3+ Sample Zero Based Budget Worksheet

FREE Zero Based Budget Worksheet s to Download

What Is a Zero-Based Budget Worksheet?

A zero-based budget worksheet is a document that has your calculations for zero-based budgeting. Zero-based budgeting is when you make your expenses and income equal. It is when you will get zero if you minus your expenses from your income. This is a strategy to allocate every dollar that you make. Your goal is to ensure that you will get zero by the end of the month. This way, you can allocate your money for all the things that you need. You will never overspend because you know that you should maintain zero by the end of the month. So, you will never get a negative amount.

For you to get the best zero-based budget worksheet, you should search on the internet for the best template that you can use. It can give you the best monthly zero-based budget worksheet that you can incorporate into your budgeting. The philosophy to transition to a zero-based system is good. You can be sure that your income will fit all your expenses. You can also have savings that you can save for yourself. You can be sure that you can meet your business needs or your household needs.

Benefits of a Zero-Based Budget Worksheet

Have you seen a free zero-based budget worksheet? Have you ever wondered what it is for? You should know that it is used by many because it has benefits and advantages. It has helped a lot of people. Well, do you want to know its benefits? Read and consider the following to know the benefits of a zero-based budget worksheet:

New Insight for Your Spending Habits: You can have new insights into your spending habits. You can cut down all the expenses that do not coincide with your values and goals. Because you have to fit your expenses with your income, you will ensure that you will have the necessary expenses only. This is not to get a negative amount on your income. You will cut the unnecessary expenses that can make you get a negative amount. This way, you will learn to have better spending habits. You will only spend on good things. You know that you have to keep your goal. So, you should ensure that you will not get a negative amount by the end of the month. You can avoid having debts by doing this. You will make sure that what you will get is zero and not a negative amount.Having a Flexible Budgeting Method: Zero-based budgeting is a flexible method. You can choose to have savings or not. You can choose the expenses that you can include in the budget. If you have excess money, you can allot the amount to other things that can give you a variety to choose from. This budgeting method is flexible and it will be easy for you to maximize your budget. You can apply different strategies to make this method work. Just be sure that you can apply the basic principle of getting zero by the end of the month. You can be sure that your expenses will fit your budget the way that you want. You will have the independence to choose the expenses that you want from your income.Control Your Spending Habits: Because you should not get a negative amount on your budget, you can control your spending habits. You will limit your expenses on important things. You will stop spending on trivial things. You will ensure that you will have a good budget. This way, you can have excess money that you can allot to savings. By having a zero-based budget worksheet, you can monitor your expenses. You will see if you have been spending on unnecessary things. Because you can keep track of your spending habits, you can eliminate your bad spending habits. You can control your expenses and you can be sure that you can have money for all the things that you need.Focus on Your Goals: It will be easy for you to focus on your financial goals by having a zero-based budget worksheet. This is a good tool that can show you how you are doing in regard to your money. You will know what to do so that you can maximize your budget. It will be easy for you to assess whether you are achieving your goals or not. You can do your priorities easily with the worksheet. The worksheet is very effective and it can show you how you can better make savings. You know that you can keep track of all your expenses by having it. You can adjust your spending habits by observing it.Not Spending More: Because your expenses should fit your income, you will not spend more. You will only base your spending habits on your income. You will not have lavish spending because you know that your expenses should not exceed your income. You will not end up having debts. You will ensure that your expenses will be enough for your income. In the end, you will spend on necessary things. If not with a budget, we tend to spend more because we do not have control of our budget. But by having a zero-based budget worksheet, you can apply a work strategy where you will not spend more so that you can control your expenses to be sure that your budget will meet a zero balance. By having this approach, your income can go to good expenses.Money Well Spent: The zero-based budget worksheet can justify all your expenses. You can ensure that you can spend on necessary things only. This way, you will know that your money is well spent. You can have a good account of how you use your income. You can see all your expenses and you may be able to choose the expenses that you will have. If you will see that you are spending on things that are not good, you can adjust your budget so that you can spend on necessary things only. In the end, you will only spend on good things. You will not spend your money on things that will ruin your budget.Strengthens Growth: Your financial growth can be strengthened by using a zero-based budget worksheet. You can ensure that you can achieve your financial goals through it. You can achieve the financial stability that you want. By having the worksheet, you will know what to do so that you can improve your financial status. By budgeting in this method, you can be sure that you will have the money for all your expenses. This way, you will lack nothing. Your income will fit all the things that you need. You can be sure that you will have no debt. This will be good for your business. Aside from not having debt, you can also have some savings. This is the best way of budgeting because you will have everything that you need.Better Decision-Making: You can keep track of your expenses easily by using the zero-based budget worksheet. In this way, you can have better decision-making on how you can adjust your expenses. You can better decide how you can use your money. Making decisions will be easy for a zero-based budget worksheet. It is comprehensive enough to tell you what to do. It can give you great insights into your financial goals. By knowing the roots of your expenses, you can easily achieve the objectives of your organization. Better decisions can be made because you will have all that you need to decide.Efficient Resource Allocation: The zero-based budget worksheet is the best method for how you can allocate your income to all your resources. It can guide you on what resources to prioritize. Spending may be easy at times. You may even spend money on not-so-important things. But by having a zero-based budget worksheet, you can have a budget plan that can tell you the things which matter most. You can end up spending on important things only or the resources that you need. You can allot a sure budget for all the needed resources. In this way, you can be sure that all your business operations will be successful.

Tips on Zero-Based Budget Worksheet

Are you looking for a zero-based budget worksheet example or a zero-based budget worksheet sample? Do you need it because you want to have some tips on a zero-based budget worksheet? If you are looking for tips, we can help you. We can provide you with some tips that you can use. Have the following tips:

Know What You Want to Achieve: In creating a zero-based budget worksheet, you must know what you want to accomplish. Be clear with your purpose. So, you must set clear goals and objectives. This is the way you can make the worksheet effective.Use Technology: Using a zero-based budget worksheet will be more effective if you use technology. So, use a zero-based budgeting app. This kind of tool can help you to make your work easier. You can be sure that you can use your zero-based budget worksheet with convenience.Develop a Plan: You should involve planning in your zero-based budgeting. Remember that without a plan, everything will be meaningless. With a plan, you will know what you want to achieve. You can be sure that you can reach your goals. A plan can make your zero-based budget worksheet successful.Get an Advisor: You should get advice on your worksheet. Find an advisor that can give you the right feedback. You need someone who can tell you where you are going. You should know if you are heading to success or not. So, have an advisor that will guide you on how you can make your budgeting successful.

How to Create a Zero-Based Budget Worksheet

Do you need a zero-based budget worksheet template? Are you about to create a zero-based budget worksheet? Maybe you are looking for steps that you can use in creating. Well, we can give you some steps to use. They are the following:

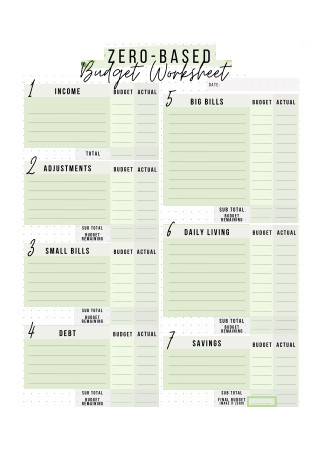

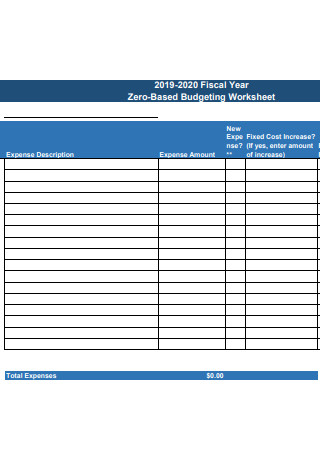

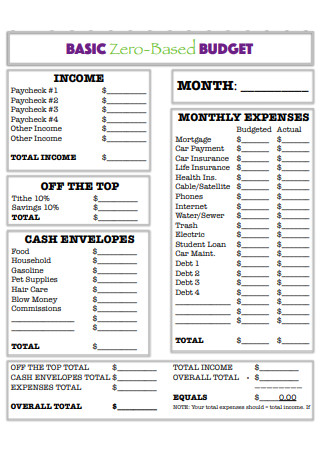

1. List Your Income

The first thing that you have to do is list your income. Your income is where you have to subtract all your expenses. So, you have to put your total income. Calculate your total income by adding all your paychecks from your job, business, and side jobs.

2. List Your Expenses

After calculating and listing your income, you can go to your expenses. You should list all your expenses. Calculate all your expenses by adding all the money that you have spent on the things that you need. Your expenses should also include your savings. So, add the savings that you want to your expenses.

3. Subtract Your Expenses from Your Income

After you have calculated your income and your expenses, you have to subtract your expenses from your income. Be sure that you can get a zero amount. If you get an extra amount, you can add additional expenses to get zero. Or you can add the amount to your savings. This way, you can get zero.

4. Monitor Your Expenses

The process is easy. You have to get zero every time you subtract your expenses from your income. To be sure that you will not get a negative amount, you have to keep track of all your expenses. Be sure that they can fit your income. So, be wise in your spending habits. This way, you can be sure that you will have a negative amount in your zero-based budgeting.

5. Make a New Budget Always

Always create a new budget at the start of the month. This can make your zero-based budget worksheet effective. You can be sure that you can monitor your expenses well. You can adapt the changes to your expenses each month.

FAQs

Can you use zero-based budgeting when you have an irregular income?

Yes, you can use zero-based budgeting even if you have an irregular income. You have to create a new budget each month that will fit your income for the month.

What are the drawbacks of zero-based budgeting?

The drawbacks of zero-based budgeting are you can have short-term thinking, you will need intensive resources, and it can be manipulated by managers.

Is a zero-based budget effective?

This budgeting style is effective. Especially, if you are doing a household budget. You can be sure that you can get through your monthly expenses by having a zero-based budgeting worksheet. So, get your paycheck budget planner and start to have this kind of budgeting. You can be sure that you will have savings from your income. You do not need any other budgeting example. By having this simple technique of budgeting, you can be sure that you can maximize your budget. This can also be easy to make. You can create it in an Excel spreadsheet or any other similar tool.

What will happen if you use zero-based budgeting?

Through this method, you will know where your money is going. You can make a plan for your savings. You can have good spending habits. To have savings, you should have the formula of income minus your expenses and savings will be zero. One of the things that can happen is that you can have savings from your income. A part of your income will be reserved for savings.

If you want budgeting that can fit your income to your expenses, you must use zero-based budgeting. You can do this more effectively by using a zero-based budget worksheet. The worksheet can help you manage your finances better. Well, do you need a template for a zero-based budget worksheet? This post has 3+ SAMPLE Zero Based Budget Worksheet in PDF. You can create the best worksheet by using these templates. Download now!