31+ Sample Settlement Statements

-

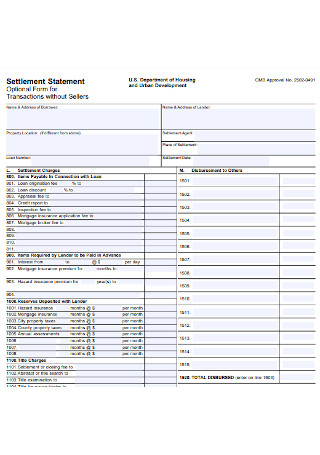

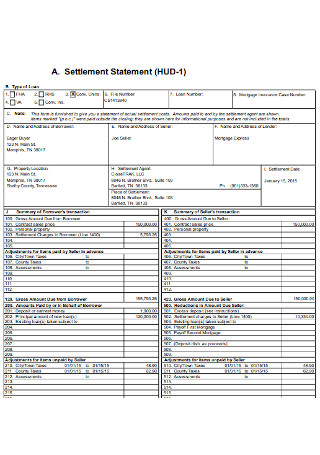

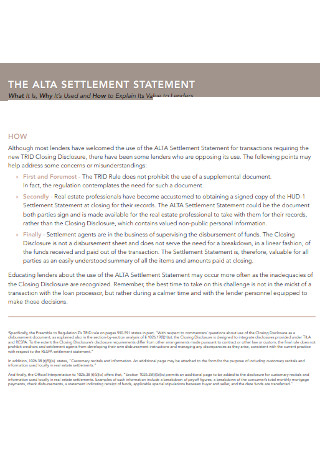

Housing Settlement Statement

download now -

Great Choice Settlement Statement

download now -

Sample Settlement Statement Template

download now -

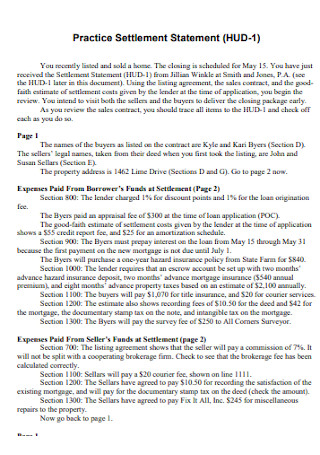

Practice Settlement Statement

download now -

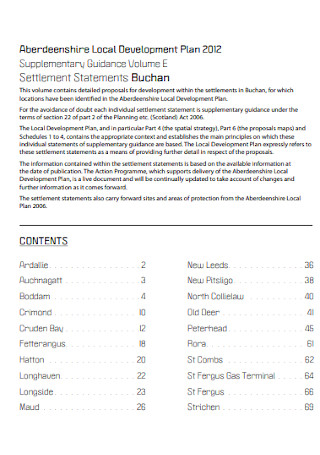

Local Plan Settlement Statements

download now -

Loan Settlement Statement Template

download now -

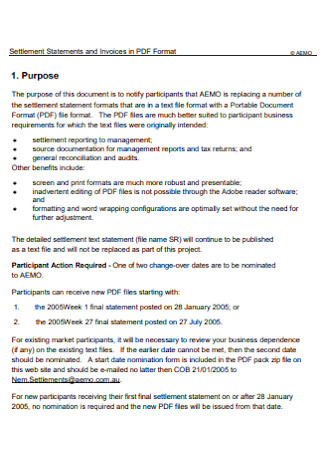

Settlement Statements and Invoices Template

download now -

Settlement Statement Format

download now -

Sample Settlement Statement Template

download now -

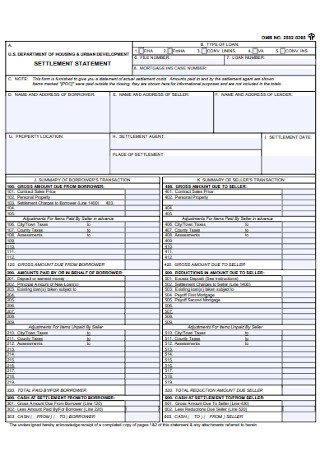

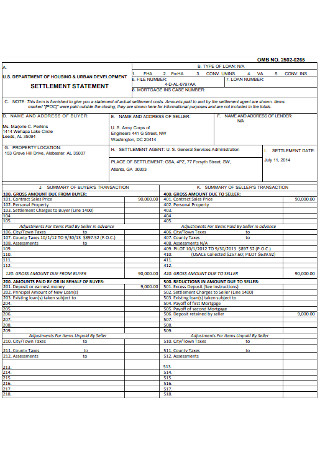

Urban Development Settlement Statement

download now -

Simple Settlement Statement Template

download now -

Addendum Settlement Statement Template

download now -

Commercial Escrow Settlement Statement

download now -

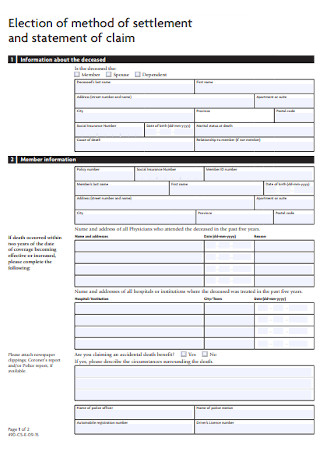

Settlement Statement of Claim

download now -

Card Settlement Statements

download now -

Basic Settlement Statement Template

download now -

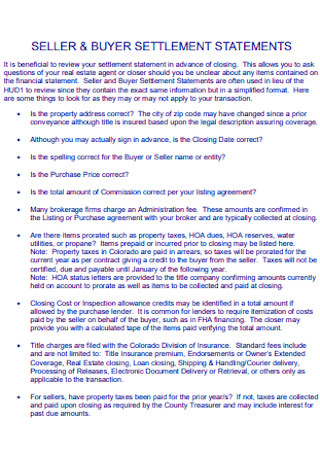

Buyer Settlement Statement

download now -

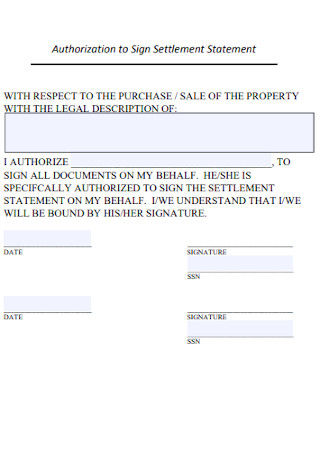

Authorization to Sign Settlement Statement

download now -

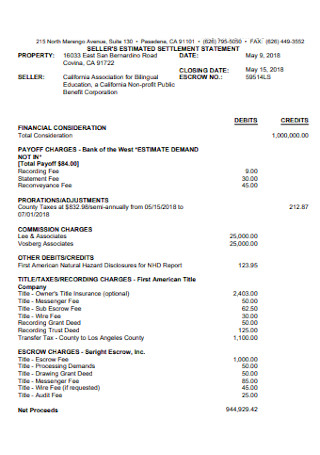

Seller Estimated Settlement Statement

download now -

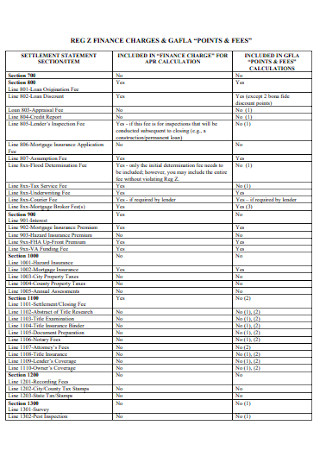

Financial Settlement Statement

download now -

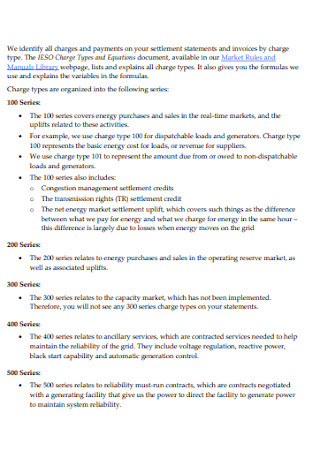

Market Operator Settlements Statement

download now -

Settlement Statements and Invoices

download now -

Formal Settlement Statement Template

download now -

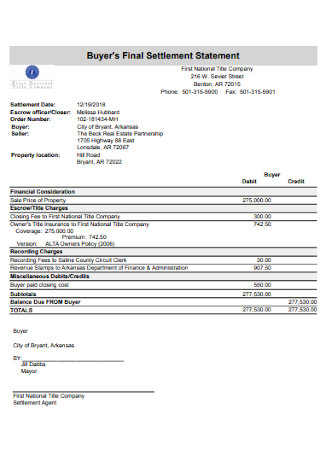

Buyer Final Settlement Statement

download now -

Final Settlement Statement Template

download now -

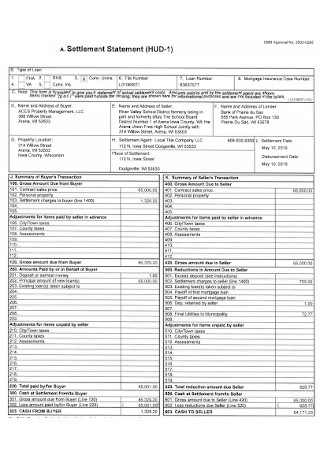

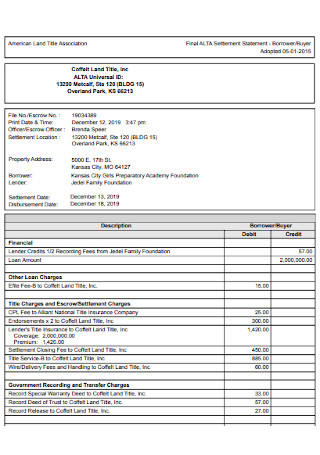

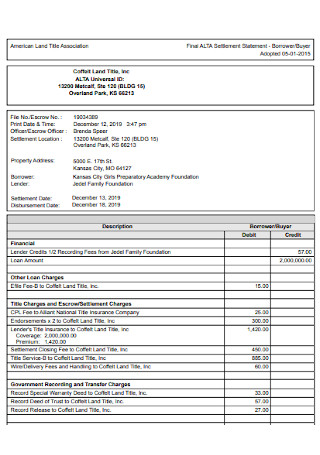

Borrower and Buyer Settlement Statement

download now -

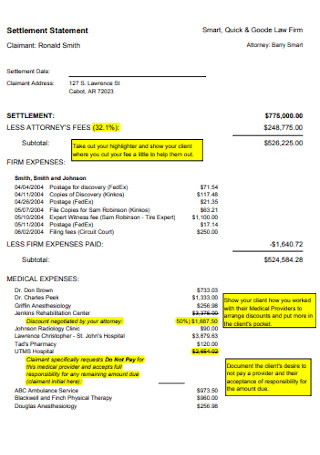

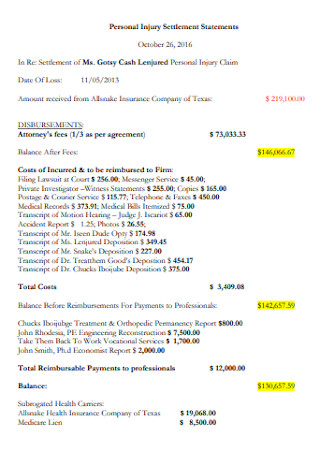

Personal Injury Settlement Statements

download now -

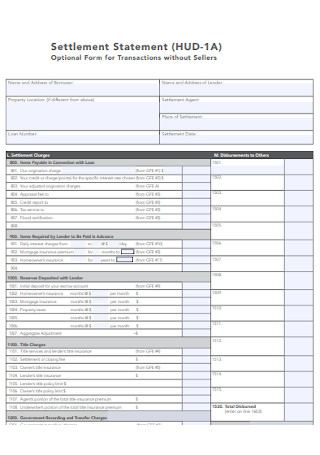

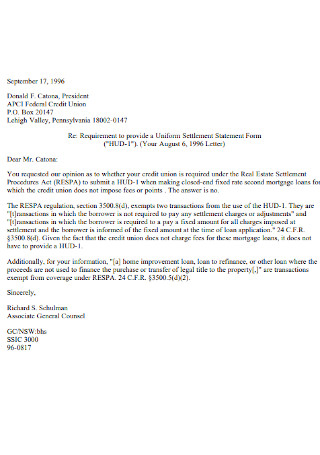

Uniform Settlement Statement Form

download now -

Printable Settlement Statement Template

download now -

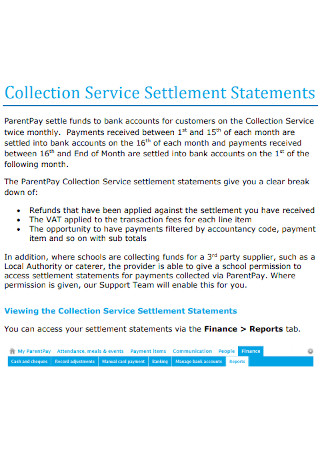

Collection Service Settlement Statements

download now -

House Settlement Statement Template

download now -

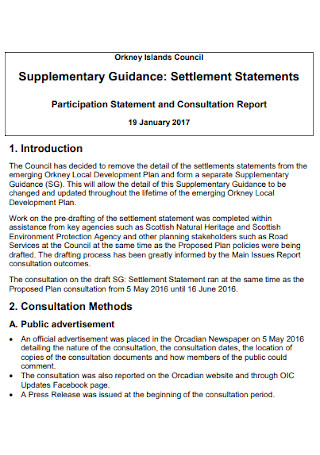

Settlement Participation Statements

download now

What Is a Settlement Statement?

A settlement statement is a type of document that details who paid for a particular mortgage or real estate transaction-related service. This statement itself is designed to document the aspects involved in the transaction to ensure that the vendor and buyer have the same information received. The settlement statement may include the property’s contract price, mortgage settlements, taxes already paid, real estate agent and title company fees, closing costs, and other transaction-related expenses. The statement describes how these fees would impact the consumer and the seller. During most transactions, you will complete a settlement statement form. States and even some local regions have regulations regarding this. The closing agent is the one who will provide the transaction’s appropriate structure.

Benefits of Loans

Personal loan agreements may be used for various purposes, such as debt settlement agreements and medical bills. Some lenders can deposit the funds into your account as quickly as the following business day. In addition, average interest rates tend to be lower than those of other forms of debt, such as credit cards. Personal loans, like all financial products, have disadvantages. For instance, some lenders impose high fees, which can substantially increase the cost of borrowing. Before taking out a loan, you should evaluate the pros and cons to determine if it’s the best financing option for you and consider other options.

How to Create a Debt Settlement Plan

If you feel as though you are drowning in debt, the notion of settling for less than you owe can be appealing. You could employ a debt settlement company to negotiate settlements with your creditors on your behalf. Before dropping your accounts, you may need to save enough money to pay the creditor and the settlement company’s charges. Although many creditors may be willing to resolve your debt for smaller than you owe, there is no assurance that debt settlement will be successful. If you’re thinking about attempting it on your own and you’re interested in this, here are some measures you may want to take:

1. Assess Your Circumstance

Create a list of your past-due accounts, including the names of your creditors, the amount you owe, and the amount of time you are behind on payments. This list will serve as the foundation for your plan and help you prioritize which accounts to tackle first. If you believe that you can afford to make minimum payments or that you may be able to remain current on your accounts with a hardship payment plan agreement template, this may be a preferable option. Debt settlement can save you money, but it’s not guaranteed to work, can harm your credit, and may incur additional fees in the interim.

2. Investigate Your Creditors

Creditors may have varying policies regarding when and how much they will accept a settlement offer. Some creditors may be more likely than others to sue you to gather an unpaid debt. It may be prudent to negotiate settlement agreements with these creditors first. You can conduct online research interest statements to learn about others’ experiences and shape your proposal but remember that their outcomes may not reflect the company’s current procedures.

3. Start a Settlement Fund

Although you will not be required to repay the total amount, you must still pay something to resolve an account. Typically, creditors may demand a single sum payment of 20 to 50 percent of the total amount owed. You can pay this amount over several monthly installments, although doing so may incur additional fees. You can establish a new bank account for your settlement fund so you are not tempted to spend it elsewhere and avoid accidental overdrafts during the settlement process. Make consistent deposits into the account to accumulate sufficient funds for a reasonable settlement offer. Keep your settlement funds in an account not managed by a creditor with whom you are negotiating to prevent the company from gaining insight into your financial situation.

4. Make an Offer of Debt Settlement to the Creditor

Once you have sufficient funds to resolve a debt, you can contact the creditor and make an offer. In some instances, the creditor may have already extended an offer of resolution. You could either accept the offer or make a reduced counteroffer. Share why you can only afford the settlement amount you’re offering, whether you’ve lost your job or are dealing with medical and health invoices. Verify that the offer is for a specific dollar amount rather than a percentage of your balance to avoid confusion. If the creditor refuses to compromise, you may wait until the debt is sold and then negotiate with the debt buyer or collection agency.

5. Review a Documented Debt Settlement Agreement

A company representative could provide a grand bargain over the phone, but you need an official written offer. Write your name, the name of the creditor or debt collector, and the account number on the proposal. It should also include the terms of the settlement, such as the quantity being paid, whether it is delivered in a lump sum or installments, and the due dates for the payments. Ensure that the letter specifies that your payment will fulfill your obligation. It may state that the account will be settled, paid in full, accepted as full settlement, or words to that effect. Keep a replica of the letter and any payment confirmations if a debt collector contacts you again. Sometimes, you may be required to negotiate a payment plan with your original creditor before receiving the settlement letter. Give the company several business days to deliver the letter to you in the interim while you attempt to negotiate a payment plan for the future. You may then cancel the payment if no note is received.

FAQs

Does settlement equal closing?

Settlement generally refers to the conclusion of the home-buying procedure and is synonymous with closing. On the day of closing, the transfer of affidavit of ownership and delivery of payment forms for the property is handled.

What is the settlement process?

Settlement is the process of paying the purchase price balance and acquiring a legal affidavit of property. At closing, your lender will disburse your home loan funds, and you will receive the house’s keys. Typically, settlement occurs six weeks after the exchange of contracts.

Is a personal loan good or bad?

Personal loans are an effective method for consolidating and paying off expensive credit card debt. You will use the funds for essential expenses. Other beneficial uses for personal loans include paying for emergency expenses and home improvements. In the third quarter of 2022, 22 million Americans will have a personal loan, up from 19.9 million at the end of 2021. The number of consumers with a personal loan has risen for five consecutive quarters. In the third quarter of 2022, 1.3% of outstanding consumer debt comprised personal loan debt.

Settlement Statements and Statements of Adjustment can be complex, despite their apparent simplicity at first glance. If you require assistance drafting your Settlement Statement or would like to review a sample Settlement Statement, please check the attached templates. If you want additional samples and formats, please refer to the settlement statement samples provided in this article.