20+ FREE Credit Limit Worksheets (Child Tax, Schedule 8812, Form 5695, Form 8863, Form 2441)

-

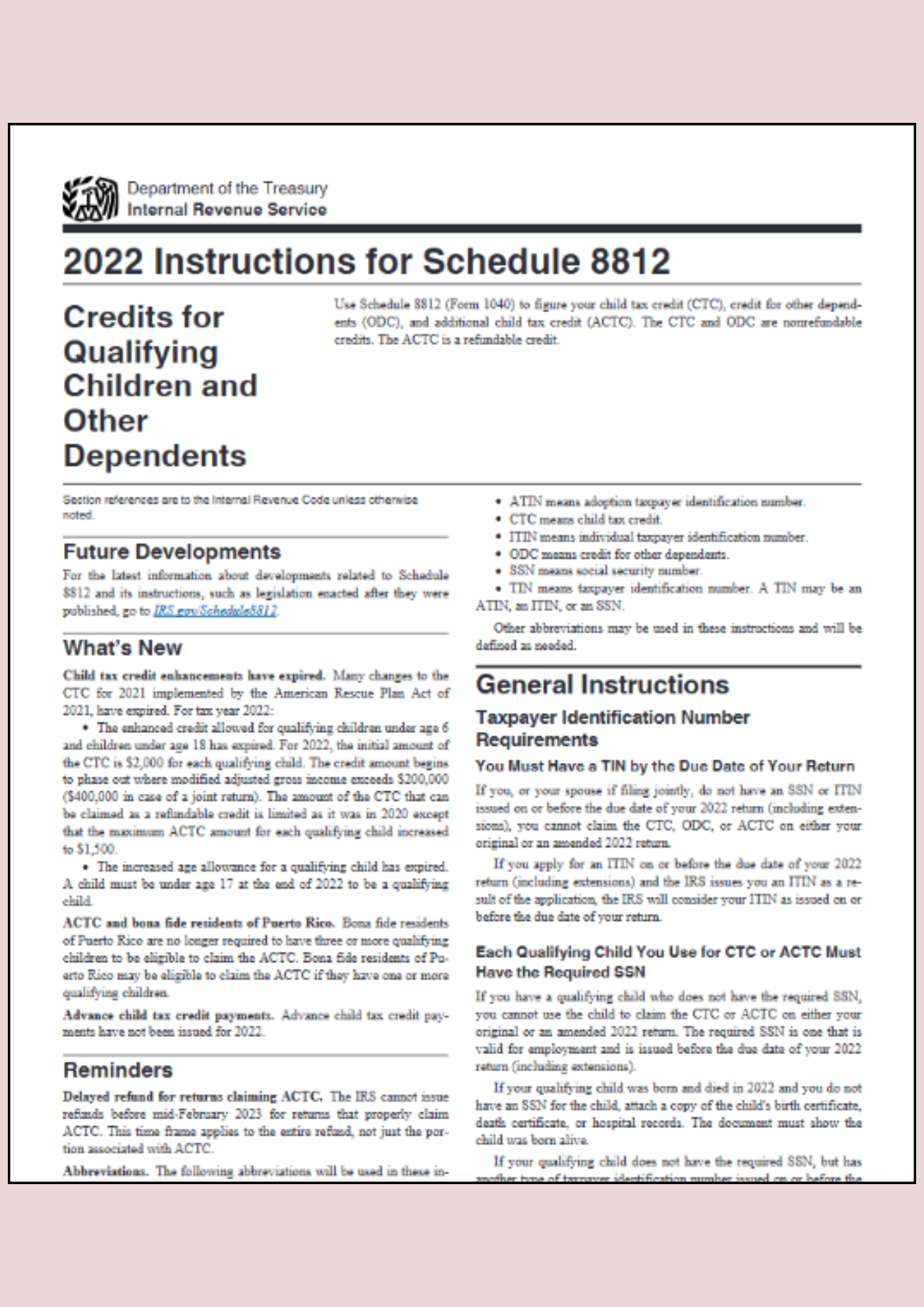

Credit Limit Worksheet 2024 Form 8812 Instructions

download now -

2023 Schedule 8812 Credit Limit Worksheet A

download now -

2022 Form 8863 Credit Limit Worksheet

download now -

2020 Form 8863 Credit Limit Worksheet

download now -

2019 Form 8863 Credit Limit Worksheet

download now -

2018 Child Tax Credit Limit Worksheet

download now -

Credit Limit Worksheet Form 1040

download now -

Credit Limit Worksheet Form 5695

download now -

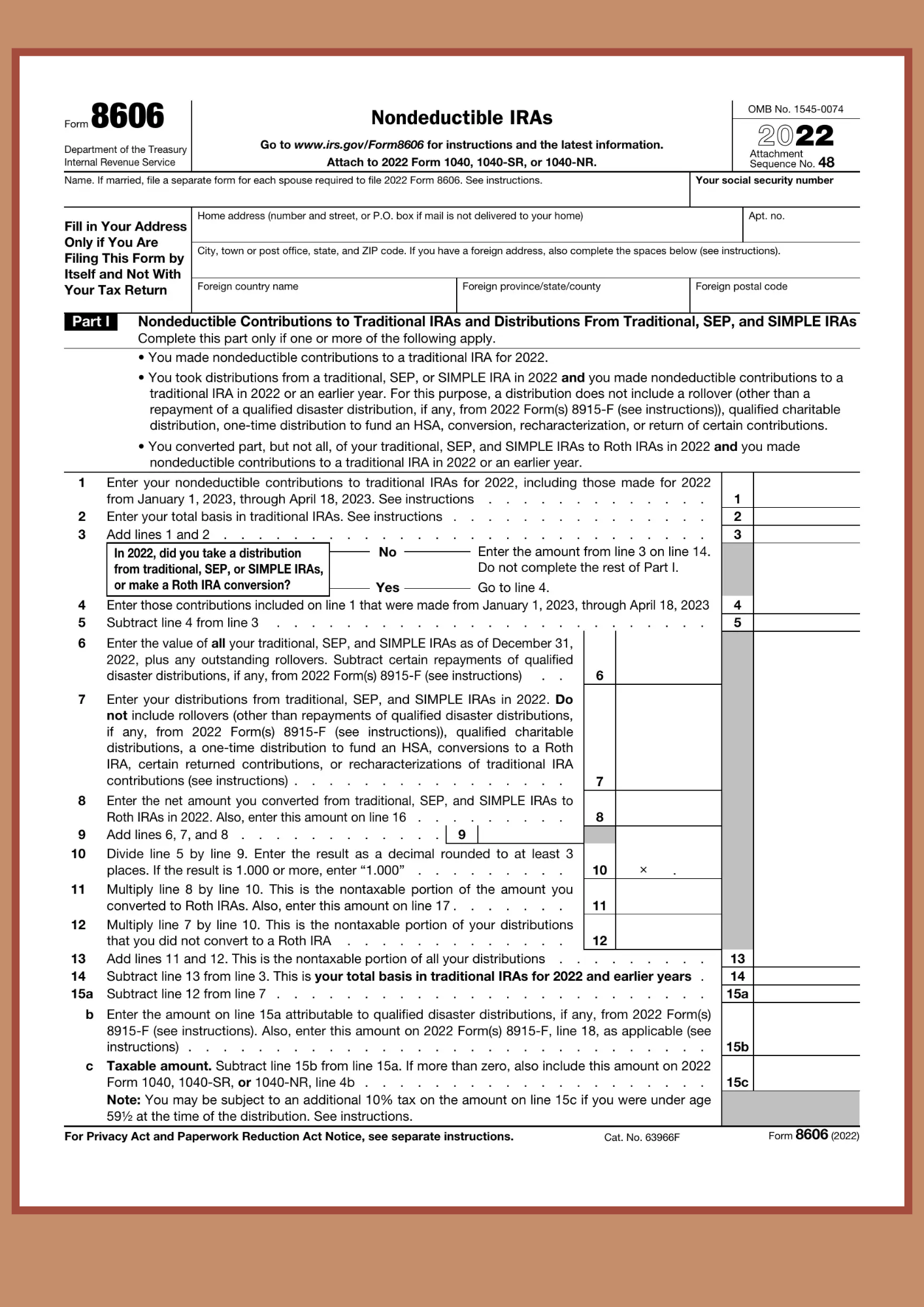

Credit Limit Worksheet Form 8606

download now -

Credit Limit Worksheet Form 8839

download now -

Credit Limit Worksheet Form 8880

download now -

Credit Limit Worksheet Schedule R

download now -

Form 5695 Residential Energy Credit Limit Worksheet

download now -

Residential Energy Efficient Property Credit Limit Worksheet

download now -

Credit Limit Worksheet 2024 Form 8863 Instructions

download now -

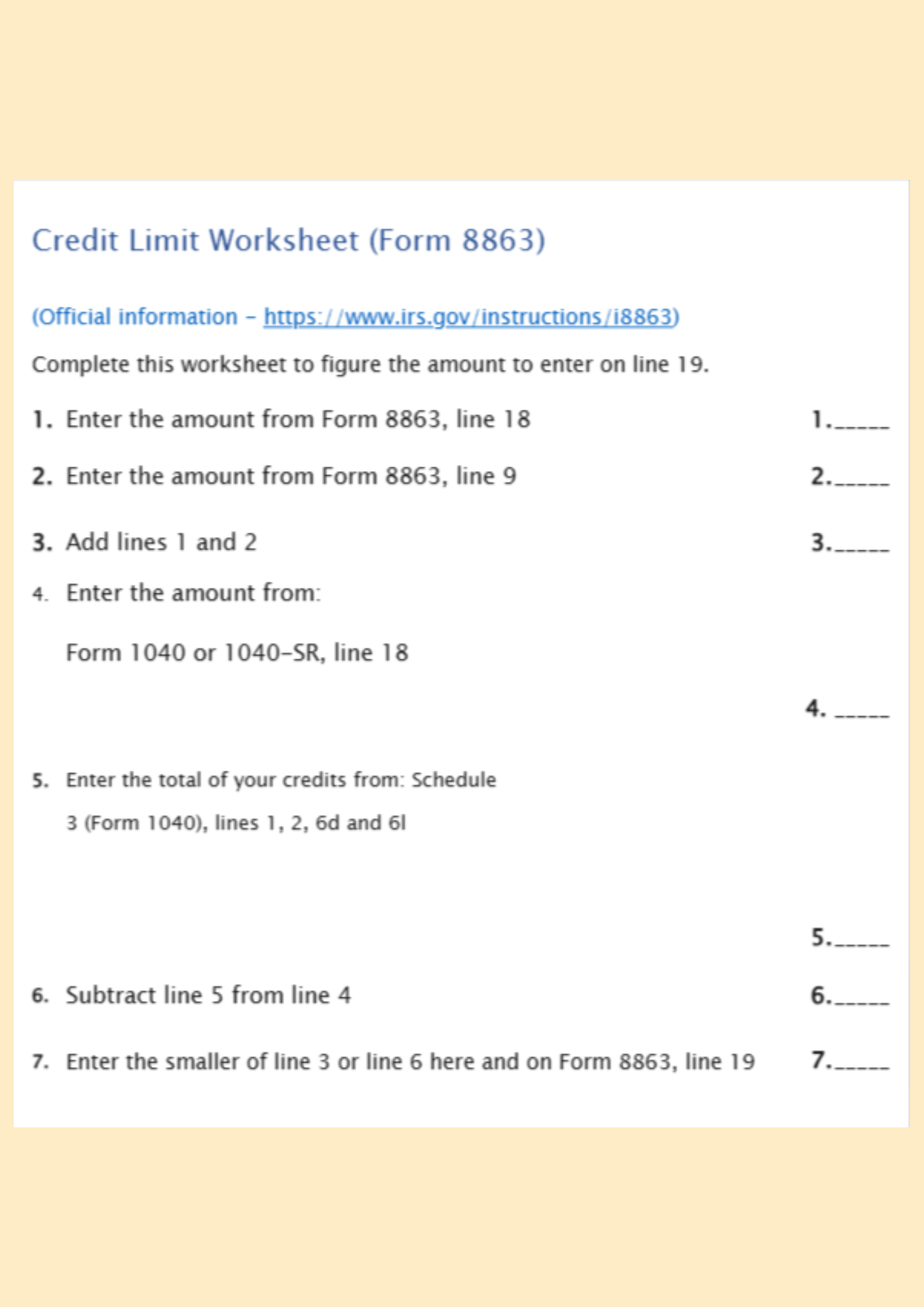

Credit Limit Worksheet Form 8863

download now -

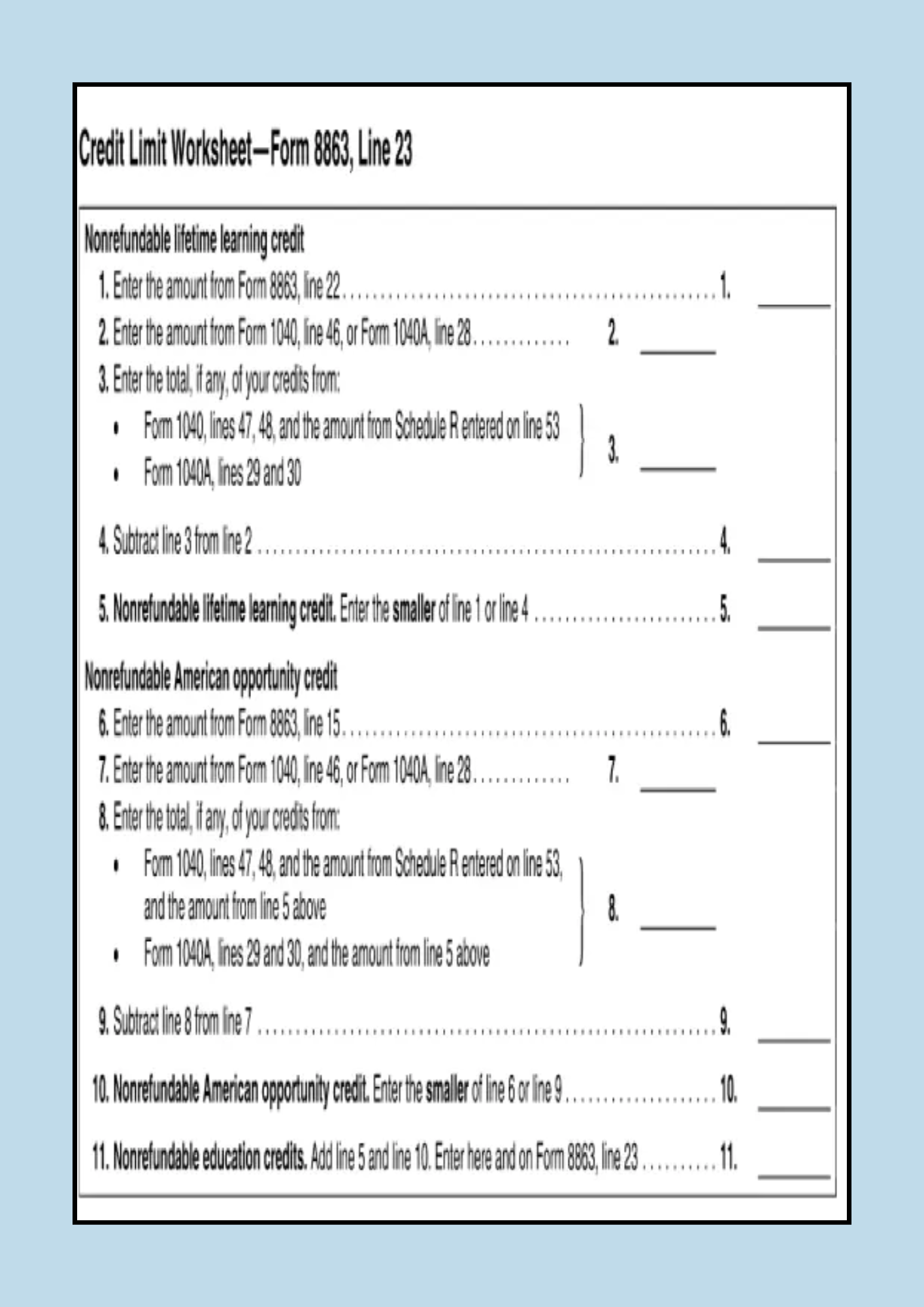

Credit Limit Worksheet Form 8863 Line 23

download now -

Credit Limit Worksheet Form 8812 Instructions

download now -

Credit Limit Worksheet Form 8606

download now -

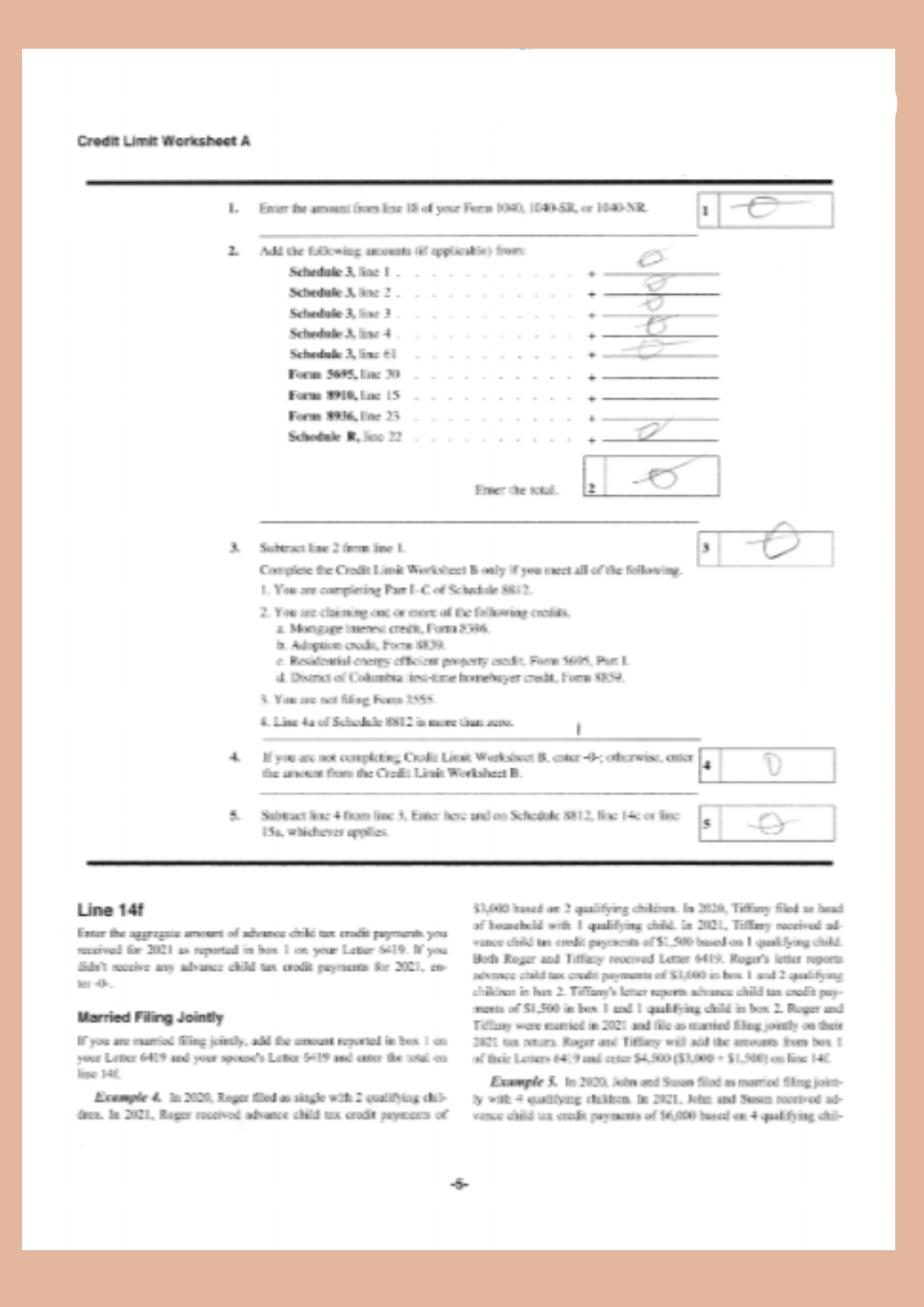

Credit Limit Worksheet A

download now -

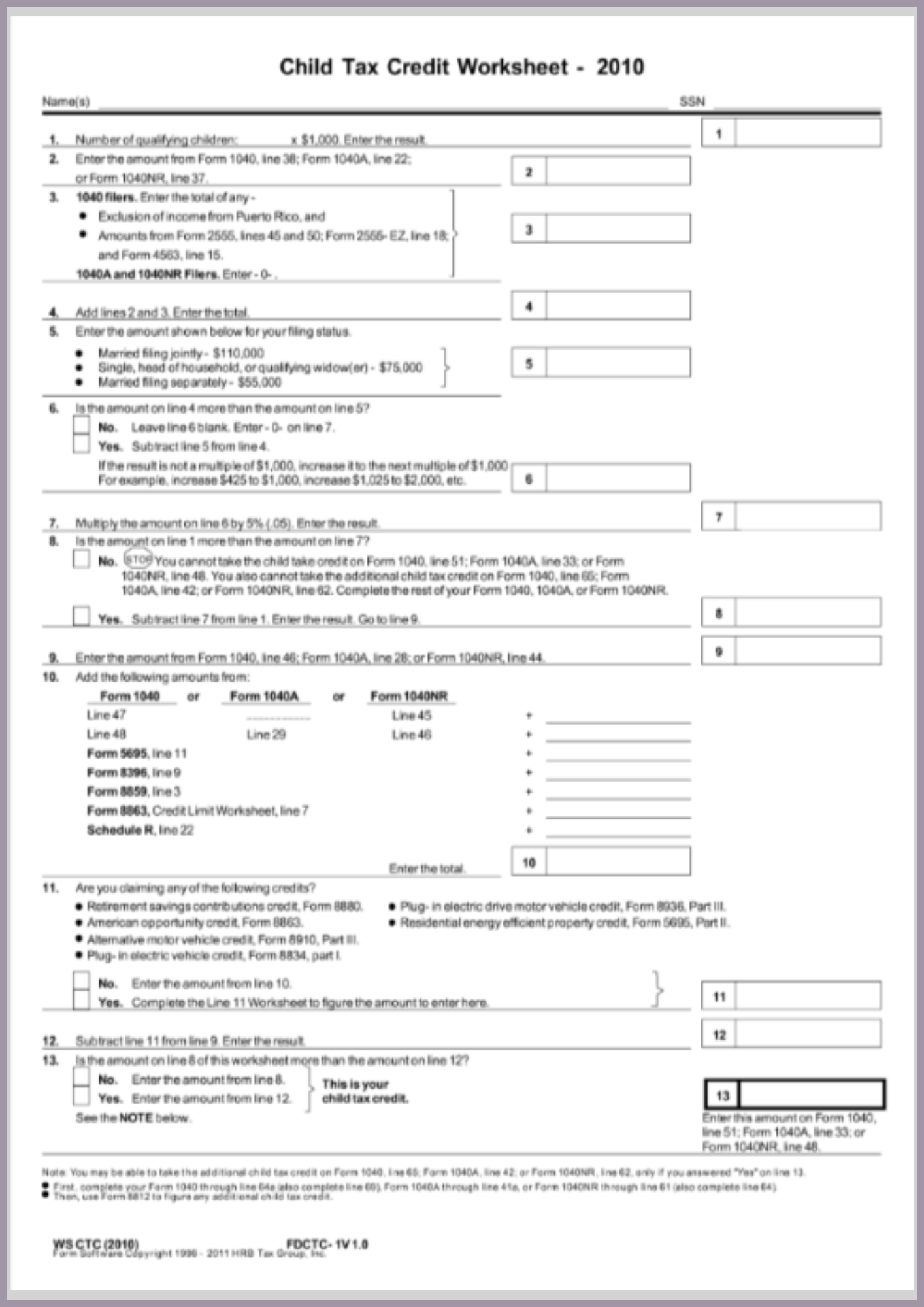

Child Tax Credit Limit Worksheet

download now

Free Printable Credit Limit Worksheet to Download

20+ FREE Credit Limit Worksheets (Child Tax, Schedule 8812, Form 5695, Form 8863, Form 2441)

What is a Credit Limit Worksheet?

Why is a Credit Limit Worksheet Important?

How to Use a Credit Limit Worksheet?

Tips for Managing Your Credit Wisely

Common Mistakes to Avoid When Managing Credit Limits

What is a Credit Limit Worksheet?

A Credit Limit Worksheet is a simple tool designed to help individuals and businesses track, manage, and control their credit limits efficiently. It allows users to record credit card balances, available credit, minimum payments, and due dates to maintain a healthy credit utilization ratio and avoid financial stress. By using a credit limit worksheet, you can keep a close watch on your credit usage, payment deadlines, and financial stability.

Why is a Credit Limit Worksheet Important?

Managing credit effectively is essential for maintaining a good credit score and avoiding debt. A Credit Limit Worksheet helps in:

✅ Preventing Overspending – Keeps you aware of your available credit and prevents unnecessary purchases.

✅ Tracking Due Dates – Avoids late payments and high interest charges.

✅ Managing Multiple Credit Accounts – Organizes all your loans and credit cards in one place.

✅ Improving Credit Score – Helps maintain an optimal credit utilization ratio (keeping it under 30% is ideal).

✅ Better Financial Planning – Provides a clear snapshot of your financial obligations.

How to Use a Credit Limit Worksheet?

Using a Credit Limit Worksheet is simple and helps you stay on top of your finances. Follow these easy steps:

1️⃣ List Your Credit Accounts – Include all credit cards, personal loans, auto loans, store cards, and business credit lines.

2️⃣ Enter Credit Limits – Write down the maximum credit limit available for each account.

3️⃣ Record Current Balances – Note the outstanding balance on each credit line to track how much you owe.

4️⃣ Calculate Available Credit – Subtract the current balance from the credit limit to determine the remaining credit.

5️⃣ Monitor Due Dates & Minimum Payments – Always keep track of your payment due dates and minimum required payments.

6️⃣ Update Regularly – Keep your worksheet updated to reflect the most accurate financial data.

Tips for Managing Your Credit Wisely

Using a Credit Limit Worksheet is just one part of maintaining a healthy financial life. Follow these expert tips to manage your credit wisely:

✔️ Keep Credit Utilization Low – Aim to keep your utilization below 30% to maintain a strong credit score.

✔️ Make Payments on Time – Avoid late fees and high-interest rates by setting up automatic payments.

✔️ Review Credit Reports Regularly – Check your credit score and report for any errors or fraud.

✔️ Use a Budgeting Plan – Track your expenses to ensure you don’t overspend.

✔️ Avoid Unnecessary Credit Accounts – Opening too many credit lines can lower your credit score.

Common Mistakes to Avoid When Managing Credit Limits

Many people unknowingly make financial mistakes that hurt their credit scores. Avoid these common pitfalls when managing credit limits:

❌ Maxing Out Your Credit Cards – Using the full credit limit can damage your credit score and increase interest rates.

❌ Only Paying Minimum Balances – Leads to higher interest charges and longer repayment periods.

❌ Ignoring Due Dates – Late payments can result in penalties and lower credit scores.

❌ Not Reviewing Your Credit Report – Errors on your credit report can affect your financial health.

❌ Applying for Too Many Credit Cards – Multiple applications in a short time can reduce your credit score.