50+ Sample Investment Policy Statements

-

University Investment Policy Statement

download now -

Sample Investment Policy Statement

download now -

Foundation Investment Policy Statement

download now -

Investment Management Policy Statement

download now -

Board Members Investment Policy Statement

download now -

Cash Investment Policy Statement

download now -

Statement of Investment Policy Example

download now -

Simple Investment Policy Statement

download now -

College investment Policy Statement

download now -

Cash Investment Policy Statement Template

download now -

Teachers Investment Policy Statement

download now -

Health Care Investment Policy Statement

download now -

Investment Policy Statement for Short-Term

download now -

Employees Investment Policy Statement

download now -

Investment of People Policy Statement

download now -

Community Foundation Investment Policy Statement

download now -

Muncipal Investment Policy Statement

download now -

Club Investment Policy Statement

download now -

Bill Investment Policy Statement

download now -

Company Investment Policy Statement

download now -

Sample Investor Policy Statement Example

download now -

House Investment Policy Statement

download now -

Capital Management Investment Policy Statement

download now -

College Investment Policy Statement Template

download now -

Trust Investment Policy Statement

download now -

Institutional Investment Policy Statement

download now -

Investment Policy Statement for Foundation

download now -

Corporation Investment Policy Statement

download now -

Investment Policy Statement Format

download now -

Organization Investment Policy Statement

download now -

Investment Name Policy Statement

download now -

Standard Investment Policy Statement

download now -

Charitable Investment Policy Statement

download now -

Basic Investment Policy Statement Template

download now -

Fund Investment Policy Statement

download now -

Personal Investment Policy Statement

download now -

Retirement Investment Policy Statement

download now -

Investment Policy Statement for Institutional

download now -

Investment Policy Statement Worksheet

download now -

Employees Retirement Investment Policy Statement

download now -

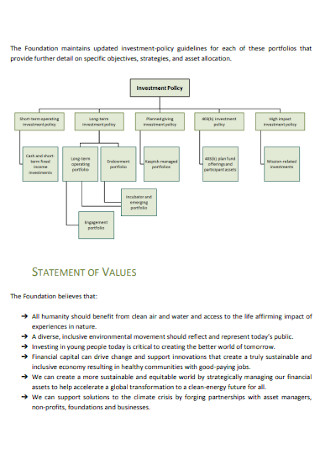

Foundation Statement of Investment Policy

download now -

Fund Portfolio Investment Policy Statement

download now -

Formal Investment Policy Statement

download now -

Investment Policy Statement for Non-Profits

download now -

Developing the Investment Policy Statement

download now -

Investment Policy Statement for Considerations

download now -

Financial Investment Policy Statement

download now -

Society Investment Policy Statement

download now -

Investment Policy Statement for Client

download now -

Trusts Investment Policy Statement

download now -

Endowment Investment Policy Statement

download now -

Investment Policy Statement for Associates

download now

FREE Investment Policy Statement s to Download

50+ Sample Investment Policy Statements

What is an Investment Policy Statement?

Examples of Investment Policy Statement

Essential Components of an Investment Policy Statement

How to Write an Investment Policy Statement

FAQs

What are the main sections of the investment policy statement?

What are the essential components of an investment policy statement?

What are some examples of investment policy statements?

What is an investment policy statement for an individual investor?

What is the importance of an investment policy statement?

What is an Investment Policy Statement?

An investment policy statement is a formal business strategy document that guides a client or an investor when it comes to the planning and implementation of an investment program. It describes the major investment goals and objectives of a client or an investor and explains the strategies that the manager must be able to carry out to fulfill these key objectives. Some main components that should be included in an investment policy statement are asset allocation, liquidity requirements, and risk tolerance.

This type of policy statement is used to provide proper guidance as it acts as a strategy map on portfolio construction and ongoing management, to care for the client’s order and standard, to help in avoiding deviations due to uncertain market conditions, and to keep clients fixated on their primary objectives. It should not be written to solely satisfy compliance or regulatory requirements and made without testing the effectiveness of the portfolio design and portfolio management plan to real results.

Examples of Investment Policy Statements

There are many investment policy statements and investment documents that many businesses and professionals use for their investment projects like an investment banking agreement or an equity investment agreement form. Here are some common examples of investment policy statements in different fields and industries.

Essential Components of an Investment Policy Statement

published a document that states the essential components of an investment policy statement. Consider these aspects when you create your investment policy statement.

How to Write an Investment Policy Statement

Be skilled in writing a well-coordinated investment policy statement to help you address a multitude of priorities and concerns and resolve the critical bottom line of investment performance. Follow the fundamental steps in creating this professional document for your investments.

Step 1: Detail the Scope and Purpose

Explain the context as you relate the information about the investor and the source of wealth. Describe who the investor is and indicate which of the assets of the investors are to be governed by the IPS. Then, elaborate the structure by setting the major responsibilities and actors, as well as building a care standard for the financial advisers. Build an organizational structure for investing. Indicate a risk management structure applicable to investing, designate responsibility for monitoring and reporting, and record acceptance of the IPS.

Step 2: Explain the Governance

Tell them who is responsible for determining investment policy, implementing investment policy, and tracking the outcomes of policy implementation. Briefly specify all stages of investment policy development and implementation to reinforce the obligations of financial advisers to give counsel and the obligations of principals to formally approve or disapprove of the policy. Outline the process for reviewing and updating the IPS. Detail the responsibility for engaging and discharging external advisers.

Step 3: Include Major Investment, Return, and Risk Objectives

Clarify the overall investment objective and mention the return, distribution, and risk requirements by stating the overall investment performance objective, specifying performance objectives for each asset class eligible for investment, explaining distribution or spending assumptions or policies, and setting up a policy portfolio as a basis for performance and risk assessments. Determine the investor’s risk tolerance and explain relevant constraints.

Step 4: Provide Risk Management

Set performance measurement and reporting accountabilities for reporting investment performance. Identify proper metrics for risk measurement and evaluation. Use those metrics to assess and evaluate the risk profile of investment portfolios. Outline the process which is crucial to rebalancing portfolios and target allocations. Add a short description in a separate appendix of the rebalancing policy in accordance to the proper risk management process.

FAQs

The main sections of the investment policy statement are the client’s extensive investing goals and financial objectives and a comprehensive discussion of the financial advisor with the client towards attaining a set of investment goals.

The essential components of an investment policy statement are the scope and purpose, governance, investment, return and risk objectives, and risk management.

Some examples of investment policy statements are university investment policy statements, foundation investment policy statements, investment management policy statements, board members investment policy statements, cash investment policy statements, college investment policy statements, teachers investment policy statements, health care investment policy statements, equity investment policy statements, employees investment policy statements, municipal investment policy statements, company investment policy statements, house investment policy statements, and nonprofit investment policy statements.

An investment policy statement for an individual investor is a statement that contains general investment goals and objectives, financial investment strategies, details on asset allocation, risk tolerance, liquidity requirements, and other related information.

The importance of an investment policy statement is to offer proper guidance on portfolio construction and current management, to keep the focus on the client’s mandate, and to guide in preventing deviations because of the unstable market conditions.

What are the main sections of the investment policy statement?

What are the essential components of an investment policy statement?

What are some examples of investment policy statements?

What is an investment policy statement for an individual investor?

What is the importance of an investment policy statement?

Whether you are creating an investment policy statement for an individual investor, equity, nonprofit, or investment management, it is integral to be well-informed on the common examples of investment policy statements, the essential components of this policy statement, and the basic steps on how to create this professional piece of writing. Access and navigate Sample.net to easily download and use our sample investment policy statement templates and other statement templates including research design statement templates, acknowledgment statement templates, and value proposition statement templates.