidated Income Statement

download now -

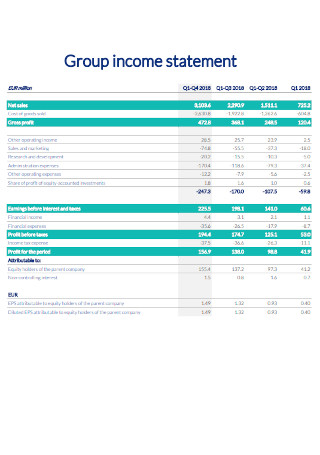

Group Income Statement

download now -

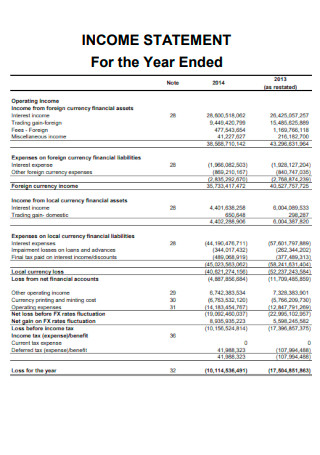

Income Statement For the Year Ended

download now -

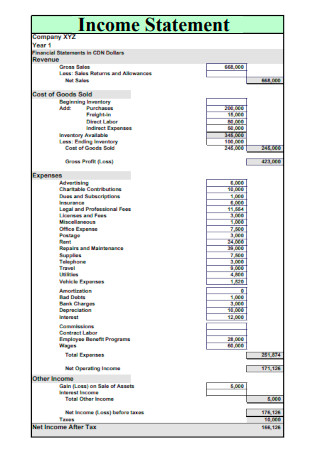

Basic Income Statement

download now -

Company Income Statement

download now -

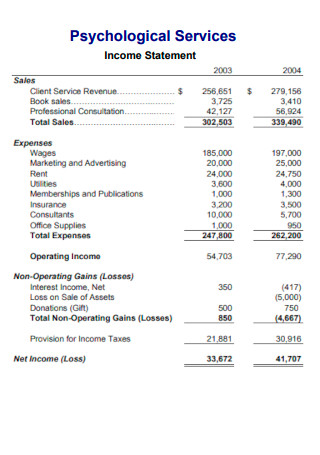

Psychological Services Income Statement

download now -

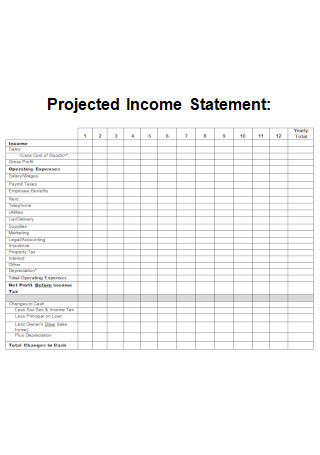

Projected Income Statement

download now -

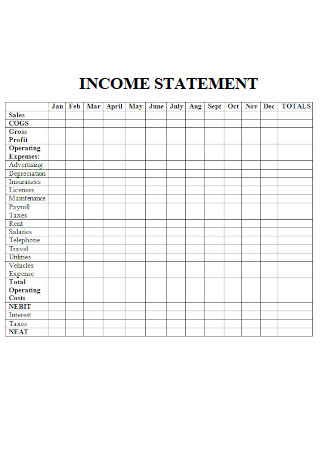

Formal Income Statement

download now

FREE Income Statement s to Download

20+ SAMPLE Income Statement

What Is an Income Statement?

Components of an Income Statement

How To Write a Comprehensive Income Statement

FAQs

What are the three most essential components of an income statement?

What is the general formula to use when calculating the income statement?

What is the purpose of writing the income statement?

What Is an Income Statement?

An income statement is a business document in the form of a report that covers the core financial statements of a business that details the profit and loss for a particular period. An income statement is also known as the profit and loss statement of a company. An organization determines the income and loss of a company by taking the total revenue and subtracting all incurred expenses from operational and non-operational tasks and activities. Companies utilize the income statement to summarize monthly, quarterly, and annual expense and income operations. The income statement is one of three statements that are used by different industries and companies for corporate financial reporting and accounting. The purpose of an income statement is to demonstrate the profitability of a business. It is also a way for a company to regulate its organizational budget by avoiding unnecessary spending more than it can afford. The income statement determines whether the business generates income or incurs loss for a specific period. Income statements contain various periods that follow different business operations. Constructing financial models also start with an income statement because it requires the least amount of information in comparison to cash flow statements and balance sheets. As such, a cash flow statement and a balance sheet come from information in an income statement.

According to the statistical data and information coming from Statista, Apple records the highest net profit of over 57.4 billion US dollars among the 50 top companies in the world for the year 2020. Saudi Aramco comes in second place with profits amounting to 49.27 billion US dollars for the same year.

Components of an Income Statement

An income statement varies from one company to another, and the income and expenses are dependent on the industry, type of business, and type of operations that an organization runs. The format of the document depends on the regulatory requirements, diverse business needs, and the operating activities of a particular company. However, there are several general components that the income statement must contain that are common in many similar documents. The section below covers the different elements of an income statement with descriptions to provide additional information about each one.

How To Write a Comprehensive Income Statement

Before the accounting team can proceed to construct the income statement using all the information at hand, they must know how to prepare it. The individuals working on the income statement must understand the essential components of the document, keep detailed records to make it easier to recover information, and decide the process of creating the document, either by hand or through computer software. The following section contains helpful steps to help an individual to construct the income statement.

-

1. Choose the Duration of the Reporting Period

The reporting period refers to a specific timeline the income statement covers. Choosing the right timeframe is critical, especially when the statement is for professional or legal purposes. Monthly, quarterly, and annual reporting periods are common for businesses. The reporting period that the accountant chooses depends on the goal of writing the document. Monthly reports detail a shorter period, convenient for applying tactical adjustments that affect the budget for the following month. Quarterly reports and annual reports provide a higher level of data analysis that leads to identifying leads and trends for the long term.

-

2. Calculate the Total Revenue and the Cost of Goods Sold to Arrive at the Amount of Gross Profit

After selecting the most appropriate reporting period for the income statement, calculate the total revenue that the company makes within that period. If the income statement speaks for the entire organization, it must consist of all the revenue from all facets and departments of the business. If the individual needs to prepare the income statement for a particular area of the business, they must make sure to limit the revenue to the products or services within that group. The next step is to calculate the cost of goods sold for the products or services that generate income for the business during the reporting period. It consists of the direct and indirect costs of producing and selling goods and services. The cost of goods sold must include the direct labor expenses, material costs, equipment expenses, distribution costs, and any other expenses that directly affect the production of products and services. After calculating the total revenue and the cost of goods sold, determine the gross profit by getting the difference between the two.

-

3. Calculate the Operating Expenses

After acquiring the figures for the gross profit, the next step is to calculate the operating expenses. These expenses are the indirect costs that are not associated with daily business operations. It differs from the COGS because these do not have a direct effect on the production of the goods and services that the company offers its customers. The operating expenses include costs that involve rent payments, utilities, overhead expenses, office supplies, and legal fees.

-

4. Calculate the Business Income

To calculate the total income for the reporting period, get the difference between the gross profit and the operating expenses. It is also the pre-tax income that the company acquires within the reporting period.

-

5. Compute the Interests and Tax Deductions

After calculating the income, the next step is to determine the interests and tax expenses. Interest is the debt or loan that the business needs to repay. In calculating the interest, there must be an understanding of how much the business owes and the interest rate that accompanies the amount. Also, calculate the tax charges for the reporting period, including federal, state, and local taxes and payroll taxes.

-

6. Calculate the Net Income

The final step in making the income statement is to calculate the net income of the business. Subtract the interests and the taxes from the business income. The resulting amount reflects the available funds of the business that it can use for added reserves, research and development, and business expansion.

FAQs

What are the three most essential components of an income statement?

The most essential elements of the income statement are revenue, expenses, and income.

What is the general formula to use when calculating the income statement?

To acquire the income of a business, subtract the organization’s expenses from the total revenue.

What is the purpose of writing the income statement?

The purpose of having an income statement for the company is to demonstrate its financial performance over a specific period. It speaks about the financial story of the company through its activities and operations.

When writing the income statement for a company, make sure to gather all the necessary information to compute its revenue for a specific period. Despite not having a format for constructing the income statement, make sure to follow all regulatory requirements, considering the business needs and the operating activities the company performs for the reporting period. It takes skill and experience to construct an accurate income statement. To help you create the document, download the 20+ Sample Income Statement in PDF | MS Word from Sample.net to construct a comprehensive income statement.