40+ Qualified Dividends and Capital Gain Tax Worksheets (Tax Computation, Tax Return, Turbo Tax, IRS, Form)

-

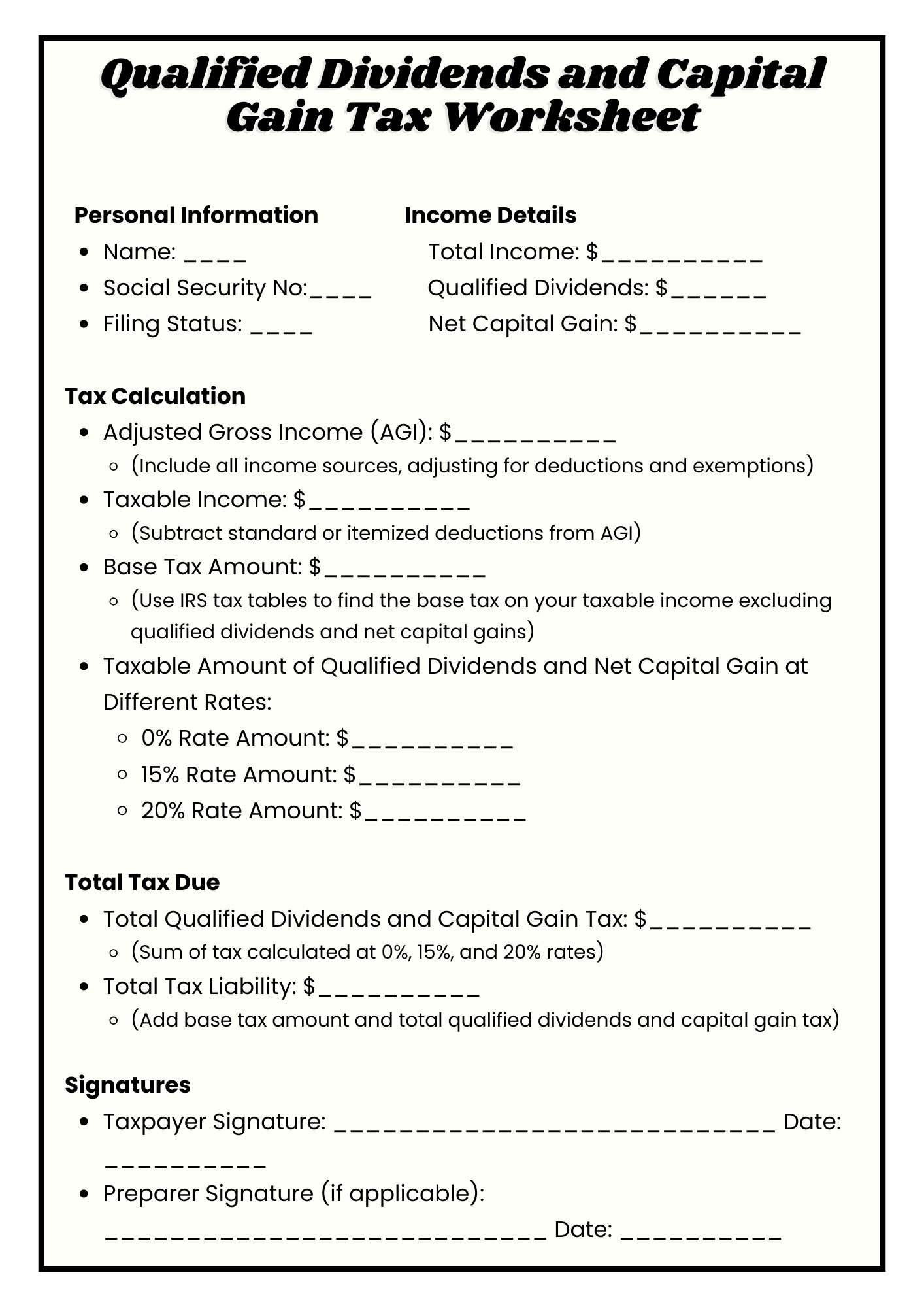

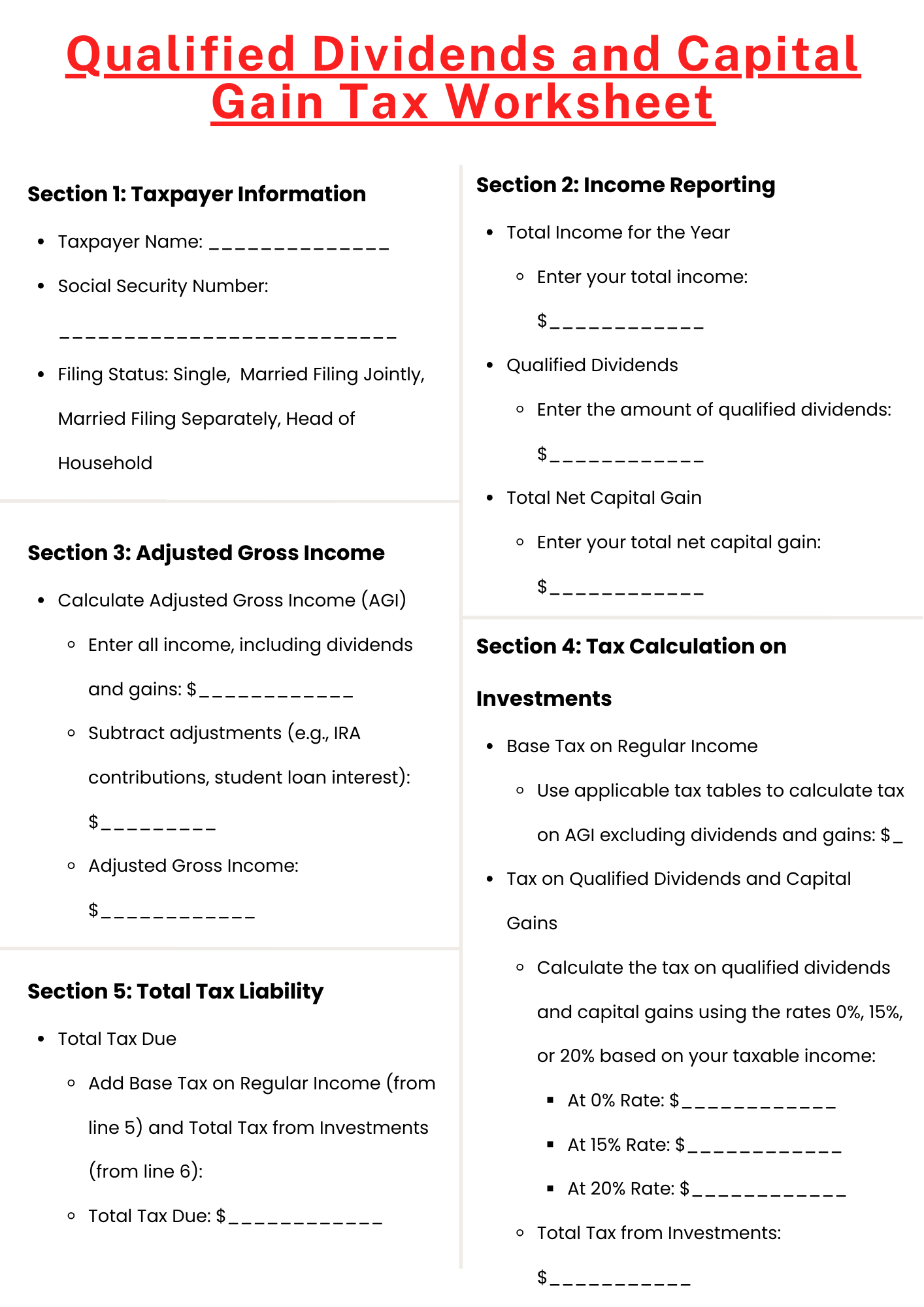

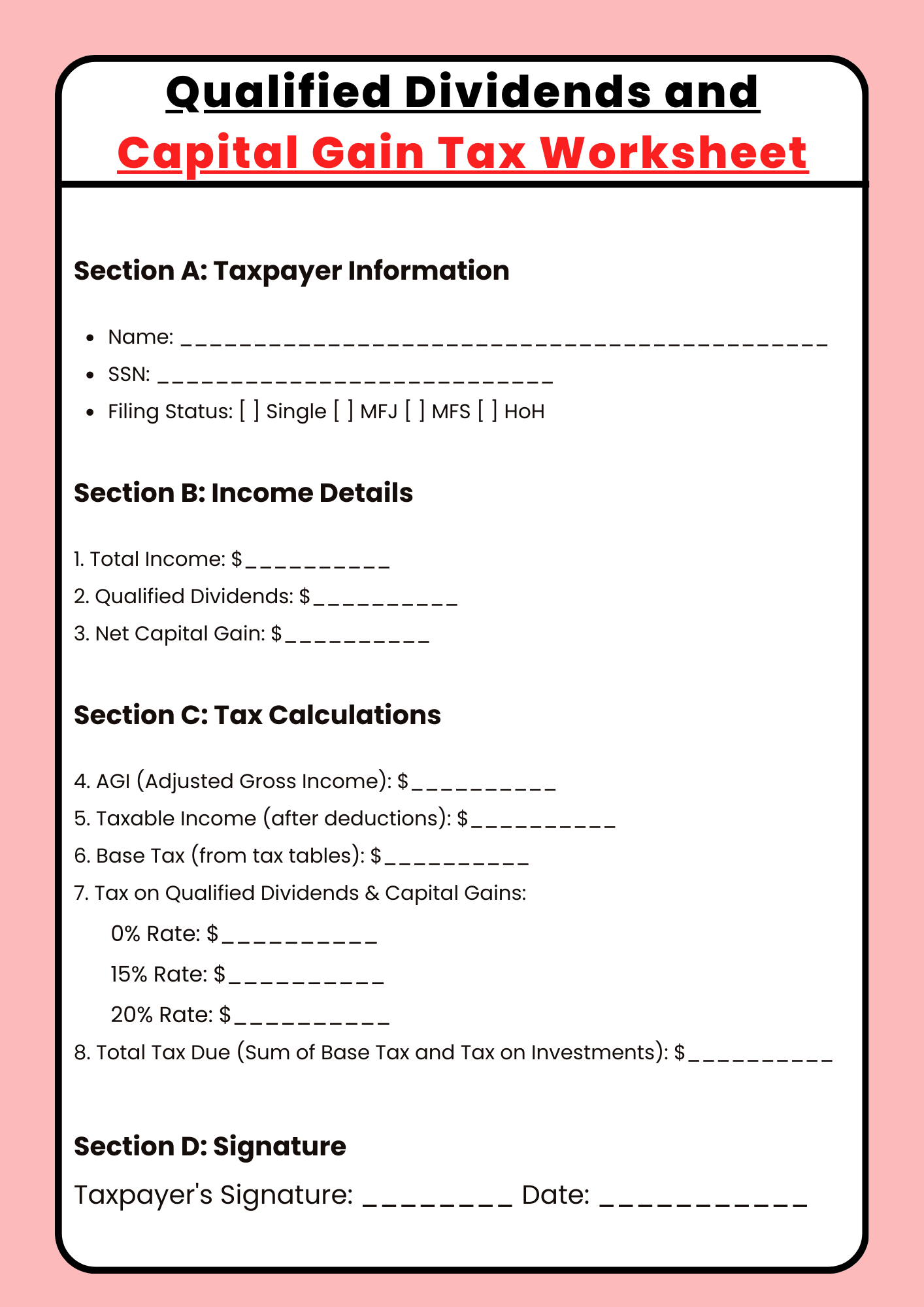

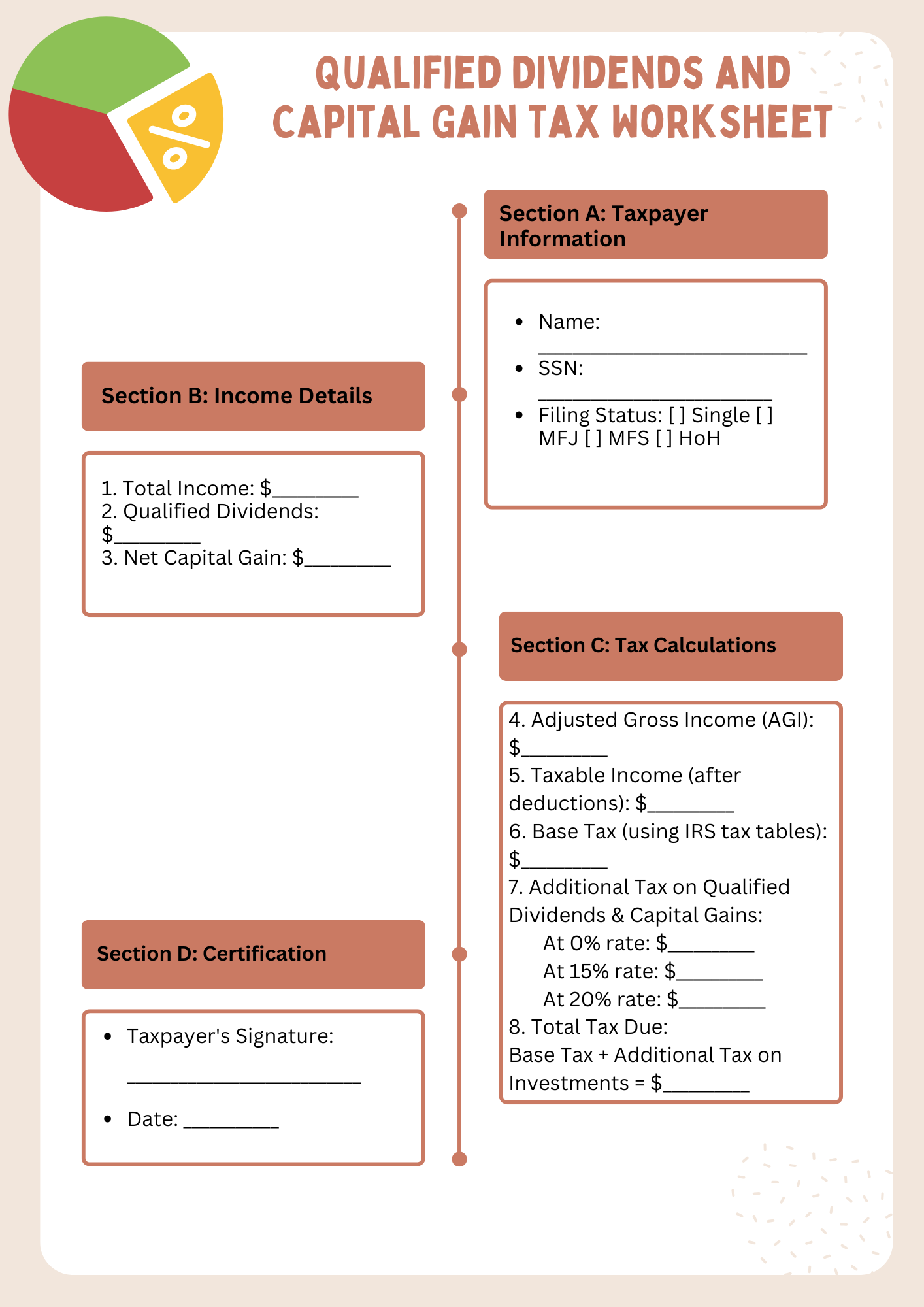

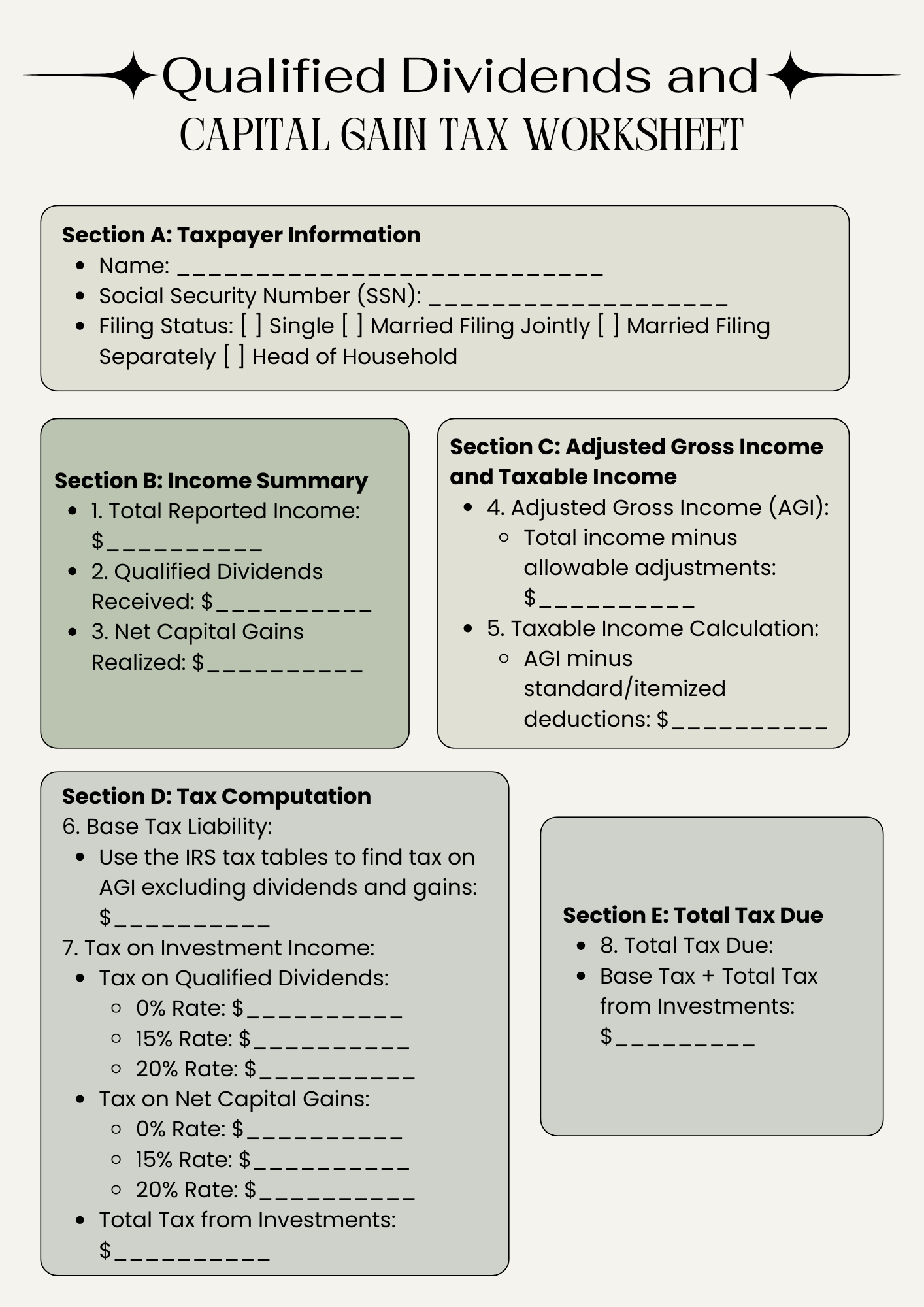

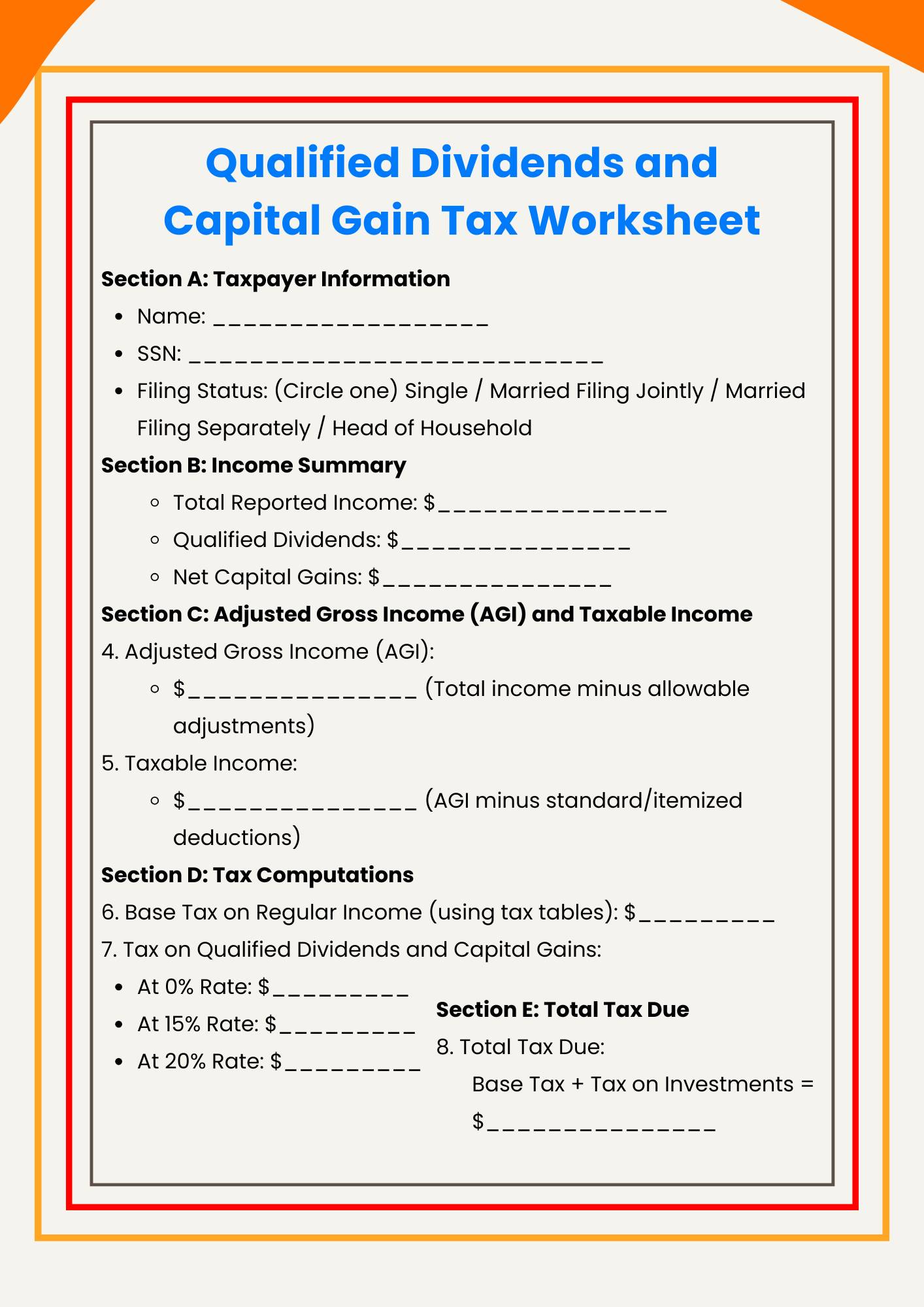

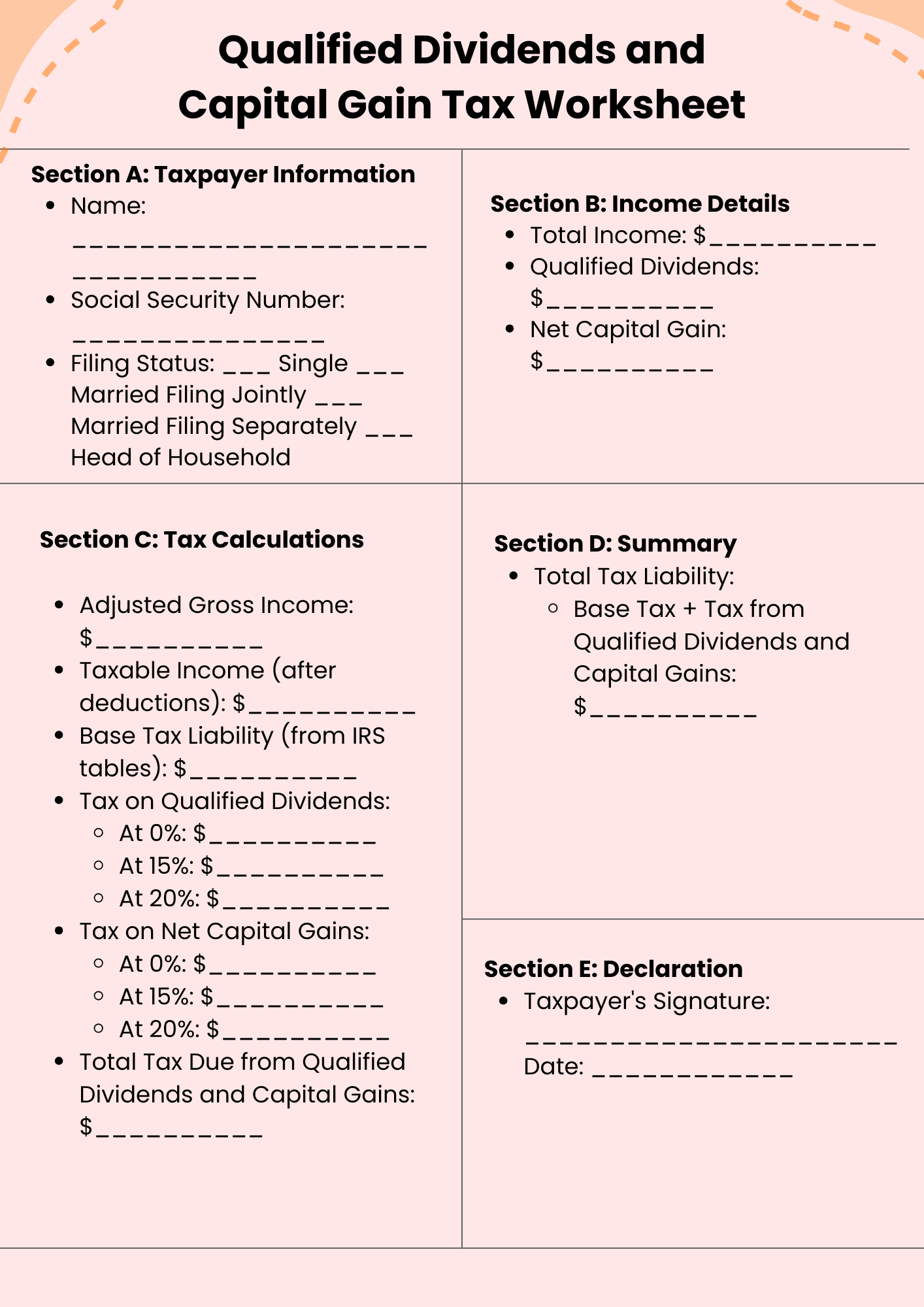

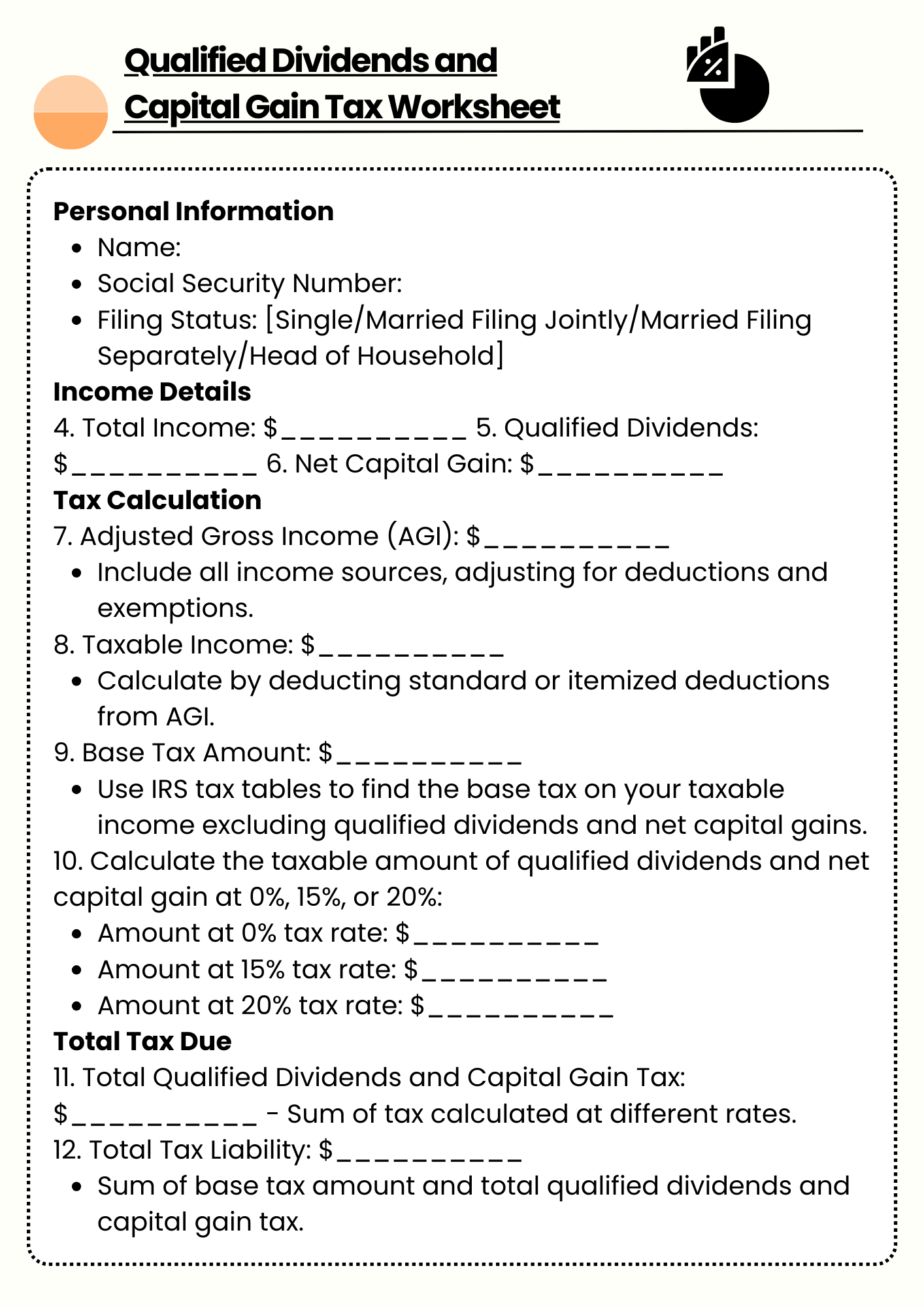

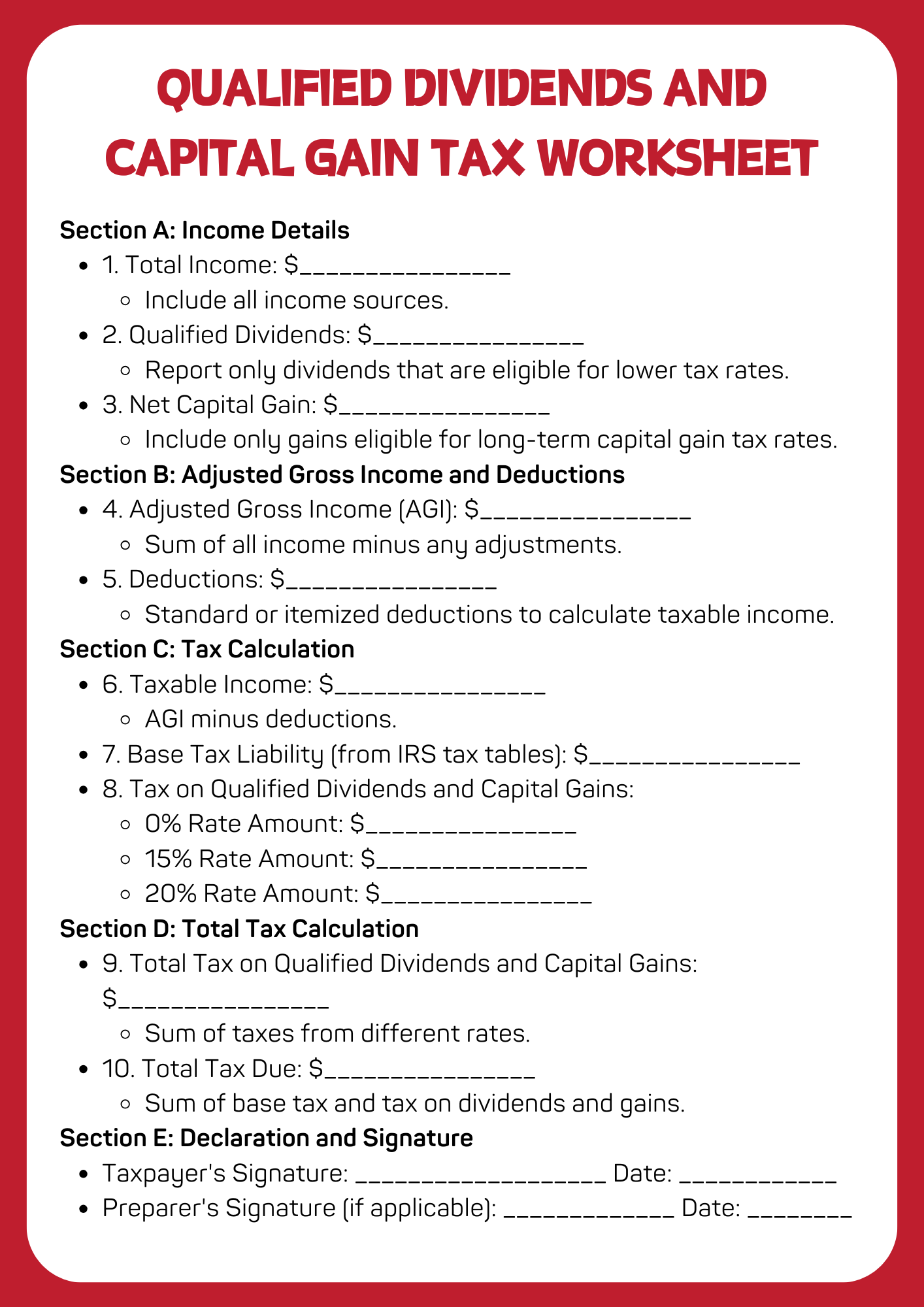

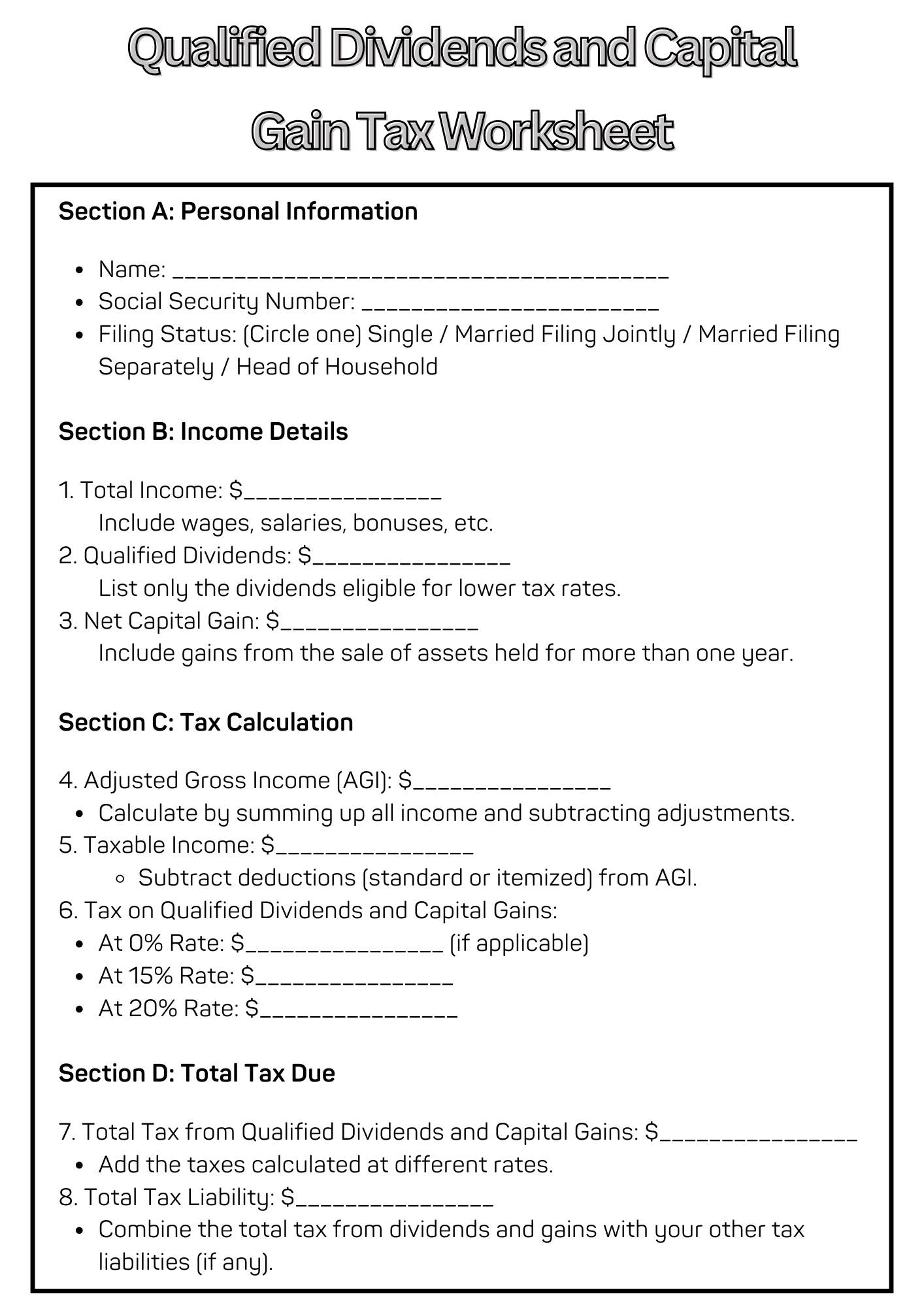

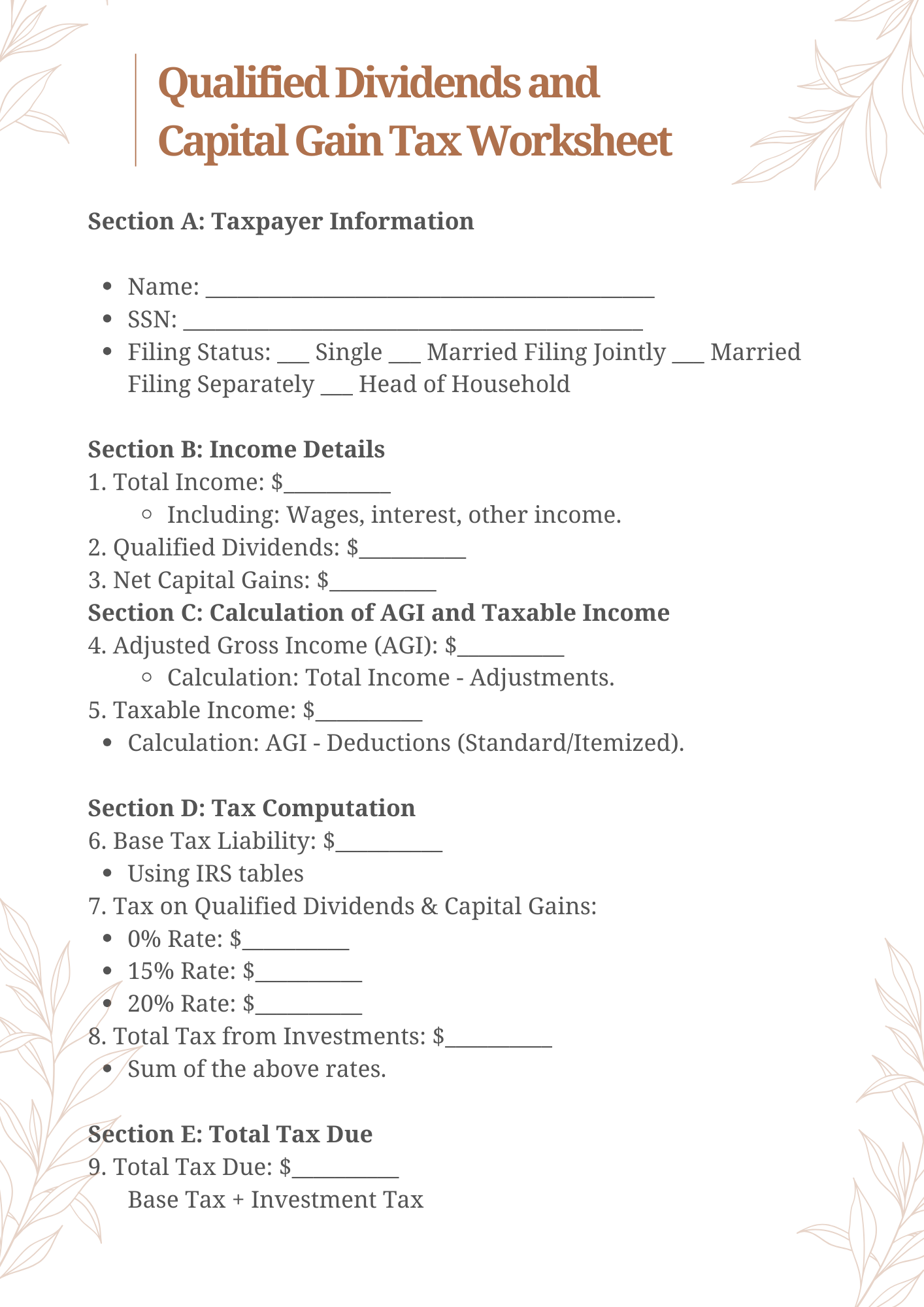

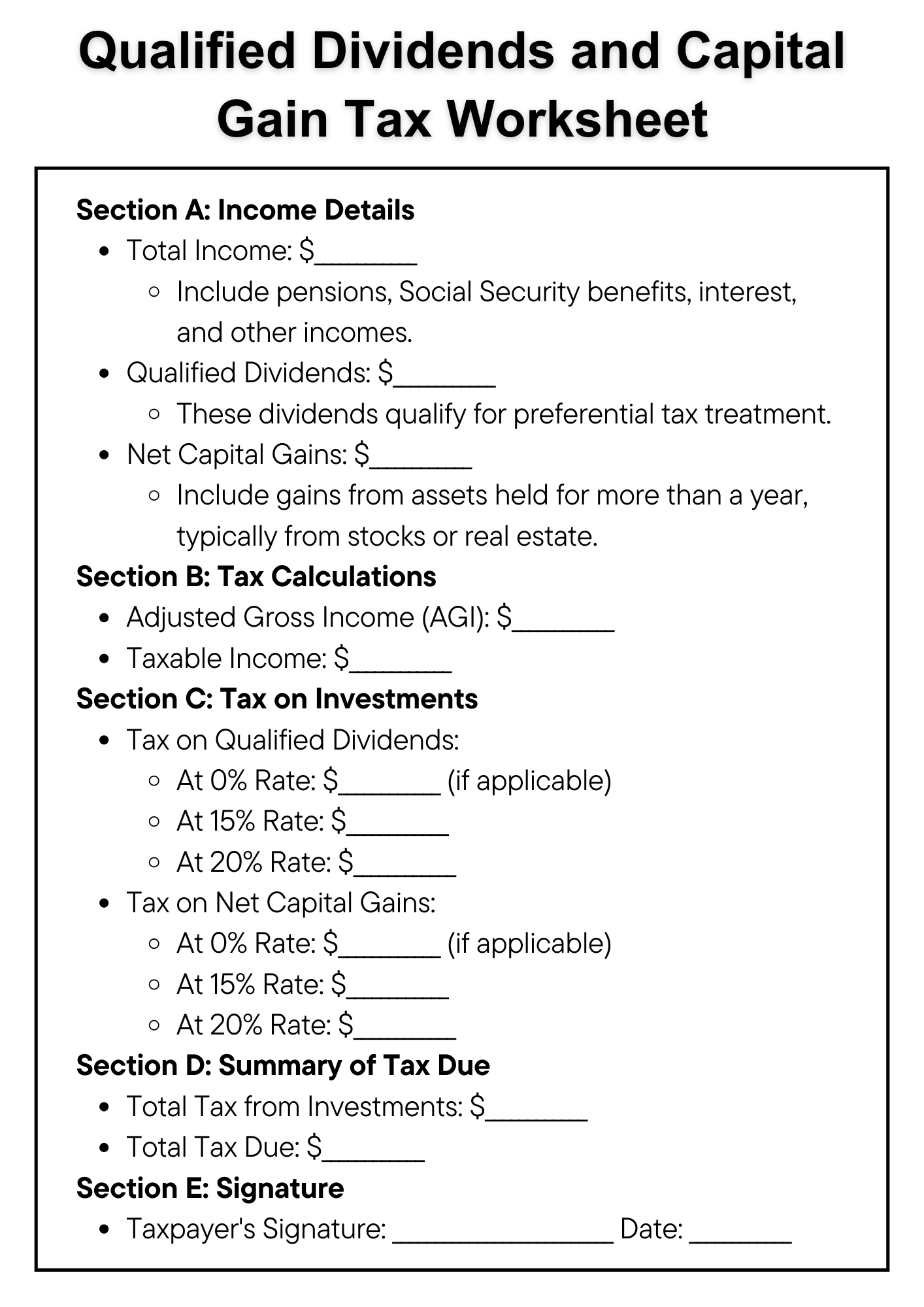

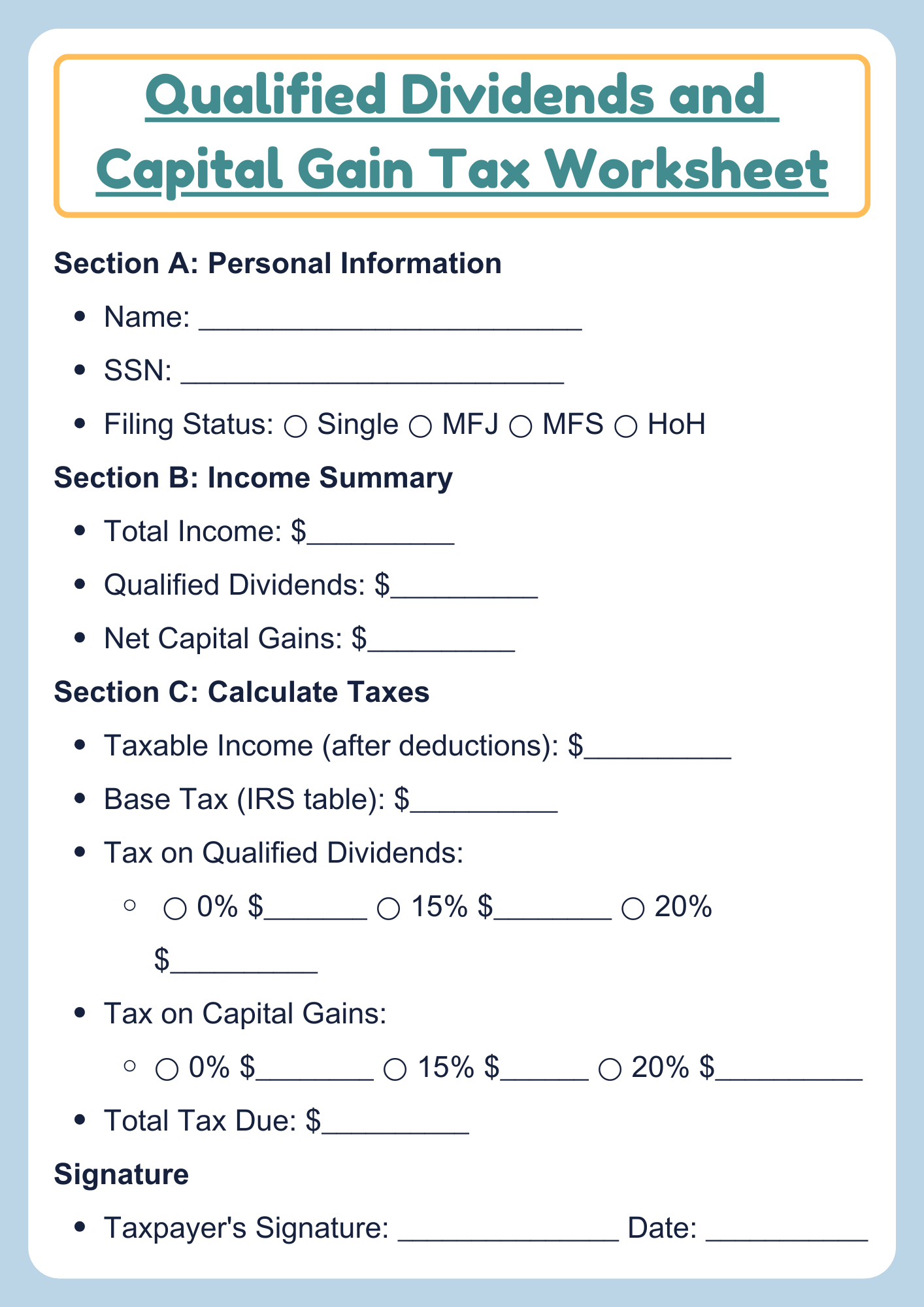

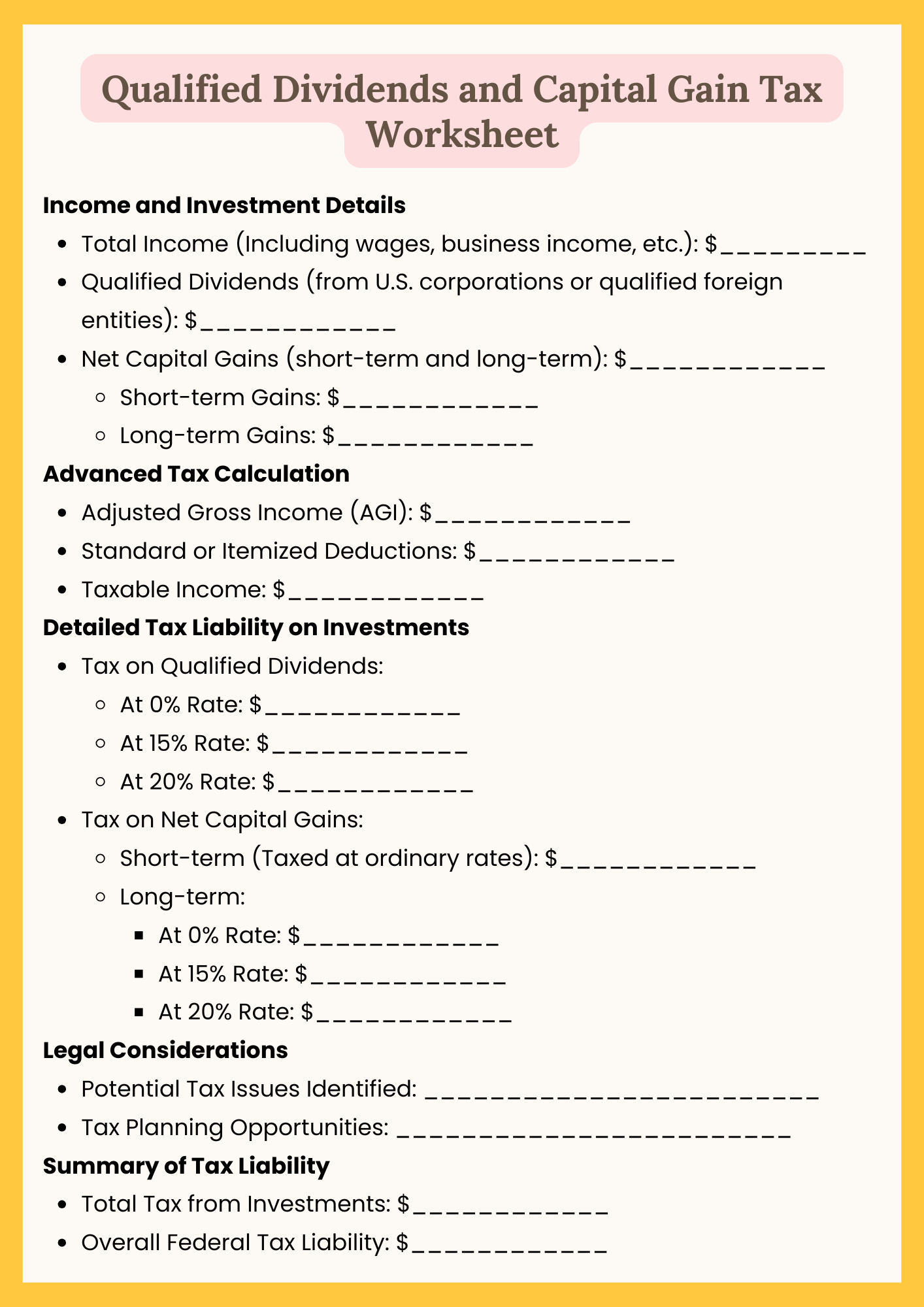

Qualified Dividends and Capital Gain Tax Worksheet

download now -

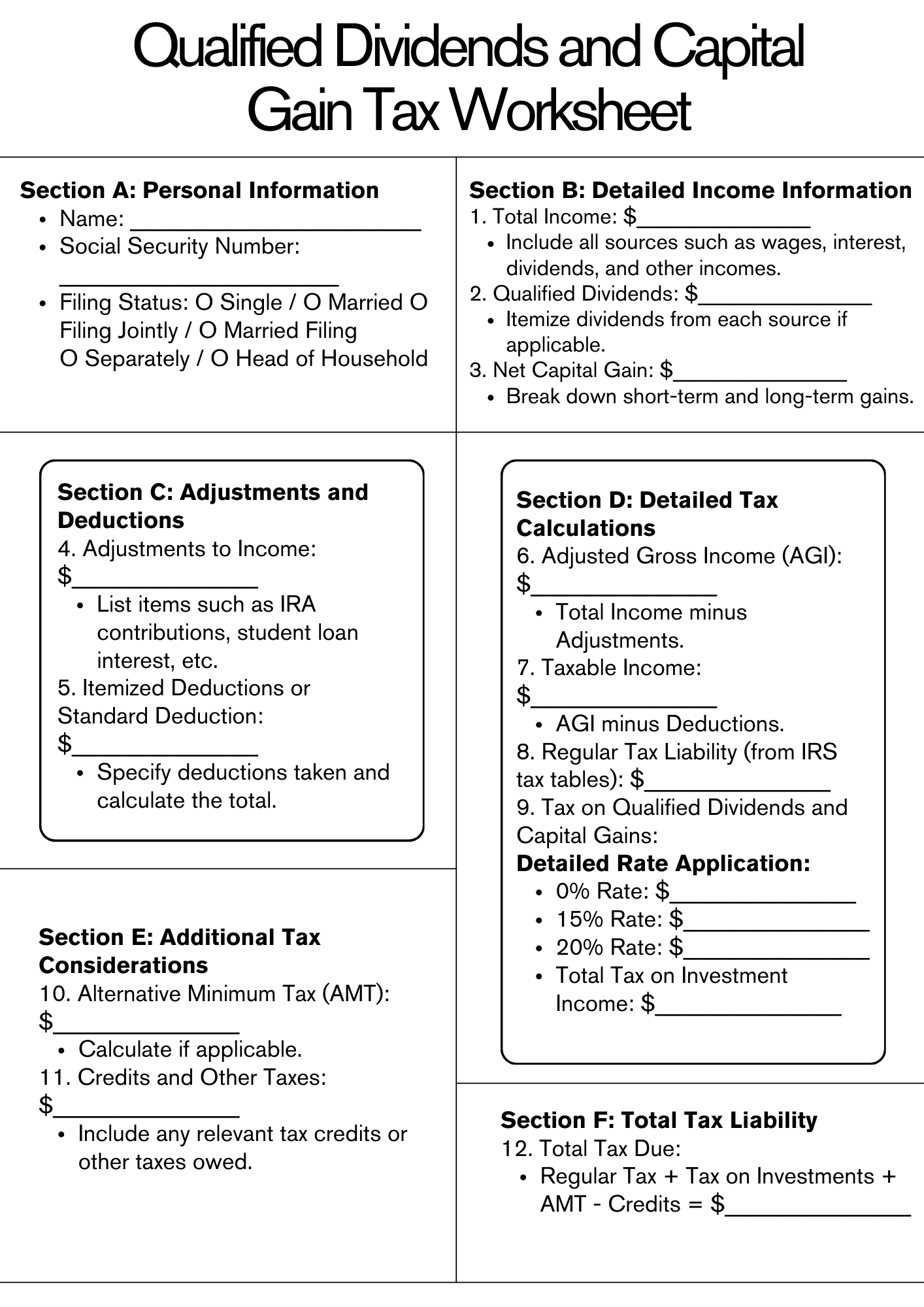

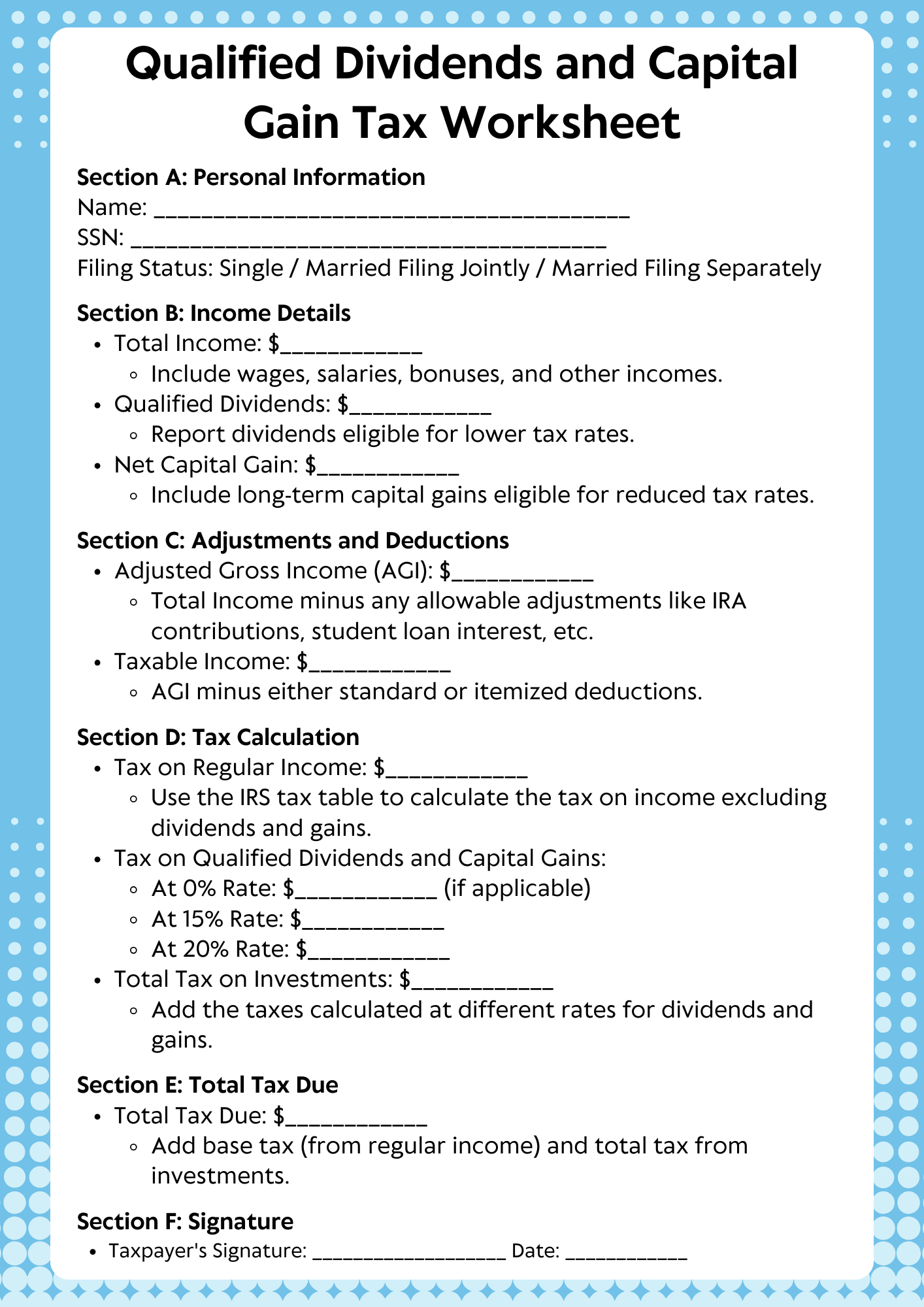

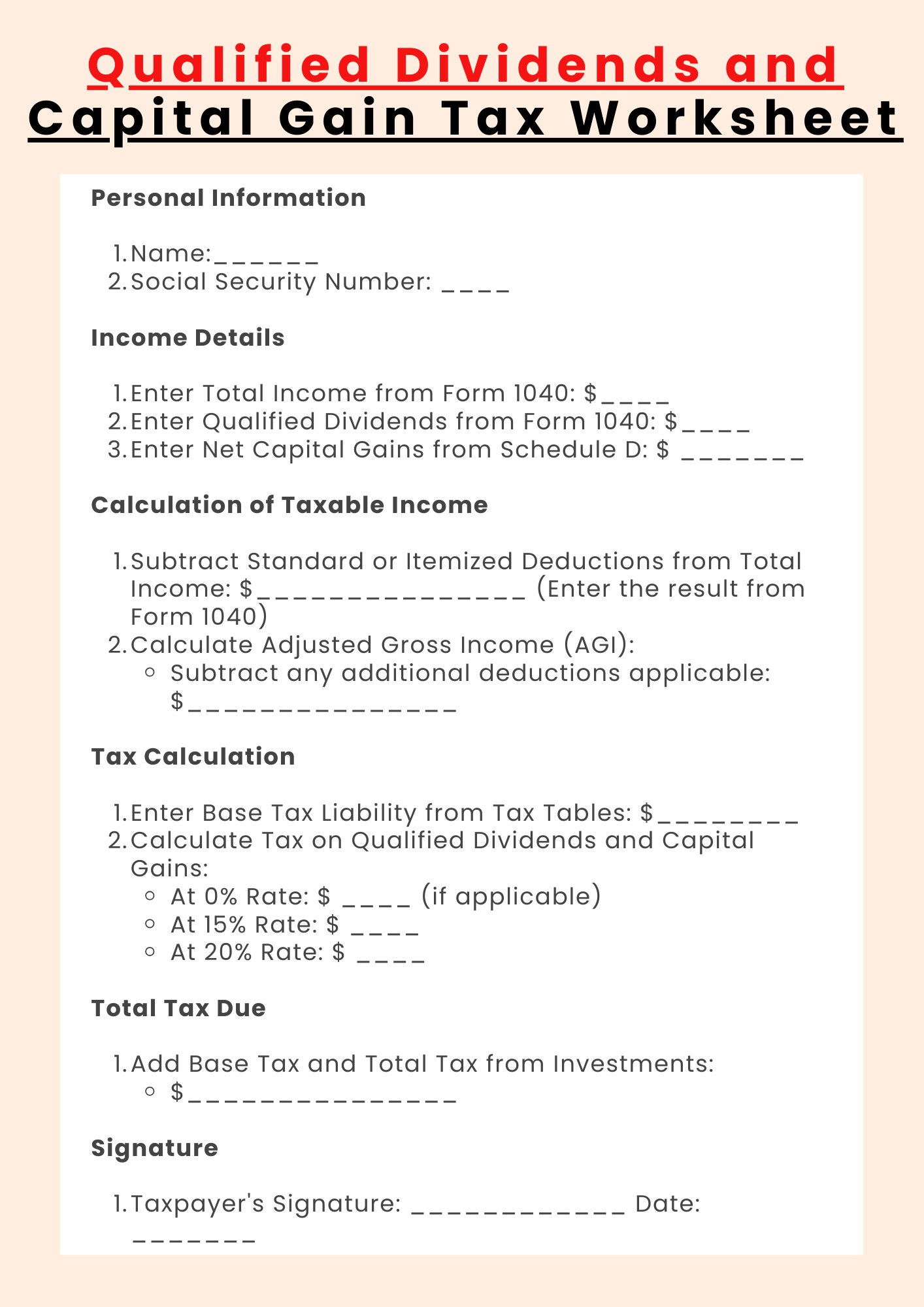

IRS Qualified Dividends and Capital Gains Tax Worksheet

download now -

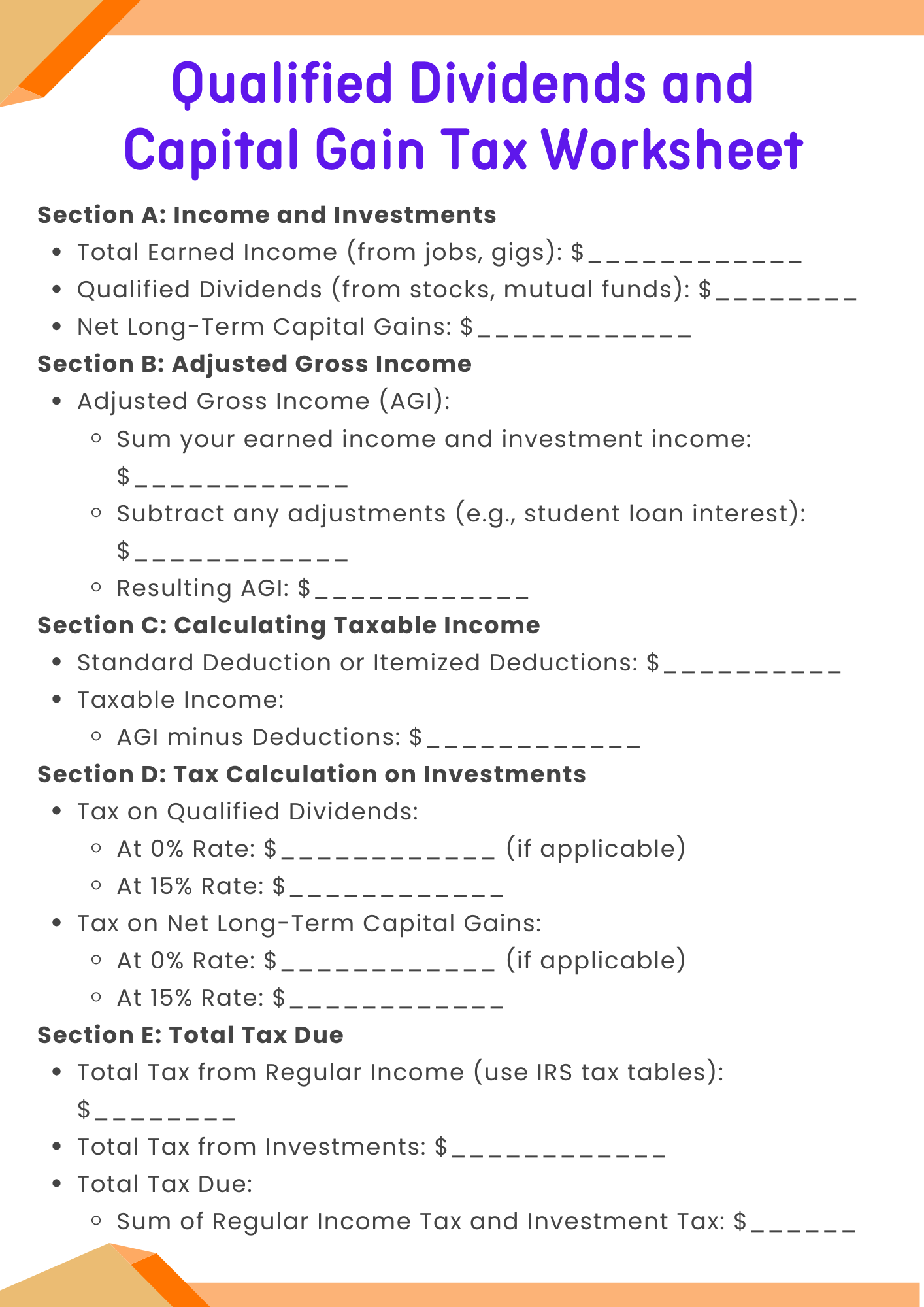

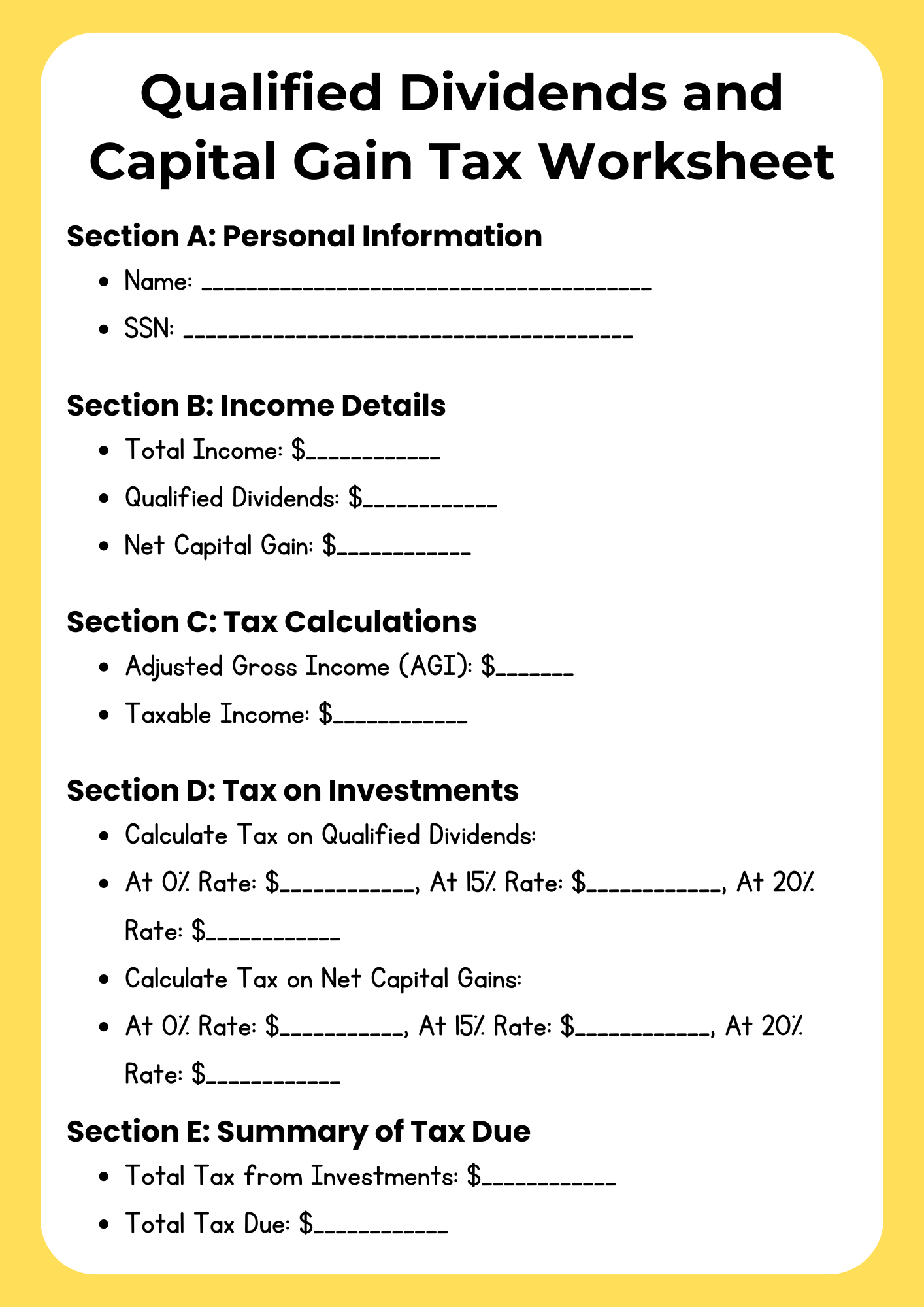

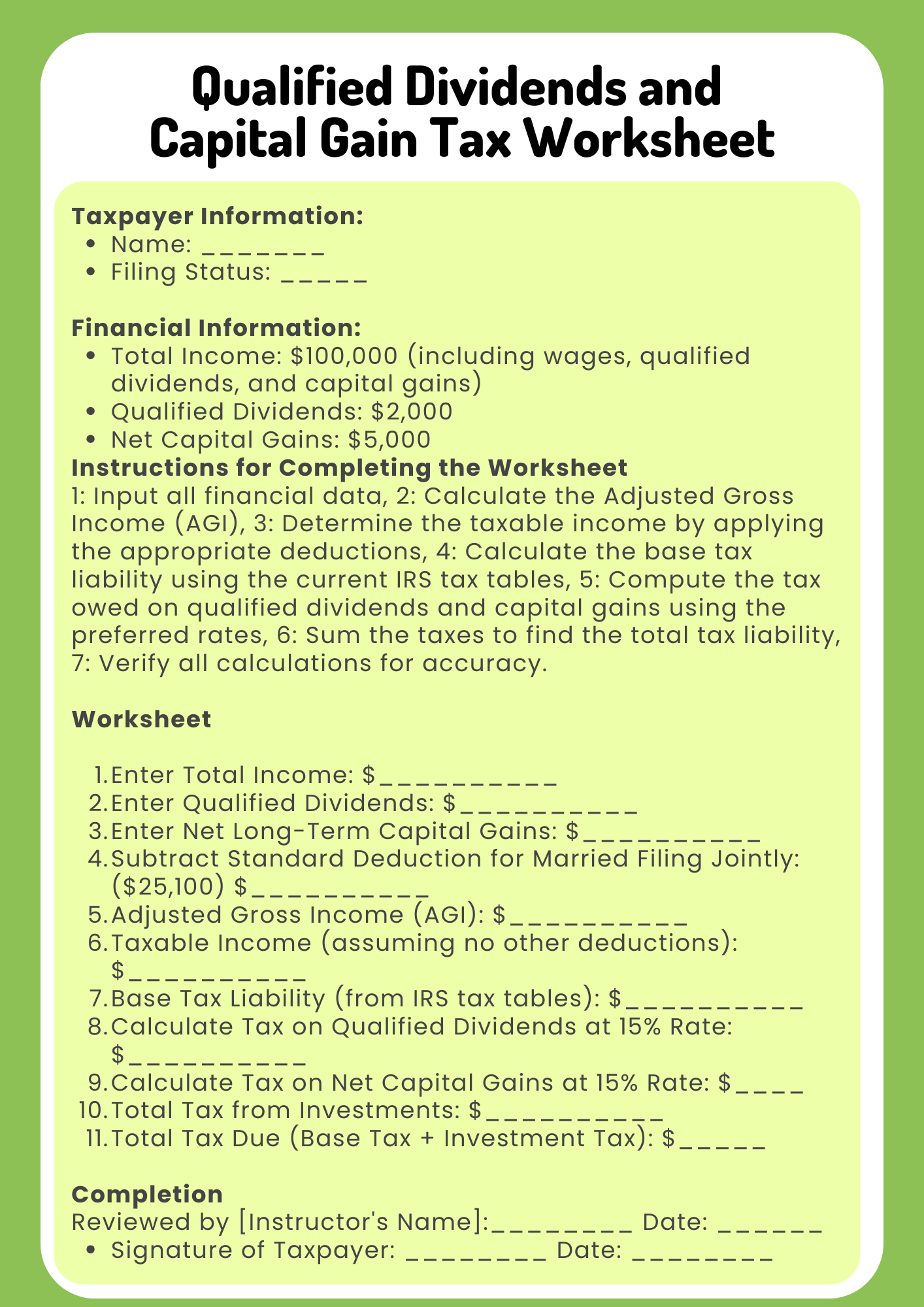

2022 Qualified Dividend and Capital Gain Tax Worksheet

download now -

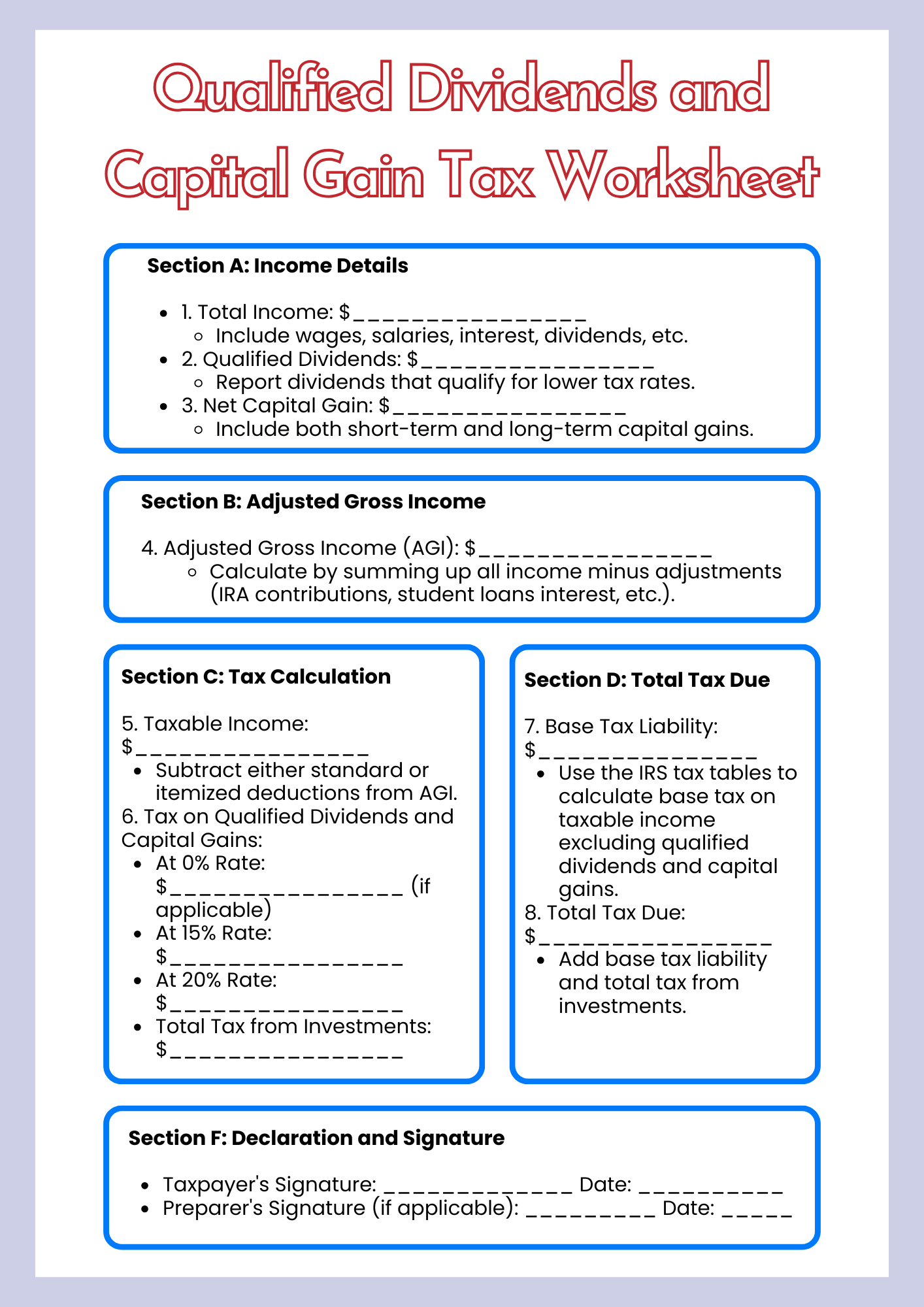

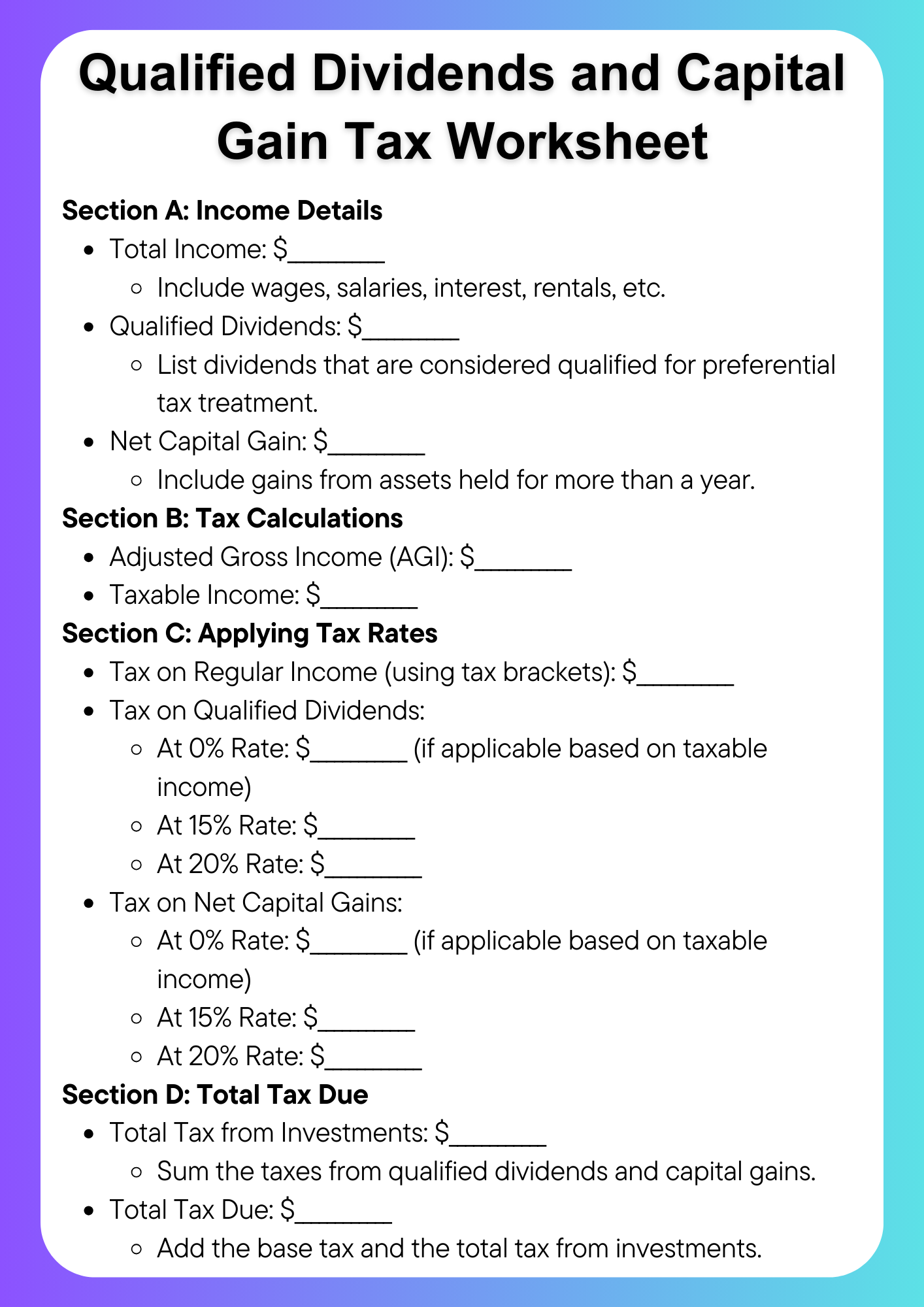

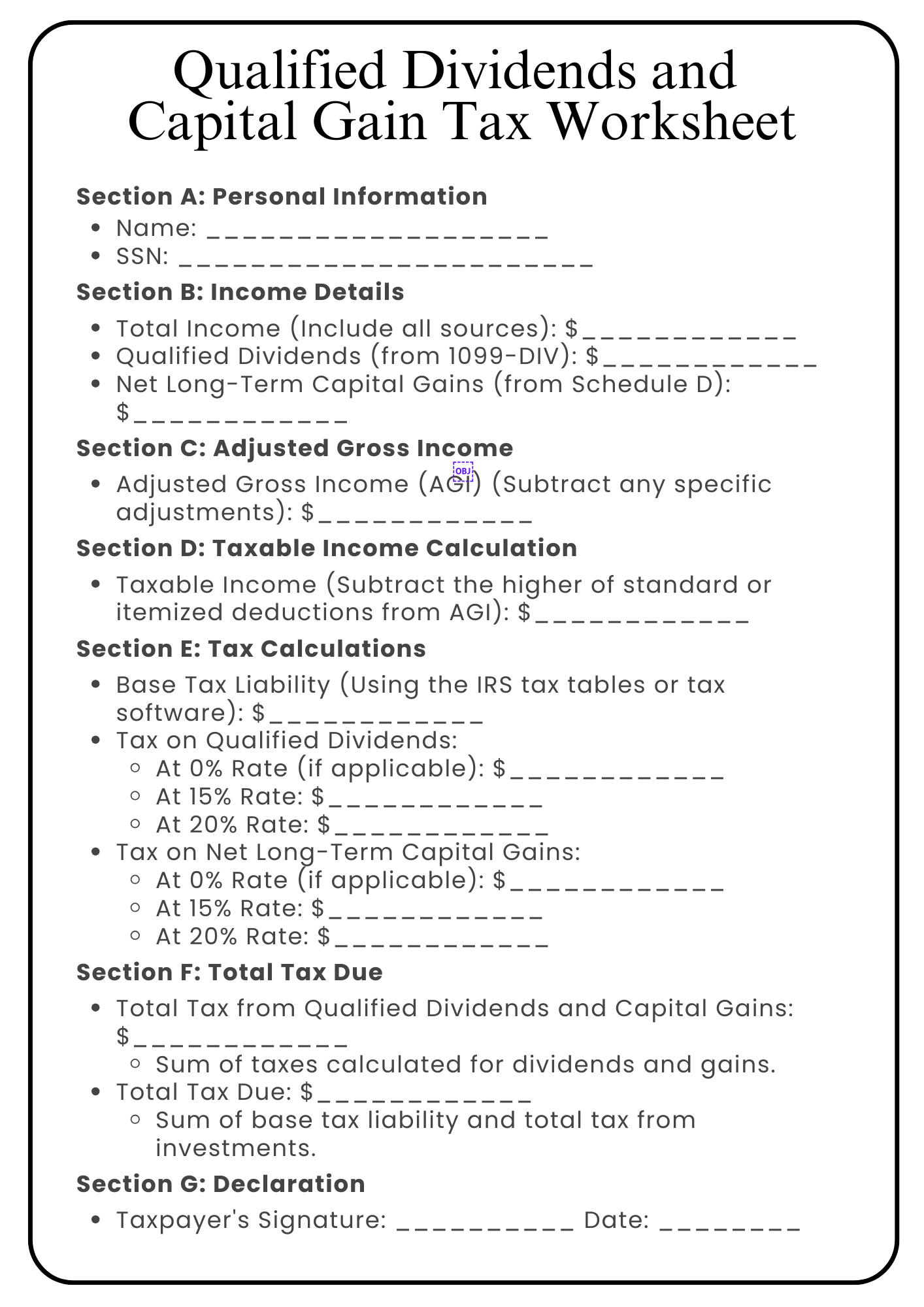

2020 Qualified Dividend and Capital Gain Tax Worksheet

download now -

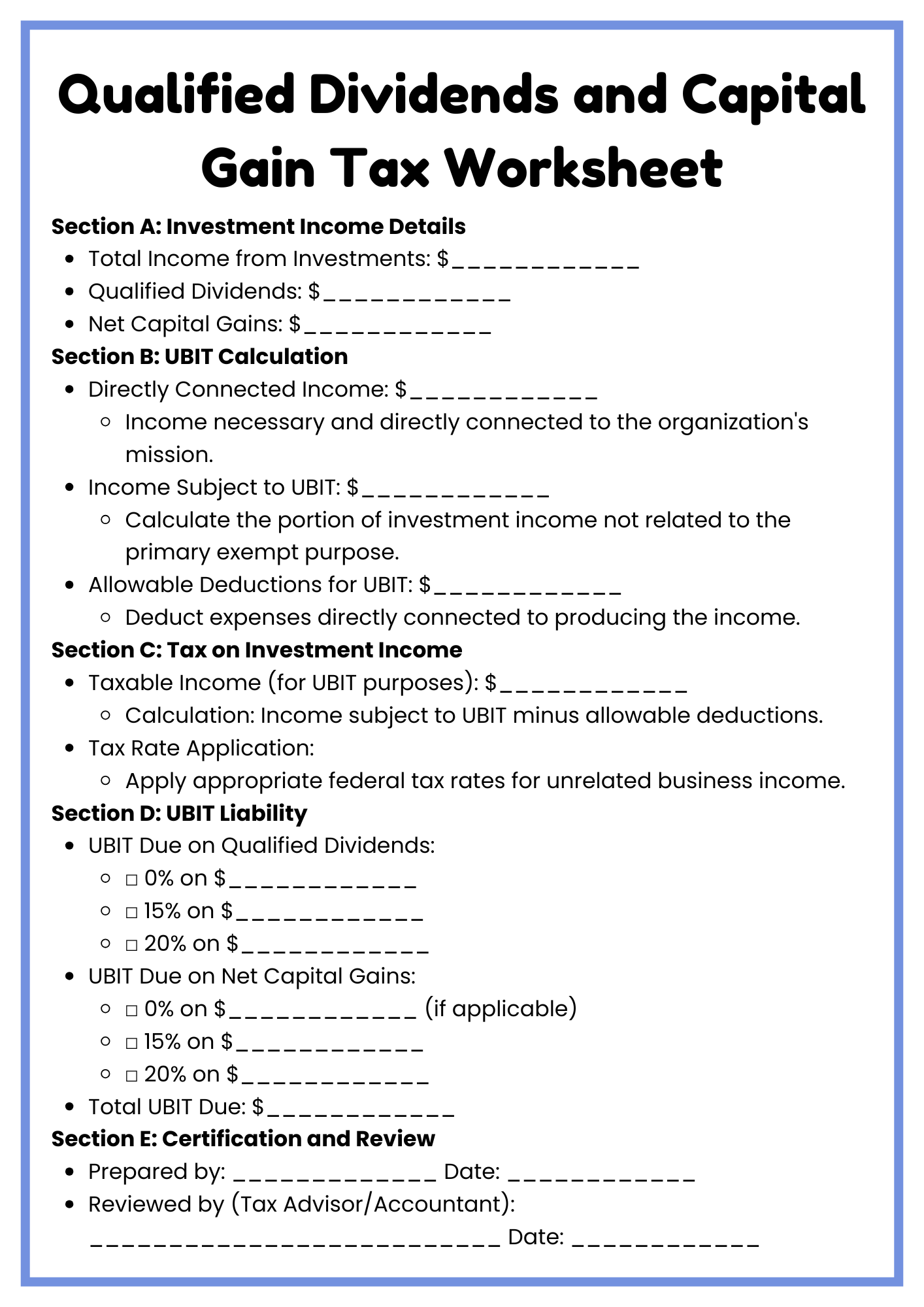

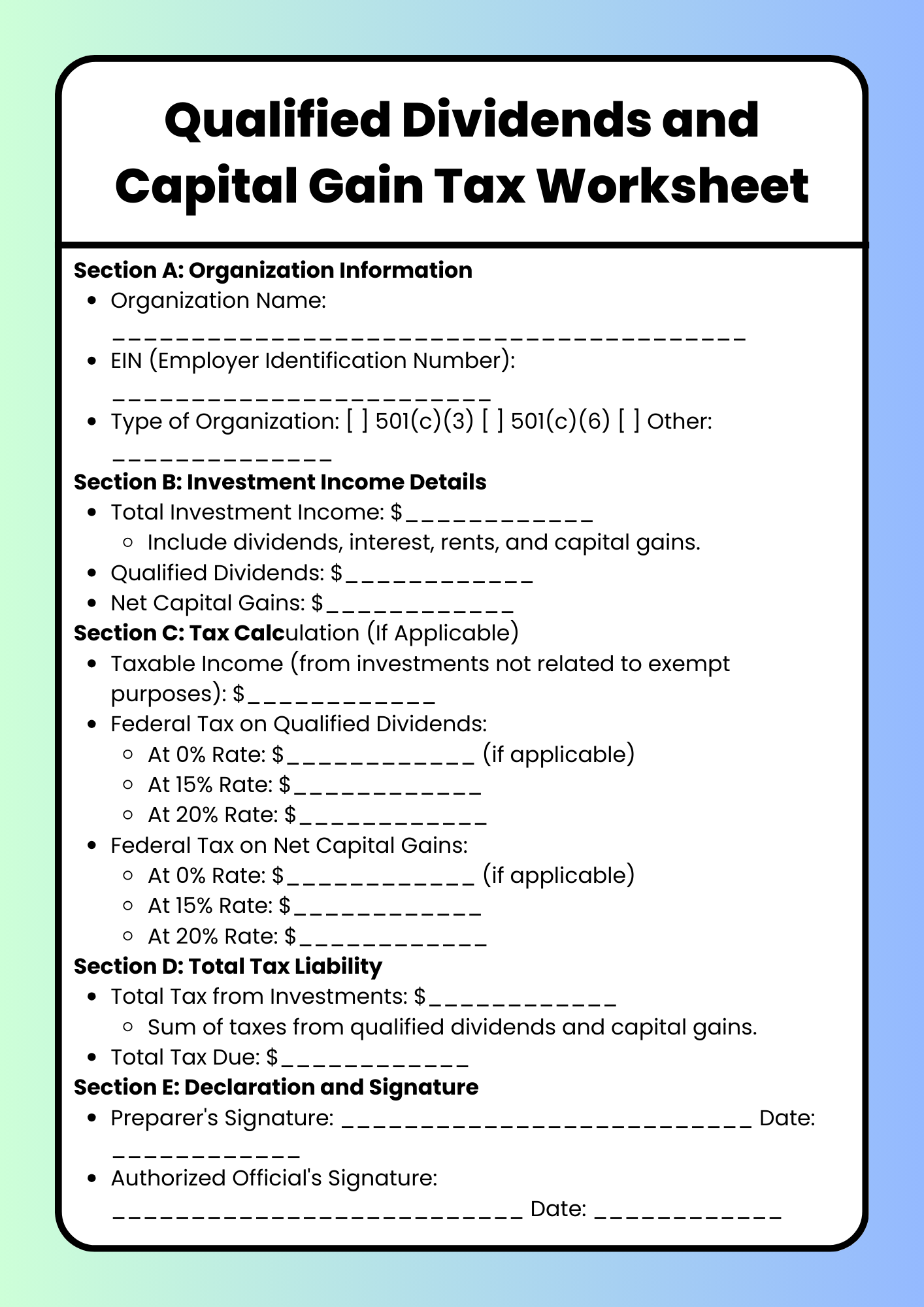

Qualified Dividends and Capital Gain Tax Worksheet Non-profit Organizations

download now -

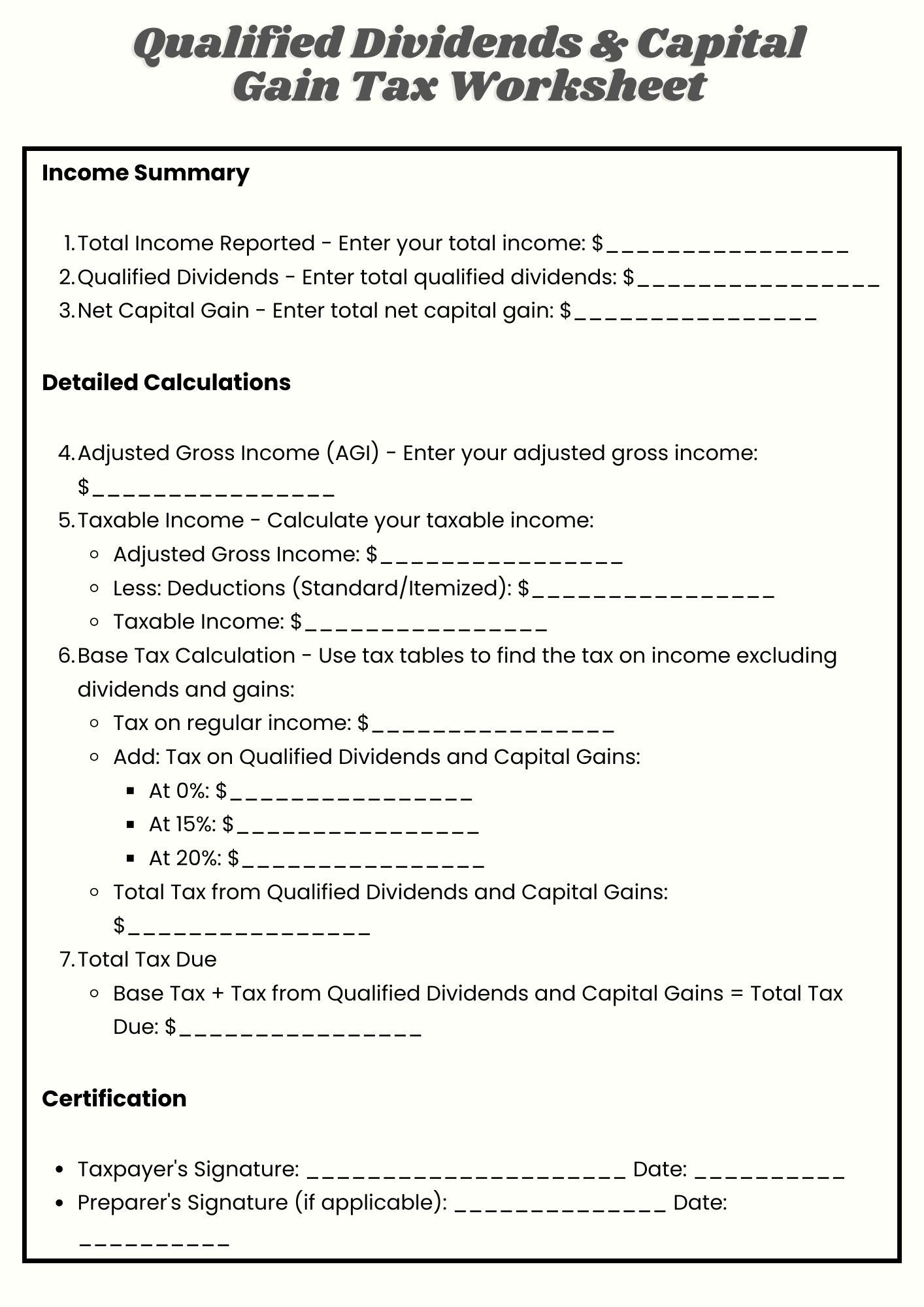

Sample Qualified Dividends & Capital Gain Tax Worksheet

download now -

IRS Qualified Dividends & Capital Gain Tax Worksheet

download now -

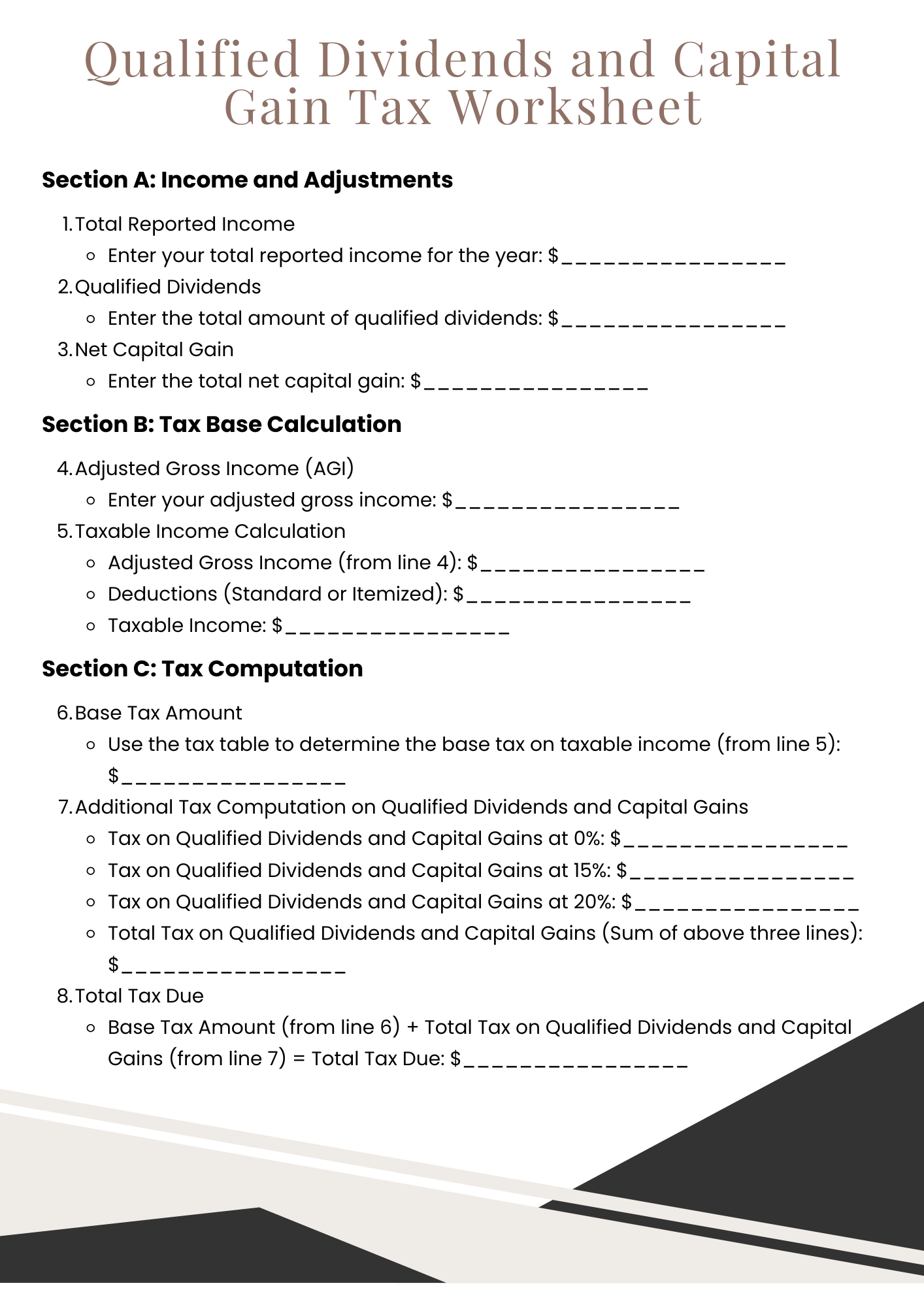

Tax Computation Qualified Dividends & Capital Gain Tax Worksheet

download now -

Income Tax Qualified Dividends and Capital Gain Tax Worksheet

download now -

Form Qualified Dividends and Capital Gain Tax Worksheet

download now -

Tax Return Qualified Dividends and Capital Gain Tax Worksheet

download now -

Accounting Qualified Dividends and Capital Gain Tax Worksheet

download now -

TurboTax Qualified Dividends and Capital Gain Tax Worksheet

download now -

Printable Qualified Dividends and Capital Gain Tax Worksheet

download now -

Free Qualified Dividends and Capital Gain Tax Worksheet

download now

-

Comprehensive Qualified Dividends and Capital Gain Tax Worksheet

download now -

Basic Qualified Dividends and Capital Gain Tax Worksheet

download now -

Advanced Qualified Dividends and Capital Gain Tax Worksheet

download now -

Qualified Dividends and Capital Gain Tax Worksheet for Young Adults

download now -

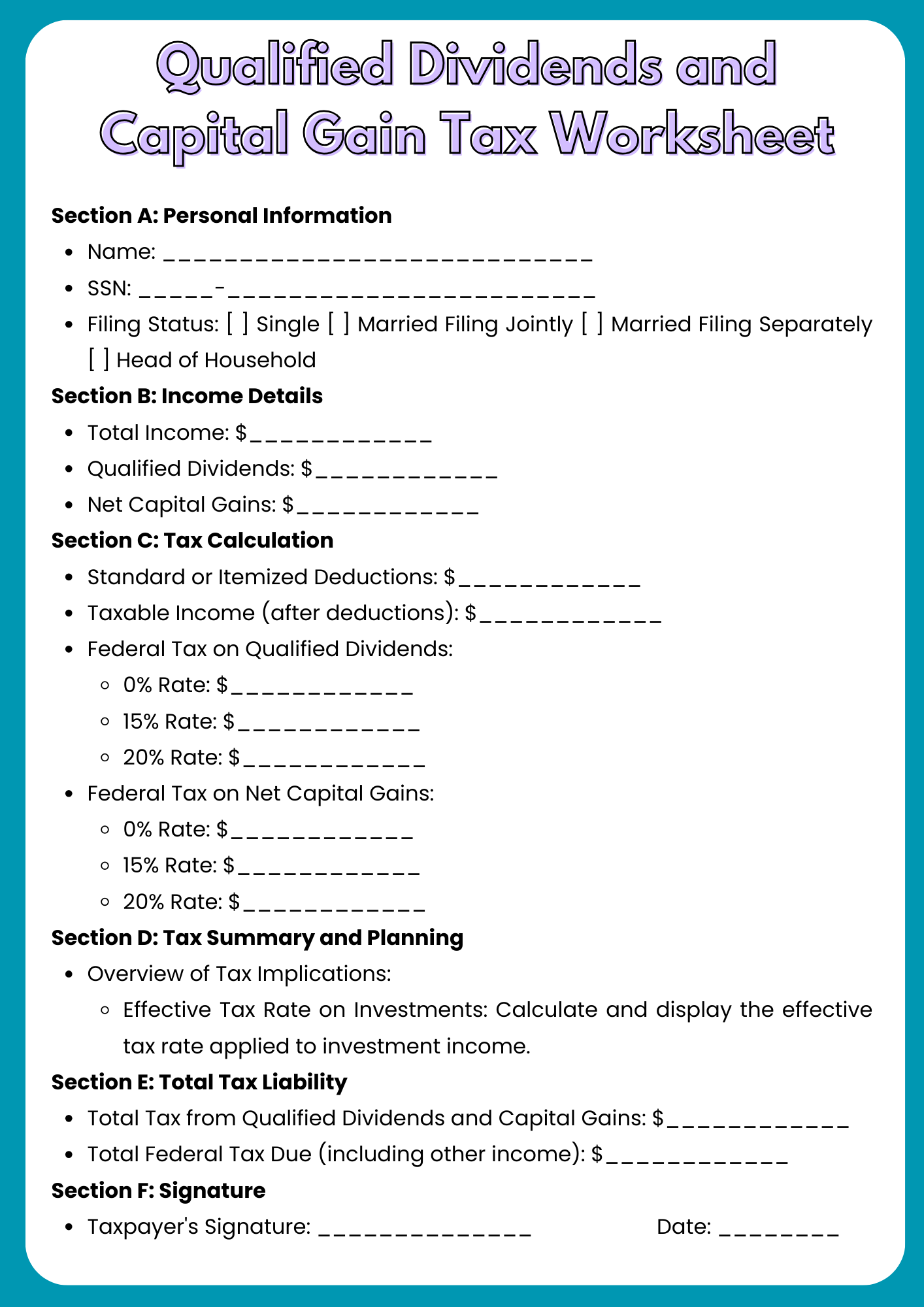

Qualified Dividends and Capital Gain Tax Worksheet for Taxpayers

download now -

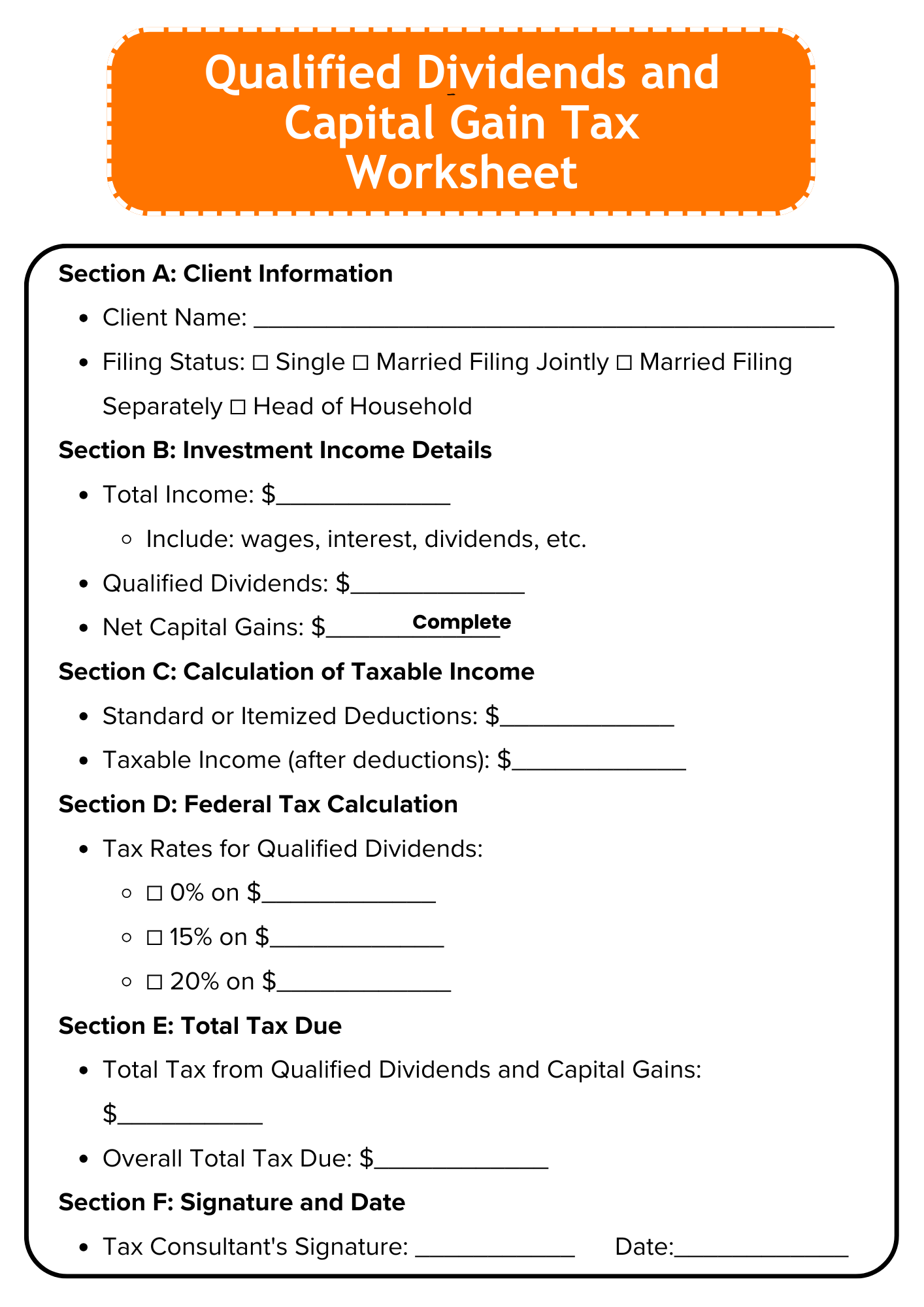

Qualified Dividends and Capital Gain Tax Worksheet for Tax Professionals

download now -

Qualified Dividends and Capital Gain Tax Worksheet for Easy Tax Filing

download now -

Qualified Dividends and Capital Gain Tax Worksheet for Beginners

download now -

Practice Qualified Dividends and Capital Gain Tax Worksheet

download now -

Qualified Dividends and Capital Gain Tax Worksheet for Seniors

download now -

Simplified Qualified Dividends and Capital Gain Tax Worksheet

download now -

Case Studies Qualified Dividends and Capital Gain Tax Worksheet

download now -

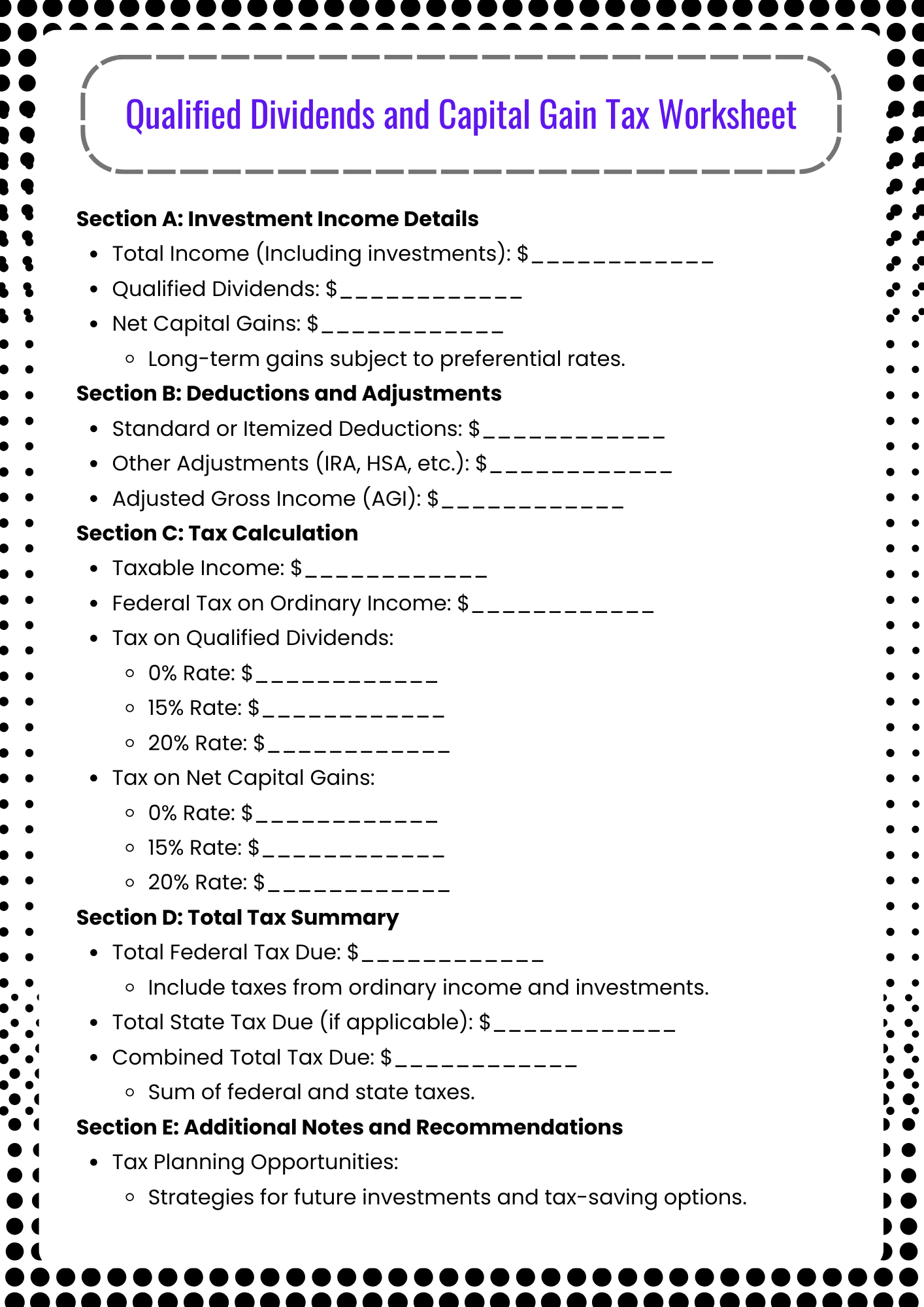

Qualified Dividends and Capital Gain Tax Worksheet for Investment Income

download now -

Saving Time with Qualified Dividends and Capital Gain Tax Worksheet

download now -

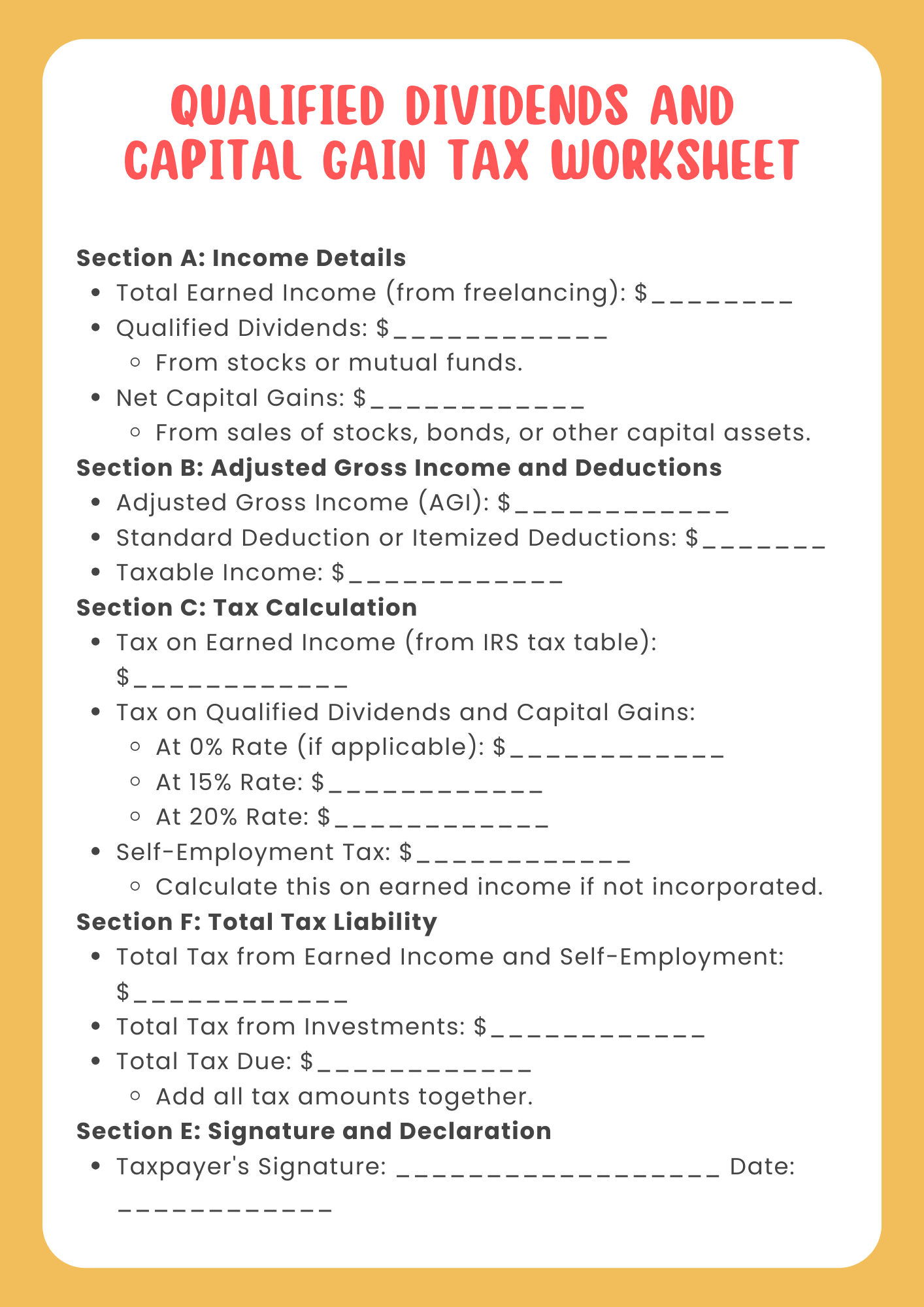

Qualified Dividends and Capital Gain Tax Worksheet for Freelancers

download now -

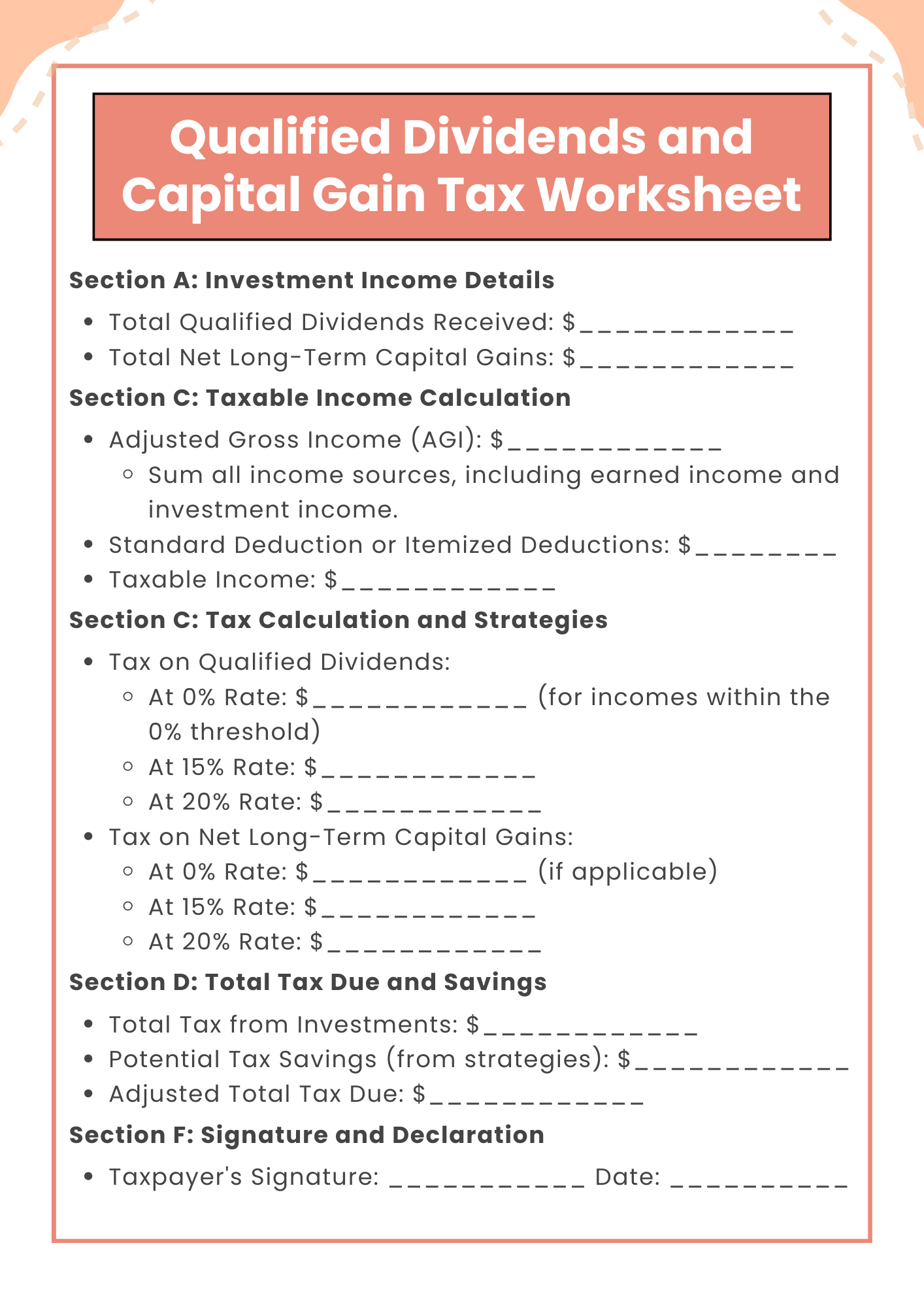

Tax Reduction Strategies with Qualified Dividends and Capital Gain Tax Worksheet

download now -

Professional Advice on Qualified Dividends and Capital Gain Tax Worksheet

download now -

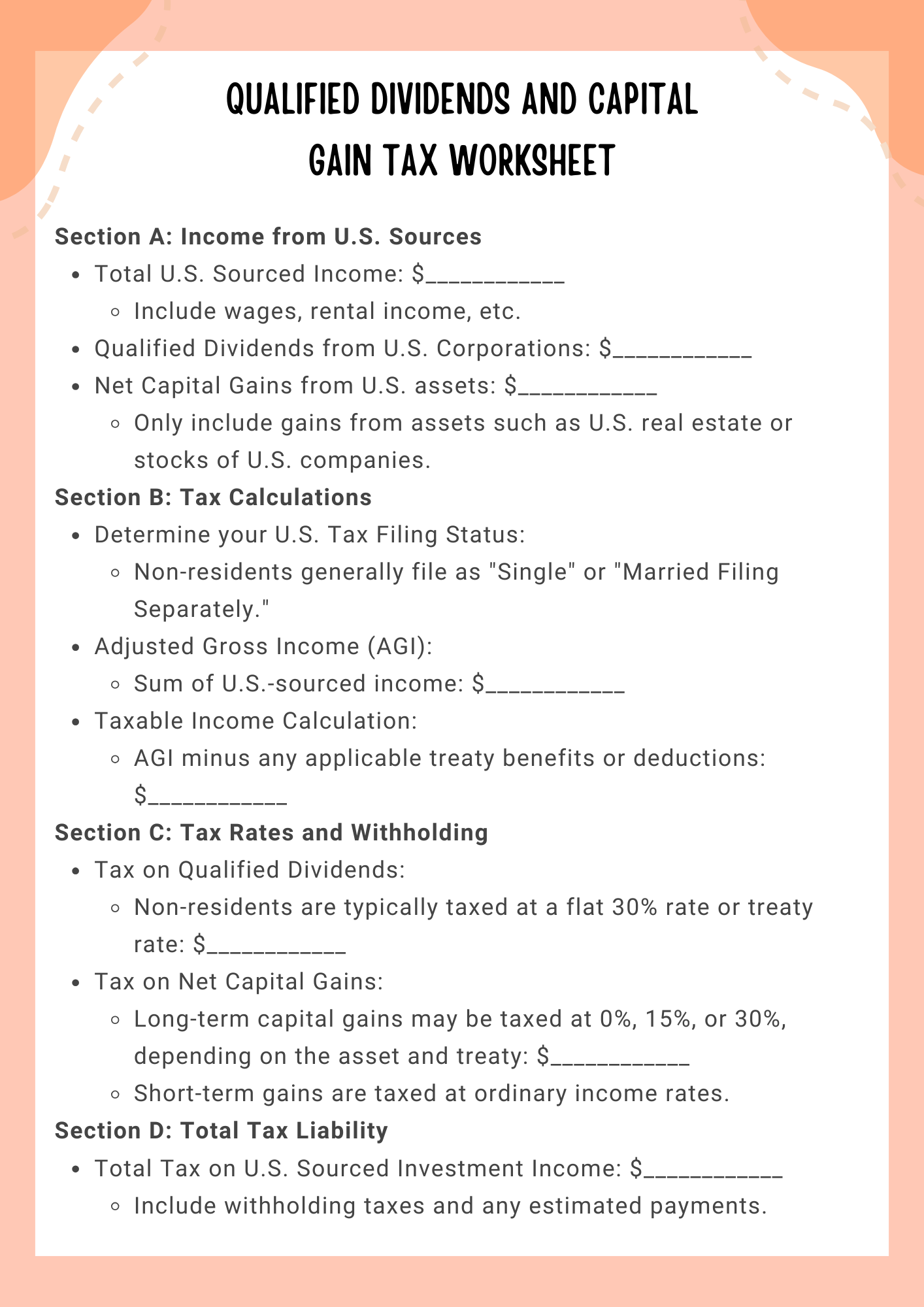

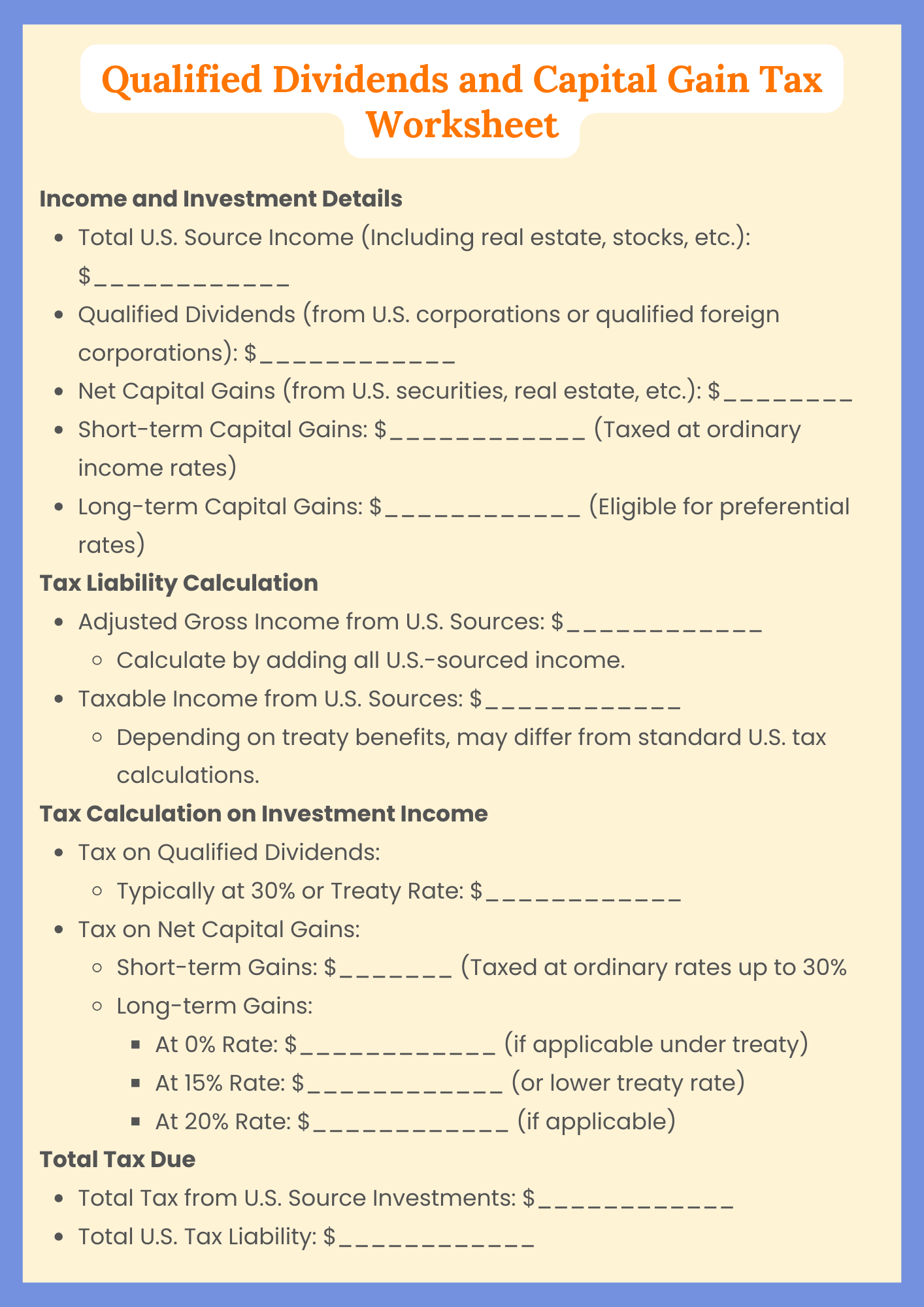

Qualified Dividends and Capital Gain Tax Worksheet for Non-Residents

download now -

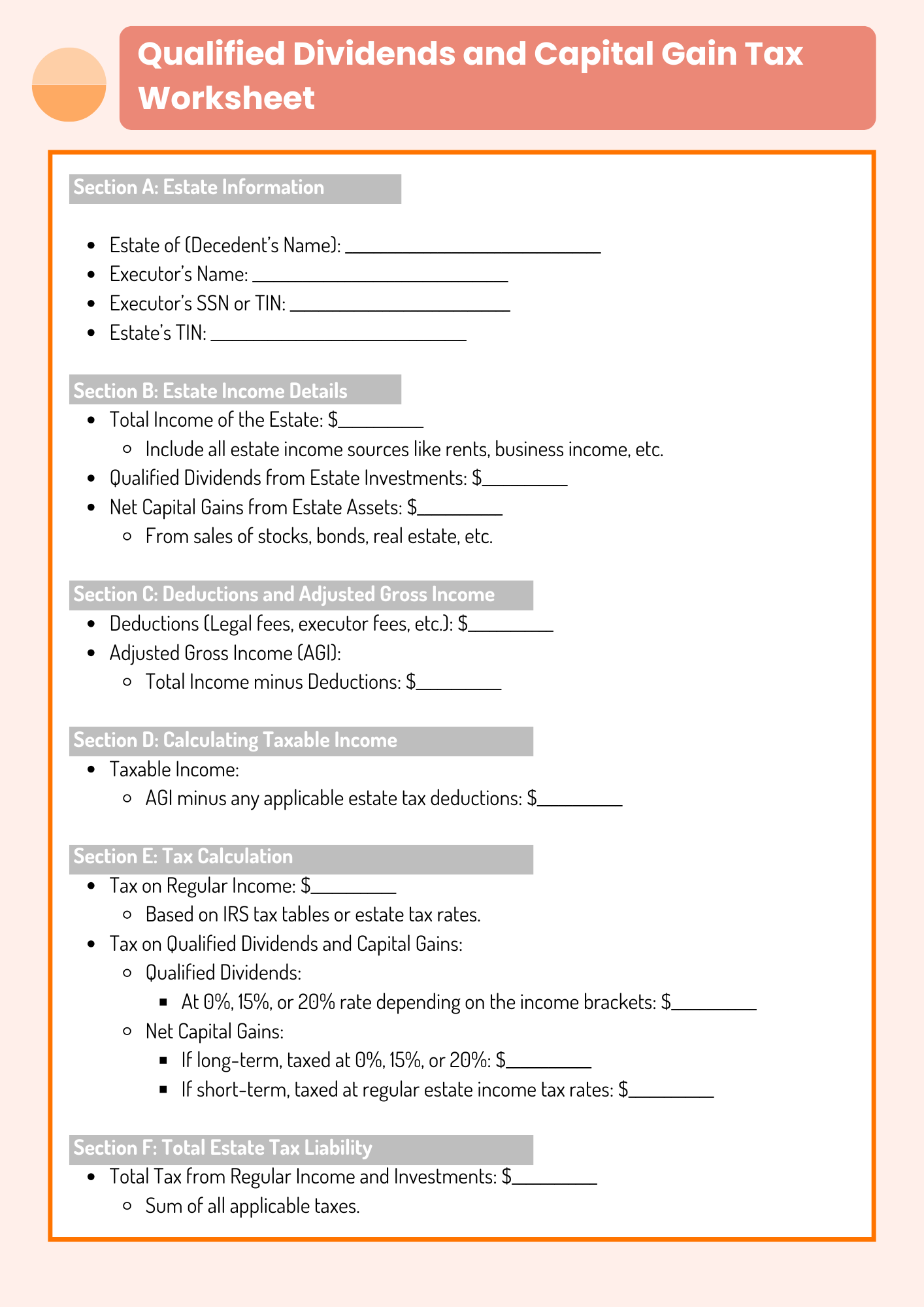

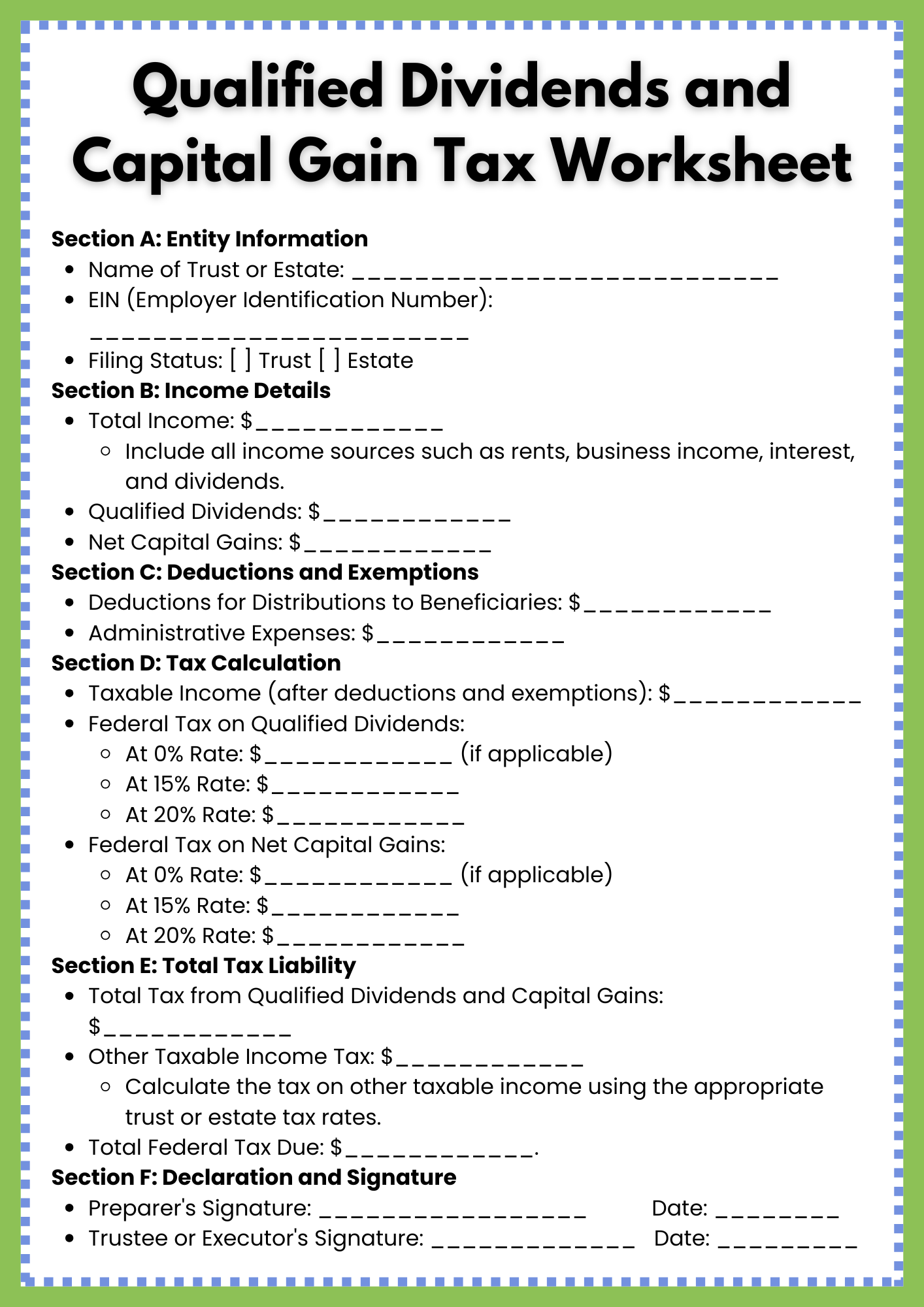

Qualified Dividends and Capital Gain Tax Worksheet for Estate Executors

download now -

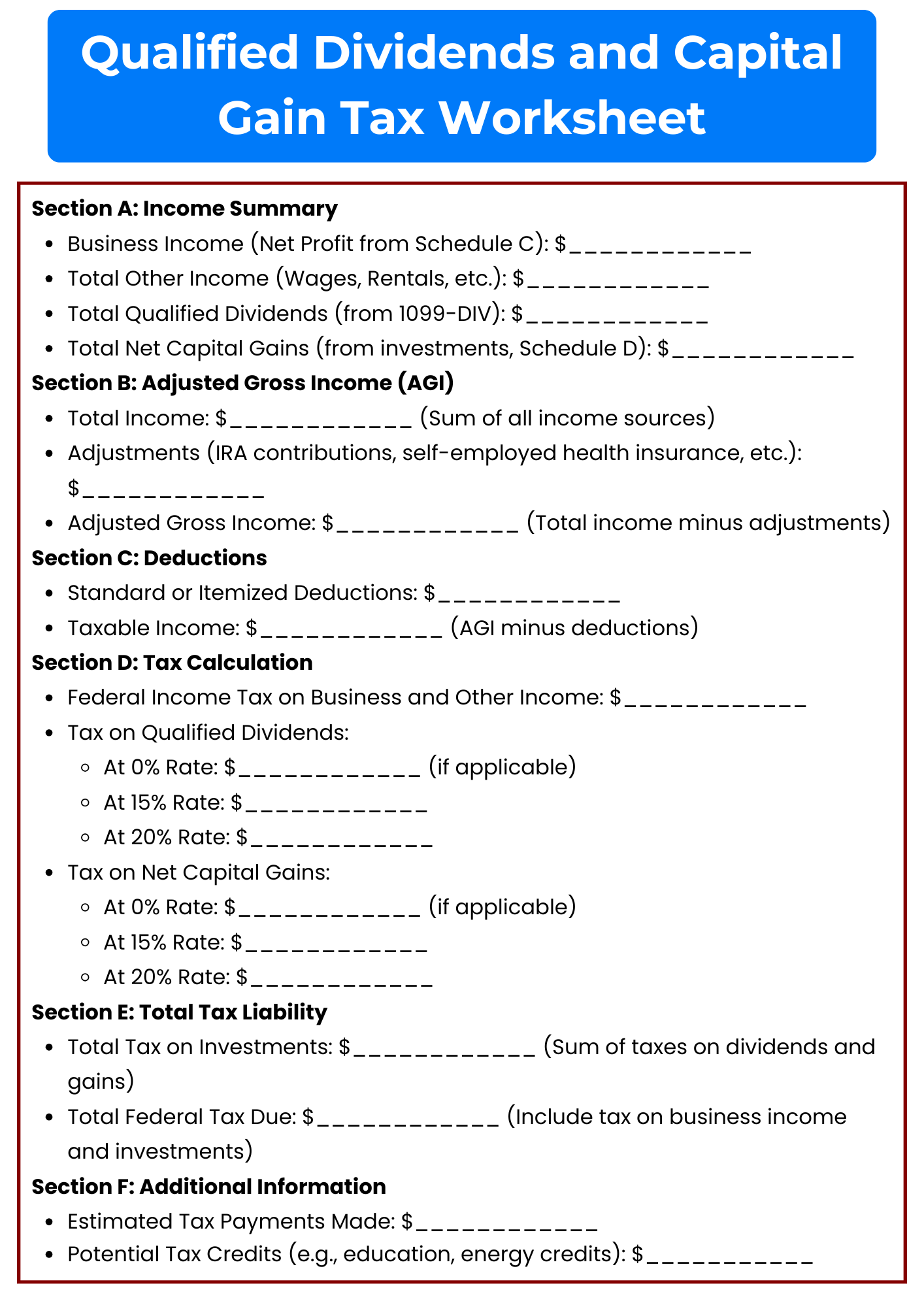

Qualified Dividends and Capital Gain Tax Worksheet for Small Business Owners

download now -

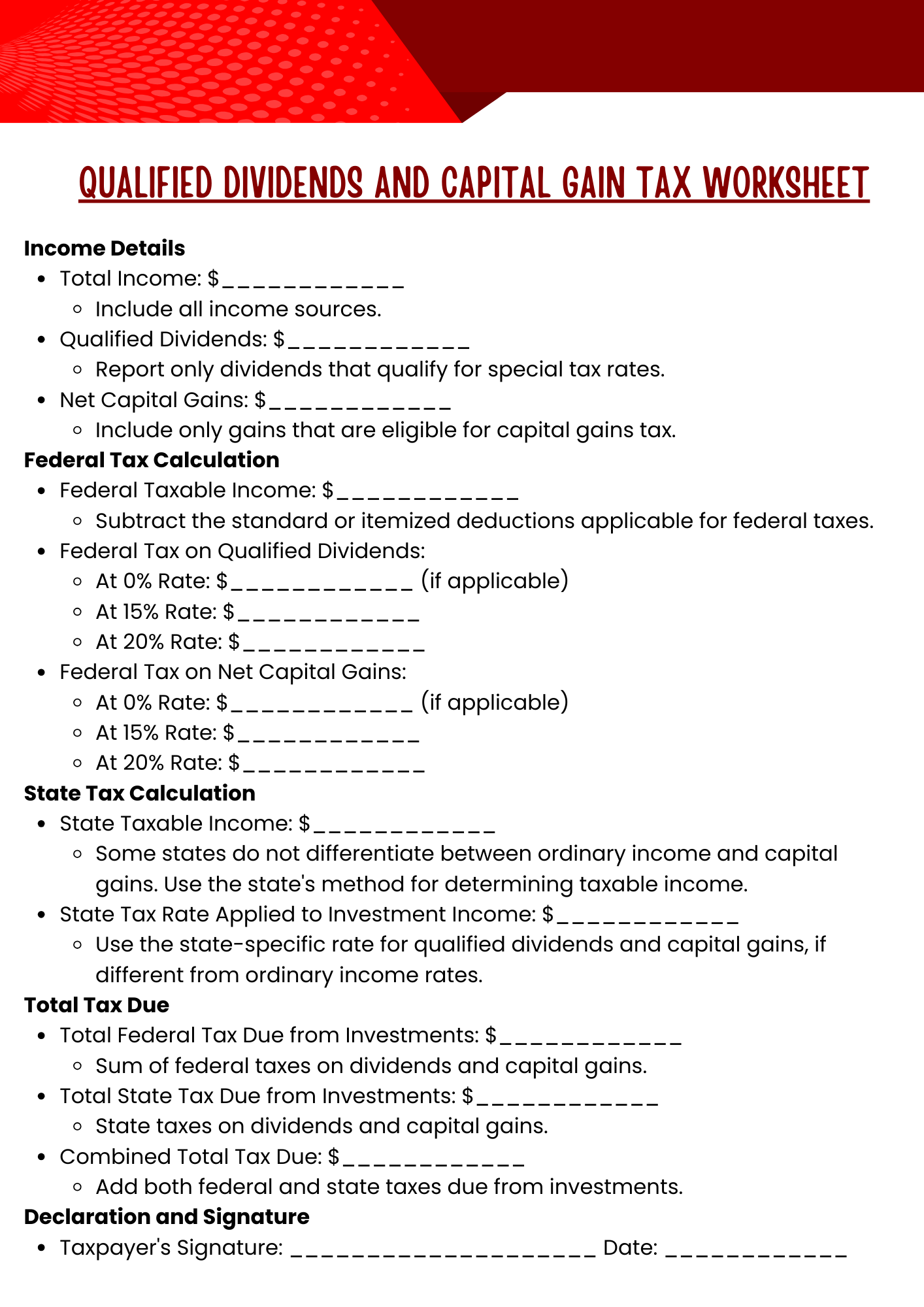

Qualified Dividends and Capital Gain Tax Worksheet for State and Federal Taxes

download now -

Qualified Dividends and Capital Gain Tax Worksheet for Tax Attorneys

download now -

Qualified Dividends and Capital Gain Tax Worksheet for International Investors

download now -

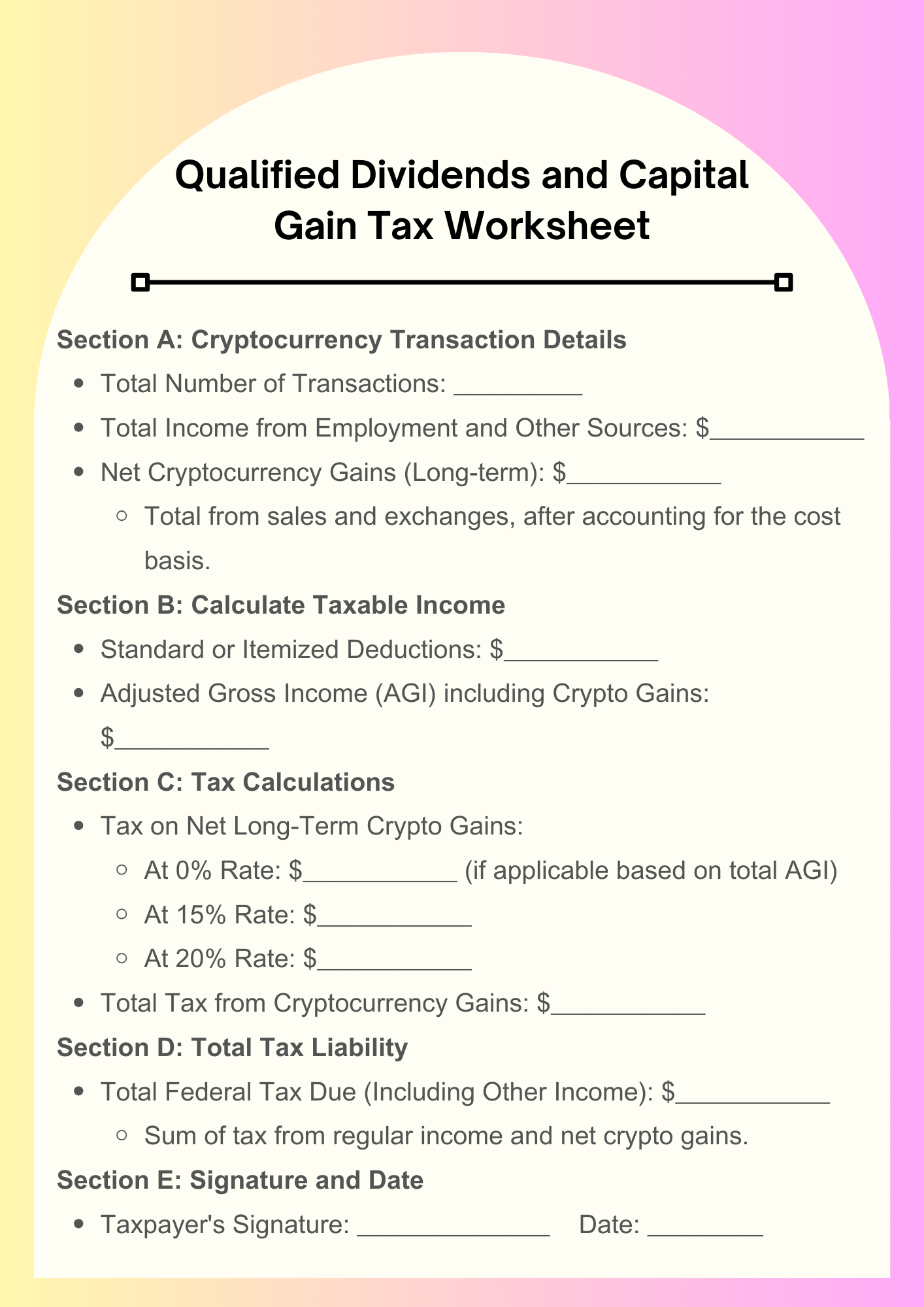

Qualified Dividends and Capital Gain Tax Worksheet for Cryptocurrency Gains

download now -

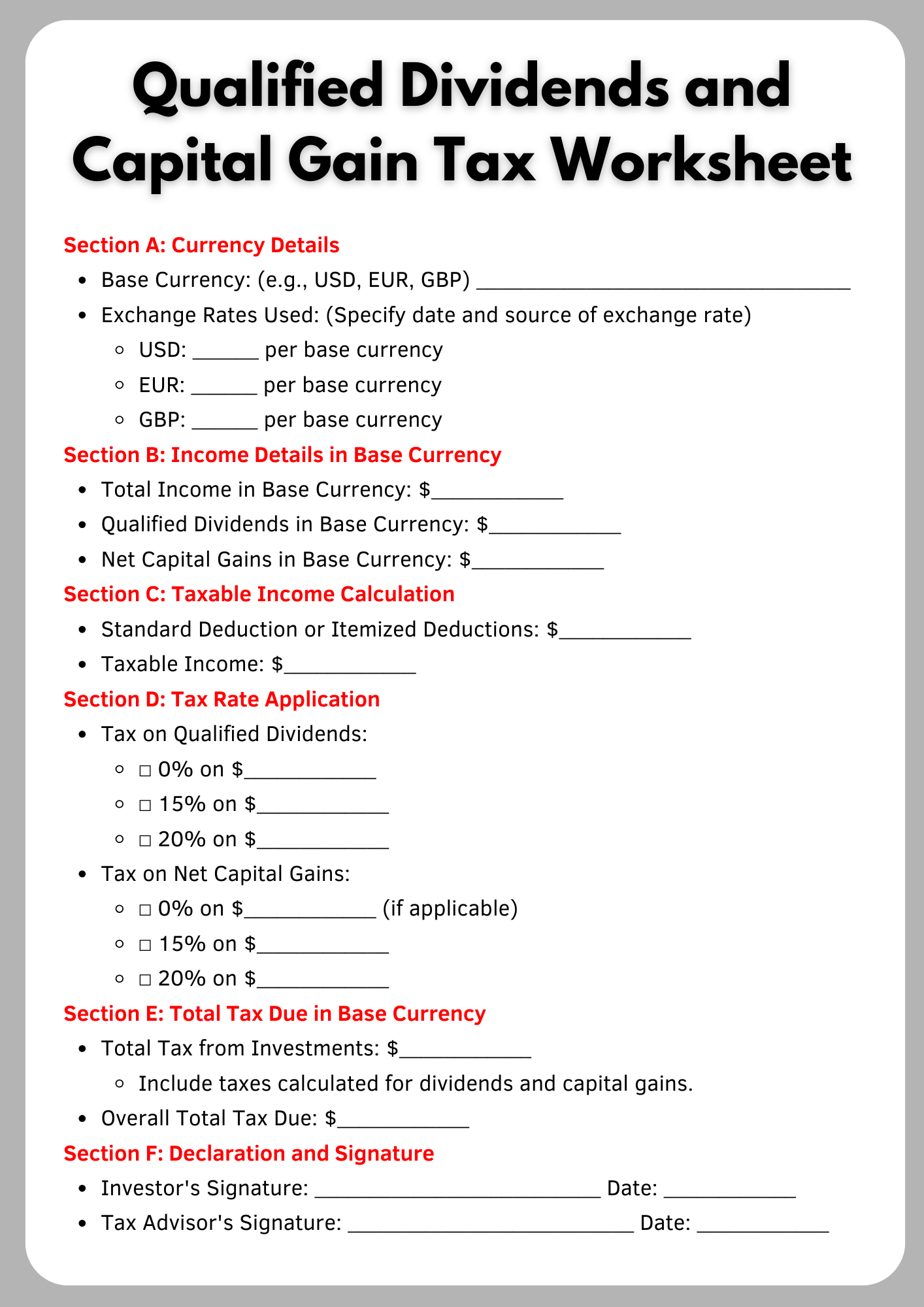

Qualified Dividends and Capital Gain Tax Worksheet for Multi-Currency Investors

download now -

Qualified Dividends and Capital Gain Tax Worksheet for Tax Consultants

download now -

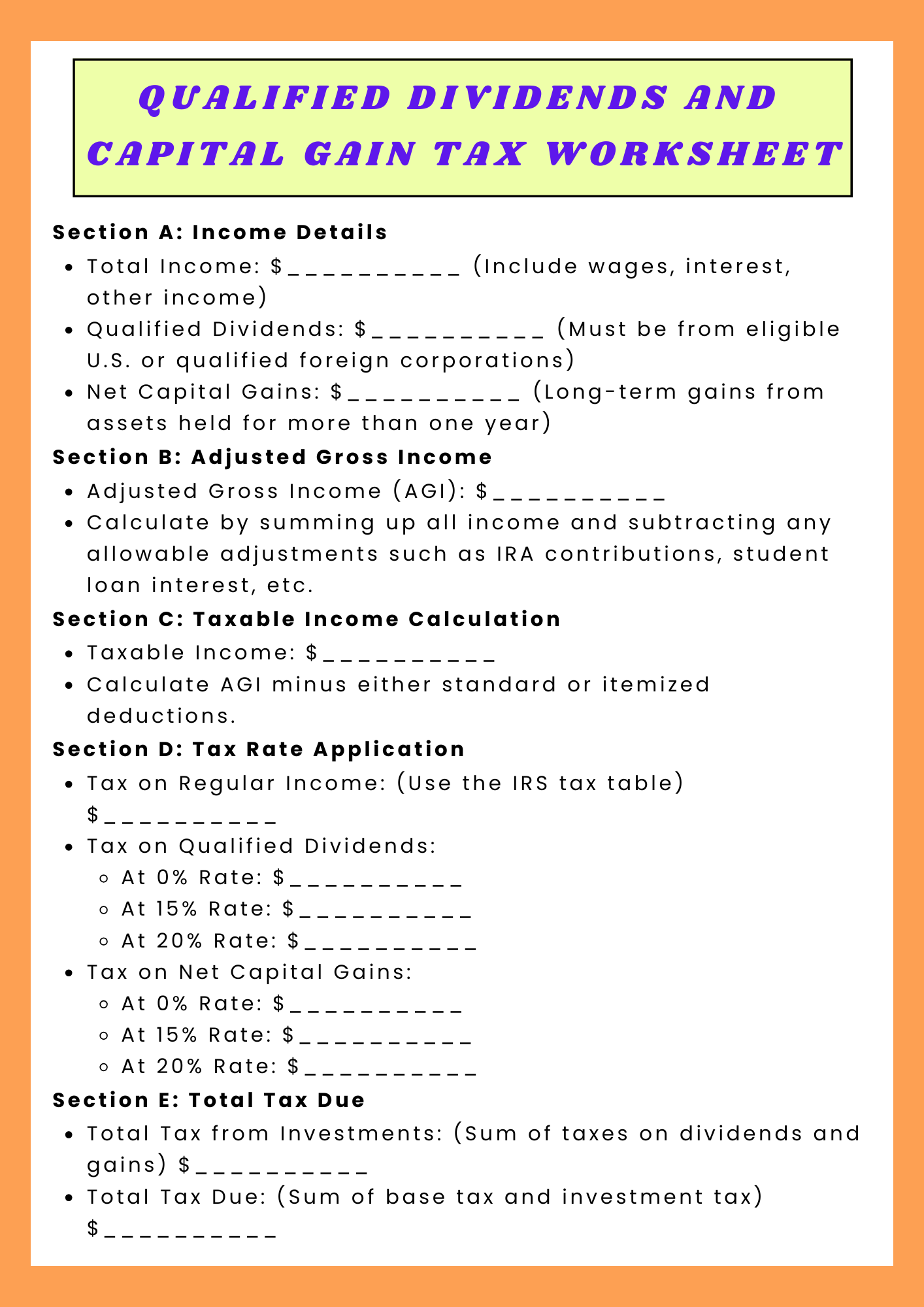

Qualified Dividends and Capital Gain Tax Worksheet From Basic to Advanced

download now -

Qualified Dividends and Capital Gain Tax Worksheet for Tax Advocates

download now -

Qualified Dividends and Capital Gain Tax Worksheet for Trusts and Estates

download now -

Qualified Dividends and Capital Gain Tax Worksheet for Tax Exempt Organizations

download now

What is a Qualified Dividends and Capital Gain Tax Worksheet?

A Qualified Dividends and Capital Gain Tax Worksheet is a financial tool used by taxpayers to accurately calculate the tax owed on qualified dividends and long-term capital gains, which are subject to preferential tax rates lower than those of ordinary income. This worksheet is typically used in conjunction with IRS form filings, like the 1040 income tax return, to apply the correct rates—0%, 15%, or 20%—based on the taxpayer’s income level, filing status, and the amounts of qualified dividends and capital gains received. It ensures that taxpayers can efficiently compute their tax liabilities, taking advantage of available tax savings on investment income and aiding in thorough tax compliance and financial planning

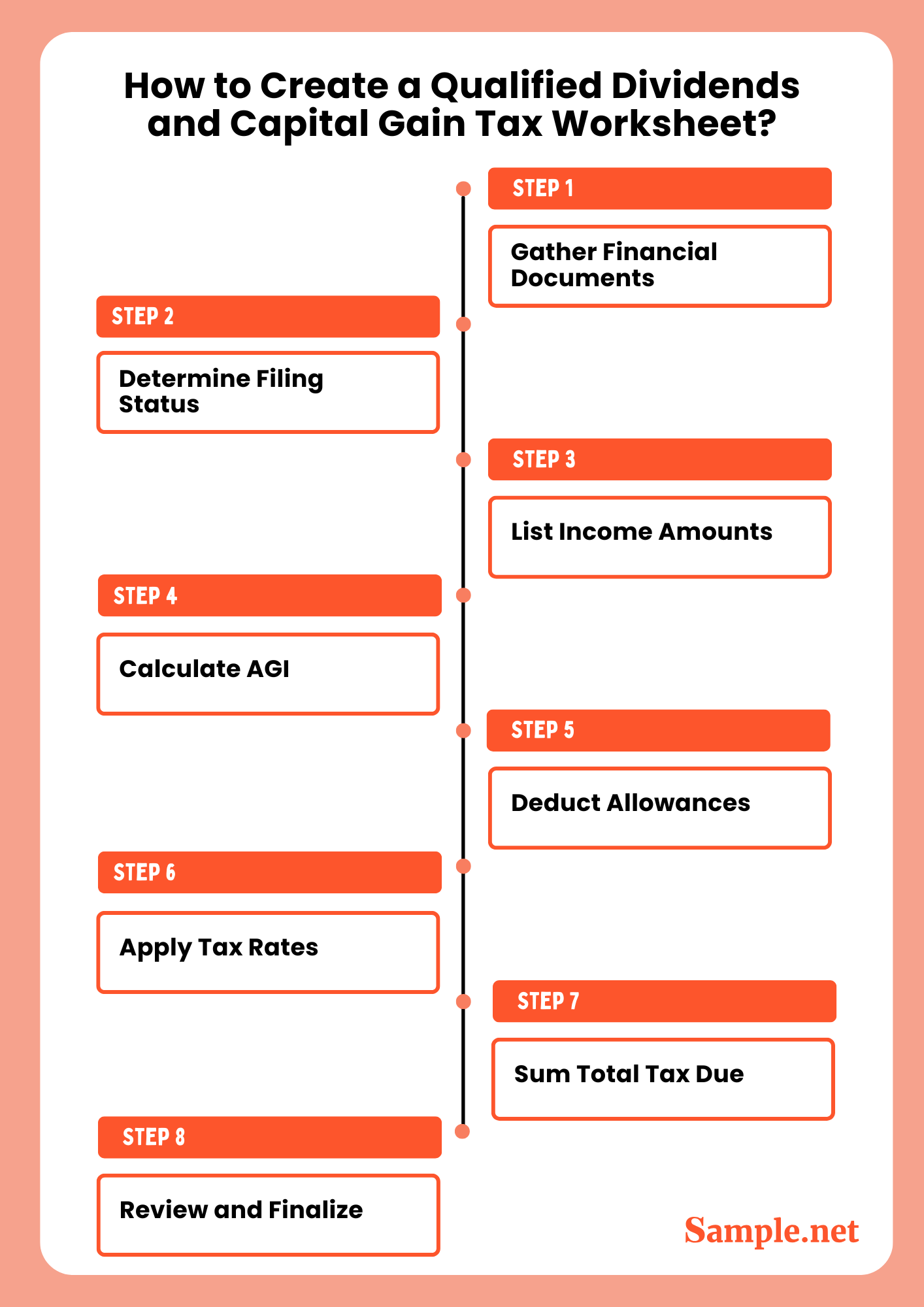

How to Create a Qualified Dividends and Capital Gain Tax Worksheet?

■ Gather Financial Documents: Collect all relevant financial statements, including 1099-DIV forms for dividends and 1099-B forms for capital gains.

■ Determine Filing Status: Identify your filing status (single, married filing jointly, etc.), as it affects the income thresholds for different tax rates.

■ List Income Amounts: Record the total amounts of qualified dividends and net capital gains on the worksheet.

■ Calculate AGI: Compute your Adjusted Gross Income (AGI) using your total income and any allowable adjustments.

■ Deduct Allowances: Subtract any standard or itemized deductions from your AGI to determine your taxable income.

■ Apply Tax Rates: Use the current IRS tax brackets to apply 0%, 15%, or 20% tax rates to your qualified dividends and capital gains based on your taxable income.

■ Sum Total Tax Due: Calculate the total amount of tax owed by adding the tax from qualified dividends, capital gains, and any other income.

■ Review and Finalize: Double-check all calculations for accuracy and ensure compliance with the latest IRS guidelines.

Why Use Qualified Dividends and Capital Gain Tax Worksheet?

✔️ Accuracy in Tax Calculation: The worksheet helps ensure that taxes on qualified dividends and capital gains are calculated accurately, applying the correct preferential tax rates.

✔️ Tax Savings: By accurately applying lower tax rates to qualified dividends and capital gains, taxpayers can maximize their tax savings.

✔️ Compliance with IRS Regulations: The worksheet guides taxpayers through the IRS’s required process for reporting and paying taxes on investment income, ensuring compliance with federal tax laws.

✔️ Simplifies Complex Calculations: The worksheet breaks down complex tax computations into simpler steps, making it easier for taxpayers to understand and calculate their tax liabilities.

✔️ Helps in Financial Planning: Understanding and utilizing the tax advantages for qualified dividends and capital gains can aid taxpayers in making more informed financial decisions regarding their investments.

✔️ Documentation for Record-Keeping: Completing the worksheet provides a detailed record of how tax figures were derived, useful for both current tax filing and future reference.

How to Use a Qualified Dividends and Capital Gain Tax Worksheet?

1️⃣ Gather Your Financial Documents: Before you start, collect all relevant financial statements that report your qualified dividends and capital gains, such as 1099-DIV and 1099-B forms.

2️⃣ Identify Your Filing Status: Determine your filing status (e.g., Single, Married Filing Jointly) as this affects the tax rates applicable to your income.

3️⃣ Fill Out Income Details: Enter the total amount of your qualified dividends and net capital gains in the designated areas of the worksheet.

4️⃣ Calculate Adjusted Gross Income (AGI): Use your total income and deductions to calculate your AGI, which will be used to determine the applicable tax brackets.

5️⃣ Determine Taxable Income: Subtract any standard or itemized deductions from your AGI to find your taxable income, which is crucial for applying the correct capital gains tax rates.

6️⃣ Apply Tax Rates: Use the worksheet to apply the appropriate tax rates to your qualified dividends and capital gains. These rates are typically 0%, 15%, or 20%, depending on your taxable income bracket.

7️⃣ Compute the Tax: Calculate the amount of tax due on your qualified dividends and capital gains by applying the calculated rates to the amounts entered earlier.

8️⃣ Total Up Your Tax Liability: Add the computed tax from qualified dividends and capital gains to your regular income tax to get your total tax liability.

9️⃣ Review and Double-Check: Carefully review the entire worksheet to ensure all entries and calculations are accurate to avoid errors in your tax return.

🔟 File Your Tax Return: Include the results of your worksheet with your tax return, using the figures calculated to complete the relevant sections of your IRS Form 1040.