10+ FREE Credit Limit Worksheet A (Schedule 8812, Form 8863, Child Tax Report, Schedule 1040)

-

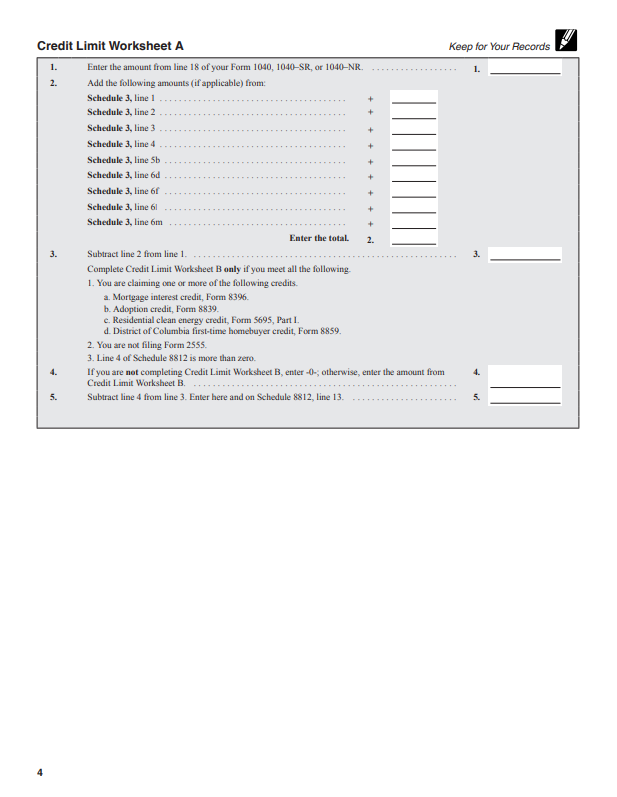

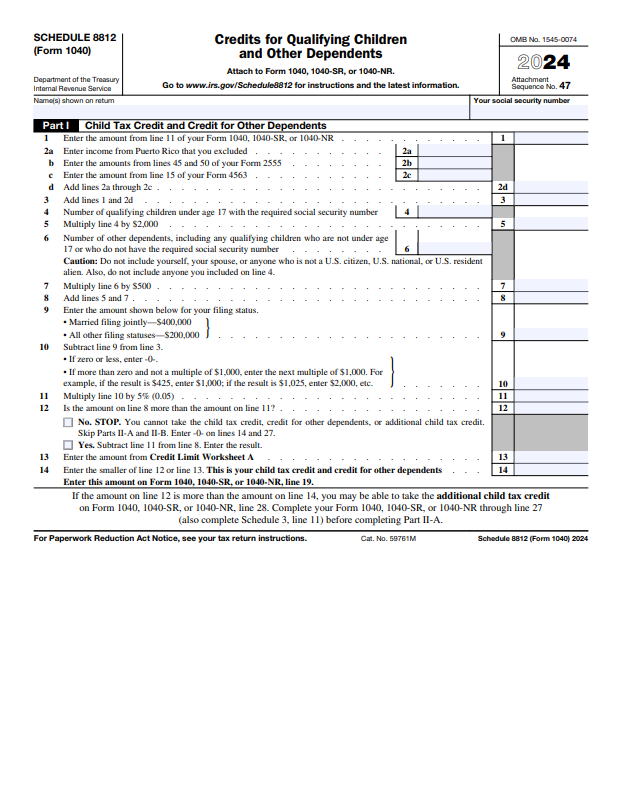

Credit Limit Worksheet A Schedule 8812

download now -

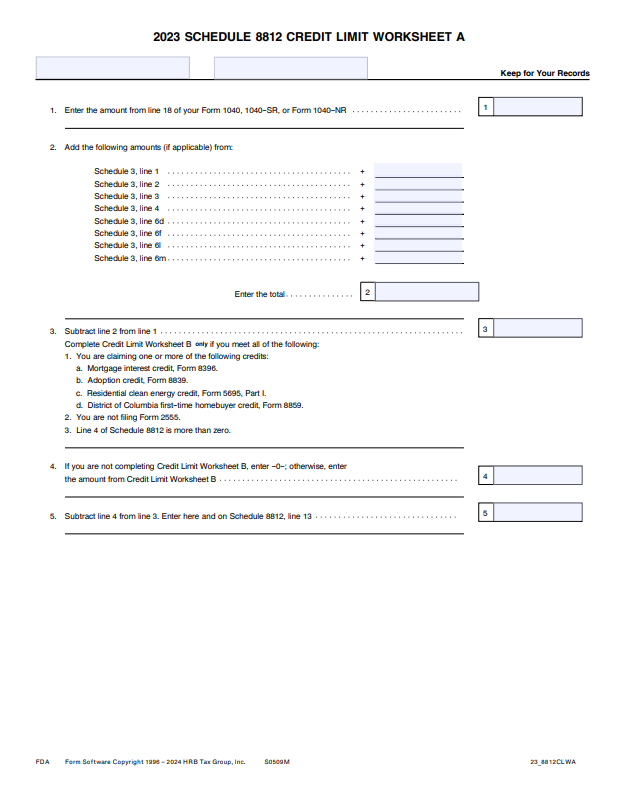

2023 Schedule 8812 Credit Limit Worksheet A

download now -

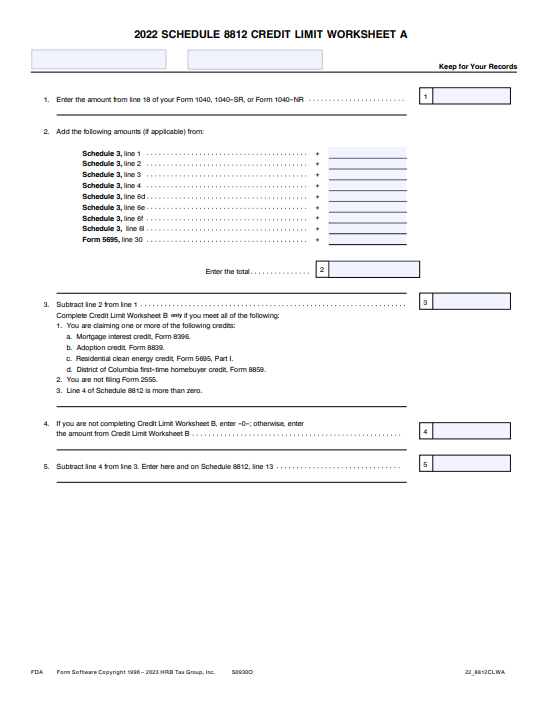

2022 Schedule 8812 Credit Limit Worksheet A

download now -

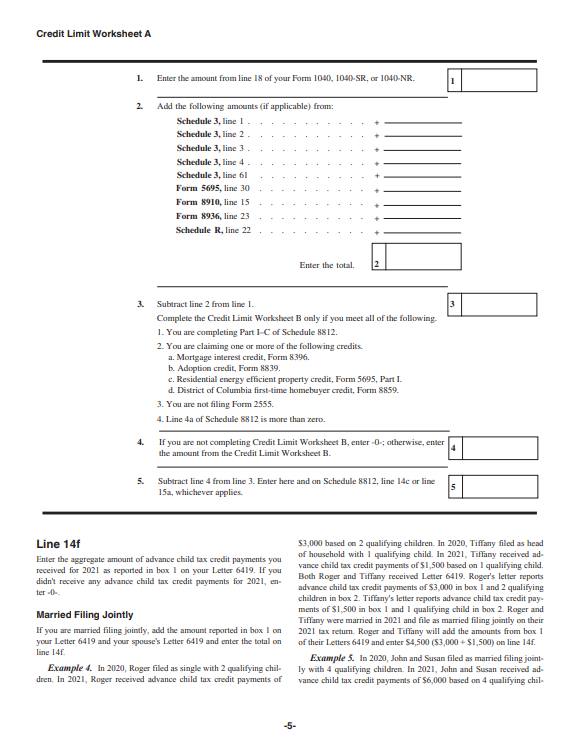

Credit Limit Worksheet A 2021

download now -

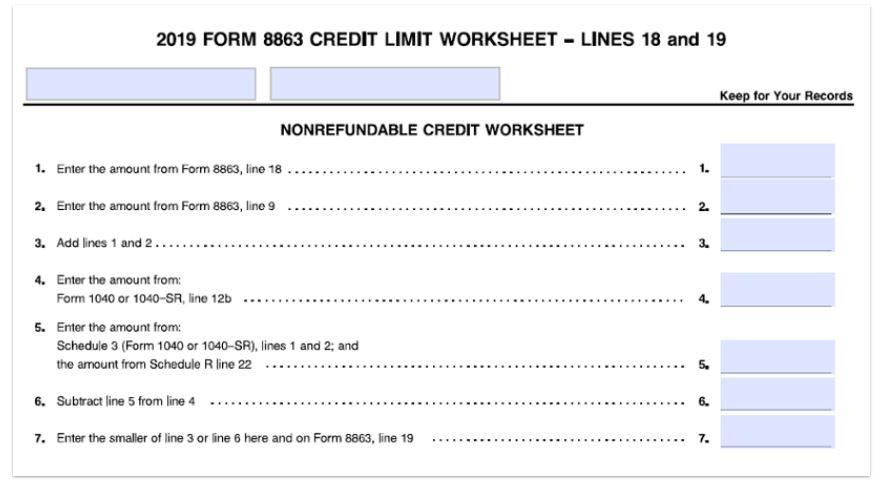

2019 Credit Limit Worksheet Form 8863

download now -

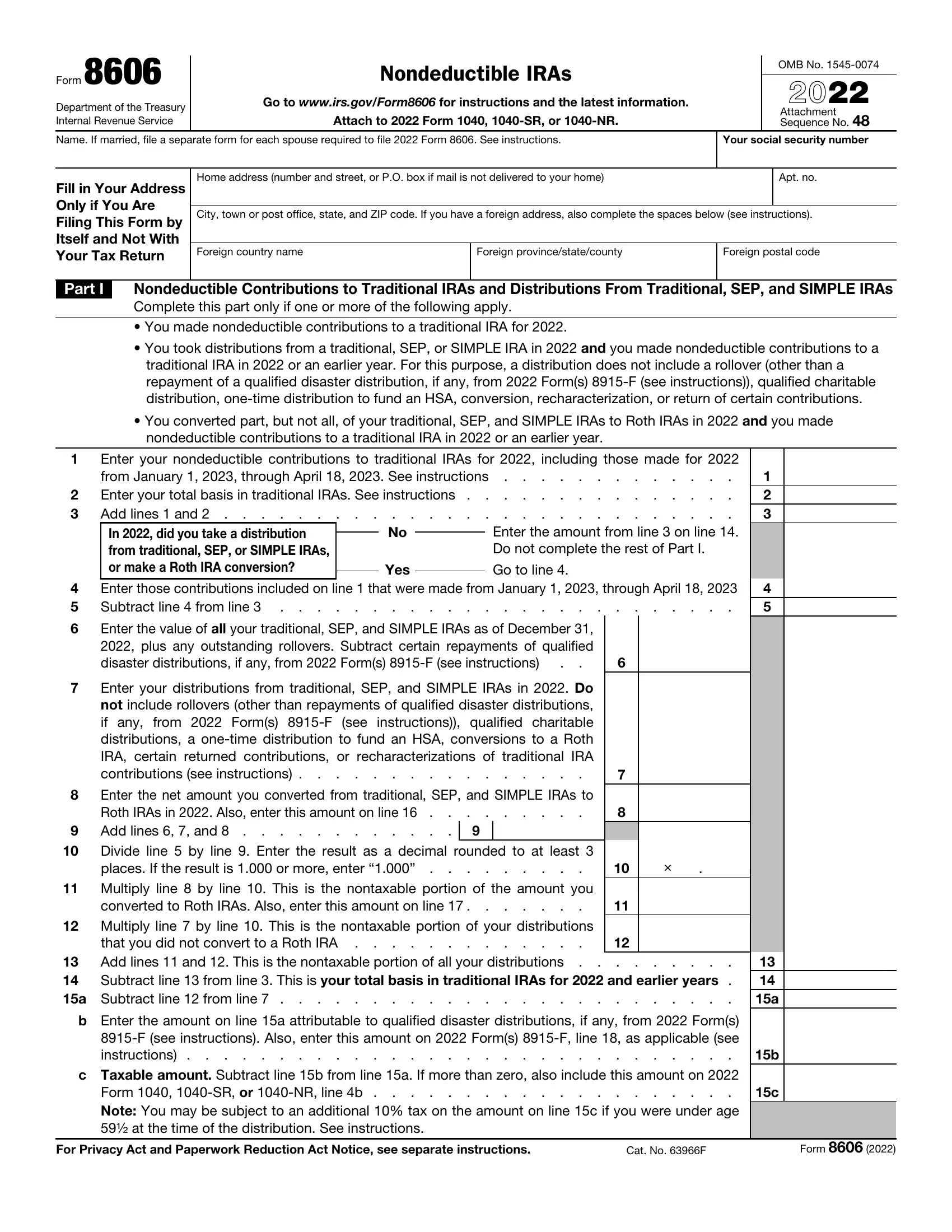

8606 Credit Limit Worksheet A

download now -

Credit Limit Worksheet A Child Tax

download now -

Credit Limit Worksheet A Form 1040

download now -

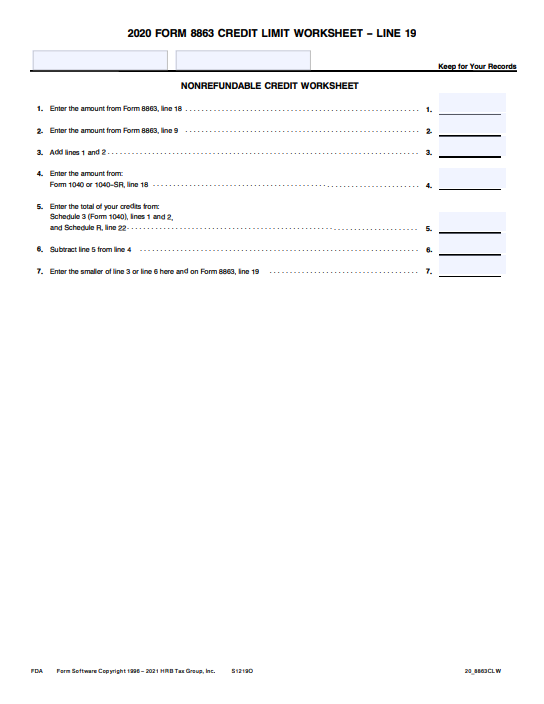

Credit Limit Worksheet A Form 8863

download now -

Credit Limit Worksheet A Line 21

download now

Free Printable Credit Limit Worksheet A to Download

10+ FREE Credit Limit Worksheet A (Schedule 8812, Form 8863, Child Tax Report, Schedule 1040)

🧾 What is Credit Limit Worksheet A?

📘 Who Needs to Use Credit Limit Worksheet A?

🛠️ How to Use Credit Limit Worksheet A (Step-by-Step Guide)

📑 When is Credit Limit Worksheet A Required?

✏️ Who Can Benefit from These Worksheets?

🎯 Benefits of Using Printable Credit Limit Worksheet A

🧠 Common Mistakes to Avoid When Using Worksheet A

🧾 What is Credit Limit Worksheet A?

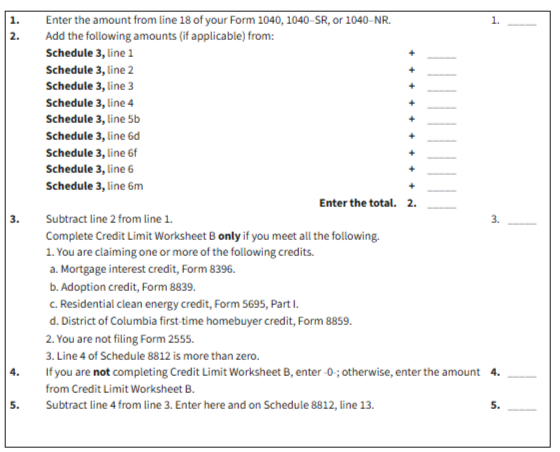

Credit Limit Worksheet A is an official IRS worksheet used to calculate the nonrefundable portion of the Child Tax Credit (CTC) and Credit for Other Dependents (ODC) on Form 1040 or 1040-SR. This worksheet helps you determine how much of these credits you can apply to your tax liability, based on your income and taxes owed. If your tax liability is low, this worksheet will show how much of the credit you can use before applying for the refundable portion through Schedule 8812.

📘 Who Needs to Use Credit Limit Worksheet A?

You need to use Credit Limit Worksheet A if:

- You’re claiming the Child Tax Credit or Credit for Other Dependents

- You want to figure out the nonrefundable portion of the credit

- You are not eligible for the Additional Child Tax Credit (ACTC), or want to calculate the credit step-by-step before claiming it

This worksheet is especially helpful for those who want to avoid errors and maximize tax savings during filing.

🛠️ How to Use Credit Limit Worksheet A (Step-by-Step Guide)

① Start with your total tax from Form 1040 (Line 18)

② Subtract other nonrefundable credits you’re claiming (such as education or foreign tax credits)

③ Enter your Child Tax Credit or Credit for Other Dependents amount

④ Use the worksheet to find the smaller amount between your remaining tax and the credit amount

⑤ Report the result on Line 19 of Form 1040 or the relevant section of Schedule 8812

📑 When is Credit Limit Worksheet A Required?

You’ll need to complete Credit Limit Worksheet A if:

- Your total tax liability is lower than your eligible credit

- You are not claiming the Additional Child Tax Credit (refundable)

- You are filing Form 1040 or 1040-SR and claiming either CTC or ODC

✏️ Who Can Benefit from These Worksheets?

These printable worksheets are perfect for:

- Individual taxpayers filing on their own

- Tax professionals managing multiple client filings

- Accounting students learning about real-life tax scenarios

- Educators teaching personal finance and taxation

- Small businesses or families filing jointly with dependents

🎯 Benefits of Using Printable Credit Limit Worksheet A

✅ Saves time during tax preparation

✅ Reduces errors in credit calculation

✅ IRS-compliant and up to date

✅ Ideal for accountants, taxpayers, and students

✅ Helps maximize your Child Tax Credit eligibility

🧠 Common Mistakes to Avoid When Using Worksheet A

❌ Skipping the worksheet when required

❌ Not subtracting other nonrefundable credits correctly

❌ Using outdated IRS instructions or tax rates

❌ Rounding incorrectly or skipping lines