30+ FREE Budget Worksheets (Kids, Students, Personal, Monthly, College)

-

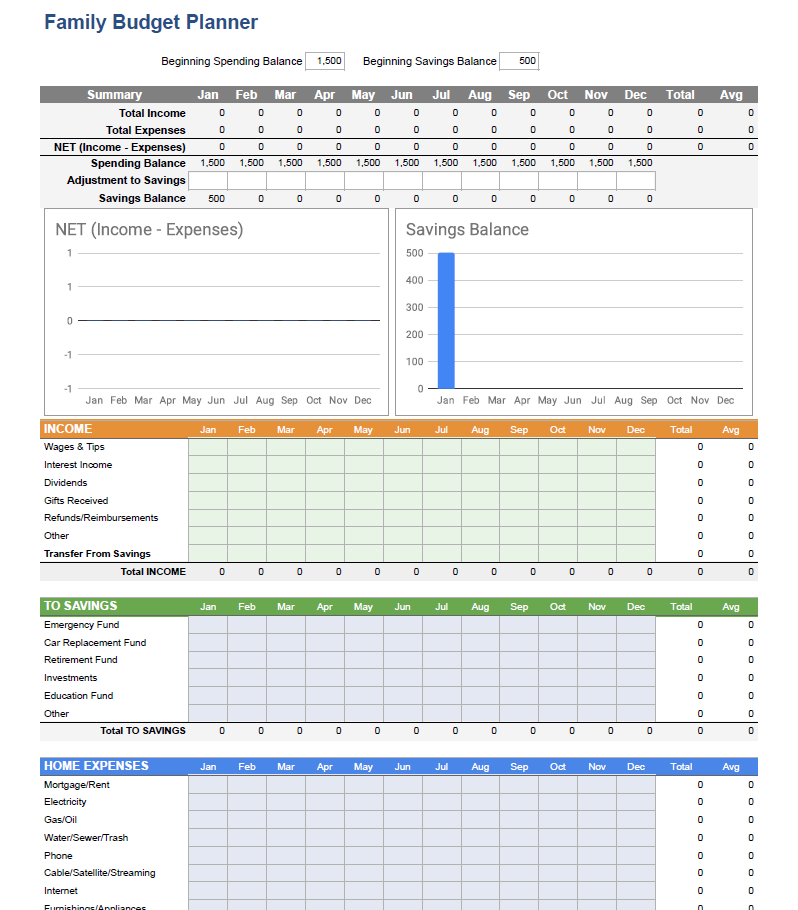

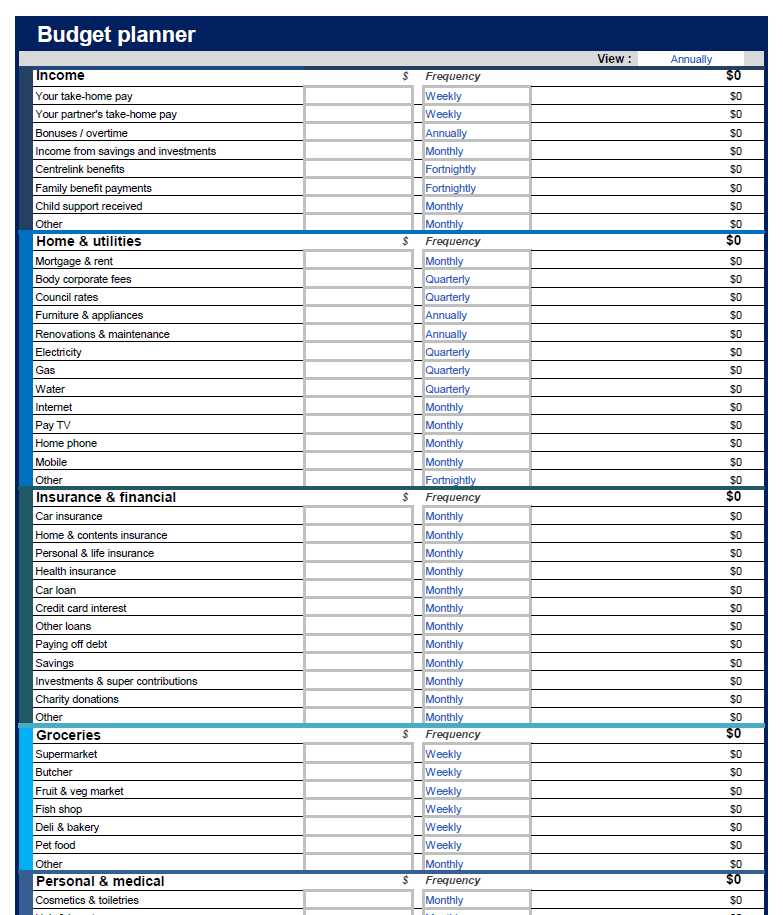

Family Budget Planner

download now -

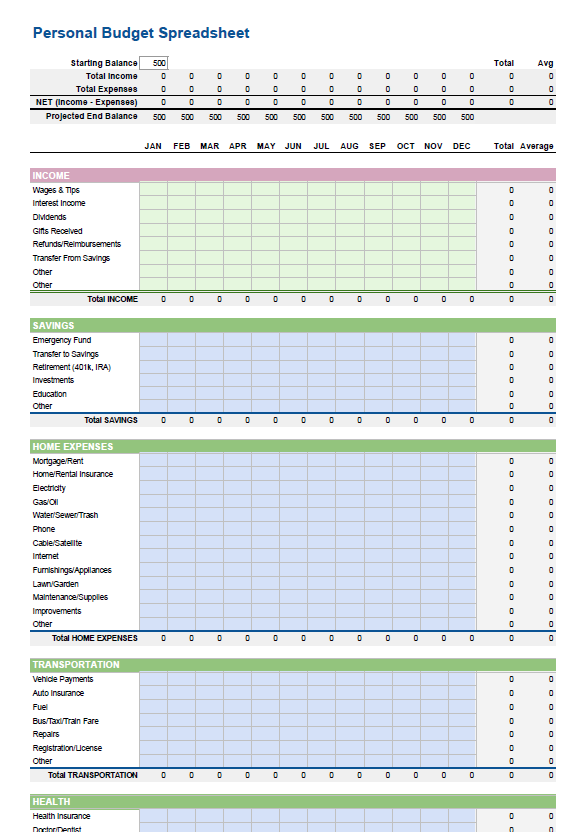

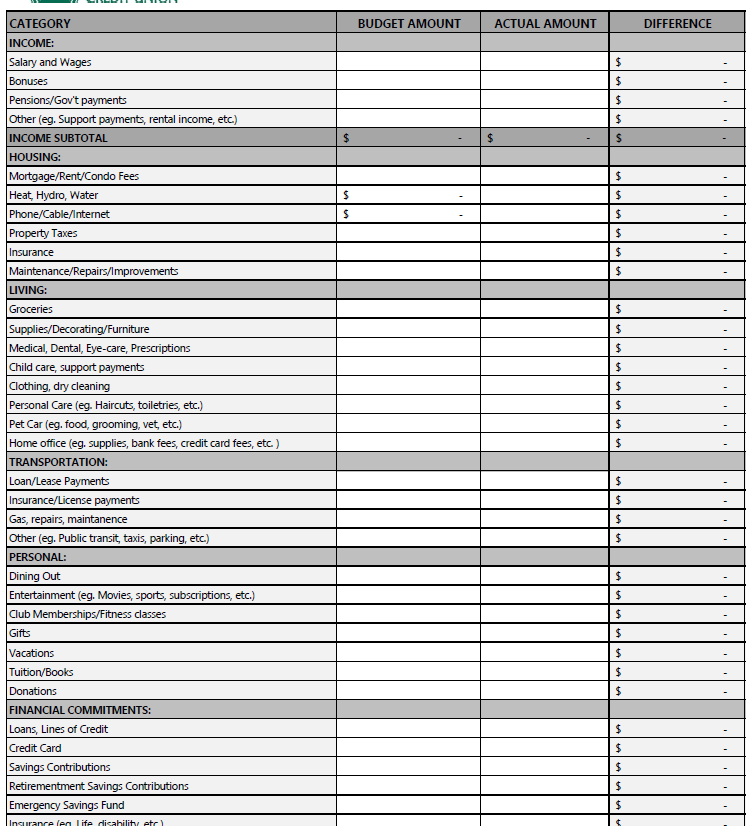

Personal Budget Worksheet

download now -

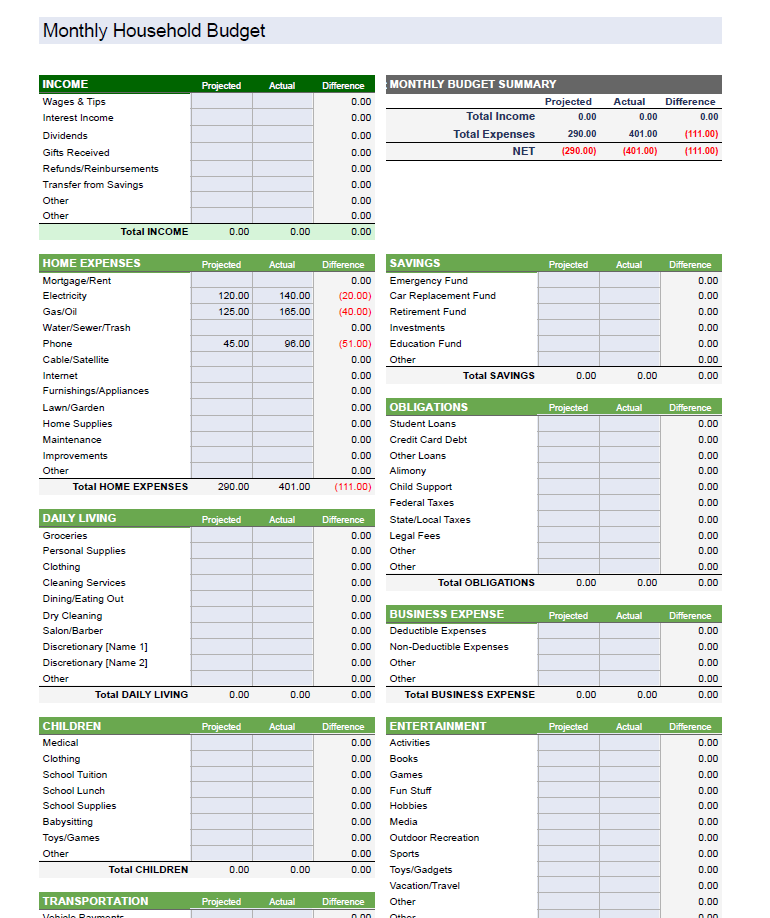

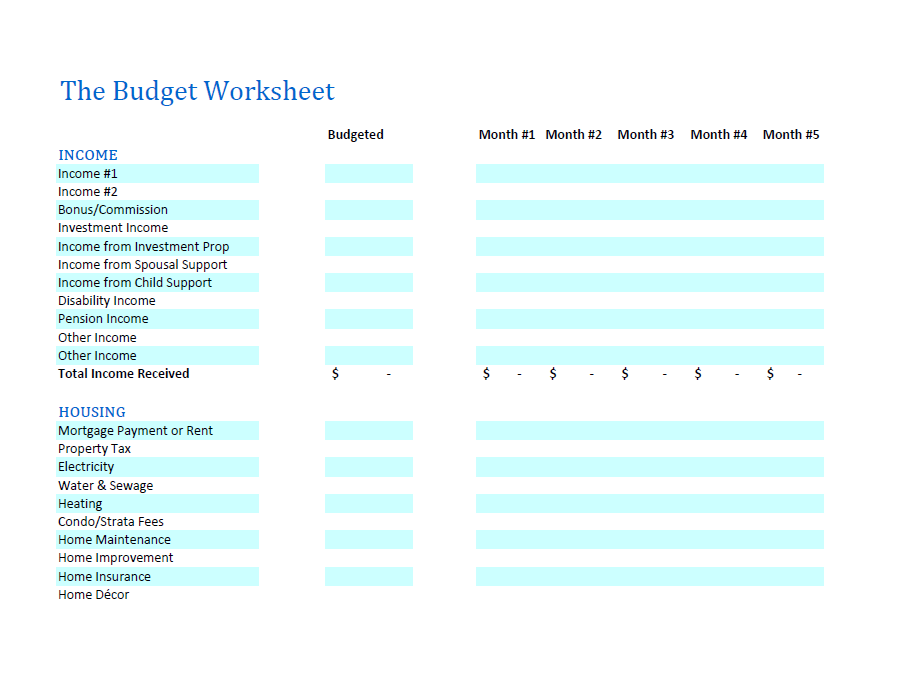

Monthly Household Budget Template

download now -

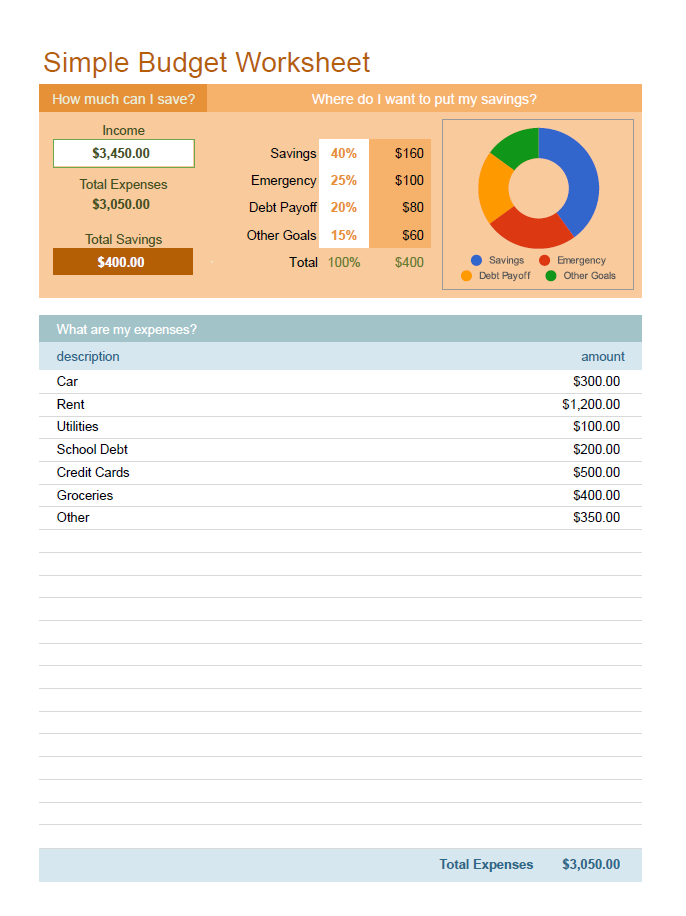

Simple Budget Worksheet

download now -

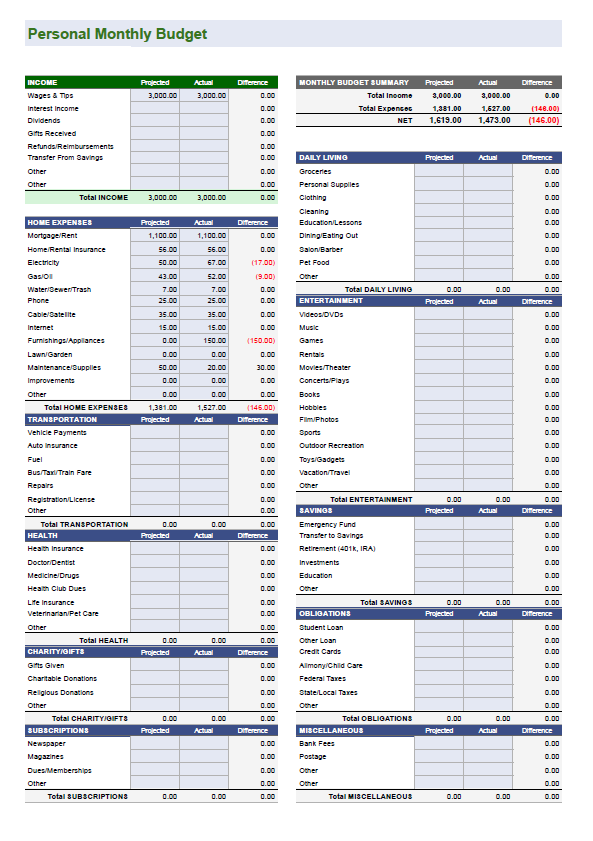

Personal Monthly Budget Worksheet

download now -

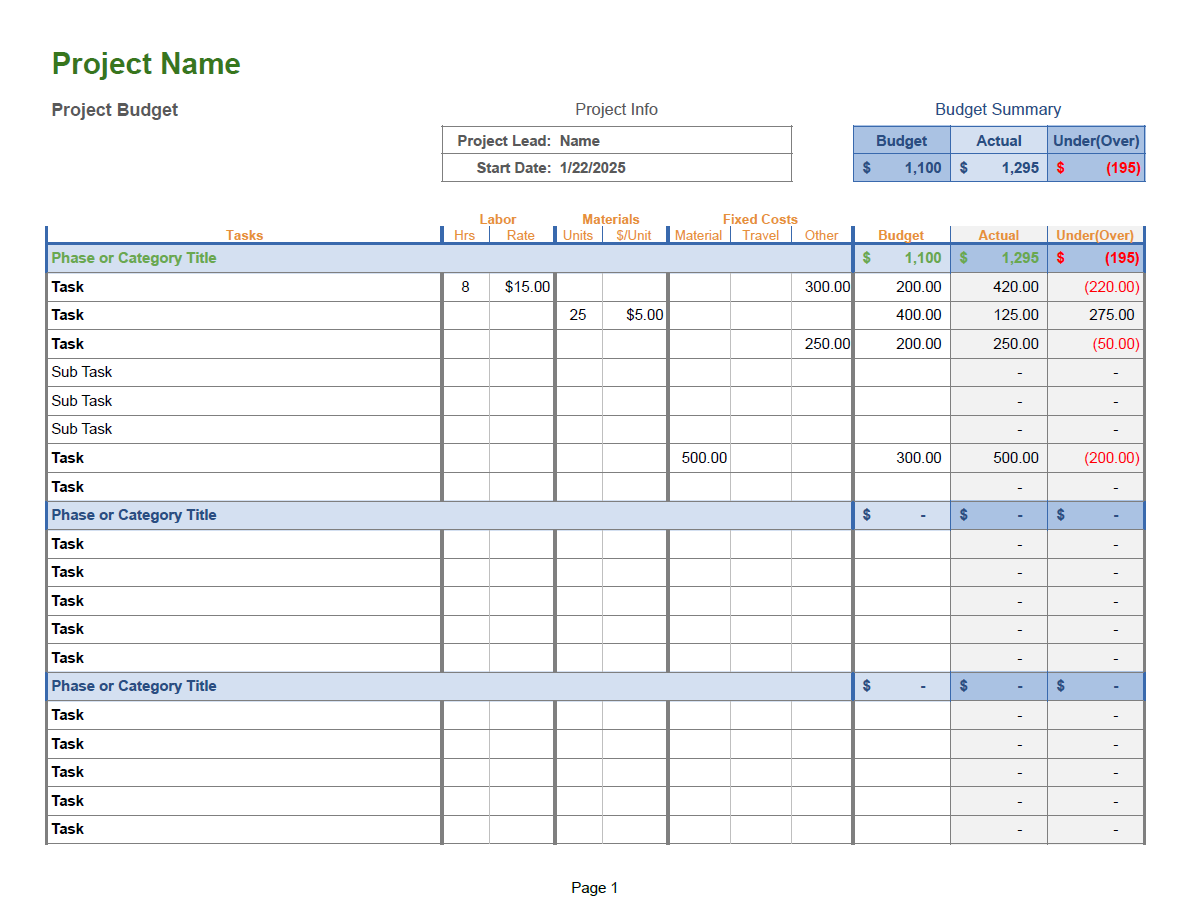

Project Budget Template

download now -

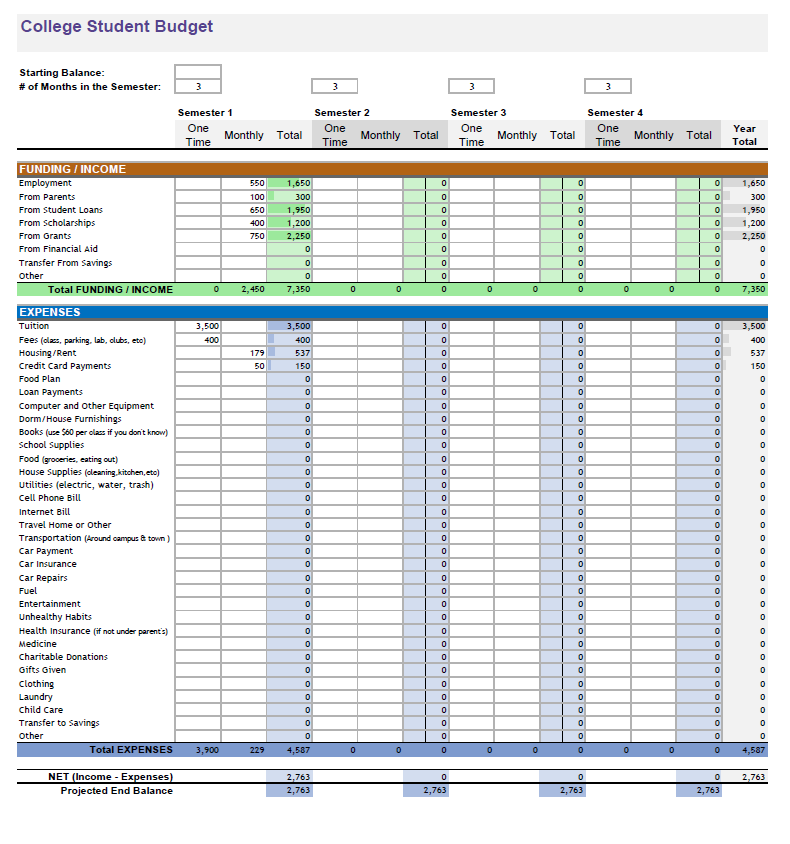

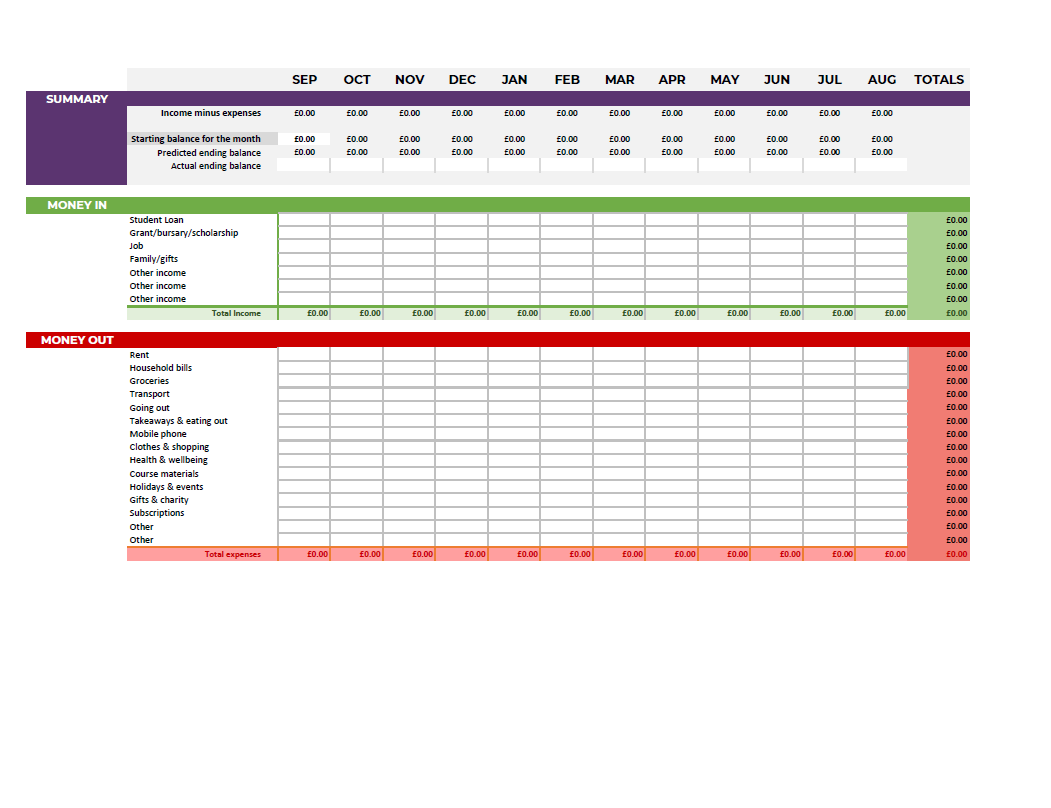

College Student Budget

download now -

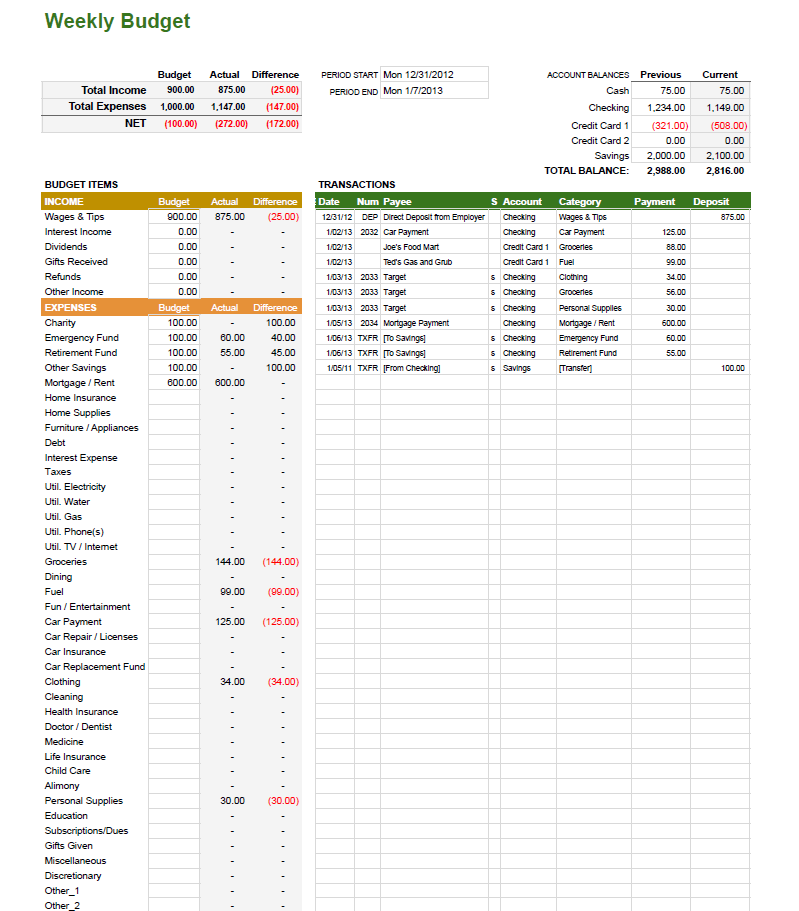

Weekly Budget Worksheet

download now -

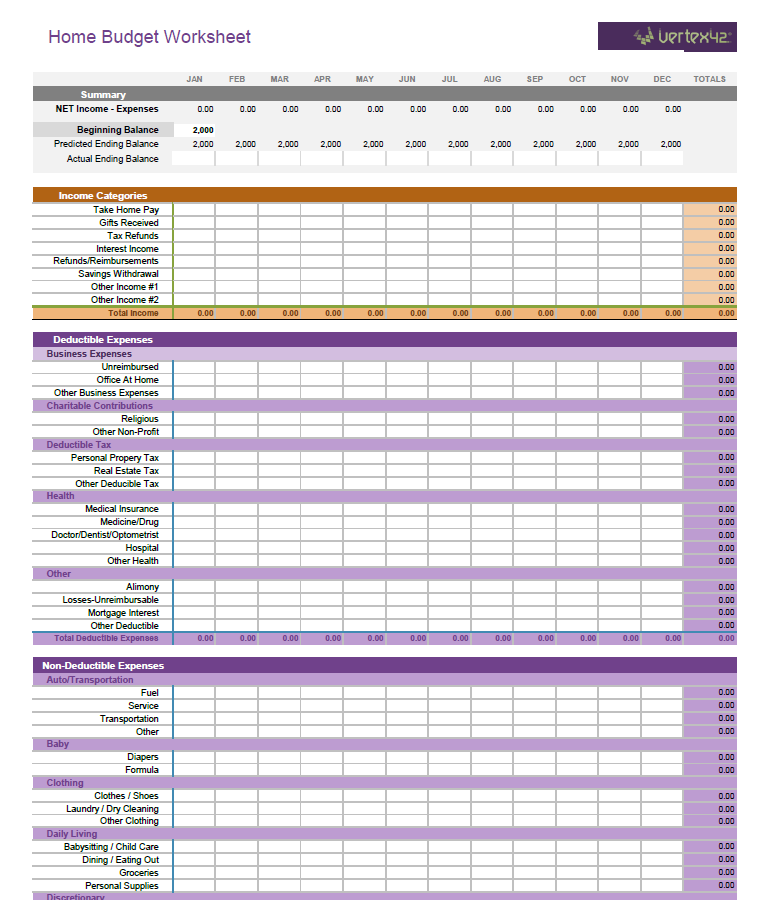

Home Budget Worksheet

download now -

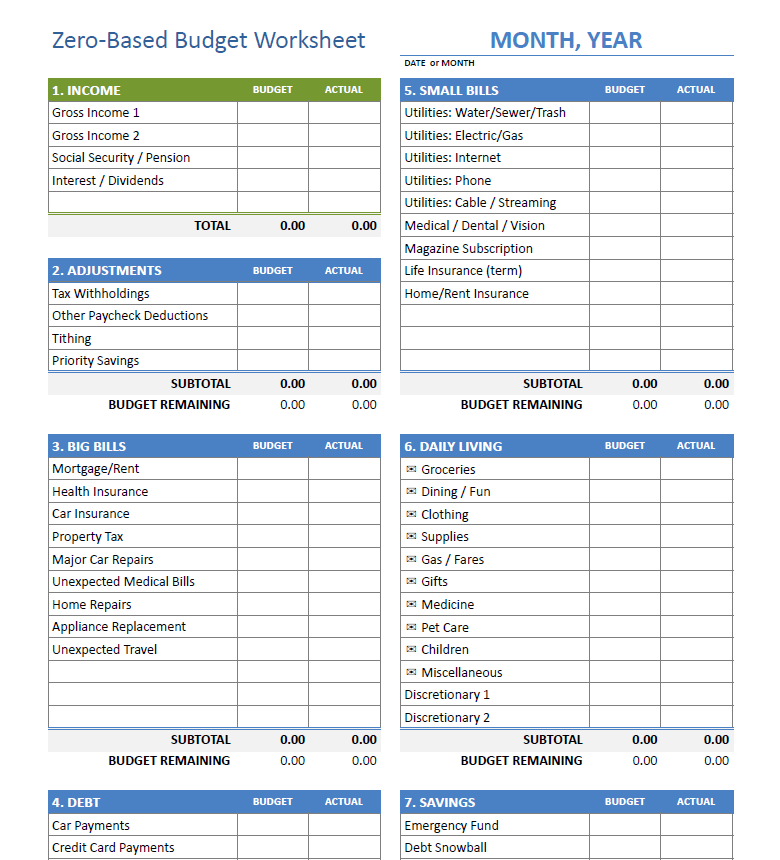

Zero Based Budget Worksheet

download now -

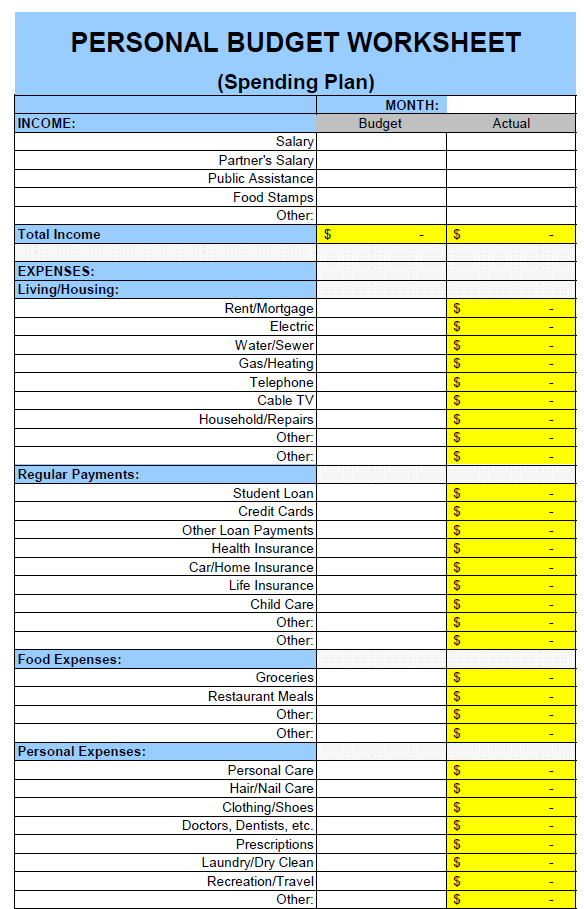

Personal Budget Worksheet

download now -

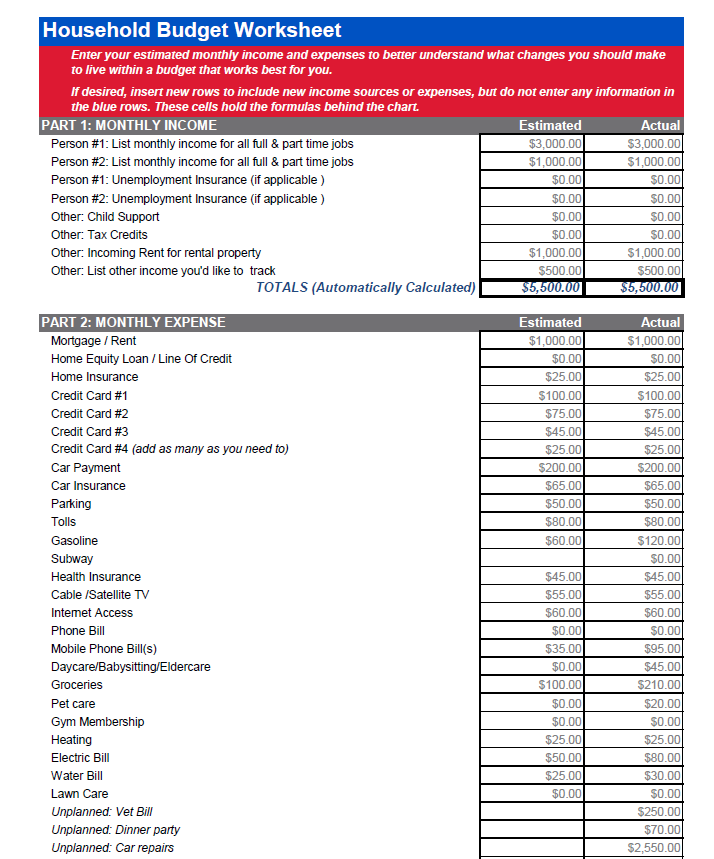

Household Budget Worksheet

download now -

Budget Planner Worksheet

download now -

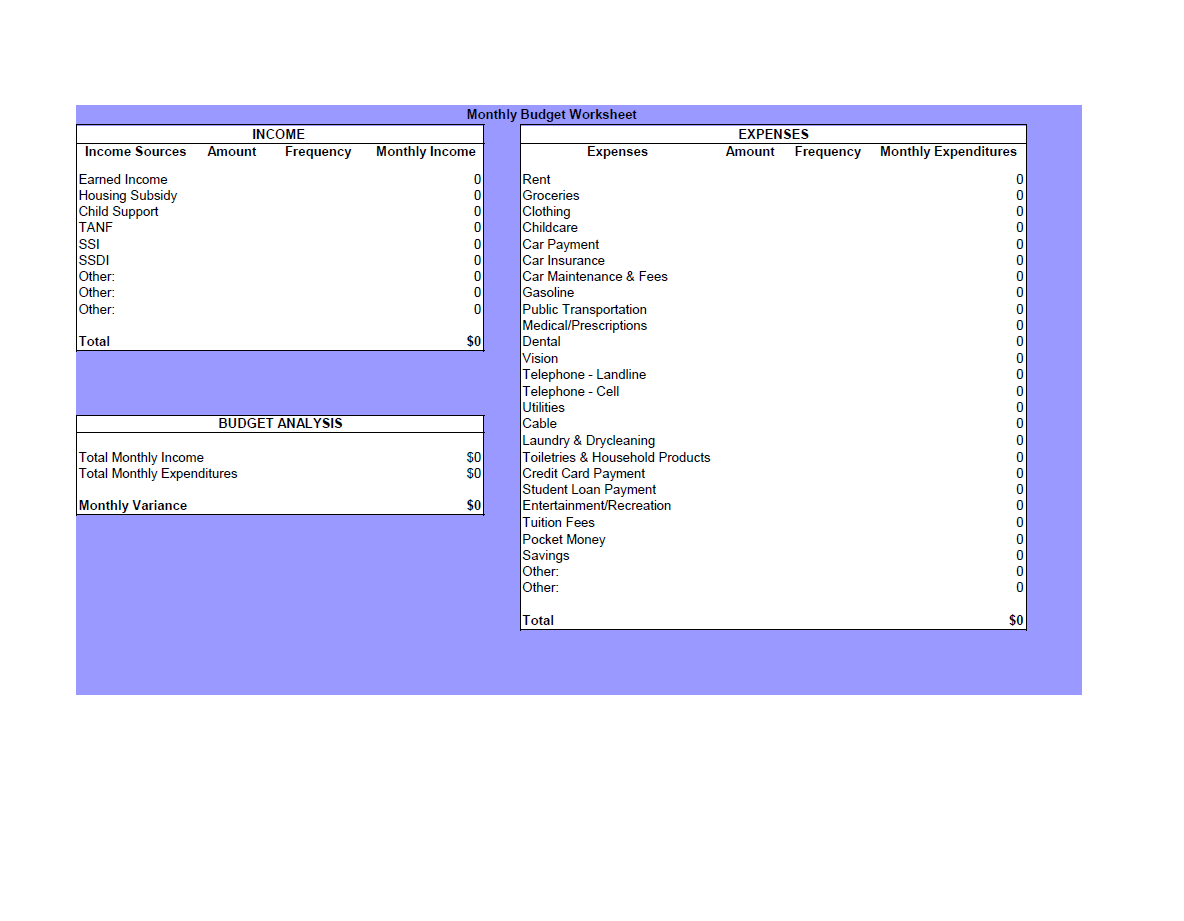

Monthly Budget Worksheet

download now -

Dailylife Budget Worksheet

download now -

School Student Budget Worksheet

download now -

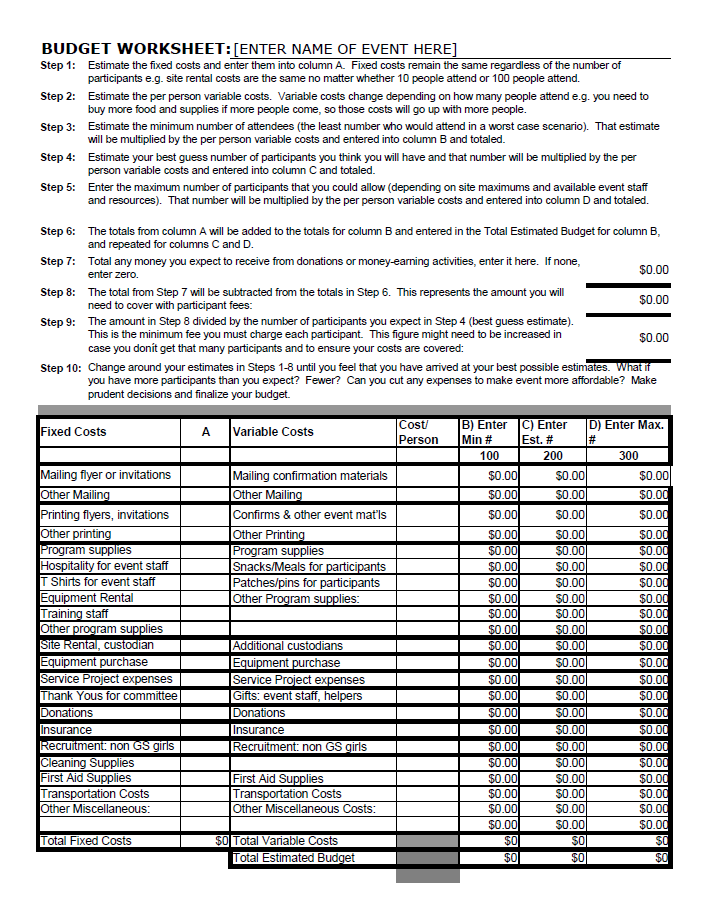

Event Budget Worksheet

download now -

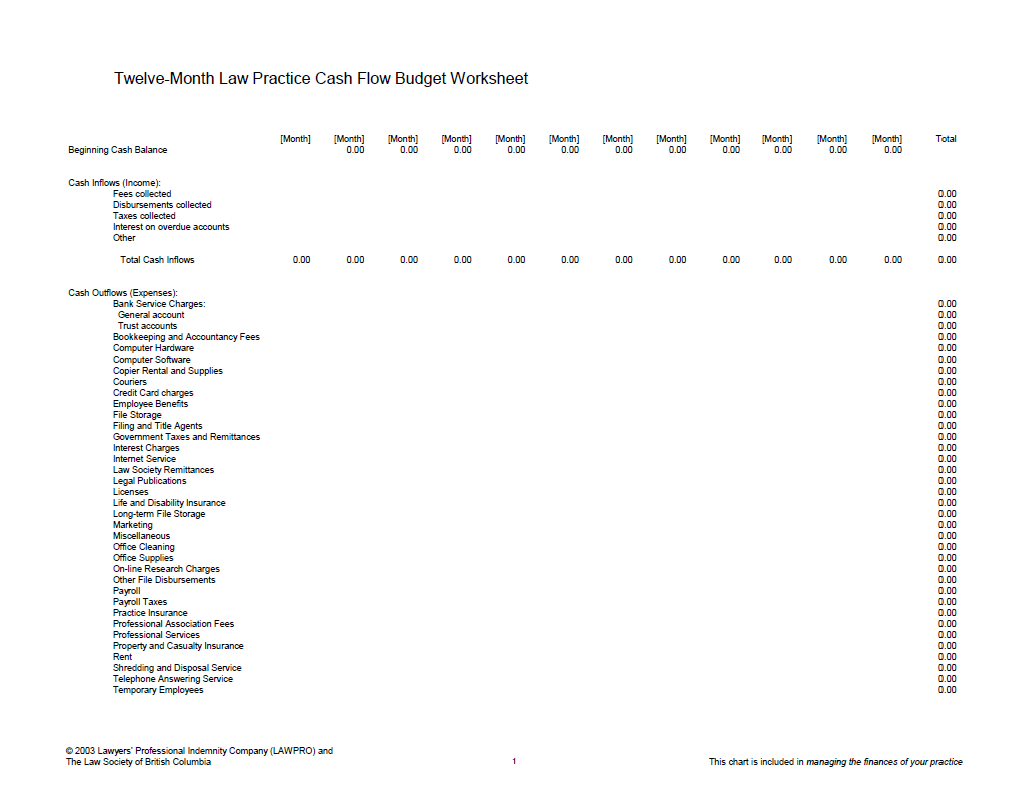

Twelve Month Law Practice Cash Flow Budget Worksheet

download now -

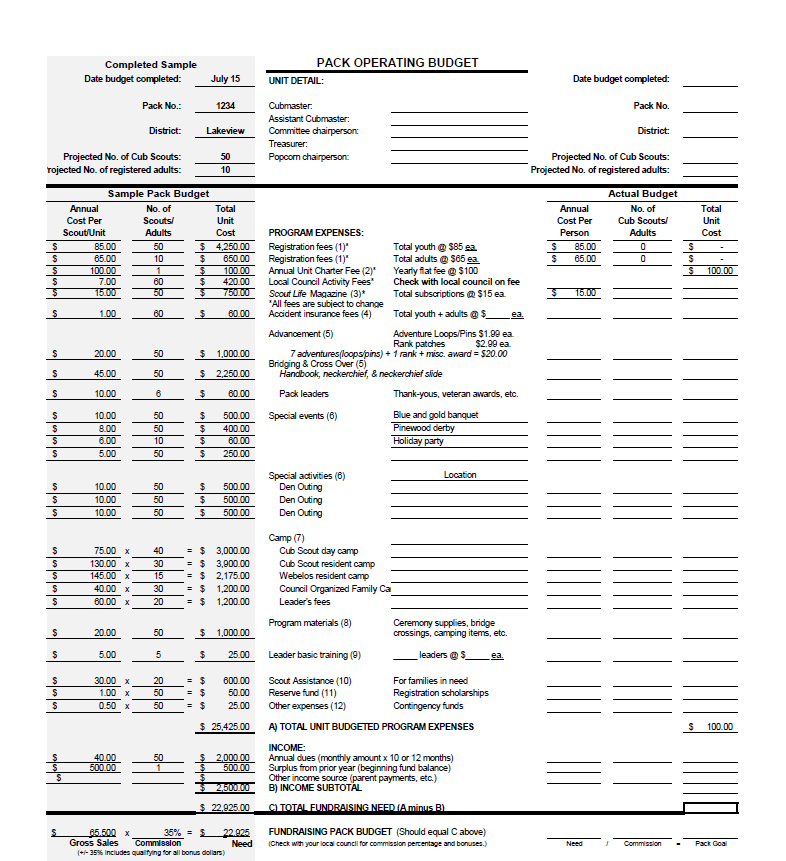

Pack Budget Worksheet

download now -

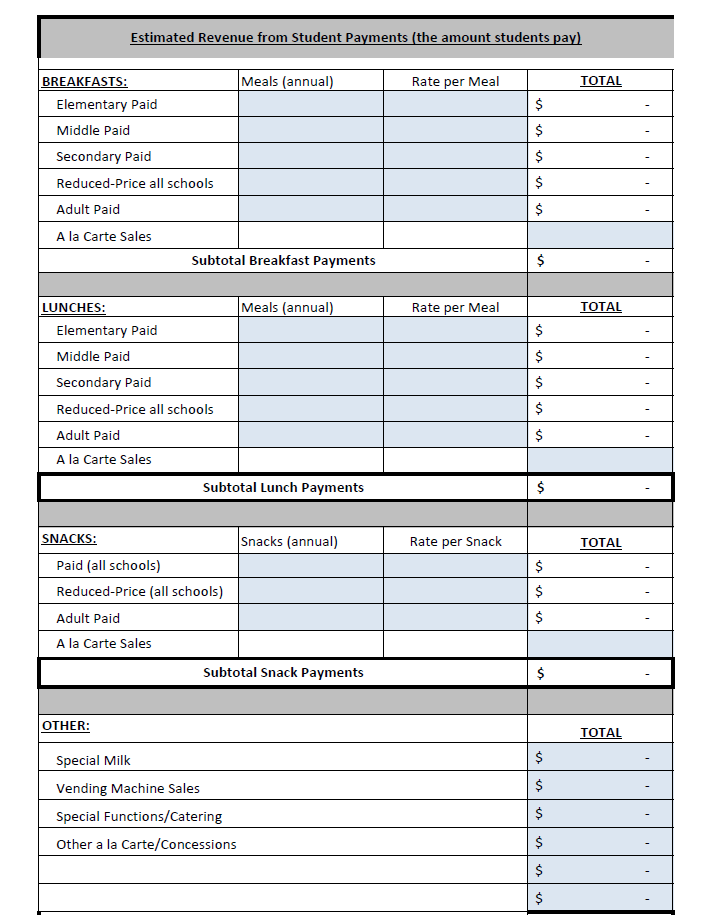

FSMC Budget Worksheet

download now -

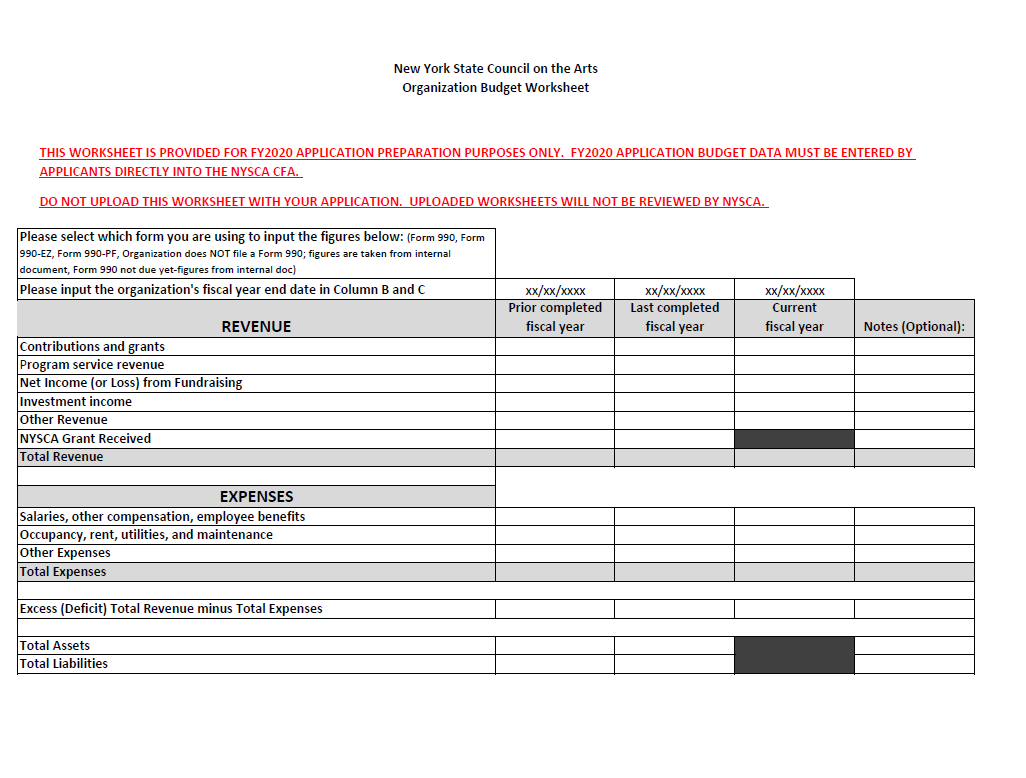

Organization Budget Worksheet

download now -

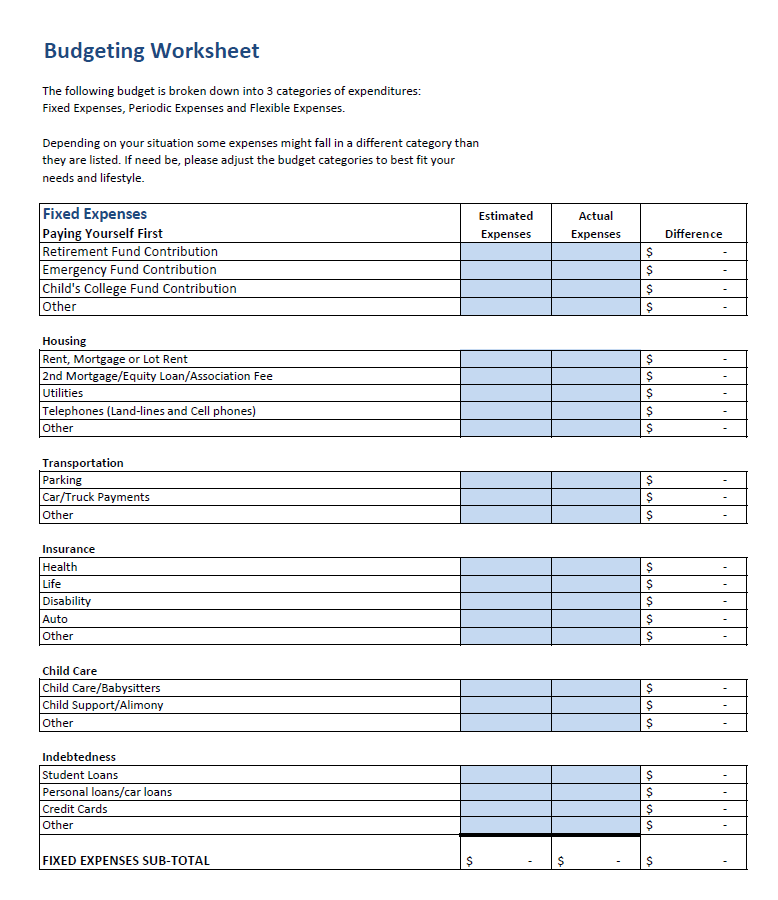

Budgeting Worksheet

download now -

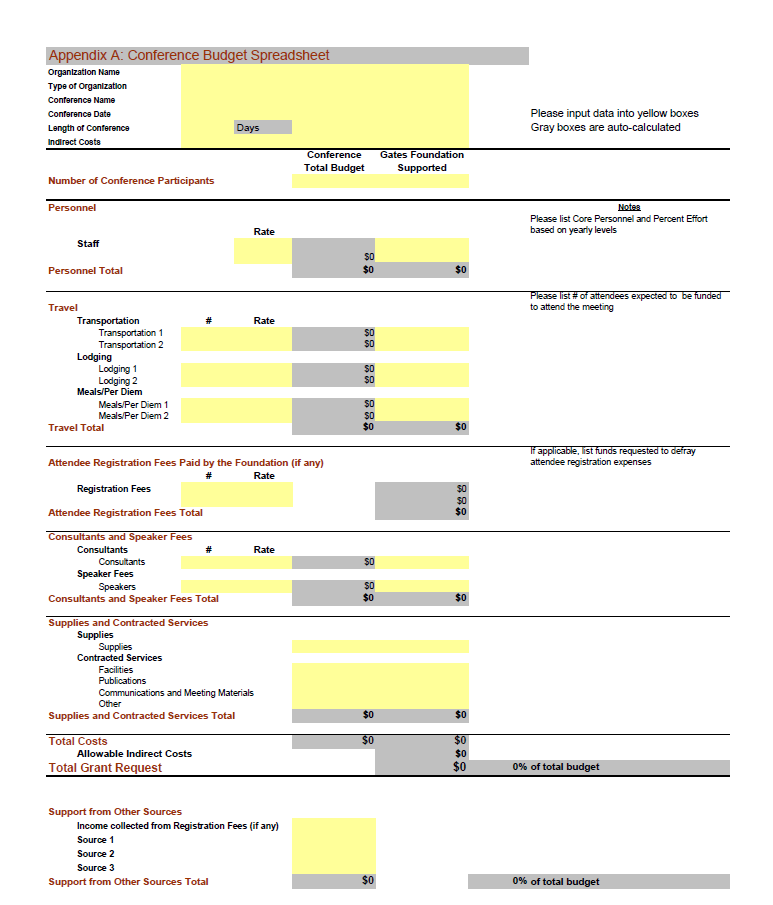

Global Health Conference Budget Worksheet

download now -

Home Budget Worksheet

download now -

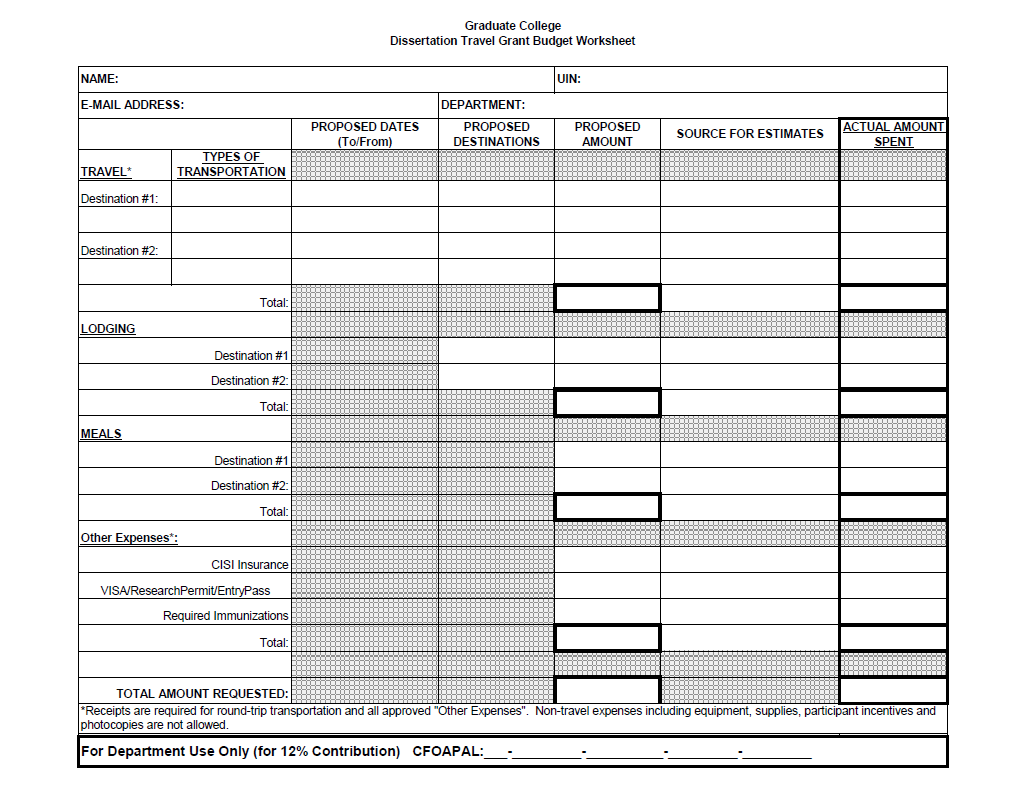

Dissertation Travel Budget Worksheet

download now -

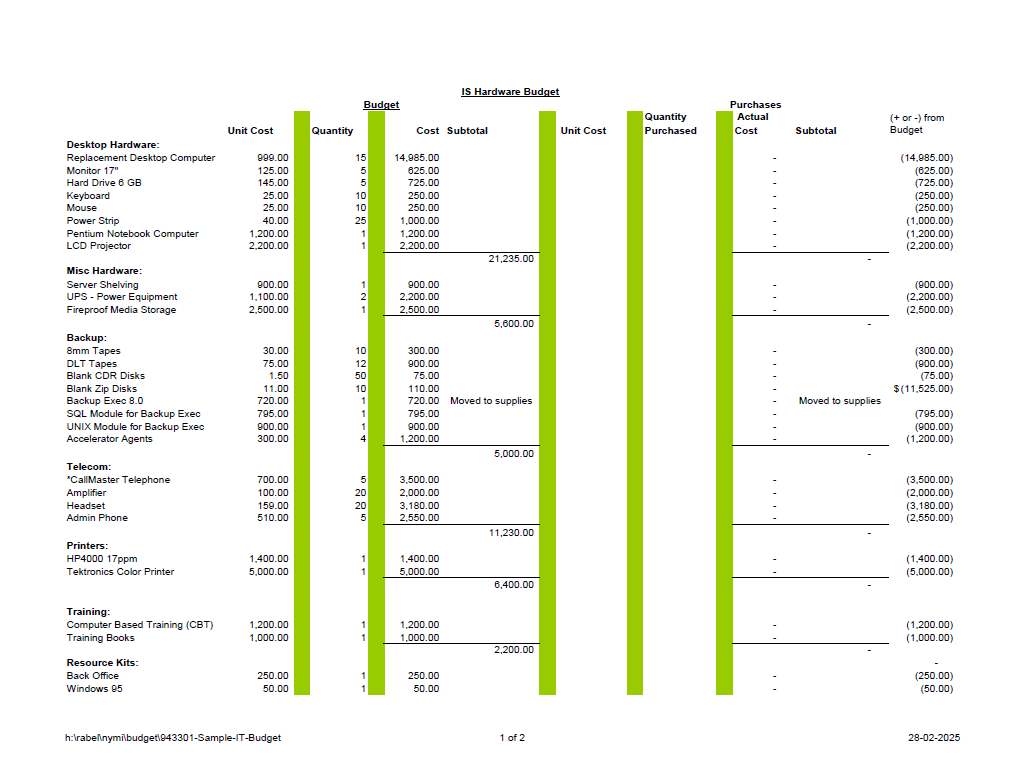

Hardware Budget Worksheet

download now -

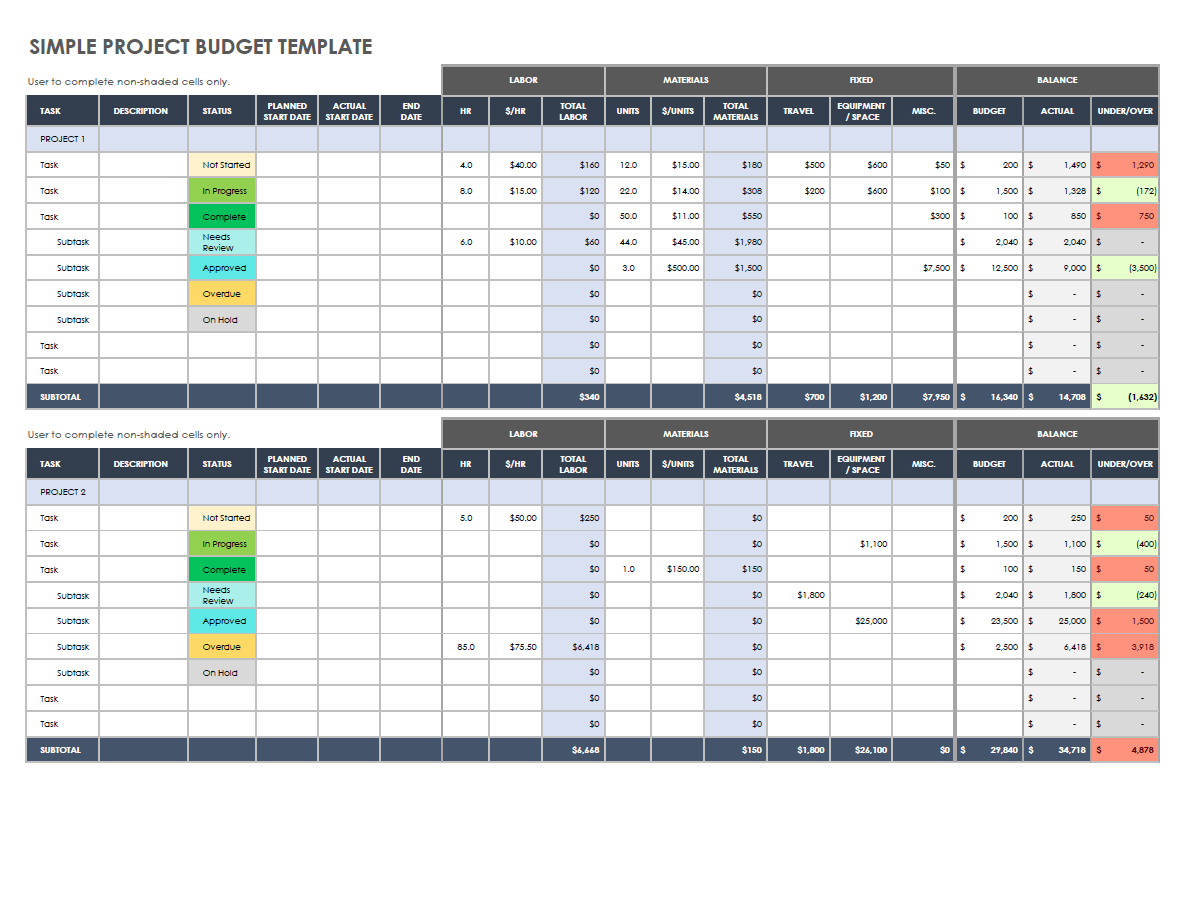

Simple Project Budget Worksheet

download now -

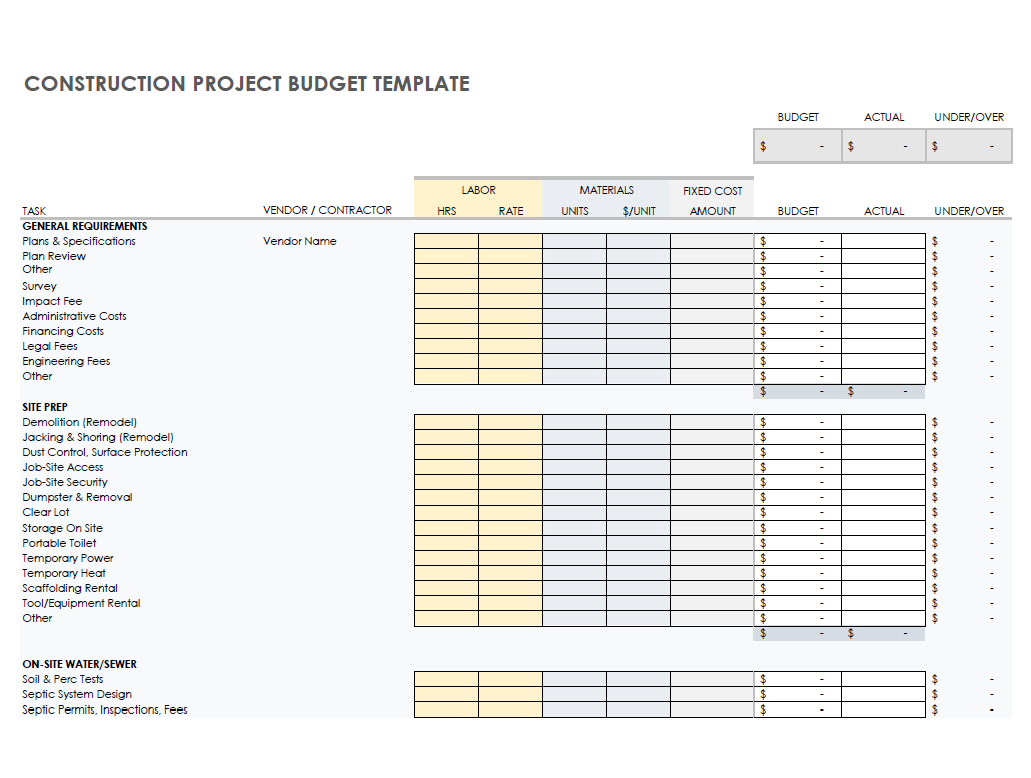

Construction Project Budget Worksheet

download now -

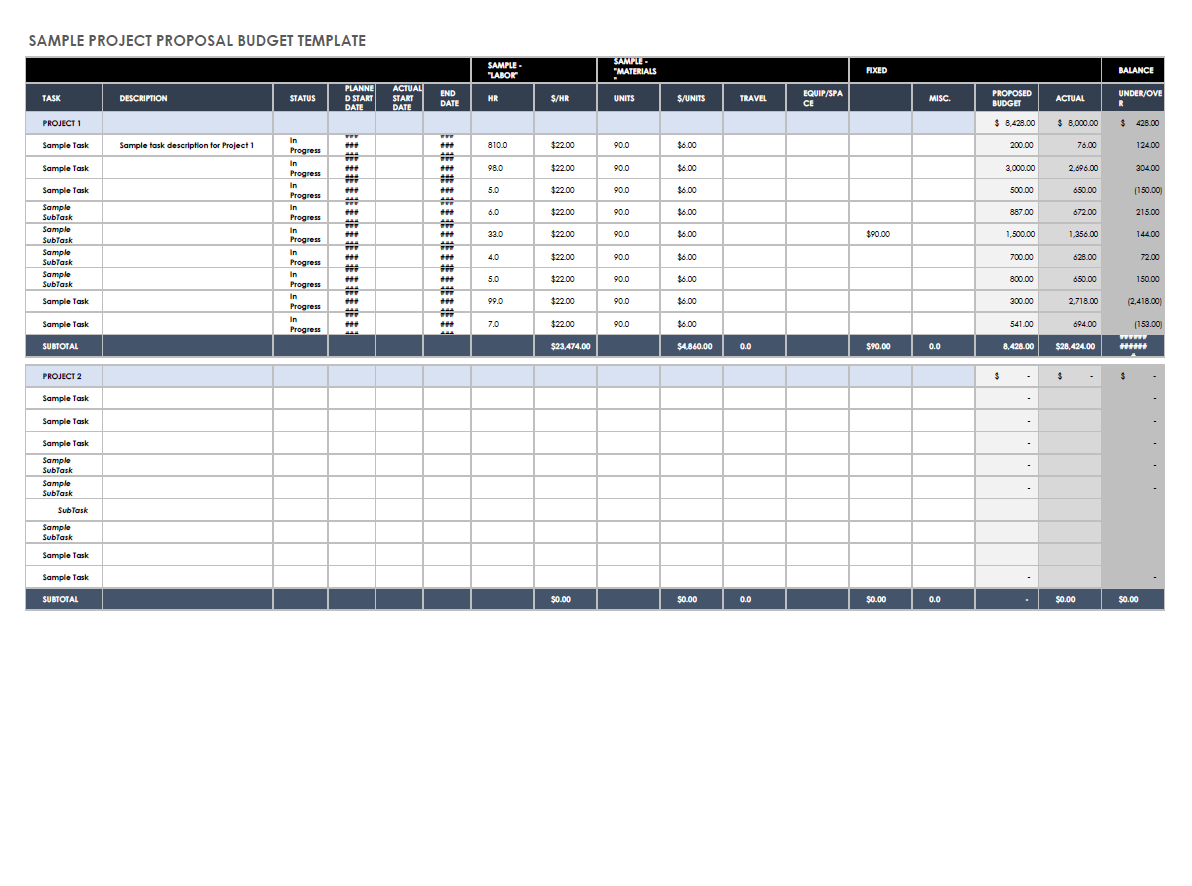

Sample Project Proposal Budget Template

download now -

Annual Budget Template

download now -

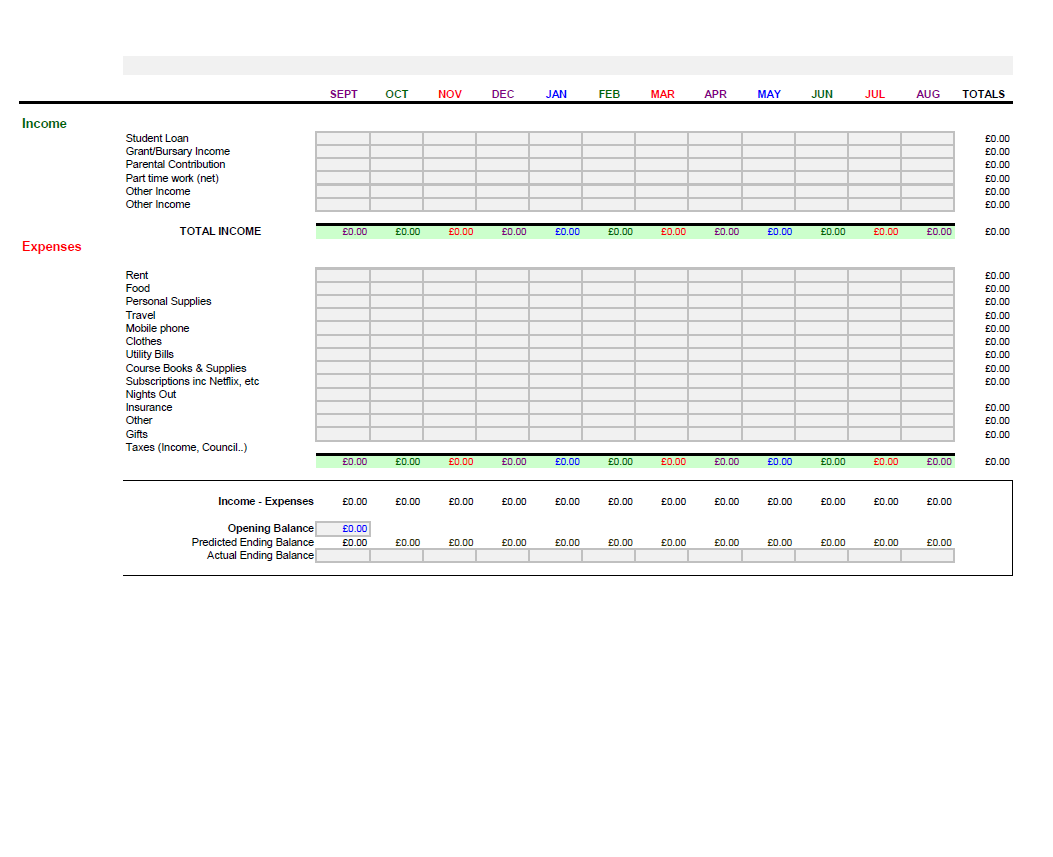

Monthly Budget Worksheet

download now

What is a Budget Worksheet?

A budget worksheet is a document that helps individuals, families, or businesses plan their income and expenses. It provides a clear overview of financial inflows and outflows, allowing users to manage spending, reduce unnecessary costs, and increase savings.

Benefits of Using a Budget Worksheet

- Tracks income and expenses accurately

- Helps identify spending habits

- Encourages savings and investment planning

- Prevents overspending and debt accumulation

- Provides financial clarity for future planning

Types of Budget Worksheets

There are various types of budget worksheets depending on the purpose and financial goals:

1. Personal Budget Worksheet

Used by individuals to track personal income, expenses, and savings. It includes:

- Salary/Wages

- Rent/Mortgage

- Utilities

- Groceries

- Transportation

- Debt payments

- Entertainment

- Savings/Investments

2. Household Budget Worksheet

Ideal for families to manage monthly household expenses and ensure all bills are covered. Key components:

- Combined household income

- Housing costs (rent, mortgage, utilities)

- Groceries and dining expenses

- Childcare and education costs

- Health and insurance expenses

- Family savings and emergency funds

3. Monthly Budget Worksheet

A structured worksheet that helps individuals or families plan their budget on a monthly basis. It includes:

- Fixed expenses (rent, loans, insurance)

- Variable expenses (groceries, dining, shopping)

- Miscellaneous spending

- Savings and investments

4. Weekly Budget Worksheet

Suitable for short-term financial planning, a weekly budget worksheet helps track income and expenses on a weekly basis, preventing last-minute financial stress.

5. Business Budget Worksheet

Used by businesses to manage operational costs, revenue, and profit projections. It includes:

- Revenue sources

- Fixed and variable business expenses

- Employee salaries

- Marketing and advertising costs

- Taxes and insurance

- Business savings

6. Event Budget Worksheet

Helps plan and track costs for special events like weddings, birthdays, corporate meetings, or travel. It includes:

- Venue costs

- Catering expenses

- Travel and accommodation

- Miscellaneous costs

How to Create a Budget Worksheet

A budget worksheet is an essential tool for tracking income, expenses, and savings. It helps in managing finances effectively and ensures that spending stays within financial limits. Below is a detailed step-by-step guide on how to create a budget worksheet.

Step 1: Choose a Format

A budget worksheet can be created using different formats:

- Microsoft Excel or Google Sheets – Best for automated calculations.

- Paper & Pen – A simple manual option.

- Budgeting Apps – Digital tools that help track finances.

- Printable Templates – Pre-made worksheets for easy use.

Step 2: List Income Sources

A budget starts with identifying all sources of income. This includes:

- Salary/Wages (after taxes)

- Freelance/Side Hustles

- Investments

- Rental Income

- Government Benefits

- Other Income Sources

If income fluctuates, an average of the last few months should be used.

Step 3: List Fixed Expenses

Fixed expenses are costs that remain constant each month. These typically include:

- Rent/Mortgage

- Car Loan

- Insurance (Health, Auto, Home)

- Internet & Phone Bills

- Subscription Services

- Childcare

- Debt Payments (Credit Cards, Loans)

These expenses should be recorded accurately to get a clear understanding of recurring costs.

Step 4: List Variable Expenses

Variable expenses fluctuate each month and should be monitored closely. These include:

- Groceries

- Eating Out

- Gas & Transportation

- Entertainment

- Clothing & Shopping

- Medical Expenses

- Personal Care

- Gifts & Donations

Tracking these expenses over time helps in identifying spending patterns and potential areas to cut costs.

Step 5: Set Savings & Emergency Fund Goals

A portion of income should be allocated towards savings and emergency funds. Common savings goals include:

- Retirement Fund

- Emergency Fund (3-6 months of expenses)

- Vacation Savings

- Education Fund

- Investment Contributions

This ensures financial stability and preparedness for unexpected expenses.

Step 6: Calculate the Budget Summary

To determine financial standing, the following formula should be used:

Total Income – (Fixed Expenses + Variable Expenses + Savings) = Remaining Balance

- A positive balance indicates surplus money that can be allocated to savings or investments.

- A negative balance suggests overspending, requiring adjustments in expenses.

Step 7: Adjust the Budget as Needed

If expenses exceed income:

- Reduce unnecessary spending.

- Cancel or downgrade subscriptions.

- Look for ways to increase income.

If there is a surplus:

- Add more to savings.

- Pay off debt faster.

- Invest for long-term financial growth.

Regular adjustments ensure that the budget aligns with financial goals.

Step 8: Track & Update the Budget Regularly

A budget should be reviewed and updated weekly or monthly to maintain financial stability.

Ways to Track:

- Use budgeting apps for real-time tracking.

- Manually update Excel or Google Sheets.

- Keep receipts and bank statements for accurate calculations.

Why Do You Need a Budget Worksheet?

A budget worksheet is essential for managing income, tracking expenses, and achieving financial goals. It helps you:

✔ Gain Financial Clarity – Understand where your money goes each month.

✔ Control Overspending – Identify unnecessary expenses and cut back.

✔ Save Consistently – Allocate funds for savings and emergencies.

✔ Stay Debt-Free – Plan debt repayments strategically.

✔ Achieve Goals Faster – Set and track financial milestones effectively.

Whether you’re an individual, a student, or a business owner, a budget worksheet ensures financial stability and smarter money management.

Common Mistakes to Avoid When Using a Budget Worksheet

Avoid these mistakes to make your budgeting accurate and effective:

❌ Not Tracking Small Expenses – Small purchases add up and impact your budget.

❌ Ignoring Irregular Expenses – Plan for annual payments like insurance and taxes.

❌ Underestimating Costs – Be realistic about monthly bills and lifestyle expenses.

❌ Not Adjusting the Budget – Update regularly to reflect income and spending changes.

❌ Skipping Emergency Savings – Always allocate funds for unexpected situations.

❌ Giving Up Too Soon – Budgeting takes time; stay consistent and tweak as needed.

By avoiding these pitfalls, you can maximize your budget’s effectiveness and build better financial habits.