7+ SAMPLE Yearly Budget

-

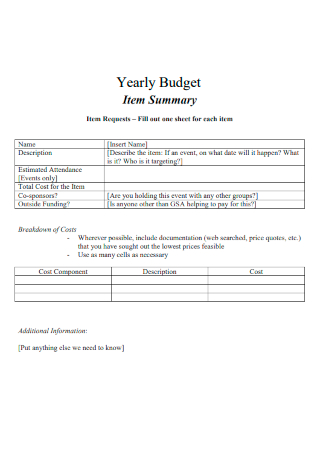

Yearly Budget Item Summary

download now -

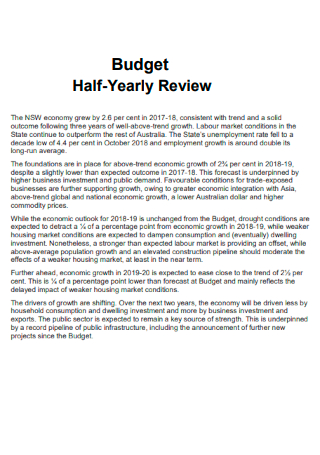

Budget Half-Yearly Review

download now -

Finances Yearly Budget

download now -

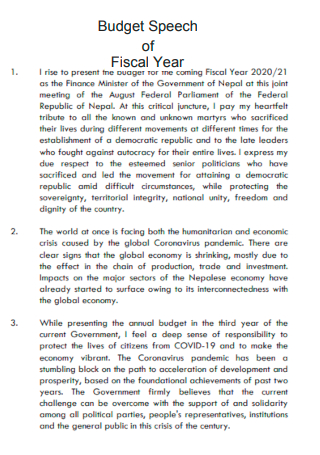

Budget Speech of Fiscal Year

download now -

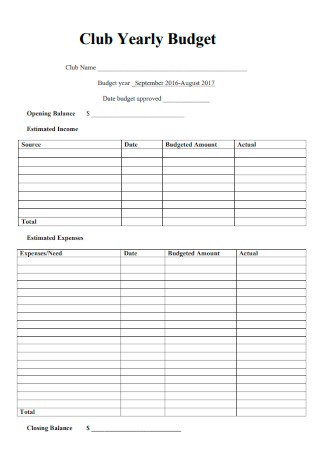

Club Yearly Budget

download now -

Example Yearly Budget

download now -

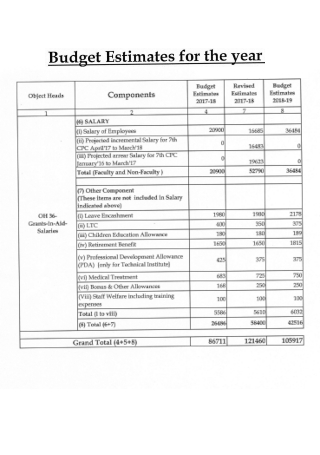

Budget Estimates for the Year

download now -

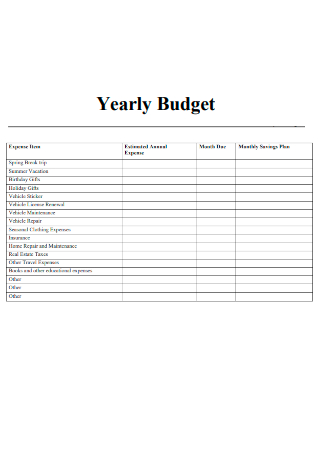

Sample Yearly Budget

download now

What Is a Yearly Budget?

A yearly budget or an annual budget is a business document that contains information about the projected income and expenses of a company within 12 months. The process of creating the budget starts with balancing and identifying the sources of income against the expenses the business incurs. In several instances, especially for organizations and businesses, the annual budget includes several other documents such as a balance sheet and cash flow statement. Individuals, corporations, agencies, governments, and other entities utilize the yearly budget to keep track of vital financial information and activities. Annual budgets are balanced if the projected expenditures are equal to the projected revenues. There is a deficit in the calculations of expenditures in which they exceed the acquired income. On the other hand, there is a budget surplus if the income exceeds the incurred expenses. Yearly budgets apply to either a fiscal or calendar year. The budgets help accounting teams to plan for the following years and make all the necessary adjustments for the company to achieve its organizational and financial goals. Meanwhile, personal yearly budgets can better manage their finances.

According to the information from the official website of the White House entitled the Budget of the United States Government for the fiscal year 2022, the United States President Joe Biden releases an amount of 6.011 trillion US dollars in the federal budget proposal in May of 2021 for the fiscal year 2022.

Components of a Yearly Budget

There must be a breakdown of the business income and the anticipated expenses on a monthly or quarterly basis for a budget to become adequate and effective. The size of the organization matters when choosing whether the division of the budget is on a monthly or quarterly basis. Note that the yearly budget must incorporate separate accounts for each department of the organization. Remember that the best budgets are simple and adjustable. If circumstances arise, the budget can adapt and change to give the organization a clear picture of its financial health and status. There are different factors that a company considers when constructing a yearly budget. The section below covers the elements that are essential in developing an annual budget to maintain control over company finances.

How To Compose a Yearly Budget for an Organization

All budgets and budget plans consist of two main elements. It must clearly state how much money the organization is earning and how much money it is spending. Before the accounting team utilizes its resources to craft and perfect a budget plan for the company, they must gather every relevant document that has to do with accounting. It must include pay stubs, utility bills, bank statements, and all other transactions that the business engages in, especially if it deals with large amounts of money. Gather all the necessary information to compose the yearly budget for the organization. The section below covers practical and useful steps that accounting teams can do to develop a yearly budget.

-

1. Decide How the Organization Creates Its Budget

There are two ways for a company to prepare its budget. They can use a previous budget plan or create a green-field budget. In using previous budget plans, accountants take the budget from the previous year to work out differences or fluctuations in pricing to modify the present budget to accommodate these changes. A green-field budget does not come from a previous budget. Instead, accountants must accurately identify the activities and resources a company needs to operate and maintain the entire system. When using a green-field budget, break the requirements down into several categories. Annual budgets must refer to the five-year plan of the organization since it shows the company a clear picture of the expenses for the next five years and prepares the organization for provisions for possible revenue increases.

-

2. Estimate For the Operating Expenses for the Year

Each year, there are recurring operating expenses. Categorize them into broader categories like administration and operations and contributions to reserves. The administration and operations category includes treatment costs, maintenance, employee wages, and utilities. Meanwhile, the contribution to reserves section refers to the contributions the organization makes to its reserve accounts. Administration costs cover wages and benefits, rentals, insurances, fees, tax, service charges, and training costs. Meanwhile, operation costs refer to utilities, maintenance, monitoring, testing, consumables, machinery, equipment, and other categories. It is also advantageous to group expenses into variable expenses and fixed costs.

-

3. Estimate the Operating Revenue

For the organization to achieve long-term operational stability, the accounting team must have a sufficient amount of income from customers each year to cover their operating expenses. When it comes to sustainability, the company must operate its systems for the long term, provide replacement of assets, and manage upgrades and expansions as necessary.

-

4. Work Out the Revenues for the Following Year

To calculate the revenue that the business receives for its operations by selling products or services, get the difference between the operating expenses and the contributions to reserves. The results that the company can either be positive or negative. Having a positive outcome means that the company stayed within the budget. If the results come out negative, it means that the accounting team must adjust the revenue, expenses, and contributions on reserves.

FAQs

How do you prepare a yearly budget?

When it comes to preparing a personal budget for each year, there are some things to keep in mind. You can start with a simple template to incorporate revenue and expenses. To compose a yearly budget, you must:

- Gather all the financial paperwork

- Calculate your monthly income

- Create a list of monthly expenses

- Identify which expenses are variable and fixed

- Get the difference between the income and expenses

- Make the necessary adjustments to expenses

Is it better to have a monthly or yearly budget?

Creating yearly budgets is advantageous to businesses that want to set long-term goals. Monthly budgets, on the other hand, allow individuals and businesses to keep track of expenses for the long-term goals they wish to claim.

What are the three types of budgets?

Budgets that businesses use are of three types, these include balanced budgets, surplus budgets, and deficit budgets.

Yearly budgets are essential for the business to achieve organizational and long-term goals to ensure business operations. Writing out the yearly budget allows organizations to compute their income, expenses, and net revenue. For individuals writing for the first time, they must take the time to research the yearly budgets that are similar to their industry and line of business. Compose a yearly budget for the organization by downloading templates from the 7+ Sample Yearly Budget in PDF in the article above, only from Sample.net.