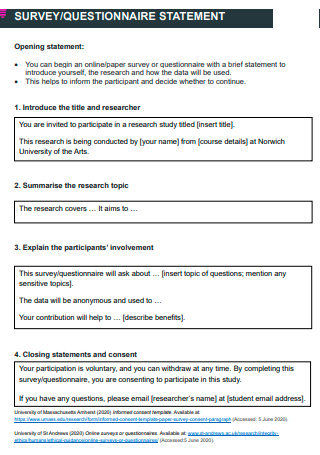

3+ Sample Questionnaire Opening Statement

FREE Questionnaire Opening Statement s to Download

3+ Sample Questionnaire Opening Statement

What Is a Questionnaire Opening Statement?

Benefits of Questionnaires

How to Create an Effective Survey

FAQs

What is a good start for an introduction?

How do you begin a conclusion?

What is a closure line on a survey?

What Is a Questionnaire Opening Statement?

A questionnaire opening statement, also known as a questionnaire introduction or survey introduction, tells the respondent what the questionnaire or survey is about. The first sentence of your questionnaire can make or break how likely people are to answer it. It tells if the questionnaire will be filled out or not. Response rates for different types of surveys are very different. Customer happiness and market research surveys often get between 10% and 30% of the people asked to fill them out. Most employee surveys get between 25% and 60% of the employees to fill out.

Benefits of Questionnaires

Have you ever questioned whether or not conducting a survey is a suitable alternative for your research? There are numerous resources available for analysis. This section will focus on what we are most familiar with: questionnaires. As with any research method, there are advantages and disadvantages. We have compiled the most incredible gems and traps so that you can make the best selection possible. Prepare to discover benefits such as cost-effectiveness, scalability, and rapid results. However, there are downsides, such as respondents having their agendas and a potential need for more personalization.

How to Create an Effective Survey

One of the most significant benefits is the ability to ask as many questions as desired. Naturally, it is to the marketer’s advantage to make each questionnaire brief, as responders may find lengthy questionnaires irritating. We propose a limit of 10 questions for online surveys. However, since they are efficient, cost-effective, and simple to administer, there is no harm in generating many questionnaires, each covering a subtopic of the significant issue and building upon the others.

1. Define the purpose of the survey

Before considering your survey questions, you must identify their aim. The purpose of the survey should be distinct, attainable, and pertinent. For instance, you may wish to comprehend why customer engagement declines in the middle of the sales process. Your objective could be: “I want to understand the internal and external factors that cause engagement to decline in the middle of the sales process.” Or you may be interested in post-sale client satisfaction. If so, the objective of the survey may be: “I want to learn how post-sale customer care and support, including online and offline channels, affect customer satisfaction.” The objective is to establish a defined, measurable, and pertinent objective for your survey. This ensures that your questions are suited to your objectives and that the data collected can match your objectives.

2. Make every question count

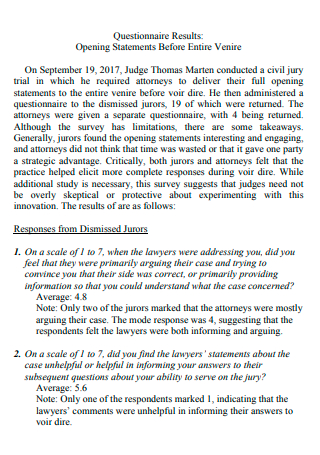

Every question on your survey questionnaire should directly affect achieving this objective as you construct it to glean vital information. Ensure that each survey question adds value and elicits responses that closely connect to your study objectives. For instance, if your participant’s exact age or state of residence is crucial to your results, feel free to inquire. If not, skip it to save yourself and your respondents time. Preparing your survey by determining the data you need to collect and then composing the questions is better. You may also use multiple-choice questions to elicit replies that contain more information than a simple yes or no. Not everything is black and white. It is also crucial to note that there might be a significant variation in the survey response for an internal and an external survey. According to research, the average employee survey response rate is between 30 and 40%, whereas the average external survey response rate is between 10 and 15%.

3. Keep it short and simple

Although you may be highly invested in your survey, the likelihood is that your respondents need to be. As a survey designer, one of your primary responsibilities is to maintain their attention and ensure they remain focused until the end of the survey. It is less likely that respondents will complete lengthy or topic-jumping questionnaires. Ensure that your survey follows a logical order and can be completed in a reasonable amount of time. Although respondents only need to know some details about your research project, it can be helpful to explain why you are asking about a particular topic. If they understand who you are and what you’re researching, they are more likely to provide focused and comprehensive responses.

4. Ask one question at a time

Although it is essential to keep your survey as concise as possible, this does not imply that you should duplicate questions. Attempting to include too much information in a single question can result in clarity and accurate responses. Take a closer look at questions in your survey that have the word “and” – it may indicate that the question has two sections. For instance: “Which of these cell phone service providers offers the best customer service and reliability?” This is troublesome because a respondent may perceive one provider as more dependable than another, although the latter has superior customer service.

5. Avoid leading and biased questions

Even if you don’t mean for them to, certain words and phrases can make your questions seem biased or lead the respondent to a specific answer. Generally, when you do a survey, you should only give people as much information as they need to provide an informed response. Keep the focus of your questions on the respondent and what they think. Don’t say anything that could be taken as your own opinion. In particular, evaluate adjectives and adverbs in your questions. If you don’t need them, get rid of them.

6. Speak your respondent’s language

This tip goes hand-in-hand with several others in this guide; it refers to using terminology that is only as complex or descriptive as necessary while conducting excellent surveys. Create questionnaires with language and vocabulary that your respondents can comprehend. Keep the language as simple as possible, minimize technical jargon, and use concise words. However, avoid reducing a question so much that its meaning is altered.

FAQs

What is a good start for an introduction?

It should start by giving your reader a general idea of the topic. In the middle of the introduction, you should check the topic so that the reader knows why the topic is essential and what you want to do with your paper.

How do you begin a conclusion?

Always begin a conclusion with a topic sentence. Restating the thesis from your introduction in the first sentence of your decision is an effective technique to remind the reader of your central point.

What is a closure line on a survey?

Our first slide defines a closing corner as a corner formed where a survey line contacts a previously set border between corners. The legal side of the closing corner is the actual intersection point, regardless of its monumented location.

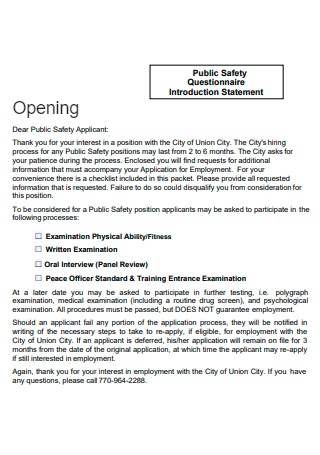

Ensure that the beginning of your survey is concise and direct, mainly if your questionnaire contains lengthy questions. People dislike reading long introductions before responding to your survey questions. By keeping the introduction to your survey as brief as possible, you force yourself to focus on the critical message. Obtaining responses to your request is the essence of the issue. Please refer to the free example templates provided above to aid you in drafting an introduction for your questionnaire.