50+ Sample Income and Expense Worksheets

-

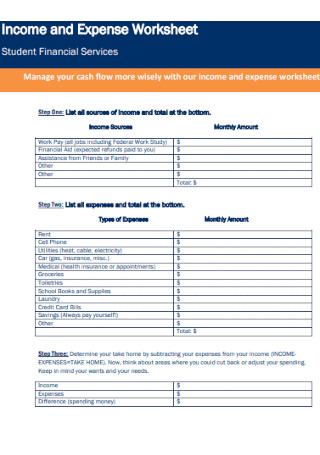

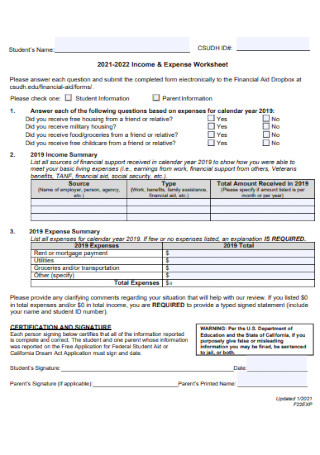

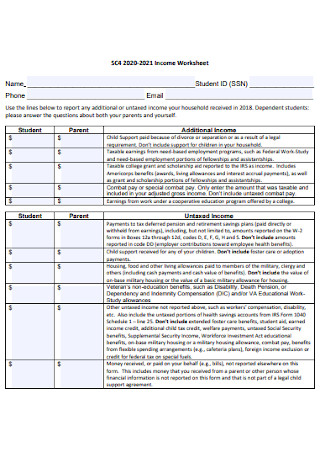

Student Income and Expense Worksheet

download now -

Monthly Income and Expense Worksheet

download now -

Household Income and Expenses Worksheet

download now -

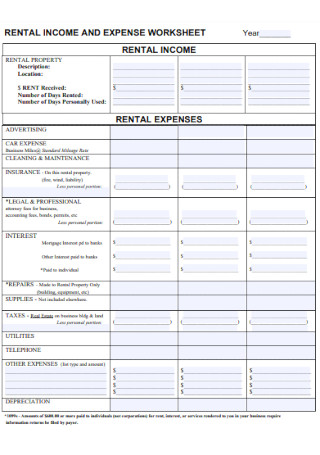

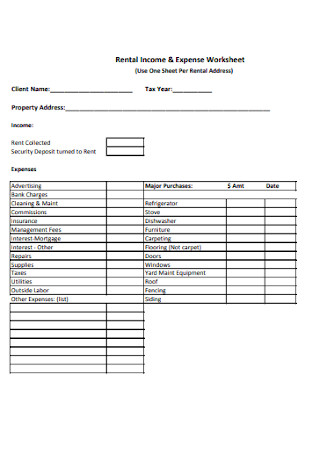

Rental Income and Expense Worksheet

download now -

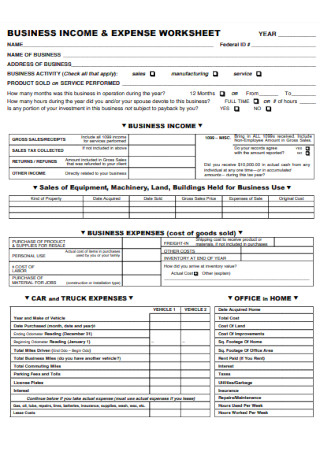

Business Income and Expense Worksheet

download now -

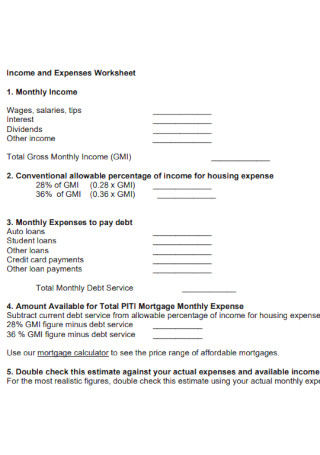

Income and Expenses Worksheet Format

download now -

Sample Monthly Income and Expense Worksheet

download now -

Office Income and Expense Worksheet

download now -

Academic Year Income and Expense Worksheet

download now -

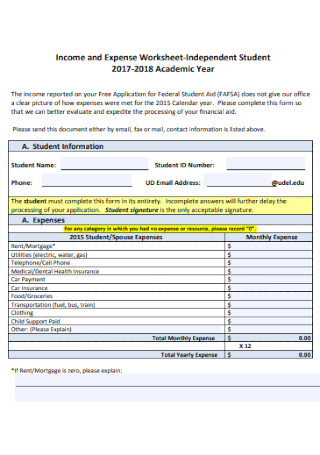

Independent Student Income and Expense Worksheet

download now -

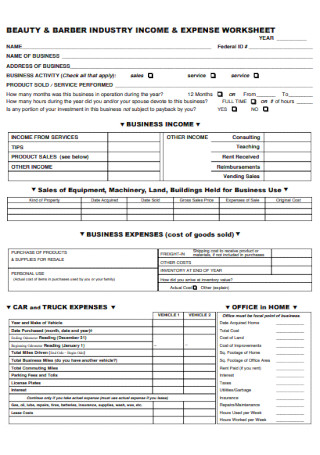

Industry Income and Expense Worksheet

download now -

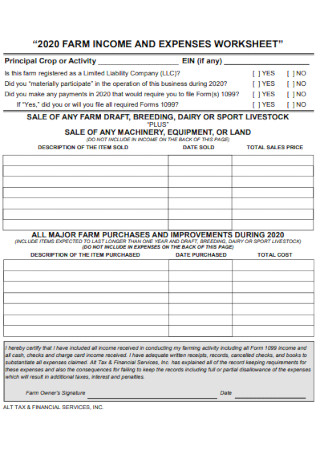

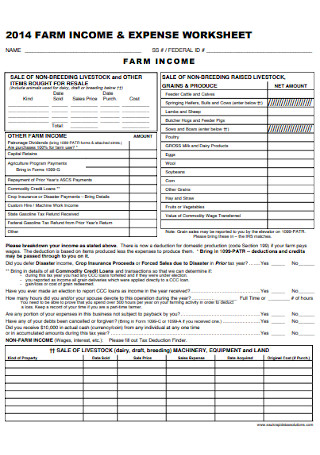

Farm Income and Expense Worksheet

download now -

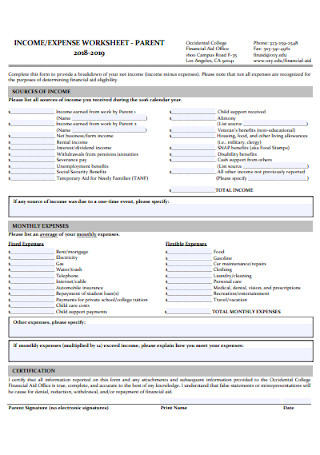

Parent Monthly Income and Expense Worksheet

download now -

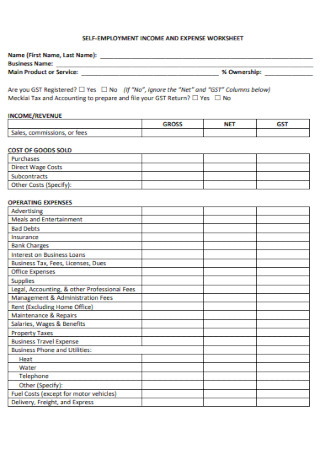

Self Employment Income and Expense Worksheet

download now -

Family Income and Expense Worksheet

download now -

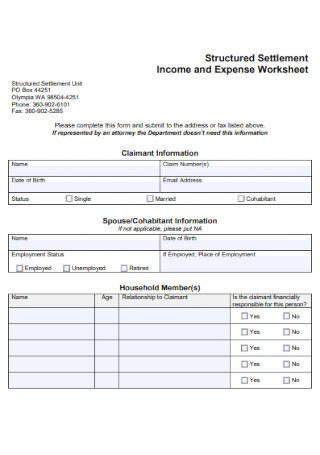

Structured Settlement Income and Expense Worksheet

download now -

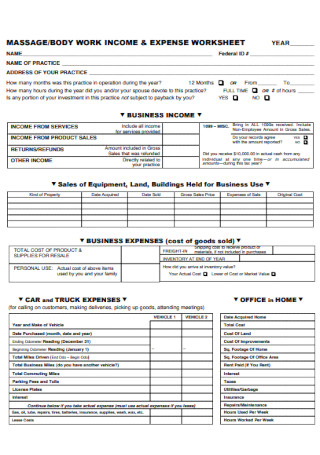

Body Work Income and Expense Worksheet

download now -

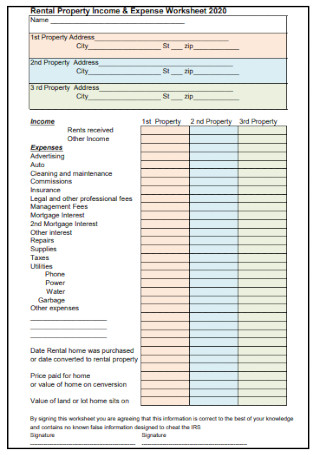

Rental Property Income and Expense Worksheet

download now - “]

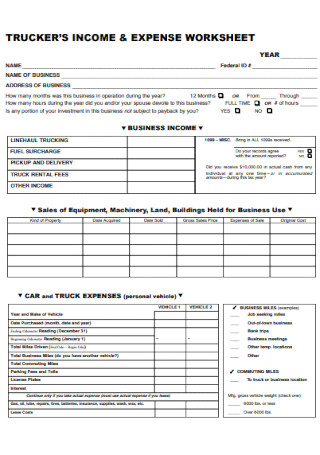

Truckers Income and Expense Worksheet

download now -

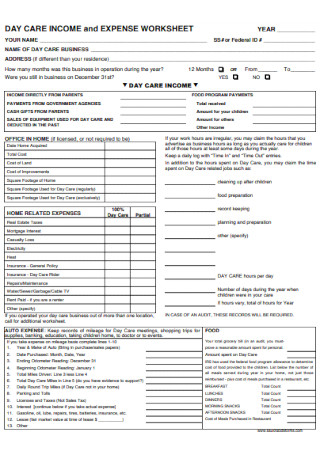

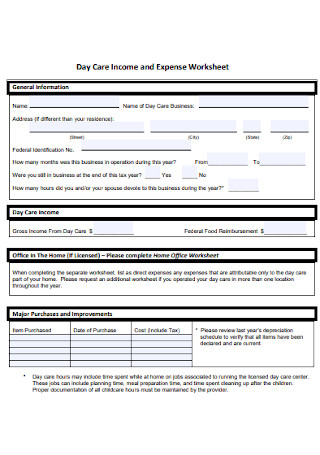

Day Care Income and Expense Worksheet

download now -

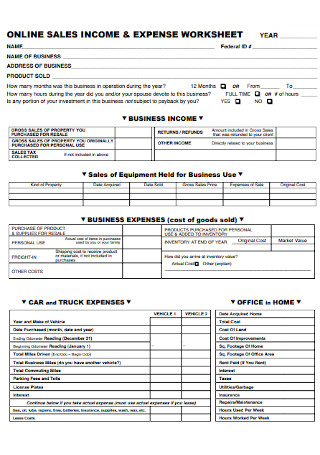

Online Sales and Income and Expense Worksheet

download now -

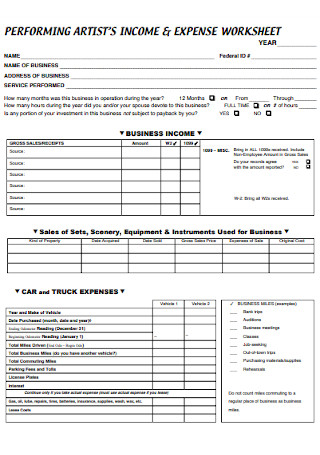

Artist Income and Expense Worksheet

download now -

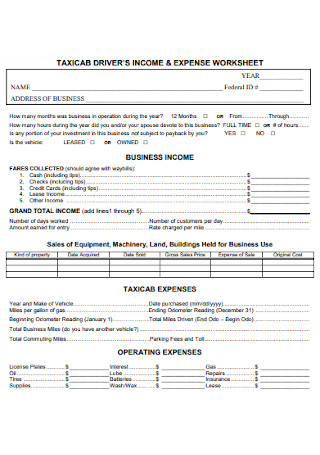

Driver Income and Expense Worksheet

download now -

Income and Expense Calculation Worksheet

download now -

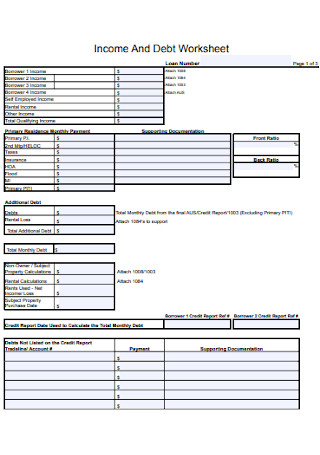

Income And Expense Debt Worksheet

download now -

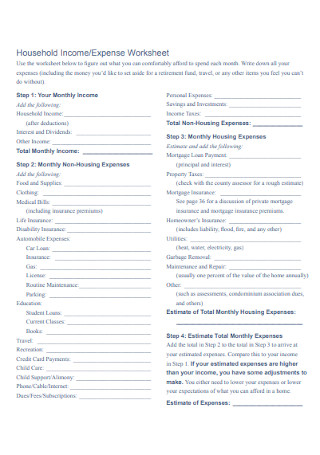

Sample Household Income and Expense Worksheet

download now -

College Income and Expense Worksheet

download now -

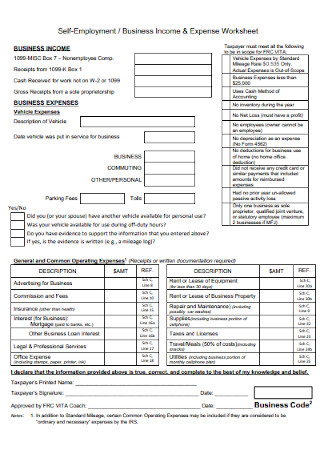

Self-Employment and Income Expense Worksheet

download now -

Financial and Income and Expense Worksheet

download now -

Untaxed Income and Expense Worksheet

download now -

Sample Rental Income and Expense Worksheet

download now -

Sample Farm Income and Expense Worksheet

download now -

Compliance Income Calculation Worksheet

download now -

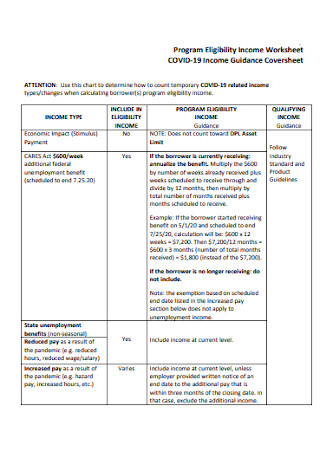

Program Eligibility Income and Expense Worksheet

download now -

Parent Income and Expense Worksheet

download now -

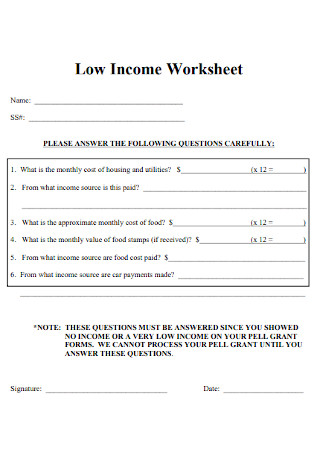

Low Income and Expense Worksheet

download now -

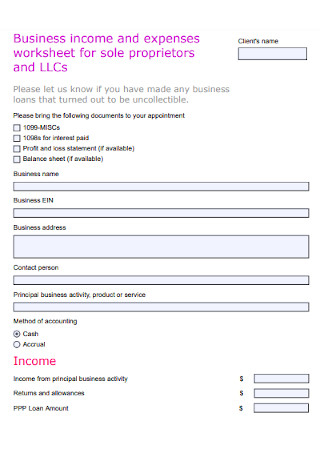

Income and Expense Worksheet for Sole Proprietors

download now -

Day Care Income and Expense Worksheet Template

download now -

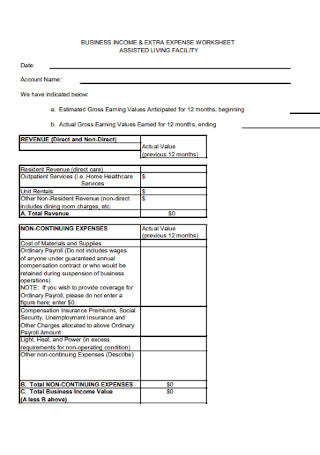

Income and Extra Expense Worksheet

download now -

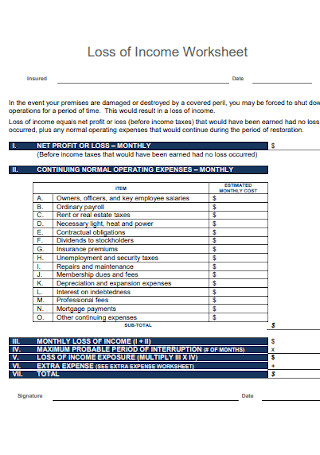

Loss of Income and Expense Worksheet

download now -

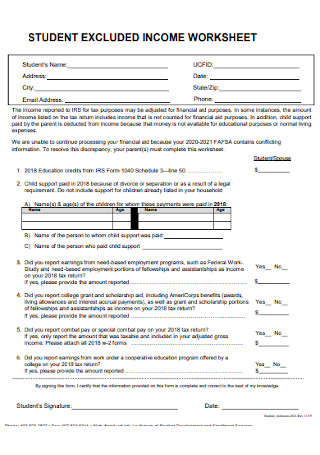

Student Excluded Income Worksheet

download now -

Income and Expense Explanation Worksheet

download now -

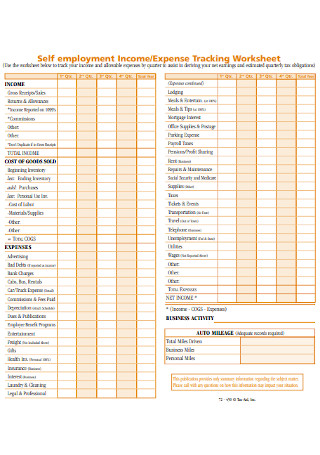

Income and Expense Tracking Worksheet

download now -

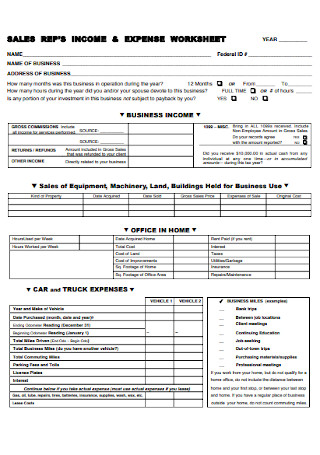

Sales Income and Expense Worksheet

download now -

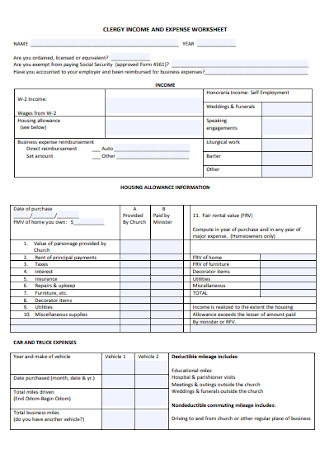

Clergy Income and Expense Worksheet

download now -

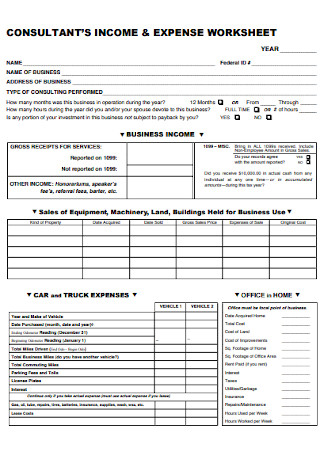

Consutant Income and Expense Worksheet

download now -

Income and Expense Planning Worksheet

download now -

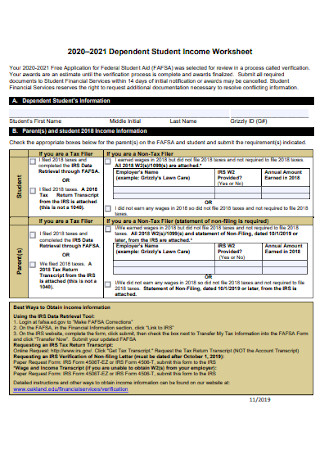

Student Income and Expense Worksheet

download now -

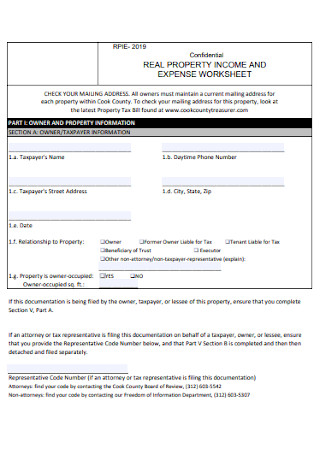

Real Property Income and Expense Worksheet

download now -

Income and Expense Worksheet Schedule

download now

FREE Income and Expense Worksheet s to Download

50+ Sample Income and Expense Worksheets

What Is An Income and Expense Worksheet?

What Are the Things Included in the Income and Expense Worksheet?

How to Make an Income and Expense Worksheet?

The Different Types Of Incomes

FAQs

What is the 70 20 10 Rule money?

What are income and expenses?

What is an income and expense report?

How do you record daily expenses and income?

How do you record household expenses?

What Is An Income and Expense Worksheet?

It is a worksheet in which incomes and expenses are filled in its cells. It is usually created in programs like Microsoft Excel and Google Sheets. However, nowadays, lots of people’s incomes are affected by the Coronavirus outbreak and most are worried about their expenses. According to Statista, as of May 31, around one-third of respondents in the United States lost 10% to 25% of their income over the past 4 weeks in 2020. Meanwhile, 13% of respondents lost all their income. That is why we will need to track our expenses and make a budget plan to keep us free from hunger during the pandemic. Set aside all of the unnecessary stuff, for now, to keep it for the essentials.

What Are the Things Included in the Income and Expense Worksheet?

In your worksheet, there are things you need to consider including. To know more, take a look at this table below:

How to Make an Income and Expense Worksheet?

If you are making one right now and you need help, here we provide you a step-by-step guide on how to make your Income and Expense Worksheet. Additionally, we also give a few tips.

Step 1: Preparations

Preparing the things needed is the first thing you should do. Open your editing software application such as Microsoft Excel and choose between blank or the template. Templates are available in the editing application already which can be found when you create a new one. You can also find more ready-made templates on our site. Gather all the receipts as you will need to input the total income and expenses for the past month. However, you do not need to do that if you will start to track on the first day of the month.

Step 2: Create And Edit

If you are starting from blank, create a table with 5 columns and you decide the number of rows. If there are no options available for creating tables, you can highlight the columns instead and manually add borders to them. Afterward, add your header by highlighting the first row and add a color of your choice. Your header will serve to label each row. Labels of the header include but are not limited to the date, description, income, and expenses. The end row should be labeled as the total income, expenses, and balance of the month.

Templates, on the other hand, did it already for you. It is up to you now whether to alter your worksheet or not. Adding colors to your worksheet is optional depending on your preference. Make sure to include the month and year in the title of the worksheet. Afterward, you can opt to print it out and record your spendings by hand or keep it on your phone or computer where you can record it anytime and anywhere as long as you have the application.

Step 3: Add The Formulas

In a spreadsheet, there is a thing called “Formula” which is used for multiple purposes based on the data in your spreadsheet. These are automatic calculations, finding value, displaying visual charts, and such. Add the “=sum(” formula in the cell after the last cell in the income column to sum up the total. Then, highlight the cells starting from below the label income to the last cell and click enter. Do the same for expenses. The spreadsheet will automatically calculate their totals as soon as the formula is detected. However, if one thing in the formula is missing or wrong, it will result in an error, or invalid formula or data.

Step 3: Continuously Recording

Every day is a brand new day and it also means new consumption. If possible, always ask for receipts as you buy stuff or pay debts and keep them. Expenses include your transportation, meals, and such. They are the ones you need to keep track of. Aside from that, you also need to record your income whenever you receive your salary from your job or earnings from your small business, or from selling products. Make sure that you can access the worksheet anytime and anywhere.

Step 4: Repeat

This type of worksheet is good for a month. This means that you have to create another one for next month by repeating these steps. Maybe try another layout and design to keep you away from being bored looking at the same thing every month. Download more ready-made templates that you might like. There are various designs you can choose from on our site and available in your preferred file format.

The Different Types Of Incomes

As income means it is an amount of cash or money that you receive from the business or company, it also has different types for you to learn more. Below are the three types of income that we define for you.

1. Passive Income

Passive Income is when an individual earns an amount of cash that requires minimal labor. It will become a progressive passive income if one manages to expend little effort to grow their income. Examples of a passive income include rentals, and owning any business in which the earner’s presence does not participate in running that said business.

2. Active Income

Active Income is the opposite of passive income which will require an individual to give more effort to earn. It is gained from actively performing a service to a company or business. Examples of an active income include wages, tips, salaries, commissions, and earnings from business in which the earner has material participation and acts as a staff of that said business.

3. Portfolio Income

The third type of income is called “Portfolio Income”. It refers to the interest, capital gains, and dividends. It can be investment assets or money lent. Examples of this type of income include savings bonds, savings accounts, exchange-traded funds, money market accounts, and more.

The Types of Expenses

Aside from the income, expenses also have different types. They are fixed, variable, and periodic expenses which will be explained below.

1. Fixed Expenses

From the name itself, they are the expenditures that have fixed amounts paid in monthly intervals. Their costs stay the same regardless of anything that has a significant impact on your cash flow and budget. Examples of this type include rental fees, mortgage, insurance, and much more.

2. Variable Expenses

Unlike fixed expenses, variable expenses do not have fixed costs but vary depending on the amount you require. The amount can be changed from month to month. This is the opposite of fixed expenses. Quite often, they are discretionary and some are necessities. Examples of variable expenses include utilities such as electric and water bills, raw materials, shipping costs, and much more. Grocery shopping can also be considered a variable expense as your amount of groceries will vary depending on the amount you need.

3. Periodic Expenses

Unlike the other two types of expenses, periodic expenses are expenditures that are spent on an irregular basis rather than monthly. Examples are but are not limited to tuition and fees, car maintenance, car insurance (if not paid monthly), birthdays, self-employment taxes, and more. To provide further information, periodic expenses can occur once or a few times a year. They can also be paid quarterly or every other month.

FAQs

What is the 70 20 10 Rule money?

It is a rule in budgeting your money which divides into three parts. The money you spend is only 70% of your income, 20% of your income goes to savings, and the rest of 10% of your income goes to donations.

What are income and expenses?

The difference between income and expenses is that income is the money received from the business or company you offer services to and expenses are the money you spend.

What is an income and expense report?

The income and expense report is utilized to analyze the money that comes in and out of your accounts based on the categories indicated in your transactions. It tracks trends in specific categories and shows if you are earning more than you spend in a certain duration of time.

How do you record daily expenses and income?

There are three ways that you can do it. One is to set a reminder on your phone every day to record your expenses into an Excel sheet. You can also use an app for it. According to US news, the best tracking apps for business and personal use are Mint, YNAB, SupportPay, SupportPay, Digits, Shoeboxed, Expensify, Xero, and Evernote. However, if you want old school, the third way tells you to jot down your expenses in a notebook every time you spend or the end of the day.

How do you record household expenses?

For an easier way for you to know how much you spend on your household expenses, use an app for it or record or track them to your worksheet. Creating different categories for expenditure will help you break down your expenses and determine how much you spend in each category. For example, rentals, bills, groceries, toiletries, leisure, and more. At the end of each day, record all of your expenses and total them.

Budgeting will be much easier if you will keep tracking your income and expenses into your worksheet. It will help you minimize your spendings each month so you can store more of your income into your savings. Be sure not to delay making one. It can also help you save more earlier. Tracking your income and expenses can also make you realize not to overspend on unnecessary things but to only focus on things that matter. Another thing to consider, a ready-made template can make your work faster as they already provide everything. The only thing you can do is to fill in the blank cells with the amount of your income and expenses.