20+ IRS Publication 915 Worksheets (Social Security Tax, Security Income Tax, Retirement Income, Social Security Benefits)

-

2024 Publication 915 Worksheet

download now -

2023 IRS Publication 915 Worksheet

download now -

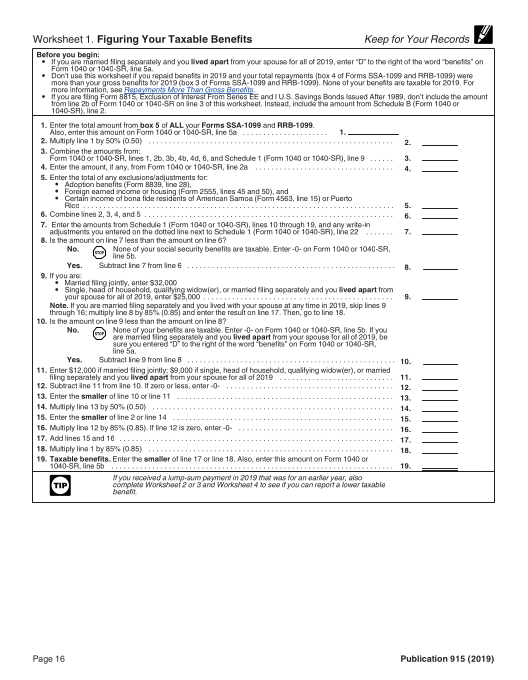

Figuring your Taxable Benefits IRS Publication 915 Worksheet

download now -

2022 IRS Publication 915 Worksheet

download now -

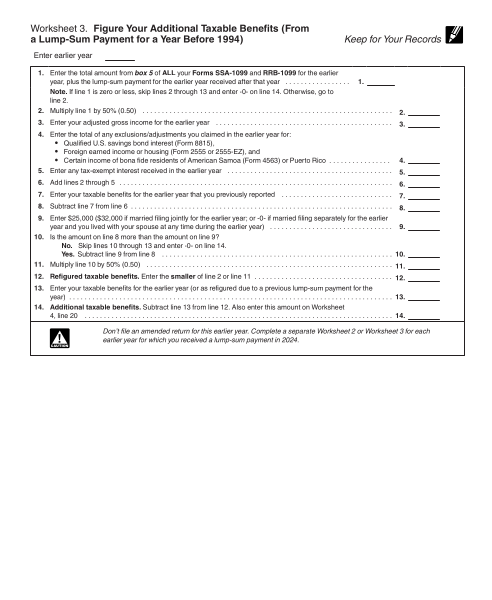

IRS Publication 915 Worksheet for Taxable Benefits from Lump-Sum Payment for a year Before 1994

download now -

2021 IRS Publication 915 Worksheet

download now -

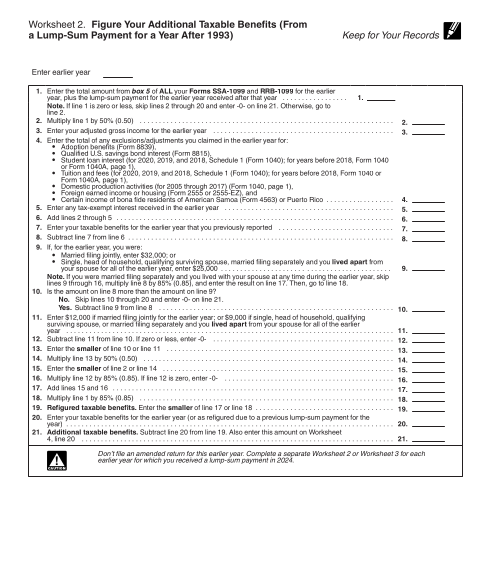

Taxable Benefits from a Lump-Sum Payment IRS Publication 915 Worksheet

download now -

2020 IRS Publication 915 Worksheet

download now -

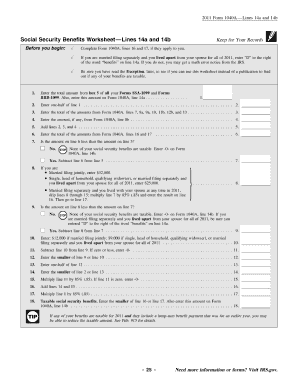

IRS Publication 915 Worksheet for Social Security Benefits

download now -

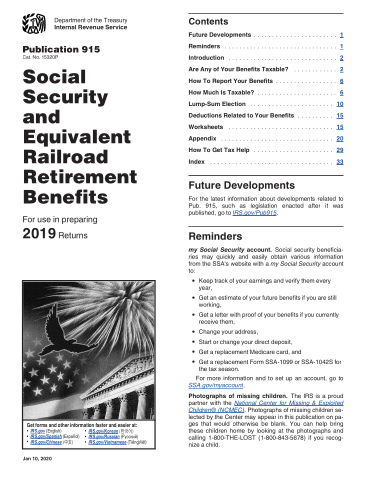

2019 IRS Publication 915 Worksheet

download now -

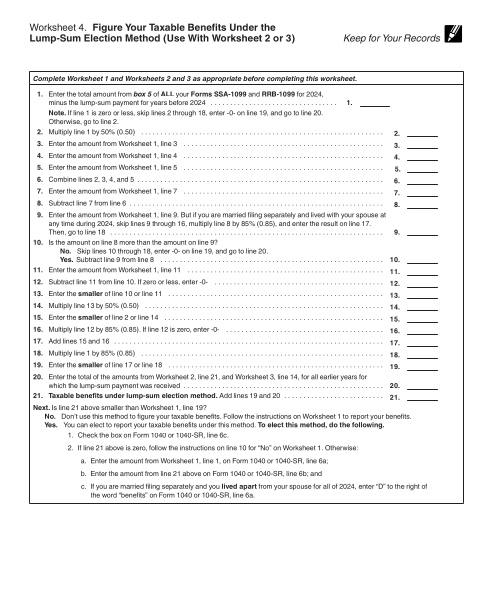

IRS Publication 915 Worksheet for Taxable Benefits under the Lump-Sum Election Method

download now -

Social Security and Equivalent Railroad Retirement Benefits IRS Publication 915 Worksheet

download now -

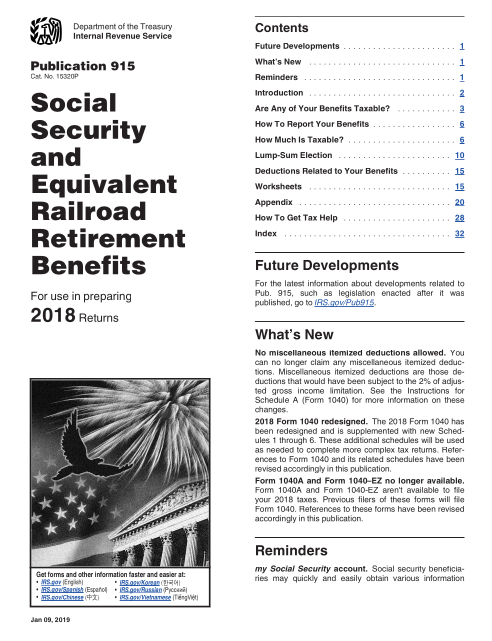

2018 IRS Publication 915 Worksheet

download now -

IRS Publication 915 Worksheet

download now -

2017 IRS Publication 915 Worksheet

download now -

2016 IRS Publication 915 Worksheet

download now -

2015 IRS Publication Worksheet

download now -

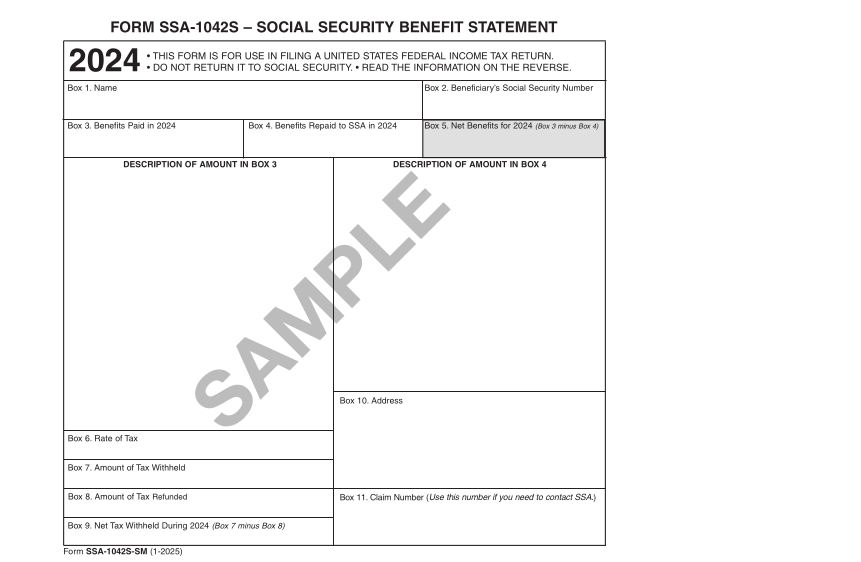

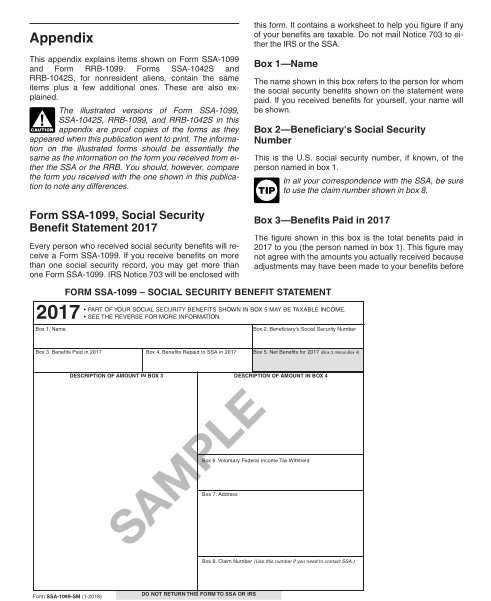

Form SSA-1099 IRS Publication 915 Worksheet

download now -

2014 IRS Publication 915 Worksheet

download now -

2013 IRS Publication 915 Worksheet

download now -

2012 IRS Publication 915 Worksheet

download now -

2011 IRS Publication 915 Worksheet

download now -

2010 IRS Publication 915 Worksheet

download now

🧾 What is a IRS Publication 915 Worksheet?

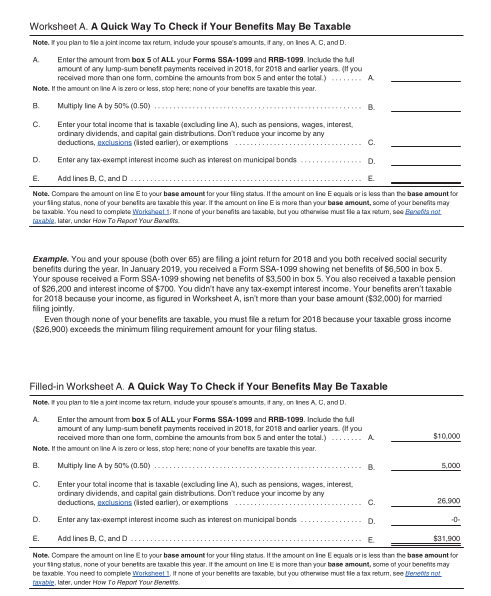

The IRS Publication 915 Worksheet is a tool used to calculate the taxable portion of Social Security and equivalent railroad retirement benefits, as outlined in IRS Publication 915. It helps taxpayers determine how much of their received benefits need to be reported as taxable income on their federal tax returns.

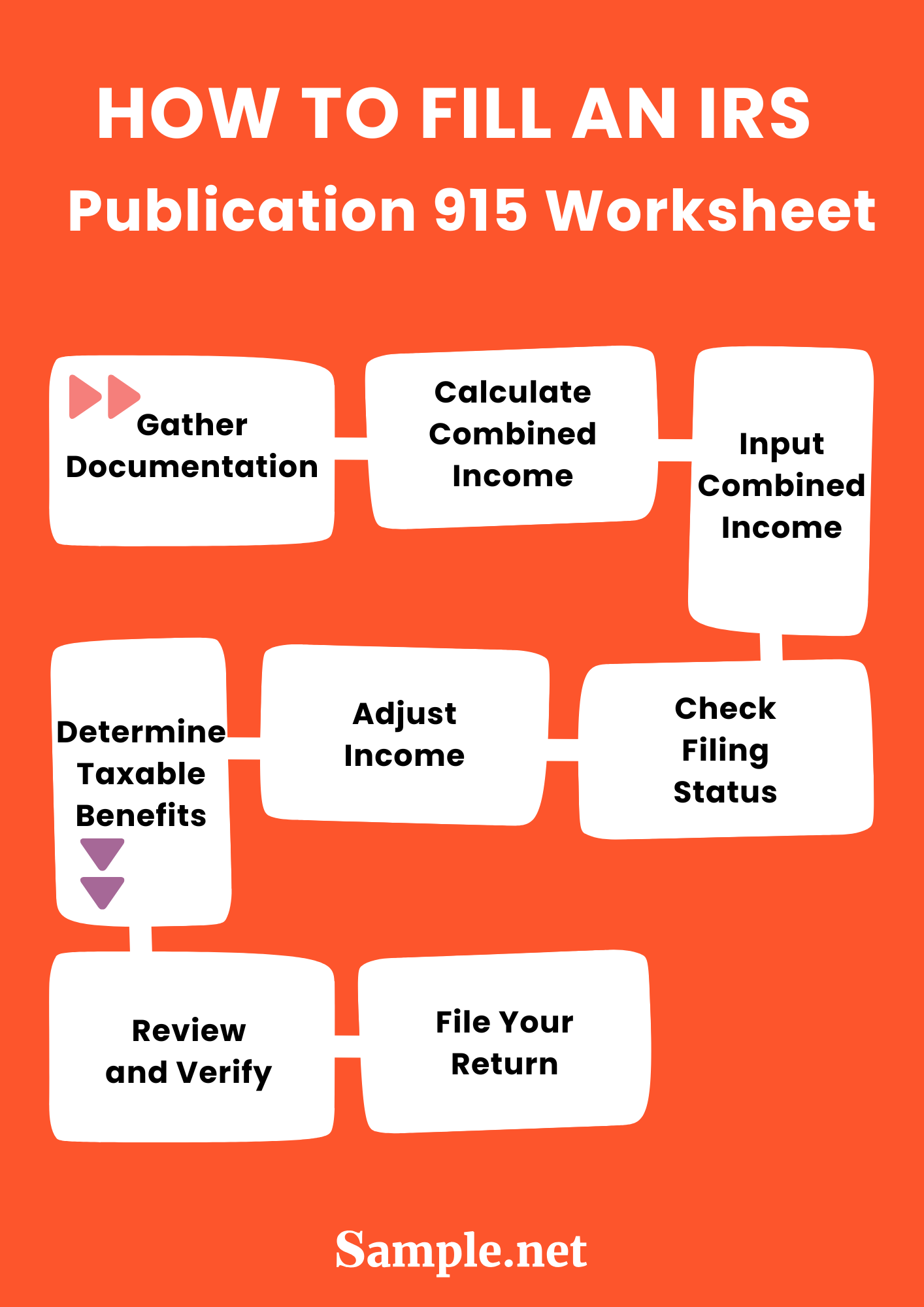

✍️ How to Fill an IRS Publication 915 Worksheet?

Free IRS Publication 915 Worksheet to Download in PDF

Free IRS Publication 915 Worksheet to Download in PDF

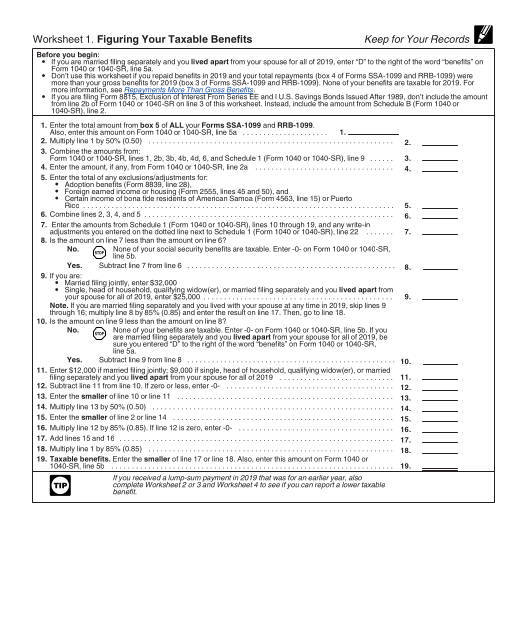

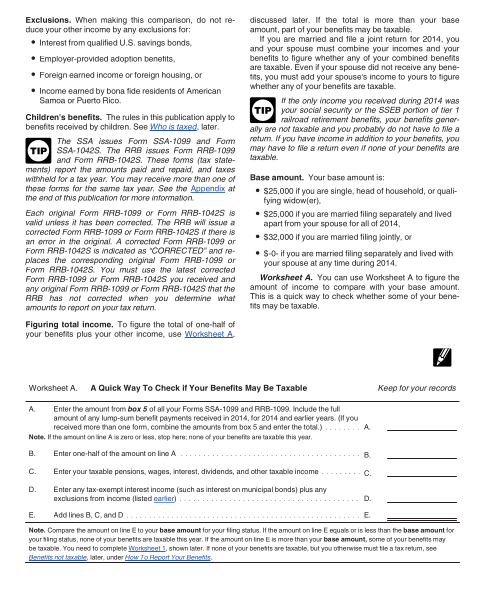

1️⃣ Gather Documentation: Collect all necessary documents, including Forms SSA-1099 and RRB-1099, which report your social security benefits.

2️⃣ Calculate Combined Income: Compute your combined income with the formula:

-

Combined Income = (Adjusted Gross Income + Nontaxable Interest + ½ of Social Security Benefits)

3️⃣ Input Combined Income: Enter your combined income on the worksheet in the specified section.

4️⃣ Check Filing Status: Mark your filing status (such as single, married filing jointly) on the worksheet.

5️⃣ Adjust Income: Make any required adjustments as directed by the worksheet to account for deductions or additional incomes.

6️⃣ Determine Taxable Benefits: Follow the worksheet’s calculations to figure out how much of your social security benefits are taxable.

7️⃣ Review and Verify: Double-check your calculations and entries for accuracy to ensure they comply with the guidelines.

8️⃣ File Your Return: Complete your tax filing by including this worksheet with your tax return if required, and submit everything to the IRS.

How to Use a IRS Publication 915 Worksheet?

1️⃣ Gather Necessary Documents:

-

Have your Form SSA-1099 ready, which shows the total amount of Social Security benefits you received during the year.

-

Collect any other financial documents that list your income, such as 1099 forms for interest or dividends.

2️⃣ Record Your Social Security Benefits:

-

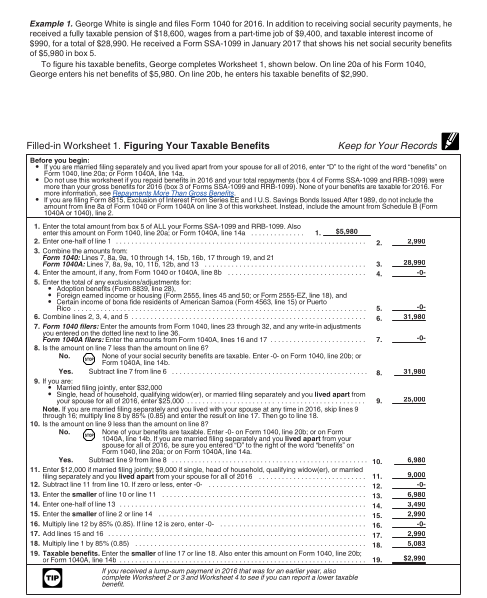

Enter the total benefits amount from Box 5 of your SSA-1099 into the designated section of the worksheet.

3️⃣ Calculate Your Combined Income:

-

Add your adjusted gross income (AGI), nontaxable interest, and half of your Social Security benefits. The worksheet should have separate fields for each input.

4️⃣ Determine the Base Amount:

-

Identify your filing status (e.g., single, married filing jointly, married filing separately) and input the corresponding base amount as specified in IRS Publication 915.

5️⃣ Calculate Your Taxable Benefits:

-

Subtract the base amount from your combined income to find your excess income.

-

Use the IRS rules in Publication 915 to determine what percentage of your Social Security benefits is taxable (either 50% or 85% depending on your excess income).

6️⃣ Input Results:

-

Fill in the calculated taxable amount of your Social Security benefits on the worksheet based on the above calculations.

7️⃣ Review and Adjust:

-

Double-check all numbers and calculations for accuracy.

-

Make necessary adjustments if initial entries were estimates or if discrepancies are discovered.

8️⃣ Consult IRS Guidelines:

-

Refer to IRS Publication 915 for any specific situations or exceptions that might affect your calculations, ensuring your worksheet is filled out in compliance with the latest tax laws.

9️⃣ Use for Tax Filing:

-

Use the calculated taxable amount from the worksheet to complete your tax return accurately.

-

Keep the completed worksheet for your records and as support for your tax return entries.

How to Calculate Taxable Social Security Benefits with IRS Publication 915

1️⃣ Gather Documents:

-

Obtain your SSA-1099 form, which lists the total Social Security benefits you received.

2️⃣ Record Total Benefits:

-

Note down the amount from Box 5 of your SSA-1099 on your worksheet.

3️⃣ Calculate Combined Income:

-

Add together your adjusted gross income (AGI), nontaxable interest, and half of the Social Security benefits.

4️⃣ Determine Base Amount:

-

Find your filing status and corresponding base amount from IRS Publication 915:

-

Single: $25,000

-

Married Filing Jointly: $32,000

-

Married Filing Separately (living apart all year): $25,000

-

5️⃣ Calculate Excess Income:

-

Subtract your base amount from your combined income.

6️⃣ Determine Taxable Benefits:

-

If excess income is:

-

Below $25,000 for single or $32,000 for married filing jointly, up to 50% of your Social Security benefits may be taxable.

-

Above these thresholds, up to 85% of your benefits may be taxable.

-

7️⃣ Complete Calculation:

-

Use the lesser of the two calculated values (50% or 85% of benefits) or your total excess income as your taxable benefit amount.

🧠 Common Mistakes to Avoid on the IRS Publication 915 Worksheet

❌ Using incorrect amounts from SSA-1099 Box 5

❌ Miscalculating combined income

❌ Using outdated base amounts

❌ Selecting incorrect filing status for base amounts

❌ Omitting nontaxable interest in combined income calculations

❌ Ignoring updates in IRS Publication 915

❌ Applying the wrong percentage (50% or 85%) to calculate taxable benefits

❌ Failing to review the worksheet thoroughly before finalizing